Key Insights

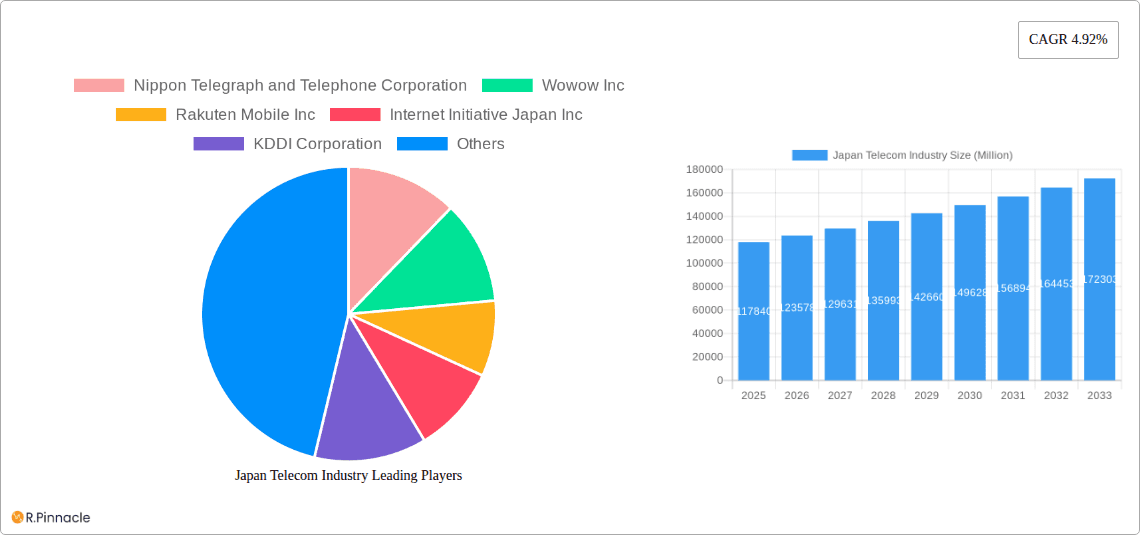

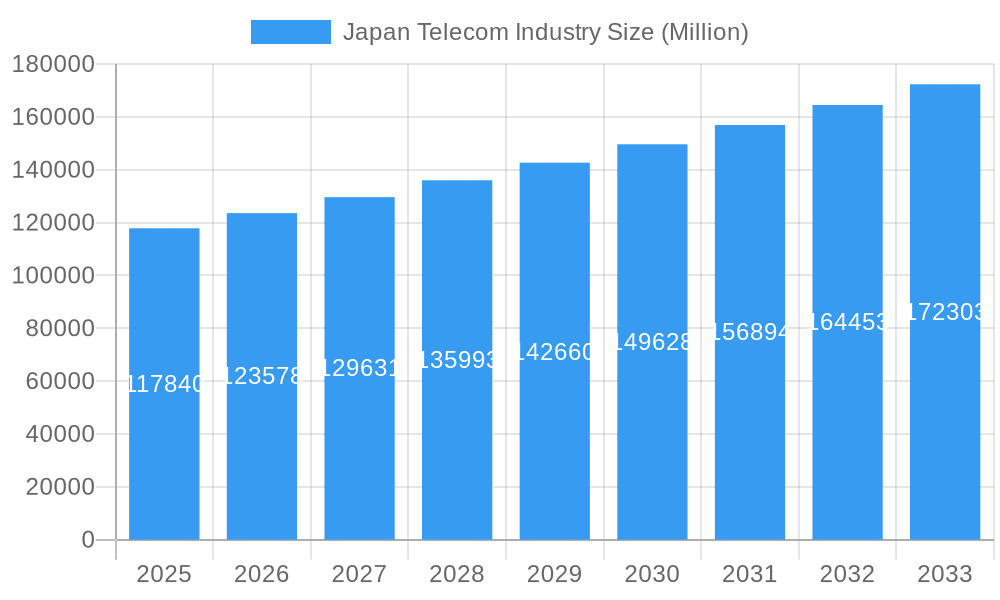

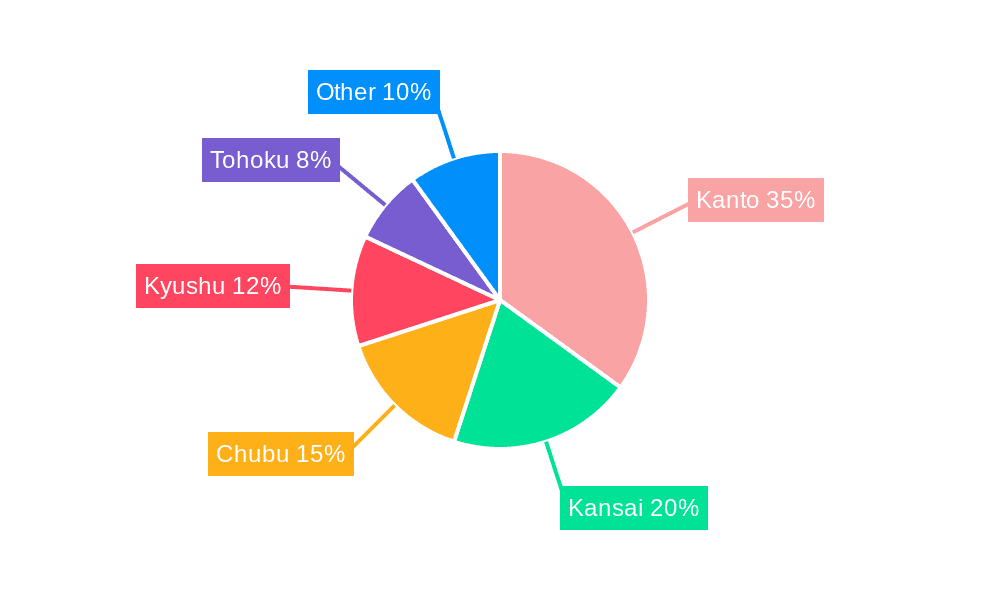

The Japanese telecommunications market, valued at $117.84 billion in 2025, is projected to experience steady growth, driven by increasing smartphone penetration, rising data consumption fueled by OTT services and the expansion of 5G networks. The market's 4.92% CAGR suggests a consistent upward trajectory through 2033. Key segments contributing to this growth include wireless data and messaging services, which benefit from the popularity of data-intensive applications and the ongoing shift towards bundled packages offering discounts. Voice services, while remaining a significant component, are experiencing slower growth as messaging and VoIP alternatives gain traction. The rise of OTT and Pay-TV services further contributes to the overall market expansion, with competition amongst providers like Nippon Telegraph and Telephone Corporation, SoftBank Group Corp, and KDDI Corporation driving innovation and competitive pricing. Regional variations exist, with Kanto, Kansai, and Chubu regions likely holding the largest market shares due to higher population density and economic activity. However, growth potential in less developed regions like Tohoku and Kyushu remains significant as infrastructure improves and digital adoption increases. The competitive landscape is characterized by established players and emerging competitors, leading to continuous innovation in service offerings and pricing strategies. Challenges include managing infrastructure investments to accommodate increasing data demand and navigating evolving regulatory frameworks.

Japan Telecom Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion, albeit at a potentially moderated pace compared to the historical period (2019-2024). Factors influencing this projection include the potential for market saturation in certain segments, economic fluctuations, and the emergence of disruptive technologies. Despite these challenges, the Japanese telecom market is expected to remain robust, driven by sustained demand for advanced communication services and the government's ongoing efforts to promote digitalization across the nation. The Average Revenue Per User (ARPU) across services will be a critical indicator to monitor, as it reflects the success of operators in adapting to changing consumer preferences and maximizing profitability in a competitive landscape. Detailed analysis of ARPU for each segment, coupled with understanding of customer churn rates and acquisition costs, will provide critical insights for investors and market participants.

Japan Telecom Industry Company Market Share

Japan Telecom Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Japan Telecom Industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, dynamics, innovation, and future growth potential. The study period (2019-2024) historical data, coupled with forecast projections (2025-2033), provides a robust understanding of this dynamic market. Key players like NTT, KDDI, SoftBank, and Rakuten are analyzed alongside emerging trends. This report is essential for anyone seeking to navigate the complexities and opportunities within the Japanese telecommunications landscape.

Japan Telecom Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Japanese telecom industry, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activity. The report examines the market share held by key players such as Nippon Telegraph and Telephone Corporation (NTT), KDDI Corporation, SoftBank Group Corp, and Rakuten Mobile Inc., revealing a moderately concentrated market. Specific metrics, including market share percentages and M&A deal values (in Millions), are provided. The influence of government regulations on market dynamics is explored, along with the impact of substitute products and evolving end-user demographics.

- Market Concentration: High concentration with top 3 players holding approximately xx% market share.

- Innovation Drivers: 5G deployment, IoT growth, increasing demand for high-speed data.

- Regulatory Framework: Analysis of the impact of Japanese telecommunications regulations on market competition.

- M&A Activity: Detailed analysis of recent mergers and acquisitions, including deal values (in Millions) and their strategic implications. For example, the impact of NTT DATA's acquisition of Aspirant is examined in detail.

- Product Substitutes: Examination of substitute technologies and their impact on market growth.

Japan Telecom Industry Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. It analyzes the Compound Annual Growth Rate (CAGR) of the overall market and individual segments (in Millions), and examines market penetration rates for key services. Factors influencing consumer behavior, such as pricing strategies and service offerings, are meticulously explored, alongside detailed analysis of emerging technologies and their impact on market structure. The influence of macroeconomic factors on market growth is also considered.

Dominant Regions & Segments in Japan Telecom Industry

This section identifies the leading regions and segments within the Japanese telecom market. Detailed analysis of the following segments are provided:

- Voice Services: Market size (in Millions), ARPU (Average Revenue Per User), and trend analysis (2020-2027).

- Wireless: Data and Messaging Services: Market size (in Millions), analysis of internet and handset data packages, and the impact of package discounts.

- OTT and Pay-TV Services: Market size (in Millions), and analysis of competition among providers.

Key drivers, such as economic policies and infrastructure development, are also highlighted, along with a detailed dominance analysis of the leading region/segment.

Japan Telecom Industry Product Innovations

This section provides a concise summary of recent product developments in the Japanese telecom sector, highlighting technological trends and their market fit. The emphasis is on innovative services and applications, competitive advantages offered by new products, and their impact on market dynamics.

Report Scope & Segmentation Analysis

This section details the market segmentation, including:

- Voice Services: Growth projections, market size (in Millions), and competitive dynamics.

- Wireless Data and Messaging Services: Growth projections, market size (in Millions), and competitive dynamics. Includes analysis of internet and handset data packages, and the impact of package discounts.

- OTT and Pay-TV Services: Growth projections, market size (in Millions), and competitive dynamics.

Key Drivers of Japan Telecom Industry Growth

This section outlines the key growth drivers for the Japanese telecom industry, categorized into technological, economic, and regulatory factors. Specific examples of each driver are included, emphasizing their individual and collective impact on market growth.

Challenges in the Japan Telecom Industry Sector

This section identifies and discusses the significant challenges faced by the Japanese telecom industry, including regulatory hurdles, supply chain issues, and competitive pressures. Quantifiable impacts of these challenges on market growth are provided.

Emerging Opportunities in Japan Telecom Industry

This section highlights promising opportunities within the Japanese telecom industry, focusing on new markets, technologies, and evolving consumer preferences.

Leading Players in the Japan Telecom Industry Market

- Nippon Telegraph and Telephone Corporation

- Wowow Inc

- Rakuten Mobile Inc

- Internet Initiative Japan Inc

- KDDI Corporation

- Z Holdings Corporation

- JSAT Corporation

- SoftBank Group Corp

- TOKAI Communications Corporation

Key Developments in Japan Telecom Industry

- October 2022: NTT DATA's acquisition of Aspirant expands its digital transformation services.

- August 2022: Rakuten Mobile launches Open Innovation Lab, promoting Open vRAN technology.

Future Outlook for Japan Telecom Industry Market

This section summarizes the key growth accelerators for the Japanese telecom industry, focusing on the future market potential and strategic opportunities for players in the sector. It provides a concise outlook on market trends and the overall growth prospects for the forecast period (2025-2033).

Japan Telecom Industry Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and Pay-tv Services

-

1.1. Voice Services

Japan Telecom Industry Segmentation By Geography

- 1. Japan

Japan Telecom Industry Regional Market Share

Geographic Coverage of Japan Telecom Industry

Japan Telecom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G Device Penetration and Accelerated Expansion of Market; Continuation of Remote Work

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness to Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. 5G Rollouts

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and Pay-tv Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nippon Telegraph and Telephone Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wowow Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rakuten Mobile Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Internet Initiative Japan Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KDDI Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Z Holdings Corporation*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JSAT Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SoftBank Group Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TOKAI Communications Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Nippon Telegraph and Telephone Corporation

List of Figures

- Figure 1: Japan Telecom Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Telecom Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Telecom Industry Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 2: Japan Telecom Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Japan Telecom Industry Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 4: Japan Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Telecom Industry?

The projected CAGR is approximately 4.92%.

2. Which companies are prominent players in the Japan Telecom Industry?

Key companies in the market include Nippon Telegraph and Telephone Corporation, Wowow Inc, Rakuten Mobile Inc, Internet Initiative Japan Inc, KDDI Corporation, Z Holdings Corporation*List Not Exhaustive, JSAT Corporation, SoftBank Group Corp, TOKAI Communications Corporation.

3. What are the main segments of the Japan Telecom Industry?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD 117.84 Million as of 2022.

5. What are some drivers contributing to market growth?

5G Device Penetration and Accelerated Expansion of Market; Continuation of Remote Work.

6. What are the notable trends driving market growth?

5G Rollouts.

7. Are there any restraints impacting market growth?

Lack of Awareness to Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

In October 2022, NTT DATA declared its intention to purchase the data analytics company, Aspirant. This purchase helped further NTT DATA's plan to become the top partner in digital innovation for businesses worldwide. By way of this agreement, Aspirant will expand its data engineering skills across major data partners, including Azure, AWS, Databricks, and Snowflake, by adding over 230 data advisers and technologists to NTT DATA's digital transformation services team.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Telecom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Telecom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Telecom Industry?

To stay informed about further developments, trends, and reports in the Japan Telecom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence