Key Insights

The North American Feed Lutein and Zeaxanthin Market is poised for significant expansion, projected to reach $52.29 million by 2025. This growth is fueled by a robust CAGR of 5.40%, indicating a healthy and sustained upward trajectory for the market throughout the forecast period of 2025-2033. The increasing consumer demand for high-quality, nutrient-rich animal products, coupled with a growing awareness among livestock producers regarding the health benefits and performance-enhancing properties of lutein and zeaxanthin in animal feed, are the primary drivers. These carotenoids play a crucial role in improving animal vision, immune function, and the overall health and welfare of poultry, swine, and ruminants. Furthermore, advancements in feed formulation technologies and the development of more bioavailable lutein and zeaxanthin ingredients are contributing to market expansion. The aquaculture sector also presents a significant growth opportunity, as these compounds are vital for the pigmentation and health of farmed fish.

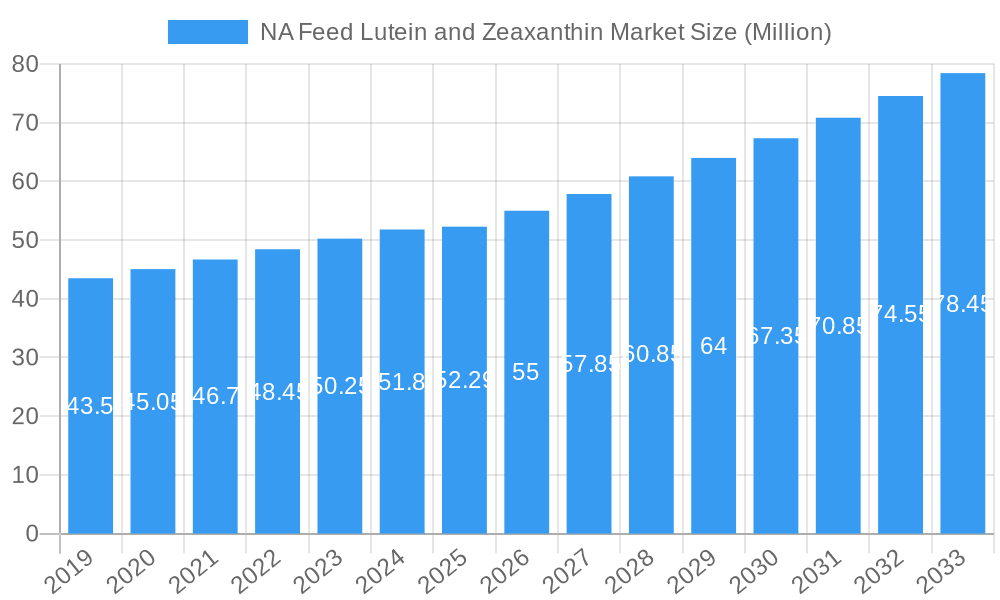

NA Feed Lutein and Zeaxanthin Market Market Size (In Million)

The market's development is further shaped by emerging trends such as the growing adoption of natural feed additives over synthetic alternatives, driven by both regulatory pressures and consumer preference for “clean label” products. Companies are investing in research and development to optimize extraction and synthesis processes, ensuring a consistent and high-quality supply of lutein and zeaxanthin. While the market benefits from strong demand, certain restraints may influence its pace. These could include the fluctuating costs of raw materials, the complexity of regulatory approvals for new feed additives in different regions, and the need for further education and extension services to fully inform producers about the long-term economic benefits of incorporating these supplements. Despite these challenges, the overarching positive outlook for animal health and productivity in North America ensures a promising future for the feed lutein and zeaxanthin market.

NA Feed Lutein and Zeaxanthin Market Company Market Share

NA Feed Lutein and Zeaxanthin Market: Comprehensive Analysis and Future Projections (2019–2033)

This in-depth market report provides a detailed analysis of the North American Feed Lutein and Zeaxanthin market, offering critical insights for industry stakeholders. Covering the historical period from 2019 to 2024, a base year of 2025, and an extensive forecast period from 2025 to 2033, this study equips you with the knowledge to navigate evolving market landscapes and capitalize on emerging opportunities. The report delves into market structure, dynamics, regional dominance, product innovations, and future outlook, supported by robust segmentation and analysis of key growth drivers and challenges.

NA Feed Lutein and Zeaxanthin Market Market Structure & Innovation Trends

The NA Feed Lutein and Zeaxanthin market exhibits a moderately concentrated structure, with key players like DSM Animal Nutrition and Kemin Industries holding significant market share. Innovation is a critical driver, fueled by advancements in extraction technologies and a growing understanding of the health benefits of lutein and zeaxanthin for animal nutrition and welfare. Regulatory frameworks, primarily driven by food safety and animal feed standards in the United States, Canada, and Mexico, influence product development and market access. While direct product substitutes are limited, alternative antioxidant feed additives present a competitive pressure. End-user demographics are dominated by large-scale animal feed producers and integrators seeking to enhance animal health, productivity, and product quality, particularly in the poultry and aquaculture segments. Mergers and acquisitions (M&A) activities, though sporadic, have been strategic, aimed at consolidating market presence and expanding product portfolios. For instance, historical M&A deals have been valued in the range of tens of millions, indicating a strategic, yet selective, approach to market consolidation.

NA Feed Lutein and Zeaxanthin Market Market Dynamics & Trends

The NA Feed Lutein and Zeaxanthin market is poised for robust growth, driven by an escalating demand for enhanced animal health and welfare, coupled with a rising global population necessitating increased animal protein production. The estimated CAGR for the forecast period is projected to be around 6.5%. Technological advancements in production processes, including improved extraction and purification techniques for lutein and zeaxanthin from natural sources like marigold, are significantly impacting market dynamics by increasing efficiency and reducing costs. Consumer preferences for products from animals raised with natural feed additives, free from synthetic alternatives, are indirectly driving the adoption of lutein and zeaxanthin in animal feed. This trend is particularly pronounced in the poultry sector, where lutein contributes to yolk color and overall egg quality, directly appealing to consumers.

The competitive landscape is characterized by a blend of established global players and emerging regional manufacturers. Companies are increasingly focusing on R&D to develop novel formulations and delivery systems that enhance bioavailability and efficacy. The market penetration of lutein and zeaxanthin in animal feed is steadily increasing, moving beyond niche applications to become a standard inclusion in many feed formulations, especially for poultry and aquaculture. The demand for traceable and sustainably sourced ingredients is also shaping market trends, pushing manufacturers to adopt more environmentally friendly production methods. Furthermore, the recognition of lutein and zeaxanthin's antioxidant and anti-inflammatory properties is expanding their application scope beyond traditional uses, influencing product development and marketing strategies. The cyclical nature of agricultural markets, influenced by feed prices and livestock cycles, also plays a role in shaping market demand and supply.

Dominant Regions & Segments in NA Feed Lutein and Zeaxanthin Market

The United States stands as the dominant region within the NA Feed Lutein and Zeaxanthin market, driven by its large-scale animal husbandry operations, particularly in poultry and swine production. The country’s advanced agricultural infrastructure, coupled with significant investment in animal nutrition research and development, fosters a strong demand for high-quality feed additives. Economic policies supporting the agricultural sector and stringent quality control measures further solidify the US's leading position.

- Poultry: This segment consistently holds the largest market share due to the widespread use of lutein for enhancing egg yolk pigmentation and zeaxanthin for improving poultry health and reducing stress. The demand for omega-3 enriched eggs and broilers with improved meat quality directly fuels the consumption of these carotenoids.

- Aquaculture: This segment is experiencing rapid growth, driven by the increasing global demand for fish and seafood. Lutein and zeaxanthin are crucial for fish pigmentation, immune function, and stress resistance, making them essential components in aquaculture feed formulations.

- Swine: While a significant market, the demand in swine is more focused on immune support and overall health, with less emphasis on product aesthetics compared to poultry.

- Ruminants: The application in ruminants is relatively niche but growing, focusing on improving animal health and potentially influencing milk and meat quality.

- Other Animal Type: This segment includes companion animals and specialty livestock, offering potential for targeted growth.

Canada and Mexico, while smaller markets, are showing promising growth trajectories. Canada's focus on sustainable agriculture and Mexico's expanding livestock sector, coupled with increasing adoption of advanced feed technologies, contribute to their market potential. The "Rest of North America" category, encompassing smaller agricultural economies, represents an emerging market with untapped potential as these regions gradually adopt similar feed additive trends.

NA Feed Lutein and Zeaxanthin Market Product Innovations

Product innovations in the NA Feed Lutein and Zeaxanthin market are primarily focused on improving bioavailability, stability, and ease of incorporation into various feed formulations. Advances in microencapsulation technologies are creating more stable and efficient delivery systems for these carotenoids, ensuring they reach their target sites within the animal effectively. The development of highly concentrated and standardized lutein and zeaxanthin products provides feed manufacturers with greater flexibility and cost-effectiveness. Furthermore, research into synergistic effects with other feed additives is leading to the creation of multi-functional premixes designed to address multiple animal health and performance parameters simultaneously.

Report Scope & Segmentation Analysis

This report segmentations encompass the entire North American market for feed-grade lutein and zeaxanthin. The Animal Type segmentation includes Ruminants, Poultry, Swine, Aquaculture, and Other Animal Type, each analyzed for their specific consumption patterns and growth forecasts. Geographically, the analysis covers the United States, Canada, Mexico, and the Rest of North America, detailing market sizes, growth projections, and competitive dynamics within each region.

- United States: Projected to maintain its leading position with a substantial market share and steady growth, driven by its large livestock industry.

- Canada: Expected to exhibit moderate growth, fueled by increasing adoption of advanced animal nutrition practices.

- Mexico: Anticipated to experience robust growth due to its expanding agricultural sector and rising demand for animal protein.

- Rest of North America: A nascent market with significant untapped potential for future expansion.

Key Drivers of NA Feed Lutein and Zeaxanthin Market Growth

The growth of the NA Feed Lutein and Zeaxanthin market is propelled by several interconnected factors. An increasing global demand for animal protein, a consequence of population growth and rising disposable incomes, necessitates more efficient and healthier animal production, directly benefiting feed additive markets. The growing awareness among farmers and feed producers about the proven health benefits of lutein and zeaxanthin – including enhanced immune function, antioxidant protection, and improved product quality (e.g., egg yolk color, meat pigmentation) – is a primary driver. Technological advancements in extraction and formulation processes are making these carotenoids more accessible and cost-effective. Furthermore, a global trend towards cleaner labels and natural ingredients in animal feed is creating a preference for plant-derived carotenoids over synthetic alternatives. Regulatory support for feed safety and animal welfare also indirectly encourages the use of beneficial additives.

Challenges in the NA Feed Lutein and Zeaxanthin Market Sector

Despite the positive growth trajectory, the NA Feed Lutein and Zeaxanthin market faces several challenges. Fluctuations in raw material prices, particularly marigold flower cultivation, can impact the cost and availability of lutein and zeaxanthin, creating supply chain volatilities. Intense competition among key players and the emergence of new entrants can lead to price pressures, affecting profit margins. Stringent regulatory approvals for novel feed additives, though crucial for safety, can also be time-consuming and resource-intensive for manufacturers. While market penetration is increasing, educating smaller farms and producers about the specific benefits and optimal usage of lutein and zeaxanthin remains a continuous effort. Economic downturns and shifts in consumer demand for animal products can also indirectly affect the market's overall performance.

Emerging Opportunities in NA Feed Lutein and Zeaxanthin Market

The NA Feed Lutein and Zeaxanthin market is ripe with emerging opportunities. The expanding aquaculture sector in North America presents a significant growth avenue, driven by the need for improved fish health and coloration. The increasing demand for premium animal products, such as omega-3 enriched eggs and meats with enhanced nutritional profiles, creates a direct market for lutein and zeaxanthin. Innovations in biotechnology are paving the way for more sustainable and efficient production methods, potentially lowering costs and increasing accessibility. Furthermore, the growing trend of pet humanization is leading to increased demand for high-quality pet food, where lutein and zeaxanthin can contribute to vision health and antioxidant support. Exploring new geographical markets within North America and developing specialized formulations for specific animal health challenges will also unlock further potential.

Leading Players in the NA Feed Lutein and Zeaxanthin Market Market

- DSM Animal Nutrition

- Kemin Industries

- PIVEG Inc

- Altratene (Allied Biotech Corporation)

- FENCHEM

- Nutrex eu

- Innov Ad NV/SA

- EW Nutrition

- Synthite Industries Private Ltd

Key Developments in NA Feed Lutein and Zeaxanthin Market Industry

- 2024: Kemin Industries launches a new innovative feed additive formulation for poultry, enhancing immune support and gut health, incorporating advanced carotenoid delivery.

- 2023: DSM Animal Nutrition announces expansion of its marigold cultivation and extraction capabilities in North America to meet rising demand.

- 2022: EW Nutrition introduces a novel zeaxanthin-rich ingredient for aquaculture, focusing on improved fish pigmentation and disease resistance.

- 2021: Altratene (Allied Biotech Corporation) receives regulatory approval for a new lutein-based feed additive in the Canadian market.

- 2020: Synthite Industries Private Ltd increases its production capacity for natural lutein extract to cater to the growing North American demand.

Future Outlook for NA Feed Lutein and Zeaxanthin Market Market

The future outlook for the NA Feed Lutein and Zeaxanthin market is exceptionally positive, driven by sustained demand for healthier animal products and advancements in animal nutrition science. The market is expected to witness continued growth as feed manufacturers increasingly recognize the value proposition of these carotenoids in improving animal welfare, productivity, and the quality of end products. Strategic collaborations between ingredient suppliers and feed producers, along with ongoing investment in research and development, will further accelerate market expansion. The growing consumer preference for natural and functional ingredients in animal feed will solidify the market position of lutein and zeaxanthin. Emerging applications in specialized animal segments and the development of innovative delivery systems will contribute to a dynamic and expanding market landscape over the next decade.

NA Feed Lutein and Zeaxanthin Market Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Type

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

NA Feed Lutein and Zeaxanthin Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

NA Feed Lutein and Zeaxanthin Market Regional Market Share

Geographic Coverage of NA Feed Lutein and Zeaxanthin Market

NA Feed Lutein and Zeaxanthin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed

- 3.3. Market Restrains

- 3.3.1. High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves

- 3.4. Market Trends

- 3.4.1. Industrialization of Livestock Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Feed Lutein and Zeaxanthin Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Type

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.2.4. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. United States NA Feed Lutein and Zeaxanthin Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Type

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.2.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Canada NA Feed Lutein and Zeaxanthin Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Type

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.2.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Mexico NA Feed Lutein and Zeaxanthin Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Type

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.2.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Rest of North America NA Feed Lutein and Zeaxanthin Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Type

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United States

- 9.2.2. Canada

- 9.2.3. Mexico

- 9.2.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 DSM Animal Nutrition

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kemin Industries

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 PIVEG Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Altratene (Allied Biotech Corporation)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 FENCHEM

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nutrex eu

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Innov Ad NV/SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 EW Nutrition

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Synthite Industries Private Ltd*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 DSM Animal Nutrition

List of Figures

- Figure 1: Global NA Feed Lutein and Zeaxanthin Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United States NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 3: United States NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: United States NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Geography 2025 & 2033

- Figure 5: United States NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: United States NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Country 2025 & 2033

- Figure 7: United States NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Canada NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 9: Canada NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: Canada NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Geography 2025 & 2033

- Figure 11: Canada NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Canada NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Canada NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Mexico NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: Mexico NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Mexico NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Geography 2025 & 2033

- Figure 17: Mexico NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Mexico NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Mexico NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of North America NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 21: Rest of North America NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: Rest of North America NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Geography 2025 & 2033

- Figure 23: Rest of North America NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest of North America NA Feed Lutein and Zeaxanthin Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of North America NA Feed Lutein and Zeaxanthin Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 5: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 8: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 11: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 14: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Global NA Feed Lutein and Zeaxanthin Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Feed Lutein and Zeaxanthin Market?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the NA Feed Lutein and Zeaxanthin Market?

Key companies in the market include DSM Animal Nutrition, Kemin Industries, PIVEG Inc, Altratene (Allied Biotech Corporation), FENCHEM, Nutrex eu, Innov Ad NV/SA, EW Nutrition, Synthite Industries Private Ltd*List Not Exhaustive.

3. What are the main segments of the NA Feed Lutein and Zeaxanthin Market?

The market segments include Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed.

6. What are the notable trends driving market growth?

Industrialization of Livestock Industry.

7. Are there any restraints impacting market growth?

High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Feed Lutein and Zeaxanthin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Feed Lutein and Zeaxanthin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Feed Lutein and Zeaxanthin Market?

To stay informed about further developments, trends, and reports in the NA Feed Lutein and Zeaxanthin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence