Key Insights

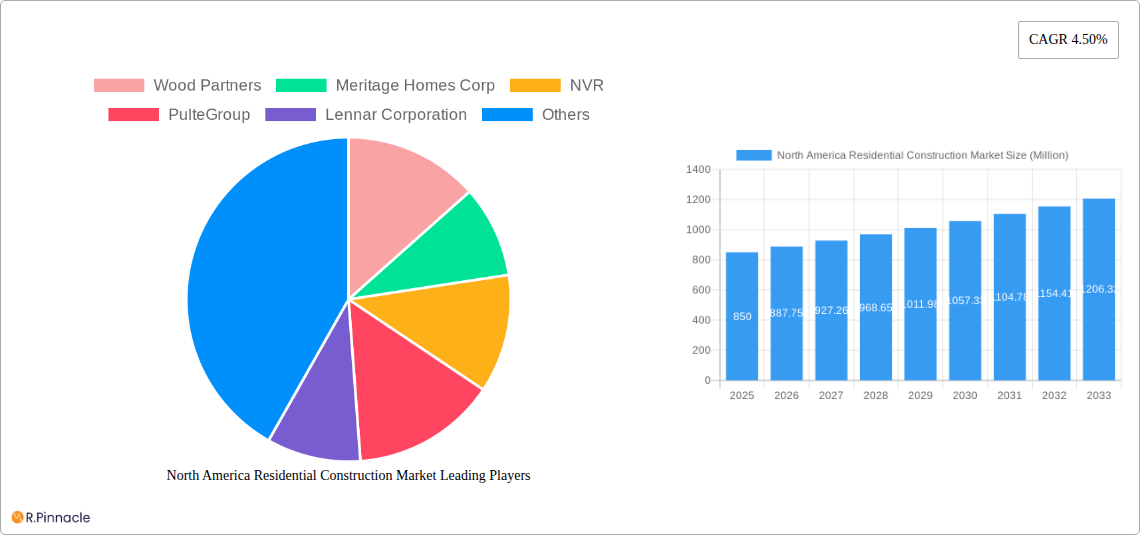

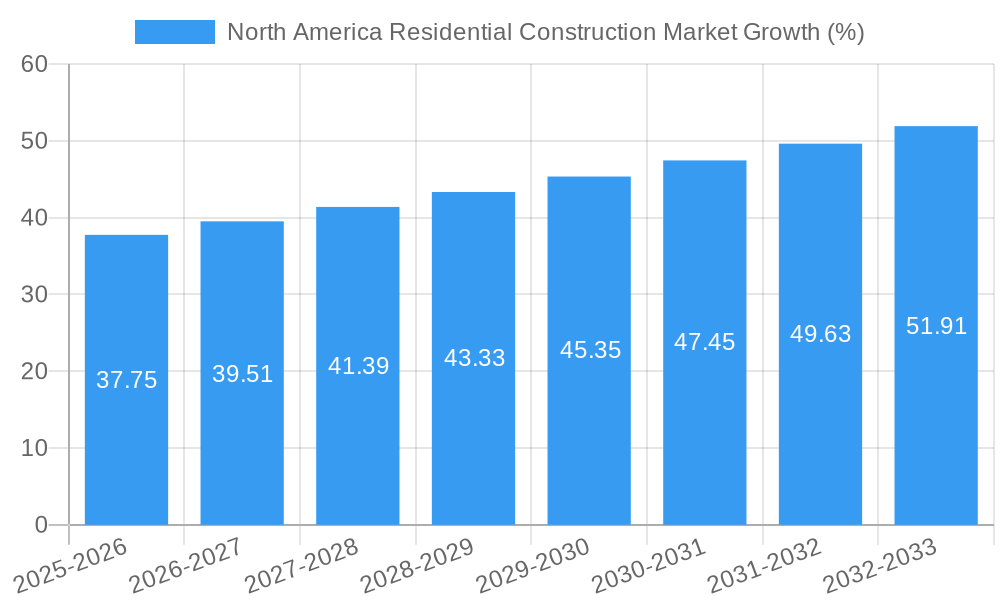

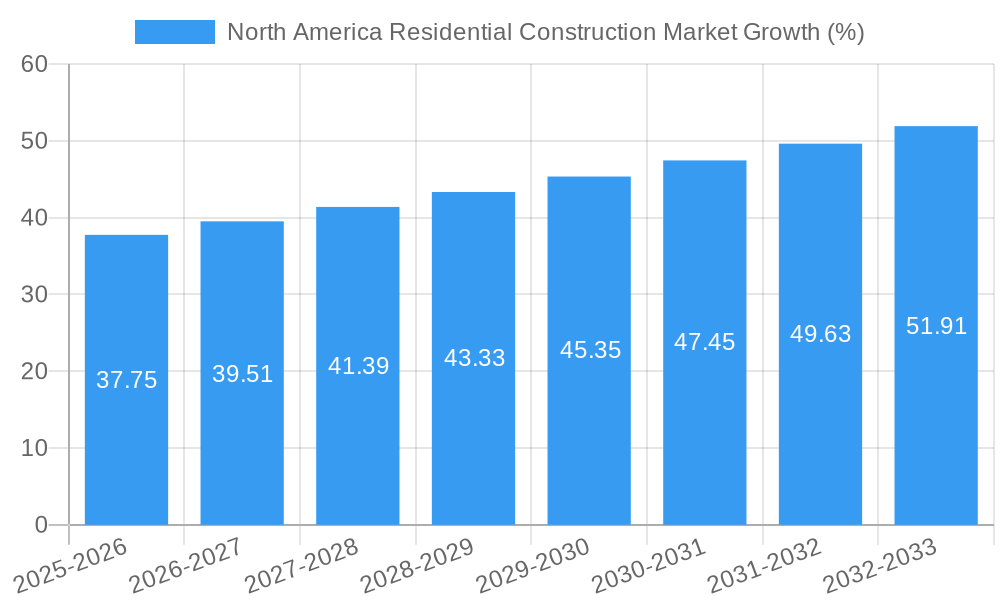

The North American residential construction market, valued at $850 million in 2025, is projected to experience robust growth, driven by several key factors. Population growth, particularly in urban centers and suburban areas, fuels the demand for new housing. Rising household incomes and favorable mortgage interest rates further incentivize homeownership and construction activity. The increasing preference for single-family homes, particularly in areas with ample land, is another significant driver. Furthermore, government initiatives promoting affordable housing and infrastructure development contribute positively to market expansion. Renovation projects, fueled by an aging housing stock and a desire for home improvements, also constitute a substantial portion of the market. While material cost inflation and labor shortages pose potential challenges, innovative construction techniques and technological advancements are mitigating these restraints. The market is segmented by property type (single-family, multi-family), construction type (new construction, renovation), and region (United States, Canada, Mexico). Key players include Wood Partners, Meritage Homes Corp, NVR, PulteGroup, Lennar Corporation, and others, constantly striving for innovation and market share.

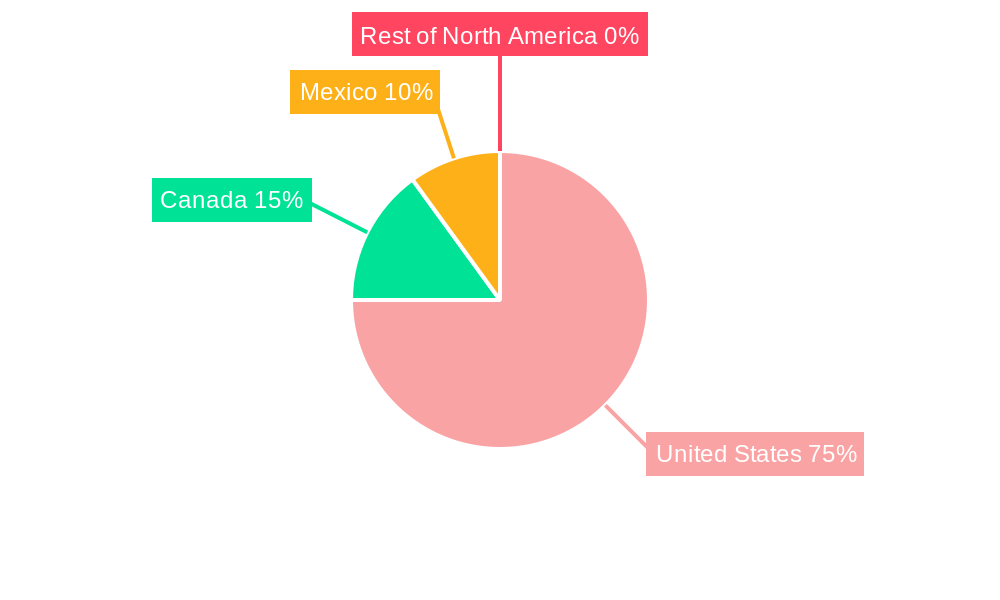

Looking ahead to 2033, a compound annual growth rate (CAGR) of 4.5% is anticipated. This sustained growth will be influenced by ongoing urbanization, evolving housing preferences, and continued economic expansion. The market is expected to see increased competition among builders as they adapt to shifting consumer demands and technological changes. The US market will dominate the North American landscape, given its larger population and greater economic activity. However, Canada and Mexico are poised for significant growth, driven by their own specific economic and demographic trends. The balance between single-family and multi-family construction will depend on factors such as land availability, affordability, and government policies. The renovation segment is also expected to grow steadily, driven by the need for upgrades and improvements in existing housing stock. The market's trajectory depends on the successful navigation of potential challenges such as inflation and supply chain disruptions.

North America Residential Construction Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America residential construction market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, key players, and future growth potential. The report leverages extensive data and analysis to forecast market trends and identify lucrative opportunities.

North America Residential Construction Market Structure & Innovation Trends

The North American residential construction market is characterized by a moderately concentrated structure with several large players holding significant market share. Key players include Wood Partners, Meritage Homes Corp, NVR, PulteGroup, Lennar Corporation, Mill Creek Residential, Clayton Properties Group, Toll Brothers Building Company, Alliance Residential, Taylor Morrison, D R Horton, LGI Homes, Century Communities, The Michaels Organization, KB Home, and LMC Residential. While the exact market share for each company varies and isn't publicly available in its entirety for all players, the top 5 firms likely hold approximately xx% of the market in 2025. Innovation is driven by advancements in building materials, construction technologies (e.g., modular construction, 3D printing), and sustainable building practices. Stringent building codes and environmental regulations significantly shape market activities. The market also witnesses ongoing mergers and acquisitions (M&A) activity, with deal values varying greatly depending on the size and nature of the transaction. Recent M&A activity has involved deals totaling approximately USD xx Million in the past year. Product substitutes, such as repurposing existing structures and manufactured homes, exert moderate pressure on new construction. Finally, demographic shifts, particularly in urban areas and suburban sprawl, greatly influence the demand for residential properties.

North America Residential Construction Market Market Dynamics & Trends

The North American residential construction market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. Rising urbanization, population growth, and increased household formation contribute significantly to the demand for housing. Technological disruptions, including the adoption of Building Information Modeling (BIM) and advanced construction techniques, improve efficiency and reduce costs. Shifting consumer preferences towards sustainable and energy-efficient homes further fuel market growth. However, fluctuations in interest rates, material costs, and labor availability pose challenges. Competitive dynamics are intense, with companies vying for market share through innovation, cost optimization, and strategic acquisitions. Market penetration of green building technologies is estimated to reach xx% by 2033, demonstrating a rising focus on sustainability.

Dominant Regions & Segments in North America Residential Construction Market

- By Region: The United States dominates the North American residential construction market, accounting for approximately xx% of the total market value in 2025, due to its larger population and robust economy. Canada and Mexico hold smaller, but still significant, shares. Key drivers for the US market include favorable economic conditions, government incentives for housing development, and ongoing infrastructure investments.

- By Property Type: The single-family segment holds a larger market share than the multi-family segment, driven by sustained demand for individual homes. Growth in both segments is largely influenced by factors such as affordability, location preferences, and government regulations.

- By Construction Type: New construction accounts for a larger share than renovations. However, the renovation segment is experiencing growth driven by an aging housing stock and the desire for home improvements. The demand for renovations is significantly impacted by consumer spending power and labor availability.

North America Residential Construction Market Product Innovations

The residential construction market is witnessing significant product innovations, particularly in sustainable building materials, energy-efficient technologies (e.g., solar panels, smart home systems), and prefabricated construction methods. These innovations aim to improve building performance, reduce environmental impact, and enhance the overall living experience. The market acceptance of these products is largely driven by increasing consumer awareness of sustainability and technological advancements. Companies are seeking competitive advantages by offering innovative, cost-effective, and eco-friendly solutions.

Report Scope & Segmentation Analysis

This report segments the North American residential construction market across various parameters:

By Property Type: Single-family homes and multi-family dwellings (apartments, townhouses, condominiums), with projected growth rates and market size for each. Competitive dynamics vary significantly between these segments, with differing construction methods and target demographics.

By Construction Type: New construction and renovations, offering insights into the market size and growth outlook for each category. The competitive landscape differs considerably between these segments; new construction is highly competitive, while renovations provide opportunities for specialized contractors.

By Region: The United States, Canada, and Mexico, providing a regional breakdown of market size, growth drivers, and competitive landscapes. Each region presents unique market characteristics influenced by local economic conditions, demographics, and government policies.

Key Drivers of North America Residential Construction Market Growth

Several factors contribute to the growth of the North American residential construction market. Strong economic conditions and rising disposable incomes boost consumer spending on housing. Favorable government policies and incentives for homebuyers stimulate demand. Technological advancements in construction methods increase efficiency and reduce costs. Finally, urbanization and population growth create a continuous need for new housing units.

Challenges in the North America Residential Construction Market Sector

The North American residential construction market faces several challenges. Fluctuations in material costs and labor shortages significantly impact project timelines and profitability. Stringent building codes and environmental regulations increase construction complexity and costs. Intense competition among builders pressures profit margins. The impact of these challenges is reflected in project delays and increased construction expenses, resulting in approximately xx% of projects experiencing cost overruns in 2024.

Emerging Opportunities in North America Residential Construction Market

The market presents several emerging opportunities. The growing demand for sustainable and energy-efficient homes creates opportunities for eco-friendly building materials and technologies. The increasing adoption of smart home technologies offers scope for integration of advanced systems. Finally, the expansion of urban areas and the rise of suburban sprawl create demand for new housing developments.

Leading Players in the North America Residential Construction Market Market

- Wood Partners

- Meritage Homes Corp (Meritage Homes)

- NVR (NVR)

- PulteGroup (PulteGroup)

- Lennar Corporation (Lennar Corporation)

- Mill Creek Residential

- Clayton Properties Group

- Toll Brothers Building Company (Toll Brothers)

- Alliance Residential

- Taylor Morrison (Taylor Morrison)

- D R Horton (D R Horton)

- LGI Homes (LGI Homes)

- Century Communities (Century Communities)

- The Michaels Organization

- KB Home (KB Home)

- LMC Residential

Key Developments in North America Residential Construction Market Industry

December 2022: D.R. Horton plans to build homes in southeast Columbus for USD 215 Million, indicating significant investment in the single-family home sector.

December 2022: Lennar Corp. cancels plans to spin off its multifamily subsidiary, Quarterra, highlighting market uncertainties affecting the multi-family sector.

December 2022: Pulte Homes purchases a 17-acre site in south Fort Myers for USD 2.4 Million to develop a 52-home neighborhood, showcasing continued activity in new construction despite market headwinds.

Future Outlook for North America Residential Construction Market Market

The North American residential construction market is poised for continued growth, driven by sustained demand for housing, technological advancements, and favorable economic conditions in certain regions. Strategic partnerships and acquisitions will likely shape the competitive landscape, with companies focusing on innovation, sustainability, and cost-effectiveness to maintain a competitive edge. The market’s long-term outlook remains positive, with potential for significant growth, particularly in segments focused on affordable housing and sustainable construction practices.

North America Residential Construction Market Segmentation

-

1. Property Type

- 1.1. Single Family

- 1.2. Multi-family

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

North America Residential Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend

- 3.3. Market Restrains

- 3.3.1. Interests and Financing; Increase in Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1 800

- 3.4.2 000 Housing Units Must Be Built Annually in Mexico to Keep Up with Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Single Family

- 5.1.2. Multi-family

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. United States North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Wood Partners

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Meritage Homes Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NVR

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PulteGroup

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lennar Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mill Creek Residential

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Clayton Properties Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toll Brothers Building Company**List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Alliance Residential

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Taylor Morrison

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 D R Horton

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 LGI Homes

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Century Communities

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 The Michaels Organization

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 KB Home

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 LMC Residential

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Wood Partners

List of Figures

- Figure 1: North America Residential Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Residential Construction Market Share (%) by Company 2024

List of Tables

- Table 1: North America Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Residential Construction Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: North America Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: North America Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Residential Construction Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 11: North America Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 12: North America Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Residential Construction Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the North America Residential Construction Market?

Key companies in the market include Wood Partners, Meritage Homes Corp, NVR, PulteGroup, Lennar Corporation, Mill Creek Residential, Clayton Properties Group, Toll Brothers Building Company**List Not Exhaustive, Alliance Residential, Taylor Morrison, D R Horton, LGI Homes, Century Communities, The Michaels Organization, KB Home, LMC Residential.

3. What are the main segments of the North America Residential Construction Market?

The market segments include Property Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend.

6. What are the notable trends driving market growth?

800. 000 Housing Units Must Be Built Annually in Mexico to Keep Up with Demand.

7. Are there any restraints impacting market growth?

Interests and Financing; Increase in Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2022: In southeast Columbus, D.R. Horton intends to build homes for USD 215 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Residential Construction Market?

To stay informed about further developments, trends, and reports in the North America Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence