Key Insights

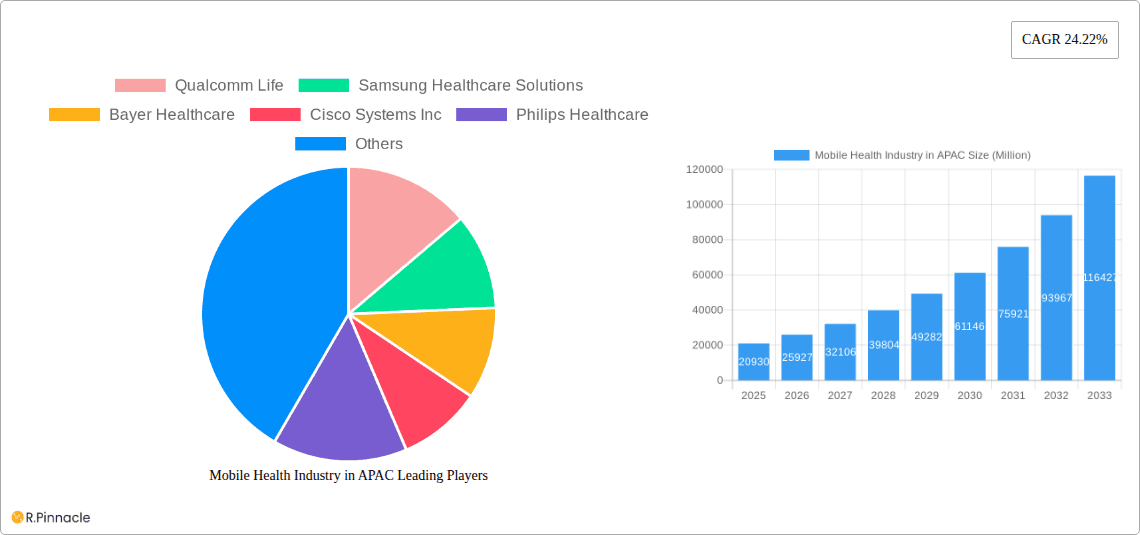

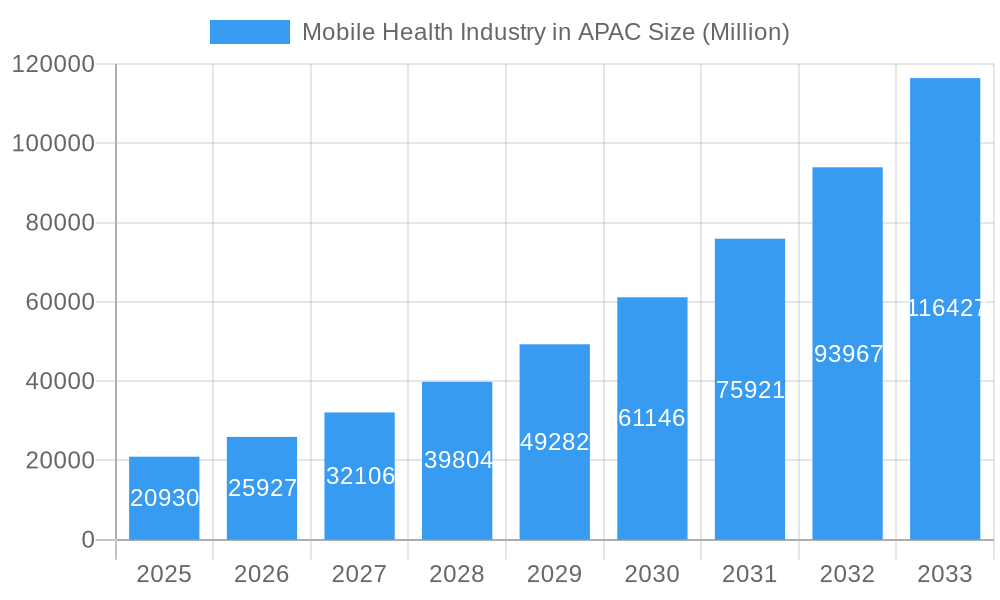

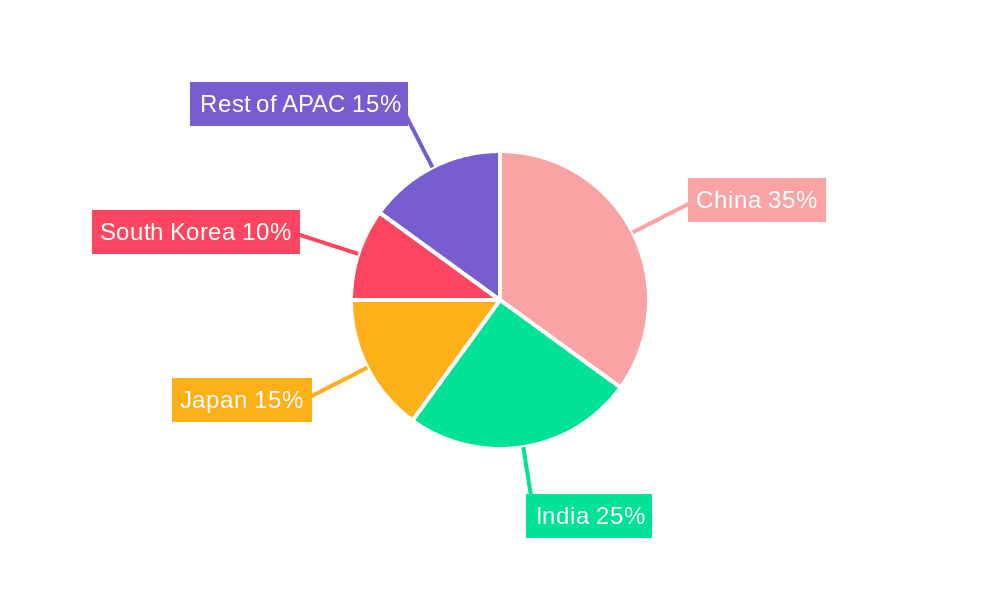

The Asia-Pacific (APAC) mobile health (mHealth) market is experiencing explosive growth, projected to reach \$20.93 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 24.22%. This surge is driven by several key factors. Firstly, the region's burgeoning population, coupled with rising healthcare costs and increasing prevalence of chronic diseases, is fueling demand for affordable and accessible healthcare solutions. Secondly, advancements in mobile technology, including the proliferation of smartphones and improved internet connectivity, are creating a fertile ground for mHealth applications. Thirdly, supportive government initiatives focused on digital health infrastructure and telemedicine are accelerating market expansion. Finally, the increasing adoption of remote patient monitoring (RPM) devices, particularly blood glucose monitors, cardiac monitors, and respiratory monitors, is significantly contributing to market growth. Key players like Qualcomm Life, Samsung Healthcare Solutions, and Medtronic are actively shaping this landscape through innovative product offerings and strategic partnerships. The diverse segments within the market, encompassing various device types, stakeholder categories, and service types, present a complex yet lucrative opportunity for businesses. Growth is particularly pronounced in countries like China, India, and Japan, which are witnessing significant investments in digital healthcare infrastructure and technological advancements.

Mobile Health Industry in APAC Market Size (In Billion)

The forecast period (2025-2033) promises further expansion, with significant opportunities in the expansion of monitoring services, diagnostic services, and wellness and fitness solutions. Challenges remain, however, including concerns about data privacy and security, the need for robust regulatory frameworks, and the digital divide that may limit access to mHealth technologies in certain areas. Despite these hurdles, the overall trajectory suggests a bright future for the APAC mHealth market, with continued growth fueled by technological innovation, increasing adoption, and supportive policy environments. The market's segmentation presents opportunities for specialized services and device development, catering to the specific needs of different demographics and healthcare settings.

Mobile Health Industry in APAC Company Market Share

Mobile Health Industry in APAC: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mobile Health (mHealth) industry in the Asia-Pacific (APAC) region, covering the period from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the dynamic growth opportunities within this rapidly evolving sector. The report leverages rigorous data analysis and expert insights to deliver actionable intelligence, encompassing market sizing, segmentation, competitive landscape, and future trends. The estimated market size in 2025 is projected at xx Million.

Mobile Health Industry in APAC Market Structure & Innovation Trends

This section analyzes the structure of the APAC mHealth market, exploring key aspects impacting its growth trajectory. We examine market concentration, identifying leading players and their market share. For instance, while precise market share data for 2025 requires in-depth proprietary research (and is unavailable here), we can anticipate that companies like Qualcomm Life, Samsung Healthcare Solutions, and Bayer Healthcare will hold significant positions. The report further delves into innovation drivers, such as advancements in mobile technology and increasing adoption of telehealth solutions. Regulatory frameworks, both supportive and restrictive, across different APAC nations are analyzed. We also explore the impact of product substitutes and the evolving end-user demographics, along with a detailed review of recent M&A activities, including their deal values. Examples will include deals in the xx Million range and illustrate the increasing consolidation within the sector. This analysis includes a detailed description of the competitive landscape and strategic partnerships within the APAC mHealth market.

Mobile Health Industry in APAC Market Dynamics & Trends

This section provides a comprehensive overview of the market dynamics shaping the APAC mHealth landscape. We analyze the key growth drivers, including rising prevalence of chronic diseases, increasing smartphone penetration, and growing government support for telehealth initiatives. The report assesses the impact of technological disruptions, such as the introduction of 5G and AI-powered diagnostics. Consumer preferences and their evolving demands are meticulously evaluated. The competitive dynamics are analyzed, incorporating factors like pricing strategies, product differentiation, and marketing efforts. The report includes key metrics such as the Compound Annual Growth Rate (CAGR) projected at xx% for the forecast period (2025-2033) and market penetration rates for various mHealth solutions. The impact of macroeconomic factors on market growth will also be analyzed.

Dominant Regions & Segments in Mobile Health Industry in APAC

This section identifies the leading regions, countries, and segments within the APAC mHealth market. Dominance will be assessed based on market size, growth rate, and key market drivers.

Leading Regions/Countries: (Analysis based on xx Million market value in 2025, with specific countries detailed in the full report). The report will include detailed data analysis which shows the dominant region and countries in APAC.

Leading Segments: (Analysis based on xx Million market value in 2025, with specific segments detailed in the full report).

- Device Type: Blood Glucose Monitors are likely to hold a significant share driven by a rising diabetic population; Remote Patient Monitoring (RPM) devices are expected to exhibit strong growth.

- Stakeholder: Healthcare Providers will be a major stakeholder, followed by Mobile Operators, heavily involved in infrastructure and data connectivity.

- Service Type: Monitoring Services will be a key segment given the rise of remote patient care.

Key Drivers (examples):

- Favorable government policies promoting telehealth adoption.

- Expanding healthcare infrastructure in several APAC nations.

- Increasing investment in digital health technologies.

Mobile Health Industry in APAC Product Innovations

This section focuses on the latest product developments within the APAC mHealth market. We examine innovative applications such as AI-powered diagnostics, wearable health trackers, and integrated mHealth platforms. The analysis highlights the competitive advantages offered by these products, focusing on factors such as enhanced accuracy, ease of use, and affordability. The analysis includes the technological trends shaping product innovation and their market fit. Examples of recent innovative product launches within the last year will be included.

Report Scope & Segmentation Analysis

This report segments the APAC mHealth market comprehensively across various parameters:

Device Type: Blood Glucose Monitors, Cardiac Monitors, Hemodynamic Monitors, Neurological Monitors, Respiratory Monitors, Body and Temperature Monitors, Remote Patient Monitoring Devices, Other Device Types. Each segment’s growth projection, market size (in xx Millions), and competitive dynamics are detailed.

Stakeholder: Mobile Operators, Healthcare Providers, Application/Content Players, Other Stakeholders. Detailed analysis of each stakeholder’s role and influence on the market.

Service Type: Monitoring Services, Diagnostic Services, Treatment Services, Wellness and Fitness Solutions, Other Service Types. A detailed analysis of market trends and future prospects for each service. Growth projections and market sizes (in Millions) are included.

Key Drivers of Mobile Health Industry in APAC Growth

The growth of the APAC mHealth market is propelled by several factors:

- Technological Advancements: Miniaturization of devices, improved sensor technology, and the rise of AI and machine learning.

- Economic Factors: Increasing disposable incomes, rising healthcare expenditure, and government initiatives promoting digital health.

- Regulatory Support: Favorable policies supporting telehealth and digital health solutions in many APAC countries.

Challenges in the Mobile Health Industry in APAC Sector

The APAC mHealth market faces several challenges:

- Regulatory Hurdles: Varied regulatory landscapes across different countries can hinder market expansion.

- Data Privacy and Security Concerns: Concerns regarding the security and privacy of patient data remain a significant challenge.

- Infrastructure Gaps: Uneven access to reliable internet connectivity and mobile infrastructure in certain regions can limit market penetration. The impact of these factors on market growth will be quantified in the report.

Emerging Opportunities in Mobile Health Industry in APAC

The APAC mHealth market presents several significant opportunities:

- Expansion into Underserved Markets: Significant untapped potential exists in rural and remote areas.

- Integration of AI and Machine Learning: AI-powered diagnostics and personalized medicine represent emerging opportunities.

- Growth of Wearable Technology: The increasing adoption of wearable health trackers presents a substantial growth area.

Leading Players in the Mobile Health Industry in APAC Market

- Qualcomm Life

- Samsung Healthcare Solutions

- Bayer Healthcare

- Cisco Systems Inc

- Philips Healthcare

- Medtronic PLC

- Omron Corporation

- Cerner Corporation

- Johnson & Johnson

- AT&T Inc

Key Developments in Mobile Health Industry in APAC Industry

- (Details of key developments, including product launches, mergers, and acquisitions, with specific dates will be included in the full report.)

Future Outlook for Mobile Health Industry in APAC Market

The future of the APAC mHealth market looks exceptionally promising. Continued technological advancements, growing government support, and rising consumer awareness are expected to fuel substantial market growth over the forecast period (2025-2033). Strategic partnerships and collaborations within the industry are expected to accelerate innovation and market expansion. The integration of AI and machine learning technologies, along with advancements in wearable devices and remote patient monitoring solutions, will create new growth opportunities and drive market transformation. The predicted market size in 2033 is estimated at xx Million.

Mobile Health Industry in APAC Segmentation

-

1. Service Type

- 1.1. Monitoring Services

- 1.2. Diagnostic Services

- 1.3. Treatment Services

- 1.4. Wellness and Fitness Solutions

- 1.5. Other Service Types

-

2. Device Type

- 2.1. Blood Glucose Monitors

- 2.2. Cardiac Monitors

- 2.3. Hemodynamic Monitors

- 2.4. Neurological Monitors

- 2.5. Respiratory Monitors

- 2.6. Body and Temperature Monitors

- 2.7. Remote Patient Monitoring Devices

- 2.8. Other Device Types

-

3. Stakeholder

- 3.1. Mobile Operators

- 3.2. Healthcare Providers

- 3.3. Application/Content Players

- 3.4. Other Stakeholders

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. China

- 4.1.2. Japan

- 4.1.3. India

- 4.1.4. Australia

- 4.1.5. South Korea

- 4.1.6. Rest of Asia-Pacific

-

4.1. Asia-Pacific

Mobile Health Industry in APAC Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. South Korea

- 1.6. Rest of Asia Pacific

Mobile Health Industry in APAC Regional Market Share

Geographic Coverage of Mobile Health Industry in APAC

Mobile Health Industry in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Usage of Smartphones

- 3.2.2 Tablets

- 3.2.3 and Mobile Technology in Healthcare; Increased Need for Point-of-care Diagnosis and Treatment

- 3.3. Market Restrains

- 3.3.1. Data Security Issues; Stringent Regulatory Policies for mHealth Applications

- 3.4. Market Trends

- 3.4.1. Neurological Monitors are Expected to Register a High Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Health Industry in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Monitoring Services

- 5.1.2. Diagnostic Services

- 5.1.3. Treatment Services

- 5.1.4. Wellness and Fitness Solutions

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. Blood Glucose Monitors

- 5.2.2. Cardiac Monitors

- 5.2.3. Hemodynamic Monitors

- 5.2.4. Neurological Monitors

- 5.2.5. Respiratory Monitors

- 5.2.6. Body and Temperature Monitors

- 5.2.7. Remote Patient Monitoring Devices

- 5.2.8. Other Device Types

- 5.3. Market Analysis, Insights and Forecast - by Stakeholder

- 5.3.1. Mobile Operators

- 5.3.2. Healthcare Providers

- 5.3.3. Application/Content Players

- 5.3.4. Other Stakeholders

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. China

- 5.4.1.2. Japan

- 5.4.1.3. India

- 5.4.1.4. Australia

- 5.4.1.5. South Korea

- 5.4.1.6. Rest of Asia-Pacific

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Qualcomm Life

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Healthcare Solutions

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Philips Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Omron Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cerner Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Johnson & Johnson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AT&T Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Qualcomm Life

List of Figures

- Figure 1: Global Mobile Health Industry in APAC Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Service Type 2025 & 2033

- Figure 3: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Device Type 2025 & 2033

- Figure 5: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Stakeholder 2025 & 2033

- Figure 7: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Stakeholder 2025 & 2033

- Figure 8: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Geography 2025 & 2033

- Figure 9: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Country 2025 & 2033

- Figure 11: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mobile Health Industry in APAC Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Mobile Health Industry in APAC Revenue Million Forecast, by Device Type 2020 & 2033

- Table 3: Global Mobile Health Industry in APAC Revenue Million Forecast, by Stakeholder 2020 & 2033

- Table 4: Global Mobile Health Industry in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Global Mobile Health Industry in APAC Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Mobile Health Industry in APAC Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Global Mobile Health Industry in APAC Revenue Million Forecast, by Device Type 2020 & 2033

- Table 8: Global Mobile Health Industry in APAC Revenue Million Forecast, by Stakeholder 2020 & 2033

- Table 9: Global Mobile Health Industry in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Mobile Health Industry in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Japan Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: India Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Australia Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: South Korea Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Asia Pacific Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Health Industry in APAC?

The projected CAGR is approximately 24.22%.

2. Which companies are prominent players in the Mobile Health Industry in APAC?

Key companies in the market include Qualcomm Life, Samsung Healthcare Solutions, Bayer Healthcare, Cisco Systems Inc, Philips Healthcare, Medtronic PLC, Omron Corporation, Cerner Corporation, Johnson & Johnson, AT&T Inc.

3. What are the main segments of the Mobile Health Industry in APAC?

The market segments include Service Type, Device Type, Stakeholder, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Smartphones. Tablets. and Mobile Technology in Healthcare; Increased Need for Point-of-care Diagnosis and Treatment.

6. What are the notable trends driving market growth?

Neurological Monitors are Expected to Register a High Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Data Security Issues; Stringent Regulatory Policies for mHealth Applications.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Health Industry in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Health Industry in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Health Industry in APAC?

To stay informed about further developments, trends, and reports in the Mobile Health Industry in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence