Key Insights

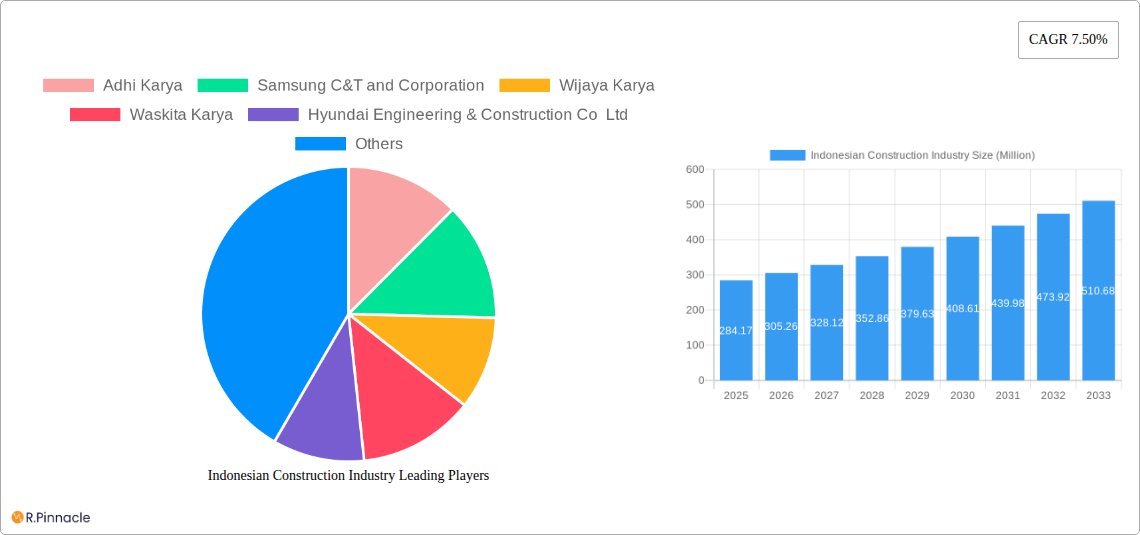

The Indonesian construction industry, valued at $284.17 million in 2025, is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033. This expansion is driven by several key factors. Firstly, significant government investment in infrastructure projects, particularly in transportation networks, aligns with Indonesia's national development plans, fueling demand for construction services. Secondly, a burgeoning population and rapid urbanization are boosting residential and commercial construction activities. The increasing need for modern energy infrastructure and the expansion of industrial sectors contribute further to the market's dynamism. Key segments like infrastructure (transportation) construction and energy & utilities construction are expected to witness particularly strong growth. Leading players like Adhi Karya, Wijaya Karya, and Samsung C&T are capitalizing on these opportunities, although competition remains fierce. While challenges such as material price fluctuations and potential labor shortages exist, the overall positive economic outlook and sustained government support suggest a bright outlook for the Indonesian construction industry.

The industry's segmentation reveals diverse growth trajectories. While Commercial and Residential construction contribute significantly to the current market value, Infrastructure (Transportation) construction is anticipated to exhibit the fastest growth in the coming years due to large-scale government projects. The Energy and Utilities sector will also see increasing investment, driven by the need for improved power generation and distribution networks. The success of major players will depend on their ability to secure contracts, manage risks associated with project delays and cost overruns, and adapt to evolving technological advancements in construction methods and materials. Analyzing the historical period from 2019 to 2024 provides a valuable benchmark for predicting future growth, considering economic fluctuations and government policy changes within this timeframe.

Indonesian Construction Industry Report: 2019-2033 Forecast

Dive deep into the dynamic Indonesian construction market with this comprehensive report, projecting a robust expansion from 2025 to 2033. This in-depth analysis provides critical insights for industry professionals, investors, and policymakers seeking to navigate this lucrative sector. The report covers market size, segmentation, key players, and future trends, offering a complete picture of Indonesia's construction landscape. Benefit from detailed data and expert analysis to inform strategic decision-making in this rapidly evolving market.

Indonesian Construction Industry Market Structure & Innovation Trends

This section analyzes the Indonesian construction market's competitive landscape, highlighting key trends influencing its evolution. We examine market concentration, revealing the market share held by leading players such as Adhi Karya, Wijaya Karya, Waskita Karya, and PT PP (Persero), alongside international giants like Samsung C&T and Hyundai Engineering & Construction Co Ltd. The report further investigates innovation drivers, including government initiatives promoting sustainable construction and technological advancements like Building Information Modeling (BIM). Regulatory frameworks impacting the industry, the presence of product substitutes, and the demographics of end-users are also thoroughly explored. Finally, we delve into merger and acquisition (M&A) activities, analyzing deal values and their impact on market consolidation. The report estimates that M&A activity in the period 2019-2024 totalled approximately xx Million USD.

- Market Concentration: Analysis of market share for top players (Adhi Karya, Wijaya Karya, etc.)

- Innovation Drivers: Focus on technological advancements (BIM, prefabrication) and government policies.

- Regulatory Framework: Examination of building codes, permits, and environmental regulations.

- M&A Activity: Analysis of deal values and impact on market structure in 2019-2024 (estimated at xx Million USD).

Indonesian Construction Industry Market Dynamics & Trends

This section explores the key drivers and trends shaping the Indonesian construction market's growth trajectory during the forecast period (2025-2033). We analyze market growth drivers, including infrastructure development projects fueled by government spending and the burgeoning population's housing needs. Technological disruptions, such as the increased adoption of prefabrication and BIM, are examined for their impact on efficiency and cost reduction. Furthermore, the report investigates evolving consumer preferences, focusing on demand for sustainable and resilient buildings. The competitive landscape is also analyzed, exploring strategies adopted by key players to maintain their market positions. We project a Compound Annual Growth Rate (CAGR) of xx% for the Indonesian construction market during 2025-2033, with market penetration rates detailed by segment.

Dominant Regions & Segments in Indonesian Construction Industry

This section identifies the leading regions and segments within the Indonesian construction market. Growth is driven by a combination of factors including infrastructure spending, urbanization, and economic development. Detailed analysis is provided for each major segment (Commercial, Residential, Industrial, Infrastructure, and Energy & Utilities Construction).

- Infrastructure (Transportation) Construction: This segment is expected to dominate due to substantial government investment in roads, railways, and airports. Key drivers include:

- Massive government spending on infrastructure projects.

- Growing demand for improved transportation networks in urban and rural areas.

- Residential Construction: Driven by population growth and increasing urbanization, leading to high demand for housing.

- Commercial Construction: Growth is influenced by economic growth, foreign investment, and expansion of business activities.

Indonesian Construction Industry Product Innovations

This section highlights the latest product innovations and technological advancements transforming the Indonesian construction industry. We examine the applications of innovative materials, construction techniques, and digital technologies, assessing their impact on efficiency, sustainability, and cost-effectiveness. This includes the integration of BIM, the adoption of prefabrication methods, and the use of sustainable building materials. The competitive advantages offered by these innovations are also analyzed.

Report Scope & Segmentation Analysis

This report provides a comprehensive overview of the Indonesian construction industry, segmented by sector:

- Commercial Construction: This segment encompasses office buildings, shopping malls, and other commercial structures. Market size in 2025 is estimated at xx Million USD, projected to reach xx Million USD by 2033. Competitive dynamics are characterized by a mix of local and international players.

- Residential Construction: This segment includes housing projects ranging from affordable to luxury developments. Market size in 2025 is projected at xx Million USD, with a projected value of xx Million USD by 2033.

- Industrial Construction: This sector focuses on factories, warehouses, and other industrial facilities. The 2025 market size is estimated at xx Million USD, anticipated to reach xx Million USD by 2033.

- Infrastructure (Transportation) Construction: This includes roads, railways, airports, and other transport infrastructure. Market size in 2025 is estimated at xx Million USD, with an anticipated value of xx Million USD by 2033.

- Energy and Utilities Construction: This encompasses power plants, pipelines, and other energy-related infrastructure. The 2025 market size is projected at xx Million USD, anticipated to reach xx Million USD by 2033.

Key Drivers of Indonesian Construction Industry Growth

The Indonesian construction industry's growth is propelled by several factors. Robust economic growth fuels demand for new buildings and infrastructure. Government initiatives, such as the development of new cities and infrastructure projects, significantly contribute to market expansion. Technological advancements enhance efficiency and reduce construction timelines. The growing population and rapid urbanization further intensify the demand for housing and commercial spaces.

Challenges in the Indonesian Construction Industry Sector

The Indonesian construction industry faces various challenges. Land acquisition and permitting processes can be lengthy and complex, delaying project timelines. Supply chain disruptions can impact material availability and costs, affecting project budgets and schedules. Intense competition among numerous players can also squeeze profit margins. The labor force skills gap poses a challenge for quality and efficiency.

Emerging Opportunities in Indonesian Construction Industry

Despite challenges, several opportunities exist for growth. The government's focus on infrastructure development creates significant prospects for construction firms. The rising demand for sustainable and green buildings presents opportunities for companies offering eco-friendly solutions. The adoption of innovative construction technologies and digital solutions can enhance efficiency and competitiveness.

Leading Players in the Indonesian Construction Industry Market

- Adhi Karya

- Samsung C&T and Corporation

- Wijaya Karya

- Waskita Karya

- Hyundai Engineering & Construction Co Ltd

- PT Jaya Konstruksi Manggala Pratama

- McConnell Dowell

- Toyo Construction Co Ltd

- Chiyoda Corp

- TBEA Co Ltd

- PT PP (Persero)

Key Developments in Indonesian Construction Industry

- 2022 Q4: Government announces a large-scale infrastructure development program, boosting investment in the sector.

- 2023 Q1: Several major construction companies merge, leading to greater market consolidation.

- 2023 Q3: Introduction of new building codes emphasizing sustainable construction practices.

Future Outlook for Indonesian Construction Industry Market

The Indonesian construction market is poised for continued growth driven by sustained economic expansion and strong government support for infrastructure projects. The increasing adoption of technological innovations will enhance efficiency and productivity. Opportunities exist for companies focusing on sustainable and green building solutions. The market's future potential remains significant, presenting attractive prospects for both local and international players.

Indonesian Construction Industry Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

Indonesian Construction Industry Segmentation By Geography

- 1. Indonesia

Indonesian Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Policies and Regulatory Support; Tourism and Hospitality Sector Growth

- 3.3. Market Restrains

- 3.3.1. Financial and Funding Challenges

- 3.4. Market Trends

- 3.4.1. Growth of Infrastructural Plans Drives the Construction Market In Indonesia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesian Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Adhi Karya

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung C&T and Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wijaya Karya

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Waskita Karya

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Engineering & Construction Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Jaya Konstruksi Manggala Pratama**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 McConnell Dowell

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyo Construction Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chiyoda Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TBEA Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT PP (Persero)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Adhi Karya

List of Figures

- Figure 1: Indonesian Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesian Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesian Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesian Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Indonesian Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Indonesian Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Indonesian Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Indonesian Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesian Construction Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Indonesian Construction Industry?

Key companies in the market include Adhi Karya, Samsung C&T and Corporation, Wijaya Karya, Waskita Karya, Hyundai Engineering & Construction Co Ltd, PT Jaya Konstruksi Manggala Pratama**List Not Exhaustive, McConnell Dowell, Toyo Construction Co Ltd, Chiyoda Corp, TBEA Co Ltd, PT PP (Persero).

3. What are the main segments of the Indonesian Construction Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 284.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Policies and Regulatory Support; Tourism and Hospitality Sector Growth.

6. What are the notable trends driving market growth?

Growth of Infrastructural Plans Drives the Construction Market In Indonesia.

7. Are there any restraints impacting market growth?

Financial and Funding Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesian Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesian Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesian Construction Industry?

To stay informed about further developments, trends, and reports in the Indonesian Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence