Key Insights

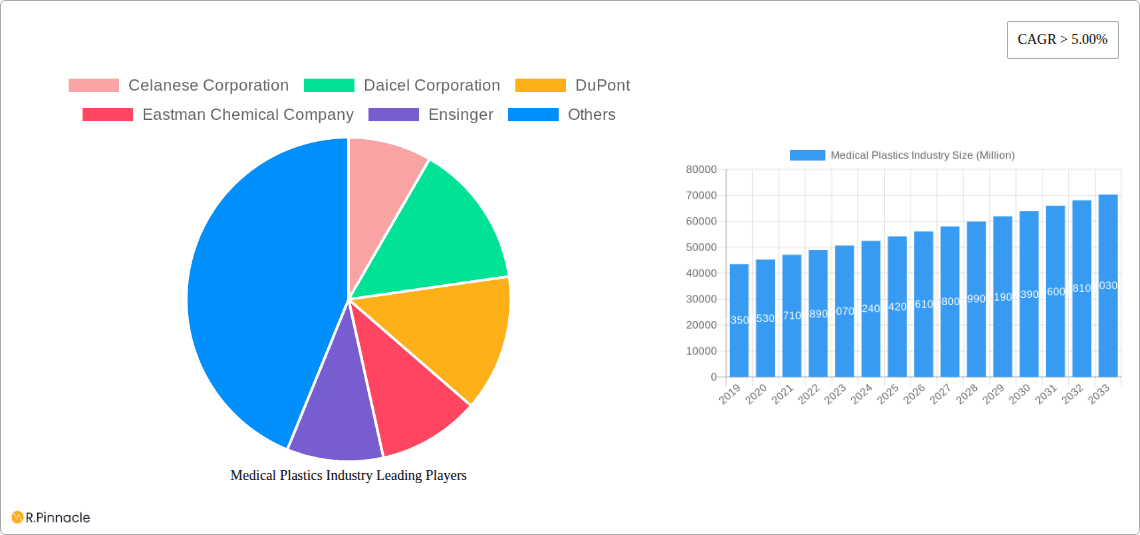

The global Medical Plastics market is projected for significant expansion, reaching an estimated market size of $27.46 billion by 2025. The market is expected to experience a robust Compound Annual Growth Rate (CAGR) of 5.56% through 2033. Key growth drivers include the rising demand for advanced medical devices, the increasing prevalence of chronic diseases, and the adoption of minimally invasive surgical procedures. Medical plastics offer superior biocompatibility, sterilizability, durability, and cost-effectiveness compared to traditional materials, facilitating their widespread use in healthcare applications. Technological advancements in material science are developing specialized plastics with enhanced properties for sophisticated medical equipment. Furthermore, a growing emphasis on disposable medical products for infection control and patient safety is significantly contributing to market momentum. The aging global population and increased healthcare expenditure globally are expected to sustain this upward trajectory.

Medical Plastics Industry Market Size (In Billion)

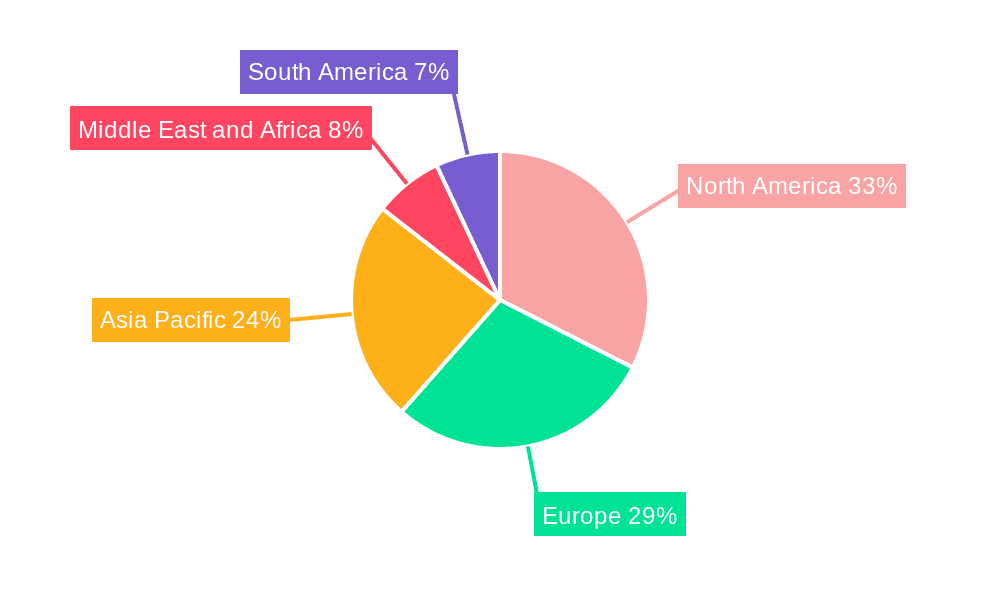

Market segmentation highlights the dominance of Traditional Plastics such as Polyethylene (PE) and Polypropylene (PP) due to their versatility and cost-effectiveness in disposables and packaging. However, Engineered Plastics, including Acrylonitrile Butadiene Styrene (ABS), Polycarbonate (PC), and Polyetheretherketone (PEEK), are experiencing accelerated growth. These advanced materials are crucial for high-performance applications like surgical instruments, diagnostic imaging, and implantable devices, where stringent biocompatibility and sterilization resistance are essential. North America and Europe currently lead the market, supported by well-established healthcare infrastructure and R&D investments. The Asia Pacific region is emerging as a high-growth frontier, driven by expanding healthcare access and a burgeoning medical device manufacturing sector. Strategic focus on innovation, product development, and geographic expansion is key for market players.

Medical Plastics Industry Company Market Share

This comprehensive report offers deep insights into the medical plastics market from 2019 to 2033, with a focus on the period up to 2025. It provides a granular analysis of market dynamics, segmentation, and future trends, exploring the impact of materials science advancements, increasing healthcare demands, and evolving regulatory landscapes on medical devices and pharmaceuticals. This report is an essential resource for stakeholders seeking to navigate and capitalize on the high-growth medical plastics sector.

Medical Plastics Industry Market Structure & Innovation Trends

The global medical plastics market exhibits a moderate to highly concentrated structure, driven by a few dominant players and a growing number of specialized innovators. Innovation is primarily fueled by the demand for advanced materials with enhanced biocompatibility, sterilizability, and mechanical properties. Key innovation drivers include the development of antimicrobial plastics, biodegradable polymers for implantable devices, and high-performance engineering plastics for complex surgical tools and diagnostic equipment. Regulatory frameworks, particularly stringent FDA and EMA guidelines, play a crucial role in dictating material choices and manufacturing processes, fostering innovation in compliance and safety. Product substitutes, such as traditional metals and ceramics, are increasingly being displaced by advanced polymers offering superior performance and cost-effectiveness. End-user demographics, including an aging global population and rising prevalence of chronic diseases, are significantly influencing product demand. Mergers and acquisitions (M&A) activities are moderate, with larger companies acquiring smaller, specialized firms to expand their technological capabilities and product portfolios. Notable M&A deal values in the recent past have ranged from tens of millions to several hundred million dollars, reflecting strategic consolidation.

Medical Plastics Industry Market Dynamics & Trends

The medical plastics industry is experiencing robust growth, driven by a confluence of powerful factors. An ever-increasing global population, coupled with an aging demographic, translates directly into a higher demand for healthcare services and medical devices, thereby fueling the consumption of medical-grade plastics. Technological advancements are at the forefront of this expansion, with continuous innovation in polymer science leading to the development of novel materials that offer superior biocompatibility, enhanced mechanical strength, improved sterilization capabilities, and greater design flexibility. These advanced materials are crucial for the creation of next-generation medical devices, from sophisticated surgical instruments and implantable devices to advanced diagnostic and drug delivery systems. The growing prevalence of chronic diseases worldwide further escalates the need for reliable and disposable medical products, where plastics play a pivotal role. Furthermore, the drive towards minimally invasive surgical procedures necessitates the use of specialized, high-precision plastic components. Consumer preferences are also shifting, with a growing demand for personalized medicine and patient-centric healthcare solutions, which often rely on customized plastic components. The competitive landscape is characterized by a mix of large, established chemical companies and smaller, niche manufacturers. Companies are investing heavily in research and development to gain a competitive edge by offering innovative solutions and catering to specific application needs. Market penetration of advanced medical plastics is steadily increasing as the benefits of their superior performance and cost-effectiveness become more apparent across various healthcare applications. The compound annual growth rate (CAGR) for the medical plastics market is projected to be a healthy xx%, indicating sustained expansion over the forecast period.

Dominant Regions & Segments in Medical Plastics Industry

The North America region currently dominates the medical plastics market, propelled by its advanced healthcare infrastructure, high per capita healthcare spending, and a strong emphasis on research and development. Within North America, the United States stands out as the leading country, owing to its vast patient population, widespread adoption of innovative medical technologies, and a robust regulatory environment that encourages material innovation.

Dominant Segments:

By Type:

- Engineered Plastics hold a significant share due to their superior mechanical properties, thermal resistance, and chemical inertness, making them ideal for critical medical applications.

- Polycarbonate (PC): Widely used for its clarity, impact resistance, and sterilizability in applications like diagnostic equipment housings and medical device components.

- Polyetheretherketone (PEEK): A high-performance polymer increasingly favored for implantable devices, spinal implants, and prosthetics due to its excellent biocompatibility, strength, and radiolucency.

- Polyoxymethylene (POM): Offers good stiffness, low friction, and dimensional stability, making it suitable for intricate medical components and surgical instruments.

- Traditional Plastics continue to play a vital role, particularly in high-volume disposable applications.

- Polyethylene (PE): Extensively used in flexible packaging for sterile medical supplies, disposable syringes, and IV bags due to its flexibility and low cost.

- Polypropylene (PP): Valued for its chemical resistance and autoclavability, it finds application in sterilization trays, medical containers, and disposable syringes.

- Engineered Plastics hold a significant share due to their superior mechanical properties, thermal resistance, and chemical inertness, making them ideal for critical medical applications.

By Application:

- Disposables represent the largest application segment. This includes a wide array of single-use medical products such as syringes, gloves, gowns, tubing, and diagnostic kits. The increasing focus on infection control and the rising number of procedures requiring sterile, single-use items are key drivers.

- Surgical Instruments is another significant segment, with a growing demand for lightweight, durable, and precisely engineered plastic components for both traditional and minimally invasive surgical tools.

Key Drivers of Dominance in North America:

- Economic Policies: Favorable healthcare reimbursement policies and government initiatives promoting medical innovation.

- Infrastructure: Advanced healthcare facilities and a well-established distribution network for medical products.

- Technological Adoption: Rapid assimilation of new medical technologies and materials.

- R&D Investment: Significant investment in research and development by both public and private sectors.

Medical Plastics Industry Product Innovations

The medical plastics industry is witnessing a surge in product innovations focused on enhancing patient outcomes and improving healthcare efficiency. Key developments include the introduction of novel biocompatible polymers for implantable devices, such as resorbable polymers that degrade safely within the body, and advanced antimicrobial plastics that help prevent healthcare-associated infections. Innovations in material science are also leading to the development of lightweight yet robust engineering plastics for surgical instruments, enabling greater precision and reduced user fatigue. Furthermore, the demand for advanced diagnostic imaging equipment is driving the use of specialized plastics with specific radiolucent or radio-opaque properties. These product developments are driven by a need for improved performance, enhanced safety, and cost-effectiveness in a rapidly evolving healthcare landscape.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the global medical plastics market, segmented by material type, application, and region. The Type segmentation includes Traditional Plastics (Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), Polyvinylchloride (PVC)) and Engineered Plastics (Acrylonitrile butadiene styrene (ABS), Polycarbonate (PC), Polymethylmethacrylate (PMMA), Polyetheretherketone (PEEK), Polyoxymethylene (POM), Polyphenylene Oxide (PPO), Others). The Application segmentation covers Surgical instruments, Disposables, Diagnosis instruments, Sterilization trays, Anesthetic and imaging equipment, and Others. The market is projected to see robust growth across all segments, with Engineered Plastics and Disposables leading in terms of market share and projected growth rates. Competitive dynamics vary across segments, with specialized players often dominating niche engineered plastics applications, while larger corporations cater to high-volume traditional plastics markets.

Key Drivers of Medical Plastics Industry Growth

The medical plastics industry is experiencing significant growth, propelled by several key factors. The escalating global demand for healthcare services, driven by an aging population and a rising incidence of chronic diseases, necessitates a continuous supply of medical devices and disposables, where plastics are indispensable. Technological advancements in polymer science are enabling the development of innovative materials with superior biocompatibility, mechanical strength, and sterilization capabilities, leading to the creation of advanced medical equipment and implantable devices. Furthermore, regulatory bodies are increasingly approving novel plastic materials for a wider range of medical applications. The shift towards minimally invasive surgeries also requires sophisticated, lightweight plastic components, further boosting market expansion.

Challenges in the Medical Plastics Industry Sector

Despite its strong growth trajectory, the medical plastics industry faces several significant challenges. Stringent and evolving regulatory requirements from bodies like the FDA and EMA impose high costs and lengthy approval processes for new materials and products, acting as a considerable barrier to entry and innovation. Supply chain disruptions, as witnessed in recent global events, can lead to material shortages and price volatility, impacting production timelines and costs. The industry also faces increasing pressure regarding environmental sustainability, with growing calls for biodegradable or recyclable medical plastics, necessitating significant investment in R&D and infrastructure changes. Competitive pressures from both established players and emerging market entrants can also impact pricing and market share.

Emerging Opportunities in Medical Plastics Industry

Emerging opportunities in the medical plastics industry are abundant, driven by ongoing technological advancements and evolving healthcare needs. The burgeoning field of personalized medicine and advanced drug delivery systems presents a significant opportunity for the development of specialized polymers and intricate plastic components. The increasing adoption of 3D printing in healthcare is opening new avenues for customized medical devices and implants manufactured from biocompatible plastics. Furthermore, the growing demand for wearable medical devices and remote patient monitoring solutions will require the development of lightweight, durable, and flexible plastic materials. The expansion of healthcare infrastructure in emerging economies also presents substantial untapped market potential.

Leading Players in the Medical Plastics Industry Market

- Celanese Corporation

- Daicel Corporation

- DuPont

- Eastman Chemical Company

- Ensinger

- GW Plastics

- Mitsubishi Chemical Corporation

- Nolato AB (publ)

- NUSIL

- Orthoplastics Ltd

- Röchling SE & Co KG

- SABIC

- Saint-Gobain Performance Plastics

- Solvay

- Sylvin Technologies

- Teknor Apex

- Westlake Plastics

Key Developments in Medical Plastics Industry Industry

- 2024: Launch of new biocompatible PEEK grades for advanced orthopedic implants, offering enhanced strength and wear resistance.

- 2023: Strategic acquisition of a specialized bioplastics manufacturer by a leading chemical company to expand its sustainable medical material portfolio.

- 2023: Introduction of novel antimicrobial PVC formulations for high-contact medical surfaces, aiming to reduce healthcare-associated infections.

- 2022: Significant investment in R&D for biodegradable polymers designed for temporary medical implants, focusing on faster patient recovery.

- 2022: Development of high-performance engineered plastics for next-generation anesthetic and imaging equipment, enabling miniaturization and improved functionality.

- 2021: Expansion of production capacity for medical-grade Polycarbonate (PC) to meet the growing demand from diagnostic instrument manufacturers.

- 2021: Collaboration between material science companies and medical device manufacturers to create advanced polymer solutions for minimally invasive surgical tools.

Future Outlook for Medical Plastics Industry Market

The future outlook for the medical plastics industry is exceptionally promising, characterized by sustained growth and transformative innovation. The increasing global demand for healthcare, coupled with the relentless pace of technological advancements in polymer science, will continue to drive market expansion. Opportunities in areas such as personalized medicine, advanced drug delivery systems, and the growing adoption of 3D printing for medical applications will create new avenues for growth. Furthermore, the focus on sustainability will lead to the development and widespread adoption of bio-based and recyclable medical plastics. Strategic partnerships and continued investment in research and development will be crucial for companies looking to capitalize on the evolving needs of the healthcare sector and maintain a competitive edge in this dynamic market.

Medical Plastics Industry Segmentation

-

1. Type

-

1.1. Traditional Plastics

- 1.1.1. Polyethylene (PE)

- 1.1.2. Polypropylene (PP)

- 1.1.3. Polystyrene(PS)

- 1.1.4. Polyvinylchloride(PVC)

-

1.2. Engineer Plastics

- 1.2.1. Acrylonitrile butadiene styrene (ABS)

- 1.2.2. Polycarbonate (PC)

- 1.2.3. Polymethylmethacrylate (PMMA)

- 1.2.4. Polyetheretherketone (PEEK)

- 1.2.5. Polyoxymethylene (POM)

- 1.2.6. Polyphenylene Oxide (PPO)

- 1.2.7. Others

-

1.1. Traditional Plastics

-

2. Application

- 2.1. Surgical instruments

- 2.2. Disposables

- 2.3. Diagnosis instruments

- 2.4. Sterilization trays

- 2.5. Anesthetic and imaging equipment

- 2.6. Others

Medical Plastics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. MiddleEast and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Medical Plastics Industry Regional Market Share

Geographic Coverage of Medical Plastics Industry

Medical Plastics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Medical Devices from the Asia-Pacific Region; Expanding Prosthetics Market

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand for Medical Devices from the Asia-Pacific Region; Expanding Prosthetics Market

- 3.4. Market Trends

- 3.4.1. Surgical Instruments Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Traditional Plastics

- 5.1.1.1. Polyethylene (PE)

- 5.1.1.2. Polypropylene (PP)

- 5.1.1.3. Polystyrene(PS)

- 5.1.1.4. Polyvinylchloride(PVC)

- 5.1.2. Engineer Plastics

- 5.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 5.1.2.2. Polycarbonate (PC)

- 5.1.2.3. Polymethylmethacrylate (PMMA)

- 5.1.2.4. Polyetheretherketone (PEEK)

- 5.1.2.5. Polyoxymethylene (POM)

- 5.1.2.6. Polyphenylene Oxide (PPO)

- 5.1.2.7. Others

- 5.1.1. Traditional Plastics

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Surgical instruments

- 5.2.2. Disposables

- 5.2.3. Diagnosis instruments

- 5.2.4. Sterilization trays

- 5.2.5. Anesthetic and imaging equipment

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. MiddleEast and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Traditional Plastics

- 6.1.1.1. Polyethylene (PE)

- 6.1.1.2. Polypropylene (PP)

- 6.1.1.3. Polystyrene(PS)

- 6.1.1.4. Polyvinylchloride(PVC)

- 6.1.2. Engineer Plastics

- 6.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 6.1.2.2. Polycarbonate (PC)

- 6.1.2.3. Polymethylmethacrylate (PMMA)

- 6.1.2.4. Polyetheretherketone (PEEK)

- 6.1.2.5. Polyoxymethylene (POM)

- 6.1.2.6. Polyphenylene Oxide (PPO)

- 6.1.2.7. Others

- 6.1.1. Traditional Plastics

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Surgical instruments

- 6.2.2. Disposables

- 6.2.3. Diagnosis instruments

- 6.2.4. Sterilization trays

- 6.2.5. Anesthetic and imaging equipment

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Traditional Plastics

- 7.1.1.1. Polyethylene (PE)

- 7.1.1.2. Polypropylene (PP)

- 7.1.1.3. Polystyrene(PS)

- 7.1.1.4. Polyvinylchloride(PVC)

- 7.1.2. Engineer Plastics

- 7.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 7.1.2.2. Polycarbonate (PC)

- 7.1.2.3. Polymethylmethacrylate (PMMA)

- 7.1.2.4. Polyetheretherketone (PEEK)

- 7.1.2.5. Polyoxymethylene (POM)

- 7.1.2.6. Polyphenylene Oxide (PPO)

- 7.1.2.7. Others

- 7.1.1. Traditional Plastics

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Surgical instruments

- 7.2.2. Disposables

- 7.2.3. Diagnosis instruments

- 7.2.4. Sterilization trays

- 7.2.5. Anesthetic and imaging equipment

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Traditional Plastics

- 8.1.1.1. Polyethylene (PE)

- 8.1.1.2. Polypropylene (PP)

- 8.1.1.3. Polystyrene(PS)

- 8.1.1.4. Polyvinylchloride(PVC)

- 8.1.2. Engineer Plastics

- 8.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 8.1.2.2. Polycarbonate (PC)

- 8.1.2.3. Polymethylmethacrylate (PMMA)

- 8.1.2.4. Polyetheretherketone (PEEK)

- 8.1.2.5. Polyoxymethylene (POM)

- 8.1.2.6. Polyphenylene Oxide (PPO)

- 8.1.2.7. Others

- 8.1.1. Traditional Plastics

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Surgical instruments

- 8.2.2. Disposables

- 8.2.3. Diagnosis instruments

- 8.2.4. Sterilization trays

- 8.2.5. Anesthetic and imaging equipment

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Traditional Plastics

- 9.1.1.1. Polyethylene (PE)

- 9.1.1.2. Polypropylene (PP)

- 9.1.1.3. Polystyrene(PS)

- 9.1.1.4. Polyvinylchloride(PVC)

- 9.1.2. Engineer Plastics

- 9.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 9.1.2.2. Polycarbonate (PC)

- 9.1.2.3. Polymethylmethacrylate (PMMA)

- 9.1.2.4. Polyetheretherketone (PEEK)

- 9.1.2.5. Polyoxymethylene (POM)

- 9.1.2.6. Polyphenylene Oxide (PPO)

- 9.1.2.7. Others

- 9.1.1. Traditional Plastics

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Surgical instruments

- 9.2.2. Disposables

- 9.2.3. Diagnosis instruments

- 9.2.4. Sterilization trays

- 9.2.5. Anesthetic and imaging equipment

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. MiddleEast and Africa Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Traditional Plastics

- 10.1.1.1. Polyethylene (PE)

- 10.1.1.2. Polypropylene (PP)

- 10.1.1.3. Polystyrene(PS)

- 10.1.1.4. Polyvinylchloride(PVC)

- 10.1.2. Engineer Plastics

- 10.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 10.1.2.2. Polycarbonate (PC)

- 10.1.2.3. Polymethylmethacrylate (PMMA)

- 10.1.2.4. Polyetheretherketone (PEEK)

- 10.1.2.5. Polyoxymethylene (POM)

- 10.1.2.6. Polyphenylene Oxide (PPO)

- 10.1.2.7. Others

- 10.1.1. Traditional Plastics

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Surgical instruments

- 10.2.2. Disposables

- 10.2.3. Diagnosis instruments

- 10.2.4. Sterilization trays

- 10.2.5. Anesthetic and imaging equipment

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Celanese Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daicel Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DuPont

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eastman Chemical Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ensinger

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GW Plastics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Chemical Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nolato AB (publ)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NUSIL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Orthoplastics Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Röchling SE & Co KG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SABIC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Saint-Gobain Performance Plastics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Solvay

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sylvin Technologies

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Teknor Apex

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Westlake Plastics*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Celanese Corporation

List of Figures

- Figure 1: Global Medical Plastics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: North America Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: MiddleEast and Africa Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: MiddleEast and Africa Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: MiddleEast and Africa Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: MiddleEast and Africa Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: MiddleEast and Africa Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: MiddleEast and Africa Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Medical Plastics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Plastics Industry?

The projected CAGR is approximately 5.56%.

2. Which companies are prominent players in the Medical Plastics Industry?

Key companies in the market include Celanese Corporation, Daicel Corporation, DuPont, Eastman Chemical Company, Ensinger, GW Plastics, Mitsubishi Chemical Corporation, Nolato AB (publ), NUSIL, Orthoplastics Ltd, Röchling SE & Co KG, SABIC, Saint-Gobain Performance Plastics, Solvay, Sylvin Technologies, Teknor Apex, Westlake Plastics*List Not Exhaustive.

3. What are the main segments of the Medical Plastics Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.46 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Medical Devices from the Asia-Pacific Region; Expanding Prosthetics Market.

6. What are the notable trends driving market growth?

Surgical Instruments Application to Dominate the Market.

7. Are there any restraints impacting market growth?

; Increasing Demand for Medical Devices from the Asia-Pacific Region; Expanding Prosthetics Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Plastics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Plastics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Plastics Industry?

To stay informed about further developments, trends, and reports in the Medical Plastics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence