Key Insights

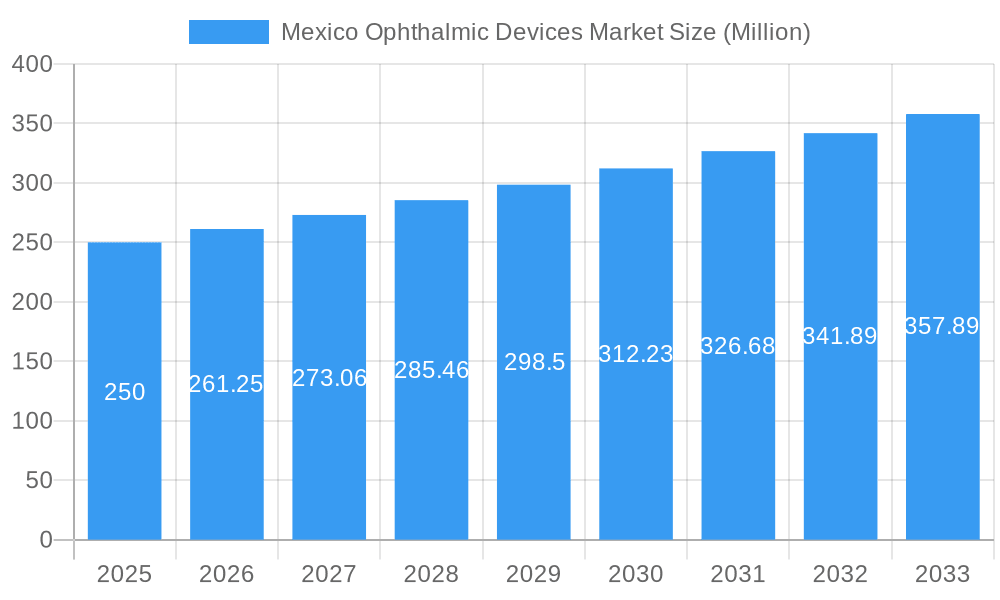

The Mexico ophthalmic devices market is poised for significant expansion, driven by the rising incidence of age-related eye conditions, including glaucoma and cataracts, an increase in diabetic retinopathy cases, and a growing geriatric population. Enhanced disposable income and improved healthcare infrastructure further bolster market growth. The market is segmented into surgical devices (e.g., glaucoma drainage devices, intraocular lenses, lasers), diagnostic and monitoring devices (e.g., autorefractors, OCT scanners), and vision correction devices (spectacles, contact lenses). Technological advancements in minimally invasive surgery and imaging technologies are key growth drivers. Challenges include the high cost of advanced devices and limited healthcare access in some regions. The competitive landscape features global leaders like Johnson & Johnson, Alcon Inc., and Bausch & Lomb Inc., alongside local players. The market is projected for sustained growth from 2025-2033, supported by continued investment in eye care infrastructure and innovation. The market's CAGR of 5.9% indicates steady expansion, with surgical devices expected to lead due to increasing procedure volumes. With a market size of 19.65 billion in the base year 2025, the sector shows substantial potential.

Mexico Ophthalmic Devices Market Market Size (In Billion)

The future outlook for the Mexico ophthalmic devices market is highly promising, reflecting advancements in the nation's healthcare sector. Government initiatives promoting healthcare accessibility and affordability, alongside heightened awareness of eye health, are anticipated to stimulate demand. Emerging trends such as teleophthalmology and AI integration in diagnostic tools are set to redefine market dynamics. Despite persistent pricing and accessibility hurdles, the long-term forecast remains optimistic, presenting considerable opportunities for growth and investment. Strategic collaborations between multinational corporations and local distributors will be instrumental in broadening market reach and ensuring broader access to advanced ophthalmic care.

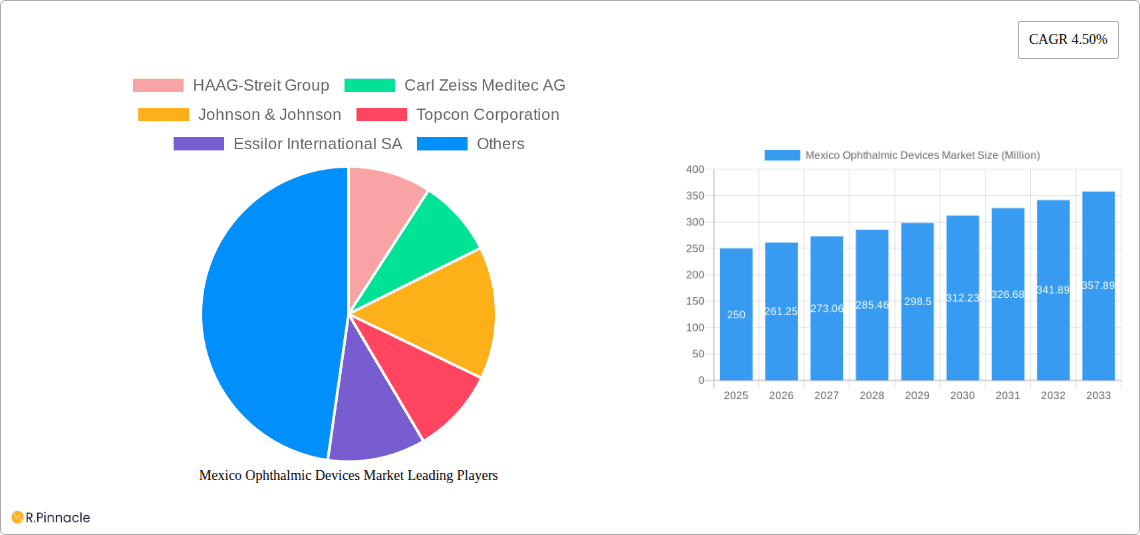

Mexico Ophthalmic Devices Market Company Market Share

Mexico Ophthalmic Devices Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico ophthalmic devices market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a detailed examination of market structure, dynamics, and future trends, this report covers the period from 2019 to 2033, with a focus on the estimated year 2025. The report leverages extensive data analysis to project market growth and identify key opportunities within this dynamic sector. Expect detailed segment breakdowns, including surgical devices, diagnostic and monitoring devices, and vision correction devices, along with profiles of leading companies such as HAAG-Streit Group, Carl Zeiss Meditec AG, Johnson & Johnson, Topcon Corporation, Essilor International SA, Alcon Inc, Bausch & Lomb Inc, Cooper Vision, Ziemer Ophthalmic Systems AG, Nidek Co Ltd, and Hoya Corporation.

Mexico Ophthalmic Devices Market Market Structure & Innovation Trends

The Mexican ophthalmic devices market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. The market share of the top five players is estimated at xx% in 2025. Innovation is driven by technological advancements in areas such as laser technology, image-guided surgery, and minimally invasive procedures. The regulatory framework, primarily overseen by COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios), plays a vital role in shaping market access and product approvals. Product substitutes, such as traditional eyeglasses and contact lenses, continue to pose competitive pressure, while the growing prevalence of age-related eye diseases, such as glaucoma and cataracts, fuels demand for advanced devices. The market has witnessed several M&A activities in recent years, with deal values totaling an estimated xx Million USD in the period 2019-2024. These transactions often involve strategic acquisitions aimed at expanding product portfolios and market access.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2025).

- Innovation Drivers: Technological advancements in laser technology, image-guided surgery, minimally invasive procedures.

- Regulatory Framework: COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios) plays a key role.

- Product Substitutes: Traditional eyeglasses and contact lenses.

- End-User Demographics: Aging population and rising prevalence of age-related eye diseases.

- M&A Activity: xx Million USD in deal value (2019-2024).

Mexico Ophthalmic Devices Market Market Dynamics & Trends

The Mexican ophthalmic devices market is projected to experience significant growth, driven by several key factors. The rising prevalence of age-related eye diseases, coupled with increasing disposable incomes and healthcare expenditure, are major contributors to market expansion. Technological advancements, such as the introduction of advanced diagnostic tools and minimally invasive surgical procedures, are also fueling market growth. Consumer preference is shifting towards more convenient and technologically advanced devices, such as smart contact lenses and personalized vision correction solutions. Competitive dynamics are characterized by intense competition among multinational corporations and local players, with companies investing heavily in research and development to gain a competitive edge. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), with market penetration increasing steadily across various segments. Specific challenges include limited access to healthcare in rural areas and affordability issues for certain segments of the population.

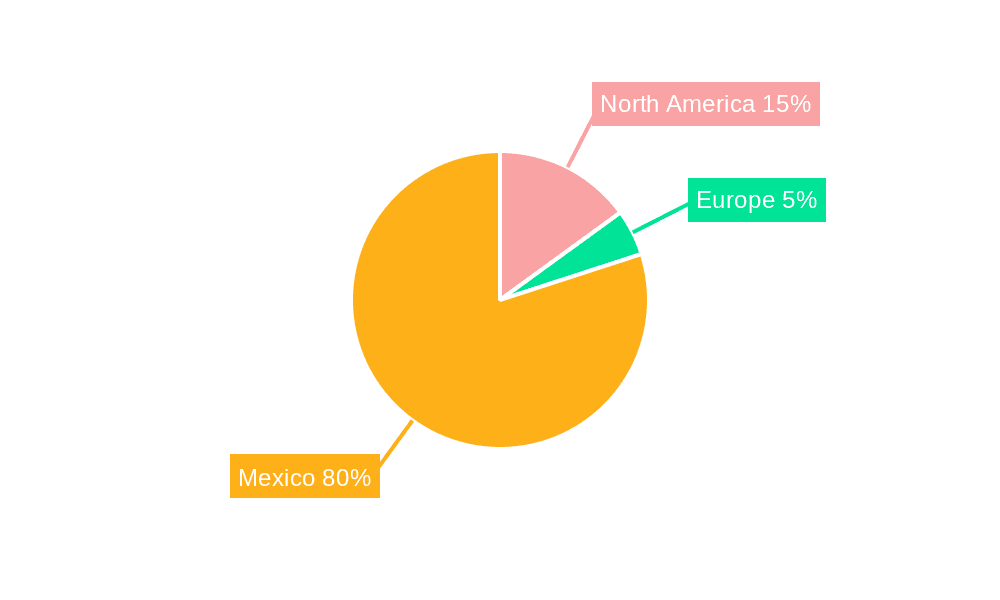

Dominant Regions & Segments in Mexico Ophthalmic Devices Market

The Mexico City Metropolitan Area and other major urban centers dominate the ophthalmic devices market due to higher healthcare infrastructure and concentration of ophthalmologists. Within the device segments, surgical devices, particularly intraocular lenses (IOLs) and glaucoma drainage devices, hold a significant share, driven by the rising prevalence of cataracts and glaucoma. Diagnostic and monitoring devices, especially Optical Coherence Tomography (OCT) scanners and ophthalmoscopes, are also witnessing robust growth due to their importance in early detection and diagnosis. Vision correction devices, primarily contact lenses and spectacles, constitute a large segment, driven by consumer demand for vision correction solutions.

- Key Drivers for Dominant Regions:

- High concentration of ophthalmologists and healthcare infrastructure.

- Increased healthcare spending in urban areas.

- Higher awareness and adoption of advanced ophthalmic procedures.

- Key Drivers for Dominant Segments:

- Surgical Devices: Increasing prevalence of age-related eye diseases (cataracts, glaucoma).

- Diagnostic & Monitoring Devices: Importance in early detection and diagnosis of eye conditions.

- Vision Correction Devices: Consumer preference for convenience and improved vision.

Mexico Ophthalmic Devices Market Product Innovations

Recent years have witnessed significant product innovations in the Mexican ophthalmic devices market. Advancements in laser technology have led to the development of more precise and effective surgical devices for cataract surgery and glaucoma management. The introduction of advanced diagnostic tools, such as OCT scanners and corneal topography systems, has improved diagnostic capabilities and treatment planning. Innovations in contact lens technology, such as multifocal and extended-wear lenses, offer patients greater comfort and convenience. These technological trends are closely aligned with market needs for improved treatment outcomes, reduced invasiveness, and enhanced patient experiences.

Report Scope & Segmentation Analysis

This report segments the Mexico ophthalmic devices market based on device type:

Surgical Devices: This segment includes glaucoma drainage devices, glaucoma stents and implants, intraocular lenses (IOLs), lasers, and other surgical devices. This segment is projected to experience xx% growth during the forecast period, driven by the rising prevalence of age-related eye diseases and technological advancements. Competition is intense among major players vying for market share with innovative offerings.

Diagnostic and Monitoring Devices: This segment encompasses autorefractors and keratometers, corneal topography systems, ophthalmic ultrasound imaging systems, ophthalmoscopes, optical coherence tomography (OCT) scanners, and other diagnostic and monitoring devices. This segment is anticipated to show xx% growth due to an increased focus on early diagnosis and advanced diagnostic technologies. The market is characterized by a diverse range of players offering sophisticated solutions.

Vision Correction Devices: This includes spectacles and contact lenses. This segment accounts for a substantial share of the market and is expected to witness a CAGR of xx%, driven by changing lifestyles and aesthetic preferences. The competitive landscape in this segment is highly dynamic, with both established and emerging players introducing new products.

Key Drivers of Mexico Ophthalmic Devices Market Growth

Several factors contribute to the growth of the Mexico ophthalmic devices market. The aging population, increased prevalence of age-related eye diseases, rising disposable incomes, and growing healthcare expenditure are primary drivers. Government initiatives promoting healthcare access and technological advancements in ophthalmic devices also play crucial roles. Improved healthcare infrastructure and increased awareness of eye health are also contributing factors.

Challenges in the Mexico Ophthalmic Devices Market Sector

The market faces challenges such as high costs of advanced devices, limited healthcare access in rural areas, and regulatory hurdles. Supply chain disruptions can impact device availability, while intense competition can pressure profit margins. Affordability remains a significant barrier for many patients, influencing the market's overall growth trajectory.

Emerging Opportunities in Mexico Ophthalmic Devices Market

Opportunities exist in expanding access to advanced eye care services in underserved rural areas. The growth of teleophthalmology and the introduction of innovative technologies create opportunities for market expansion. Increased demand for personalized vision correction solutions, such as customized contact lenses, presents significant growth potential.

Leading Players in the Mexico Ophthalmic Devices Market Market

- HAAG-Streit Group

- Carl Zeiss Meditec AG

- Johnson & Johnson

- Topcon Corporation

- Essilor International SA

- Alcon Inc

- Bausch & Lomb Inc

- Cooper Vision

- Ziemer Ophthalmic Systems AG

- Nidek Co Ltd

- Hoya Corporation

Key Developments in Mexico Ophthalmic Devices Market Industry

September 2022: Johnson & Johnson Vision Care, Inc. launched ACUVUE OASYS MAX 1-DAY contact lenses in North America, including Mexico. This launch expands product offerings in the contact lens segment, increasing competition and consumer choice.

May 2022: The inauguration of the Naval Hospital of Coatzacoalcos, offering ophthalmology services, is expected to increase demand for ophthalmic devices in the region. This development expands healthcare access and strengthens the market's growth prospects.

Future Outlook for Mexico Ophthalmic Devices Market Market

The future outlook for the Mexico ophthalmic devices market remains positive, driven by continued growth in the aging population and increasing prevalence of eye diseases. Technological advancements and rising healthcare expenditure will contribute to market expansion. Focus on improving healthcare access and affordability will be crucial for realizing the market's full potential. Strategic investments in research and development, coupled with effective marketing strategies, will be vital for companies seeking success in this dynamic market.

Mexico Ophthalmic Devices Market Segmentation

-

1. Devices

-

1.1. Surgical Devices

- 1.1.1. Glaucoma Drainage Devices

- 1.1.2. Glaucoma Stents and Implants

- 1.1.3. Intraocular Lenses

- 1.1.4. Lasers

- 1.1.5. Other Surgical Devices

-

1.2. Diagnostic and Monitoring Devices

- 1.2.1. Autorefractors and Keratometers

- 1.2.2. Corneal Topography Systems

- 1.2.3. Ophthalmic Ultrasound Imaging Systems

- 1.2.4. Ophthalmoscopes

- 1.2.5. Optical Coherence Tomography Scanners

- 1.2.6. Other Diagnostic and Monitoring Devices

-

1.3. Vision Correction Devices

- 1.3.1. Spectacles

- 1.3.2. Contact Lenses

-

1.1. Surgical Devices

Mexico Ophthalmic Devices Market Segmentation By Geography

- 1. Mexico

Mexico Ophthalmic Devices Market Regional Market Share

Geographic Coverage of Mexico Ophthalmic Devices Market

Mexico Ophthalmic Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Eye Disease; Technological Advancements; High Adoption of Digital Devices

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Eye Surgery; Lack of Awareness

- 3.4. Market Trends

- 3.4.1. The Contact Lenses Segment is Expected to Witness Significant Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Ophthalmic Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Surgical Devices

- 5.1.1.1. Glaucoma Drainage Devices

- 5.1.1.2. Glaucoma Stents and Implants

- 5.1.1.3. Intraocular Lenses

- 5.1.1.4. Lasers

- 5.1.1.5. Other Surgical Devices

- 5.1.2. Diagnostic and Monitoring Devices

- 5.1.2.1. Autorefractors and Keratometers

- 5.1.2.2. Corneal Topography Systems

- 5.1.2.3. Ophthalmic Ultrasound Imaging Systems

- 5.1.2.4. Ophthalmoscopes

- 5.1.2.5. Optical Coherence Tomography Scanners

- 5.1.2.6. Other Diagnostic and Monitoring Devices

- 5.1.3. Vision Correction Devices

- 5.1.3.1. Spectacles

- 5.1.3.2. Contact Lenses

- 5.1.1. Surgical Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HAAG-Streit Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carl Zeiss Meditec AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson & Johnson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Topcon Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Essilor International SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alcon Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bausch & Lomb Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cooper Vision

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ziemer Ophthalmic Systems AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nidek Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hoya Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 HAAG-Streit Group

List of Figures

- Figure 1: Mexico Ophthalmic Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Ophthalmic Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Ophthalmic Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 2: Mexico Ophthalmic Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: Mexico Ophthalmic Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Ophthalmic Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Mexico Ophthalmic Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 6: Mexico Ophthalmic Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 7: Mexico Ophthalmic Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Mexico Ophthalmic Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Ophthalmic Devices Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Mexico Ophthalmic Devices Market?

Key companies in the market include HAAG-Streit Group, Carl Zeiss Meditec AG, Johnson & Johnson, Topcon Corporation, Essilor International SA, Alcon Inc, Bausch & Lomb Inc, Cooper Vision, Ziemer Ophthalmic Systems AG, Nidek Co Ltd, Hoya Corporation.

3. What are the main segments of the Mexico Ophthalmic Devices Market?

The market segments include Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.65 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Eye Disease; Technological Advancements; High Adoption of Digital Devices.

6. What are the notable trends driving market growth?

The Contact Lenses Segment is Expected to Witness Significant Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

Risk Associated with Eye Surgery; Lack of Awareness.

8. Can you provide examples of recent developments in the market?

In September 2022, Johnson & Johnson Vision Care, Inc launched its newest innovation, ACUVUE OASYS MAX 1-DAY contact lenses. ACUVUE OASYS MAX 1-Day multifocal contact lenses for presbyopia. The lens was launched in North America, including Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Ophthalmic Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Ophthalmic Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Ophthalmic Devices Market?

To stay informed about further developments, trends, and reports in the Mexico Ophthalmic Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence