Key Insights

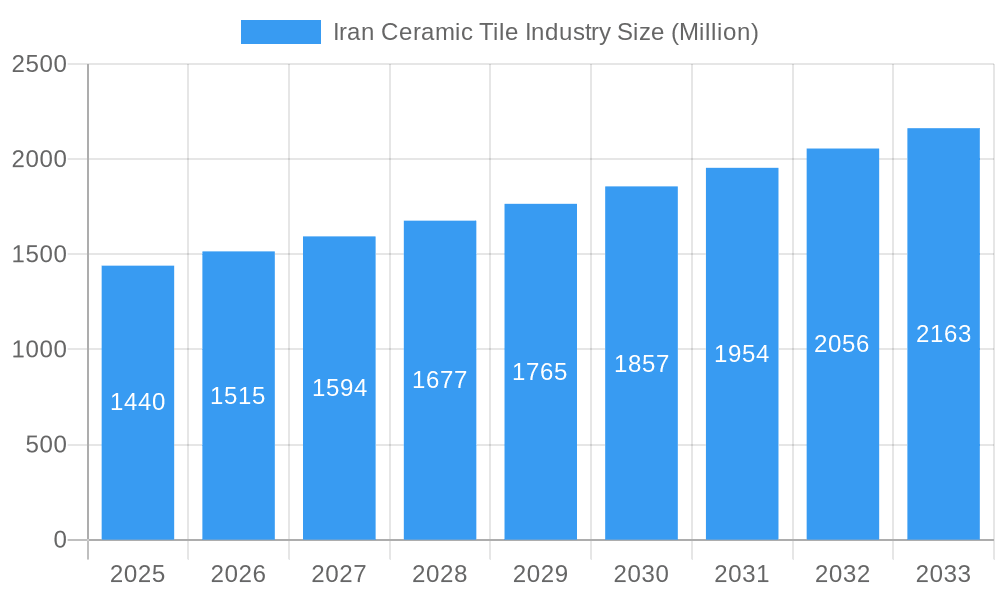

The Iranian ceramic tile industry, valued at $1.44 billion in 2025, is projected to experience robust growth, driven by a consistent compound annual growth rate (CAGR) of 4.97% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a burgeoning construction sector, particularly in residential and commercial building projects, creates significant demand for tiles. Secondly, evolving design preferences and a rise in disposable incomes are boosting demand for high-quality, aesthetically pleasing tiles, such as glazed and porcelain varieties. Furthermore, government initiatives promoting infrastructure development and urban renewal further contribute to market growth. The industry is segmented by end-user type (residential and commercial), product type (glazed, porcelain, scratch-free, and others), application (floor, wall, and other tiles), and construction type (new construction and renovation/replacement). Major players like Marjan Tile Co, RAK Ceramics, and Setareh Meybod Ceramic Tile Co dominate the market, leveraging their established distribution networks and brand recognition. While the industry faces challenges such as fluctuations in raw material prices and competition from imports, the overall outlook remains positive, supported by sustained economic growth and ongoing infrastructure projects across the country's diverse regions (North, South, East, and West).

Iran Ceramic Tile Industry Market Size (In Billion)

The market's segmentation allows for targeted strategies by industry participants. For example, focusing on the growing demand for scratch-free tiles in high-traffic commercial areas could yield significant returns. Similarly, catering to the evolving design trends through the introduction of innovative tile patterns and finishes remains a crucial aspect for maintaining a competitive edge. Regional variations in demand are also likely, with areas experiencing rapid urbanization potentially offering greater growth opportunities. Careful monitoring of government policies and regulatory changes will be essential for companies to optimize their strategies and effectively navigate the market's evolving dynamics. The forecast period of 2025-2033 presents substantial opportunities for both established players and new entrants to the Iranian ceramic tile market.

Iran Ceramic Tile Industry Company Market Share

Iran Ceramic Tile Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Iranian ceramic tile industry, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report analyzes market trends, key players, and future growth potential. The study uses a combination of primary and secondary research to deliver actionable intelligence on market size (in Millions), segmentation, and competitive dynamics.

Iran Ceramic Tile Industry Market Structure & Innovation Trends

This section delves into the competitive landscape of the Iranian ceramic tile market, examining market concentration, innovation drivers, and regulatory influences. We analyze the impact of mergers and acquisitions (M&A) activity on market share and explore the role of product substitutes and end-user demographics.

Market Concentration: The Iranian ceramic tile market exhibits a [Insert Level of Concentration, e.g., moderately concentrated] structure, with [Insert Number] xx Million in total market value in 2025. Leading players hold a combined market share of approximately xx%, indicating [Insert Analysis of Market Concentration, e.g., opportunities for smaller players].

Innovation Drivers: Key innovation drivers include the increasing demand for aesthetically pleasing and sustainable tiles, technological advancements in manufacturing processes (like digital printing), and government initiatives promoting energy efficiency in construction.

Regulatory Framework: [Describe the regulatory framework and its impact on the industry. Include specific regulations and their implications].

Product Substitutes: [Discuss alternative flooring materials and their impact on market share].

M&A Activity: While specific M&A deal values are unavailable, anecdotal evidence suggests [Describe observed M&A activity, if any].

Iran Ceramic Tile Industry Market Dynamics & Trends

This section analyzes market growth drivers, technological disruptions, consumer preferences, and competitive dynamics within the Iranian ceramic tile industry. We explore the factors influencing market expansion and the evolving landscape of the sector.

[Insert a 600-word paragraph analyzing market growth drivers (e.g., construction boom, government infrastructure projects), technological disruptions (e.g., adoption of digital printing), consumer preferences (e.g., shift towards sustainable and eco-friendly products), and competitive dynamics (e.g., pricing strategies, product differentiation). Include specific metrics like CAGR (e.g., The market is projected to register a CAGR of xx% during the forecast period) and market penetration (e.g., Porcelain tiles have achieved xx% market penetration in the residential sector).]

Dominant Regions & Segments in Iran Ceramic Tile Industry

This section identifies the leading regions and market segments within the Iranian ceramic tile industry. We analyze factors driving segment dominance across various categories:

By End-User Type: The residential segment dominates the market, driven by [Explain reasons for dominance, e.g., growing urbanization and increased disposable incomes]. The commercial segment is experiencing [Describe growth or stagnation].

By Product Type: Porcelain tiles hold the largest market share due to [Explain reasons for dominance, e.g., durability and aesthetic appeal]. Glazed tiles maintain significant market presence, while other specialized tiles (scratch-free, etc.) represent a niche market segment.

By Application: Floor tiles constitute the majority of market demand because of [Explain reasons]. Wall tiles comprise a significant portion of the market, but [Discuss other applications and their market share].

By Construction Type: The new construction segment is the primary driver of market growth, followed by replacement and renovation projects [Elaborate on each segment].

[Bullet points will be followed by a detailed dominance analysis in paragraphs]

Iran Ceramic Tile Industry Product Innovations

Recent product innovations in the Iranian ceramic tile industry have focused on enhancing aesthetic appeal, durability, and sustainability. Technological advancements, like digital printing and improved glazing techniques, have enabled manufacturers to offer a wider variety of designs and finishes. This focus on innovation is crucial for maintaining competitiveness in a market with increasing consumer demand for sophisticated and environmentally conscious products.

Report Scope & Segmentation Analysis

This report provides a comprehensive overview of the Iranian ceramic tile market, segmented by end-user type (residential, commercial), product type (glazed, porcelain, scratch-free, others), application (floor tiles, wall tiles, other tiles), and construction type (new construction, replacement & renovation). Each segment's growth projections, market size (in Millions USD), and competitive dynamics are analyzed in detail.

[A paragraph will be included for each segment mentioned above, detailing the growth projections, market size, and competitive dynamics.]

Key Drivers of Iran Ceramic Tile Industry Growth

The growth of the Iranian ceramic tile industry is fueled by several key factors. These include:

Increased Construction Activity: [Explain the impact of construction growth].

Government Infrastructure Projects: [Explain the impact of government projects].

Rising Disposable Incomes: [Explain the effect of increased incomes].

Technological Advancements: [Describe the role of technology].

Challenges in the Iran Ceramic Tile Industry Sector

The Iranian ceramic tile industry faces several challenges, including:

Economic Sanctions: [Explain the negative impacts of sanctions].

Fluctuating Currency Exchange Rates: [Discuss the volatility of the currency].

Raw Material Costs: [Analyze the impact of raw material price fluctuations].

Competition from Imports: [Discuss the impact of imported tiles].

Emerging Opportunities in Iran Ceramic Tile Industry

Despite the challenges, several emerging opportunities exist for growth in the Iranian ceramic tile market. These include:

Focus on Sustainable and Eco-Friendly Products: [Explain the potential for green tiles].

Expansion into Niche Markets: [Discuss potential new market segments].

Adoption of Advanced Technologies: [Discuss technology adoption potential].

Government Initiatives Promoting Local Manufacturing: [Describe the opportunities provided by government support].

Leading Players in the Iran Ceramic Tile Industry Market

- Marjan Tile Co

- RAK Ceramics RAK Ceramics

- Setareh Meybod Ceramic Tile Co

- Mehregan Trading Co

- Kam Ceramics

- Sina Tile and Ceramic co

- Ardakan Industrial Ceramics Co

- Saba Tile

- Ceramara Co

Key Developments in Iran Ceramic Tile Industry Industry

May 2023: Durst and Altadia Group's collaboration to advance ceramic sector product innovation using cutting-edge digital glazing and printing technology at Esmalglass's technology center signifies a significant technological leap for the industry.

August 2022: RAK Ceramics' USD 1.23 Million investment in advanced manufacturing and sustainability programs demonstrates a commitment to enhancing efficiency and catering to growing demand for sustainable products.

Future Outlook for Iran Ceramic Tile Industry Market

The Iranian ceramic tile market is poised for continued growth, driven by factors like increasing urbanization, government infrastructure projects, and the rising demand for high-quality, aesthetically pleasing tiles. Strategic opportunities lie in embracing sustainable production practices, leveraging technological advancements, and catering to the evolving preferences of consumers. This market presents significant potential for expansion and innovation in the coming years.

Iran Ceramic Tile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Iran Ceramic Tile Industry Segmentation By Geography

- 1. Iran

Iran Ceramic Tile Industry Regional Market Share

Geographic Coverage of Iran Ceramic Tile Industry

Iran Ceramic Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Spending on Home Renovations and Luxury Bathroom Fittings Driving the Market Growth; Increasing Government Spending on Infrastructure Projects including Residential and Commercial Buildings Boosting the Market

- 3.3. Market Restrains

- 3.3.1. Highly Competitive Market with Numerous Local and International Players; Volatility in the Prices of Raw Materials Used in the Production of Ceramic Tiles

- 3.4. Market Trends

- 3.4.1. Rising Construction Activity is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Ceramic Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marjan Tile Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RAK Ceramics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Setareh Meybod Ceramic Tile Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mehregan Trading Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kam Ceramics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sina Tile and Ceramic co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ardakan Industrial Ceramics Co**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saba Tile

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ceramara Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Marjan Tile Co

List of Figures

- Figure 1: Iran Ceramic Tile Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Iran Ceramic Tile Industry Share (%) by Company 2025

List of Tables

- Table 1: Iran Ceramic Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Iran Ceramic Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Iran Ceramic Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Iran Ceramic Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Iran Ceramic Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Iran Ceramic Tile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Iran Ceramic Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Iran Ceramic Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Iran Ceramic Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Iran Ceramic Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Iran Ceramic Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Iran Ceramic Tile Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Ceramic Tile Industry?

The projected CAGR is approximately 4.97%.

2. Which companies are prominent players in the Iran Ceramic Tile Industry?

Key companies in the market include Marjan Tile Co, RAK Ceramics, Setareh Meybod Ceramic Tile Co, Mehregan Trading Co, Kam Ceramics, Sina Tile and Ceramic co, Ardakan Industrial Ceramics Co**List Not Exhaustive, Saba Tile, Ceramara Co.

3. What are the main segments of the Iran Ceramic Tile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending on Home Renovations and Luxury Bathroom Fittings Driving the Market Growth; Increasing Government Spending on Infrastructure Projects including Residential and Commercial Buildings Boosting the Market.

6. What are the notable trends driving market growth?

Rising Construction Activity is Driving the Market.

7. Are there any restraints impacting market growth?

Highly Competitive Market with Numerous Local and International Players; Volatility in the Prices of Raw Materials Used in the Production of Ceramic Tiles.

8. Can you provide examples of recent developments in the market?

In May 2023, Durst and Altadia Group have recently unveiled a strategic collaboration aimed at spearheading product innovation in the ceramic sector. In a notable move, Durst is set to deploy its cutting-edge technology, including the Gamma DG digital glazing machine and the Durst Gamma XD digital tile printer, at Esmalglass's technology center in Sassuolo. Esmalglass, a global leader in frits, glazes, colors, and inks for the ceramic industry, owns the center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Ceramic Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Ceramic Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Ceramic Tile Industry?

To stay informed about further developments, trends, and reports in the Iran Ceramic Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence