Key Insights

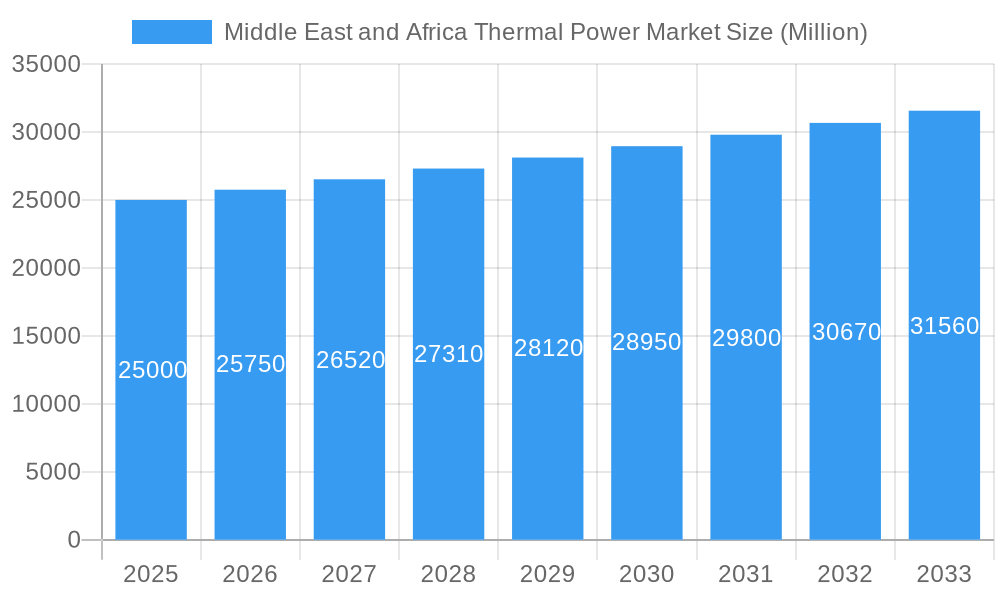

The Middle East and Africa thermal power market is projected for significant expansion, with an estimated market size of $1.54 billion in 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% through 2033. This growth is primarily driven by escalating electricity demand fueled by population growth, rapid urbanization, and industrial development across both regions. Middle Eastern countries, including Saudi Arabia and the UAE, are making substantial investments in new power generation capacity to support their expanding economies and diversification strategies. Concurrently, African nations are increasingly relying on thermal power to improve electricity access and foster economic advancement, even as renewable energy integration gains momentum. The market outlook indicates a sustained need for dependable and scalable power solutions, with thermal power remaining a critical component of the energy mix.

Middle East and Africa Thermal Power Market Market Size (In Billion)

Key factors propelling this market growth include significant infrastructure investments, particularly in the Middle East, and ongoing efforts to enhance energy security and affordability in Africa. Despite the increasing adoption of renewable energy, its inherent intermittency and infrastructure requirements underscore the continued importance of thermal power for baseload generation and grid stability. However, the market also confronts challenges such as evolving environmental regulations and a global imperative towards decarbonization, which may influence the selection of thermal power technologies. Nonetheless, the ongoing dependence on fossil fuels, combined with advancements in more efficient and cleaner thermal power technologies, ensures its continued relevance. Major industry participants, including Saudi Electricity Company, Electricite de France SA, and Siemens AG, are actively shaping this dynamic market through new plant construction and technological upgrades.

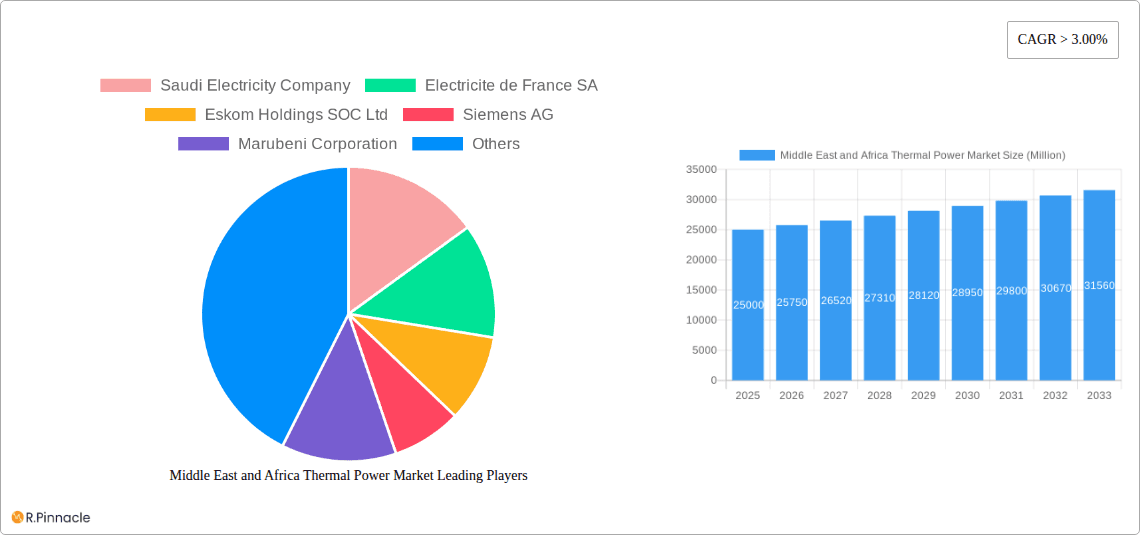

Middle East and Africa Thermal Power Market Company Market Share

Middle East and Africa Thermal Power Market Analysis: Growth, Trends, and Forecast (2025-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa Thermal Power Market, offering critical insights for stakeholders. Covering the forecast period up to 2033, with a base year of 2025, this study delivers actionable intelligence on market structure, dynamics, leading players, and future trends.

Middle East and Africa Thermal Power Market Market Structure & Innovation Trends

The Middle East and Africa Thermal Power Market exhibits a moderately concentrated structure, with key players like Saudi Electricity Company, Electricite de France SA, Eskom Holdings SOC Ltd, Siemens AG, Marubeni Corporation, Egyptian Electricity Holding Company, Dubai Electricity and Water Authority, and Acwa Power Barka SAOG holding significant market shares. Innovation is primarily driven by the pursuit of greater efficiency, reduced emissions, and enhanced grid stability. Regulatory frameworks, while evolving, play a crucial role in shaping market entry and operational standards, with a growing emphasis on environmental compliance and the integration of cleaner thermal technologies. Product substitutes, such as renewable energy sources, are increasingly influencing the thermal power landscape, necessitating strategic adaptation and investment in hybrid solutions. End-user demographics are diverse, ranging from rapidly urbanizing populations demanding increased electricity access to industrial sectors requiring reliable and robust power supply. Mergers and acquisition (M&A) activities are moderate, often focusing on strategic partnerships to access new markets, acquire advanced technologies, or consolidate existing operations. For instance, recent M&A deals in the region have focused on integrating renewable energy components into existing thermal infrastructure, with estimated deal values in the hundreds of millions.

Middle East and Africa Thermal Power Market Market Dynamics & Trends

The Middle East and Africa Thermal Power Market is poised for robust growth, driven by a confluence of factors including burgeoning populations, escalating urbanization, and the sustained demand for industrial and commercial electricity. The projected Compound Annual Growth Rate (CAGR) is estimated at XX%, reflecting the region's ongoing commitment to expanding its energy infrastructure. Technological disruptions are at the forefront of market evolution, with a significant push towards the adoption of advanced gas turbine technologies for enhanced efficiency and reduced environmental impact. Furthermore, the increasing integration of digital solutions for grid management and predictive maintenance is optimizing operational performance and minimizing downtime. Consumer preferences are shifting, with a growing awareness and demand for cleaner energy sources, prompting a recalibration of thermal power generation strategies to incorporate cleaner fuels and emission control technologies. The competitive dynamics within the market are intensifying, characterized by strategic collaborations, technological innovation races, and a focus on cost optimization. Market penetration for modern, efficient thermal power solutions is on an upward trajectory across key economies within the region. The strategic imperative to meet rising energy demands while addressing climate change concerns is shaping the investment landscape, favoring projects that balance economic viability with environmental responsibility. The ongoing development of large-scale power projects, often supported by government initiatives and international investment, is a key indicator of the market's forward momentum.

Dominant Regions & Segments in Middle East and Africa Thermal Power Market

The United Arab Emirates stands out as a dominant region within the Middle East and Africa Thermal Power Market, driven by its ambitious economic diversification strategies and substantial investments in modern energy infrastructure. This dominance is underpinned by significant government backing for energy security and economic development.

- Economic Policies & Infrastructure: The UAE's proactive economic policies, including incentives for foreign investment and a clear roadmap for energy independence, have fostered a conducive environment for thermal power development. Massive infrastructure projects, such as the expansion of power generation capacity and transmission networks, directly contribute to market growth.

- Technological Adoption: The region has been a frontrunner in adopting advanced thermal power technologies, including highly efficient gas-fired power plants and the integration of carbon capture, utilization, and storage (CCUS) technologies, setting benchmarks for the wider MEA region.

Saudi Arabia emerges as another pivotal player, propelled by its Vision 2030 initiatives aimed at transforming its economy and ensuring energy security. The country's substantial oil and gas reserves provide a natural advantage for thermal power generation.

- Resource Abundance: Saudi Arabia's vast reserves of oil and natural gas offer a readily available and cost-effective fuel source for thermal power plants, supporting large-scale generation projects.

- Strategic Projects: The development of mega-projects, often in collaboration with international entities, underscores the kingdom's commitment to expanding its thermal power capacity and modernizing its energy grid.

Egypt is experiencing significant growth in its thermal power sector, driven by a growing population, increasing industrial demand, and strategic investments in new power generation facilities. The government's focus on energy independence and infrastructure development has been a key catalyst.

- Population Growth & Industrialization: A rapidly expanding population and a drive towards industrialization are creating unprecedented demand for reliable electricity, making thermal power a crucial component of Egypt's energy mix.

- Infrastructure Modernization: Significant investments in upgrading and expanding its power generation and transmission infrastructure have bolstered Egypt's thermal power capabilities.

From a Source perspective, Natural Gas is emerging as the dominant fuel in the Middle East and Africa Thermal Power Market.

- Environmental Advantages: Compared to oil and coal, natural gas offers a cleaner burning alternative with lower emissions, aligning with the region's growing environmental considerations.

- Availability and Cost-Effectiveness: The region's substantial natural gas reserves make it a readily available and economically viable fuel source for power generation, driving its widespread adoption.

- Technological Advancements: Modern gas turbines are highly efficient, enabling greater energy output with reduced fuel consumption.

The Rest of the Middle-East and Africa collectively represents a significant growth frontier, with numerous countries actively seeking to expand their energy access and industrial capabilities. This segment, though fragmented, offers immense potential for thermal power development driven by demographic and economic expansion.

Middle East and Africa Thermal Power Market Product Innovations

Product innovations in the Middle East and Africa Thermal Power Market are primarily focused on enhancing operational efficiency, reducing environmental footprints, and improving grid reliability. Advanced combined cycle gas turbine (CCGT) technologies offering higher thermal efficiencies and lower emissions are gaining traction. The development of integrated carbon capture, utilization, and storage (CCUS) solutions for existing and new thermal plants is a key innovation area, addressing growing environmental concerns. Furthermore, digital solutions for real-time performance monitoring, predictive maintenance, and grid integration are transforming the operational landscape, offering competitive advantages through optimized energy delivery and reduced downtime.

Report Scope & Segmentation Analysis

This report offers a granular analysis of the Middle East and Africa Thermal Power Market, segmented by Source and Geography. The Source segmentation includes Oil, Natural Gas, Nuclear, and Coal. The Geography segmentation encompasses the United Arab Emirates, Saudi Arabia, South Africa, Egypt, Qatar, and the Rest of the Middle-East and Africa. Each segment is analyzed for market size, growth projections, and competitive dynamics, with a particular focus on the evolving role of natural gas and the varying developmental stages of thermal power infrastructure across different regions. Projections indicate a sustained growth for natural gas-based thermal power, while coal's dominance is expected to gradually diminish due to environmental regulations.

Key Drivers of Middle East and Africa Thermal Power Market Growth

The growth of the Middle East and Africa Thermal Power Market is propelled by several key drivers. Firstly, rapid population growth and increasing urbanization are creating an insatiable demand for electricity. Secondly, economic diversification and industrialization initiatives across many nations require a robust and reliable power supply. Thirdly, significant investments in infrastructure development, including the construction of new power plants and grid enhancements, are crucial. Finally, government policies supporting energy security and domestic resource utilization, particularly abundant natural gas reserves, play a pivotal role. The integration of advanced technologies for efficiency and emission reduction further stimulates market expansion.

Challenges in the Middle East and Africa Thermal Power Market Sector

Despite significant growth potential, the Middle East and Africa Thermal Power Market faces several challenges. Regulatory hurdles and the complexity of obtaining permits and approvals can lead to project delays. Supply chain disruptions, particularly for specialized equipment and skilled labor, can impact project timelines and costs. Intense competitive pressures, coupled with volatile fuel prices, necessitate continuous cost optimization and efficiency improvements. Furthermore, growing environmental concerns and the increasing global push towards renewable energy sources pose a long-term challenge, requiring thermal power operators to invest in cleaner technologies and emission control measures to remain competitive and compliant.

Emerging Opportunities in Middle East and Africa Thermal Power Market

Emerging opportunities within the Middle East and Africa Thermal Power Market lie in the growing demand for decentralized power solutions and the integration of advanced technologies. The development of hybrid power plants, combining thermal and renewable energy sources, offers a pathway to enhance grid stability and reduce carbon intensity. Investment in carbon capture, utilization, and storage (CCUS) technologies presents a significant opportunity to mitigate the environmental impact of thermal power generation. Furthermore, the expansion of electricity access in underserved regions across Africa and the Middle East creates a substantial market for new thermal power capacity, particularly leveraging readily available natural gas resources.

Leading Players in the Middle East and Africa Thermal Power Market Market

Saudi Electricity Company Electricite de France SA Eskom Holdings SOC Ltd Siemens AG Marubeni Corporation Egyptian Electricity Holding Company Dubai Electricity and Water Authority Acwa Power Barka SAOG

Key Developments in Middle East and Africa Thermal Power Market Industry

- 2023: Saudi Electricity Company announces significant investments in upgrading its gas turbine fleet for enhanced efficiency.

- 2023: Egyptian Electricity Holding Company inaugurates a new, highly efficient natural gas-fired power plant, boosting national generation capacity by XX%.

- 2024: Siemens AG secures a major contract for the supply of advanced gas turbines to a new power project in the UAE.

- 2024: Acwa Power Barka SAOG announces plans for a pilot project integrating CCUS technology at one of its thermal power facilities.

- 2024: Marubeni Corporation finalizes an agreement for a joint venture to develop a new LNG-to-power project in a key African market.

Future Outlook for Middle East and Africa Thermal Power Market Market

The future outlook for the Middle East and Africa Thermal Power Market remains positive, driven by the region's escalating energy demands and ongoing infrastructure development. While the global energy transition towards renewables is a significant factor, thermal power, particularly natural gas-fired generation, will continue to play a crucial role in ensuring energy security and reliability in the medium term. Strategic opportunities lie in embracing cleaner thermal technologies, including advanced CCGT systems and CCUS solutions, to meet evolving environmental standards. The market is expected to witness continued investment in modernization and efficiency improvements, positioning thermal power as a vital component of the region's diverse energy mix for the foreseeable future.

Middle East and Africa Thermal Power Market Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Nuclear

- 1.4. Coal

-

2. Geogrpahy

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. South Africa

- 2.4. Egypt

- 2.5. Qatar

- 2.6. Rest of the Middle-East and Africa

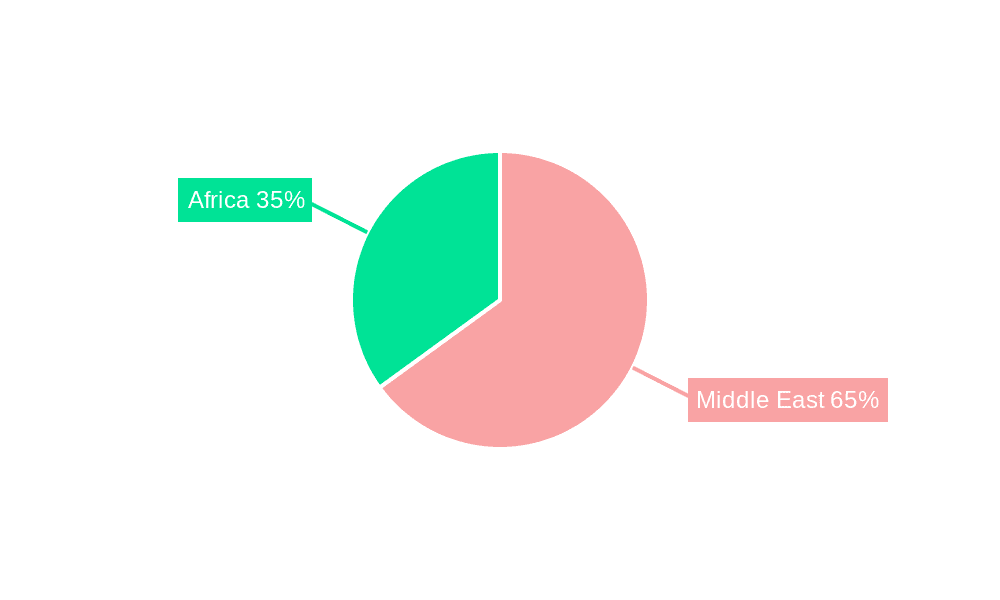

Middle East and Africa Thermal Power Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Thermal Power Market Regional Market Share

Geographic Coverage of Middle East and Africa Thermal Power Market

Middle East and Africa Thermal Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Natural Gas-based Thermal Plants to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Thermal Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Nuclear

- 5.1.4. Coal

- 5.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. South Africa

- 5.2.4. Egypt

- 5.2.5. Qatar

- 5.2.6. Rest of the Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Saudi Electricity Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Electricite de France SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eskom Holdings SOC Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Marubeni Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Egyptian Electricity Holding company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dubai Electricity and Water Authority

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Acwa Power Barka SAOG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Saudi Electricity Company

List of Figures

- Figure 1: Middle East and Africa Thermal Power Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Thermal Power Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Thermal Power Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: Middle East and Africa Thermal Power Market Revenue billion Forecast, by Geogrpahy 2020 & 2033

- Table 3: Middle East and Africa Thermal Power Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Thermal Power Market Revenue billion Forecast, by Source 2020 & 2033

- Table 5: Middle East and Africa Thermal Power Market Revenue billion Forecast, by Geogrpahy 2020 & 2033

- Table 6: Middle East and Africa Thermal Power Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Thermal Power Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Thermal Power Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Thermal Power Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Thermal Power Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Thermal Power Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Thermal Power Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Thermal Power Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Thermal Power Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Thermal Power Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Thermal Power Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Middle East and Africa Thermal Power Market?

Key companies in the market include Saudi Electricity Company, Electricite de France SA, Eskom Holdings SOC Ltd, Siemens AG, Marubeni Corporation, Egyptian Electricity Holding company, Dubai Electricity and Water Authority, Acwa Power Barka SAOG.

3. What are the main segments of the Middle East and Africa Thermal Power Market?

The market segments include Source, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.54 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Natural Gas-based Thermal Plants to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Thermal Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Thermal Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Thermal Power Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Thermal Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence