Key Insights

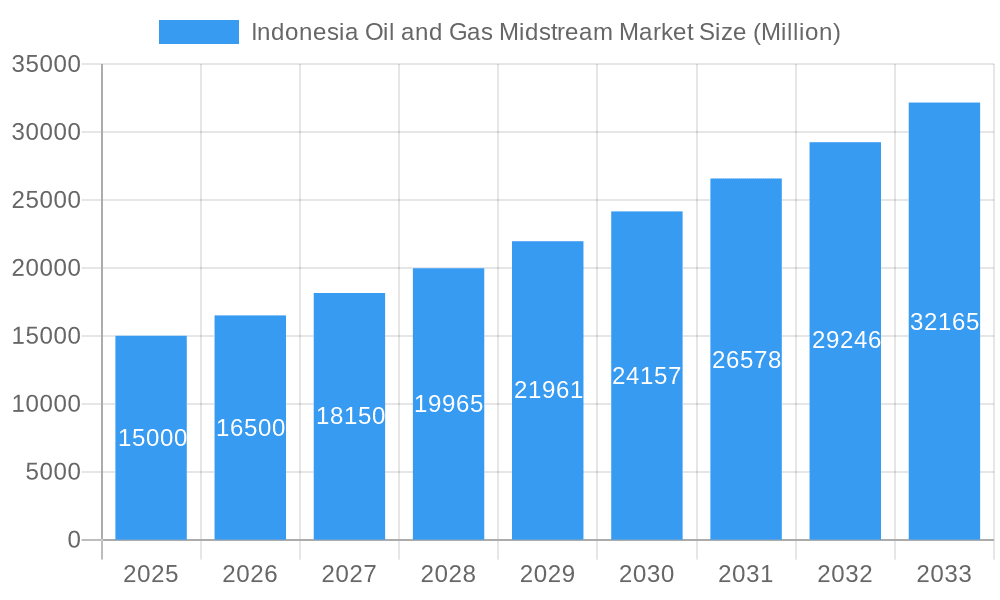

The Indonesian oil and gas midstream sector, covering crude oil and natural gas transportation, storage, and processing, is projected for substantial expansion. Based on current analysis, the market is estimated at $281.5 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 7.66% between 2025 and 2033. Key growth drivers include escalating domestic energy consumption and strategic infrastructure investments supporting both national demand and export potential. Government priorities focused on energy security and attracting foreign direct investment will further catalyze sector growth. However, challenges such as the modernization of aging infrastructure and the imperative for sustainable practices demand significant investment in pipeline, storage, and processing plant upgrades, alongside the exploration of innovative solutions like carbon capture. Enhanced regulatory clarity and streamlined administrative processes are vital for fostering a stable investment environment and accelerating project execution.

Indonesia Oil and Gas Midstream Market Market Size (In Billion)

This growth trajectory is underpinned by increasing domestic energy needs, supportive government policies for energy infrastructure enhancement, and Indonesia's expanding influence as a regional energy hub. While the global energy transition towards renewables presents a long-term consideration, the midstream sector can adapt by integrating renewable gas and hydrogen transportation. Despite these evolving dynamics, the Indonesian oil and gas midstream market offers significant opportunities for investors and stakeholders prepared to navigate the regulatory framework and embrace future energy trends.

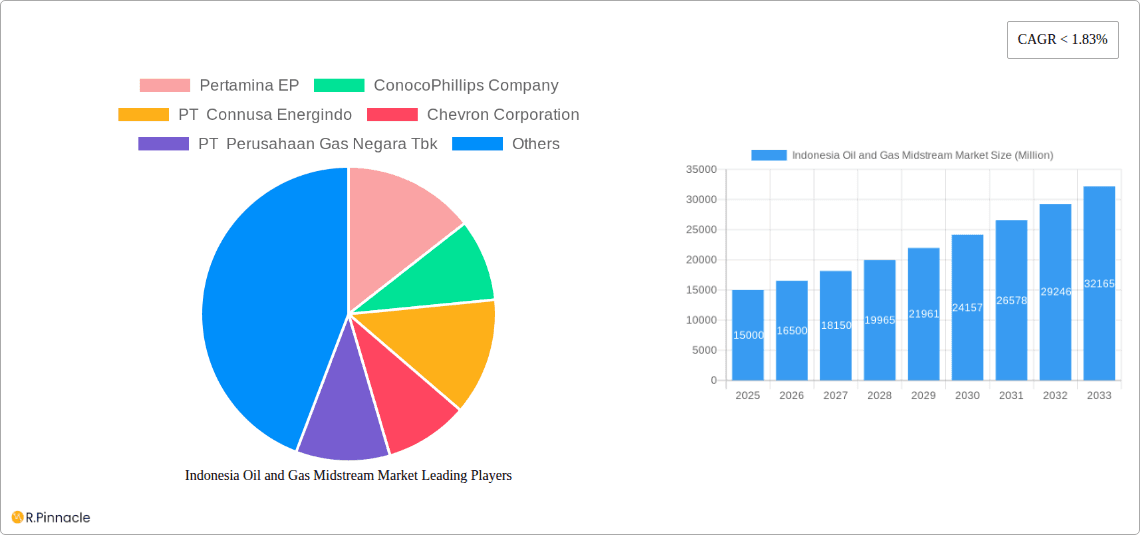

Indonesia Oil and Gas Midstream Market Company Market Share

Indonesia Oil & Gas Midstream Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Indonesia oil and gas midstream market, offering crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. We delve into key segments, including transportation, storage, and LNG terminals, highlighting dominant players like Pertamina EP, ConocoPhillips, PT Connusa Energindo, Chevron Corporation, and PT Perusahaan Gas Negara Tbk. Expect detailed analysis of market size, growth rates (CAGR), and key trends shaping this dynamic sector.

Indonesia Oil and Gas Midstream Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of Indonesia's oil and gas midstream market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. We examine the market share held by key players such as Pertamina EP, ConocoPhillips, and PT Perusahaan Gas Negara Tbk, assessing their strategic positioning and competitive advantages. The report also explores the impact of regulatory changes on market dynamics and the influence of technological innovation, including the adoption of digitalization and automation within midstream operations. Furthermore, we evaluate the influence of product substitutes and evolving end-user demographics, along with quantifying the value and impact of recent mergers and acquisitions (M&A) deals within the sector. The analysis incorporates data from the historical period (2019-2024), base year (2025), and estimated year (2025), providing a comprehensive overview of market structure and trends. M&A deal values are estimated at xx Million for the period 2019-2024. Market share data for 2025 will illustrate the dominance of specific players and potential shifts in market power.

- Market Share Analysis (2025): Pertamina EP (xx%), ConocoPhillips (xx%), PT Perusahaan Gas Negara Tbk (xx%), Others (xx%)

- Key M&A Activities (2019-2024): Deal values totaling approximately xx Million.

- Regulatory Framework Analysis: Impact of recent policy changes on market competition and investment.

- Innovation Drivers: Focus on technological advancements impacting efficiency and cost reduction.

Indonesia Oil and Gas Midstream Market Market Dynamics & Trends

This section delves into the factors driving market growth, technological disruptions, evolving consumer preferences (in terms of energy demand and type), and the competitive dynamics at play in Indonesia's oil and gas midstream sector. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), based on analysis of historical data and future market projections. Market penetration rates for key segments will also be analyzed, highlighting areas of significant growth and potential challenges. The report examines the impact of government policies, infrastructure development, and global energy trends on market expansion. Specific focus will be given to the influence of fluctuating oil and gas prices and the shift towards renewable energy sources on the overall market trajectory. The analysis encompasses the historical period (2019-2024) and projects future trends until 2033.

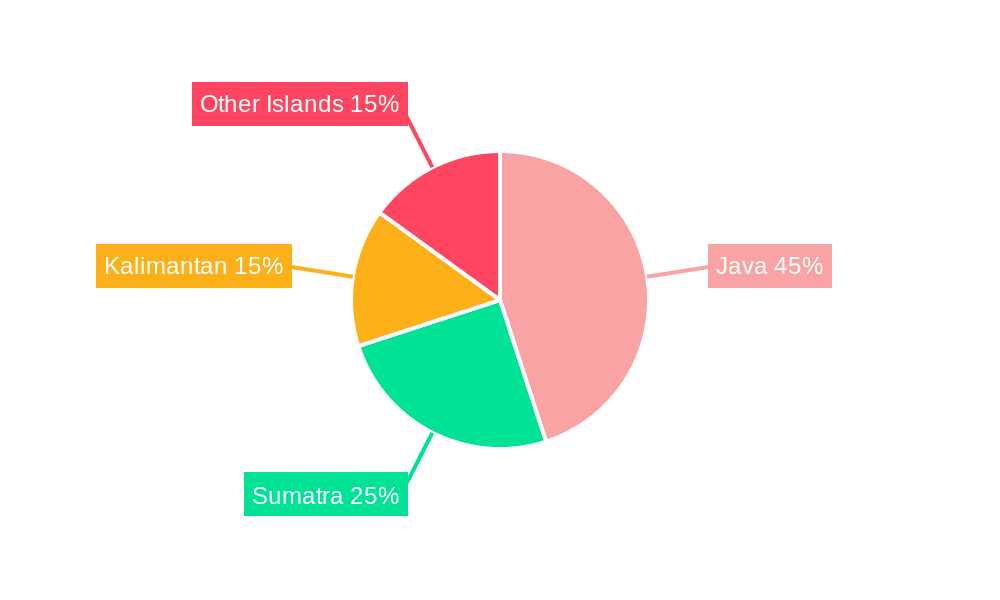

Dominant Regions & Segments in Indonesia Oil and Gas Midstream Market

This section identifies the leading regions and segments within Indonesia's oil and gas midstream market. The analysis considers the Transportation (pipelines, tankers, interconnections), Storage (underground storage facilities, LNG terminals, floating storage units), and LNG Terminals (import, export, regasification) segments. We will assess the market size and growth potential of each segment, identifying key drivers of dominance. This analysis will highlight the geographic concentration of midstream activities and the factors influencing regional disparities in market performance.

- Transportation: Dominant regions will be identified based on pipeline network density, tanker traffic volume, and interconnection infrastructure.

- Key Drivers: Government investment in pipeline infrastructure, proximity to production and consumption hubs.

- Storage: The analysis will identify the regions with the largest storage capacity (LNG terminals, underground storage) and factors behind their dominance.

- Key Drivers: Strategic location, proximity to demand centers, and government regulations.

- LNG Terminals: The report will identify the regions with the highest LNG import/export activity and analyze factors behind their dominance, such as the presence of regasification facilities.

- Key Drivers: Access to international LNG markets, government incentives for LNG import/export, and domestic demand for LNG.

Indonesia Oil and Gas Midstream Market Product Innovations

This section summarizes recent product developments, including advancements in pipeline technologies, LNG storage solutions, and improved transportation efficiency. The analysis focuses on the competitive advantages offered by these innovations and their impact on market dynamics. We highlight specific examples of technological trends and their adoption rate within the industry, explaining how these innovations are shaping the future of the Indonesian oil and gas midstream market.

Report Scope & Segmentation Analysis

This report comprehensively segments the Indonesian oil and gas midstream market based on Transportation (pipelines, tankers, interconnections), Storage (underground storage facilities, LNG terminals, floating storage units), and LNG Terminals (import, export, regasification facilities). Each segment's market size, growth projections (2025-2033), and competitive dynamics are analyzed. This section provides a detailed overview of the market's structure and the key characteristics of each segment.

- Transportation: Market size (2025): xx Million; Projected CAGR (2025-2033): xx%; Competitive dynamics: analysis of major players and their market share.

- Storage: Market size (2025): xx Million; Projected CAGR (2025-2033): xx%; Competitive dynamics: focusing on the role of private and state-owned companies.

- LNG Terminals: Market size (2025): xx Million; Projected CAGR (2025-2033): xx%; Competitive dynamics: analysis of import, export, and regasification capacities.

Key Drivers of Indonesia Oil and Gas Midstream Market Growth

Key drivers include increasing domestic energy demand, government investments in infrastructure development (particularly pipelines and LNG terminals), and supportive regulatory policies that aim to enhance energy security. The growing adoption of advanced technologies like automation and digitalization, to improve efficiency and optimize operations, is another significant driver. Furthermore, Indonesia's strategic location within the Asian energy market contributes to its importance as a transit point for LNG and other energy products.

Challenges in the Indonesia Oil and Gas Midstream Market Sector

Challenges include maintaining and upgrading aging infrastructure, balancing energy security needs with environmental concerns, and ensuring regulatory consistency to attract further investment. Supply chain disruptions can also significantly affect the industry. Furthermore, competition from other energy sources (e.g., renewable energy) poses a long-term challenge.

Emerging Opportunities in Indonesia Oil and Gas Midstream Market

Opportunities exist in developing and expanding midstream infrastructure to support future energy demand, particularly in the LNG sector. Further investments in pipeline networks and storage facilities will be vital. The increasing adoption of digital technologies presents an opportunity for increased efficiency and cost reduction within the industry. Exploring the potential of carbon capture and storage (CCS) technologies to reduce emissions is another significant opportunity.

Leading Players in the Indonesia Oil and Gas Midstream Market Market

- Pertamina EP

- ConocoPhillips Company

- PT Connusa Energindo

- Chevron Corporation

- PT Perusahaan Gas Negara Tbk

Key Developments in Indonesia Oil and Gas Midstream Market Industry

- 2022-Q4: Government announces plans for significant investment in pipeline infrastructure development.

- 2023-Q1: Major LNG terminal expansion project commences.

- 2024-Q2: New regulatory framework introduced to encourage private sector participation in the midstream sector.

- Further key developments will be included in the final report.

Future Outlook for Indonesia Oil and Gas Midstream Market Market

The Indonesian oil and gas midstream market is projected to experience continued growth, driven by increasing domestic energy demand and investments in infrastructure projects. Strategic opportunities exist for companies that can adapt to evolving technological landscapes and regulatory changes. This growth will be further influenced by regional energy dynamics and global trends in the oil and gas sector, making a flexible and adaptable approach critical for success in this dynamic market.

Indonesia Oil and Gas Midstream Market Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

-

3. LNG Terminals

-

3.1. Overview

- 3.1.1. Existing Infrastructure

- 3.1.2. Projects in Pipeline

- 3.1.3. Upcoming Projects

-

3.1. Overview

Indonesia Oil and Gas Midstream Market Segmentation By Geography

- 1. Indonesia

Indonesia Oil and Gas Midstream Market Regional Market Share

Geographic Coverage of Indonesia Oil and Gas Midstream Market

Indonesia Oil and Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Pipeline Capacity to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.1.1. Existing Infrastructure

- 5.3.1.2. Projects in Pipeline

- 5.3.1.3. Upcoming Projects

- 5.3.1. Overview

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pertamina EP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ConocoPhillips Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Connusa Energindo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chevron Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Perusahaan Gas Negara Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Pertamina EP

List of Figures

- Figure 1: Indonesia Oil and Gas Midstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Oil and Gas Midstream Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 2: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2020 & 2033

- Table 3: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Storage 2020 & 2033

- Table 4: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Storage 2020 & 2033

- Table 5: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by LNG Terminals 2020 & 2033

- Table 6: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2020 & 2033

- Table 7: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 10: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2020 & 2033

- Table 11: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Storage 2020 & 2033

- Table 12: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Storage 2020 & 2033

- Table 13: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by LNG Terminals 2020 & 2033

- Table 14: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2020 & 2033

- Table 15: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Oil and Gas Midstream Market?

The projected CAGR is approximately 7.66%.

2. Which companies are prominent players in the Indonesia Oil and Gas Midstream Market?

Key companies in the market include Pertamina EP, ConocoPhillips Company, PT Connusa Energindo, Chevron Corporation, PT Perusahaan Gas Negara Tbk.

3. What are the main segments of the Indonesia Oil and Gas Midstream Market?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD 281.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Pipeline Capacity to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Oil and Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Oil and Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Oil and Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Indonesia Oil and Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence