Key Insights

The Middle East and Africa (MEA) telecom market is poised for significant expansion, projected to reach $8 billion by 2033. This growth will be propelled by a compound annual growth rate (CAGR) of 13% from the base year 2025. Key drivers include escalating smartphone adoption, increased internet penetration, and rising data consumption. Government-led digital transformation initiatives and infrastructure development are also vital catalysts. Furthermore, the widespread use of mobile money in underbanked populations significantly contributes to the sector's growth. However, persistent challenges such as infrastructure limitations in rural areas and varied regulatory landscapes across countries may temper growth. The market is segmented by service type into mobile, fixed-line, and broadband, with mobile services leading due to accessibility and affordability. Major players like Mobily, Saudi Telecom Company, Ooredoo Group, Oman Telecommunications Company, Etisalat Group, Telecom Egypt, and Zain Group are actively investing in network infrastructure and service innovation to capture market share amidst intense competition.

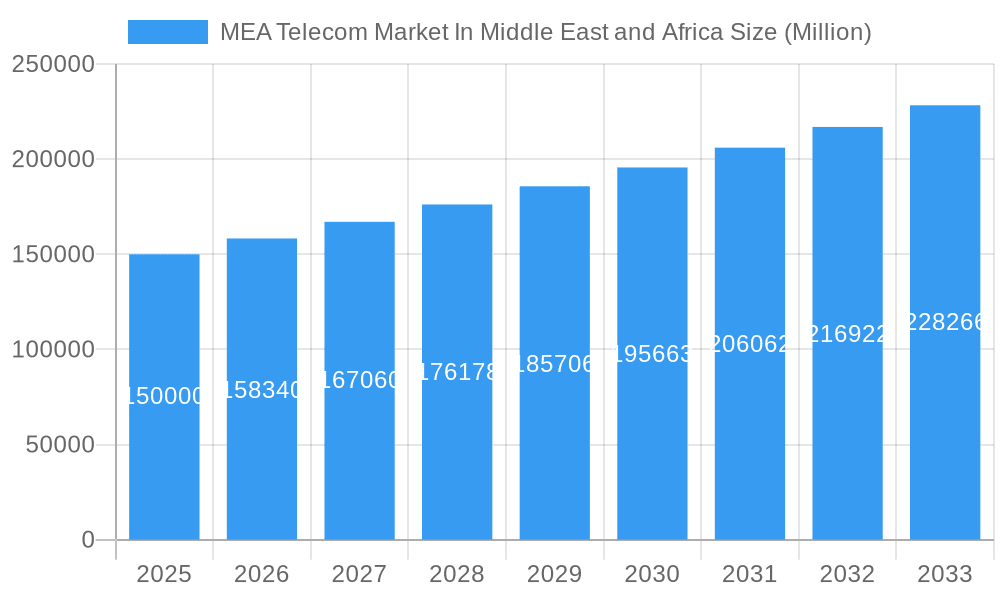

MEA Telecom Market In Middle East and Africa Market Size (In Billion)

The African telecom segment, spanning nations such as South Africa, Sudan, Uganda, Tanzania, and Kenya, presents a diverse market environment. While certain economies exhibit rapid growth, others contend with economic and infrastructure constraints. Africa's growth trajectory is expected to surpass the overall MEA average, driven by expanding mobile penetration in previously underserved regions and the rollout of 4G and 5G networks. This presents substantial opportunities for telecom operators willing to invest in infrastructure and customize offerings for specific African markets. The upcoming decade is critical for enhancing broadband access and achieving digital inclusivity across the continent. The ongoing shift towards data-centric services and the adoption of advanced technologies like 5G will redefine competitive dynamics and foster continuous innovation within the MEA telecom sector.

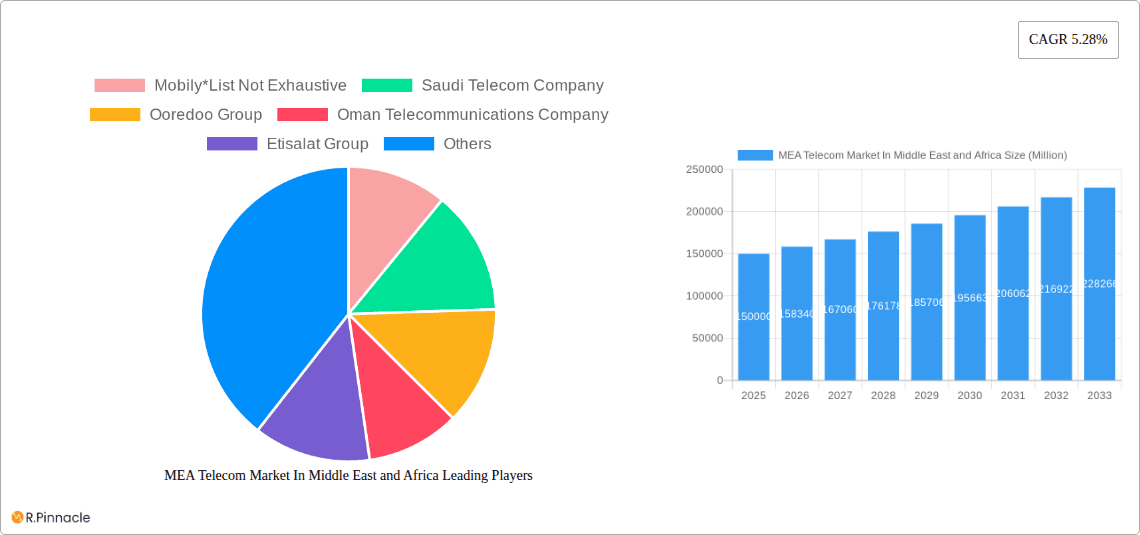

MEA Telecom Market In Middle East and Africa Company Market Share

MEA Telecom Market: Middle East and Africa Analysis and Forecast (2025-2033)

This comprehensive report delivers an in-depth analysis of the MEA Telecom Market in the Middle East and Africa, providing critical insights for industry leaders, investors, and strategists. Focusing on the period from 2025 to 2033, with an emphasis on the base year 2025, this report meticulously examines market structure, dynamics, key stakeholders, and future growth potential. Utilizing robust data and analytical methodologies, the report offers actionable intelligence to empower businesses to make informed strategic decisions within this dynamic and rapidly evolving market landscape.

MEA Telecom Market In Middle East and Africa Market Structure & Innovation Trends

The MEA telecom market exhibits a complex interplay of established players and emerging innovators. Market concentration is moderate, with significant regional variations. Key players like Saudi Telecom Company, Ooredoo Group, Etisalat Group, Telecom Egypt, Zain Group, and Mobily hold substantial market share, though the exact figures vary by segment and region. However, smaller, specialized providers are increasingly active, particularly in niche areas like enterprise solutions and IoT.

- Market Share: STC and Etisalat hold the largest market shares, with xx% and xx%, respectively, in the overall market, though this differs regionally.

- Innovation Drivers: 5G deployment, digital transformation initiatives, and the growing adoption of cloud-based services are key innovation drivers. Government support for digital infrastructure development also significantly influences market growth.

- Regulatory Frameworks: Regulatory environments vary considerably across the region, impacting market entry and competition. Harmonization efforts are underway but face challenges in some countries.

- Product Substitutes: Over-the-top (OTT) services and alternative communication platforms pose competitive challenges to traditional telecom services.

- M&A Activities: The MEA telecom market has witnessed significant M&A activity in recent years, with deal values exceeding xx Million in the last 5 years. These deals often focus on expanding market reach, acquiring technological capabilities, or consolidating market positions. For instance, [insert details of a specific M&A deal if available, otherwise replace with “Further details on specific M&A activity are available within the full report.”]

MEA Telecom Market In Middle East and Africa Market Dynamics & Trends

The MEA telecom market is characterized by strong growth, driven by factors such as increasing smartphone penetration, rising internet usage, and growing demand for data services. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, fueled by several key trends:

- Technological Disruptions: 5G technology adoption is rapidly accelerating, driving significant growth in data consumption and enabling new applications. The ongoing transition to cloud computing further fuels innovation and creates new market opportunities.

- Consumer Preferences: Consumers increasingly demand high-speed, reliable internet access and a wide range of digital services. This is reflected in the growing popularity of OTT platforms and social media, alongside the demand for affordable data plans.

- Competitive Dynamics: Intense competition among established players and the emergence of new entrants are shaping the market landscape. Differentiation through value-added services and innovative pricing models is crucial for success.

- Market Penetration: Mobile penetration is high in many parts of the region, while broadband penetration shows substantial room for growth. This presents significant expansion opportunities for telecom providers.

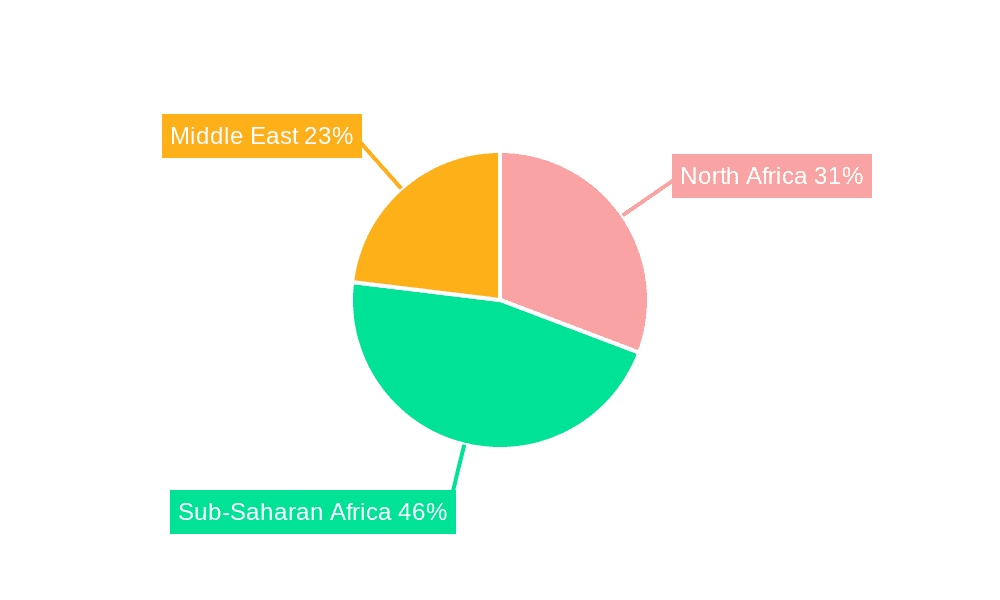

Dominant Regions & Segments in MEA Telecom Market In Middle East and Africa

The MEA telecom market shows significant regional variation in terms of growth and market dynamics. [Specify the most dominant region, for example, “The Gulf Cooperation Council (GCC) countries, especially Saudi Arabia and the UAE,”] consistently demonstrates the highest revenue and growth rates within the MEA region. This dominance is attributed to several factors:

- Key Drivers in Dominant Region:

- Strong economic growth and high per capita income.

- Government investments in digital infrastructure.

- Favorable regulatory environment.

- High smartphone penetration and increasing internet usage.

Dominant Segment Analysis (By Type): The mobile segment currently dominates the MEA telecom market, accounting for approximately xx% of the total revenue in 2025. This is driven by the high mobile penetration rates, the affordability of mobile devices, and the proliferation of mobile data services. However, the broadband segment is experiencing rapid growth, with a projected CAGR of xx% during the forecast period, as consumers and businesses increasingly rely on high-speed internet access. Fixed-line services, while still relevant, are witnessing slower growth compared to mobile and broadband.

MEA Telecom Market In Middle East and Africa Product Innovations

The MEA telecom market is witnessing rapid product innovation, driven by the deployment of 5G technology, the increasing adoption of cloud-based services, and the growing demand for data-centric solutions. Innovations include enhanced mobile broadband services, advanced IoT applications, cloud-based telecom infrastructure, and new security solutions for digital platforms. These innovations are designed to meet the evolving needs of both consumers and businesses, allowing telecom operators to gain a competitive advantage and cater to the growing demand for data.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the MEA telecom market, segmented by type:

Mobile: This segment includes mobile voice and data services, SMS, and other mobile-related value-added services. Market size is projected to reach xx Million by 2033, driven by increasing smartphone penetration and data consumption. Competitive dynamics are intense, with price competition and value-added services playing a key role.

Fixed Line: This segment comprises traditional fixed-line telephony services. Market size is expected to remain relatively stable but decline slightly during the forecast period due to the shift towards mobile and broadband services. Competition remains, though less intense than in other segments.

Broadband: This segment covers fixed and wireless broadband services, including DSL, fiber, and cable internet. This is the fastest-growing segment, projected to reach xx Million by 2033, fueled by rising demand for high-speed internet access and the expansion of broadband infrastructure. Competition is increasing as new players enter the market.

Key Drivers of MEA Telecom Market In Middle East and Africa Growth

Several factors are driving the growth of the MEA telecom market: Firstly, rising disposable incomes and increasing urbanization are leading to higher demand for communication and data services. Secondly, government initiatives promoting digital inclusion and infrastructure development are creating a favorable environment for market expansion. Finally, technological advancements, such as the rollout of 5G networks and the increasing adoption of cloud-based solutions, are facilitating innovation and creating new opportunities.

Challenges in the MEA Telecom Market In Middle East and Africa Sector

The MEA telecom market faces several challenges: Regulatory complexities and varying licensing requirements across different countries create hurdles for market entry and expansion. Furthermore, infrastructure limitations, particularly in some rural areas, hinder broadband penetration. Finally, intense competition among existing players and the emergence of new entrants exert significant pressure on profit margins. These challenges necessitate strategic planning and adaptability by telecom operators.

Emerging Opportunities in MEA Telecom Market In Middle East and Africa

The MEA telecom market presents numerous emerging opportunities: The growth of the IoT sector offers new possibilities for innovative service offerings. The increasing adoption of cloud computing and big data analytics creates opportunities for specialized services and enhanced customer experiences. Finally, the expansion of mobile financial services creates a significant growth area for telecom companies. These opportunities require strategic investments and collaborations.

Leading Players in the MEA Telecom Market In Middle East and Africa Market

- Mobily

- Saudi Telecom Company

- Ooredoo Group

- Oman Telecommunications Company

- Etisalat Group

- Telecom Egypt

- Zain Group

Key Developments in MEA Telecom Market In Middle East and Africa Industry

- June 2022: ZainTech partners with LigaData to leverage data analytics for enhanced digital services in the MENA region. This signifies a growing focus on data-driven solutions and partnerships to enhance capabilities.

- March 2022: Ericsson and Saudi Telecom Company (stc) collaborate to advance 5G connectivity in Saudi Arabia, highlighting the focus on 5G infrastructure and innovation in a major market.

- March 2022: Ooredoo Group partners with SAP for digital business transformation, demonstrating the increasing importance of digitalization across the telecom industry.

Future Outlook for MEA Telecom Market In Middle East and Africa Market

The MEA telecom market is poised for continued robust growth, driven by factors such as increasing mobile and internet penetration, the expansion of 5G networks, and rising demand for data-centric services. Strategic partnerships, investments in infrastructure, and innovation in service offerings will be crucial for sustained success in this dynamic and competitive market. The market is predicted to reach xx Million by 2033.

MEA Telecom Market In Middle East and Africa Segmentation

-

1. Type

- 1.1. Mobile

- 1.2. Fixed Line

- 1.3. Broadband

-

2. Geography

-

2.1. UAE

- 2.1.1. By Type

- 2.2. Saudi Arabia (KSA)

- 2.3. Rest of

-

2.1. UAE

MEA Telecom Market In Middle East and Africa Segmentation By Geography

-

1. UAE

- 1.1. By Type

- 2. Saudi Arabia

- 3. By Type

- 4. Rest of MEA

MEA Telecom Market In Middle East and Africa Regional Market Share

Geographic Coverage of MEA Telecom Market In Middle East and Africa

MEA Telecom Market In Middle East and Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Development of Fiber-based Networks and Fixed Broadband Service; Successful Liberalization of Telecom Sector & Launch of MVNOs

- 3.3. Market Restrains

- 3.3.1. Budget Constraints and Technological Limitations

- 3.4. Market Trends

- 3.4.1. 5G technology is Expected to have Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Telecom Market In Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mobile

- 5.1.2. Fixed Line

- 5.1.3. Broadband

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. UAE

- 5.2.1.1. By Type

- 5.2.2. Saudi Arabia (KSA)

- 5.2.3. Rest of

- 5.2.1. UAE

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.3.3. By Type

- 5.3.4. Rest of MEA

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. UAE MEA Telecom Market In Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mobile

- 6.1.2. Fixed Line

- 6.1.3. Broadband

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. UAE

- 6.2.1.1. By Type

- 6.2.2. Saudi Arabia (KSA)

- 6.2.3. Rest of

- 6.2.1. UAE

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia MEA Telecom Market In Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mobile

- 7.1.2. Fixed Line

- 7.1.3. Broadband

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. UAE

- 7.2.1.1. By Type

- 7.2.2. Saudi Arabia (KSA)

- 7.2.3. Rest of

- 7.2.1. UAE

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. By Type MEA Telecom Market In Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mobile

- 8.1.2. Fixed Line

- 8.1.3. Broadband

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. UAE

- 8.2.1.1. By Type

- 8.2.2. Saudi Arabia (KSA)

- 8.2.3. Rest of

- 8.2.1. UAE

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of MEA MEA Telecom Market In Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mobile

- 9.1.2. Fixed Line

- 9.1.3. Broadband

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. UAE

- 9.2.1.1. By Type

- 9.2.2. Saudi Arabia (KSA)

- 9.2.3. Rest of

- 9.2.1. UAE

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mobily*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Saudi Telecom Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ooredoo Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oman Telecommunications Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Etisalat Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Telecom Egypt

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Zain Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Mobily*List Not Exhaustive

List of Figures

- Figure 1: MEA Telecom Market In Middle East and Africa Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: MEA Telecom Market In Middle East and Africa Share (%) by Company 2025

List of Tables

- Table 1: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 2: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Region 2020 & 2033

- Table 4: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 5: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 7: By Type MEA Telecom Market In Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 9: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 11: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 12: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Geography 2020 & 2033

- Table 13: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 14: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Type 2020 & 2033

- Table 15: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: MEA Telecom Market In Middle East and Africa Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Telecom Market In Middle East and Africa?

The projected CAGR is approximately 13%.

2. Which companies are prominent players in the MEA Telecom Market In Middle East and Africa?

Key companies in the market include Mobily*List Not Exhaustive, Saudi Telecom Company, Ooredoo Group, Oman Telecommunications Company, Etisalat Group, Telecom Egypt, Zain Group.

3. What are the main segments of the MEA Telecom Market In Middle East and Africa?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Development of Fiber-based Networks and Fixed Broadband Service; Successful Liberalization of Telecom Sector & Launch of MVNOs.

6. What are the notable trends driving market growth?

5G technology is Expected to have Significant Share.

7. Are there any restraints impacting market growth?

Budget Constraints and Technological Limitations.

8. Can you provide examples of recent developments in the market?

June 2022 - To support its vision of providing cutting-edge, data-driven digital services to enterprise and government customers throughout the Middle East and North Africa (MENA), ZainTech, the ICT solutions and digital powerhouse of the Zain Group, has announced a partnership with data analytics specialist, LigaData. The strategic cooperation between ZainTech and LigaData highlights ZainTech's dedication to utilizing data's potential to create cutting-edge digital solutions for its corporate and government clients and the larger Zain Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Telecom Market In Middle East and Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Telecom Market In Middle East and Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Telecom Market In Middle East and Africa?

To stay informed about further developments, trends, and reports in the MEA Telecom Market In Middle East and Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence