Key Insights

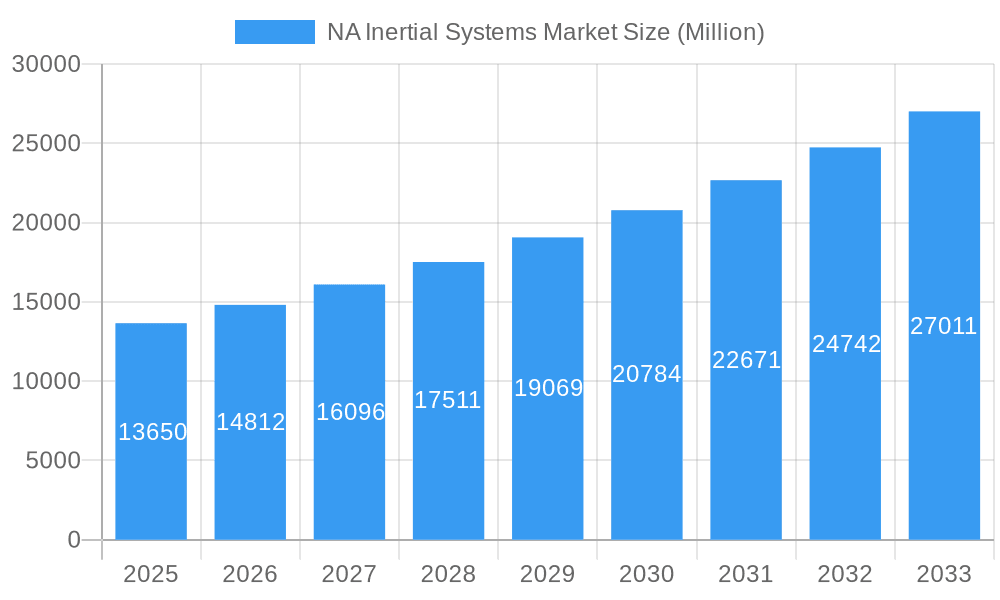

The North American (NA) Inertial Systems Market is poised for robust expansion, projected to reach $13.65 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.6% through 2033. This significant growth is underpinned by several key drivers, including the increasing adoption of advanced inertial systems in civil aviation for enhanced navigation and flight control, and the escalating demand within the defense sector for sophisticated guidance, navigation, and targeting (GNT) systems. The burgeoning consumer electronics market, with its integration of inertial sensors in wearables and smart devices, alongside advancements in automotive safety features like electronic stability control and advanced driver-assistance systems (ADAS), are also contributing substantially to market momentum. Furthermore, the energy and infrastructure sectors are increasingly leveraging inertial systems for precise surveying, monitoring, and structural health assessment, adding another layer of demand.

NA Inertial Systems Market Market Size (In Billion)

The market's expansion is further fueled by evolving technological trends, such as the miniaturization of inertial sensors, enhanced accuracy and performance through sensor fusion techniques, and the integration of artificial intelligence and machine learning for predictive maintenance and improved operational efficiency. The development of cost-effective and highly precise inertial measurement units (IMUs) is democratizing access to this technology across various applications. While growth is strong, potential restraints include the high initial investment costs for complex inertial systems and the need for skilled personnel for installation and maintenance. However, ongoing innovation in materials science and manufacturing processes are expected to mitigate these challenges. Key segments driving this growth include Accelerometers, Gyroscopes, and IMUs, with Civil Aviation and Defense emerging as the dominant application areas.

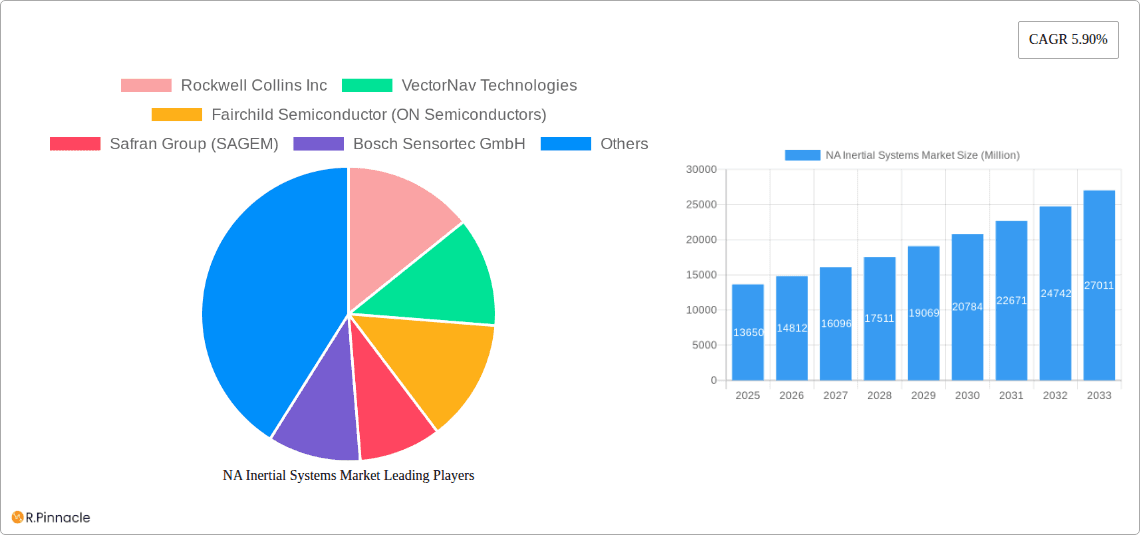

NA Inertial Systems Market Company Market Share

This in-depth report provides a detailed analysis of the North American Inertial Systems Market, encompassing a study period from 2019 to 2033, with a base year of 2025. It offers crucial insights into market structure, dynamics, dominant regions, product innovations, key drivers, challenges, emerging opportunities, and leading players. Leveraging high-ranking keywords and a reader-centric approach, this report is designed to equip industry professionals with actionable intelligence to navigate this dynamic sector. The forecast period of 2025–2033 will see significant growth, driven by advancements in sensor technology and expanding applications across various industries. The estimated market size for 2025 is projected to be in the billions, with substantial growth anticipated throughout the forecast period.

NA Inertial Systems Market Market Structure & Innovation Trends

The North American Inertial Systems Market exhibits a moderately concentrated structure, with key players dominating specific application segments and technological niches. Innovation is primarily driven by the relentless pursuit of higher accuracy, miniaturization, and reduced power consumption in inertial sensors like accelerometers and gyroscopes. Regulatory frameworks, particularly in civil aviation and defense, play a significant role in shaping product development and adoption, emphasizing safety and reliability. Product substitutes are emerging, especially in consumer electronics, where lower-cost MEMS-based solutions are gaining traction, albeit with trade-offs in precision. End-user demographics are diversifying, with increasing demand from the automotive sector for advanced driver-assistance systems (ADAS) and autonomous driving capabilities. Mergers and acquisitions (M&A) activities, valued in the billions, are instrumental in consolidating market share and acquiring critical technologies. For instance, acquisitions of specialized sensor manufacturers by larger aerospace and defense conglomerates are prevalent, aiming to integrate cutting-edge inertial navigation systems into their broader offerings.

- Market Concentration: Dominated by a few key players with strong R&D capabilities and established customer relationships.

- Innovation Drivers: Miniaturization, enhanced accuracy, reduced power consumption, improved resilience to environmental factors.

- Regulatory Frameworks: Stringent standards in aerospace and defense drive demand for high-reliability components.

- Product Substitutes: Growing competition from lower-cost MEMS solutions in non-critical applications.

- End-User Demographics: Expansion into automotive, robotics, and industrial automation segments.

- M&A Activities: Strategic acquisitions to gain technological advantage and market access, with deal values reaching billions.

NA Inertial Systems Market Market Dynamics & Trends

The North American Inertial Systems Market is poised for robust growth, driven by a confluence of technological advancements and expanding application footprints. The CAGR for the forecast period is projected to be substantial, reflecting increasing adoption across diverse sectors. Market penetration of inertial systems is steadily rising, particularly in the automotive industry, where the development of autonomous vehicles necessitates sophisticated navigation and control. Technological disruptions, such as the advancement of fiber optic gyroscopes (FOG) and ring laser gyroscopes (RLG) for high-precision applications, alongside the maturation of MEMS technology for cost-sensitive segments, are reshaping the competitive landscape. Consumer preferences are evolving towards greater autonomy and enhanced safety features in vehicles, electronics, and even personal devices, directly fueling demand for accurate inertial sensing. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a growing emphasis on integrated solutions that combine GNSS with IMUs for superior positioning in GNSS-denied environments. The market is also witnessing a trend towards specialized inertial systems tailored for specific high-dynamic applications, requiring extreme precision and rapid response times. Investment in research for next-generation inertial navigation units is a key indicator of future growth, with companies like TT Electronics actively engaging in designing advanced power supplies, signaling a commitment to supporting these evolving needs.

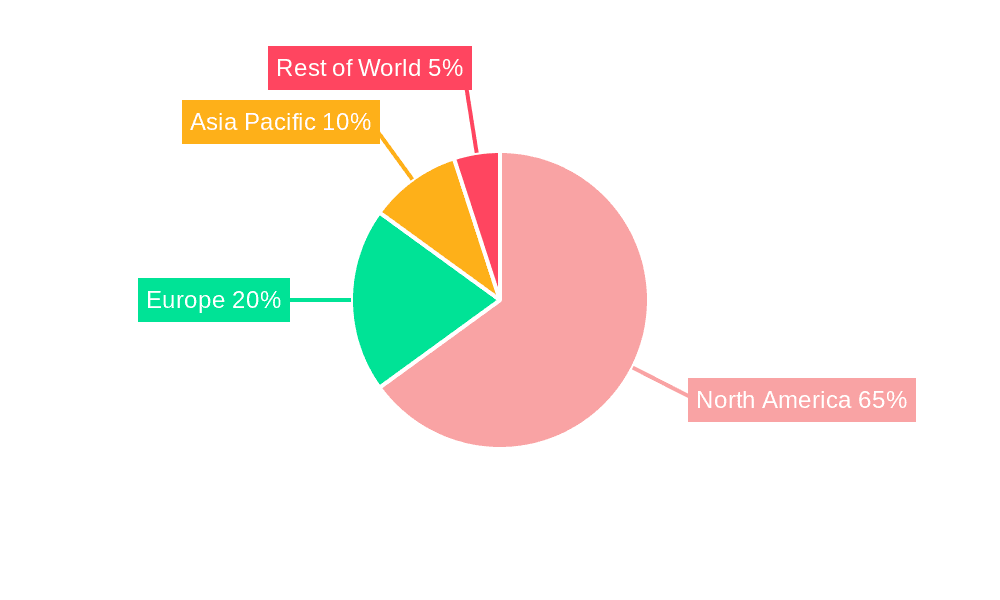

Dominant Regions & Segments in NA Inertial Systems Market

The United States stands as the dominant region within the North American Inertial Systems Market, driven by its significant defense spending, thriving civil aviation sector, and rapid advancements in automotive and consumer electronics. Economic policies supportive of technological innovation and substantial investments in infrastructure for both aerospace and automotive industries further solidify its leading position.

- Leading Region: United States.

- Key Drivers in the US:

- Defense Sector: Extensive use of inertial navigation systems in aircraft, unmanned aerial vehicles (UAVs), missiles, and naval vessels.

- Civil Aviation: Growing demand for enhanced navigation, flight control, and safety systems in commercial and private aircraft.

- Automotive Industry: Rapid development and adoption of ADAS and autonomous driving technologies requiring precise motion sensing.

- Consumer Electronics: Integration of IMUs in smartphones, wearables, and gaming devices for motion tracking and augmented reality.

- Space Exploration: Crucial role in satellite navigation and spacecraft orientation.

Among the segments, Defense and Civil Aviation represent significant market shares due to the stringent requirements for high-performance and reliable inertial systems. The Automotive segment is experiencing the most rapid growth, propelled by the push towards autonomous driving and advanced safety features.

- Dominant Application Segments:

- Defense: Critical for guidance, navigation, and control (GNC) of military platforms. High-value contracts and continuous modernization efforts drive consistent demand.

- Civil Aviation: Essential for autopilot systems, flight management, and situational awareness, with ongoing upgrades and fleet expansions.

- Automotive: Exploding growth due to ADAS and autonomous vehicle development. Increased adoption of IMUs for enhanced vehicle stability and driver assistance.

- Consumer Electronics: Ubiquitous use in smartphones, drones, and gaming consoles for motion sensing and augmented reality experiences.

In terms of components, IMUs (Inertial Measurement Units), which integrate accelerometers and gyroscopes, are fundamental building blocks and command a significant market share. Attitude Heading and Navigation Systems (AHNS), which combine inertial data with other sensors like GPS, are also highly critical, especially for advanced navigation applications.

- Dominant Component Segments:

- IMU (Inertial Measurement Unit): The core component, providing acceleration and angular velocity data. Increasingly sophisticated and miniaturized.

- Attitude Heading and Navigation System (AHNS): Integrates IMUs with GNSS and magnetometers for comprehensive navigation solutions.

- Gyroscope: Essential for measuring angular velocity and maintaining orientation.

- Accelerometer: Measures linear acceleration, crucial for determining motion and orientation.

The Canada market, while smaller than the US, also contributes to the North American landscape, particularly in segments like civil aviation, mining, and unmanned systems for resource exploration.

NA Inertial Systems Market Product Innovations

Product innovations in the NA Inertial Systems Market are centered on delivering higher accuracy, greater robustness, and increased integration. Companies are developing smaller, lighter, and more power-efficient inertial sensors that can withstand extreme environmental conditions, crucial for defense and industrial applications. Advancements in IMU technology, including the fusion of data from multiple sensors and improved algorithms for drift correction, are enabling more precise navigation, even in GNSS-denied environments. The development of specialized inertial navigation systems for high-dynamic applications, capable of measuring airspeed up to 600 KNOTS, is a testament to this trend. These innovations offer significant competitive advantages by enhancing the performance and reliability of end-user systems.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North American Inertial Systems Market, covering the United States and Canada. The market is segmented by application, including Civil Aviation, Defense, Consumer Electronics, Automotive, Energy and Infrastructure, Medical, and Other Applications. Each application segment presents unique growth projections and market sizes driven by specific industry trends.

- Application Segmentation:

- Civil Aviation: Driven by fleet modernization and enhanced safety requirements.

- Defense: Sustained demand due to ongoing defense modernization and evolving threat landscapes.

- Consumer Electronics: Rapid growth fueled by the proliferation of smart devices and AR/VR technologies.

- Automotive: Explosive growth anticipated with the advancement of autonomous driving and ADAS.

- Energy and Infrastructure: Increasing use in surveying, inspection, and robotics for oil, gas, and renewable energy sectors.

- Medical: Growing application in surgical robotics, rehabilitation devices, and patient monitoring.

- Other Applications: Includes robotics, industrial automation, and scientific research.

The market is also analyzed by component type, encompassing Accelerometer, Gyroscope, IMU, Magnetometer, Attitude Heading and Navigation System, and Other Components.

- Component Segmentation:

- Accelerometer: Foundational sensor for measuring linear motion and gravity.

- Gyroscope: Crucial for measuring angular velocity and maintaining orientation.

- IMU: Integrates accelerometers and gyroscopes for comprehensive motion sensing.

- Magnetometer: Used for determining magnetic heading and improving navigation accuracy.

- Attitude Heading and Navigation System: Advanced systems for precise navigation and orientation.

- Other Components: Includes associated electronics and housings.

Key Drivers of NA Inertial Systems Market Growth

The growth of the NA Inertial Systems Market is propelled by several key factors. The increasing demand for autonomous systems across industries, from self-driving cars to unmanned aerial vehicles, is a primary driver. Advancements in sensor technology, leading to more accurate, compact, and cost-effective inertial measurement units (IMUs), are expanding their application scope. Furthermore, the significant investments by defense agencies in advanced navigation and guidance systems for military platforms continue to fuel market expansion. The growing adoption of inertial sensors in consumer electronics for enhanced user experiences, such as motion tracking and augmented reality, also contributes substantially to market growth. The development of sophisticated AI and machine learning algorithms for processing inertial data further enhances the value proposition of these systems.

Challenges in the NA Inertial Systems Market Sector

Despite its strong growth trajectory, the NA Inertial Systems Market faces several challenges. Intense price competition, particularly from MEMS-based solutions in less critical applications, can put pressure on profit margins for manufacturers of higher-end systems. Stringent regulatory compliance, especially in aerospace and defense, requires significant investment in testing and certification, adding to development costs and timelines. Supply chain disruptions and the reliance on specialized raw materials can also pose risks. Furthermore, the need for continuous innovation to keep pace with evolving technological demands and the threat of obsolescence necessitate substantial and ongoing R&D investment. The complexity of integrating inertial systems with other navigation technologies, such as GNSS, to achieve optimal performance in all environments also presents a technical hurdle.

Emerging Opportunities in NA Inertial Systems Market

Emerging opportunities in the NA Inertial Systems Market are abundant and diverse. The burgeoning market for drones and unmanned systems in logistics, agriculture, and surveillance presents a significant growth avenue. The rapid advancement of the Industrial Internet of Things (IIoT) and smart factory initiatives are creating demand for highly accurate and reliable inertial sensors for robotics and automated machinery. The growing interest in space exploration and the development of small satellite constellations offer a niche but high-value market for space-grade inertial components. Furthermore, the integration of inertial systems into wearable technology for health monitoring and fitness tracking is poised for substantial expansion. The increasing need for robust navigation solutions in harsh environments, such as deep-sea exploration and underground mining, also opens up new frontiers for specialized inertial systems.

Leading Players in the NA Inertial Systems Market Market

- Rockwell Collins Inc

- VectorNav Technologies

- Fairchild Semiconductor (ON Semiconductors)

- Safran Group (SAGEM)

- Bosch Sensortec GmbH

- Moog Inc

- Thales Group

- STMicroelectronics NV

- Meggitt PLC

- Analog Devices Inc

- Honeywell Aerospace Inc

- InvenSense Inc

- Northrop Grumman Corporation

Key Developments in NA Inertial Systems Market Industry

- January 2023: Inertial Labs released an upgraded version of the "INS-U" GPS-Aided Inertial Navigation System and an extended version of the Differential Pressure Sensor and Embedded Air Data Computer, allowing the unit to measure airspeed with up to 600 KNOTS to enhance high dynamic applications. This new INS-U version can send fused (GNSS + IMU) NMEA data to Pixhawk Autopilot, allowing Pixhawk Autopilot to navigate UAVs in GNSS-denied environments for extended periods (more than 1 hour).

- July 2022: TT Electronics, a technology provider of engineered technologies for mission-critical applications, announced that its Kansas City facility received a Letter of Authority from long-term partner Honeywell Aerospace to begin designing a new power supply for next-generation inertial navigation units.

Future Outlook for NA Inertial Systems Market Market

The future outlook for the North American Inertial Systems Market is exceptionally bright, driven by continuous technological advancements and expanding applications. The relentless pursuit of greater autonomy in vehicles, drones, and industrial equipment will be a significant growth accelerator. The increasing sophistication of AI and machine learning will further enhance the capabilities and value of inertial systems, enabling more intelligent and adaptive navigation and control. The miniaturization and cost reduction of high-performance inertial sensors will democratize their adoption across a wider spectrum of consumer and industrial products. Furthermore, the growing emphasis on navigation and positioning in GPS-denied environments will spur innovation in alternative and hybrid navigation solutions, where inertial systems will play a pivotal role. Strategic investments in research and development, coupled with potential collaborations and acquisitions, will shape the competitive landscape, positioning the market for sustained, multi-billion-dollar growth throughout the forecast period and beyond.

NA Inertial Systems Market Segmentation

-

1. Application

- 1.1. Civil Aviation

- 1.2. Defense

- 1.3. Consumer Electronics

- 1.4. Automotive

- 1.5. Energy and Infrastructure

- 1.6. Medical

- 1.7. Other Applications

-

2. Component

- 2.1. Accelerometer

- 2.2. Gyroscope

- 2.3. IMU

- 2.4. Magnetometer

- 2.5. Attitude Heading and Navigation System

- 2.6. Other Components

-

3. Geography

- 3.1. United States

- 3.2. Canada

NA Inertial Systems Market Segmentation By Geography

- 1. United States

- 2. Canada

NA Inertial Systems Market Regional Market Share

Geographic Coverage of NA Inertial Systems Market

NA Inertial Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of MEMS Technology; Inclination of Growth Toward Defense and Aerospace; Technological Advancements in Navigation Systems

- 3.3. Market Restrains

- 3.3.1. Operational Complexity and High Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Increasing Demand in Accuracy to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Inertial Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Civil Aviation

- 5.1.2. Defense

- 5.1.3. Consumer Electronics

- 5.1.4. Automotive

- 5.1.5. Energy and Infrastructure

- 5.1.6. Medical

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Accelerometer

- 5.2.2. Gyroscope

- 5.2.3. IMU

- 5.2.4. Magnetometer

- 5.2.5. Attitude Heading and Navigation System

- 5.2.6. Other Components

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States NA Inertial Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Civil Aviation

- 6.1.2. Defense

- 6.1.3. Consumer Electronics

- 6.1.4. Automotive

- 6.1.5. Energy and Infrastructure

- 6.1.6. Medical

- 6.1.7. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Accelerometer

- 6.2.2. Gyroscope

- 6.2.3. IMU

- 6.2.4. Magnetometer

- 6.2.5. Attitude Heading and Navigation System

- 6.2.6. Other Components

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Canada NA Inertial Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Civil Aviation

- 7.1.2. Defense

- 7.1.3. Consumer Electronics

- 7.1.4. Automotive

- 7.1.5. Energy and Infrastructure

- 7.1.6. Medical

- 7.1.7. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Accelerometer

- 7.2.2. Gyroscope

- 7.2.3. IMU

- 7.2.4. Magnetometer

- 7.2.5. Attitude Heading and Navigation System

- 7.2.6. Other Components

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Rockwell Collins Inc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 VectorNav Technologies

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Fairchild Semiconductor (ON Semiconductors)

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Safran Group (SAGEM)

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Bosch Sensortec GmbH

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Moog Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Thales Group

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 STMicroelectronics NV

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Meggitt PLC*List Not Exhaustive

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Analog Devices Inc

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Honeywell Aerospace Inc

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 InvenSense Inc

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Northrop Grumman Corporation

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.1 Rockwell Collins Inc

List of Figures

- Figure 1: Global NA Inertial Systems Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: United States NA Inertial Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: United States NA Inertial Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: United States NA Inertial Systems Market Revenue (undefined), by Component 2025 & 2033

- Figure 5: United States NA Inertial Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: United States NA Inertial Systems Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: United States NA Inertial Systems Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United States NA Inertial Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: United States NA Inertial Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Canada NA Inertial Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Canada NA Inertial Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Canada NA Inertial Systems Market Revenue (undefined), by Component 2025 & 2033

- Figure 13: Canada NA Inertial Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 14: Canada NA Inertial Systems Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Canada NA Inertial Systems Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Canada NA Inertial Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Canada NA Inertial Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NA Inertial Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global NA Inertial Systems Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 3: Global NA Inertial Systems Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global NA Inertial Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global NA Inertial Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global NA Inertial Systems Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 7: Global NA Inertial Systems Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global NA Inertial Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global NA Inertial Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global NA Inertial Systems Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 11: Global NA Inertial Systems Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global NA Inertial Systems Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Inertial Systems Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the NA Inertial Systems Market?

Key companies in the market include Rockwell Collins Inc, VectorNav Technologies, Fairchild Semiconductor (ON Semiconductors), Safran Group (SAGEM), Bosch Sensortec GmbH, Moog Inc, Thales Group, STMicroelectronics NV, Meggitt PLC*List Not Exhaustive, Analog Devices Inc, Honeywell Aerospace Inc, InvenSense Inc, Northrop Grumman Corporation.

3. What are the main segments of the NA Inertial Systems Market?

The market segments include Application, Component, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Emergence of MEMS Technology; Inclination of Growth Toward Defense and Aerospace; Technological Advancements in Navigation Systems.

6. What are the notable trends driving market growth?

Increasing Demand in Accuracy to Drive the Market.

7. Are there any restraints impacting market growth?

Operational Complexity and High Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2023 - Inertial Labs released an upgraded version of the "INS-U" GPS-Aided Inertial Navigation System and an extended version of the Differential Pressure Sensor and Embedded Air Data Computer, allowing the unit to measure airspeed with up to 600 KNOTS to enhance high dynamic applications. This new INS-U version can send fused (GNSS + IMU) NMEA data to Pixhawk Autopilot, allowing Pixhawk Autopilot to navigate UAVs in GNSS-denied environments for extended periods (more than 1 hour).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Inertial Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Inertial Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Inertial Systems Market?

To stay informed about further developments, trends, and reports in the NA Inertial Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence