Key Insights

The global industrial bearings market is projected for substantial growth, forecasted to reach $148.29 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.3% through 2033. This expansion is driven by robust demand from key sectors including mining & metal, construction, and energy. Advancements in automotive technology, particularly the rise of electric vehicles, and the expanding material handling sector, fueled by e-commerce, further propel market growth. The Asia Pacific region exhibits significant potential due to rapid industrialization and infrastructure development.

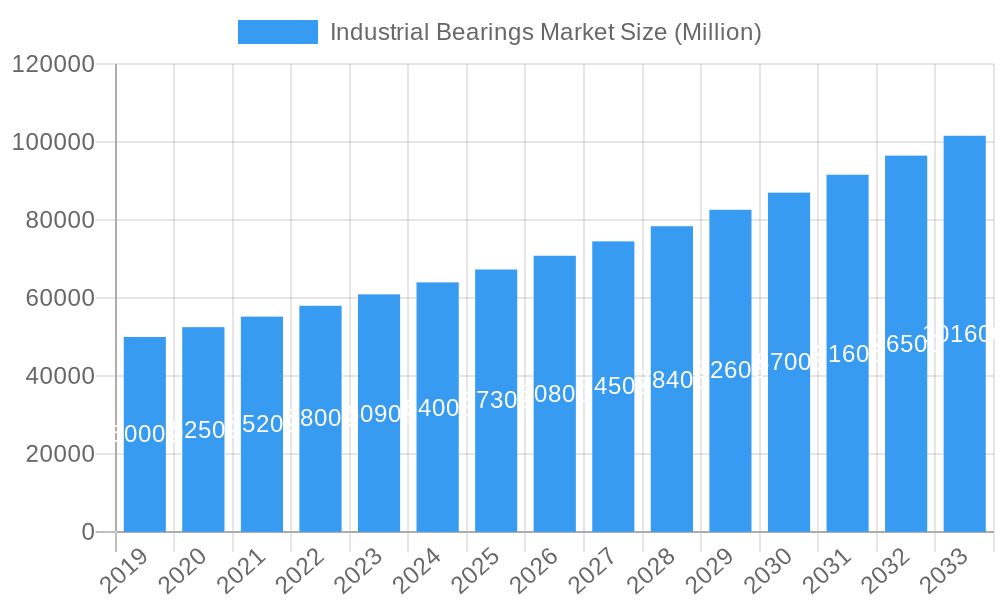

Industrial Bearings Market Market Size (In Billion)

The market features a diverse product landscape, with ball and roller bearings dominating due to their broad applicability. Emerging specialized bearing technologies present niche opportunities. Key trends include the increasing demand for high-precision, low-friction bearings to improve energy efficiency and reduce operational costs. The adoption of smart bearings with predictive maintenance capabilities is a significant trend, aiming to minimize downtime and optimize asset performance. While volatile raw material prices and intense competition present challenges, the industrial bearings market outlook remains highly positive, underpinned by continuous innovation and the critical role of bearings in industrial operations.

Industrial Bearings Market Company Market Share

This comprehensive report offers critical insights into the global Industrial Bearings Market dynamics, technological advancements, regional trends, and key growth drivers from 2019 to 2033. It is designed for industry professionals, procurement managers, investors, and strategic planners, providing actionable intelligence for navigating the evolving industrial bearing solutions landscape.

Industrial Bearings Market Market Structure & Innovation Trends

The Industrial Bearings Market exhibits a moderately concentrated structure, with a blend of large multinational corporations and specialized regional manufacturers. Innovation is a primary driver, fueled by the demand for enhanced efficiency, reduced maintenance, and improved lifespan across diverse industrial applications. Key innovation trends include the integration of smart technologies, development of advanced materials for extreme environments, and miniaturization of bearing solutions. Regulatory frameworks primarily focus on product safety, environmental impact, and performance standards, influencing manufacturing processes and material choices. Product substitutes, while present in niche applications, are generally outcompeted by the specialized performance and reliability offered by bearings. End-user demographics are broad, encompassing heavy industries like mining and construction to high-precision sectors such as aerospace and automotive. Mergers and acquisitions (M&A) activities are strategic, often aimed at expanding product portfolios, gaining market access, or acquiring innovative technologies. For instance, historical M&A deal values in the past five years have ranged from tens of millions to hundreds of millions of dollars, indicating consolidation and strategic growth. Leading players hold significant market share, but innovation allows agile competitors to gain traction.

Industrial Bearings Market Market Dynamics & Trends

The Industrial Bearings Market is poised for robust growth, driven by escalating industrialization, infrastructure development, and the relentless pursuit of operational efficiency across the globe. A projected Compound Annual Growth Rate (CAGR) of approximately 5.5% for the forecast period 2025-2033 underscores this expansion. Technological disruptions are continuously reshaping the market, with a notable shift towards smart bearings incorporating sensors for real-time condition monitoring and predictive maintenance. This trend significantly enhances uptime and reduces costly unplanned downtime. Consumer preferences are increasingly leaning towards bearings that offer extended service life, lower friction, higher load capacities, and improved energy efficiency. The automotive sector, for example, is demanding lighter, more durable bearings for electric vehicles. Competitive dynamics are characterized by intense rivalry based on product quality, technological innovation, price, and customer service. Companies are investing heavily in research and development to gain a competitive edge. Market penetration of advanced bearing technologies is steadily increasing, especially in sectors like renewable energy and advanced manufacturing, where performance is paramount. The increasing adoption of Industry 4.0 principles further fuels the demand for intelligent and connected bearing solutions, pushing the market towards a more data-driven and proactive maintenance paradigm.

Dominant Regions & Segments in Industrial Bearings Market

The Asia-Pacific region is projected to maintain its dominance in the Industrial Bearings Market throughout the forecast period. This leadership is propelled by robust economic growth, extensive industrialization, and significant investments in manufacturing and infrastructure development across countries like China, India, and South Korea.

- Key Drivers for Asia-Pacific Dominance:

- Rapid Industrialization: Expansion of manufacturing, automotive, and construction sectors fuels demand.

- Government Initiatives: Supportive policies for manufacturing and infrastructure projects.

- Growing Automotive Sector: Increased production of vehicles, including electric variants.

- Technological Adoption: Increasing uptake of advanced manufacturing and automation.

Among end-user industries, Automotive and Construction are expected to be major contributors to market growth. The automotive sector's transition towards electric vehicles, requiring specialized bearings for lighter weight and higher efficiency, is a significant trend. The construction industry's continuous global expansion, driven by urbanization and infrastructure projects, also generates substantial demand for robust and durable bearings in heavy machinery.

In terms of Bearing Type, Roller Bearings are anticipated to hold a significant market share due to their superior load-carrying capacity and suitability for heavy-duty applications in industries like mining, construction, and heavy machinery. However, Ball Bearings will remain crucial for applications requiring high speeds and precision, such as in the automotive and aerospace sectors.

- Dominance Analysis by Segment:

- End-user Industry: The Automotive industry’s continuous evolution, especially with the rise of EVs, alongside the persistent demand from the Construction and Energy sectors, solidifies their leading positions. The mining and metal industry, despite its cyclical nature, remains a significant consumer of heavy-duty bearings.

- Bearing Type: Roller Bearings are vital for high-load applications, making sectors like construction and mining significant demand drivers. Ball Bearings remain indispensable for high-speed, precision applications in automotive and aerospace.

The dominance of these regions and segments is further reinforced by factors such as favorable economic policies, increasing disposable incomes, and technological advancements tailored to specific regional needs.

Industrial Bearings Market Product Innovations

Product innovations in the Industrial Bearings Market are primarily focused on enhancing performance, durability, and intelligence. This includes the development of bearings with advanced lubrication systems for extended life, novel materials for extreme temperature or corrosive environments, and the integration of sensors for real-time condition monitoring and predictive maintenance. For example, the development of sensor-integrated bearings like NTN Corporation's "Talking Bearing" offers unparalleled capabilities for early abnormality detection. These innovations provide competitive advantages by enabling industries to achieve higher operational efficiency, reduce maintenance costs, and improve overall equipment reliability, thereby meeting the evolving demands of sectors like renewable energy and advanced manufacturing.

Report Scope & Segmentation Analysis

This report meticulously segments the Industrial Bearings Market by Bearing Type and End-user Industry. The Bearing Type segmentation includes Ball Bearings, Roller Bearings, and Other Bearings. Growth projections indicate steady expansion across all types, with roller bearings likely to see robust demand from heavy industries. The End-user Industry segmentation encompasses Mining and Metal, Material Handling, Construction, Energy, Aerospace, Automotive, Food and Beverage, and Other End-user Industries. Each segment is analyzed for its current market size, projected growth rate, and the competitive landscape influencing its development. For instance, the Automotive segment is expected to witness strong growth due to the electrification trend.

Key Drivers of Industrial Bearings Market Growth

The Industrial Bearings Market is propelled by several key growth drivers. Foremost among these is the global expansion of manufacturing and infrastructure development, particularly in emerging economies, which necessitates a continuous supply of industrial bearings for machinery and equipment. Technological advancements, such as the integration of smart sensors for predictive maintenance and the development of high-performance materials, are creating new market opportunities and driving demand for advanced bearing solutions. The increasing focus on energy efficiency and operational cost reduction across industries also fuels the adoption of bearings that offer lower friction and extended service life. Furthermore, government initiatives promoting industrial growth and technological innovation indirectly contribute to market expansion.

Challenges in the Industrial Bearings Market Sector

Despite the promising growth trajectory, the Industrial Bearings Market faces several challenges. Fluctuations in raw material prices, particularly for steel, can impact manufacturing costs and profit margins. Supply chain disruptions, as witnessed in recent years, can lead to production delays and affect product availability. Intense price competition among numerous players, especially in the commoditized segments, puts pressure on profitability. Moreover, the stringent quality and performance requirements in niche sectors like aerospace and medical devices necessitate significant R&D investment and adherence to rigorous certifications, posing a barrier to entry for smaller players. The environmental impact of manufacturing processes and the disposal of end-of-life bearings are also becoming increasingly scrutinized.

Emerging Opportunities in Industrial Bearings Market

The Industrial Bearings Market is ripe with emerging opportunities. The rapid growth of the renewable energy sector, especially wind and solar power, is creating substantial demand for specialized, high-performance bearings. The increasing adoption of electric vehicles (EVs) presents a significant opportunity for manufacturers to develop and supply bearings optimized for EV powertrains and components. The ongoing digital transformation (Industry 4.0) is driving the demand for smart bearings with integrated sensors for condition monitoring and predictive maintenance, opening avenues for innovative product development and service offerings. Furthermore, the burgeoning industrial sectors in emerging economies offer significant untapped market potential.

Leading Players in the Industrial Bearings Market Market

- JTEKT Corporation

- NTN Corporation

- The Timken Company

- THB Bearings Co Ltd

- NSK Ltd

- SKF

- RBC Bearings

- MinebeaMitsumi Inc

- Rexnord Corporation

- HKT BEARINGS LIMITED

Key Developments in Industrial Bearings Market Industry

- July 2022: NTN Corporation developed the "Talking Bearing," a sensor-integrated bearing that wirelessly transmits temperature, vibration, and rotational speed information, enabling advanced condition monitoring and early abnormality detection.

- June 2022: The Timken Company announced the design and supply of main shaft bearings for GE Renewable Energy's Haliade-X, the world's most powerful offshore wind turbine.

Future Outlook for Industrial Bearings Market Market

The future outlook for the Industrial Bearings Market is exceptionally positive, driven by ongoing technological advancements and the sustained demand from critical global industries. The increasing integration of smart technologies, such as IoT and AI-powered predictive maintenance, will continue to define the market, leading to more efficient and reliable industrial operations. The ongoing transition towards electric mobility and the expansion of renewable energy infrastructure will further accelerate demand for specialized and high-performance bearing solutions. Strategic investments in R&D, capacity expansion, and market penetration in emerging economies will be crucial for players aiming to capitalize on future growth opportunities and maintain a competitive edge in this dynamic and evolving market. The market is expected to witness significant value creation through innovation and the development of sustainable bearing solutions.

Industrial Bearings Market Segmentation

-

1. Bearing Type

- 1.1. Ball Bearings

- 1.2. Roller Bearings

- 1.3. Other Bearings

-

2. End-user Industry

- 2.1. Mining and Metal

- 2.2. Material handling

- 2.3. Construction

- 2.4. Energy

- 2.5. Aerospace

- 2.6. Automotive

- 2.7. Food and Beverage

- 2.8. Other End-user Industries

Industrial Bearings Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Industrial Bearings Market Regional Market Share

Geographic Coverage of Industrial Bearings Market

Industrial Bearings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Bearings from the Automotive Industry; Evolution of Smart Technologies Embedded in Bearings

- 3.3. Market Restrains

- 3.3.1. Cyber Security concerns may hinder the growth of the sports betting kiosk market

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Bearings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bearing Type

- 5.1.1. Ball Bearings

- 5.1.2. Roller Bearings

- 5.1.3. Other Bearings

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Mining and Metal

- 5.2.2. Material handling

- 5.2.3. Construction

- 5.2.4. Energy

- 5.2.5. Aerospace

- 5.2.6. Automotive

- 5.2.7. Food and Beverage

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Bearing Type

- 6. North America Industrial Bearings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Bearing Type

- 6.1.1. Ball Bearings

- 6.1.2. Roller Bearings

- 6.1.3. Other Bearings

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Mining and Metal

- 6.2.2. Material handling

- 6.2.3. Construction

- 6.2.4. Energy

- 6.2.5. Aerospace

- 6.2.6. Automotive

- 6.2.7. Food and Beverage

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Bearing Type

- 7. Europe Industrial Bearings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Bearing Type

- 7.1.1. Ball Bearings

- 7.1.2. Roller Bearings

- 7.1.3. Other Bearings

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Mining and Metal

- 7.2.2. Material handling

- 7.2.3. Construction

- 7.2.4. Energy

- 7.2.5. Aerospace

- 7.2.6. Automotive

- 7.2.7. Food and Beverage

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Bearing Type

- 8. Asia Pacific Industrial Bearings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Bearing Type

- 8.1.1. Ball Bearings

- 8.1.2. Roller Bearings

- 8.1.3. Other Bearings

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Mining and Metal

- 8.2.2. Material handling

- 8.2.3. Construction

- 8.2.4. Energy

- 8.2.5. Aerospace

- 8.2.6. Automotive

- 8.2.7. Food and Beverage

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Bearing Type

- 9. Latin America Industrial Bearings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Bearing Type

- 9.1.1. Ball Bearings

- 9.1.2. Roller Bearings

- 9.1.3. Other Bearings

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Mining and Metal

- 9.2.2. Material handling

- 9.2.3. Construction

- 9.2.4. Energy

- 9.2.5. Aerospace

- 9.2.6. Automotive

- 9.2.7. Food and Beverage

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Bearing Type

- 10. Middle East and Africa Industrial Bearings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Bearing Type

- 10.1.1. Ball Bearings

- 10.1.2. Roller Bearings

- 10.1.3. Other Bearings

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Mining and Metal

- 10.2.2. Material handling

- 10.2.3. Construction

- 10.2.4. Energy

- 10.2.5. Aerospace

- 10.2.6. Automotive

- 10.2.7. Food and Beverage

- 10.2.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Bearing Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JTEKT Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NTN Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Timken Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 THB Bearings Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NSK Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SKF

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RBC Bearings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MinebeaMitsumi Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rexnord Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HKT BEARINGS LIMITED*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 JTEKT Corporation

List of Figures

- Figure 1: Global Industrial Bearings Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Industrial Bearings Market Revenue (billion), by Bearing Type 2025 & 2033

- Figure 3: North America Industrial Bearings Market Revenue Share (%), by Bearing Type 2025 & 2033

- Figure 4: North America Industrial Bearings Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Industrial Bearings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Industrial Bearings Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Industrial Bearings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Industrial Bearings Market Revenue (billion), by Bearing Type 2025 & 2033

- Figure 9: Europe Industrial Bearings Market Revenue Share (%), by Bearing Type 2025 & 2033

- Figure 10: Europe Industrial Bearings Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Industrial Bearings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Industrial Bearings Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Industrial Bearings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Industrial Bearings Market Revenue (billion), by Bearing Type 2025 & 2033

- Figure 15: Asia Pacific Industrial Bearings Market Revenue Share (%), by Bearing Type 2025 & 2033

- Figure 16: Asia Pacific Industrial Bearings Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Industrial Bearings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Industrial Bearings Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Industrial Bearings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Industrial Bearings Market Revenue (billion), by Bearing Type 2025 & 2033

- Figure 21: Latin America Industrial Bearings Market Revenue Share (%), by Bearing Type 2025 & 2033

- Figure 22: Latin America Industrial Bearings Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Latin America Industrial Bearings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Industrial Bearings Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Industrial Bearings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Industrial Bearings Market Revenue (billion), by Bearing Type 2025 & 2033

- Figure 27: Middle East and Africa Industrial Bearings Market Revenue Share (%), by Bearing Type 2025 & 2033

- Figure 28: Middle East and Africa Industrial Bearings Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Industrial Bearings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Industrial Bearings Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Industrial Bearings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Bearings Market Revenue billion Forecast, by Bearing Type 2020 & 2033

- Table 2: Global Industrial Bearings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Industrial Bearings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Bearings Market Revenue billion Forecast, by Bearing Type 2020 & 2033

- Table 5: Global Industrial Bearings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Industrial Bearings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Industrial Bearings Market Revenue billion Forecast, by Bearing Type 2020 & 2033

- Table 10: Global Industrial Bearings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Industrial Bearings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Industrial Bearings Market Revenue billion Forecast, by Bearing Type 2020 & 2033

- Table 17: Global Industrial Bearings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Industrial Bearings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Industrial Bearings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Industrial Bearings Market Revenue billion Forecast, by Bearing Type 2020 & 2033

- Table 24: Global Industrial Bearings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Industrial Bearings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Industrial Bearings Market Revenue billion Forecast, by Bearing Type 2020 & 2033

- Table 27: Global Industrial Bearings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Industrial Bearings Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Bearings Market?

The projected CAGR is approximately 9.3%.

2. Which companies are prominent players in the Industrial Bearings Market?

Key companies in the market include JTEKT Corporation, NTN Corporation, The Timken Company, THB Bearings Co Ltd, NSK Ltd, SKF, RBC Bearings, MinebeaMitsumi Inc, Rexnord Corporation, HKT BEARINGS LIMITED*List Not Exhaustive.

3. What are the main segments of the Industrial Bearings Market?

The market segments include Bearing Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 148.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Bearings from the Automotive Industry; Evolution of Smart Technologies Embedded in Bearings.

6. What are the notable trends driving market growth?

Automotive Sector to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Cyber Security concerns may hinder the growth of the sports betting kiosk market.

8. Can you provide examples of recent developments in the market?

July 2022: NTN Corporation developed a sensor-integrated bearing, the Talking Bearing, that incorporates sensors, power generation units, and wireless devices into the bearing and wirelessly transmits temperature, vibration, and rotational speed information. As the sensors are built into the bearing, the newly developed product realizes more advanced condition monitoring and early abnormality detection than sensors attached to the outside equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Bearings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Bearings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Bearings Market?

To stay informed about further developments, trends, and reports in the Industrial Bearings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence