Key Insights

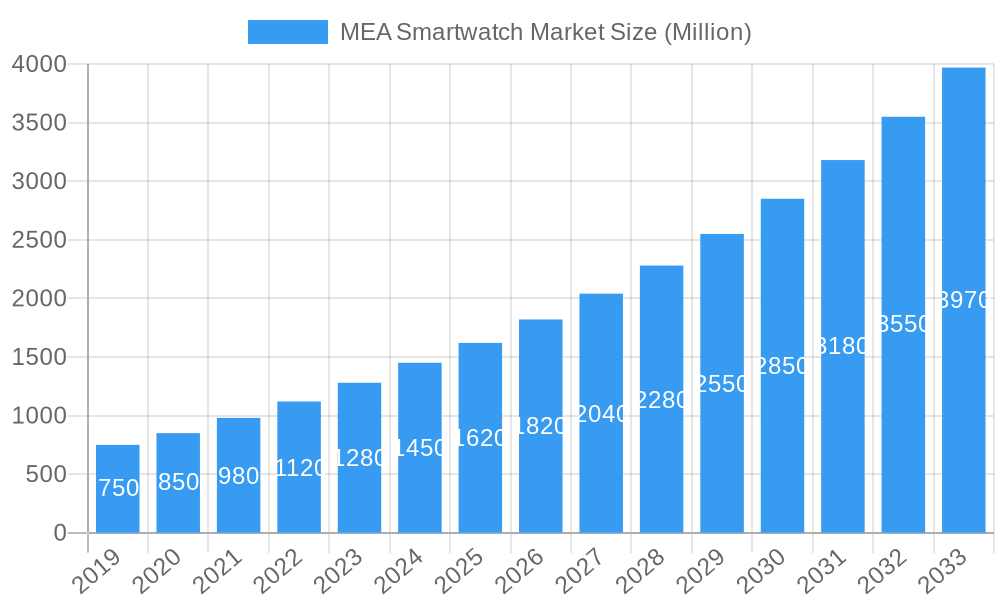

The Middle East & Africa (MEA) smartwatch market is poised for significant expansion, projected to reach $1.62 billion by 2025, driven by a robust CAGR of 12.17% through 2033. This dynamic growth is fueled by escalating consumer adoption of wearable technology, increasing disposable incomes across key MEA nations, and a burgeoning interest in health and fitness tracking. The demand for smartwatches as personal assistance devices, seamlessly integrating with smartphones for notifications, communication, and contactless payments, is a primary growth engine. Furthermore, the rising prevalence of chronic diseases and a heightened awareness of preventative healthcare are propelling the medical application segment, with smartwatches offering vital health monitoring features like heart rate tracking, ECG, and sleep analysis. The operating systems landscape is dominated by Android/Wear OS and Watch OS, reflecting the widespread popularity of Samsung and Apple devices, while "Other Operating Systems" are expected to see incremental growth from emerging brands. The AMOLED display segment is leading, offering superior visual clarity and energy efficiency, crucial for battery-conscious wearables.

MEA Smartwatch Market Market Size (In Million)

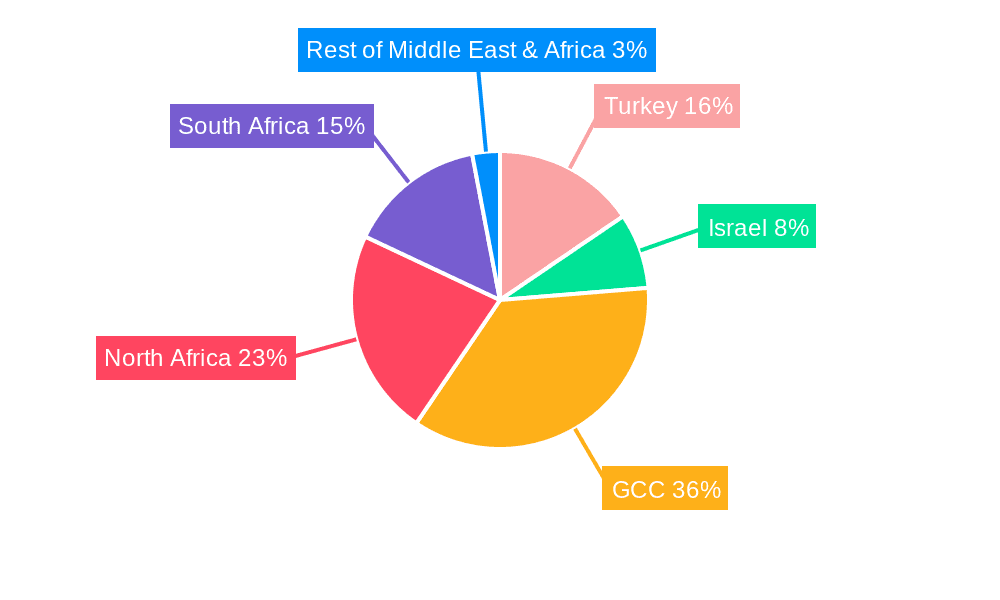

The MEA smartwatch market’s trajectory is further shaped by several key trends. The integration of advanced health sensors and the development of sophisticated fitness tracking algorithms are enhancing the value proposition for consumers. Expansion of e-commerce platforms is democratizing access to smartwatches across diverse geographies within the region. While the market exhibits strong growth, certain restrains like the initial high cost of premium devices and varying levels of internet penetration in some sub-regions may present challenges. However, the increasing availability of affordable mid-range models and the rapid rollout of improved mobile infrastructure are mitigating these concerns. Geographically, the GCC countries are expected to be significant contributors due to higher disposable incomes and early adoption rates, followed by North Africa and South Africa. Companies like Samsung, Apple, and Fitbit (Google) are leading the charge with innovative product portfolios, while regional players are increasingly focusing on feature-rich yet competitively priced offerings to capture market share.

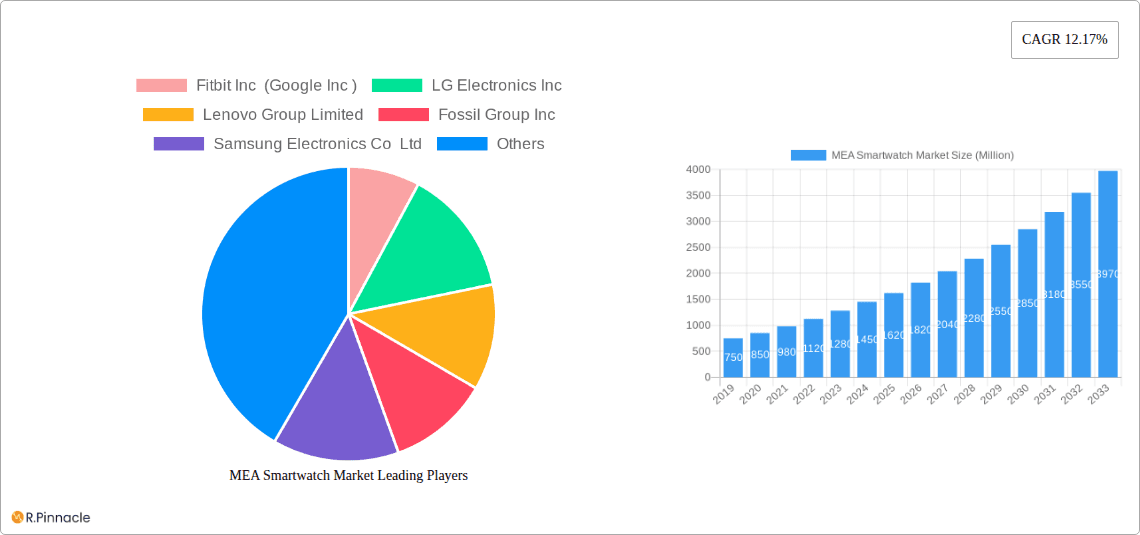

MEA Smartwatch Market Company Market Share

This in-depth report provides a granular analysis of the Middle East & Africa (MEA) Smartwatch Market, offering critical insights and actionable intelligence for industry stakeholders. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this research delves into the intricate dynamics, dominant regions, emerging opportunities, and key players shaping the MEA wearable technology landscape. Leveraging high-ranking keywords such as "MEA smartwatch market," "wearable technology MEA," "smartwatch market share MEA," and "fitness tracker MEA," this report is optimized for maximum search visibility and engagement with industry professionals.

MEA Smartwatch Market Market Structure & Innovation Trends

The MEA Smartwatch Market is characterized by a dynamic structure with increasing concentration driven by strategic product launches and evolving consumer preferences. Innovation is a key differentiator, with companies continuously investing in advanced features like enhanced health monitoring, longer battery life, and superior display technologies. Regulatory frameworks, while still developing in certain regions, are progressively aligning with global standards, fostering a more stable market environment. Substitutes, such as basic fitness trackers and smartphones with similar functionalities, pose a moderate challenge, but the unique value proposition of dedicated smartwatches continues to drive adoption. End-user demographics are broadening, with a significant increase in adoption among the younger, tech-savvy population and a growing segment of health-conscious individuals across all age groups. Mergers and acquisitions (M&A) activities, while not yet at peak levels, are anticipated to rise as established players seek to consolidate market share and acquire innovative technologies. The market is expected to see an approximate 25% market share consolidation among the top five players by 2033, with estimated M&A deal values reaching several hundred million.

- Market Concentration: Moderate to high, with a discernible shift towards consolidation among key global players.

- Innovation Drivers: Health and fitness tracking capabilities, connectivity features, battery efficiency, and advanced display technologies (e.g., AMOLED).

- Regulatory Frameworks: Evolving landscape, with a growing emphasis on data privacy and security.

- Product Substitutes: Basic fitness trackers, smartphones with limited wearable functionalities.

- End-User Demographics: Growing penetration among millennials and Gen Z, with increasing adoption by older demographics for health monitoring.

- M&A Activities: Expected to increase, driven by the pursuit of market share and technological advancements.

MEA Smartwatch Market Market Dynamics & Trends

The MEA Smartwatch Market is poised for significant growth, propelled by a confluence of expanding market drivers, disruptive technological advancements, evolving consumer preferences, and intensifying competitive dynamics. The increasing disposable income across various MEA nations, coupled with a rising awareness of health and fitness, is acting as a primary growth engine. Consumers are increasingly seeking wearable devices that offer comprehensive health tracking, including heart rate monitoring, sleep analysis, and blood oxygen saturation levels. This demand is further amplified by the growing popularity of sports and fitness activities across the region. Technological disruptions are playing a crucial role, with advancements in battery technology leading to longer usage times, more sophisticated sensor integration enabling accurate health metrics, and the development of more intuitive user interfaces enhancing the overall user experience. The integration of advanced operating systems like Wear OS and WatchOS is further refining the functionality and appeal of smartwatches. Consumer preferences are shifting towards devices that offer a blend of style, functionality, and personalization. Brands that can effectively cater to these diverse needs by offering a wide range of designs and customizable features are likely to gain a competitive edge. The competitive landscape is robust, with both global tech giants and emerging regional players vying for market dominance. This intense competition is fostering a cycle of innovation, leading to more feature-rich and competitively priced products. Market penetration is projected to surge from approximately 15% in 2024 to an estimated 45% by 2033, with a Compound Annual Growth Rate (CAGR) estimated at 18.5% for the forecast period. The integration of 5G technology and the expanding IoT ecosystem will further fuel market penetration and unlock new application possibilities for smartwatches.

Dominant Regions & Segments in MEA Smartwatch Market

The MEA Smartwatch Market is experiencing significant growth, with the United Arab Emirates (UAE) emerging as a dominant region due to its high disposable income, tech-savvy population, and early adoption of new technologies. This dominance is further bolstered by robust government initiatives promoting digitalization and a strong presence of leading global technology brands. Within the UAE, Dubai stands out as a key market hub. The Android/Wear OS segment is currently leading in terms of market share, owing to its broad compatibility with a wide range of smartphones and its open-source nature, allowing for greater customization and app development. However, Watch OS is rapidly gaining traction, particularly among premium users, due to its seamless integration with Apple's ecosystem and its sophisticated user interface. The AMOLED display type is the undisputed leader, offering superior color vibrancy, contrast ratios, and energy efficiency, which are critical for wearable devices. This technological advantage directly translates into enhanced user experience, making AMOLED screens a preferred choice for both manufacturers and consumers. In terms of applications, Personal Assistance and Sports are the most dominant segments. The growing emphasis on health and wellness, coupled with the increasing participation in fitness activities, has propelled the demand for smartwatches that offer advanced fitness tracking, personalized coaching, and real-time health monitoring. The Medical application segment, while still nascent, holds immense future potential, driven by the increasing need for remote patient monitoring and the integration of sophisticated health sensors capable of detecting early signs of chronic diseases. The Other Applications segment, encompassing features like mobile payments, navigation, and entertainment, also contributes significantly to overall market adoption.

- Leading Region: United Arab Emirates (UAE)

- Key Drivers: High disposable income, tech-savvy population, government digitalization initiatives, strong retail infrastructure.

- Dominant Country Hub: Dubai

- Leading Operating System: Android/Wear OS

- Key Drivers: Broad smartphone compatibility, open-source nature, extensive app ecosystem.

- Emerging Trend: Rapid growth of Watch OS driven by ecosystem integration.

- Leading Display Type: AMOLED

- Key Drivers: Superior color quality, high contrast, energy efficiency, enhanced user experience.

- Dominant Applications:

- Personal Assistance: Notifications, communication, smart home control.

- Sports: Fitness tracking, workout analysis, GPS mapping.

- Emerging Potential: Medical applications for health monitoring.

MEA Smartwatch Market Product Innovations

Product innovations in the MEA smartwatch market are focused on enhancing user experience and expanding functionality. Companies are integrating advanced health sensors for more accurate blood pressure and glucose monitoring, alongside improved sleep tracking capabilities. The development of longer-lasting batteries and faster charging technologies addresses a key consumer pain point. Furthermore, the incorporation of AI-driven personalized insights and coaching is enhancing the value proposition for both fitness enthusiasts and health-conscious individuals. The trend towards customizable designs and premium materials is also notable, catering to the discerning tastes of the MEA consumer base. These innovations are creating significant competitive advantages, enabling brands to differentiate themselves in a rapidly evolving market.

Report Scope & Segmentation Analysis

This report comprehensively segments the MEA Smartwatch Market across key parameters. The Operating Systems segmentation includes Watch OS, Android/Wear OS, and Other Operating Systems, with Android/Wear OS expected to lead in market share during the forecast period (2025-2033) with a projected market size of approximately $4,000 million. The Display Type segmentation covers AMOLED, PMOLED, and TFT LCD, with AMOLED dominating due to its superior visual performance and energy efficiency, anticipated to reach a market size of over $5,500 million by 2033. The Application segmentation analyzes Personal Assistance, Medical, Sports, and Other Applications. The Sports and Personal Assistance segments are expected to drive significant growth, with the Medical segment showing substantial future potential, projected to grow at a CAGR of over 22%.

- Operating Systems: Watch OS, Android/Wear OS (projected market size ~$4,000 million by 2033), Other Operating Systems.

- Display Type: AMOLED (projected market size >$5,500 million by 2033), PMOLED, TFT LCD.

- Application: Personal Assistance, Medical (CAGR >22%), Sports, Other Applications.

Key Drivers of MEA Smartwatch Market Growth

The MEA Smartwatch Market is experiencing robust growth driven by several key factors. The escalating health consciousness and demand for advanced fitness tracking capabilities are paramount. The increasing disposable incomes across the region fuel consumer spending on premium and technologically advanced gadgets. Furthermore, the widespread adoption of smartphones and the burgeoning mobile ecosystem create a fertile ground for wearable technology. Government initiatives promoting digital transformation and smart city development indirectly support the smartwatch market by fostering a tech-friendly environment. The growing popularity of e-sports and outdoor recreational activities also contributes to the demand for smartwatches with specialized features.

Challenges in the MEA Smartwatch Market Sector

Despite the promising growth, the MEA Smartwatch Market faces several challenges. Affordability remains a significant barrier in certain lower-income segments of the region, limiting mass market adoption. Lack of robust after-sales service and repair infrastructure in some countries can deter potential buyers. Concerns regarding data privacy and security, particularly for health-related data, also pose a restraint, requiring stringent adherence to regional regulations. The intense competition from established global players and the threat of increasingly capable feature-rich smartphones also present ongoing challenges. Supply chain disruptions, though less prominent than in previous years, can still impact product availability and pricing.

Emerging Opportunities in MEA Smartwatch Market

The MEA Smartwatch Market presents numerous emerging opportunities. The rapid expansion of the health and wellness sector offers a significant avenue for smartwatches with advanced medical monitoring features, including remote patient monitoring and chronic disease management. The increasing demand for personalized user experiences opens doors for brands that can offer extensive customization options, from watch faces to strap designs and app integrations. The burgeoning e-commerce landscape in the MEA region facilitates wider product reach and accessibility. Furthermore, the potential integration with 5G networks will unlock new possibilities for seamless connectivity and real-time data processing, enhancing functionalities like augmented reality experiences and advanced communication. The untapped potential in emerging markets within Africa, coupled with strategic partnerships with local businesses, can unlock substantial growth.

Leading Players in the MEA Smartwatch Market Market

- Apple Inc

- Samsung Electronics Co Ltd

- Fitbit Inc (Google Inc )

- Garmin Ltd

- Huawei Technologies Co Ltd

- Xiaomi Corporation (part of this market via brands like Amazfit)

- Amazfit (Huami Corporation)

- Lenovo Group Limited

- Fossil Group Inc

- LG Electronics Inc

- Sony Middle East & Africa (Sony Corporation)

Key Developments in MEA Smartwatch Market Industry

- November 2022: Amazfit, owned by Zepp Health, launched the fourth generation of its GTR and GTS series in Qatar, in partnership with Intertec Group. These new models feature advanced sporting capabilities, HD AMOLED displays, and innovative circularly polarized GPS antenna technology.

- October 2022: Xiaomi introduced the Smart Band 7 Pro in the UAE, featuring a larger 1.64" rectangular AMOLED screen with auto-brightness, over 110 sports modes, and enhanced viewing experience for practical and enjoyable use.

Future Outlook for MEA Smartwatch Market Market

The future outlook for the MEA Smartwatch Market is exceptionally bright, driven by sustained technological advancements and evolving consumer behavior. The continued integration of sophisticated health sensors, enabling predictive diagnostics and personalized wellness plans, will be a major growth accelerator. The increasing focus on connectivity, particularly with the widespread rollout of 5G, will unlock new applications and enhance the seamless integration of smartwatches into the broader IoT ecosystem. Strategic collaborations between tech companies and healthcare providers are anticipated to further propel the adoption of smartwatches for medical purposes. The growing trend of personalization, catering to diverse fashion preferences and lifestyle needs, will also play a crucial role in market expansion. As disposable incomes rise and digital literacy improves across more MEA countries, the market penetration of smartwatches is set to reach new heights, solidifying their position as indispensable personal technology devices. The market is expected to witness an overall market valuation exceeding $15,000 million by 2033.

MEA Smartwatch Market Segmentation

-

1. Operating Systems

- 1.1. Watch OS

- 1.2. Android/Wear OS

- 1.3. Other Operating Systems

-

2. Display Type

- 2.1. AMOLED

- 2.2. PMOLED

- 2.3. TFT LCD

-

3. Application

- 3.1. Personal Assistance

- 3.2. Medical

- 3.3. Sports

- 3.4. Other Applications

MEA Smartwatch Market Segmentation By Geography

-

1. Middle East & Africa

- 1.1. Turkey

- 1.2. Israel

- 1.3. GCC

- 1.4. North Africa

- 1.5. South Africa

- 1.6. Rest of Middle East & Africa

MEA Smartwatch Market Regional Market Share

Geographic Coverage of MEA Smartwatch Market

MEA Smartwatch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumers

- 3.3. Market Restrains

- 3.3.1 Growing Complexity of Wearable Devices and Limited Use of Features

- 3.3.2 Augmented with Security Risks

- 3.4. Market Trends

- 3.4.1. The rise in initiatives for monitoring the health concerns of older people

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Smartwatch Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 5.1.1. Watch OS

- 5.1.2. Android/Wear OS

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. AMOLED

- 5.2.2. PMOLED

- 5.2.3. TFT LCD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Assistance

- 5.3.2. Medical

- 5.3.3. Sports

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East & Africa

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fitbit Inc (Google Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG Electronics Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lenovo Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fossil Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Garmin Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonly Middle East & Africa (Sony Corporation)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amazfit (Huami Corporation)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Fitbit Inc (Google Inc )

List of Figures

- Figure 1: MEA Smartwatch Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MEA Smartwatch Market Share (%) by Company 2025

List of Tables

- Table 1: MEA Smartwatch Market Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 2: MEA Smartwatch Market Volume Million Forecast, by Operating Systems 2020 & 2033

- Table 3: MEA Smartwatch Market Revenue Million Forecast, by Display Type 2020 & 2033

- Table 4: MEA Smartwatch Market Volume Million Forecast, by Display Type 2020 & 2033

- Table 5: MEA Smartwatch Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: MEA Smartwatch Market Volume Million Forecast, by Application 2020 & 2033

- Table 7: MEA Smartwatch Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: MEA Smartwatch Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: MEA Smartwatch Market Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 10: MEA Smartwatch Market Volume Million Forecast, by Operating Systems 2020 & 2033

- Table 11: MEA Smartwatch Market Revenue Million Forecast, by Display Type 2020 & 2033

- Table 12: MEA Smartwatch Market Volume Million Forecast, by Display Type 2020 & 2033

- Table 13: MEA Smartwatch Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: MEA Smartwatch Market Volume Million Forecast, by Application 2020 & 2033

- Table 15: MEA Smartwatch Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: MEA Smartwatch Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: Turkey MEA Smartwatch Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Turkey MEA Smartwatch Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Israel MEA Smartwatch Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Israel MEA Smartwatch Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: GCC MEA Smartwatch Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: GCC MEA Smartwatch Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: North Africa MEA Smartwatch Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: North Africa MEA Smartwatch Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: South Africa MEA Smartwatch Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Africa MEA Smartwatch Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Middle East & Africa MEA Smartwatch Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East & Africa MEA Smartwatch Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Smartwatch Market?

The projected CAGR is approximately 12.17%.

2. Which companies are prominent players in the MEA Smartwatch Market?

Key companies in the market include Fitbit Inc (Google Inc ), LG Electronics Inc, Lenovo Group Limited, Fossil Group Inc, Samsung Electronics Co Ltd, Garmin Ltd, Sonly Middle East & Africa (Sony Corporation), Amazfit (Huami Corporation), Huawei Technologies Co Ltd, Apple Inc.

3. What are the main segments of the MEA Smartwatch Market?

The market segments include Operating Systems, Display Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumers.

6. What are the notable trends driving market growth?

The rise in initiatives for monitoring the health concerns of older people.

7. Are there any restraints impacting market growth?

Growing Complexity of Wearable Devices and Limited Use of Features. Augmented with Security Risks.

8. Can you provide examples of recent developments in the market?

November 2022 - With the assistance of Intertec Group, which serves as the country of Qatar's authorized distributor for Amzfit smart watches, Amazfit, a global brand of wearable technology owned by Zepp Health, has introduced the fourth generation of its GTR and GTS series in Qatar. The new watches have advanced sporting capabilities, huge HD AMOLED displays, and the industry's first circularly polarised GPS antenna technology, all housed in fashionable designs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Smartwatch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Smartwatch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Smartwatch Market?

To stay informed about further developments, trends, and reports in the MEA Smartwatch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence