Key Insights

The medical device contract manufacturing market is exhibiting substantial expansion, driven by escalating outsourcing trends among medical device companies seeking cost efficiencies and strategic focus on core competencies. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 10.9%, with an estimated market size of $83.77 billion by 2025. Key growth drivers include a burgeoning global geriatric population requiring increased medical device utilization, rapid technological advancements leading to the development of sophisticated devices demanding specialized manufacturing expertise, and a complex regulatory environment necessitating partnerships with compliant and quality-focused contract manufacturers. The market segmentation highlights significant contributions from In Vitro Diagnostics (IVD) consumables and diagnostic imaging devices, underscoring the robust demand within the diagnostics sector. The services segment, particularly device development and manufacturing, indicates a strong need for integrated solutions extending beyond basic production. Leading entities such as Nordson Corporation, Jabil Inc., and Integer Holdings Corporation are strategically positioned to leverage this growth through their specialized expertise across various device types and manufacturing processes. Geographically, North America and Europe represent significant markets, while the Asia-Pacific region is anticipated to witness accelerated expansion due to increased healthcare investments and infrastructure development. The forecast period from 2025 to 2033 anticipates sustained growth, propelled by continuous technological innovation and rising global healthcare expenditures.

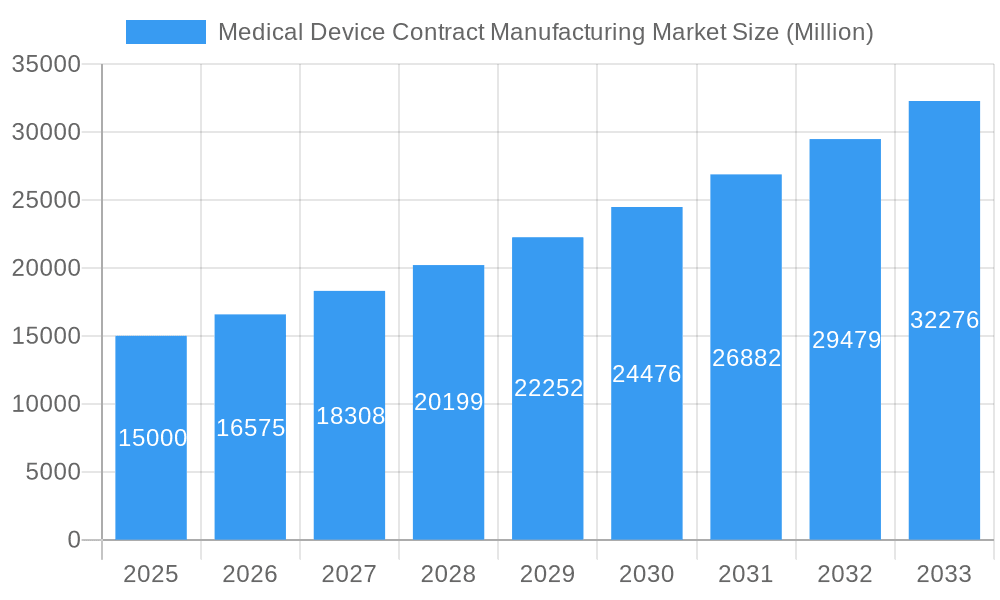

Medical Device Contract Manufacturing Market Market Size (In Billion)

Market success will be contingent upon contract manufacturers' agility in adapting to evolving regulatory landscapes, emerging technologies, and precise client requirements. Maintaining stringent quality standards, optimizing production processes, and fortifying supply chains are paramount for sustained growth. Manufacturers offering comprehensive service portfolios, encompassing design, development, final packaging, and validation, will likely offer seamless and efficient solutions to their medical device partners. Specific segments like cardiovascular and orthopedic devices are expected to experience above-average growth, driven by the increasing prevalence of related chronic conditions and the demand for advanced implants and therapeutic devices. Intensifying competition will necessitate continuous innovation and differentiation through specialized services and cutting-edge technologies.

Medical Device Contract Manufacturing Market Company Market Share

Medical Device Contract Manufacturing Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Medical Device Contract Manufacturing market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities.

Medical Device Contract Manufacturing Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the medical device contract manufacturing market. We examine market concentration, identifying key players and their respective market shares. The report also explores the impact of mergers and acquisitions (M&A) activities, including deal values and their influence on market consolidation. Innovation drivers such as technological advancements in 3D printing and automation are discussed, alongside regulatory frameworks like FDA guidelines and their effect on manufacturing processes. The analysis also considers the role of product substitutes and the evolving demographics of end-users.

Market Concentration: The market shows a moderately concentrated structure with a few large players holding significant market share. For example, Jabil Inc. and Integer Holdings Corporation are predicted to hold xx% and xx% of the market respectively in 2025. Smaller companies focusing on niche segments also play a vital role.

M&A Activity: The past five years have witnessed significant M&A activity, with deal values exceeding $XX Million in 2024 alone. These transactions reflect consolidation efforts and expansion into new therapeutic areas.

Regulatory Landscape: Stringent regulatory requirements, particularly in regions like North America and Europe, heavily influence manufacturing processes and operational standards.

Medical Device Contract Manufacturing Market Dynamics & Trends

This section delves into the key dynamics driving market growth, including technological advancements, evolving consumer preferences, and competitive pressures. We examine the Compound Annual Growth Rate (CAGR) and market penetration rates for various segments. The analysis encompasses emerging technologies like AI-powered quality control systems and their impact on efficiency and cost reduction. Furthermore, we explore the influence of consumer demand for personalized medical devices and the resulting impact on manufacturing strategies.

CAGR: The global medical device contract manufacturing market is projected to experience a CAGR of xx% during the forecast period (2025-2033).

Market Penetration: The penetration of advanced manufacturing technologies, such as automation and robotics, is increasing steadily. We project xx% market penetration by 2033.

Technological Disruptions: The rise of additive manufacturing (3D printing) is transforming prototyping and small-batch production.

Dominant Regions & Segments in Medical Device Contract Manufacturing Market

This section identifies the leading regions and segments within the medical device contract manufacturing market, offering a detailed analysis of their dominance. We explore the key growth drivers within each segment, including economic policies, infrastructure, and consumer demand.

By Device:

Cardiovascular Devices: This segment is expected to maintain its leading position driven by increasing prevalence of cardiovascular diseases and technological advancements in minimally invasive procedures.

IVD Devices & Consumables: Growing demand for rapid diagnostics and point-of-care testing fuels the growth in this segment.

Drug Delivery Devices: The rising prevalence of chronic diseases and demand for convenient drug administration methods contributes to the growth in this sector.

By Service:

Device Development and Manufacturing Service: This segment is predicted to witness significant growth owing to increasing outsourcing of device development by medical device companies.

Device Manufacturing Service: The demand for specialized manufacturing expertise in this service segment is high.

Key Drivers (Examples):

- Favorable regulatory environment in certain regions.

- Robust healthcare infrastructure.

- Increasing government funding for R&D.

Medical Device Contract Manufacturing Market Product Innovations

This section highlights recent product developments, focusing on technological advancements and their market relevance. The integration of smart technologies, miniaturization, and improved material science are impacting device design and manufacturing. Innovations are geared towards improving device performance, reducing costs, and enhancing patient safety.

Report Scope & Segmentation Analysis

This report segments the Medical Device Contract Manufacturing market by device type (IVD Devices, IVD Consumables, Diagnostic Imaging Devices, Cardiovascular Devices, Drug Delivery Devices, Endoscopy Devices, Ophthalmology Devices, Orthopedic Devices, Dental Devices, Other Devices) and by service type (Device Development and Manufacturing Service, Device Manufacturing Service, Quality Management Service, Packaging Validation Service, Assembly Service). Each segment's growth projections, market size, and competitive dynamics are analyzed.

Examples (Not exhaustive):

- The IVD Devices segment is projected to reach $XX Million by 2033, driven by technological advancements and increasing demand.

- The Device Development and Manufacturing Service segment will experience strong growth due to increased outsourcing.

Key Drivers of Medical Device Contract Manufacturing Market Growth

The Medical Device Contract Manufacturing market's growth is fueled by several factors. The increasing prevalence of chronic diseases necessitates advanced medical devices, driving demand for contract manufacturing services. Technological advancements, particularly in automation and 3D printing, enhance production efficiency and reduce costs. Favorable regulatory frameworks in some regions further stimulate market expansion.

Challenges in the Medical Device Contract Manufacturing Market Sector

Several challenges impede market growth. Stringent regulatory requirements increase manufacturing costs and complexity. Supply chain disruptions and material shortages can impact production timelines and profitability. Intense competition and pricing pressures also constrain profit margins. These challenges can collectively result in a loss of $XX Million in projected revenue per year.

Emerging Opportunities in Medical Device Contract Manufacturing Market

Emerging opportunities abound in the Medical Device Contract Manufacturing market. The rising demand for personalized medicine and the adoption of digital health technologies present growth avenues. Expansion into emerging markets with growing healthcare infrastructure provides further opportunities. The increasing focus on sustainability and environmentally friendly manufacturing processes also opens new market niches.

Leading Players in the Medical Device Contract Manufacturing Market Market

- Nordson Corporation

- Jabil Inc

- Nipro Corporation

- Biofortuna Limited

- SteriPack Group Ltd

- Invetech

- TE Connectivity Ltd

- Nortech Systems Inc

- Celestica Inc

- Teleflex Incorporated

- Celestica International

- Gerresheimer AG

- Integer Holdings Corporation

- Synecco

Key Developments in Medical Device Contract Manufacturing Market Industry

- June 2022: Amnovis and BAAT Medical partnered to offer rapid turnaround for 3D-printed medical devices.

- May 2022: Biomerics opened a balloon catheter center of excellence in Galway, Ireland.

Future Outlook for Medical Device Contract Manufacturing Market Market

The future of the Medical Device Contract Manufacturing market looks promising. Continued technological advancements, increasing healthcare spending, and the expansion of the global medical device industry will drive substantial growth. Strategic partnerships and investments in R&D will further strengthen the market's position. The market is expected to reach $XX Million by 2033, representing a significant increase from the 2025 value.

Medical Device Contract Manufacturing Market Segmentation

-

1. Device

-

1.1. IVD Devices

- 1.1.1. IVD Equipments

- 1.1.2. IVD Consumables

- 1.2. Diagnostic Imaging Devices

- 1.3. Cardiovascular Devices

-

1.4. Drug Delivery Devices

- 1.4.1. Syringes

- 1.4.2. Pen Injectors

- 1.4.3. Others

- 1.5. Endoscopy Devices

- 1.6. Ophthalmology Devices

- 1.7. Orthopedic Devices

- 1.8. Dental Devices

- 1.9. Other Devices

-

1.1. IVD Devices

-

2. Service

-

2.1. Device Development and Manufacturing Service

- 2.1.1. Device Engineering Service

- 2.1.2. Process Development Service

- 2.1.3. Device Manufacturing Service

-

2.2. Quality Management Service

- 2.2.1. Inspection & Testing Service

- 2.2.2. Packaging Validation Service

- 2.3. Assembly Service

-

2.1. Device Development and Manufacturing Service

Medical Device Contract Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Medical Device Contract Manufacturing Market Regional Market Share

Geographic Coverage of Medical Device Contract Manufacturing Market

Medical Device Contract Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Medical Device Market; Advancement in Technology

- 3.3. Market Restrains

- 3.3.1. Medical Device Market Consolidation

- 3.4. Market Trends

- 3.4.1. IVD Device Segment is Expected to Hold the Largest Market Share in the Medical Device Contract Manufacturing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Device Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. IVD Devices

- 5.1.1.1. IVD Equipments

- 5.1.1.2. IVD Consumables

- 5.1.2. Diagnostic Imaging Devices

- 5.1.3. Cardiovascular Devices

- 5.1.4. Drug Delivery Devices

- 5.1.4.1. Syringes

- 5.1.4.2. Pen Injectors

- 5.1.4.3. Others

- 5.1.5. Endoscopy Devices

- 5.1.6. Ophthalmology Devices

- 5.1.7. Orthopedic Devices

- 5.1.8. Dental Devices

- 5.1.9. Other Devices

- 5.1.1. IVD Devices

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Device Development and Manufacturing Service

- 5.2.1.1. Device Engineering Service

- 5.2.1.2. Process Development Service

- 5.2.1.3. Device Manufacturing Service

- 5.2.2. Quality Management Service

- 5.2.2.1. Inspection & Testing Service

- 5.2.2.2. Packaging Validation Service

- 5.2.3. Assembly Service

- 5.2.1. Device Development and Manufacturing Service

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. North America Medical Device Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. IVD Devices

- 6.1.1.1. IVD Equipments

- 6.1.1.2. IVD Consumables

- 6.1.2. Diagnostic Imaging Devices

- 6.1.3. Cardiovascular Devices

- 6.1.4. Drug Delivery Devices

- 6.1.4.1. Syringes

- 6.1.4.2. Pen Injectors

- 6.1.4.3. Others

- 6.1.5. Endoscopy Devices

- 6.1.6. Ophthalmology Devices

- 6.1.7. Orthopedic Devices

- 6.1.8. Dental Devices

- 6.1.9. Other Devices

- 6.1.1. IVD Devices

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Device Development and Manufacturing Service

- 6.2.1.1. Device Engineering Service

- 6.2.1.2. Process Development Service

- 6.2.1.3. Device Manufacturing Service

- 6.2.2. Quality Management Service

- 6.2.2.1. Inspection & Testing Service

- 6.2.2.2. Packaging Validation Service

- 6.2.3. Assembly Service

- 6.2.1. Device Development and Manufacturing Service

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Europe Medical Device Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. IVD Devices

- 7.1.1.1. IVD Equipments

- 7.1.1.2. IVD Consumables

- 7.1.2. Diagnostic Imaging Devices

- 7.1.3. Cardiovascular Devices

- 7.1.4. Drug Delivery Devices

- 7.1.4.1. Syringes

- 7.1.4.2. Pen Injectors

- 7.1.4.3. Others

- 7.1.5. Endoscopy Devices

- 7.1.6. Ophthalmology Devices

- 7.1.7. Orthopedic Devices

- 7.1.8. Dental Devices

- 7.1.9. Other Devices

- 7.1.1. IVD Devices

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Device Development and Manufacturing Service

- 7.2.1.1. Device Engineering Service

- 7.2.1.2. Process Development Service

- 7.2.1.3. Device Manufacturing Service

- 7.2.2. Quality Management Service

- 7.2.2.1. Inspection & Testing Service

- 7.2.2.2. Packaging Validation Service

- 7.2.3. Assembly Service

- 7.2.1. Device Development and Manufacturing Service

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Asia Pacific Medical Device Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. IVD Devices

- 8.1.1.1. IVD Equipments

- 8.1.1.2. IVD Consumables

- 8.1.2. Diagnostic Imaging Devices

- 8.1.3. Cardiovascular Devices

- 8.1.4. Drug Delivery Devices

- 8.1.4.1. Syringes

- 8.1.4.2. Pen Injectors

- 8.1.4.3. Others

- 8.1.5. Endoscopy Devices

- 8.1.6. Ophthalmology Devices

- 8.1.7. Orthopedic Devices

- 8.1.8. Dental Devices

- 8.1.9. Other Devices

- 8.1.1. IVD Devices

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Device Development and Manufacturing Service

- 8.2.1.1. Device Engineering Service

- 8.2.1.2. Process Development Service

- 8.2.1.3. Device Manufacturing Service

- 8.2.2. Quality Management Service

- 8.2.2.1. Inspection & Testing Service

- 8.2.2.2. Packaging Validation Service

- 8.2.3. Assembly Service

- 8.2.1. Device Development and Manufacturing Service

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Middle East and Africa Medical Device Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. IVD Devices

- 9.1.1.1. IVD Equipments

- 9.1.1.2. IVD Consumables

- 9.1.2. Diagnostic Imaging Devices

- 9.1.3. Cardiovascular Devices

- 9.1.4. Drug Delivery Devices

- 9.1.4.1. Syringes

- 9.1.4.2. Pen Injectors

- 9.1.4.3. Others

- 9.1.5. Endoscopy Devices

- 9.1.6. Ophthalmology Devices

- 9.1.7. Orthopedic Devices

- 9.1.8. Dental Devices

- 9.1.9. Other Devices

- 9.1.1. IVD Devices

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Device Development and Manufacturing Service

- 9.2.1.1. Device Engineering Service

- 9.2.1.2. Process Development Service

- 9.2.1.3. Device Manufacturing Service

- 9.2.2. Quality Management Service

- 9.2.2.1. Inspection & Testing Service

- 9.2.2.2. Packaging Validation Service

- 9.2.3. Assembly Service

- 9.2.1. Device Development and Manufacturing Service

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. South America Medical Device Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device

- 10.1.1. IVD Devices

- 10.1.1.1. IVD Equipments

- 10.1.1.2. IVD Consumables

- 10.1.2. Diagnostic Imaging Devices

- 10.1.3. Cardiovascular Devices

- 10.1.4. Drug Delivery Devices

- 10.1.4.1. Syringes

- 10.1.4.2. Pen Injectors

- 10.1.4.3. Others

- 10.1.5. Endoscopy Devices

- 10.1.6. Ophthalmology Devices

- 10.1.7. Orthopedic Devices

- 10.1.8. Dental Devices

- 10.1.9. Other Devices

- 10.1.1. IVD Devices

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Device Development and Manufacturing Service

- 10.2.1.1. Device Engineering Service

- 10.2.1.2. Process Development Service

- 10.2.1.3. Device Manufacturing Service

- 10.2.2. Quality Management Service

- 10.2.2.1. Inspection & Testing Service

- 10.2.2.2. Packaging Validation Service

- 10.2.3. Assembly Service

- 10.2.1. Device Development and Manufacturing Service

- 10.1. Market Analysis, Insights and Forecast - by Device

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nordson Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Synecco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jabil Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nipro Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biofortuna Limited*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SteriPack Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Invetech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TE Connectivity Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nortech Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Celestica Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teleflex Incorporated

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Celestica International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Gerresheimer AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Integer Holdings Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Nordson Corporation

List of Figures

- Figure 1: Global Medical Device Contract Manufacturing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Medical Device Contract Manufacturing Market Revenue (billion), by Device 2025 & 2033

- Figure 3: North America Medical Device Contract Manufacturing Market Revenue Share (%), by Device 2025 & 2033

- Figure 4: North America Medical Device Contract Manufacturing Market Revenue (billion), by Service 2025 & 2033

- Figure 5: North America Medical Device Contract Manufacturing Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Medical Device Contract Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Medical Device Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Medical Device Contract Manufacturing Market Revenue (billion), by Device 2025 & 2033

- Figure 9: Europe Medical Device Contract Manufacturing Market Revenue Share (%), by Device 2025 & 2033

- Figure 10: Europe Medical Device Contract Manufacturing Market Revenue (billion), by Service 2025 & 2033

- Figure 11: Europe Medical Device Contract Manufacturing Market Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Medical Device Contract Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Medical Device Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Medical Device Contract Manufacturing Market Revenue (billion), by Device 2025 & 2033

- Figure 15: Asia Pacific Medical Device Contract Manufacturing Market Revenue Share (%), by Device 2025 & 2033

- Figure 16: Asia Pacific Medical Device Contract Manufacturing Market Revenue (billion), by Service 2025 & 2033

- Figure 17: Asia Pacific Medical Device Contract Manufacturing Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Asia Pacific Medical Device Contract Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Medical Device Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Medical Device Contract Manufacturing Market Revenue (billion), by Device 2025 & 2033

- Figure 21: Middle East and Africa Medical Device Contract Manufacturing Market Revenue Share (%), by Device 2025 & 2033

- Figure 22: Middle East and Africa Medical Device Contract Manufacturing Market Revenue (billion), by Service 2025 & 2033

- Figure 23: Middle East and Africa Medical Device Contract Manufacturing Market Revenue Share (%), by Service 2025 & 2033

- Figure 24: Middle East and Africa Medical Device Contract Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Medical Device Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Medical Device Contract Manufacturing Market Revenue (billion), by Device 2025 & 2033

- Figure 27: South America Medical Device Contract Manufacturing Market Revenue Share (%), by Device 2025 & 2033

- Figure 28: South America Medical Device Contract Manufacturing Market Revenue (billion), by Service 2025 & 2033

- Figure 29: South America Medical Device Contract Manufacturing Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: South America Medical Device Contract Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Medical Device Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Device 2020 & 2033

- Table 2: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Device 2020 & 2033

- Table 5: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Device 2020 & 2033

- Table 11: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Service 2020 & 2033

- Table 12: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Device 2020 & 2033

- Table 20: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Service 2020 & 2033

- Table 21: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Device 2020 & 2033

- Table 29: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Service 2020 & 2033

- Table 30: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Device 2020 & 2033

- Table 35: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Service 2020 & 2033

- Table 36: Global Medical Device Contract Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Medical Device Contract Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Device Contract Manufacturing Market?

The projected CAGR is approximately 10.9%.

2. Which companies are prominent players in the Medical Device Contract Manufacturing Market?

Key companies in the market include Nordson Corporation, Synecco, Jabil Inc, Nipro Corporation, Biofortuna Limited*List Not Exhaustive, SteriPack Group Ltd, Invetech, TE Connectivity Ltd, Nortech Systems Inc, Celestica Inc, Teleflex Incorporated, Celestica International, Gerresheimer AG, Integer Holdings Corporation.

3. What are the main segments of the Medical Device Contract Manufacturing Market?

The market segments include Device, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 83.77 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Medical Device Market; Advancement in Technology.

6. What are the notable trends driving market growth?

IVD Device Segment is Expected to Hold the Largest Market Share in the Medical Device Contract Manufacturing Market.

7. Are there any restraints impacting market growth?

Medical Device Market Consolidation.

8. Can you provide examples of recent developments in the market?

In June 2022, Belgian contract manufacturer Amnovis and medical device service provider BAAT Medical teamed up to offer an innovative and rapid turnaround process for 3D printed medical devices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Device Contract Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Device Contract Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Device Contract Manufacturing Market?

To stay informed about further developments, trends, and reports in the Medical Device Contract Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence