Key Insights

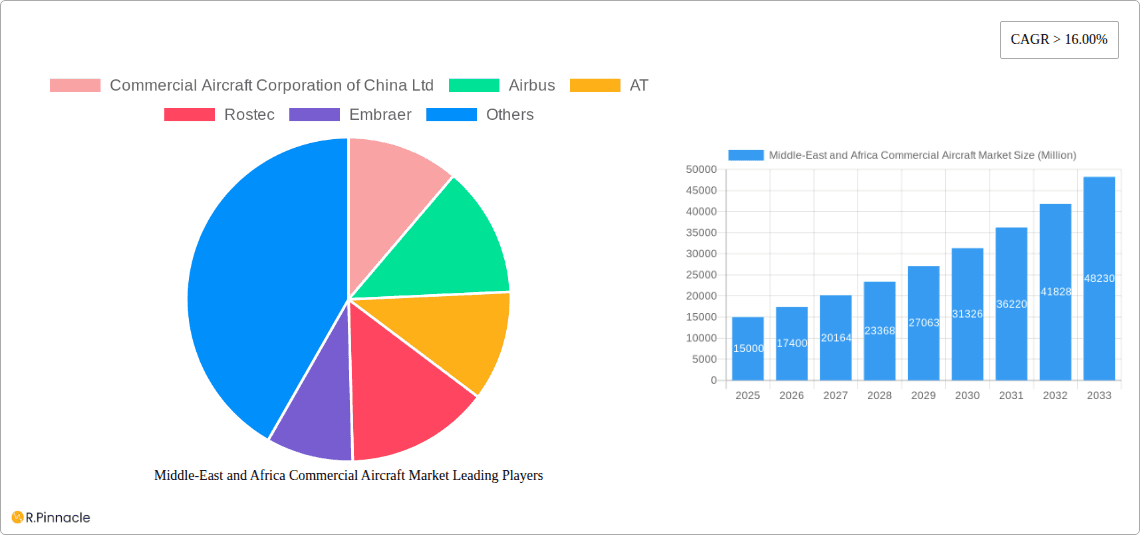

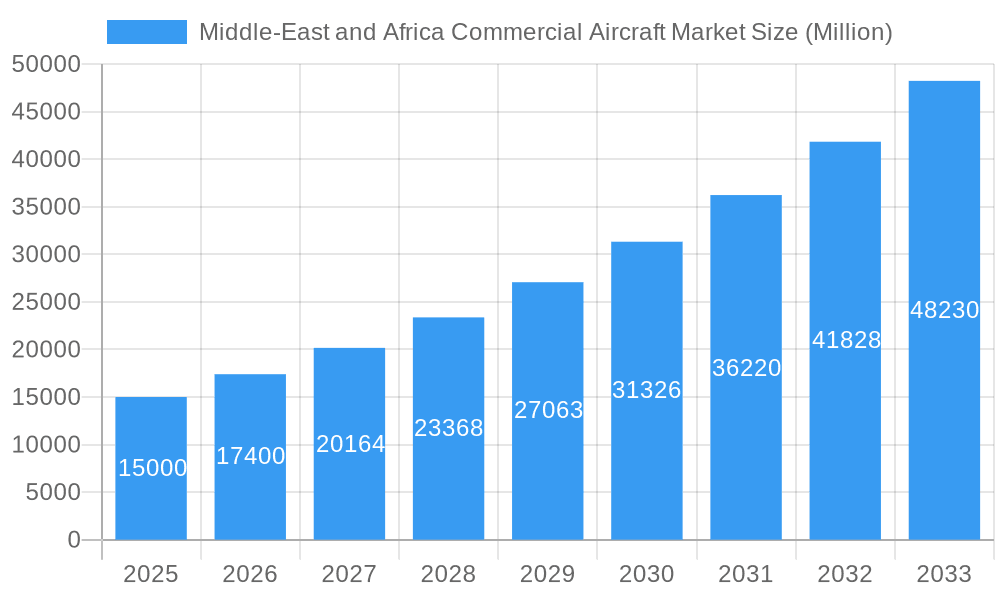

The Middle East and Africa Commercial Aircraft Market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 16% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing passenger traffic within the region, driven by burgeoning populations and rising disposable incomes, necessitates a larger fleet of commercial aircraft. Secondly, several airlines in the Middle East and Africa are undertaking fleet modernization programs, replacing older aircraft with more fuel-efficient and technologically advanced models. This trend is further amplified by government initiatives promoting tourism and economic development, which directly stimulates the demand for air travel. Finally, the expansion of low-cost carriers across the region is contributing to increased competition and the subsequent need for larger aircraft fleets to meet higher travel demands. However, economic volatility in certain African nations and potential geopolitical instability present challenges to sustained market growth.

Middle-East and Africa Commercial Aircraft Market Market Size (In Billion)

Despite these potential headwinds, the long-term outlook for the Middle East and Africa Commercial Aircraft Market remains positive. The market is segmented by aircraft type (narrow-body, wide-body, regional), engine type (turbofan, turboprop), and application (passenger, freighter). Key players like Boeing, Airbus, Embraer, and Commercial Aircraft Corporation of China (COMAC) are actively competing for market share, driving innovation and technological advancements within the industry. Regional differences in growth are expected, with countries experiencing rapid economic development likely exhibiting higher demand. The continued focus on infrastructure development and investment in aviation across the region promises significant opportunities for commercial aircraft manufacturers and related service providers in the coming years. This market analysis suggests a need for continuous monitoring of economic and political factors to accurately forecast future growth potential.

Middle-East and Africa Commercial Aircraft Market Company Market Share

Middle East & Africa Commercial Aircraft Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa Commercial Aircraft Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and future opportunities. The analysis is segmented by aircraft type (Narrow-body, Wide-body, Regional), engine type (Turbofan, Turboprop), and application (Passenger, Freighter), providing a granular understanding of this dynamic market. Key players such as Boeing, Airbus, Commercial Aircraft Corporation of China Ltd, Embraer, and others are profiled, offering a competitive landscape overview.

Middle-East and Africa Commercial Aircraft Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Middle East and Africa commercial aircraft market. Market concentration is moderate, with Boeing and Airbus holding significant market share (estimated at xx% and xx%, respectively, in 2025), while other players like Commercial Aircraft Corporation of China Ltd and Embraer compete for market share. The market is characterized by ongoing innovation in fuel efficiency, technology integration, and passenger comfort. Regulatory frameworks, including airworthiness certifications and safety standards, significantly influence market dynamics. Product substitutes, such as high-speed rail for shorter distances, present a competitive challenge. M&A activities in the sector have been relatively modest in recent years, with total deal values estimated at xx Million in the period 2019-2024. End-user demographics, primarily driven by population growth and increasing air travel demand in the region, are a key factor influencing market expansion.

Middle-East and Africa Commercial Aircraft Market Market Dynamics & Trends

The Middle East and Africa commercial aircraft market is projected to experience significant growth over the forecast period (2025-2033). Driven by factors such as rising disposable incomes, expanding tourism, and the development of new airport infrastructure, the market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological advancements, such as the introduction of more fuel-efficient aircraft and advanced avionics systems, are further stimulating market growth. Consumer preferences are shifting towards enhanced in-flight comfort and connectivity, prompting aircraft manufacturers to invest in cabin innovations. Competitive dynamics are intense, with established players like Boeing and Airbus vying for market dominance while regional players aim to increase their share. Market penetration of narrow-body aircraft is expected to remain high, given their suitability for regional routes and affordability.

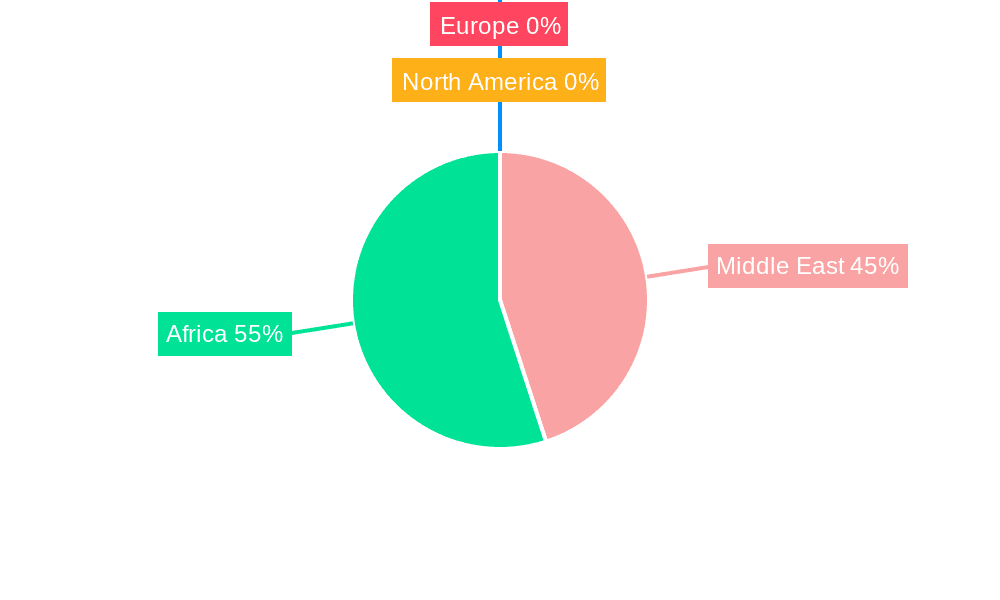

Dominant Regions & Segments in Middle-East and Africa Commercial Aircraft Market

- Dominant Region: The Middle East is currently the dominant region, with rapidly growing air traffic hubs such as Dubai and Doha. Key drivers include robust economic growth, strategic investments in airport infrastructure, and the expansion of airline networks.

- Dominant Country: The UAE currently holds the largest market share within the Middle East due to substantial investments in aviation and tourism.

- Dominant Segment (Aircraft Type): Narrow-body aircraft dominate the market, driven by high demand for cost-effective solutions on regional routes.

- Dominant Segment (Engine Type): Turbofan engines hold the largest market share, due to their superior fuel efficiency and performance compared to turboprop engines.

- Dominant Segment (Application): Passenger aircraft represent the largest segment, driven by the rapid increase in air travel demand. However, the freighter segment is also expected to witness substantial growth driven by increasing e-commerce and trade activities. The growth is driven by economic growth, supportive government policies promoting air travel, and growing tourism.

Key Drivers:

- Economic Growth: Robust economic growth across several Middle Eastern and African countries is fueling demand for air travel.

- Infrastructure Development: Significant investments in airport infrastructure are improving capacity and connectivity.

- Government Policies: Supportive government policies fostering aviation development are crucial in driving growth.

Middle-East and Africa Commercial Aircraft Market Product Innovations

Recent innovations focus on enhancing fuel efficiency, reducing emissions, and improving passenger experience. Manufacturers are incorporating advanced materials, aerodynamic designs, and improved engine technologies to achieve these goals. The integration of advanced avionics and in-flight entertainment systems are also key product differentiators, reflecting market trends toward enhanced connectivity and comfort. These innovations cater to the rising demand for sustainable and efficient air travel within the region.

Report Scope & Segmentation Analysis

By Aircraft Type: The report analyzes the market size and growth projections for Narrow-body (xx Million), Wide-body (xx Million), and Regional (xx Million) aircraft segments. Competitive dynamics are analyzed for each segment.

By Engine Type: The market is segmented by Turbofan (xx Million) and Turboprop (xx Million) engines, with individual growth forecasts and competitive analysis.

By Application: The report details the market size and projections for Passenger (xx Million) and Freighter (xx Million) aircraft, examining competitive landscapes in each segment.

Key Drivers of Middle-East and Africa Commercial Aircraft Market Growth

Several key factors drive market expansion. Firstly, rapid economic growth in several key countries increases disposable income, fueling air travel demand. Secondly, investments in airport infrastructure enhance connectivity, boosting passenger volume. Thirdly, supportive government policies promoting aviation development provide a favorable market environment. Finally, the tourism sector’s growth increases the need for air travel capacity.

Challenges in the Middle-East and Africa Commercial Aircraft Market Sector

The market faces several challenges. High fuel prices significantly impact operational costs. Infrastructure limitations in some regions hinder expansion. Geopolitical instability in certain areas poses operational risks. Finally, intense competition among aircraft manufacturers creates price pressures.

Emerging Opportunities in Middle-East and Africa Commercial Aircraft Market

The growth of low-cost carriers presents a significant opportunity. The demand for more fuel-efficient and environmentally friendly aircraft offers a significant opportunity for innovation. The expansion of regional air connectivity across Africa creates substantial growth potential. Finally, the development of new airport infrastructure in emerging markets unlocks further market expansion.

Key Developments in Middle-East and Africa Commercial Aircraft Market Industry

- 2022-Q4: Airbus secures a significant order for narrow-body aircraft from a Middle Eastern airline.

- 2023-Q1: Boeing announces the delivery of new wide-body aircraft to a major African airline.

- 2023-Q2: Embraer signs a partnership agreement with an African airline to expand its regional aircraft operations. Further developments will be added upon completion of the report.

Future Outlook for Middle-East and Africa Commercial Aircraft Market Market

The market exhibits significant growth potential, driven by sustained economic growth and increasing air travel demand. Strategic investments in airport infrastructure and ongoing technological advancements are expected to fuel market expansion. The focus on sustainability and fuel efficiency will drive innovation and shape the competitive landscape in the coming years. The market is poised for robust growth, with substantial opportunities for both established players and new entrants.

Middle-East and Africa Commercial Aircraft Market Segmentation

-

1. Engine Type

- 1.1. Turbofan

- 1.2. Turboprop

-

2. Application

- 2.1. Passenger Aircraft

- 2.2. Freighter

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. South Africa

- 3.5. Rest of Middle-East and Africa

Middle-East and Africa Commercial Aircraft Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. South Africa

- 5. Rest of Middle East and Africa

Middle-East and Africa Commercial Aircraft Market Regional Market Share

Geographic Coverage of Middle-East and Africa Commercial Aircraft Market

Middle-East and Africa Commercial Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Airline Fleet Expansion Plans is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 5.1.1. Turbofan

- 5.1.2. Turboprop

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger Aircraft

- 5.2.2. Freighter

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. South Africa

- 5.3.5. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. South Africa

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 6. Saudi Arabia Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 6.1.1. Turbofan

- 6.1.2. Turboprop

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger Aircraft

- 6.2.2. Freighter

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. South Africa

- 6.3.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 7. United Arab Emirates Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 7.1.1. Turbofan

- 7.1.2. Turboprop

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger Aircraft

- 7.2.2. Freighter

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. South Africa

- 7.3.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 8. Qatar Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 8.1.1. Turbofan

- 8.1.2. Turboprop

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger Aircraft

- 8.2.2. Freighter

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. South Africa

- 8.3.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 9. South Africa Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 9.1.1. Turbofan

- 9.1.2. Turboprop

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger Aircraft

- 9.2.2. Freighter

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. South Africa

- 9.3.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 10. Rest of Middle East and Africa Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 10.1.1. Turbofan

- 10.1.2. Turboprop

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Passenger Aircraft

- 10.2.2. Freighter

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Qatar

- 10.3.4. South Africa

- 10.3.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Commercial Aircraft Corporation of China Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Airbus

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AT

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rostec

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Embraer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MITSUBISHI HEAVY INDUSTRIES Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boeing

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Commercial Aircraft Corporation of China Ltd

List of Figures

- Figure 1: Middle-East and Africa Commercial Aircraft Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Commercial Aircraft Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 2: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 6: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 10: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 14: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 18: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 22: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Commercial Aircraft Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Middle-East and Africa Commercial Aircraft Market?

Key companies in the market include Commercial Aircraft Corporation of China Ltd, Airbus, AT, Rostec, Embraer, MITSUBISHI HEAVY INDUSTRIES Ltd, Boeing.

3. What are the main segments of the Middle-East and Africa Commercial Aircraft Market?

The market segments include Engine Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Airline Fleet Expansion Plans is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Commercial Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Commercial Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Commercial Aircraft Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Commercial Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence