Key Insights

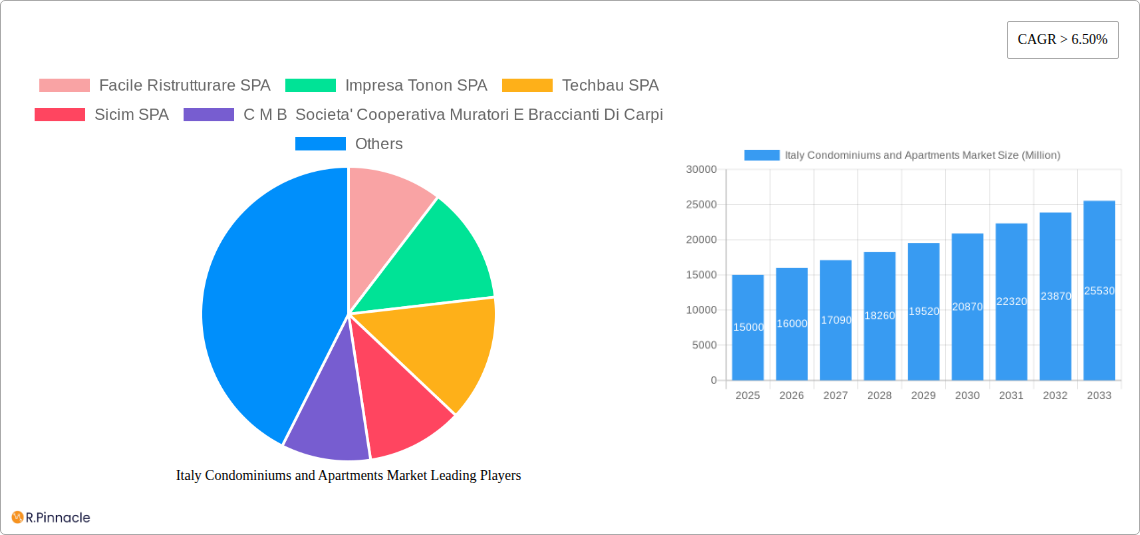

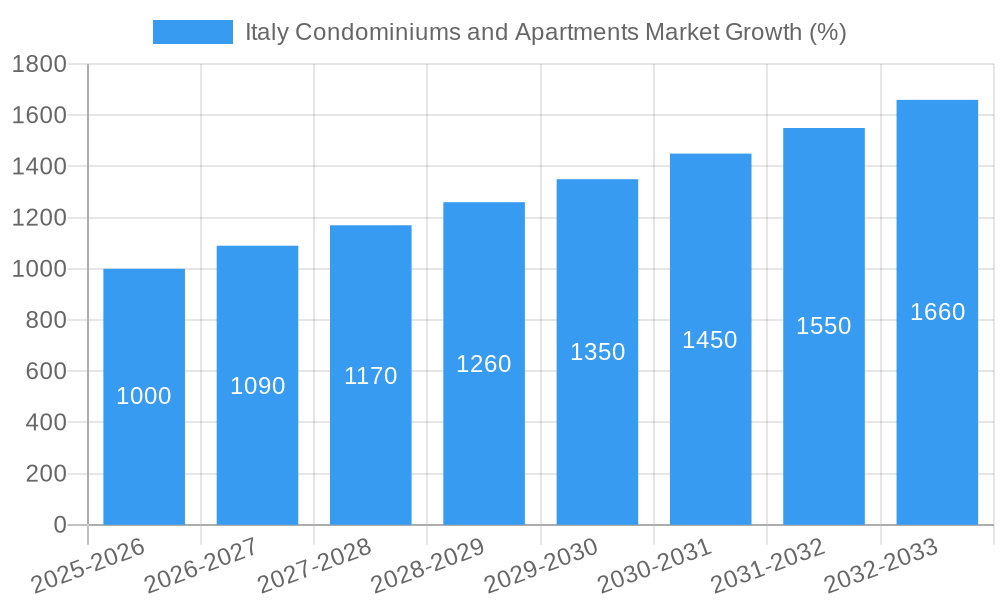

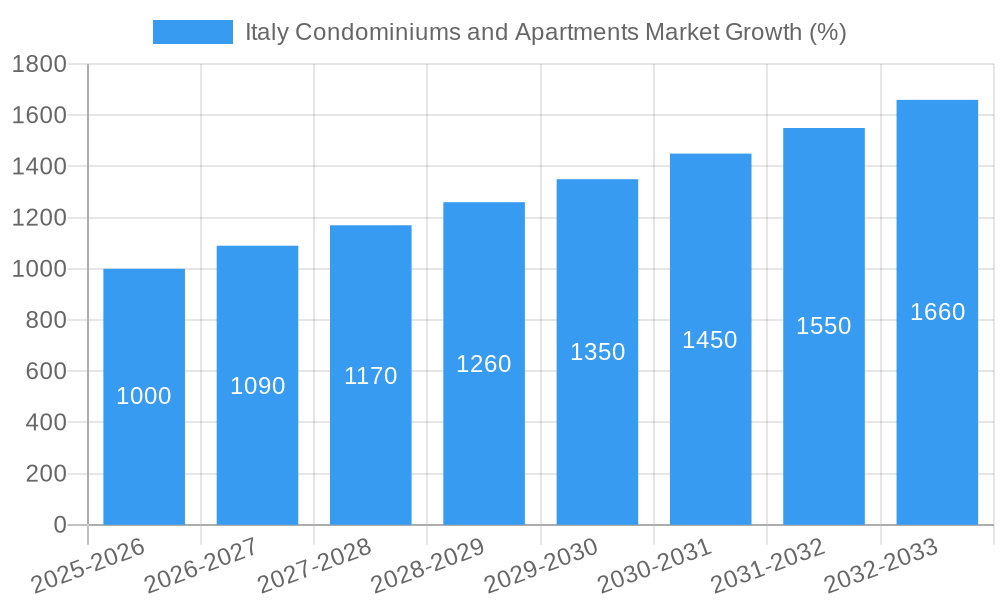

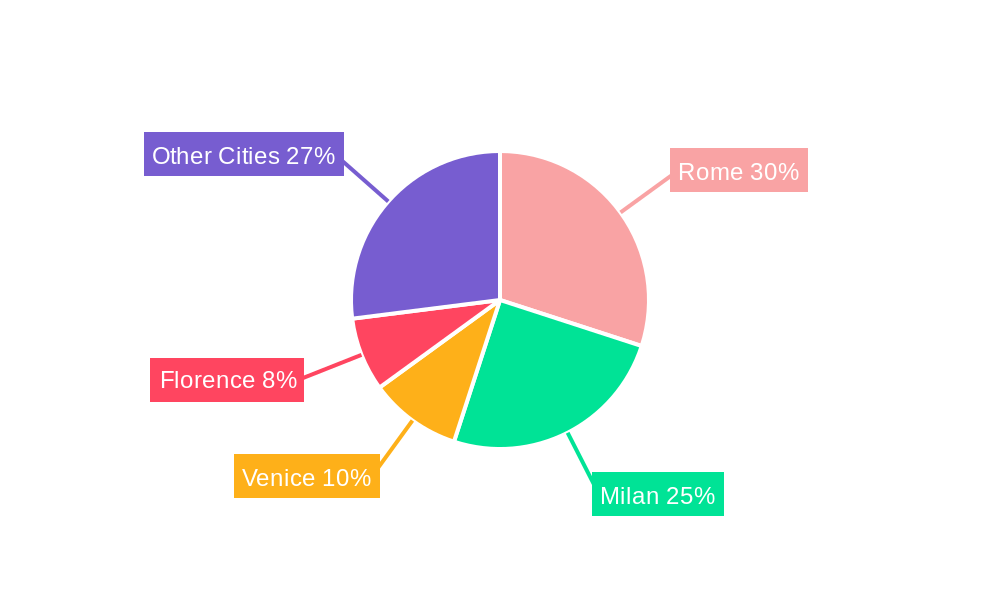

The Italian condominiums and apartments market, encompassing major cities like Rome, Milan, Venice, and Florence, exhibits robust growth potential. With a market size exceeding €XX million in 2025 (exact figure unavailable but estimated based on provided CAGR and industry benchmarks) and a Compound Annual Growth Rate (CAGR) exceeding 6.5%, the market is projected to reach significant value by 2033. This growth is fueled by several key drivers: a burgeoning tourism sector driving demand for short-term rentals and holiday homes, increasing urbanization leading to higher demand for residential spaces, and government initiatives aimed at revitalizing older properties. Furthermore, a growing preference for modern amenities and energy-efficient buildings is shaping the market landscape, along with a rising demand for luxury condominiums in prime locations. However, certain restraints, including high construction costs, bureaucratic hurdles in the permitting process, and fluctuating property prices, present challenges for consistent growth. The market is segmented geographically, with Rome, Milan, and Venice likely representing the largest shares due to population density and tourist activity. Leading companies such as Facile Ristrutturare SPA, Impresa Tonon SPA, and others play a crucial role in construction and renovation, catering to the diverse needs of buyers and investors. The historical period (2019-2024) likely showed fluctuating growth dependent on economic conditions and government policies. The forecast period (2025-2033) anticipates sustained growth, driven by the factors mentioned above.

The competitive landscape features both large established players and smaller specialized firms. Strategic partnerships, mergers, and acquisitions are likely to shape the industry in the coming years. Innovation in construction technologies and sustainable building practices will play a pivotal role in driving market growth. The increasing focus on smart home technologies is further influencing consumer preferences, creating new opportunities for companies offering integrated solutions. Understanding the regional variations within Italy is crucial, with northern regions potentially demonstrating stronger growth compared to the south, due to economic disparities and urban development patterns. This market presents significant opportunities for investment and expansion, particularly for firms capable of navigating regulatory complexities and adapting to evolving consumer demands. Further research would clarify the exact market size and refine projections.

Italy Condominiums and Apartments Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Italian condominiums and apartments market, covering the period 2019-2033, with a focus on the key trends, drivers, and challenges shaping this dynamic sector. The report offers actionable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within the Italian real estate market.

Italy Condominiums and Apartments Market Structure & Innovation Trends

This section analyzes the market's structure, highlighting key players, competitive dynamics, and innovation trends. The Italian condominiums and apartments market is characterized by a fragmented landscape with a mix of large national players and smaller regional operators. Market concentration is relatively low, with no single company holding a dominant share. However, several large construction firms significantly influence the market, including: Facile Ristrutturare SPA, Impresa Tonon SPA, Techbau SPA, Sicim SPA, C M B Societa' Cooperativa Muratori E Braccianti Di Carpi, Rizzani De Eccher SPA, Consorzio Integra Soc Coop, IGEFI SRL, Impresa Percassi SPA, Impresa Pizzarotti & C SPA, Salini Costruttori SPA, IREM SPA, and Takenaka Europe GmbH. This list is not exhaustive.

- Market Share: The top five players account for approximately xx% of the total market share in 2024.

- M&A Activity: Significant M&A activity is observed, reflecting consolidation trends within the industry. For example, in June 2022, Borgosesia invested EUR 7 million (USD 7.5 Million) in acquiring Como 11 Srl, owner of 13 renovated Milan apartments. Another notable transaction saw DoveVivo acquire ALTIDO, adding 51 properties to its portfolio. The total value of M&A deals in the historical period (2019-2024) reached approximately XX Million.

- Innovation Drivers: Increasing demand for sustainable and energy-efficient buildings, coupled with technological advancements in construction materials and techniques, are driving innovation.

- Regulatory Framework: Stringent building codes and environmental regulations influence the design and construction of new condominiums and apartments.

- Product Substitutes: Limited substitutes exist for condominiums and apartments as primary housing options; however, the rental market presents an alternative.

- End-User Demographics: The market caters primarily to young professionals, families, and retirees with varying income levels and preferences.

Italy Condominiums and Apartments Market Dynamics & Trends

The Italian condominiums and apartments market is experiencing steady growth, driven by several factors. The CAGR (Compound Annual Growth Rate) for the forecast period (2025-2033) is estimated at xx%, driven by increasing urbanization, rising disposable incomes, and government initiatives promoting affordable housing. Market penetration in major cities is high, with xx% of households residing in condominiums or apartments.

Technological disruptions, such as the adoption of Building Information Modeling (BIM) and prefabrication techniques, are enhancing efficiency and reducing construction costs. Consumer preferences are shifting toward sustainable and smart homes, with features like energy-efficient appliances, renewable energy sources, and smart home technology gaining popularity. Competitive dynamics are characterized by increasing competition, particularly in major cities like Rome and Milan, with companies focusing on product differentiation, quality, and customer service.

Dominant Regions & Segments in Italy Condominiums and Apartments Market

Milan and Rome are the dominant regions in the Italian condominiums and apartments market, driven by factors such as high population density, strong economic activity, and significant infrastructure investments.

- Milan:

- Strong job market and high concentration of multinational companies.

- Extensive public transportation network and well-developed infrastructure.

- High demand from young professionals and international residents.

- Rome:

- Large population base and robust tourism industry.

- Significant historical and cultural attractions.

- Growing demand for luxury apartments and condominiums.

- Venice, Florence, and Other Cities: These cities exhibit considerable market activity but at a smaller scale compared to Milan and Rome.

Italy Condominiums and Apartments Market Product Innovations

Recent product innovations focus on sustainable design, smart home technologies, and enhanced energy efficiency. Prefabricated modular construction is gaining traction, offering faster construction times and reduced costs. The integration of renewable energy sources, such as solar panels and geothermal heating, is becoming increasingly common. These innovations appeal to environmentally conscious consumers and help developers meet stricter building codes.

Report Scope & Segmentation Analysis

This report segments the market by key city: Rome, Milan, Venice, Florence, and Other Cities. Each segment is analyzed based on market size, growth projections, and competitive dynamics. Rome and Milan are expected to experience the highest growth rates, while smaller cities are likely to see more modest expansion. Competitive intensity varies across segments, with higher competition in major cities.

Key Drivers of Italy Condominiums and Apartments Market Growth

Several factors are driving growth in the Italian condominiums and apartments market. Government policies promoting affordable housing, increasing urbanization, and rising disposable incomes are key drivers. Technological advancements in construction, leading to efficiency gains, also contribute significantly. Finally, a growing preference for sustainable and energy-efficient housing fuels further expansion.

Challenges in the Italy Condominiums and Apartments Market Sector

The market faces challenges, including bureaucratic hurdles in obtaining building permits, fluctuating construction material prices impacting project costs, and intense competition, particularly from smaller local developers. Supply chain disruptions also pose challenges, impacting project timelines and budgets. The total impact of these factors on the market size is estimated to be a reduction of approximately xx Million annually.

Emerging Opportunities in Italy Condominiums and Apartments Market

Emerging opportunities include the development of sustainable and smart homes catering to growing environmental awareness. Renovation and redevelopment projects in older buildings offer potential, while the increasing popularity of co-living spaces presents an additional niche. Finally, expansion into smaller cities with growing populations may provide new avenues for growth.

Leading Players in the Italy Condominiums and Apartments Market Market

- Facile Ristrutturare SPA

- Impresa Tonon SPA

- Techbau SPA

- Sicim SPA

- C M B Societa' Cooperativa Muratori E Braccianti Di Carpi

- Rizzani De Eccher SPA

- Consorzio Integra Soc Coop

- IGEFI SRL

- Impresa Percassi SPA

- Impresa Pizzarotti & C SPA

- Salini Costruttori SPA

- IREM SPA

- Takenaka Europe GmbH

Key Developments in Italy Condominiums and Apartments Market Industry

- June 2022: Borgosesia acquired Como 11 Srl, boosting its portfolio by 13 renovated Milan apartments for EUR 7 million (USD 7.5 Million). This demonstrates the growing trend of acquiring existing properties for renovation rather than new construction.

- June 2022: DoveVivo's acquisition of ALTIDO signaled a significant investment in the market, expanding its inventory by 51 properties and bolstering its post-pandemic recovery. This highlights consolidation and expansion strategies within the sector.

Future Outlook for Italy Condominiums and Apartments Market Market

The Italian condominiums and apartments market is poised for continued growth, driven by persistent urbanization, economic growth, and a shift towards more sustainable and technologically advanced housing solutions. Strategic investments in sustainable construction, smart home technologies, and targeted marketing campaigns will be crucial for capturing future market share. The market is expected to continue experiencing strong growth, especially in major cities. The total market value is predicted to reach XX Million by 2033.

Italy Condominiums and Apartments Market Segmentation

-

1. Key City

- 1.1. Rome

- 1.2. Milan

- 1.3. Venice

- 1.4. Florence

- 1.5. Other Cities

Italy Condominiums and Apartments Market Segmentation By Geography

- 1. Italy

Italy Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The growing number of high-rise buildings and skyscrapers globally has created a robust market for facade systems4.; Building owners and developers are placing greater emphasis on the overall performance of their structures

- 3.3. Market Restrains

- 3.3.1 4.; High-quality facade materials and designs can be costly

- 3.3.2 making it challenging for some projects to meet budget constraint4.; Facades must comply with building codes and safety regulations

- 3.3.3 which can vary based on location

- 3.4. Market Trends

- 3.4.1 Despite skyrocketing living expenses fueled by high inflation

- 3.4.2 average home prices in Italy rose.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Key City

- 5.1.1. Rome

- 5.1.2. Milan

- 5.1.3. Venice

- 5.1.4. Florence

- 5.1.5. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Key City

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Facile Ristrutturare SPA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Impresa Tonon SPA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Techbau SPA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sicim SPA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 C M B Societa' Cooperativa Muratori E Braccianti Di Carpi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rizzani De Eccher SPA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Consorzio Integra Soc Coop

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IGEFI SRL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Impresa Percassi SPA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Impresa Pizzarotti & C SPA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Salini Costruttori SPA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 IREM SPA**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Takenaka Europe Gmbh

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Facile Ristrutturare SPA

List of Figures

- Figure 1: Italy Condominiums and Apartments Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Condominiums and Apartments Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Condominiums and Apartments Market Revenue Million Forecast, by Key City 2019 & 2032

- Table 3: Italy Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Italy Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Italy Condominiums and Apartments Market Revenue Million Forecast, by Key City 2019 & 2032

- Table 6: Italy Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Condominiums and Apartments Market?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the Italy Condominiums and Apartments Market?

Key companies in the market include Facile Ristrutturare SPA, Impresa Tonon SPA, Techbau SPA, Sicim SPA, C M B Societa' Cooperativa Muratori E Braccianti Di Carpi, Rizzani De Eccher SPA, Consorzio Integra Soc Coop, IGEFI SRL, Impresa Percassi SPA, Impresa Pizzarotti & C SPA, Salini Costruttori SPA, IREM SPA**List Not Exhaustive, Takenaka Europe Gmbh.

3. What are the main segments of the Italy Condominiums and Apartments Market?

The market segments include Key City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The growing number of high-rise buildings and skyscrapers globally has created a robust market for facade systems4.; Building owners and developers are placing greater emphasis on the overall performance of their structures.

6. What are the notable trends driving market growth?

Despite skyrocketing living expenses fueled by high inflation. average home prices in Italy rose..

7. Are there any restraints impacting market growth?

4.; High-quality facade materials and designs can be costly. making it challenging for some projects to meet budget constraint4.; Facades must comply with building codes and safety regulations. which can vary based on location.

8. Can you provide examples of recent developments in the market?

June 2022: Borgosesia purchased the full capital of Como 11 Srl, which owns 13 freshly renovated apartments in Milan's Corso Como, for EUR 7 million (USD 7.5 Million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Italy Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence