Key Insights

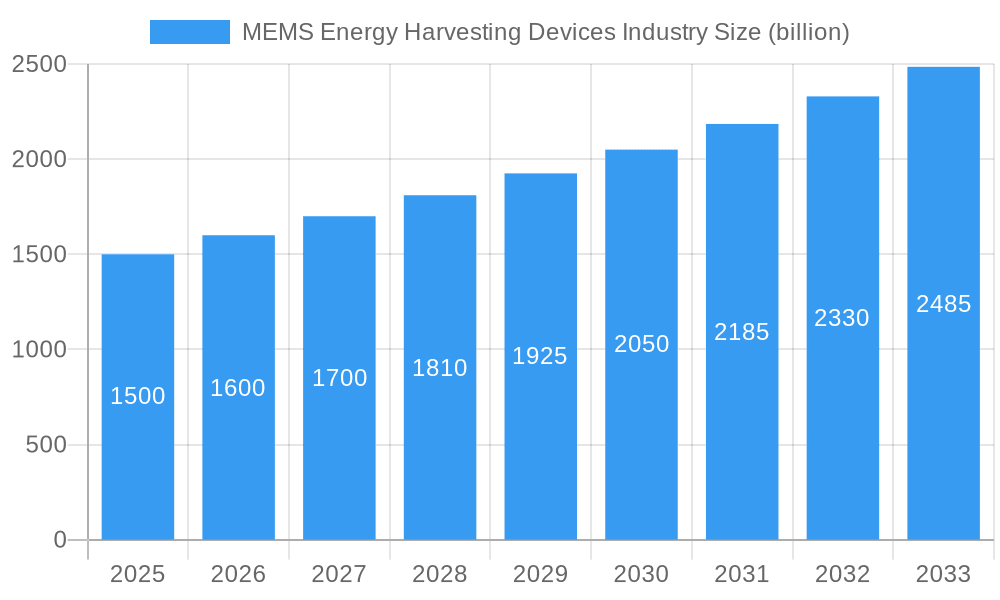

The MEMS Energy Harvesting Devices Industry is poised for significant expansion, driven by the growing demand for self-powered and sustainable electronic solutions across various sectors. Projections indicate a robust market size of $1.5 billion in 2025, with an anticipated compound annual growth rate (CAGR) of 6.37% from 2019 to 2033. This upward trajectory is fueled by advancements in microelectromechanical systems (MEMS) technology, enabling the efficient conversion of ambient energy sources into usable electrical power. Key technological drivers include the increasing sophistication of Vibration Energy Harvesting, Thermal Energy Harvesting, and RF Energy Harvesting techniques, offering diverse solutions for different energy scavenging needs. The proliferation of the Internet of Things (IoT) devices, wearables, and remote sensing applications further bolsters market growth, as these devices often operate in environments where traditional battery replacement is impractical or impossible.

MEMS Energy Harvesting Devices Industry Market Size (In Billion)

The market's expansion is further supported by its wide-ranging applications, with the Automotive sector leveraging energy harvesting for enhanced sensor reliability and reduced battery load, while the Industrial segment utilizes it for powering remote monitoring systems and predictive maintenance sensors. The Military and Aerospace industries are adopting these technologies for mission-critical applications requiring perpetual power, and Building and Home Automation systems are benefiting from wireless, battery-free sensor networks. Consumer Electronics also presents a substantial growth avenue, particularly in smart wearables and portable devices. Despite the positive outlook, potential restraints such as the initial cost of integration and the efficiency limitations of certain energy harvesting technologies at low ambient energy levels may pose challenges. However, ongoing research and development by leading companies like ABB Ltd, STMicroelectronics NV, and Analog Devices Inc. are expected to overcome these hurdles, driving innovation and market penetration.

MEMS Energy Harvesting Devices Industry Company Market Share

MEMS Energy Harvesting Devices Industry: Comprehensive Market Analysis and Forecast (2019–2033)

This in-depth report provides a strategic analysis of the global MEMS Energy Harvesting Devices market, offering a detailed roadmap for stakeholders navigating this rapidly evolving landscape. With a study period spanning from 2019 to 2033, and a robust base year of 2025, this research meticulously dissects market dynamics, technological advancements, and emerging opportunities. Dive into actionable insights, understand key growth drivers, and identify potential challenges to empower your business decisions in this billion-dollar industry. The report leverages high-ranking keywords to ensure maximum visibility for industry professionals seeking cutting-edge information on MEMS energy harvesting solutions.

MEMS Energy Harvesting Devices Industry Market Structure & Innovation Trends

The MEMS Energy Harvesting Devices market is characterized by moderate to high concentration, with leading players investing heavily in research and development to gain a competitive edge. Innovation drivers are primarily fueled by the escalating demand for self-powered IoT devices, remote sensing, and the increasing emphasis on sustainable energy solutions. Regulatory frameworks are gradually evolving to support the adoption of energy harvesting technologies, particularly in consumer electronics and industrial automation. Product substitutes, such as advanced battery technologies, pose a challenge, but the inherent benefits of energy harvesting – extended device lifespan, reduced maintenance, and environmental friendliness – are driving its adoption. End-user demographics are broadening, with significant interest from industrial sectors, automotive manufacturers, and the military. Mergers and acquisitions (M&A) are anticipated to shape the market structure further, with deal values projected to reach multi-billion dollar figures as companies seek to consolidate expertise and expand their product portfolios. Key players like ABB Ltd and STMicroelectronics NV are actively involved in strategic partnerships and acquisitions to bolster their market share, which is projected to grow significantly in the coming years, with overall market share by leading companies reaching over 60%.

MEMS Energy Harvesting Devices Industry Market Dynamics & Trends

The MEMS Energy Harvesting Devices market is poised for substantial growth, driven by an unprecedented surge in the Internet of Things (IoT) adoption across various sectors. The relentless pursuit of smaller, more efficient, and sustainable power sources for an ever-increasing number of connected devices is the primary growth accelerator. Technological disruptions, particularly in the miniaturization and efficiency of MEMS fabrication processes, are enabling the development of more powerful and cost-effective energy harvesting solutions. Consumer preferences are increasingly leaning towards products with reduced reliance on traditional batteries, favouring the convenience and environmental benefits offered by energy harvesting. This shift is opening up new avenues for product development and market penetration. Competitive dynamics are intensifying, with established semiconductor giants and agile startups vying for market dominance. Companies are focusing on enhancing the power output density, operational efficiency, and integration capabilities of their energy harvesting modules. The market penetration of energy harvesting solutions is projected to witness a compound annual growth rate (CAGR) of approximately 15% over the forecast period, reaching an estimated market size of over $25 billion by 2033. This growth is underpinned by the expanding application scope, from wearable electronics and smart sensors to industrial machinery monitoring and autonomous vehicles, all of which demand continuous, reliable, and maintenance-free power. The trend towards wireless sensor networks (WSNs) and smart infrastructure further bolsters the demand for self-sustaining power solutions, making MEMS energy harvesting devices an indispensable component of future technological ecosystems. The decreasing cost of MEMS fabrication and the increasing sophistication of power management integrated circuits are also key enablers, making energy harvesting solutions more accessible and economically viable for a wider range of applications.

Dominant Regions & Segments in MEMS Energy Harvesting Devices Industry

The MEMS Energy Harvesting Devices industry exhibits significant regional and segmental dominance, driven by distinct economic policies, infrastructure development, and application-specific demands.

- Dominant Region: North America currently leads the market, propelled by strong government initiatives promoting IoT adoption and smart city development, substantial investments in research and development, and a robust presence of key end-user industries such as automotive, industrial, and military.

- Key Drivers: Government funding for IoT research, advanced manufacturing capabilities, high consumer adoption of smart devices, and significant defense spending.

- Dominant Country: The United States stands out as the leading country within North America, with a mature technological ecosystem and a proactive approach to innovation in energy harvesting technologies. Its large industrial base and sophisticated consumer market create substantial demand.

- Dominant Technology Segment: Vibration Energy Harvesting is currently the most dominant technology segment. This is attributed to its widespread applicability in industrial machinery, automotive components, and structural health monitoring, where continuous or intermittent vibrations are readily available.

- Key Drivers: Ubiquitous presence of vibration sources in industrial settings, advancements in piezoelectric and electromagnetic transduction mechanisms, and its suitability for powering wireless sensors in challenging environments.

- Dominant End-user Application: Industrial applications command the largest market share. This is due to the critical need for reliable, maintenance-free power for sensors, actuators, and monitoring equipment in factories, power plants, and oil and gas facilities, where battery replacement is often impractical or costly.

- Key Drivers: Automation of industrial processes, predictive maintenance initiatives, harsh operating conditions necessitating robust and self-sustaining power, and the significant return on investment from reduced downtime and operational costs.

While other segments like Thermal Energy Harvesting and RF Energy Harvesting are experiencing rapid growth, and applications in Building and Home Automation and Consumer Electronics are expanding, the industrial sector and vibration-based harvesting currently represent the most mature and lucrative segments of the MEMS Energy Harvesting Devices market.

MEMS Energy Harvesting Devices Industry Product Innovations

Recent product innovations in MEMS energy harvesting devices are significantly enhancing their power output and applicability. Asahi Kasei Microdevices (AKM) launched a new DC-DC step-up converter in February 2023, specifically designed for efficient energy harvesting. This innovation boosts low voltages, paving the way for remote, battery-free operation in asset monitoring and IoT applications, drastically reducing maintenance needs. WePower Technologies, in January 2023, unveiled their Gemns Energy Harvesting Generator (EHG) product line, featuring three distinct products that utilize permanent and oscillating magnets for kinetic energy harvesting via electromagnetic induction. These advancements are crucial for enabling the widespread adoption of self-powered wireless sensors and transmitters, offering a competitive edge through improved efficiency and extended operational lifespans.

Report Scope & Segmentation Analysis

This report meticulously segments the MEMS Energy Harvesting Devices market to provide a granular understanding of its various facets.

- Technology Segmentation: The market is analyzed across Vibration Energy Harvesting, Thermal Energy Harvesting, RF Energy Harvesting, and Other Types of Energy Harvesting. Each technology segment is examined for its current market size, projected growth rate, and key drivers, offering insights into their competitive landscape and technological maturity.

- End-user Application Segmentation: The report further divides the market by Automotive, Industrial, Military and Aerospace, Building and Home Automation, Consumer Electronics, and Other End-user Applications. This segmentation highlights the specific demands, adoption rates, and growth potential within each sector, detailing market sizes and competitive dynamics specific to each application.

Key Drivers of MEMS Energy Harvesting Devices Industry Growth

The growth of the MEMS Energy Harvesting Devices industry is propelled by several key factors. The burgeoning Internet of Things (IoT) ecosystem, requiring ubiquitous and sustainable power for billions of sensors and devices, is a primary driver. Advancements in MEMS technology, leading to smaller, more efficient, and cost-effective harvesters, are critical enablers. The increasing global focus on sustainability and reducing electronic waste, coupled with the demand for reduced battery maintenance and replacement costs, particularly in remote or inaccessible locations, further fuels market expansion. Government initiatives promoting green technologies and smart infrastructure also play a significant role.

Challenges in the MEMS Energy Harvesting Devices Industry Sector

Despite the promising growth trajectory, the MEMS Energy Harvesting Devices sector faces several challenges. Low power output density compared to traditional batteries remains a hurdle for high-power applications. The intermittent nature of ambient energy sources necessitates sophisticated power management systems, adding complexity and cost. Regulatory hurdles related to the disposal of e-waste from traditional batteries, while a long-term driver, can also present short-term compliance challenges for new technologies. Supply chain issues for specialized MEMS components and the high initial cost of some advanced energy harvesting solutions can also impact market penetration, especially for cost-sensitive applications.

Emerging Opportunities in MEMS Energy Harvesting Devices Industry

Emerging opportunities in the MEMS Energy Harvesting Devices industry are abundant. The expansion of smart cities, requiring self-powered infrastructure for streetlights, traffic sensors, and environmental monitoring, presents a vast market. The growth of wearable technology and implantable medical devices, demanding biocompatible and long-lasting power solutions, offers significant potential. Advancements in thermoelectric generators (TEGs) for waste heat recovery in industrial processes and data centers are opening new avenues. Furthermore, the increasing demand for battery-free solutions in remote asset monitoring, agricultural sensors, and unmanned aerial vehicles (UAVs) provides substantial growth prospects.

Leading Players in the MEMS Energy Harvesting Devices Industry Market

- ABB Ltd

- Micropelt (EH4 GmbH)

- EnOcean Gmbh

- Cymbet Corp

- STMicroelectronics NV

- Analog Devices Inc

- Coventor Inc (Lam Research Corporation)

Key Developments in MEMS Energy Harvesting Devices Industry Industry

- February 2023: Asahi Kasei Microdevices (AKM) launched a new DC-DC step-up converter for efficient energy harvesting applications. It can boost low voltages, offering remote and battery-free operation solutions and low-maintenance asset monitoring and IoT applications.

- January 2023: WePower Technologies, a kinetic energy harvesting startup providing scalable and sustainable power solutions for wireless IoT sensors, transmitters, and related devices, unveiled their Gemns Energy Harvesting Generator (EHG) product line. The Gemns product line includes three different products. Each uses permanent and oscillating magnets to harvest kinetic energy through electromagnetic induction: the Gemns G100 Integrated RF Switch, the Gemns G200 EHG, and the Gemns G300 EHG.

Future Outlook for MEMS Energy Harvesting Devices Industry Market

The future outlook for the MEMS Energy Harvesting Devices industry is exceptionally bright, driven by continuous technological innovation and the escalating global demand for sustainable and autonomous power solutions. The ongoing miniaturization of MEMS devices, coupled with improvements in energy conversion efficiencies and power management integrated circuits, will further reduce costs and expand application possibilities. Strategic collaborations between semiconductor manufacturers, device OEMs, and end-users will accelerate market penetration. The increasing adoption of smart technologies across all sectors, from smart grids and connected vehicles to intelligent buildings and advanced healthcare, will necessitate reliable, self-sustaining power sources, making MEMS energy harvesting an indispensable technology for the foreseeable future, with market potential exceeding hundreds of billions.

MEMS Energy Harvesting Devices Industry Segmentation

-

1. Technology

- 1.1. Vibration Energy Harvesting

- 1.2. Thermal Energy Harvesting

- 1.3. RF Energy Harvesting

- 1.4. Other Types of Energy Harvesting

-

2. End-user Applications

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Military and Aerospace

- 2.4. Building and Home Automation

- 2.5. Consumer Electronics

- 2.6. Other End-user Applications

MEMS Energy Harvesting Devices Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

MEMS Energy Harvesting Devices Industry Regional Market Share

Geographic Coverage of MEMS Energy Harvesting Devices Industry

MEMS Energy Harvesting Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Smart Cities; Commercial Applications are Slowly Getting into the Market for Industrial Applications and Home Automation Appliances

- 3.3. Market Restrains

- 3.3.1. Ultra Low Power Electronics; Wireless Data Transmissions Rates and Standards

- 3.4. Market Trends

- 3.4.1. Building and Home Automation to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEMS Energy Harvesting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Vibration Energy Harvesting

- 5.1.2. Thermal Energy Harvesting

- 5.1.3. RF Energy Harvesting

- 5.1.4. Other Types of Energy Harvesting

- 5.2. Market Analysis, Insights and Forecast - by End-user Applications

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Military and Aerospace

- 5.2.4. Building and Home Automation

- 5.2.5. Consumer Electronics

- 5.2.6. Other End-user Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America MEMS Energy Harvesting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Vibration Energy Harvesting

- 6.1.2. Thermal Energy Harvesting

- 6.1.3. RF Energy Harvesting

- 6.1.4. Other Types of Energy Harvesting

- 6.2. Market Analysis, Insights and Forecast - by End-user Applications

- 6.2.1. Automotive

- 6.2.2. Industrial

- 6.2.3. Military and Aerospace

- 6.2.4. Building and Home Automation

- 6.2.5. Consumer Electronics

- 6.2.6. Other End-user Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe MEMS Energy Harvesting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Vibration Energy Harvesting

- 7.1.2. Thermal Energy Harvesting

- 7.1.3. RF Energy Harvesting

- 7.1.4. Other Types of Energy Harvesting

- 7.2. Market Analysis, Insights and Forecast - by End-user Applications

- 7.2.1. Automotive

- 7.2.2. Industrial

- 7.2.3. Military and Aerospace

- 7.2.4. Building and Home Automation

- 7.2.5. Consumer Electronics

- 7.2.6. Other End-user Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific MEMS Energy Harvesting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Vibration Energy Harvesting

- 8.1.2. Thermal Energy Harvesting

- 8.1.3. RF Energy Harvesting

- 8.1.4. Other Types of Energy Harvesting

- 8.2. Market Analysis, Insights and Forecast - by End-user Applications

- 8.2.1. Automotive

- 8.2.2. Industrial

- 8.2.3. Military and Aerospace

- 8.2.4. Building and Home Automation

- 8.2.5. Consumer Electronics

- 8.2.6. Other End-user Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World MEMS Energy Harvesting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Vibration Energy Harvesting

- 9.1.2. Thermal Energy Harvesting

- 9.1.3. RF Energy Harvesting

- 9.1.4. Other Types of Energy Harvesting

- 9.2. Market Analysis, Insights and Forecast - by End-user Applications

- 9.2.1. Automotive

- 9.2.2. Industrial

- 9.2.3. Military and Aerospace

- 9.2.4. Building and Home Automation

- 9.2.5. Consumer Electronics

- 9.2.6. Other End-user Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Micropelt (EH4 GmbH)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 EnOcean Gmbh

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cymbet Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 STMicroelectronics NV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Analog Devices Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Coventor Inc (Lam Research Corporation)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: MEMS Energy Harvesting Devices Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: MEMS Energy Harvesting Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by End-user Applications 2020 & 2033

- Table 4: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by End-user Applications 2020 & 2033

- Table 5: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 9: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by End-user Applications 2020 & 2033

- Table 10: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by End-user Applications 2020 & 2033

- Table 11: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 15: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by End-user Applications 2020 & 2033

- Table 16: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by End-user Applications 2020 & 2033

- Table 17: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 21: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by End-user Applications 2020 & 2033

- Table 22: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by End-user Applications 2020 & 2033

- Table 23: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by End-user Applications 2020 & 2033

- Table 28: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by End-user Applications 2020 & 2033

- Table 29: MEMS Energy Harvesting Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: MEMS Energy Harvesting Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEMS Energy Harvesting Devices Industry?

The projected CAGR is approximately 6.37%.

2. Which companies are prominent players in the MEMS Energy Harvesting Devices Industry?

Key companies in the market include ABB Ltd, Micropelt (EH4 GmbH), EnOcean Gmbh, Cymbet Corp, STMicroelectronics NV, Analog Devices Inc, Coventor Inc (Lam Research Corporation).

3. What are the main segments of the MEMS Energy Harvesting Devices Industry?

The market segments include Technology, End-user Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of Smart Cities; Commercial Applications are Slowly Getting into the Market for Industrial Applications and Home Automation Appliances.

6. What are the notable trends driving market growth?

Building and Home Automation to Hold Major Share.

7. Are there any restraints impacting market growth?

Ultra Low Power Electronics; Wireless Data Transmissions Rates and Standards.

8. Can you provide examples of recent developments in the market?

February 2023: Asahi Kasei Microdevices (AKM) launched a new DC-DC step-up converter for efficient energy harvesting applications. It can boost low voltages, offering remote and battery-free operation solutions and low-maintenance asset monitoring and IoT applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEMS Energy Harvesting Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEMS Energy Harvesting Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEMS Energy Harvesting Devices Industry?

To stay informed about further developments, trends, and reports in the MEMS Energy Harvesting Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence