Key Insights

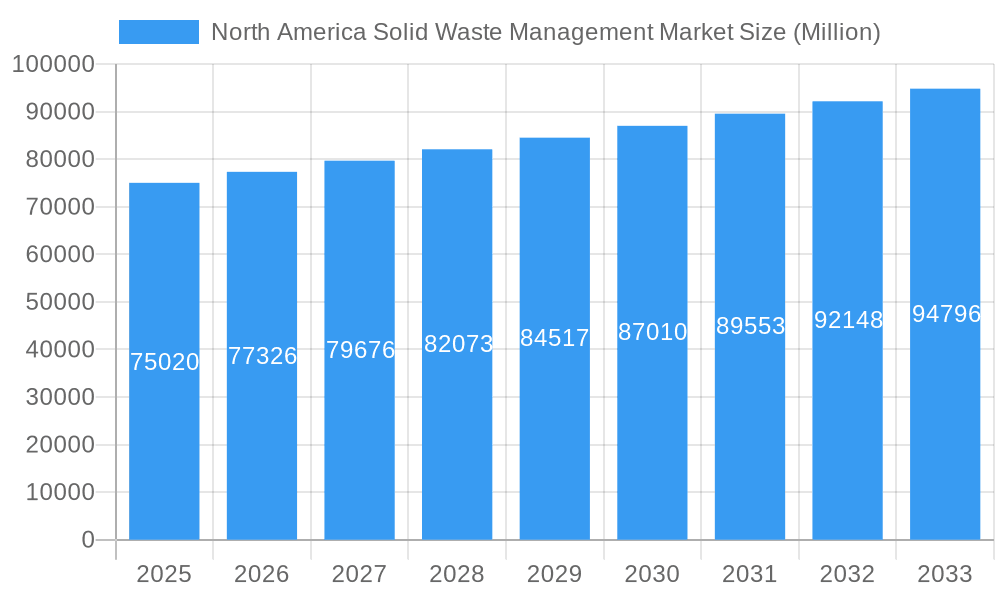

The North American solid waste management market, valued at $75.02 billion in 2025, is projected to experience steady growth, driven by a rising population, increasing urbanization, and stricter environmental regulations. The 3.01% CAGR indicates a consistent expansion over the forecast period (2025-2033). Key drivers include the growing volume of municipal solid waste, industrial waste, and hazardous waste generated across the region. Increased awareness of environmental sustainability and the need for responsible waste disposal are also fueling market growth. Trends such as advancements in waste-to-energy technologies, the adoption of smart waste management solutions, and the increasing focus on recycling and resource recovery are shaping the market landscape. While challenges remain, such as the high cost of waste disposal and the need for infrastructure upgrades, the overall outlook for the North American solid waste management market remains positive.

North America Solid Waste Management Market Market Size (In Billion)

Despite potential restraints like fluctuating commodity prices for recycled materials and the need for significant investment in infrastructure improvements, the market is poised for consistent growth. Leading players like Waste Management Inc., Republic Services, and Clean Harbors are strategically investing in innovative technologies and expanding their service offerings to capture market share. The segmental breakdown, while not explicitly provided, likely includes municipal solid waste, industrial waste, hazardous waste, and specialized waste streams. Geographic variations in waste generation and management practices will lead to different growth rates across various regions within North America. The market's growth will be further influenced by government policies promoting sustainable waste management practices and encouraging private sector investment. The forecast period suggests continued expansion, potentially reaching over $95 billion by 2033 based on the given CAGR and current market valuation.

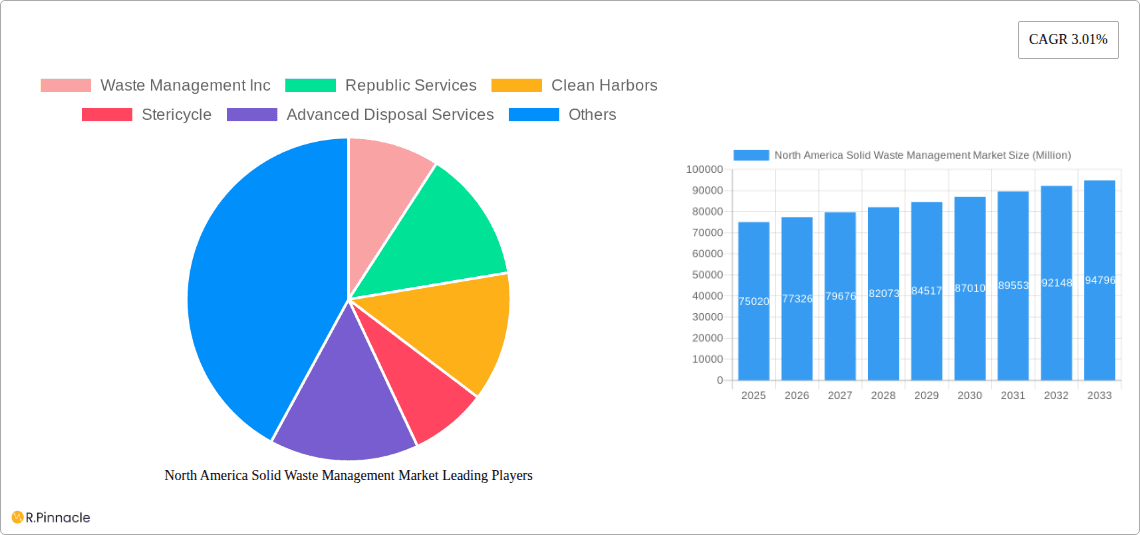

North America Solid Waste Management Market Company Market Share

North America Solid Waste Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America solid waste management market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils key market trends, growth drivers, challenges, and opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Solid Waste Management Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key players and their market share. The report delves into innovation drivers, regulatory frameworks, and the impact of mergers and acquisitions (M&A) activities.

Market Concentration: The North American solid waste management market is moderately concentrated, with a few dominant players holding significant market share. Waste Management Inc. and Republic Services are the leading companies, collectively commanding approximately xx% of the market in 2025. Other key players include Clean Harbors, Stericycle, Advanced Disposal Services, Recology, Casella Waste Management, US Ecology, Waste Pro USA, and Covanta Holdings Corporation. The remaining market share is distributed among numerous smaller regional players.

Innovation Drivers: Technological advancements in waste-to-energy technologies, recycling processes, and waste management software are driving market innovation. Increased demand for sustainable waste management solutions and stricter environmental regulations are further pushing the development of eco-friendly technologies and practices.

Regulatory Framework: Stringent environmental regulations at both the federal and state levels significantly influence market dynamics. These regulations impact waste disposal methods, recycling targets, and the adoption of sustainable technologies.

Product Substitutes: The emergence of alternative waste management solutions, such as anaerobic digestion and composting, presents both opportunities and challenges to traditional methods.

End-User Demographics: The market's end-users span across various sectors, including residential, commercial, industrial, and municipal entities. The report provides a detailed demographic breakdown and analyzes the waste generation patterns of each segment.

M&A Activities: The industry has witnessed significant M&A activity in recent years, including the July 2023 acquisition of Environmental Recycling & Disposal by LRS and Veolia North America's October 2023 acquisition of USIT. These transactions have altered the market landscape, impacting market share and competitive dynamics. The total value of M&A deals in the North American solid waste management market during the historical period (2019-2024) was estimated at xx Million.

North America Solid Waste Management Market Dynamics & Trends

This section explores the key factors driving market growth, including technological disruptions, consumer preferences, and competitive dynamics.

The market is witnessing robust growth due to several factors, including rising waste generation, increasing environmental awareness, and the implementation of stringent government regulations. Technological advancements, such as advanced sorting technologies and waste-to-energy solutions, are enhancing efficiency and sustainability within the industry. Changing consumer preferences towards environmentally responsible practices are also boosting the demand for recycling and waste reduction services. However, intense competition among established players and the emergence of new entrants is creating a dynamic and competitive market landscape. The market's growth is further influenced by factors such as fluctuating raw material prices, economic growth, and infrastructure development. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), driven by the growing demand for sustainable waste management practices. Market penetration of advanced technologies, such as AI-powered waste sorting systems, is expected to increase significantly during this period.

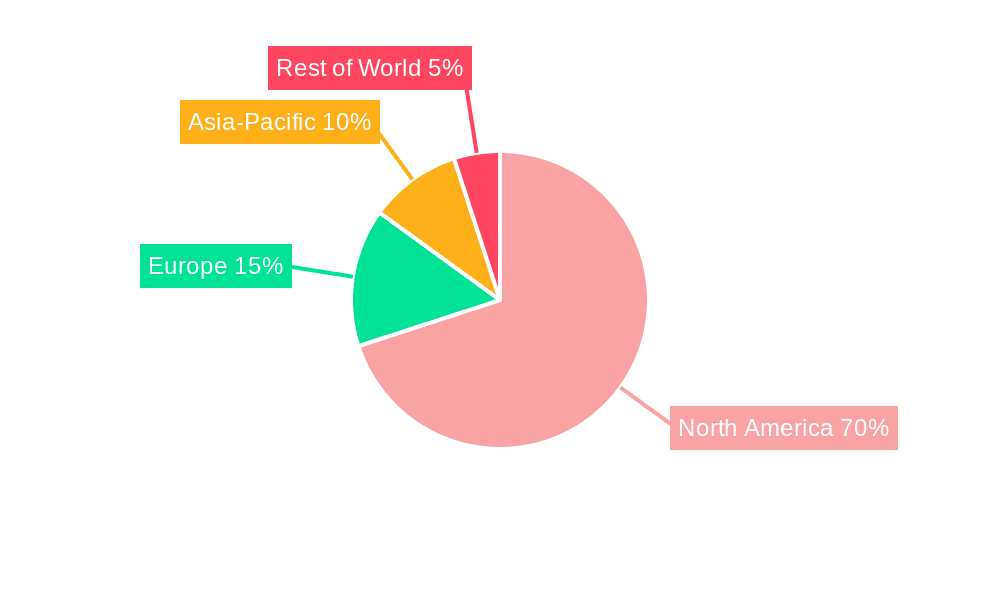

Dominant Regions & Segments in North America Solid Waste Management Market

This section provides an in-depth analysis of the leading geographical regions and critical segments shaping the North American solid waste management market landscape. Understanding these dominant forces is key to identifying market opportunities and strategic planning.

-

Dominant Region: The Northeast region currently commands a significant market share within North America. This dominance is attributed to a confluence of factors including exceptional population density, the presence of highly stringent environmental regulations that drive demand for advanced waste management solutions, and a robust, well-established infrastructure for waste collection, processing, and disposal.

-

Key Drivers for Dominant Region:

- High Population Density: Leading to a consistently high volume of waste generation from residential, commercial, and institutional sources.

- Stringent Environmental Regulations: Mandates for waste reduction, recycling, and proper disposal incentivize the adoption of more sophisticated and sustainable waste management practices.

- Well-Developed Infrastructure: Advanced collection networks, state-of-the-art processing facilities, and comprehensive landfill operations ensure efficient and compliant waste management.

- Government Spending and Support: Significant investments in environmental protection initiatives, public health, and infrastructure development further bolster the market.

- Industrial Concentration: The presence of diverse industries in some of these regions contributes to specific waste streams that require specialized management.

-

Dominant Segment: The Municipal Solid Waste (MSW) segment is the largest contributor to the North American solid waste management market. This dominance stems from the sheer volume of waste generated daily by households, businesses, and public institutions. MSW encompasses a broad range of materials, including organics, recyclables, and residual waste, making its effective management a continuous and substantial undertaking. The growth potential for the MSW segment is intrinsically linked to population growth, consumption patterns, and evolving recycling and composting rates.

Detailed Dominance Analysis of MSW: The continuous generation of waste from urban centers and suburban areas, coupled with increasing awareness and mandates for source separation and diversion, fuels the demand for MSW management services. Trends such as the expansion of single-stream recycling, the development of anaerobic digestion facilities for organic waste, and the increasing utilization of waste-to-energy technologies are significantly impacting this segment. Market growth is further propelled by municipal contracts and private sector waste hauling services.

Analysis of Other Key Segments:

- Industrial Waste: This segment, comprising non-hazardous byproducts from manufacturing and industrial processes, holds a substantial market share. Its growth is tied to industrial output and the increasing emphasis on waste minimization and resource recovery within these sectors. Specialized treatment and disposal methods are often required.

- Hazardous Waste: While a smaller segment in terms of volume compared to MSW, hazardous waste is critically important due to its environmental and health risks. It includes materials from industrial processes, healthcare facilities, and certain consumer products. Stringent regulations govern its collection, treatment, and disposal, leading to high operational costs and specialized service providers. Growth is driven by increased industrial activity and stricter regulatory enforcement.

- Medical Waste: Generated by healthcare facilities, medical waste presents unique challenges due to its potential biohazard. Segments include sharps, infectious waste, pathological waste, and pharmaceutical waste. The growing healthcare sector and increased awareness of infection control contribute to the stable growth of this segment. Specialized autoclaving, incineration, and secure disposal are standard practices.

North America Solid Waste Management Market Product Innovations

Recent innovations focus on improving waste sorting efficiency through AI-powered systems and enhancing waste-to-energy conversion technologies. These advancements are improving the overall sustainability and economic viability of waste management operations, leading to a competitive advantage for companies adopting them. The market is also witnessing increased adoption of smart bins and sensors for real-time waste level monitoring and optimized waste collection routes, thus improving efficiency and reducing operational costs.

Report Scope & Segmentation Analysis

The report segments the North American solid waste management market based on various factors, including waste type (municipal solid waste, industrial waste, hazardous waste, medical waste), collection method (curbside collection, drop-off centers, transfer stations), and treatment method (landfilling, incineration, recycling, composting). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. [Detailed paragraph analysis for each segment, elaborating on their individual market sizes, growth projections and competitive dynamics].

Key Drivers of North America Solid Waste Management Market Growth

The growth of the North American solid waste management market is propelled by several key factors: stricter environmental regulations mandating efficient waste disposal, growing environmental awareness amongst consumers, increasing urbanization leading to higher waste generation, and technological advancements providing more efficient and sustainable waste management solutions. Furthermore, government initiatives and investments in recycling infrastructure contribute significantly to market growth.

Challenges in the North America Solid Waste Management Market Sector

The North American solid waste management sector navigates a complex landscape of challenges. A primary hurdle is the substantial capital investment required for developing and upgrading infrastructure, including advanced recycling facilities, modern landfills, and waste-to-energy plants. Fluctuations in raw material prices for recyclables and energy can significantly impact the profitability of recycling and waste-to-energy operations. Meeting and adapting to increasingly stringent regulatory compliance requirements, encompassing environmental standards, emissions control, and worker safety, necessitates continuous investment and operational adjustments. The market also experiences intense competition, not only from large established players but also from smaller, agile companies, which can put pressure on pricing and margins. Furthermore, supply chain disruptions, whether in the availability of equipment, spare parts, or the transportation of waste, can lead to operational inefficiencies, increased costs, and reduced profitability. The process of securing the necessary permits and approvals for new waste management facilities is often lengthy, complex, and subject to public scrutiny, posing a significant barrier to expansion and development.

Emerging Opportunities in North America Solid Waste Management Market

Opportunities exist in developing innovative recycling technologies, expanding waste-to-energy facilities, and exploring new markets for recycled materials. The growing demand for sustainable packaging and the increasing focus on circular economy principles will create further opportunities for companies offering environmentally friendly waste management solutions. Developing smart waste management systems leveraging IoT and AI can enhance efficiency and reduce costs, presenting a significant opportunity for growth.

Leading Players in the North America Solid Waste Management Market Market

Key Developments in North America Solid Waste Management Industry

October 2023: Veolia North America acquired United States Industrial Technologies (USIT), expanding its presence in industrial waste management. This acquisition is expected to strengthen Veolia's market position and broaden its service offerings.

July 2023: LRS acquired Environmental Recycling & Disposal and Moen Transfer Station, bolstering its operations in Illinois and enhancing its market share in the Midwest. This expansion signifies LRS's strategic growth plans and commitment to the region.

Future Outlook for North America Solid Waste Management Market

The North American solid waste management market is projected to experience sustained and robust growth in the coming years. This expansion will be propelled by a combination of factors, including a persistent increase in waste generation driven by economic activity and population growth, the ongoing implementation of stricter environmental regulations and policies, and the continuous advancement and adoption of innovative technologies. The paramount importance of adopting sustainable practices and embracing cutting-edge technologies cannot be overstated; these will be critical determinants for companies aiming to maintain and enhance their competitive positioning. Significant opportunities exist for organizations to pioneer and implement effective circular economy models, focusing on waste reduction at the source, maximizing resource recovery, and promoting the reuse and recycling of materials. Strategic alliances, mergers, and acquisitions, alongside substantial investments in research and development for novel waste treatment and resource recovery solutions, will undoubtedly play a pivotal role in shaping the future trajectory and defining the success of the industry.

North America Solid Waste Management Market Segmentation

-

1. Product Type

- 1.1. Waste Disposal Equipment

- 1.2. Waste Recycling and Sorting Equipment

-

2. Waste Type

- 2.1. Hazardous Waste

- 2.2. Non-hazardous Waste

-

3. collection type

- 3.1. curbside pickup

- 3.2. door-to-door collection

- 3.3. community recycling programs

-

4. End User

- 4.1. Municipal Waste Management

- 4.2. Healthcare

- 4.3. Chemical

- 4.4. Mining

North America Solid Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Solid Waste Management Market Regional Market Share

Geographic Coverage of North America Solid Waste Management Market

North America Solid Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing awareness among consumers4.; Environmental concerns and sustainability

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing awareness among consumers4.; Environmental concerns and sustainability

- 3.4. Market Trends

- 3.4.1. Booming Plastic segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Solid Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Waste Disposal Equipment

- 5.1.2. Waste Recycling and Sorting Equipment

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Hazardous Waste

- 5.2.2. Non-hazardous Waste

- 5.3. Market Analysis, Insights and Forecast - by collection type

- 5.3.1. curbside pickup

- 5.3.2. door-to-door collection

- 5.3.3. community recycling programs

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Municipal Waste Management

- 5.4.2. Healthcare

- 5.4.3. Chemical

- 5.4.4. Mining

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Waste Management Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Republic Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Clean Harbors

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stericycle

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Advanced Disposal Services

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Recology

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Casella Waste Management

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 US Ecology

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Waste Pro USA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Covanta Holdings Corporation*List Not Exhaustive 6 3 Other Companies (Key Information/Overview

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Waste Management Inc

List of Figures

- Figure 1: North America Solid Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Solid Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: North America Solid Waste Management Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Solid Waste Management Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: North America Solid Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 4: North America Solid Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 5: North America Solid Waste Management Market Revenue Million Forecast, by collection type 2020 & 2033

- Table 6: North America Solid Waste Management Market Volume Billion Forecast, by collection type 2020 & 2033

- Table 7: North America Solid Waste Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: North America Solid Waste Management Market Volume Billion Forecast, by End User 2020 & 2033

- Table 9: North America Solid Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: North America Solid Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: North America Solid Waste Management Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: North America Solid Waste Management Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: North America Solid Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 14: North America Solid Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 15: North America Solid Waste Management Market Revenue Million Forecast, by collection type 2020 & 2033

- Table 16: North America Solid Waste Management Market Volume Billion Forecast, by collection type 2020 & 2033

- Table 17: North America Solid Waste Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: North America Solid Waste Management Market Volume Billion Forecast, by End User 2020 & 2033

- Table 19: North America Solid Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: North America Solid Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United States North America Solid Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States North America Solid Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Canada North America Solid Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada North America Solid Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Mexico North America Solid Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico North America Solid Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Solid Waste Management Market?

The projected CAGR is approximately 3.01%.

2. Which companies are prominent players in the North America Solid Waste Management Market?

Key companies in the market include Waste Management Inc, Republic Services, Clean Harbors, Stericycle, Advanced Disposal Services, Recology, Casella Waste Management, US Ecology, Waste Pro USA, Covanta Holdings Corporation*List Not Exhaustive 6 3 Other Companies (Key Information/Overview.

3. What are the main segments of the North America Solid Waste Management Market?

The market segments include Product Type, Waste Type, collection type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.02 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing awareness among consumers4.; Environmental concerns and sustainability.

6. What are the notable trends driving market growth?

Booming Plastic segment.

7. Are there any restraints impacting market growth?

4.; Increasing awareness among consumers4.; Environmental concerns and sustainability.

8. Can you provide examples of recent developments in the market?

October 2023: Veolia North America (VNA), a leading integrated environmental services provider in the United States and Canada, announced the acquisition of United States Industrial Technologies (USIT), a wholly-owned subsidiary of Michigan-based Total Waste and Recycling Services (WRS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Solid Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Solid Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Solid Waste Management Market?

To stay informed about further developments, trends, and reports in the North America Solid Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence