Key Insights

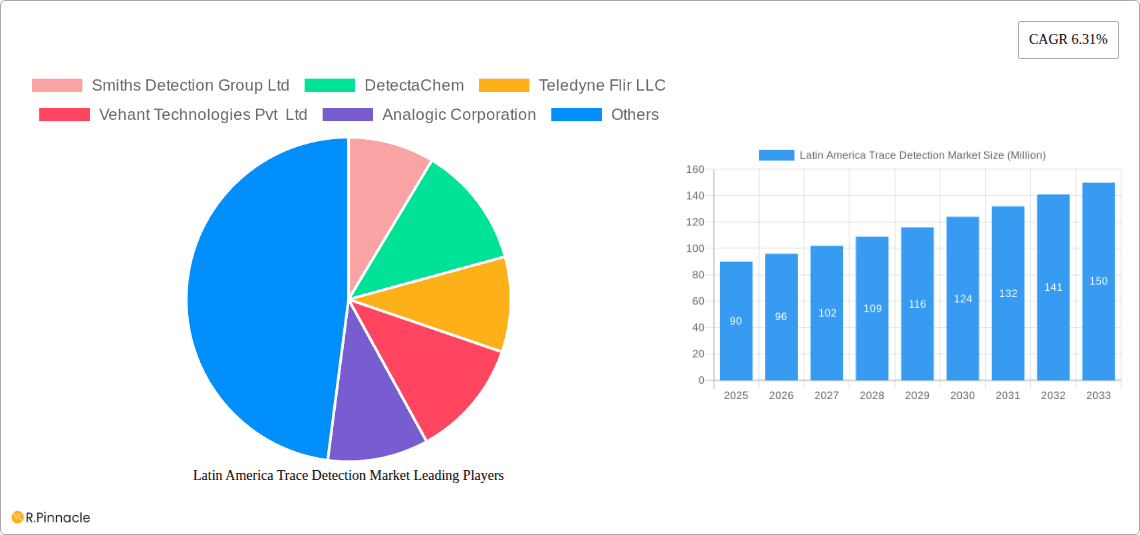

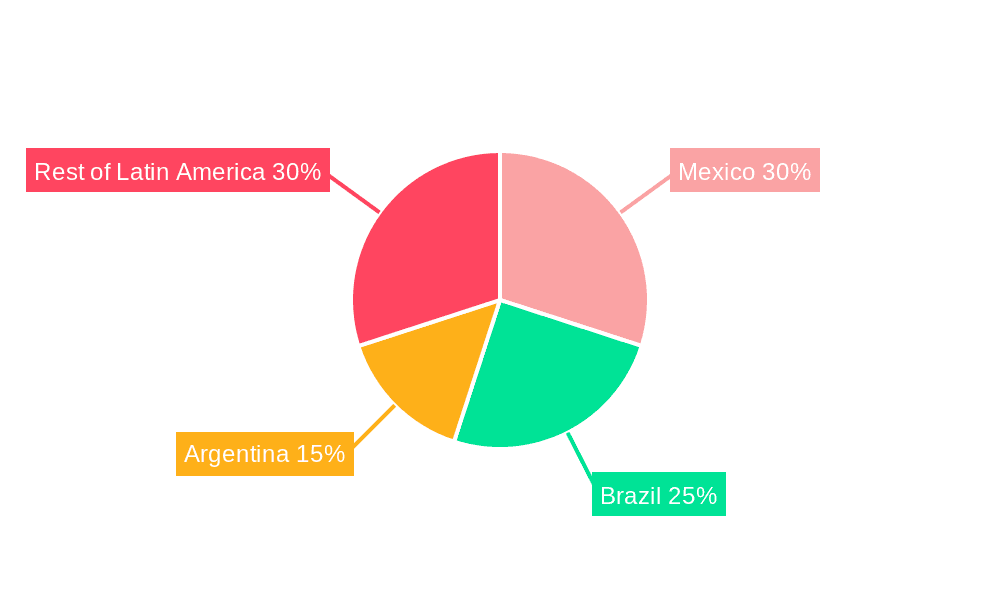

The Latin American trace detection market, valued at $90 million in 2025, is projected to experience robust growth, driven by increasing cross-border trade, heightened security concerns, and a rising need for effective contraband detection across various sectors. A compound annual growth rate (CAGR) of 6.31% from 2025 to 2033 indicates a significant expansion, with the market expected to surpass $150 million by 2033. This growth is fueled by several key factors. Firstly, the rising prevalence of illicit activities like drug trafficking and smuggling necessitates advanced detection technologies across borders, ports, and airports. Secondly, governments in the region are increasing investments in security infrastructure and technological upgrades, boosting demand for sophisticated trace detection equipment. Furthermore, the increasing adoption of handheld and portable devices enhances accessibility and operational efficiency for law enforcement and security personnel. The market is segmented by product type (handheld, portable/movable, and fixed), end-user industry (commercial, military and defense, law enforcement, ports and borders, public safety), and by the type of substance detected (explosives and narcotics). Mexico, Brazil, and Argentina represent the largest market segments due to their significant economic activities and strategic geographical locations.

Latin America Trace Detection Market Market Size (In Million)

While the market presents significant opportunities, certain challenges exist. These include high initial investment costs for advanced technologies, the need for skilled personnel to operate and maintain equipment, and potential budgetary constraints within certain government agencies. However, technological advancements leading to smaller, more user-friendly, and cost-effective devices are expected to mitigate these challenges, fueling further market expansion. The competitive landscape includes both established international players like Smiths Detection and Teledyne FLIR, and regional companies catering to specific market needs. This mix ensures a dynamic and evolving market with a strong potential for innovation and growth throughout the forecast period.

Latin America Trace Detection Market Company Market Share

This comprehensive report provides a detailed analysis of the Latin America Trace Detection Market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, key players, and future growth potential. The market is segmented by type (explosive, narcotics), product (handheld, portable/movable, fixed), end-user industry (commercial, military & defense, law enforcement, ports & borders, public safety, other), and country (Mexico, Brazil, Argentina, Colombia, Chile). Expected market value is xx Million.

Latin America Trace Detection Market Structure & Innovation Trends

The Latin America trace detection market exhibits a moderately concentrated structure, with key players such as Smiths Detection Group Ltd, Teledyne Flir LLC, and Rapiscan Systems Inc holding significant market share. Precise market share figures are xx%, xx%, and xx%, respectively, as of 2025. Innovation is driven by the need for enhanced security, stricter regulatory frameworks, and the emergence of sophisticated technologies like nanotechnology and IoT sensors. Regulatory changes, particularly those related to border security and counter-terrorism, significantly influence market growth. Product substitutes, such as traditional canine detection methods, still hold a niche in the market, though their adoption is declining due to the growing adoption of more efficient and accurate technological solutions. The market has witnessed several mergers and acquisitions (M&A) in recent years, with deal values totaling approximately xx Million in 2024. End-user demographics are heavily influenced by the increasing urbanization and growth of key industries in the region, leading to higher demand for trace detection solutions.

Latin America Trace Detection Market Dynamics & Trends

The Latin America trace detection market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by several factors: increasing cross-border trade leading to heightened security concerns at ports and borders; rising government spending on homeland security and defense initiatives; and technological advancements leading to the development of more sensitive and user-friendly trace detection systems. Market penetration in specific segments, such as airports and high-security buildings, is relatively high, while substantial growth opportunities remain within other end-user segments. Consumer preferences shift towards systems offering high accuracy, portability, and ease of use. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and intense competition among established players and emerging technology providers. Technological disruptions, such as the integration of AI and machine learning, are driving significant changes in the market landscape.

Dominant Regions & Segments in Latin America Trace Detection Market

Leading Country: Mexico holds the largest market share within Latin America due to its prominent role in international trade and its relatively advanced security infrastructure. Brazil follows closely as another major market player due to its size and economic activity.

Dominant Segment (By Type): The explosive trace detection segment currently dominates due to the persistent threat of terrorism and security breaches.

Dominant Segment (By Product): Portable/movable systems enjoy high demand given their versatility and adaptability across various settings.

Dominant Segment (By End-user Industry): Ports and borders represent a significant segment due to strict regulatory measures and high traffic volume.

Mexico's strong economic performance and proactive security policies fuel its dominance. The robust growth in e-commerce and related logistics activities further underscores the need for robust trace detection measures in the region's largest economy. Brazil's large population and extensive coastline contribute to its high demand for trace detection solutions. Argentina, Colombia, and Chile also showcase considerable growth potential, although their respective markets are smaller at present. Growth drivers in these countries include factors such as economic development, rising tourism, and modernization of infrastructure.

Latin America Trace Detection Market Product Innovations

Recent years have witnessed significant advancements in trace detection technology, with a focus on improving sensitivity, reducing response times, and enhancing ease of use. The introduction of handheld devices featuring advanced sensor technology has streamlined detection processes, particularly in high-traffic areas. Integration of AI and machine learning algorithms is enhancing the accuracy and efficiency of these systems. New products offer expanded detection capabilities for various substances, leading to enhanced threat identification. Furthermore, manufacturers are increasingly focusing on developing user-friendly interfaces and portable designs to cater to diverse operational requirements.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Latin America trace detection market across various segments.

By Type: The market is segmented into explosive and narcotics trace detection systems, with detailed analysis of each segment's growth trajectory, market size, and competitive landscape.

By Product: The report includes handheld, portable/movable, and fixed systems. Growth projections and competitive analyses are provided for each.

By End-user Industry: This section covers commercial, military and defense, law enforcement, ports and borders, public safety, and other end-user industries.

By Country: The report analyzes Mexico, Brazil, Argentina, Colombia, and Chile, providing a detailed market overview, segment breakdown, and future projections for each.

Key Drivers of Latin America Trace Detection Market Growth

The Latin America trace detection market's growth is primarily driven by factors such as increasing security concerns following recent events; stringent government regulations aimed at enhancing security protocols at airports, ports, and other critical infrastructure; and the growing adoption of advanced technologies, such as AI and IoT sensors, enabling improved detection capabilities. Economic growth in several Latin American countries also contributes to higher investment in security infrastructure.

Challenges in the Latin America Trace Detection Market Sector

Challenges include the high initial cost of advanced trace detection systems, hindering adoption in some regions; supply chain disruptions impacting product availability and increasing costs; and the need for continuous training and skilled personnel to effectively operate and maintain these complex systems. Budgetary constraints in certain governmental agencies also limit investment capacity. Furthermore, intense competition among vendors can lead to price pressures.

Emerging Opportunities in Latin America Trace Detection Market

Emerging opportunities include the integration of cloud-based data analytics for improved threat assessment; the development of more portable and user-friendly systems tailored to specific needs; and the expansion into new market segments such as private sector security companies. Governments are also increasingly investing in modernization of customs and border protection, creating further growth prospects.

Leading Players in the Latin America Trace Detection Market Market

- Smiths Detection Group Ltd

- DetectaChem

- Teledyne Flir LLC

- Vehant Technologies Pvt Ltd

- Analogic Corporation

- DSA Detection LLC

- Rapiscan Systems Inc

- Leidos Holdings Inc

- OSI Systems Inc

- Westminster Group PL

- Autoclear LLC

- High Tech Detection Systems (HTDS)

- Bruker Corporation

- Mass Spec Analytical Ltd

Key Developments in Latin America Trace Detection Market Industry

March 2023: Smiths Detection launched its latest CASI (Chemical Agent Identifier) 4 with the LCD XID extension, expanding detection capabilities to include narcotics, explosives, pharmaceuticals, and other chemical threats. This significantly enhances the product's versatility and market appeal.

March 2023: MS Tech Ltd completed shipments and installations of EXPLOSCAN and DUOSCAN systems across Chile, expanding its presence in Latin American border control and aviation security. This reinforces the growing demand for advanced trace detection technologies in the region.

Future Outlook for Latin America Trace Detection Market Market

The Latin America trace detection market is poised for substantial growth, driven by increasing security concerns, technological advancements, and supportive government policies. Opportunities exist in expanding the adoption of advanced technologies in under-penetrated segments, and focusing on developing cost-effective solutions to improve accessibility. The market is expected to witness a surge in demand for intelligent, integrated solutions combining trace detection with other security technologies.

Latin America Trace Detection Market Segmentation

-

1. Type

- 1.1. Explosive

- 1.2. Narcotics

-

2. Product

- 2.1. Handheld

- 2.2. Portable/Movable

- 2.3. Fixed

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Military and Defense

- 3.3. Law Enforcement

- 3.4. Ports and Borders

- 3.5. Public Safety

- 3.6. Other End-user Industries

Latin America Trace Detection Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Trace Detection Market Regional Market Share

Geographic Coverage of Latin America Trace Detection Market

Latin America Trace Detection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Upsurge in Terrorist Activities Across the Region; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel

- 3.4. Market Trends

- 3.4.1. Upsurge in Terrorist Activities Across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Trace Detection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosive

- 5.1.2. Narcotics

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Handheld

- 5.2.2. Portable/Movable

- 5.2.3. Fixed

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Military and Defense

- 5.3.3. Law Enforcement

- 5.3.4. Ports and Borders

- 5.3.5. Public Safety

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Smiths Detection Group Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DetectaChem

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Teledyne Flir LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vehant Technologies Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Analogic Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DSA Detection LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rapiscan Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Leidos Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 OSI Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Westminster Group PL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Autoclear LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 High Tech Detection Systems (HTDS)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Bruker Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mass Spec Analytical Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Smiths Detection Group Ltd

List of Figures

- Figure 1: Latin America Trace Detection Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Trace Detection Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Trace Detection Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Latin America Trace Detection Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Latin America Trace Detection Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Latin America Trace Detection Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Trace Detection Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Latin America Trace Detection Market Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Latin America Trace Detection Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Latin America Trace Detection Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Trace Detection Market?

The projected CAGR is approximately 6.31%.

2. Which companies are prominent players in the Latin America Trace Detection Market?

Key companies in the market include Smiths Detection Group Ltd, DetectaChem, Teledyne Flir LLC, Vehant Technologies Pvt Ltd, Analogic Corporation, DSA Detection LLC, Rapiscan Systems Inc, Leidos Holdings Inc, OSI Systems Inc, Westminster Group PL, Autoclear LLC, High Tech Detection Systems (HTDS), Bruker Corporation, Mass Spec Analytical Ltd.

3. What are the main segments of the Latin America Trace Detection Market?

The market segments include Type, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Upsurge in Terrorist Activities Across the Region; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening.

6. What are the notable trends driving market growth?

Upsurge in Terrorist Activities Across the Region.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel.

8. Can you provide examples of recent developments in the market?

March 2023: Smiths Detection launched its latest CASI (Chemical Agent Identifier) 4 in conjunction with the LCD XID extension. This extension expands the LCD’s detection capabilities to include street-level Narcotics, explosive substances, pharmaceuticals, and other high-toxicity chemical threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Trace Detection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Trace Detection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Trace Detection Market?

To stay informed about further developments, trends, and reports in the Latin America Trace Detection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence