Key Insights

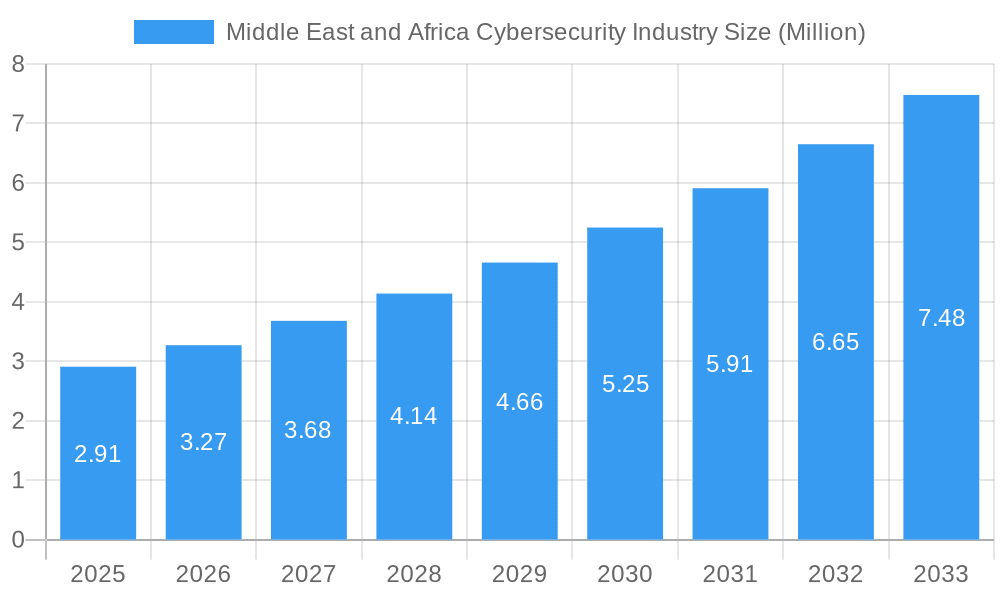

The Middle East and Africa cybersecurity market is poised for significant expansion, projecting a current market size of $2.91 million and an impressive Compound Annual Growth Rate (CAGR) of 12.42%. This robust growth is fueled by a confluence of escalating cyber threats, increasing digitalization across critical sectors, and a growing awareness among organizations of the paramount importance of robust data protection and compliance. The region's evolving digital infrastructure, coupled with the increasing sophistication of cyberattacks targeting sensitive data and critical systems, necessitates substantial investment in advanced cybersecurity solutions. Key market drivers include the imperative to safeguard intellectual property, protect customer data in line with global privacy regulations, and ensure business continuity in an increasingly interconnected environment. Emerging trends such as the widespread adoption of cloud-based security solutions and the integration of AI and machine learning into threat detection and response mechanisms are further propelling market dynamism.

Middle East and Africa Cybersecurity Industry Market Size (In Million)

While the market demonstrates strong growth potential, certain restraints such as budget limitations for some smaller enterprises and a persistent shortage of skilled cybersecurity professionals in specific sub-regions need to be addressed. However, the overall trajectory remains overwhelmingly positive. The market is segmented across various solutions including Threat Intelligence and Response Management, Identity and Access Management, and Data Loss Prevention Management, all of which are experiencing heightened demand. The service segment, encompassing Managed Services and Professional Services, is also set to benefit from this surge. Deployment models are shifting towards cloud-based solutions, although on-premise deployments still hold relevance. End-user industries like BFSI, Healthcare, and Government are leading adoption due to the sensitive nature of their data and the critical services they provide. Major players are actively investing in expanding their presence and offerings within the Middle East and Africa, indicating a highly competitive yet opportunity-rich landscape. The Middle East, with countries like Saudi Arabia and the UAE at the forefront, is expected to be a significant contributor to this market's expansion, followed by other GCC nations and key African economies.

Middle East and Africa Cybersecurity Industry Company Market Share

This in-depth report provides a detailed examination of the Middle East and Africa (MEA) Cybersecurity Industry, offering critical insights for stakeholders, industry professionals, and investors. With a study period spanning from 2019 to 2033, this analysis leverages the base year of 2025 and a forecast period of 2025-2033 to project future market trajectories. The historical period of 2019-2024 lays the groundwork for understanding past trends and current market dynamics. Uncover critical market structures, innovation trends, growth drivers, challenges, and opportunities within this rapidly evolving sector.

Middle East and Africa Cybersecurity Industry Market Structure & Innovation Trends

The MEA cybersecurity market is characterized by a moderate to high concentration, with a few dominant players like Cisco Systems Inc, IBM Corporation, and Palo Alto Networks Inc holding significant market share, estimated to be around 30% collectively. Innovation is a key differentiator, driven by increasing sophistication of cyber threats and a growing demand for advanced solutions such as Threat Intelligence and Response Management and Identity and Access Management. Regulatory frameworks are progressively strengthening across the region, with countries like the UAE and Saudi Arabia implementing stringent data protection laws, further stimulating market growth. Product substitutes are emerging, particularly in the form of integrated security platforms that offer a comprehensive suite of functionalities, potentially impacting the market share of single-solution providers. End-user demographics are diverse, with BFSI, Government, and IT and Telecommunication sectors being the primary adopters, seeking robust security to protect sensitive data and critical infrastructure. Mergers and acquisitions (M&A) activities are on the rise, with recent deals valued in the tens of millions of dollars, indicating strategic consolidation and expansion efforts by key companies aiming to enhance their service portfolios and market reach. For instance, acquisitions of specialized threat intelligence firms are becoming more common.

Middle East and Africa Cybersecurity Industry Market Dynamics & Trends

The MEA cybersecurity market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033. This significant expansion is propelled by a confluence of factors, including the escalating frequency and severity of cyberattacks, a heightened awareness of data privacy regulations across the region, and the accelerating digital transformation initiatives undertaken by governments and enterprises. The increasing adoption of cloud computing and the Internet of Things (IoT) devices, while offering immense benefits, also introduces new vulnerabilities that necessitate advanced cybersecurity solutions. Consumer preferences are shifting towards proactive and managed security services, as businesses recognize the need for specialized expertise to combat sophisticated threats. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into cybersecurity platforms, are revolutionizing threat detection and response capabilities, offering real-time anomaly detection and predictive analytics. Competitive dynamics are intensifying, with established global players vying for market share alongside emerging regional cybersecurity providers. Key companies like Check Point Software Technologies Ltd and Trend Micro Inc are investing heavily in research and development to stay ahead of evolving threats. The increasing demand for robust Data Loss Prevention Management and Security and Vulnerability Management solutions reflects the growing concern over data breaches. Market penetration for advanced cybersecurity solutions is projected to reach over 60% by 2033, driven by sustained investment and increasing cyber resilience needs across various industries. The deployment of cybersecurity solutions is increasingly leaning towards cloud-based models, offering scalability and cost-effectiveness.

Dominant Regions & Segments in Middle East and Africa Cybersecurity Industry

The United Arab Emirates (UAE) stands out as the dominant region in the MEA cybersecurity market, driven by its progressive economic policies, advanced digital infrastructure, and a strong commitment to becoming a global technology hub. Its proactive stance on cybersecurity, coupled with significant investments in smart city initiatives and digital transformation, creates a fertile ground for cybersecurity solutions. Key drivers for the UAE's dominance include:

- Economic Policies: Government incentives and policies encouraging technological innovation and digital adoption.

- Infrastructure: World-class digital infrastructure that supports the deployment of advanced cybersecurity solutions.

- Regulatory Framework: Stringent data protection laws and cybersecurity mandates fostering high adoption rates.

Within the Solution segment, Security and Vulnerability Management and Threat Intelligence and Response Management are experiencing the highest growth and adoption rates. This dominance is fueled by the escalating sophistication of cyber threats and the critical need for organizations to proactively identify and mitigate vulnerabilities, as well as respond effectively to ongoing attacks. The BFSI sector, in particular, heavily relies on these solutions to safeguard sensitive financial data and ensure operational continuity.

In the Service segment, Managed Services are taking the lead. This trend is a direct response to the growing shortage of skilled cybersecurity professionals in the region and the increasing complexity of managing advanced security solutions. Businesses are increasingly outsourcing their cybersecurity operations to specialized providers, allowing them to leverage expertise and focus on their core competencies. Tata Communications International Pte Ltd's expanded collaboration with Intertec Systems exemplifies this trend.

Regarding Deployment, Cloud-based solutions are rapidly gaining traction, overtaking on-premise deployments. The scalability, flexibility, and cost-effectiveness offered by cloud platforms make them an attractive option for businesses of all sizes, especially SMEs. This shift is further accelerated by the growing adoption of cloud-native applications and services across various industries.

Among End Users, the IT and Telecommunication sector, followed closely by BFSI and Government, represent the largest consumer segments for cybersecurity solutions. These sectors handle vast amounts of sensitive data and are prime targets for cyberattacks, necessitating robust security measures. The Aerospace and Defense sector is also a significant adopter, driven by national security concerns and the protection of critical intellectual property.

Middle East and Africa Cybersecurity Industry Product Innovations

Product innovations in the MEA cybersecurity landscape are focused on leveraging AI and ML for enhanced threat detection and response, including predictive analytics and automated incident remediation. Unified Threat Management (UTM) solutions are evolving to offer more integrated functionalities, simplifying security management for businesses. The development of sophisticated Identity and Access Management (IAM) systems, including multi-factor authentication and privileged access management, is crucial for preventing unauthorized access. Furthermore, advanced Data Loss Prevention (DLP) tools are being enhanced to address the complexities of cloud environments and evolving data privacy regulations.

Report Scope & Segmentation Analysis

This report meticulously segments the MEA cybersecurity market across several key dimensions. The Solution segment includes Threat Intelligence and Response Management, Identity and Access Management, Data Loss Prevention Management, Security and Vulnerability Management, Unified Threat Management, and Enterprise Risk and Compliance. Each of these sub-segments is projected to witness significant growth, with Security and Vulnerability Management and Threat Intelligence and Response Management leading the pack. The Service segment encompasses Managed Services and Professional Services, with Managed Services expected to dominate due to the demand for outsourced security expertise. In terms of Deployment, the market is split between Cloud and On-premise, with Cloud deployment anticipated to capture a larger market share owing to its scalability and cost-effectiveness. The End User segment covers Aerospace and Defense, BFSI, Healthcare, Manufacturing, Retail, Government, IT and Telecommunication, and Other End users. The IT and Telecommunication and BFSI sectors are expected to exhibit the highest growth rates, driven by their critical need for robust cybersecurity.

Key Drivers of Middle East and Africa Cybersecurity Industry Growth

The MEA cybersecurity industry's growth is fundamentally driven by the escalating threat landscape, characterized by increasingly sophisticated and frequent cyberattacks. This necessitates robust security measures across all sectors. The acceleration of digital transformation initiatives across the region, including the adoption of cloud computing, IoT, and AI, inherently expands the attack surface, creating a demand for comprehensive cybersecurity solutions. Furthermore, the growing emphasis on data privacy and regulatory compliance, with countries implementing stricter data protection laws, compels organizations to invest in advanced security technologies. Increased awareness among businesses and consumers about the financial and reputational damages associated with cyber incidents also plays a pivotal role in driving market expansion.

Challenges in the Middle East and Africa Cybersecurity Industry Sector

Despite the robust growth trajectory, the MEA cybersecurity sector faces several challenges. A significant hurdle is the persistent shortage of skilled cybersecurity professionals, leading to increased reliance on managed services and a higher cost of in-house talent. The nascent stage of cybersecurity maturity in some smaller economies within the region can also be a restraining factor, with limited budgets and awareness hindering adoption of advanced solutions. Regulatory fragmentation across different countries, while improving, can still present complexities for businesses operating pan-regionally. Furthermore, the high cost of implementing and maintaining sophisticated cybersecurity solutions can be a barrier for Small and Medium-sized Enterprises (SMEs), despite initiatives like Mastercard's partnership with NowNow aimed at addressing this.

Emerging Opportunities in Middle East and Africa Cybersecurity Industry

Emerging opportunities in the MEA cybersecurity industry are abundant, particularly in the realm of cloud security and IoT security solutions, given the rapid adoption of these technologies. The growing demand for managed security services presents a significant avenue for growth for specialized providers. The increasing focus on nation-state sponsored cyber threats and critical infrastructure protection is creating opportunities for advanced threat intelligence and incident response platforms. Moreover, the development of localized cybersecurity expertise and solutions tailored to the specific needs and regulatory environments of the MEA region holds immense potential. The rise of FinTech and digital payment systems also necessitates specialized cybersecurity services to combat financial fraud and data breaches.

Leading Players in the Middle East and Africa Cybersecurity Industry Market

- Paramount Computer Systems LLC

- FireEye Inc

- IBM Corporation

- Trend Micro Inc

- Kaspersky Lab

- Check Point Software Technologies Ltd

- Cisco Systems Inc

- Broadcom Inc (Symantec Corporation)

- DTS Solutions In

- Palo Alto Networks Inc

- Dell Technologies

Key Developments in Middle East and Africa Cybersecurity Industry Industry

- February 2023: Mastercard partnered with Nigeria-based digital payment startup NowNow to help SMEs avoid the risk of cyberattacks by providing free educational resources and web application penetration tests, strengthening their cybersecurity ecosystem.

- January 2023: Tata Communications International Pte Ltd expanded its collaboration with Intertec Systems in the UAE to provide managed services, contributing its Cyber Security Operations Centre (SOC) and managed security services to enhance regional firms' cyber defenses.

Future Outlook for Middle East and Africa Cybersecurity Industry Market

The future outlook for the MEA cybersecurity industry is exceptionally bright, fueled by persistent and evolving cyber threats, rapid digital adoption, and strengthening regulatory frameworks. Growth accelerators will include the increasing demand for AI-driven security solutions, cloud-native security services, and comprehensive managed security offerings. Strategic opportunities lie in addressing the cybersecurity needs of emerging sectors like renewable energy and advanced manufacturing, alongside the continued expansion within established segments like BFSI and Government. The ongoing investment in digital infrastructure and the drive towards smart cities across the region will further solidify the market's growth trajectory, making it a critical and expanding frontier for cybersecurity innovation and investment.

Middle East and Africa Cybersecurity Industry Segmentation

-

1. Solution

- 1.1. Threat Intelligence and Response Management

- 1.2. Identity and Access Management

- 1.3. Data Loss Prevention Management

- 1.4. Security and Vulnerability Management

- 1.5. Unified Threat Management

- 1.6. Enterprise Risk and Compliance

-

2. Service

- 2.1. Managed Services

- 2.2. Professional Services

-

3. Deployment

- 3.1. Cloud

- 3.2. On-premise

-

4. End User

- 4.1. Aerospace and Defense

- 4.2. BFSI

- 4.3. Healthcare

- 4.4. Manufacturing

- 4.5. Retail

- 4.6. Government

- 4.7. IT and Telecommunication

- 4.8. Other End users

Middle East and Africa Cybersecurity Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Cybersecurity Industry Regional Market Share

Geographic Coverage of Middle East and Africa Cybersecurity Industry

Middle East and Africa Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Cyber Security Incidents; Consistent Threats From the Underground Market

- 3.3. Market Restrains

- 3.3.1. Lack of Cyber Security Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness

- 3.4. Market Trends

- 3.4.1. Cloud Segment is expected to grow at a higher pace.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Cybersecurity Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Threat Intelligence and Response Management

- 5.1.2. Identity and Access Management

- 5.1.3. Data Loss Prevention Management

- 5.1.4. Security and Vulnerability Management

- 5.1.5. Unified Threat Management

- 5.1.6. Enterprise Risk and Compliance

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Managed Services

- 5.2.2. Professional Services

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Cloud

- 5.3.2. On-premise

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Aerospace and Defense

- 5.4.2. BFSI

- 5.4.3. Healthcare

- 5.4.4. Manufacturing

- 5.4.5. Retail

- 5.4.6. Government

- 5.4.7. IT and Telecommunication

- 5.4.8. Other End users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Paramount Computer Systems LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FireEye Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trend Micro Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kaspersky Lab

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Check Point Software Technologies Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cisco Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Broadcom Inc (Symantec Corporation)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DTS Solutions In

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Palo Alto Networks Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dell Technologies

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Paramount Computer Systems LLC

List of Figures

- Figure 1: Middle East and Africa Cybersecurity Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Cybersecurity Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 2: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 3: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 7: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 9: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Saudi Arabia Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Arab Emirates Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Israel Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Qatar Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Kuwait Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Oman Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bahrain Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Jordan Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Lebanon Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Cybersecurity Industry?

The projected CAGR is approximately 12.42%.

2. Which companies are prominent players in the Middle East and Africa Cybersecurity Industry?

Key companies in the market include Paramount Computer Systems LLC, FireEye Inc, IBM Corporation, Trend Micro Inc, Kaspersky Lab, Check Point Software Technologies Ltd, Cisco Systems Inc, Broadcom Inc (Symantec Corporation), DTS Solutions In, Palo Alto Networks Inc, Dell Technologies.

3. What are the main segments of the Middle East and Africa Cybersecurity Industry?

The market segments include Solution, Service, Deployment , End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Cyber Security Incidents; Consistent Threats From the Underground Market.

6. What are the notable trends driving market growth?

Cloud Segment is expected to grow at a higher pace..

7. Are there any restraints impacting market growth?

Lack of Cyber Security Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness.

8. Can you provide examples of recent developments in the market?

February 2023: Mastercard has partnered with Nigeria-based digital payment startup NowNow to help SMEs avoid the risk of cyberattacks. The alliance intends to accomplish this by giving free resources to SMEs to assist in educating and strengthening their cybersecurity ecosystem. Through regular web application penetration tests, NowNow strives to protect SMEs. Such checks guarantee that SMEs' apps are not vulnerable to cyber threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence