Key Insights

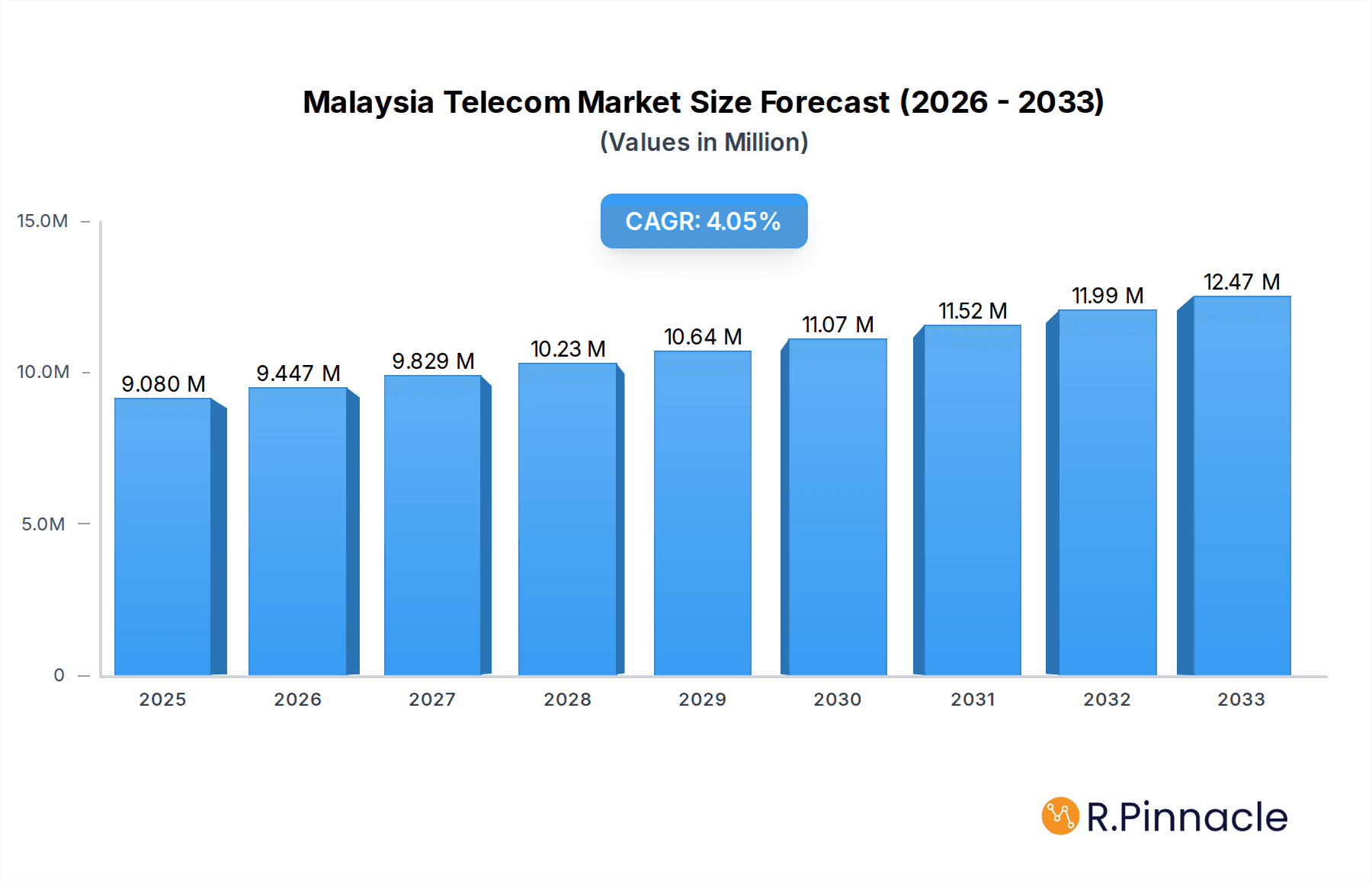

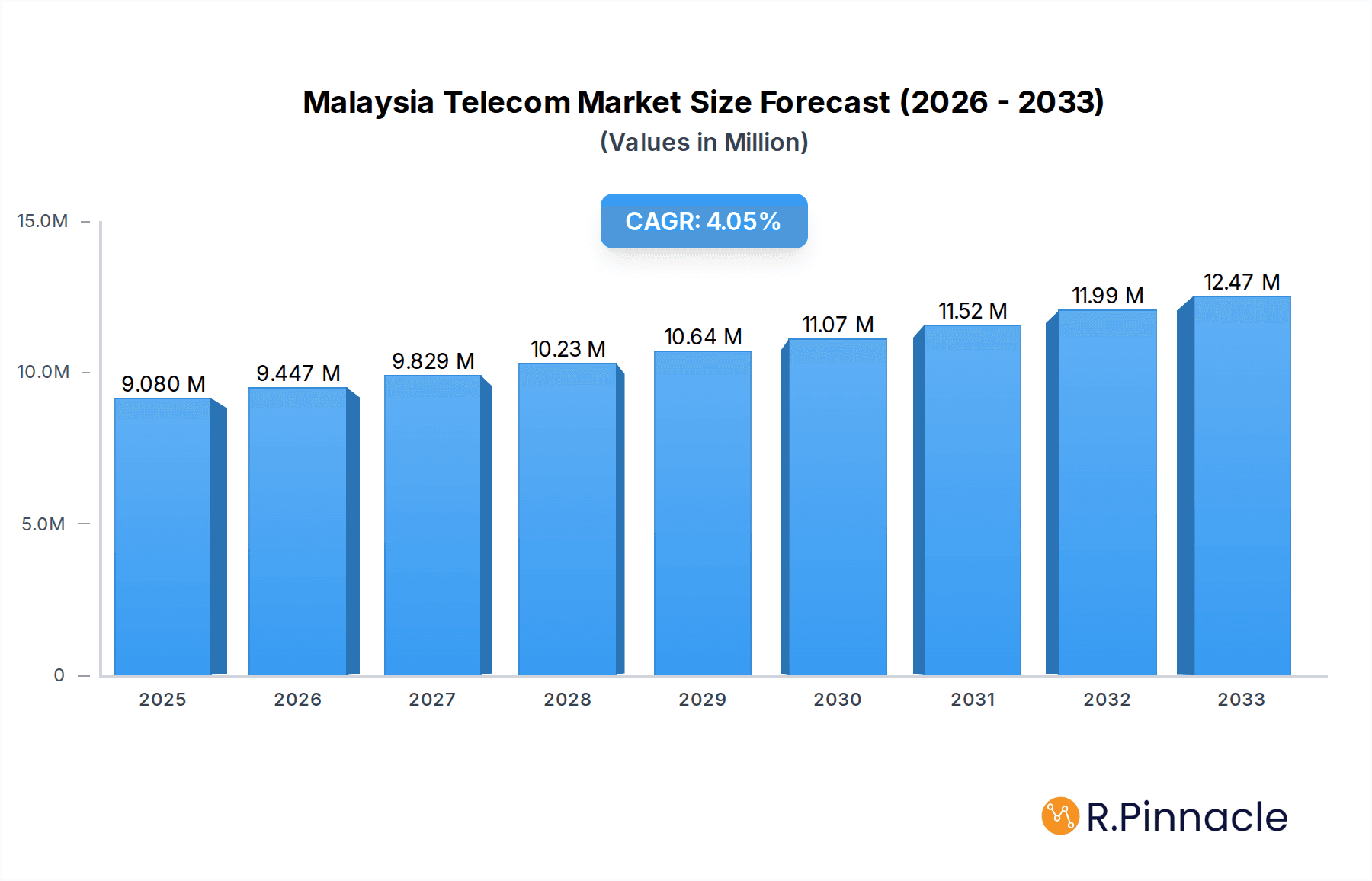

The Malaysia Telecom Market is poised for robust growth, projecting a market size of 9.08 million by 2025, with a compelling CAGR of 4.07% expected to drive expansion throughout the forecast period of 2025-2033. This growth trajectory is significantly influenced by key drivers such as the increasing demand for high-speed internet, the pervasive adoption of smartphones, and the continuous evolution of digital services. The telecommunications sector in Malaysia is actively embracing technological advancements, including 5G deployment and the expansion of fiber optic networks, which are crucial for supporting a data-intensive environment. Furthermore, the rising popularity of Over-The-Top (OTT) and PayTV services, alongside the persistent demand for both voice and data/messaging services across wired and wireless platforms, are fundamental pillars of this market expansion. Investments in infrastructure development and a focus on enhancing customer experience are expected to further solidify the market's upward trend.

Malaysia Telecom Market Market Size (In Million)

However, the market faces certain restraints that warrant strategic attention. These include the intense competition among established players, leading to pricing pressures and a constant need for innovation. The significant capital expenditure required for network upgrades, particularly for 5G rollout, and the ongoing challenge of ensuring widespread digital inclusivity across all demographics and geographical regions can also impact growth rates. Despite these challenges, the Malaysian telecommunications landscape is characterized by a dynamic ecosystem with key companies like Telekom Malaysia Berhad, Maxis Berhad, and CelcomDigi Berhad actively shaping the market. The trend towards convergent services, bundling various offerings to enhance customer value, and the growing significance of IoT applications are set to redefine the market's future, ensuring its continued relevance and growth in the digital era.

Malaysia Telecom Market Company Market Share

This comprehensive report provides an in-depth analysis of the Malaysia Telecom Market, offering critical insights into its structure, dynamics, trends, and future outlook. Leveraging high-ranking keywords and actionable data, this report is an essential resource for telecom operators, service providers, investors, and industry professionals seeking to navigate the evolving Malaysian telecommunications landscape. The study period spans from 2019 to 2033, with a base year of 2025, an estimated year of 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024.

Malaysia Telecom Market Market Structure & Innovation Trends

The Malaysian telecom market exhibits a dynamic and increasingly concentrated structure, driven by strategic mergers and significant innovation. Key players like CelcomDigi Berhad and Telekom Malaysia Berhad hold substantial market share, influencing competitive dynamics and investment in next-generation technologies. Innovation is a critical differentiator, with companies actively pursuing advancements in 5G deployment, AI integration, and the expansion of fiber optic networks to meet escalating data demands. Regulatory frameworks, while evolving to support market growth, also play a crucial role in shaping competition and M&A activities. The threat of product substitutes, such as over-the-top (OTT) communication services, continues to push traditional service providers to enhance their value propositions. End-user demographics are shifting towards a more tech-savvy population, demanding faster speeds and richer digital experiences. Mergers and acquisitions (M&A) are on the rise, with estimated deal values in the billions of Malaysian Ringgit, as companies seek to consolidate market presence, achieve economies of scale, and expand their service portfolios. For instance, the merger forming CelcomDigi Berhad significantly altered the market concentration. Continuous investment in network infrastructure and the adoption of new business models are crucial for maintaining competitive advantage and fostering sustained growth within this vibrant market.

Malaysia Telecom Market Market Dynamics & Trends

The Malaysia Telecom Market is characterized by robust growth and continuous evolution, driven by a confluence of technological advancements, shifting consumer preferences, and intense competitive pressures. The increasing demand for high-speed internet access, fueled by the proliferation of digital services, streaming platforms, and the growing adoption of 5G technology, serves as a primary growth engine. This surge in data consumption necessitates substantial investments in network infrastructure, particularly in expanding 5G coverage and upgrading existing fiber optic networks. The market penetration of mobile broadband continues to rise, with a significant portion of the population now reliant on mobile devices for their primary internet access.

Technological disruptions are at the forefront of market dynamics. The ongoing rollout of 5G technology is a transformative force, promising to unlock new applications and services, including enhanced mobile broadband, low-latency communications for critical IoT applications, and fixed wireless access solutions. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is also reshaping service delivery, network management, and customer engagement. Companies are leveraging AI for predictive maintenance, personalized customer experiences, and the development of innovative digital solutions.

Consumer preferences are increasingly shifting towards integrated digital experiences, demanding seamless connectivity across devices and platforms. There is a growing appetite for over-the-top (OTT) services, which are compelling telecom operators to explore partnerships or develop their own content and service offerings to remain competitive. The demand for bundled services, encompassing mobile, broadband, and entertainment, is also on the rise, as consumers seek convenience and cost-effectiveness.

Competitive dynamics within the Malaysian telecom market are fierce, with major players like Telekom Malaysia Berhad, Maxis Berhad, and the newly formed CelcomDigi Berhad vying for market share. These companies are investing heavily in network upgrades, innovative product development, and aggressive marketing strategies to attract and retain subscribers. The market is also witnessing increased competition from smaller, agile players and new entrants offering specialized services. The continuous innovation in service offerings, coupled with strategic pricing and promotional activities, defines the competitive landscape. The overall Compound Annual Growth Rate (CAGR) for the telecom services segment is projected to be robust, reflecting the sustained demand for connectivity and digital services in Malaysia. The market penetration for broadband services is expected to continue its upward trajectory, driven by government initiatives and the increasing affordability of these services.

Dominant Regions & Segments in Malaysia Telecom Market

The Malaysian Telecom Market is characterized by a significant dominance in urban and semi-urban regions, driven by higher population density, greater purchasing power, and more developed infrastructure. Data and Messaging Services emerge as the most dominant segment, reflecting the pervasive use of smartphones and the increasing reliance on digital communication and content consumption. The widespread adoption of social media platforms, instant messaging applications, and the continuous growth of e-commerce and online entertainment contribute to the unparalleled demand for data services.

Dominance of Data and Messaging Services:

- High Smartphone Penetration: Malaysia boasts a high smartphone penetration rate, with a large segment of the population reliant on mobile devices for their daily communication, information access, and entertainment needs. This directly fuels the demand for robust data plans and reliable mobile internet connectivity.

- Growth of Digital Economy: The burgeoning digital economy in Malaysia, encompassing e-commerce, online learning, and digital payment systems, necessitates uninterrupted and high-speed data access, further solidifying the dominance of this segment.

- Shift from Voice to Data: While voice services remain important, the trend has decisively shifted towards data consumption. Consumers are increasingly prioritizing data allowances and speed over traditional voice minutes, leading to a significant portion of telco revenues being generated from data-related services.

- Emergence of 5G: The ongoing rollout of 5G technology is set to further amplify the importance of the data segment. Enhanced mobile broadband capabilities and new use cases enabled by 5G will drive even greater data consumption and create new revenue streams.

- Competitive Pricing and Bundling: Telecom operators are actively offering competitive data plans and attractive bundles that include data, messaging, and increasingly, access to content services. This strategy encourages higher data usage and customer loyalty.

Other Key Segments and Their Influence:

- Wireless Voice Services: Despite the rise of data, wireless voice services remain a fundamental component of the telecom market. The extensive coverage provided by major operators ensures continued reliance on mobile voice calls, especially in areas where data connectivity might be less reliable or for specific user demographics.

- Wired Voice Services: While declining in relative importance compared to wireless, wired voice services, primarily delivered through fixed-line broadband connections, continue to serve businesses and households requiring stable and dedicated communication channels. The convergence of voice and data over fiber optic networks is a key trend.

- OTT and PayTV Services: This segment represents a dynamic and growing area, directly impacting and often complementing traditional telecom services. Over-the-top (OTT) platforms for communication, video streaming, and content delivery have reshaped consumer entertainment habits. Telecom operators are actively participating in this space through partnerships, content bundling, or by offering their own branded streaming services to capture a share of the evolving entertainment market. The competition and collaboration between traditional PayTV providers and OTT services define the innovation and strategic direction within this segment.

The dominance of Data and Messaging Services is underscored by substantial market revenue figures, with projections indicating continued double-digit growth over the forecast period. Economic policies supporting digital transformation, coupled with infrastructure development initiatives, are key drivers reinforcing this segment's leading position.

Malaysia Telecom Market Product Innovations

The Malaysian telecom market is a hotbed of product innovations, driven by the relentless pursuit of enhanced connectivity and customer experience. Key developments include the introduction of advanced 5G fixed wireless access solutions offering fiber-like speeds without traditional installations, as exemplified by U Mobile's U Home 5G broadband plan. Furthermore, the integration of generative AI into service offerings and internal workflows by players like Maxis, in collaboration with Google Cloud, signifies a leap towards intelligent network management and personalized customer interactions. These innovations aim to enhance network efficiency, unlock new service capabilities, and provide seamless, high-performance digital experiences for both consumers and enterprises, creating significant competitive advantages.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Malaysia Telecom Market across its key service segments. The segmentation includes Voice Services, further divided into Wired and Wireless categories, reflecting traditional but still relevant communication channels. Data and Messaging Services form a crucial segment, encompassing mobile data, broadband internet, and various messaging applications, which constitute the largest revenue drivers. Finally, the OTT and PayTV Services segment captures the rapidly growing market for over-the-top content delivery, streaming services, and digital entertainment. Each segment is analyzed for its market size, growth projections, and competitive dynamics, offering detailed insights into the unique opportunities and challenges within.

Key Drivers of Malaysia Telecom Market Growth

Several key factors are propelling the growth of the Malaysia Telecom Market. The accelerated rollout of 5G infrastructure is a primary driver, promising enhanced mobile broadband speeds and enabling new enterprise applications. Government initiatives focused on digital transformation and digital inclusion, such as the National Digital Network (JENDELA) plan, are crucial for expanding broadband access, particularly in rural areas. The burgeoning digital economy, characterized by the growth of e-commerce, fintech, and digital services, significantly increases the demand for robust and reliable connectivity. Furthermore, evolving consumer preferences for high-definition content streaming, online gaming, and seamless communication experiences are fueling data consumption and driving upgrades to faster and more capable network services.

Challenges in the Malaysia Telecom Market Sector

Despite robust growth, the Malaysia Telecom Market faces several significant challenges. High capital expenditure requirements for network infrastructure development, particularly for 5G deployment and fiber optic expansion, pose a considerable financial burden. Intense market competition among major players can lead to price wars and reduced profit margins, impacting the financial health of operators. Regulatory hurdles and evolving compliance requirements can also create complexities and delays in service deployment. Additionally, ensuring equitable broadband access and affordability in remote or underserved regions remains a persistent challenge, requiring targeted government support and innovative deployment strategies. Cybersecurity threats and data privacy concerns also necessitate continuous investment in security measures.

Emerging Opportunities in Malaysia Telecom Market

The Malaysia Telecom Market presents numerous emerging opportunities for growth and innovation. The widespread adoption of 5G technology opens doors for new enterprise solutions, including IoT applications, smart city initiatives, and advanced telecommunications for industries like healthcare and manufacturing. The increasing demand for cloud-based services and edge computing creates opportunities for telecom operators to leverage their network infrastructure to offer enhanced cloud services. The growing popularity of streaming services and digital entertainment fuels demand for bundled offerings and content partnerships. Furthermore, the expansion of digital payment systems and the "gig economy" rely heavily on reliable mobile connectivity, presenting opportunities for telcos to integrate financial services and support remote workforces. The focus on sustainability and green technology within network operations also presents opportunities for innovation and differentiation.

Leading Players in the Malaysia Telecom Market Market

- Maxis Berhad

- Time Dotcom Bh

- Ansar Mobile (Redtone Digital Berhad)

- U Mobile Sdn Bhd (ST Telemedia)

- Telekom Malaysia Berhad

- YTL Communications Sdn Bhd

- ONE XOX Sdn Bhd (XOX Sdn Bhd)

- Hellosim (Merchantrade Sdn Bhd)

- Celcomdigi Berhad

Key Developments in Malaysia Telecom Market Industry

- March 2024: U Mobile Sdn Bhd introduced the U Home 5G broadband plan, offering a plug-and-play solution for fiber-like speeds. The U Home 5G CPE Bundle provides a complimentary Wi-Fi-6 5G CPE for customers signing up for a 24-month plan at MYR 68 monthly, eliminating the need for separate modem or router purchases and enabling immediate access to high-speed 5G/4G.

- February 2024: Maxis Communication expanded its collaboration with Google Cloud, integrating generative artificial intelligence (GenAI) into its workflows and service offerings. This partnership aims to enable enterprise-grade GenAI for internal operations and customer services, leveraging Duet AI for developers and Gemini models on the Vertex AI platform for AI-powered coding assistance.

Future Outlook for Malaysia Telecom Market Market

The future outlook for the Malaysia Telecom Market is exceptionally positive, driven by ongoing technological advancements and a strong digital imperative. The continued expansion of 5G networks will unlock a new era of connectivity, supporting sophisticated applications across industries and enhancing consumer experiences. The increasing integration of AI and machine learning will further optimize network performance, personalize services, and drive operational efficiency for telecom operators. Government policies supporting digital infrastructure and innovation will continue to be a significant catalyst for growth. Opportunities abound in emerging areas such as IoT, cloud services, and advanced digital entertainment, positioning the Malaysian telecom market for sustained growth and strategic evolution in the coming years.

Malaysia Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Malaysia Telecom Market Segmentation By Geography

- 1. Malaysia

Malaysia Telecom Market Regional Market Share

Geographic Coverage of Malaysia Telecom Market

Malaysia Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation

- 3.4. Market Trends

- 3.4.1. Rising Demand for 5G Drives the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Maxis Berhad

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Time Dotcom Bh

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ansar Mobile (Redtone Digital Berhad)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 U Mobile Sdn Bhd (ST Telemedia)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telekom Malaysia Berhad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 YTL Communications Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ONE XOX Sdn Bhd (XOX Sdn Bhd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hellosim (Merchantrade Sdn Bhd)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Celcomdigi Berhad

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Maxis Berhad

List of Figures

- Figure 1: Malaysia Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Malaysia Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Malaysia Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Malaysia Telecom Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Telecom Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the Malaysia Telecom Market?

Key companies in the market include Maxis Berhad, Time Dotcom Bh, Ansar Mobile (Redtone Digital Berhad), U Mobile Sdn Bhd (ST Telemedia), Telekom Malaysia Berhad, YTL Communications Sdn Bhd, ONE XOX Sdn Bhd (XOX Sdn Bhd), Hellosim (Merchantrade Sdn Bhd), Celcomdigi Berhad.

3. What are the main segments of the Malaysia Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

Rising Demand for 5G Drives the Market's Growth.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation.

8. Can you provide examples of recent developments in the market?

March 2024 - U Mobile Sdn Bhd introduced the U Home 5G broadband plan, which offers customers a hassle-free, plug-and-play solution to enjoy fiber-like speeds without having to hack or install ports. U Mobile has just made the experience even more seamless by introducing the U Home 5G CPE Bundle. Customers will receive a brand-new Wi-Fi-6 5G CPE for free when they sign up for the U Home 5G CPE bundle for 24 months at MYR 68 monthly. With this new bundle, customers will immediately get U Home 5G’s unbeatable 5G/4G high speeds, as they will not need to purchase a modem or router.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Telecom Market?

To stay informed about further developments, trends, and reports in the Malaysia Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence