Key Insights

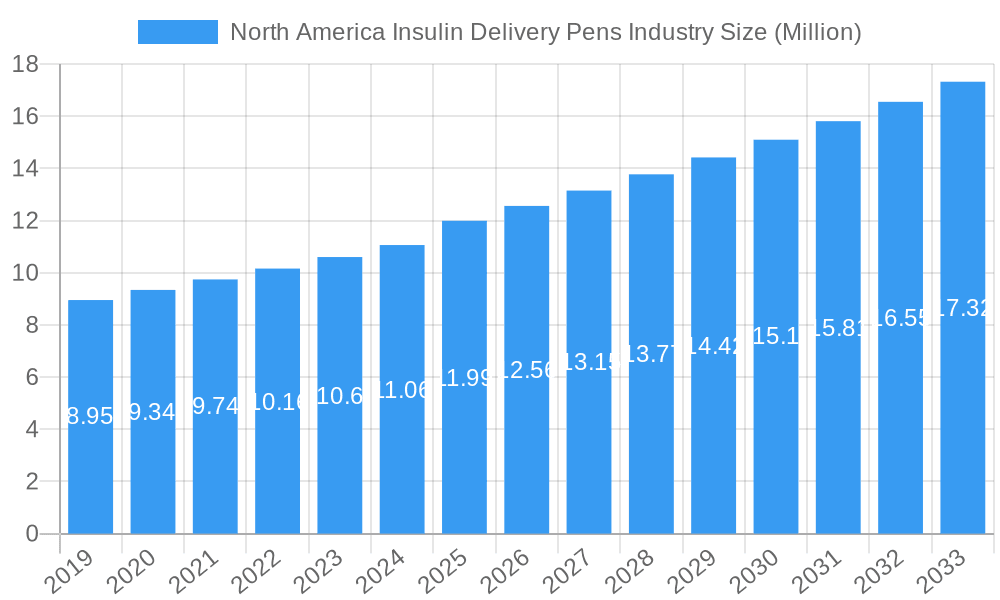

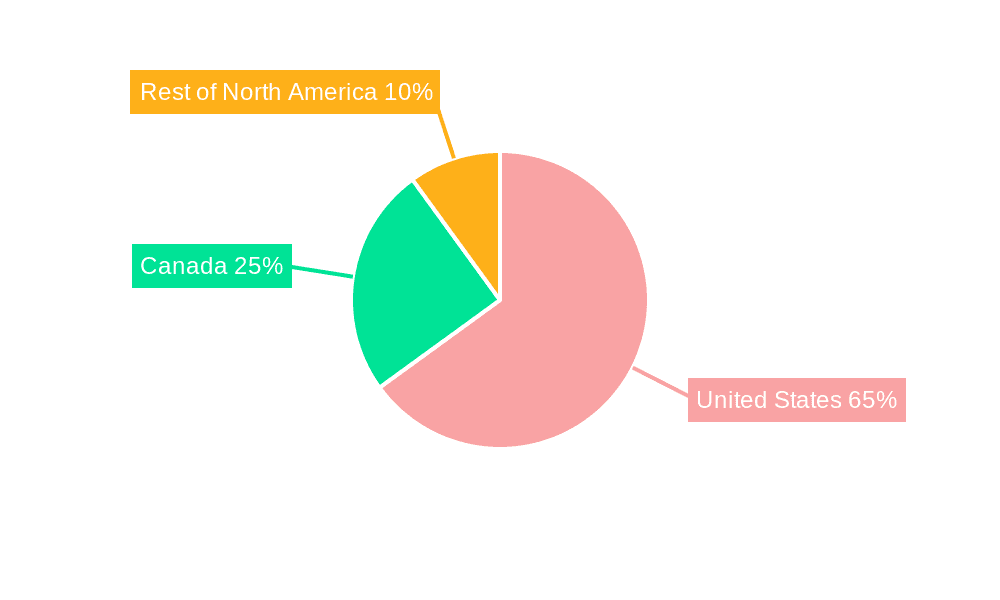

The North America Insulin Delivery Pens market is poised for significant growth, projected to reach \$11.99 million with a compound annual growth rate (CAGR) of 4.87% between 2025 and 2033. This expansion is primarily driven by the increasing global prevalence of diabetes, particularly type 2, which necessitates consistent and convenient insulin administration. The rising adoption of technologically advanced insulin pens, including smart pens that offer dose tracking and connectivity features, is also a major growth catalyst. Furthermore, an aging population, a key demographic for diabetes, contributes to sustained demand. The market is segmented into Disposable Insulin Pens and Cartridges in Reusable Pens, with disposable pens likely holding a larger share due to their ease of use and convenience for many patients. Geographically, the United States represents the largest market within North America, owing to its high diabetes rates, advanced healthcare infrastructure, and strong market penetration of innovative diabetes management devices. Canada and the Rest of North America also present substantial growth opportunities, driven by increasing awareness and access to advanced insulin delivery systems.

North America Insulin Delivery Pens Industry Market Size (In Million)

Key trends shaping the North America Insulin Delivery Pens industry include the continuous innovation in smart insulin pens, offering enhanced user experience and adherence support, which are critical for effective diabetes management. The growing preference for less invasive and more user-friendly insulin delivery methods over traditional syringes is another significant trend. However, the market also faces restraints such as the high cost of advanced insulin pens, which can limit access for some patient populations, and the need for greater patient and healthcare provider education regarding the benefits of pen devices. The competitive landscape is characterized by the presence of major pharmaceutical and medical device companies such as Eli Lilly, Sanofi, Medtronic, and Novo Nordisk, who are actively engaged in research and development to introduce new and improved insulin delivery solutions. Their strategic partnerships and product launches will continue to influence market dynamics and drive innovation.

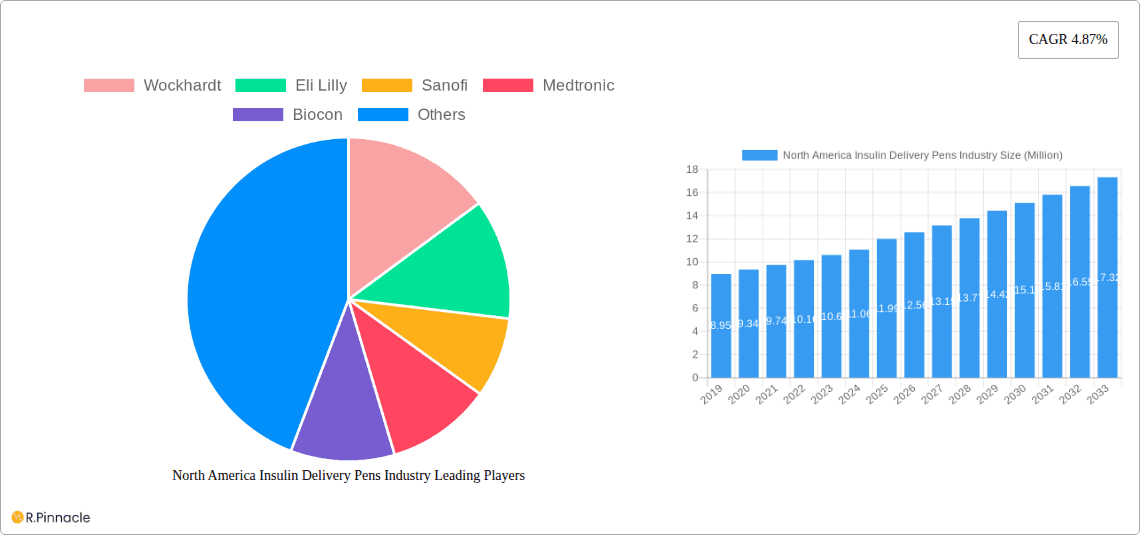

North America Insulin Delivery Pens Industry Company Market Share

Gain unparalleled insights into the dynamic North America Insulin Delivery Pens Industry. This comprehensive report, covering the Study Period of 2019–2033 with a Base Year of 2025, provides an in-depth analysis of market structure, key trends, dominant regions, and product innovations. Leveraging advanced analytics and meticulous research, we equip industry professionals, investors, and stakeholders with actionable intelligence to navigate this rapidly evolving landscape. Understand the competitive strategies of major players like Wockhardt, Eli Lilly, Sanofi, Medtronic, Biocon, and Novo Nordisk, alongside emerging innovators such as Cequr. Our detailed segmentation covers Product types (Disposable Insulin Pens, Cartridges in Reusable Pens) and Geographies (Canada, United States, Rest of North America), offering a granular view of market penetration and growth projections.

North America Insulin Delivery Pens Industry Market Structure & Innovation Trends

The North America Insulin Delivery Pens market exhibits a moderate to high concentration, with a few key players like Novo Nordisk, Eli Lilly, and Sanofi holding significant market share, estimated collectively to be around 60-70%. Innovation is a primary driver, fueled by advancements in user-friendly designs, smart connectivity, and enhanced dosing accuracy. Regulatory frameworks, particularly stringent FDA approvals in the United States, shape product development and market entry. The threat of product substitutes is relatively low for advanced insulin pens due to their convenience and efficacy, though traditional vials and syringes remain a consideration. End-user demographics are shifting towards an aging population with diabetes and a growing number of younger individuals diagnosed with the condition, demanding increasingly personalized and accessible solutions. Mergers and acquisitions (M&A) activities have been strategic, focusing on acquiring novel technologies and expanding market reach, with estimated deal values in the hundreds of millions of dollars for significant acquisitions in the last five years.

North America Insulin Delivery Pens Industry Market Dynamics & Trends

The North America Insulin Delivery Pens market is experiencing robust growth, driven by an escalating prevalence of diabetes, an aging global population, and a growing demand for convenient and user-friendly insulin delivery methods. Technological advancements are at the forefront of market dynamics, with a significant emphasis on the development of smart insulin pens that offer connectivity features, data logging capabilities, and integration with continuous glucose monitoring (CGM) systems. These innovations not only enhance treatment adherence and outcomes but also empower patients with better self-management tools. Consumer preferences are increasingly leaning towards devices that offer a discreet, less intrusive, and more precise way to manage insulin therapy, thereby driving the adoption of advanced pen devices over traditional methods. The competitive landscape is characterized by intense rivalry, with established pharmaceutical and medical device companies investing heavily in research and development to launch next-generation products. This competitive pressure fosters continuous innovation and drives down costs, making advanced insulin delivery more accessible. The market penetration of insulin pens is steadily increasing, particularly in the United States, as healthcare providers and patients recognize their benefits in improving glycemic control and quality of life. Projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7-9% over the forecast period, the market's trajectory is supported by favorable reimbursement policies and increasing healthcare expenditure dedicated to diabetes management. The demand for disposable pens remains strong due to their convenience and single-use nature, while the market for reusable pens with interchangeable cartridges is gaining traction, offering a more sustainable and potentially cost-effective option for long-term users. The increasing focus on personalized medicine and the development of biosimilar insulins also play a crucial role in shaping market trends, demanding flexible and adaptable delivery systems.

Dominant Regions & Segments in North America Insulin Delivery Pens Industry

The United States stands as the dominant region within the North America Insulin Delivery Pens industry, accounting for an estimated 75-80% of the total market value. This dominance is propelled by several key factors, including the highest prevalence of diabetes in the region, substantial healthcare expenditure dedicated to diabetes management, and a robust regulatory environment that encourages innovation and swift product approvals.

- Economic Policies: Favorable reimbursement policies for diabetes management devices and a well-established private healthcare insurance infrastructure in the U.S. significantly contribute to the accessibility and adoption of insulin pens. Government initiatives aimed at improving chronic disease management further bolster the market.

- Infrastructure: The advanced healthcare infrastructure, including a high density of endocrinologists, diabetes educators, and pharmacies, ensures widespread availability and physician recommendation of insulin pens. The seamless integration of prescription and dispensing processes facilitates patient access.

Within product segments, Disposable Insulin Pens currently hold the largest market share, estimated at approximately 55-60%. Their popularity stems from their convenience, ease of use, and the elimination of the need for cartridge refills, making them ideal for patients who prefer a simpler administration process or travel frequently.

- Key Drivers for Disposable Insulin Pens:

- High convenience for on-the-go use.

- Lower initial cost compared to reusable pen devices with cartridges.

- Reduced risk of user error in handling cartridges.

- Strong preference among newly diagnosed patients.

However, Cartridges in Reusable Pens are experiencing significant growth and are projected to capture a substantial portion of the market in the coming years, estimated to reach 35-40% of the market share by the end of the forecast period. This segment's expansion is driven by the growing environmental consciousness among consumers, the long-term cost-effectiveness of reusable devices, and advancements in the design and functionality of reusable pen systems.

- Key Drivers for Cartridges in Reusable Pens:

- Long-term cost savings for patients.

- Reduced environmental waste compared to disposable pens.

- Technological advancements in reusable pens, including digital features.

- Preference for a more sustainable and integrated diabetes management approach.

Canada represents a significant, albeit smaller, market within North America, accounting for approximately 15-20% of the industry's value. Its market dynamics are influenced by a universal healthcare system that, while ensuring access, can sometimes lead to longer approval timelines for new medical technologies. Nonetheless, increasing diabetes rates and a growing awareness of advanced insulin delivery solutions are driving consistent growth. The Rest of North America, encompassing Mexico and other smaller nations, comprises the remaining market share. While these regions are developing, their adoption rates for advanced insulin delivery pens are gradually increasing due to expanding healthcare access and growing awareness of diabetes management technologies.

North America Insulin Delivery Pens Industry Product Innovations

Recent product innovations in the North America Insulin Delivery Pens industry are centered on enhancing user experience and integrating smart technology. Key developments include pens with built-in glucose monitoring capabilities and connected devices that sync with smartphone applications. These innovations aim to improve dosing accuracy, streamline data tracking for better diabetes management, and offer greater convenience to patients. For instance, Cequr's Insulin Pen 2.0TM, a wearable device with an integrated blood glucose meter and automated injection system, exemplifies the trend towards miniaturization and enhanced functionality. Such advancements provide a significant competitive advantage by offering superior patient compliance and improved glycemic control, differentiating products in a competitive market.

Report Scope & Segmentation Analysis

This report meticulously analyzes the North America Insulin Delivery Pens market, segmenting it by Product and Geography. The Product segmentation includes Disposable Insulin Pens, characterized by their convenience and single-use nature, and Cartridges in Reusable Pens, offering long-term cost-effectiveness and sustainability. Projections indicate steady growth for both segments, with reusable options gaining momentum. The Geographical segmentation covers Canada, showcasing consistent growth driven by increasing diabetes prevalence; the United States, the dominant market with substantial growth due to high diabetes rates and advanced healthcare infrastructure; and the Rest of North America, an emerging market with growing adoption rates. Market sizes and competitive dynamics within each segment are thoroughly detailed.

Key Drivers of North America Insulin Delivery Pens Industry Growth

The North America Insulin Delivery Pens industry is propelled by several key drivers. The escalating global prevalence of diabetes, coupled with an aging population, creates a sustained and growing demand for effective insulin management solutions. Technological advancements, particularly in the development of smart insulin pens with connectivity features and integrated glucose monitoring, are revolutionizing patient care and enhancing adherence. Favorable reimbursement policies and increased healthcare expenditure dedicated to chronic disease management, especially in the United States, further facilitate market expansion. Moreover, a growing patient preference for discreet, convenient, and user-friendly insulin delivery methods over traditional syringes is a significant catalyst for the adoption of insulin pens.

Challenges in the North America Insulin Delivery Pens Industry Sector

Despite robust growth, the North America Insulin Delivery Pens industry faces several challenges. Stringent regulatory approval processes, particularly in the United States, can prolong time-to-market for new innovations and increase development costs. Supply chain disruptions and raw material price volatility can impact manufacturing efficiency and product availability. Furthermore, the high cost of advanced insulin pens and associated cartridges can present a barrier to access for some patient populations, particularly in regions with limited insurance coverage or lower disposable incomes. Intense competition among major players can also lead to price pressures, potentially affecting profit margins.

Emerging Opportunities in North America Insulin Delivery Pens Industry

Emerging opportunities in the North America Insulin Delivery Pens industry are abundant. The development of highly personalized insulin delivery systems that cater to individual patient needs and lifestyles presents a significant avenue for growth. Expansion into emerging markets within North America, where diabetes prevalence is rising and healthcare infrastructure is improving, offers substantial untapped potential. The integration of artificial intelligence (AI) and machine learning (ML) in smart insulin pens for predictive analytics and personalized treatment recommendations represents a futuristic frontier. Furthermore, collaborations between insulin manufacturers, device companies, and digital health platforms can create integrated ecosystems that enhance the overall diabetes management experience.

Leading Players in the North America Insulin Delivery Pens Industry Market

- Wockhardt

- Eli Lilly

- Sanofi

- Medtronic

- Biocon

- Novo Nordisk

- Cequr

Key Developments in North America Insulin Delivery Pens Industry Industry

- March 2023: Novo Nordisk announced a significant initiative to drop prices for vials and pens of NovoLog and other insulin brands by 75 percent starting January 1, 2024, in the United States. This was followed by an expected 65 percent price reduction for some other Novo Nordisk insulin brands, aiming to improve affordability and access.

- June 2022: Cequr, a leader in wearable diabetes technology, launched its innovative Insulin Pen 2.0TM. This device is designed for continuous wear, features a built-in blood glucose meter for real-time tracking, and offers an integrated injection system that eliminates manual pumping, simplifying insulin administration.

Future Outlook for North America Insulin Delivery Pens Industry Market

The future outlook for the North America Insulin Delivery Pens industry is exceptionally promising, driven by a confluence of increasing diabetes incidence, continuous technological innovation, and a growing demand for patient-centric solutions. The trend towards smart insulin pens, offering enhanced connectivity, data analytics, and personalized dosing, is expected to accelerate, further improving treatment outcomes and patient adherence. Innovations in material science and device miniaturization will lead to more discreet, comfortable, and user-friendly pens. Furthermore, the growing emphasis on value-based healthcare and integrated diabetes management solutions will foster collaborations between pharmaceutical companies, device manufacturers, and digital health providers, creating a comprehensive ecosystem for diabetes care. Strategic investments in research and development, coupled with favorable regulatory landscapes, will continue to fuel market growth, ensuring that insulin pens remain a cornerstone of effective diabetes management in North America.

North America Insulin Delivery Pens Industry Segmentation

-

1. Product

- 1.1. Disposable Insulin Pens

- 1.2. Cartridges in Reusable Pens

-

2. Geography

- 2.1. Canada

- 2.2. United States

- 2.3. Rest of North America

North America Insulin Delivery Pens Industry Segmentation By Geography

- 1. Canada

- 2. United States

- 3. Rest of North America

North America Insulin Delivery Pens Industry Regional Market Share

Geographic Coverage of North America Insulin Delivery Pens Industry

North America Insulin Delivery Pens Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Insulin cartridges in reusable pens are expected to witness significant growth over the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Insulin Delivery Pens Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Disposable Insulin Pens

- 5.1.2. Cartridges in Reusable Pens

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Canada

- 5.2.2. United States

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.3.2. United States

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Canada North America Insulin Delivery Pens Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Disposable Insulin Pens

- 6.1.2. Cartridges in Reusable Pens

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Canada

- 6.2.2. United States

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. United States North America Insulin Delivery Pens Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Disposable Insulin Pens

- 7.1.2. Cartridges in Reusable Pens

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Canada

- 7.2.2. United States

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Rest of North America North America Insulin Delivery Pens Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Disposable Insulin Pens

- 8.1.2. Cartridges in Reusable Pens

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Canada

- 8.2.2. United States

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Wockhardt

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Eli Lilly

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Sanofi

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Medtronic

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Biocon

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Novo Nordisk

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Other Company Share Analyse

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Cequr

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Wockhardt

List of Figures

- Figure 1: North America Insulin Delivery Pens Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Insulin Delivery Pens Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 15: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 20: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 21: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: North America Insulin Delivery Pens Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Insulin Delivery Pens Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Insulin Delivery Pens Industry?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the North America Insulin Delivery Pens Industry?

Key companies in the market include Wockhardt, Eli Lilly, Sanofi, Medtronic, Biocon, Novo Nordisk, Other Company Share Analyse, Cequr.

3. What are the main segments of the North America Insulin Delivery Pens Industry?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.99 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Insulin cartridges in reusable pens are expected to witness significant growth over the forecast period.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

March 2023: Novo Nordisk announced that the company would drop prices for vials and pens of NovoLog and other insulin brands by 75 percent beginning January 1, 2024, in the United States. There is expected to be a 65 percent price reduction for some of the other Novo Nordisk insulin brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Insulin Delivery Pens Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Insulin Delivery Pens Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Insulin Delivery Pens Industry?

To stay informed about further developments, trends, and reports in the North America Insulin Delivery Pens Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence