Key Insights

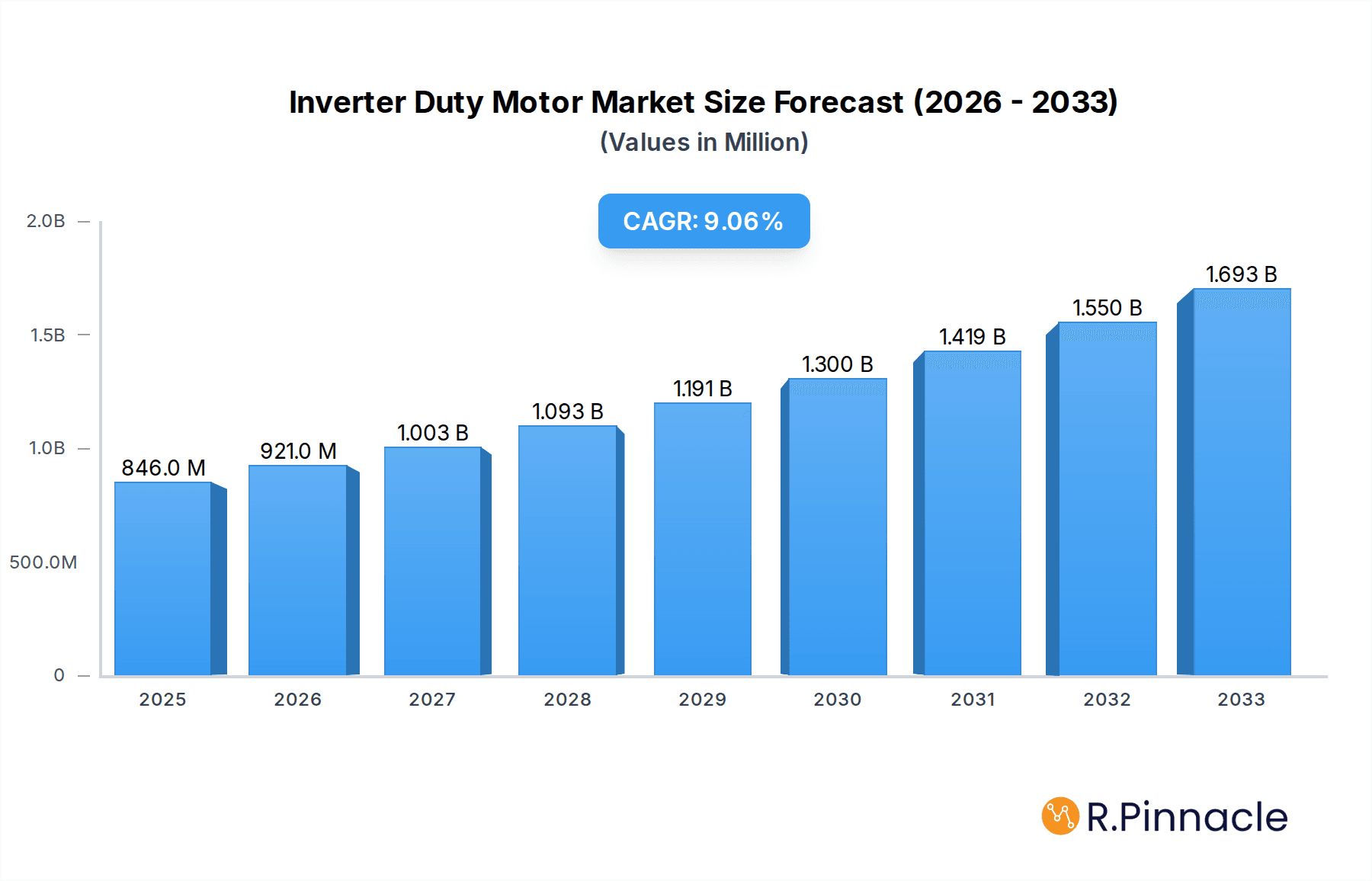

The global Inverter Duty Motor Market is poised for robust expansion, projected to reach $846 million by 2025, with an impressive compound annual growth rate (CAGR) of 8.9% expected through 2033. This significant growth is fueled by the increasing adoption of variable frequency drives (VFDs) across various industrial applications, driven by the demand for enhanced energy efficiency and precise process control. Industries like Oil & Gas, Chemicals, and Metal & Mining are at the forefront of this adoption, leveraging inverter duty motors for their ability to optimize operations, reduce energy consumption, and extend equipment lifespan. The growing emphasis on automation, smart manufacturing, and Industry 4.0 initiatives further bolsters the market's trajectory. Additionally, the development of advanced motor technologies, including those with higher power density and improved thermal management, will continue to drive innovation and market demand.

Inverter Duty Motor Market Market Size (In Million)

The market is segmented across key applications such as Conveyors, Pumps, and Fans, with "Others" encompassing a range of specialized uses. End-user industries are diverse, with Oil & Gas, Chemicals, Metal & Mining, and Food & Beverage leading the charge, alongside significant contributions from the Construction sector. The materials used in these motors, primarily Laminated Steel and Cast Iron, are undergoing continuous refinement to meet stringent performance and durability requirements. Key players like Siemens AG, ABB Ltd, and Nidec Motor Corporation are actively investing in research and development to introduce innovative solutions and expand their global footprint. While the market exhibits strong growth potential, factors such as the initial cost of inverter duty motor systems and the need for specialized technical expertise for installation and maintenance could pose moderate restraints. However, the long-term benefits in terms of energy savings and operational efficiency are expected to outweigh these challenges, ensuring sustained market expansion.

Inverter Duty Motor Market Company Market Share

Unlock the strategic advantage within the dynamic Inverter Duty Motor Market with this in-depth, SEO-optimized industry report. Designed for industry professionals, procurement managers, and strategic planners, this report offers unparalleled insights into market trends, growth drivers, competitive landscapes, and future projections. Leveraging high-ranking keywords such as "variable frequency drive motors," "energy-efficient motors," "industrial automation," and "electric motor market," we provide a definitive roadmap for navigating this rapidly evolving sector. Our analysis spans the historical period of 2019–2024, the base and estimated year of 2025, and a comprehensive forecast period from 2025–2033, projecting the market to reach $xx billion by 2033 with a robust CAGR of xx%.

Inverter Duty Motor Market Market Structure & Innovation Trends

The Inverter Duty Motor Market exhibits a moderately concentrated structure, with key players like Siemens AG, ABB Ltd, and Rockwell Automation Inc holding significant market share, estimated at xx% combined. Innovation is primarily driven by the increasing demand for energy efficiency, advanced control capabilities, and enhanced durability in demanding industrial applications. Regulatory frameworks, particularly those focused on energy conservation and emissions reduction, are also shaping product development and market adoption. The emergence of IoT-enabled motors, offering predictive maintenance and remote monitoring, represents a significant technological advancement. Product substitutes, though present in the form of traditional motors for non-variable speed applications, are increasingly being challenged by the cost-effectiveness and performance benefits of inverter duty motors. End-user demographics are shifting towards industries prioritizing operational efficiency and reduced energy consumption. Recent M&A activities, such as the acquisition of [Company Name] by [Acquiring Company Name] for $xx million in [Year], highlight the consolidation trend and strategic focus on expanding product portfolios and market reach.

Inverter Duty Motor Market Market Dynamics & Trends

The Inverter Duty Motor Market is experiencing a significant growth trajectory, propelled by a confluence of powerful market dynamics and evolving industry trends. A primary growth driver is the escalating global demand for enhanced operational efficiency and substantial energy savings across various industrial sectors. As industries worldwide strive to reduce their carbon footprint and optimize operational costs, the adoption of inverter duty motors, which offer precise speed control and minimize energy wastage compared to conventional motors, is surging. The market penetration of variable frequency drives (VFDs) is a critical factor; as VFD technology becomes more sophisticated and cost-effective, its integration with inverter duty motors becomes increasingly seamless and attractive to businesses. Technological disruptions are constantly reshaping the landscape, with advancements in motor design, insulation materials, and bearing technologies leading to motors that are more robust, reliable, and capable of withstanding harsh operating conditions and extreme temperature fluctuations.

Consumer preferences are increasingly leaning towards intelligent and connected motor solutions. The demand for motors integrated with IoT capabilities, enabling real-time performance monitoring, predictive maintenance, and remote diagnostics, is on the rise. This trend is particularly prominent in sectors like Oil & Gas and Chemicals, where downtime can be incredibly costly. Competitive dynamics are intensifying, with established players continually investing in R&D to develop next-generation products that offer superior performance, lower maintenance requirements, and extended service life. The market is also witnessing a rise in customized motor solutions tailored to specific application needs, further fueling innovation and market growth. The overall market size is projected to reach $xx billion by 2033, reflecting a compound annual growth rate (CAGR) of xx% during the forecast period. This robust growth is underpinned by the continuous pursuit of automation and efficiency improvements across the global industrial spectrum.

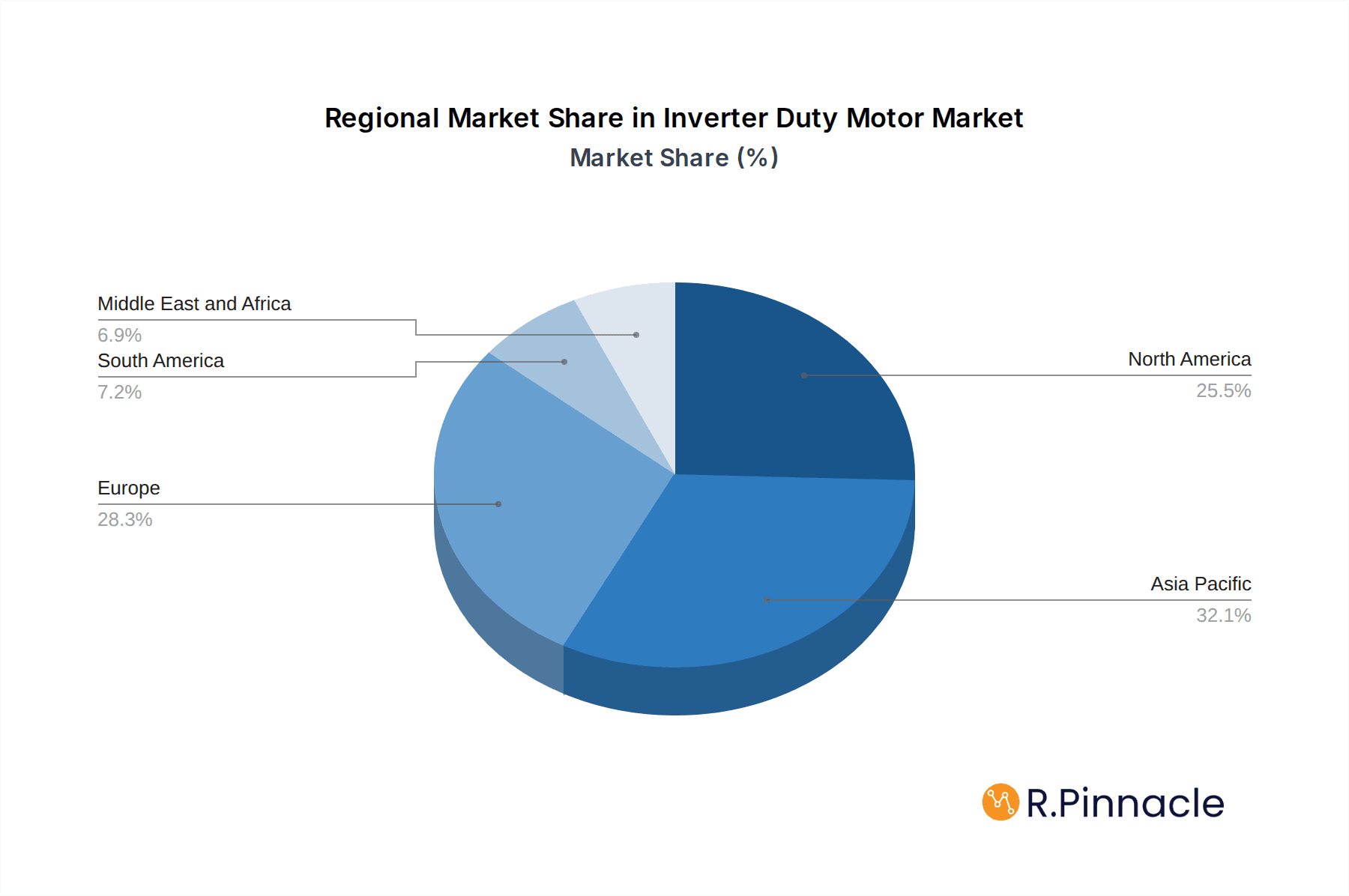

Dominant Regions & Segments in Inverter Duty Motor Market

The North America region stands as a dominant force in the global Inverter Duty Motor Market, driven by its advanced industrial infrastructure, significant investment in automation technologies, and stringent energy efficiency regulations. The United States, in particular, is a key contributor, with its robust manufacturing sector, particularly in Metal & Mining, Oil & Gas, and Food & Beverage, actively adopting inverter duty motors to enhance productivity and reduce energy consumption. Favorable economic policies promoting industrial modernization and substantial government initiatives focused on energy conservation further bolster the market's growth in this region.

Key Drivers for Dominance in North America:

- Advanced Industrial Automation: Widespread adoption of Industry 4.0 principles and smart manufacturing practices.

- Stringent Energy Efficiency Standards: Government regulations and incentives pushing for energy-saving solutions.

- High Investment in R&D: Leading companies consistently invest in developing cutting-edge motor technologies.

- Strong Presence of Key End-Use Industries: Significant demand from sectors like Oil & Gas, Chemicals, and Food & Beverage.

Within the Application segment, Pumps represent a leading category, accounting for an estimated xx% of the total market share. The widespread use of pumps in water management, industrial processes, and oil and gas extraction, coupled with the significant energy savings offered by inverter duty motors in variable flow applications, drives this dominance. Fans also represent a substantial segment, crucial for ventilation, cooling, and material handling across numerous industries.

In terms of End-User, the Oil & Gas industry is a major consumer of inverter duty motors. The demanding operating environments, continuous operational requirements, and the critical need for precise control in exploration, extraction, and refining processes make these motors indispensable. The Chemicals industry also exhibits strong demand due to similar requirements for process control, safety, and efficiency in potentially hazardous environments.

The predominant Construction Material for inverter duty motors is Laminated Steel, valued for its excellent magnetic properties and efficiency in converting electrical energy into mechanical output, especially at varying speeds. Aluminium is also gaining traction due to its lightweight properties and good thermal conductivity, particularly in specialized applications.

Inverter Duty Motor Market Product Innovations

Product innovations in the Inverter Duty Motor Market are primarily focused on enhancing energy efficiency, improving thermal management, and increasing durability. Advancements in winding techniques and insulation materials allow motors to operate effectively under fluctuating loads and high temperatures, a crucial advantage in demanding sectors. The integration of smart technologies, such as embedded sensors for condition monitoring and predictive maintenance, is a significant trend, offering end-users greater operational insight and reduced downtime. These innovations provide competitive advantages by enabling motors to deliver superior performance, extended lifespan, and lower total cost of ownership.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Inverter Duty Motor Market, segmented across key parameters to offer granular insights.

Application: The market is segmented into Conveyors, Pumps, Fans, and Others. Each segment is analyzed for its specific growth trajectory, market size, and competitive dynamics, with Pumps and Fans projected to hold the largest market shares due to their widespread industrial applications.

End-User: Key end-user industries include Oil & Gas, Chemicals, Metal & Mining, Food & Beverage, and Others. The Oil & Gas and Chemicals segments are expected to exhibit the highest growth rates, driven by their critical need for reliable and efficient motor solutions in complex operational environments.

Construction Material: The market is also analyzed based on the primary construction materials: Laminated Steel, Cast Iron, and Aluminium. Laminated Steel is anticipated to remain the dominant material due to its optimal magnetic properties for inverter duty applications.

Key Drivers of Inverter Duty Motor Market Growth

The Inverter Duty Motor Market's growth is primarily propelled by the increasing global emphasis on energy efficiency and conservation. Governments worldwide are implementing stricter regulations and offering incentives for adopting energy-saving technologies, directly benefiting inverter duty motors. The continuous advancements in variable frequency drive (VFD) technology, making VFDs more affordable and accessible, are significantly expanding the adoption of inverter duty motors. Furthermore, the relentless pursuit of industrial automation and operational efficiency across sectors like manufacturing, Oil & Gas, and Food & Beverage necessitates the precise speed control and robust performance offered by these motors. The growing awareness of total cost of ownership (TCO), where the long-term energy savings and reduced maintenance of inverter duty motors outweigh the initial investment, also acts as a strong growth accelerator.

Challenges in the Inverter Duty Motor Market Sector

Despite robust growth, the Inverter Duty Motor Market faces several challenges. The initial cost of inverter duty motors and VFD systems can be a barrier for some small and medium-sized enterprises (SMEs) compared to conventional motor setups, impacting market penetration. Technical expertise required for installation and programming of VFDs can also be a constraint, necessitating skilled labor and training. Supply chain disruptions, as observed in recent years, can impact the availability of raw materials and components, leading to price volatility and extended lead times. Furthermore, fierce competition from established global players and emerging regional manufacturers puts pressure on profit margins and necessitates continuous innovation to maintain market share. The lack of standardized testing and certification protocols in certain regions can also create market complexities.

Emerging Opportunities in Inverter Duty Motor Market

The Inverter Duty Motor Market is ripe with emerging opportunities. The growing adoption of smart grid technologies and renewable energy integration presents opportunities for inverter duty motors in applications such as wind turbine pitch control and solar tracking systems. The increasing focus on electrification of industrial processes, particularly in the automotive and heavy machinery sectors, will drive demand for high-performance inverter duty motors. The expansion of digitalization and IoT integration allows for the development of predictive maintenance solutions and remote diagnostics, creating new service revenue streams. Furthermore, the emerging economies in Asia-Pacific and Latin America, with their rapidly industrializing landscapes, offer significant untapped potential for market growth. The development of highly specialized motors for niche applications, such as explosion-proof or wash-down duty motors, also presents lucrative opportunities.

Leading Players in the Inverter Duty Motor Market Market

- ABB Ltd

- Havells India Ltd

- Adlee Powertronic Co Ltd

- Bison Gear & Engineering Corporation

- Siemens AG

- Nidec Motor Corporation

- Rockwell Automation Inc

- Regal Beloit Corporation

- General Electric Company

Key Developments in Inverter Duty Motor Market Industry

- 2023 Q4: Siemens AG launches a new series of highly efficient IE5 ultra-premium efficiency inverter duty motors, enhancing energy savings for industrial applications.

- 2023 Q2: Rockwell Automation Inc. acquires P.L.M. S.r.l., a leading Italian manufacturer of integrated motor and automation solutions, to strengthen its European market presence.

- 2022 Q4: Nidec Motor Corporation introduces an advanced intelligent motor controller with integrated IoT capabilities for enhanced predictive maintenance in the HVAC sector.

- 2022 Q1: ABB Ltd announces a significant investment in expanding its manufacturing capacity for variable speed drives and inverter duty motors to meet growing global demand.

- 2021 Q3: Havells India Ltd unveils a new range of energy-efficient inverter duty motors designed for the agricultural and water management sectors, offering significant cost savings.

Future Outlook for Inverter Duty Motor Market Market

The future outlook for the Inverter Duty Motor Market is exceptionally bright, characterized by sustained growth driven by megatrends in industrial automation, energy efficiency, and digitalization. The increasing demand for smart and connected industrial equipment will fuel the integration of IoT and AI-enabled features into inverter duty motors, enabling sophisticated predictive maintenance and remote operational management. As global environmental regulations become more stringent, the inherent energy-saving benefits of inverter duty motors will become an even more compelling factor for adoption across all industrial verticals. Emerging economies present significant untapped markets, offering substantial opportunities for expansion and market penetration. Strategic collaborations, mergers, and acquisitions are expected to continue, allowing key players to broaden their product portfolios, geographic reach, and technological capabilities, further shaping a dynamic and innovation-driven market landscape. The market is poised for continuous evolution, with a strong emphasis on sustainable and intelligent motor solutions.

Inverter Duty Motor Market Segmentation

-

1. Application

- 1.1. Conveyors

- 1.2. Pumps

- 1.3. Fans

- 1.4. Others

-

2. End-User

- 2.1. Oil & Gas

- 2.2. Chemicals

- 2.3. Metal & Mining

- 2.4. Food & Beverage

- 2.5. Others

-

3. Construction Material

- 3.1. Laminated Steel

- 3.2. Cast Iron

- 3.3. Aluminium

Inverter Duty Motor Market Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Inverter Duty Motor Market Regional Market Share

Geographic Coverage of Inverter Duty Motor Market

Inverter Duty Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Pumps Application to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inverter Duty Motor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Conveyors

- 5.1.2. Pumps

- 5.1.3. Fans

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Oil & Gas

- 5.2.2. Chemicals

- 5.2.3. Metal & Mining

- 5.2.4. Food & Beverage

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Construction Material

- 5.3.1. Laminated Steel

- 5.3.2. Cast Iron

- 5.3.3. Aluminium

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia Pacific

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Inverter Duty Motor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Conveyors

- 6.1.2. Pumps

- 6.1.3. Fans

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Oil & Gas

- 6.2.2. Chemicals

- 6.2.3. Metal & Mining

- 6.2.4. Food & Beverage

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Construction Material

- 6.3.1. Laminated Steel

- 6.3.2. Cast Iron

- 6.3.3. Aluminium

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Asia Pacific Inverter Duty Motor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Conveyors

- 7.1.2. Pumps

- 7.1.3. Fans

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Oil & Gas

- 7.2.2. Chemicals

- 7.2.3. Metal & Mining

- 7.2.4. Food & Beverage

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Construction Material

- 7.3.1. Laminated Steel

- 7.3.2. Cast Iron

- 7.3.3. Aluminium

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Inverter Duty Motor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Conveyors

- 8.1.2. Pumps

- 8.1.3. Fans

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Oil & Gas

- 8.2.2. Chemicals

- 8.2.3. Metal & Mining

- 8.2.4. Food & Beverage

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Construction Material

- 8.3.1. Laminated Steel

- 8.3.2. Cast Iron

- 8.3.3. Aluminium

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Inverter Duty Motor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Conveyors

- 9.1.2. Pumps

- 9.1.3. Fans

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Oil & Gas

- 9.2.2. Chemicals

- 9.2.3. Metal & Mining

- 9.2.4. Food & Beverage

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Construction Material

- 9.3.1. Laminated Steel

- 9.3.2. Cast Iron

- 9.3.3. Aluminium

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Inverter Duty Motor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Conveyors

- 10.1.2. Pumps

- 10.1.3. Fans

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Oil & Gas

- 10.2.2. Chemicals

- 10.2.3. Metal & Mining

- 10.2.4. Food & Beverage

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Construction Material

- 10.3.1. Laminated Steel

- 10.3.2. Cast Iron

- 10.3.3. Aluminium

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Havells India Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Adlee Powertronic Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bison Gear & Engineering Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nidec Motor Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rockwell Automation Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Regal Beloit Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Electric Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Inverter Duty Motor Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Inverter Duty Motor Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Inverter Duty Motor Market Revenue (million), by Application 2025 & 2033

- Figure 4: North America Inverter Duty Motor Market Volume (K Unit), by Application 2025 & 2033

- Figure 5: North America Inverter Duty Motor Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Inverter Duty Motor Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Inverter Duty Motor Market Revenue (million), by End-User 2025 & 2033

- Figure 8: North America Inverter Duty Motor Market Volume (K Unit), by End-User 2025 & 2033

- Figure 9: North America Inverter Duty Motor Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Inverter Duty Motor Market Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America Inverter Duty Motor Market Revenue (million), by Construction Material 2025 & 2033

- Figure 12: North America Inverter Duty Motor Market Volume (K Unit), by Construction Material 2025 & 2033

- Figure 13: North America Inverter Duty Motor Market Revenue Share (%), by Construction Material 2025 & 2033

- Figure 14: North America Inverter Duty Motor Market Volume Share (%), by Construction Material 2025 & 2033

- Figure 15: North America Inverter Duty Motor Market Revenue (million), by Country 2025 & 2033

- Figure 16: North America Inverter Duty Motor Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Inverter Duty Motor Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Inverter Duty Motor Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Inverter Duty Motor Market Revenue (million), by Application 2025 & 2033

- Figure 20: Asia Pacific Inverter Duty Motor Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Asia Pacific Inverter Duty Motor Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Inverter Duty Motor Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Asia Pacific Inverter Duty Motor Market Revenue (million), by End-User 2025 & 2033

- Figure 24: Asia Pacific Inverter Duty Motor Market Volume (K Unit), by End-User 2025 & 2033

- Figure 25: Asia Pacific Inverter Duty Motor Market Revenue Share (%), by End-User 2025 & 2033

- Figure 26: Asia Pacific Inverter Duty Motor Market Volume Share (%), by End-User 2025 & 2033

- Figure 27: Asia Pacific Inverter Duty Motor Market Revenue (million), by Construction Material 2025 & 2033

- Figure 28: Asia Pacific Inverter Duty Motor Market Volume (K Unit), by Construction Material 2025 & 2033

- Figure 29: Asia Pacific Inverter Duty Motor Market Revenue Share (%), by Construction Material 2025 & 2033

- Figure 30: Asia Pacific Inverter Duty Motor Market Volume Share (%), by Construction Material 2025 & 2033

- Figure 31: Asia Pacific Inverter Duty Motor Market Revenue (million), by Country 2025 & 2033

- Figure 32: Asia Pacific Inverter Duty Motor Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Asia Pacific Inverter Duty Motor Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Inverter Duty Motor Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Inverter Duty Motor Market Revenue (million), by Application 2025 & 2033

- Figure 36: Europe Inverter Duty Motor Market Volume (K Unit), by Application 2025 & 2033

- Figure 37: Europe Inverter Duty Motor Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Europe Inverter Duty Motor Market Volume Share (%), by Application 2025 & 2033

- Figure 39: Europe Inverter Duty Motor Market Revenue (million), by End-User 2025 & 2033

- Figure 40: Europe Inverter Duty Motor Market Volume (K Unit), by End-User 2025 & 2033

- Figure 41: Europe Inverter Duty Motor Market Revenue Share (%), by End-User 2025 & 2033

- Figure 42: Europe Inverter Duty Motor Market Volume Share (%), by End-User 2025 & 2033

- Figure 43: Europe Inverter Duty Motor Market Revenue (million), by Construction Material 2025 & 2033

- Figure 44: Europe Inverter Duty Motor Market Volume (K Unit), by Construction Material 2025 & 2033

- Figure 45: Europe Inverter Duty Motor Market Revenue Share (%), by Construction Material 2025 & 2033

- Figure 46: Europe Inverter Duty Motor Market Volume Share (%), by Construction Material 2025 & 2033

- Figure 47: Europe Inverter Duty Motor Market Revenue (million), by Country 2025 & 2033

- Figure 48: Europe Inverter Duty Motor Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Inverter Duty Motor Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Inverter Duty Motor Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Inverter Duty Motor Market Revenue (million), by Application 2025 & 2033

- Figure 52: South America Inverter Duty Motor Market Volume (K Unit), by Application 2025 & 2033

- Figure 53: South America Inverter Duty Motor Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: South America Inverter Duty Motor Market Volume Share (%), by Application 2025 & 2033

- Figure 55: South America Inverter Duty Motor Market Revenue (million), by End-User 2025 & 2033

- Figure 56: South America Inverter Duty Motor Market Volume (K Unit), by End-User 2025 & 2033

- Figure 57: South America Inverter Duty Motor Market Revenue Share (%), by End-User 2025 & 2033

- Figure 58: South America Inverter Duty Motor Market Volume Share (%), by End-User 2025 & 2033

- Figure 59: South America Inverter Duty Motor Market Revenue (million), by Construction Material 2025 & 2033

- Figure 60: South America Inverter Duty Motor Market Volume (K Unit), by Construction Material 2025 & 2033

- Figure 61: South America Inverter Duty Motor Market Revenue Share (%), by Construction Material 2025 & 2033

- Figure 62: South America Inverter Duty Motor Market Volume Share (%), by Construction Material 2025 & 2033

- Figure 63: South America Inverter Duty Motor Market Revenue (million), by Country 2025 & 2033

- Figure 64: South America Inverter Duty Motor Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: South America Inverter Duty Motor Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Inverter Duty Motor Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Inverter Duty Motor Market Revenue (million), by Application 2025 & 2033

- Figure 68: Middle East and Africa Inverter Duty Motor Market Volume (K Unit), by Application 2025 & 2033

- Figure 69: Middle East and Africa Inverter Duty Motor Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: Middle East and Africa Inverter Duty Motor Market Volume Share (%), by Application 2025 & 2033

- Figure 71: Middle East and Africa Inverter Duty Motor Market Revenue (million), by End-User 2025 & 2033

- Figure 72: Middle East and Africa Inverter Duty Motor Market Volume (K Unit), by End-User 2025 & 2033

- Figure 73: Middle East and Africa Inverter Duty Motor Market Revenue Share (%), by End-User 2025 & 2033

- Figure 74: Middle East and Africa Inverter Duty Motor Market Volume Share (%), by End-User 2025 & 2033

- Figure 75: Middle East and Africa Inverter Duty Motor Market Revenue (million), by Construction Material 2025 & 2033

- Figure 76: Middle East and Africa Inverter Duty Motor Market Volume (K Unit), by Construction Material 2025 & 2033

- Figure 77: Middle East and Africa Inverter Duty Motor Market Revenue Share (%), by Construction Material 2025 & 2033

- Figure 78: Middle East and Africa Inverter Duty Motor Market Volume Share (%), by Construction Material 2025 & 2033

- Figure 79: Middle East and Africa Inverter Duty Motor Market Revenue (million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Inverter Duty Motor Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Inverter Duty Motor Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Inverter Duty Motor Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inverter Duty Motor Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Inverter Duty Motor Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Global Inverter Duty Motor Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Global Inverter Duty Motor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Global Inverter Duty Motor Market Revenue million Forecast, by Construction Material 2020 & 2033

- Table 6: Global Inverter Duty Motor Market Volume K Unit Forecast, by Construction Material 2020 & 2033

- Table 7: Global Inverter Duty Motor Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Global Inverter Duty Motor Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Inverter Duty Motor Market Revenue million Forecast, by Application 2020 & 2033

- Table 10: Global Inverter Duty Motor Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Inverter Duty Motor Market Revenue million Forecast, by End-User 2020 & 2033

- Table 12: Global Inverter Duty Motor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 13: Global Inverter Duty Motor Market Revenue million Forecast, by Construction Material 2020 & 2033

- Table 14: Global Inverter Duty Motor Market Volume K Unit Forecast, by Construction Material 2020 & 2033

- Table 15: Global Inverter Duty Motor Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Inverter Duty Motor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Inverter Duty Motor Market Revenue million Forecast, by Application 2020 & 2033

- Table 18: Global Inverter Duty Motor Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 19: Global Inverter Duty Motor Market Revenue million Forecast, by End-User 2020 & 2033

- Table 20: Global Inverter Duty Motor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 21: Global Inverter Duty Motor Market Revenue million Forecast, by Construction Material 2020 & 2033

- Table 22: Global Inverter Duty Motor Market Volume K Unit Forecast, by Construction Material 2020 & 2033

- Table 23: Global Inverter Duty Motor Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Inverter Duty Motor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Inverter Duty Motor Market Revenue million Forecast, by Application 2020 & 2033

- Table 26: Global Inverter Duty Motor Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Global Inverter Duty Motor Market Revenue million Forecast, by End-User 2020 & 2033

- Table 28: Global Inverter Duty Motor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 29: Global Inverter Duty Motor Market Revenue million Forecast, by Construction Material 2020 & 2033

- Table 30: Global Inverter Duty Motor Market Volume K Unit Forecast, by Construction Material 2020 & 2033

- Table 31: Global Inverter Duty Motor Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Global Inverter Duty Motor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Inverter Duty Motor Market Revenue million Forecast, by Application 2020 & 2033

- Table 34: Global Inverter Duty Motor Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Global Inverter Duty Motor Market Revenue million Forecast, by End-User 2020 & 2033

- Table 36: Global Inverter Duty Motor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 37: Global Inverter Duty Motor Market Revenue million Forecast, by Construction Material 2020 & 2033

- Table 38: Global Inverter Duty Motor Market Volume K Unit Forecast, by Construction Material 2020 & 2033

- Table 39: Global Inverter Duty Motor Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Global Inverter Duty Motor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Inverter Duty Motor Market Revenue million Forecast, by Application 2020 & 2033

- Table 42: Global Inverter Duty Motor Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 43: Global Inverter Duty Motor Market Revenue million Forecast, by End-User 2020 & 2033

- Table 44: Global Inverter Duty Motor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 45: Global Inverter Duty Motor Market Revenue million Forecast, by Construction Material 2020 & 2033

- Table 46: Global Inverter Duty Motor Market Volume K Unit Forecast, by Construction Material 2020 & 2033

- Table 47: Global Inverter Duty Motor Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: Global Inverter Duty Motor Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inverter Duty Motor Market?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Inverter Duty Motor Market?

Key companies in the market include ABB Ltd, Havells India Ltd, Adlee Powertronic Co Ltd, Bison Gear & Engineering Corporation, Siemens AG, Nidec Motor Corporation, Rockwell Automation Inc, Regal Beloit Corporation, General Electric Company.

3. What are the main segments of the Inverter Duty Motor Market?

The market segments include Application, End-User, Construction Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 846 million as of 2022.

5. What are some drivers contributing to market growth?

Drivers; Restraints.

6. What are the notable trends driving market growth?

Pumps Application to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inverter Duty Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inverter Duty Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inverter Duty Motor Market?

To stay informed about further developments, trends, and reports in the Inverter Duty Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence