Key Insights

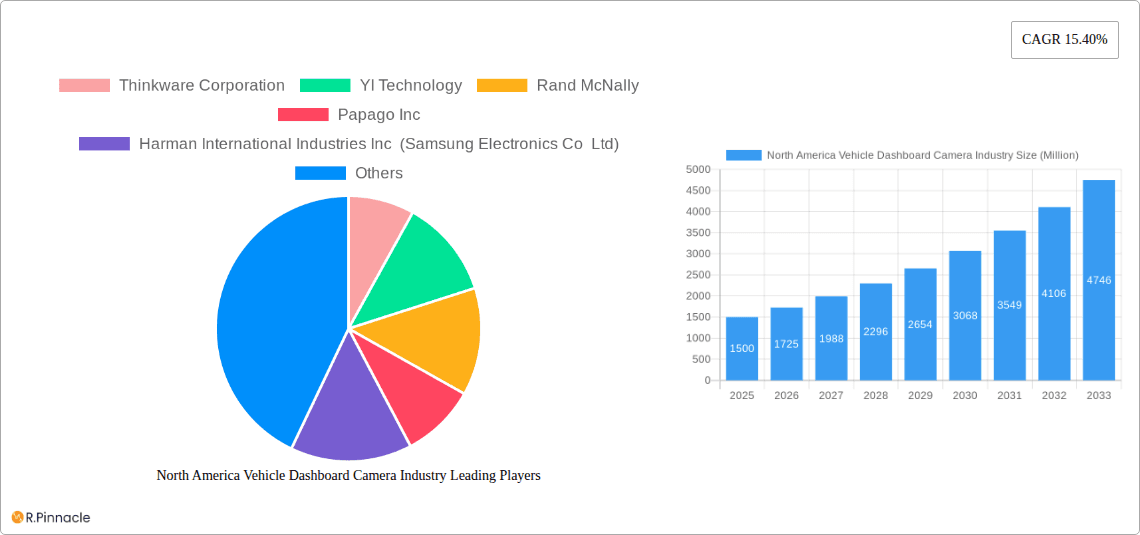

The North American vehicle dashboard camera market is poised for substantial expansion, projecting a Compound Annual Growth Rate (CAGR) of 15.40% from 2025 to 2033. This robust growth trajectory is propelled by heightened consumer focus on road safety and the demonstrable benefits of insurance claim mitigation. Technological advancements, including the integration of smart features such as cloud connectivity, GPS tracking, and Advanced Driver-Assistance Systems (ADAS), are expanding consumer appeal. The increasing incidence of aggressive driving and the imperative for accident evidence further stimulate market adoption. The market is segmented by technology (basic vs. smart cameras), distribution channels (offline vs. online retailers), and geography (primarily the United States and Canada, with Mexico representing a smaller segment). The competitive landscape features established leaders like Garmin, BlackVue, and Thinkware, alongside emerging innovators. While offline distribution channels currently dominate, online sales are steadily rising, mirroring evolving consumer purchasing behaviors.

North America Vehicle Dashboard Camera Industry Market Size (In Billion)

The North American market forecast indicates sustained growth, driven by increasing vehicle sales and the broader adoption of smart dashcams. Key challenges include pricing pressures from new entrants and consumer concerns regarding data privacy. Government regulations on data storage and usage may also present constraints. To maintain momentum, manufacturers are encouraged to prioritize innovative feature development, robust data security enhancements, and strategic collaborations with insurance providers for bundled services. This strategic approach will enable capitalizing on the escalating demand for advanced automotive safety and data-driven insights. The ongoing integration of dashcam technology with ADAS systems offers significant market expansion potential. A strong emphasis on intuitive user interfaces and competitive pricing will be vital for broader consumer acquisition and future market growth.

North America Vehicle Dashboard Camera Industry Company Market Share

North America Vehicle Dashboard Camera Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America vehicle dashboard camera industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The report leverages extensive data and analysis to provide actionable intelligence for navigating this rapidly evolving market.

North America Vehicle Dashboard Camera Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the North American vehicle dashboard camera market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities.

The market exhibits a moderately concentrated structure, with key players holding significant market share. Thinkware Corporation, BlackVue (Pittasoft Co Ltd), and Garmin Ltd are some of the major players, although precise market share data requires proprietary access to detailed sales figures. However, based on available market information, we predict the top 5 players hold approximately xx% of the market share in 2025.

Innovation in the industry is driven by advancements in image processing, connectivity, and AI-powered features. Regulatory frameworks, particularly those related to data privacy and road safety, significantly influence product development and market growth. The existence of substitutes, such as mobile phone-based recording solutions, presents a competitive challenge. The end-user demographic is diverse, encompassing individual consumers, fleet operators, and law enforcement agencies.

M&A activity has been relatively moderate in recent years. While precise deal values are unavailable publicly for all transactions, we estimate total M&A value in the industry from 2019-2024 to be approximately $xx Million. These activities have primarily focused on consolidating market share and enhancing technological capabilities.

North America Vehicle Dashboard Camera Industry Market Dynamics & Trends

This section delves into the market's dynamic growth trajectory, exploring key drivers, technological disruptions, evolving consumer preferences, and intensifying competition.

The North American vehicle dashboard camera market is experiencing robust growth, driven by increasing safety concerns, rising vehicle ownership rates, and the expanding adoption of connected car technologies. We project a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Technological advancements, such as the incorporation of AI and cloud connectivity, are significantly impacting consumer preferences, leading to the demand for advanced features like driver behavior monitoring and automated incident reporting. The competitive landscape is characterized by intense rivalry among established players and emerging entrants, with continuous product innovation and aggressive pricing strategies shaping market dynamics.

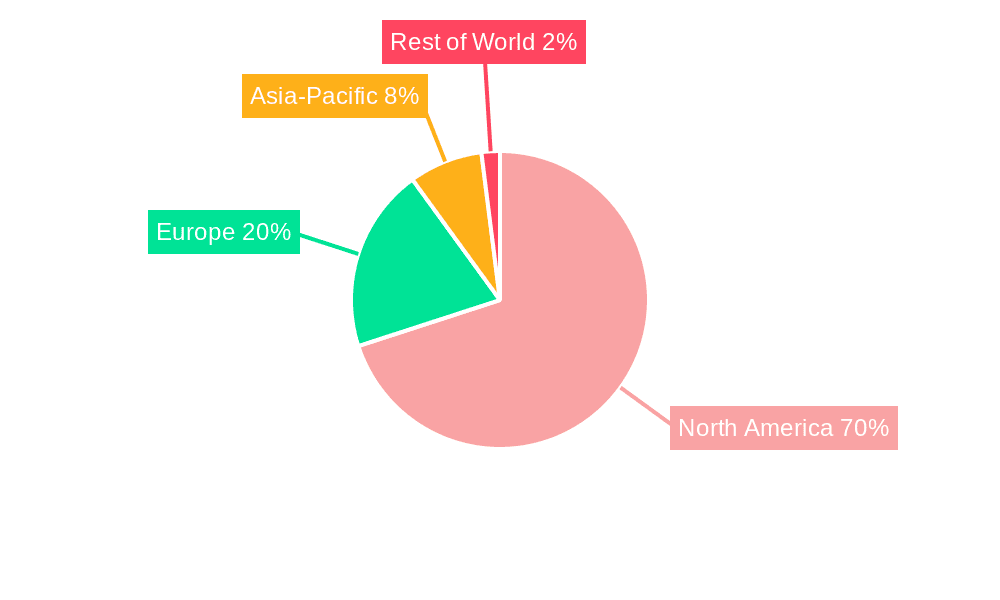

Dominant Regions & Segments in North America Vehicle Dashboard Camera Industry

This section identifies the leading regions, countries, and segments within the North American vehicle dashboard camera market.

Leading Region: The United States dominates the North American market, driven by high vehicle ownership, advanced technological infrastructure, and strong consumer demand for safety and security features. Canada holds a smaller but steadily growing market share.

Leading Country: The United States significantly outpaces Canada in terms of market size and growth, driven by factors such as higher disposable incomes, greater adoption of connected car technologies, and a more established regulatory framework.

Leading Technology Segment: The smart dash cam segment, with its advanced features like cloud connectivity and AI-based functionalities, is experiencing faster growth compared to the basic dash cam segment.

Leading Distribution Channel: Online distribution channels are gaining prominence, offering broader reach, increased convenience, and competitive pricing options for consumers. Offline channels, such as automotive retailers and electronics stores, still maintain a significant share of the market.

North America Vehicle Dashboard Camera Industry Product Innovations

Recent product innovations showcase a trend towards integrating advanced features like 4K video recording, improved night vision capabilities, and AI-powered driver assistance systems. These advancements enhance video quality, expand functionalities, and cater to evolving consumer demands for greater safety and security while driving. The integration of cloud connectivity enables real-time data sharing and remote access to recorded footage, providing added convenience and functionality. The market fit of these innovations is strong, driven by an increasing consumer preference for comprehensive vehicle safety solutions.

Report Scope & Segmentation Analysis

This report segments the North American vehicle dashboard camera market across various parameters:

By Country: United States and Canada. Growth projections vary based on economic conditions and regulatory changes in each country. The US market is expected to be substantially larger.

By Technology: Basic and Smart. Smart dash cams offer higher growth potential due to the addition of advanced functionalities.

By Distribution Channel: Online and Offline. Online sales are expected to grow at a faster rate, owing to their convenience and wider reach. Offline channels remain relevant through established retail networks.

Key Drivers of North America Vehicle Dashboard Camera Industry Growth

The market's growth is propelled by several key factors:

- Increased safety concerns: Consumers are increasingly seeking ways to enhance vehicle safety, with dash cams offering an effective solution.

- Technological advancements: Innovations in camera technology, AI, and connectivity are driving product improvements and market appeal.

- Favorable regulatory environment: Government regulations in some areas promoting road safety support the adoption of dash cams.

- Rising vehicle ownership: A rising number of vehicles on the road creates a larger potential market for dash cams.

Challenges in the North America Vehicle Dashboard Camera Industry Sector

The industry faces certain challenges:

- Data privacy concerns: Concerns over data privacy and potential misuse of recorded footage could hinder market growth.

- Supply chain disruptions: Global supply chain issues can impact the availability and cost of components, affecting production and pricing.

- Intense competition: A competitive landscape with several players may lead to price wars and reduced profit margins.

Emerging Opportunities in North America Vehicle Dashboard Camera Industry

Significant opportunities exist in this industry:

- Expansion into new vehicle segments: Targeting specific vehicle types, such as commercial fleets or ride-sharing services, can generate substantial revenue.

- Integration with telematics and IoT: Combining dash cams with other connected car technologies opens up new possibilities.

- Development of advanced analytics features: Analyzing dash cam footage for driver behavior or safety insights creates new revenue streams.

Leading Players in the North America Vehicle Dashboard Camera Industry Market

- Thinkware Corporation

- YI Technology

- Rand McNally

- Papago Inc

- Harman International Industries Inc (Samsung Electronics Co Ltd)

- BlackVue (Pittasoft Co Ltd)

- Transcend Information Inc

- Garmin Ltd

- HP Inc

- Cobra Electronics Corporation (Cedar Electronics Holdings Corp)

- Waylens Inc

- LG Innotek

- Nextbase

- Panasonic Corporation

Key Developments in North America Vehicle Dashboard Camera Industry

August 2022: Garmin International, Inc. announced the Garmin Drivecam 76 and RVcam 795, integrating navigation with high-definition dash cam functionality. This broadened their product offerings and tapped into the growing demand for all-in-one devices.

August 2022: Nextbase Dash Cams partnered with Grubhub to enhance driver safety and security, showcasing a strategic move to cater to specific professional driver segments. This partnership underscores the growing importance of dash cams in various professional driving contexts.

Future Outlook for North America Vehicle Dashboard Camera Industry Market

The North American vehicle dashboard camera market is poised for continued growth, driven by ongoing technological advancements, increasing consumer awareness of safety benefits, and the expanding integration with connected car ecosystems. Strategic opportunities lie in developing innovative features, expanding into new market segments, and strengthening partnerships with key players in the automotive and technology industries. The market's trajectory is expected to remain positive, with sustained growth projected throughout the forecast period.

North America Vehicle Dashboard Camera Industry Segmentation

-

1. Technology

- 1.1. Basic

- 1.2. Smart

-

2. Distribution Channel

- 2.1. Offline

- 2.2. Online

North America Vehicle Dashboard Camera Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Vehicle Dashboard Camera Industry Regional Market Share

Geographic Coverage of North America Vehicle Dashboard Camera Industry

North America Vehicle Dashboard Camera Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Driver Safety Coupled With Growing Acceptance of Dashboard Footage as Evidence in Court of Law; Technological Advancements in Smart Dashboard Camera Segment Driving Adoption in the United States; Declining Unit Prices in the Region

- 3.3. Market Restrains

- 3.3.1. High System Cost and Lack of Supporting Infrastructure in Developing Countries

- 3.4. Market Trends

- 3.4.1. Dual-channel Dashboard Camera to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vehicle Dashboard Camera Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Basic

- 5.1.2. Smart

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Thinkware Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 YI Technology

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rand McNally

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Papago Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harman International Industries Inc (Samsung Electronics Co Ltd)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BlackVue (Pittasoft Co Ltd)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Transcend Information Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Garmin Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HP Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cobra Electronics Corporation (Cedar Electronics Holdings Corp )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Waylens Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 LG Innotek

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Nextbase

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Panasonic Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Thinkware Corporation

List of Figures

- Figure 1: North America Vehicle Dashboard Camera Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Vehicle Dashboard Camera Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Vehicle Dashboard Camera Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 2: North America Vehicle Dashboard Camera Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Vehicle Dashboard Camera Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Vehicle Dashboard Camera Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 5: North America Vehicle Dashboard Camera Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Vehicle Dashboard Camera Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States North America Vehicle Dashboard Camera Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Vehicle Dashboard Camera Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Vehicle Dashboard Camera Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vehicle Dashboard Camera Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the North America Vehicle Dashboard Camera Industry?

Key companies in the market include Thinkware Corporation, YI Technology, Rand McNally, Papago Inc, Harman International Industries Inc (Samsung Electronics Co Ltd), BlackVue (Pittasoft Co Ltd), Transcend Information Inc, Garmin Ltd, HP Inc, Cobra Electronics Corporation (Cedar Electronics Holdings Corp ), Waylens Inc, LG Innotek, Nextbase, Panasonic Corporation.

3. What are the main segments of the North America Vehicle Dashboard Camera Industry?

The market segments include Technology, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1649.68 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Driver Safety Coupled With Growing Acceptance of Dashboard Footage as Evidence in Court of Law; Technological Advancements in Smart Dashboard Camera Segment Driving Adoption in the United States; Declining Unit Prices in the Region.

6. What are the notable trends driving market growth?

Dual-channel Dashboard Camera to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High System Cost and Lack of Supporting Infrastructure in Developing Countries.

8. Can you provide examples of recent developments in the market?

August 2022 -Garmin International, Inc., a unit of Garmin Ltd, announced the Garmin Drivecam 76 and RVcam 795 all-in-one navigators with a built-in, high-definition dash camera. Both models feature a sharp 7-inch display, 1080p HD video recording, and a wide 140-degree field of view to capture a broad picture of the road ahead. Once plugged in, the camera continually records and saves video of detected incidents, serving as an eyewitness behind the wheel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vehicle Dashboard Camera Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vehicle Dashboard Camera Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vehicle Dashboard Camera Industry?

To stay informed about further developments, trends, and reports in the North America Vehicle Dashboard Camera Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence