Key Insights

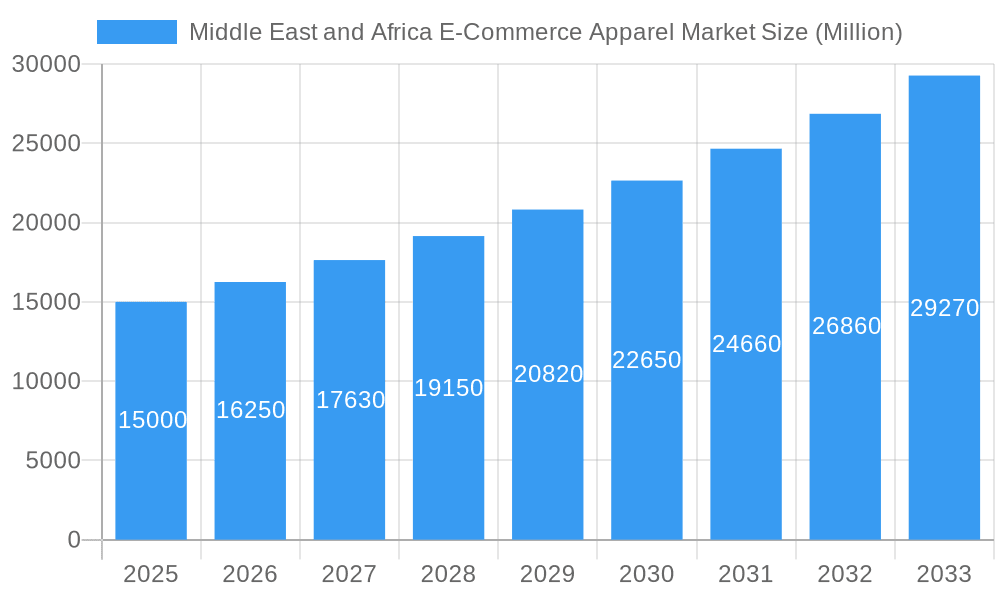

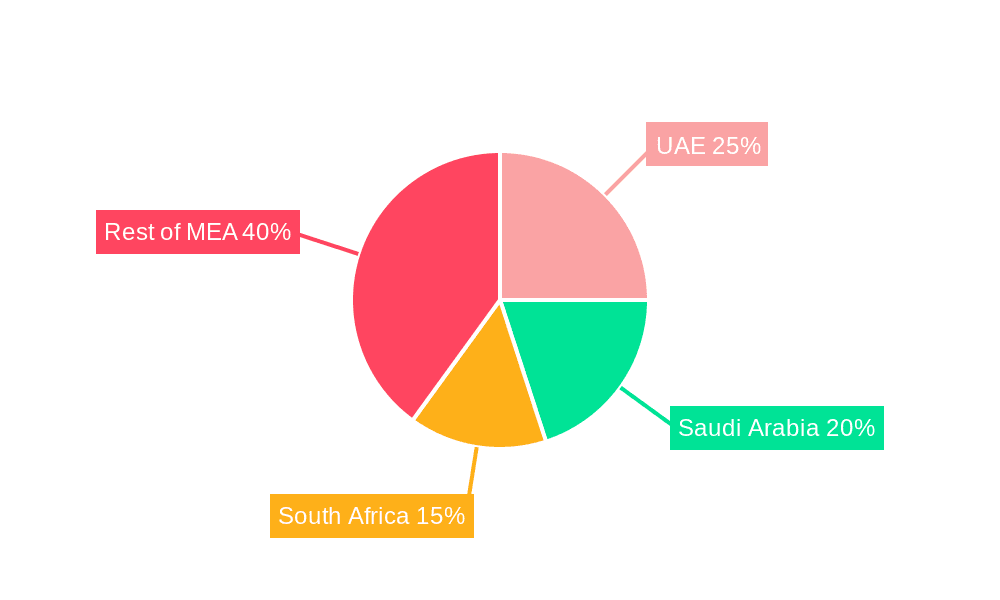

The Middle East and Africa (MEA) e-commerce apparel market is experiencing robust growth, driven by increasing internet and smartphone penetration, a burgeoning young population with a high propensity for online shopping, and the expanding reach of e-commerce platforms. The market's value is estimated to be significantly large in 2025, considering the substantial existing market size and the impressive Compound Annual Growth Rate (CAGR) of 8.72%. This growth is fueled by several key factors: the rising adoption of mobile commerce, particularly in regions with limited traditional retail infrastructure; increasing disposable incomes, especially in urban areas; and a growing preference for convenience and wider product selection offered online. While challenges remain, such as concerns about online payment security and logistics infrastructure limitations in certain areas, the MEA region's potential for e-commerce apparel growth is undeniable. Strong regional variations exist, with countries like the UAE and Saudi Arabia leading the charge, while other nations in the MEA region are demonstrating considerable potential for future expansion. The market segmentation, encompassing various product types (formal, casual, sportswear, etc.) and end-users (men, women, children), presents further opportunities for tailored marketing and product development. The dominance of both third-party retailers and company-owned websites underscores the dynamism and competitive landscape of this thriving market.

Middle East and Africa E-Commerce Apparel Market Market Size (In Billion)

The projected growth trajectory for the MEA e-commerce apparel market over the forecast period (2025-2033) is expected to remain strong, potentially exceeding the historical CAGR. This optimism stems from continuous improvements in logistics and payment gateways, targeted marketing campaigns reaching specific demographics, and the increasing presence of international and regional brands. However, sustained growth will depend on addressing persisting challenges like ensuring reliable and affordable delivery, combating counterfeiting, and adapting to evolving consumer preferences and technological advancements. Competitive pressures will also intensify as more players enter the market, necessitating strategic investments in technology, marketing, and customer service. The strong presence of major global and regional players indicates a highly competitive but lucrative sector poised for significant expansion in the coming years. Successful players will leverage data analytics to personalize customer experiences and optimize their supply chains to meet the increasing demand effectively.

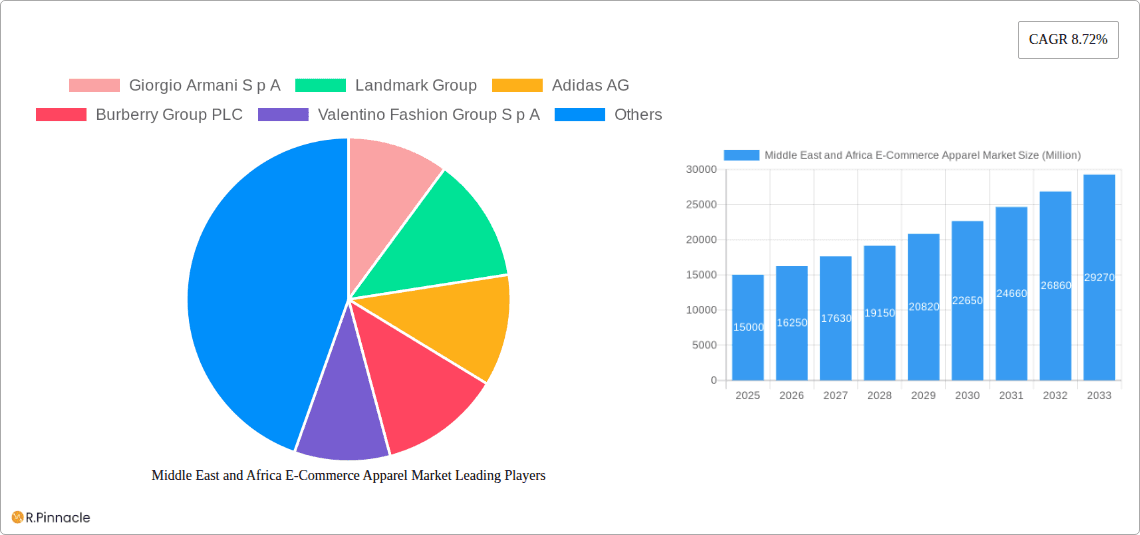

Middle East and Africa E-Commerce Apparel Market Company Market Share

Middle East & Africa E-Commerce Apparel Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa e-commerce apparel market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the base year 2025 and forecast period 2025-2033. Expect detailed segmentation, competitive landscape analysis, and future growth projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, showcasing significant growth potential.

Middle East and Africa E-Commerce Apparel Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Middle East and Africa e-commerce apparel market. We examine market concentration, identifying key players and their market share. The impact of M&A activity, including deal values (where available), is assessed. Innovation drivers, such as technological advancements and evolving consumer preferences, are explored, alongside the regulatory framework and the presence of substitute products. End-user demographics are analyzed, revealing key trends in consumer behavior.

- Market Concentration: The market exhibits a [High/Medium/Low - Insert Actual Metric based on analysis] level of concentration, with key players holding significant market share. For example, [Insert Specific Example: e.g., Inditex holds approximately x% market share, while H&M holds y%].

- Innovation Drivers: E-commerce platforms are constantly innovating to enhance user experience. Mobile commerce, personalized recommendations, and improved logistics are driving growth.

- Regulatory Frameworks: Varying regulatory landscapes across different countries influence market dynamics. [Insert specific examples and impact of regulations on ecommerce and apparel in MEA]

- Product Substitutes: The emergence of [mention specific examples of substitute products or services] presents both challenges and opportunities.

- End-User Demographics: [Describe key demographic trends. For example, a growing young population with increasing disposable income fuels market expansion.]

- M&A Activities: The market has witnessed [Number] significant M&A deals in the recent past, with total deal value estimated at xx Million. [Provide specific examples of mergers and acquisitions if available, and analyze their impact].

Middle East and Africa E-Commerce Apparel Market Market Dynamics & Trends

The Middle East and Africa (MEA) e-commerce apparel market is a dynamic and rapidly evolving landscape, characterized by significant growth potential and shifting consumer behaviors. This section delves into the core forces shaping this market, including the key growth drivers that are fueling its expansion, the transformative impact of technological disruptions, the increasingly sophisticated and segmented consumer preferences, and the intricate competitive dynamics at play. We will meticulously examine the Compound Annual Growth Rate (CAGR) projections across various segments and analyze the current and projected market penetration rates, offering a comprehensive understanding of the market's trajectory.

The MEA e-commerce apparel market is experiencing a substantial uplift, driven by a confluence of economic and social factors. A primary engine of growth is the **rising disposable incomes** across many nations within the region, which translates directly into increased consumer spending power for fashion and apparel. Complementing this, **increasing internet penetration**, particularly mobile internet, is democratizing access to online retail, bringing e-commerce within reach of a larger demographic. This digital accessibility is crucial in a region with diverse geographical spread. Furthermore, **changing fashion trends**, influenced by global fashion weeks, social media influencers, and a growing desire for self-expression through clothing, are encouraging more frequent and diverse apparel purchases. Technologically, the **rise of mobile commerce (m-commerce)** is paramount, with smartphones serving as the primary gateway to online shopping for a significant portion of the population. Innovations in this space, such as AI-powered personalization and virtual try-on technologies, are enhancing the online shopping experience, making it more engaging and efficient. Consumer preferences are also undergoing a significant shift. There is a discernible **demand for sustainable and ethically sourced apparel**, reflecting a growing awareness of environmental and social responsibility among consumers. This is often coupled with a **preference for online shopping** due to convenience, wider product selection, and competitive pricing. The competitive dynamics are characterized by intense **price competition**, with online retailers striving to offer the best value. However, **brand loyalty** remains a significant factor, especially for established international and emerging regional brands. The influx of **new entrants**, including both local startups and international players, further intensifies this competitive environment, pushing for greater innovation and customer-centric strategies. While specific CAGR figures vary by country and segment, the overall market is projected to see consistent double-digit growth in the coming years, with e-commerce apparel penetration steadily increasing across the MEA region.

Dominant Regions & Segments in Middle East and Africa E-Commerce Apparel Market

This section identifies the leading regions, countries, and segments within the Middle East and Africa e-commerce apparel market. We analyze market dominance across Product Type (Formal Wear, Casual Wear, Sportswear, Nightwear, Other Types), End User (Men, Women, Kids/Children), and Platform Type (Third Party Retailer, Company's Own Website).

- Leading Region/Country: [Identify the dominant region/country and explain why – e.g., The UAE dominates due to its advanced e-commerce infrastructure and high disposable income].

- Dominant Product Type: [Identify the most popular product type and provide reasoning – e.g., Casual wear dominates due to its broad appeal and affordability].

- Dominant End User: [Identify the most significant end-user segment and provide reasoning – e.g., Women constitute the largest segment due to higher spending on apparel].

- Dominant Platform Type: [Identify the most popular platform type and provide reasoning – e.g., Third-party retailers dominate due to their wider reach and established customer bases.]

[Insert bullet points for key drivers (economic policies, infrastructure, consumer behavior) for each dominant segment. Include paragraphs for detailed dominance analysis of each segment].

Middle East and Africa E-Commerce Apparel Market Product Innovations

This section summarizes recent product developments, highlighting technological trends and their impact on market competitiveness. Emphasis is placed on market fit and competitive advantages offered by innovative products.

[Insert 100-150 words summarizing product developments, applications, and competitive advantages. Mention specific examples of innovative products and technologies, their impact on market dynamics, and competitive advantages they offer. ]

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Middle East and Africa e-commerce apparel market based on Product Type, End User, and Platform Type. We offer growth projections, market size estimations, and competitive dynamics for each segment.

- Product Type: The report analyzes the market size and growth projections for Formal Wear, Casual Wear, Sportswear, Nightwear, and Other Types. Competitive dynamics within each segment are also assessed.

- End User: The report examines market size and growth projections for Men, Women, and Kids/Children segments, considering the unique characteristics and purchasing behavior of each.

- Platform Type: The analysis includes market size and growth estimations for Third-Party Retailers and Company's Own Websites, comparing their respective strengths and challenges.

[Insert 100-150 words providing more detail for each segment—include growth projections, market sizes, and competitive dynamics. ]

Key Drivers of Middle East and Africa E-Commerce Apparel Market Growth

Several potent factors are actively contributing to the robust growth of the Middle East and Africa e-commerce apparel market, creating a fertile ground for expansion and innovation. These include:

- Rising Disposable Incomes: A growing middle class across many MEA economies is leading to increased disposable incomes, which directly fuels demand for discretionary spending on apparel and fashion.

- Expanding Internet and Smartphone Penetration: The rapid and widespread adoption of smartphones and improving internet connectivity, especially in urban and peri-urban areas, is significantly broadening the reach of e-commerce platforms, making online shopping more accessible to a larger consumer base.

- Government Initiatives: Forward-thinking governments in the MEA region are actively promoting digital transformation and e-commerce through supportive policies, investment in digital infrastructure, and initiatives aimed at fostering a conducive business environment for online retailers, thereby directly impacting market expansion.

Beyond these core drivers, a suite of other critical factors are propelling the MEA e-commerce apparel market forward. **Technological advancements** play a pivotal role; the pervasive adoption of mobile commerce (m-commerce) is reshaping how consumers shop for apparel, with mobile-first strategies becoming essential for success. Improvements in **logistics and supply chain management** are also crucial, addressing historical challenges and enabling faster, more reliable delivery across diverse geographies. Furthermore, **favorable economic conditions** in certain key markets, characterized by economic diversification and a burgeoning digital economy, are creating a positive climate for investment and consumer spending. The increasing digitalization of payment systems and the growing trust in online transactions are also contributing significantly to the overall market growth, making it easier and safer for consumers to engage with e-commerce apparel platforms.

Challenges in the Middle East and Africa E-Commerce Apparel Market Sector

The Middle East and Africa e-commerce apparel market faces several challenges:

- Logistical hurdles: Inefficient delivery networks increase costs and delivery times.

- Cybersecurity concerns: Data breaches and online fraud discourage online shopping.

- Payment Gateway Limitations: Limited acceptance of online payment methods hampers transactions.

[Insert 150 words detailing other challenges – regulatory hurdles, supply chain disruptions, intense competition, and counterfeit products]

Emerging Opportunities in Middle East and Africa E-Commerce Apparel Market

Despite existing complexities and challenges within the MEA e-commerce apparel market, a wealth of compelling opportunities is emerging, promising substantial growth for agile and innovative businesses:

- Growth of Mobile Commerce: The unparalleled popularity and widespread ownership of smartphones across the MEA region present a massive opportunity for mobile-first e-commerce strategies. This includes optimizing mobile websites and apps, leveraging social commerce features, and developing seamless mobile payment solutions to capture this highly engaged audience.

- Expansion into Underserved Markets: Vast geographical areas within the Middle East and Africa remain relatively underserved by traditional retail and even existing e-commerce players. Developing robust logistics networks, localized marketing campaigns, and accessible payment options can unlock significant potential in these untapped markets, reaching new customer segments.

- Personalization and Customization: As consumers become more discerning, the demand for tailored shopping experiences is escalating. Implementing AI-driven recommendation engines, offering personalized product selections, and providing options for customization can dramatically enhance customer engagement, foster loyalty, and differentiate brands in a crowded marketplace.

Further opportunities are ripe for exploitation within the MEA e-commerce apparel sector. The development of **niche market segments**, such as modest fashion, athleisure, or specialized children's wear, can cater to specific consumer demands and build strong brand communities. There is a growing global emphasis on **sustainable and ethical fashion**, and MEA consumers are increasingly receptive to brands that prioritize eco-friendly materials, fair labor practices, and transparent supply chains. Companies that can effectively communicate and deliver on these values are likely to gain a competitive edge. The **adoption of new technologies** extends beyond personalization; exploring augmented reality (AR) for virtual try-ons, leveraging data analytics for better inventory management and demand forecasting, and incorporating innovative marketing techniques such as influencer collaborations and live shopping events are all avenues for capturing market share and enhancing the overall customer journey.

Leading Players in the Middle East and Africa E-Commerce Apparel Market Market

- Giorgio Armani S p A

- Landmark Group

- Adidas AG

- Burberry Group PLC

- Valentino Fashion Group S p A

- Industria de Diseño Textil S A (INDITEX)

- Prada S p A

- Dolce & Gabbana S r l

- LVMH Moët Hennessy Louis Vuitton

- H & M Hennes & Mauritz AB

- PVH Corp

- Namshi (part of Global Fashion Group)

- Noon.com

- Shein (significant presence and growth)

- *List Not Exhaustive

Key Developments in Middle East and Africa E-Commerce Apparel Market Industry

- March 2023: H&M launched its Limited Edition 2023 Ramadan collection in three capsules, priced from DHS 139, available online and in select stores. This highlights the increasing importance of catering to religious holidays.

- February 2023: H&M South Africa partnered with Superbalist to expand its online presence, indicating a strategic move to enhance market reach.

- March 2022: H&M launched its "H&M Ramadan & Eid Statements 2022" collection online and in select stores, demonstrating the significance of seasonal collections.

[Insert bullet points with more key developments if available]

Future Outlook for Middle East and Africa E-Commerce Apparel Market Market

The Middle East and Africa e-commerce apparel market is on an unequivocal trajectory for substantial and sustained growth in the foreseeable future. This optimistic outlook is underpinned by several fundamental drivers: the consistent increase in disposable incomes across a growing population, the ever-expanding reach of internet and smartphone penetration, and a palpable evolution in consumer preferences towards convenience, variety, and digital engagement. Strategic opportunities abound for companies that demonstrate agility in adapting to these rapidly changing market dynamics, embrace and integrate technological advancements to enhance customer experience, and possess the foresight to cater to the diverse and often unique needs of the myriad consumer segments within this vast and varied region. The market's future potential is indeed considerable, with projected expansion across a wide spectrum of apparel categories and price points, promising a dynamic and rewarding landscape for stakeholders.

Middle East and Africa E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. South Africa

- 4.3. Rest of Middle East & Africa

Middle East and Africa E-Commerce Apparel Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East

Middle East and Africa E-Commerce Apparel Market Regional Market Share

Geographic Coverage of Middle East and Africa E-Commerce Apparel Market

Middle East and Africa E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Internet Penetration and Increased Social Media Usage Boosting the Market; Seasonal Demand Surge & Discounts in Online Stores Driving the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products Restricting the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration & Increased Social Media Usage Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Rest of Middle East & Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. South Africa

- 6.4.3. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. South Africa

- 7.4.3. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. South Africa

- 8.4.3. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Giorgio Armani S p A

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Landmark Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Adidas AG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Burberry Group PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Valentino Fashion Group S p A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Industria de Diseño Textil S A (INDITEX)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Prada S p A

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Dolce & Gabbana S r l

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 LVMH Moët Hennessy Louis Vuitton

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 H & M Hennes & Mauritz AB

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 PVH Corp *List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Middle East and Africa E-Commerce Apparel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 4: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 9: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 14: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 19: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa E-Commerce Apparel Market?

The projected CAGR is approximately 8.72%.

2. Which companies are prominent players in the Middle East and Africa E-Commerce Apparel Market?

Key companies in the market include Giorgio Armani S p A, Landmark Group, Adidas AG, Burberry Group PLC, Valentino Fashion Group S p A, Industria de Diseño Textil S A (INDITEX), Prada S p A, Dolce & Gabbana S r l, LVMH Moët Hennessy Louis Vuitton, H & M Hennes & Mauritz AB, PVH Corp *List Not Exhaustive.

3. What are the main segments of the Middle East and Africa E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration and Increased Social Media Usage Boosting the Market; Seasonal Demand Surge & Discounts in Online Stores Driving the Market.

6. What are the notable trends driving market growth?

Rising Internet Penetration & Increased Social Media Usage Boosting the Market.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products Restricting the Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: H&M announced the launch of its Limited Edition 2023 collection for Ramadan. The products were launched in three unique capsules. The H&M Limited Edition 2023 collection prices ranged from DHS 139 in different sizes XS-XL. The first 'Ramadan Ready capsule went on sale online and in a few select stores on March 2, 2023. The second one went on sale on March 16 of that same year, and the last one went on sale on April 6 of that same year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence