Key Insights

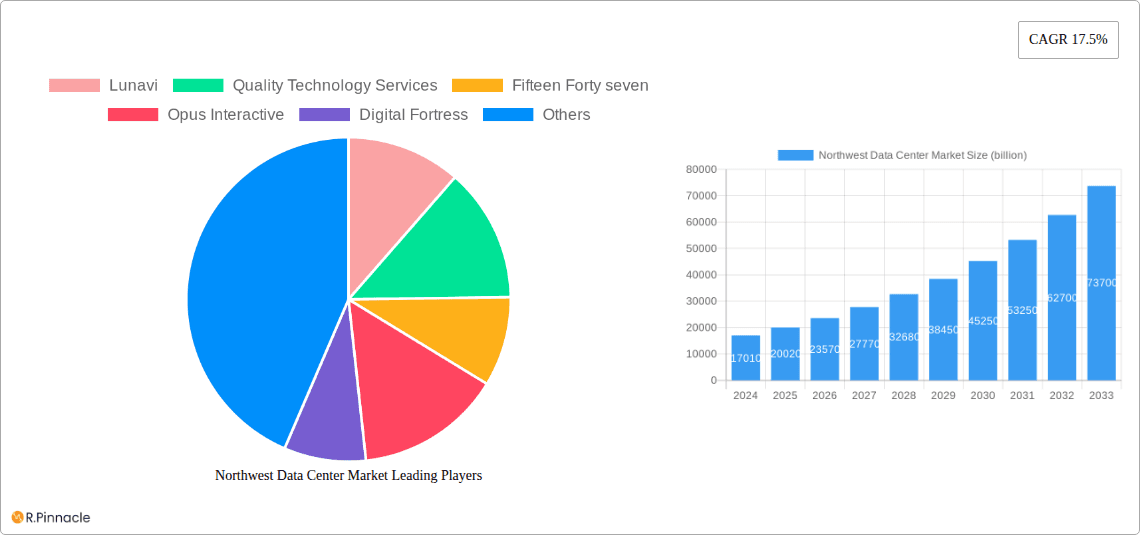

The Northwest Data Center Market is experiencing robust growth, projected to reach approximately $17.01 billion in 2024, with an impressive CAGR of 17.5% anticipated over the forecast period. This rapid expansion is fueled by a confluence of critical drivers, including the escalating demand for cloud computing services, the proliferation of big data analytics, and the continuous evolution of the Internet of Things (IoT) ecosystem. Furthermore, the increasing adoption of digital transformation initiatives across various industries, coupled with the burgeoning need for high-performance computing and AI capabilities, are significantly bolstering market expansion. The region's strategic location and its growing status as a hub for technological innovation are attracting substantial investments, positioning it as a key player in the global data center landscape.

Northwest Data Center Market Market Size (In Billion)

Key trends shaping the Northwest Data Center Market include a pronounced shift towards hyperscale and edge data centers, driven by the need for lower latency and localized data processing. The growing emphasis on sustainability is also a significant trend, with data center operators increasingly investing in renewable energy sources and energy-efficient infrastructure to minimize their environmental footprint. While the market demonstrates strong growth potential, potential restraints such as rising operational costs, the increasing complexity of data center management, and stringent regulatory compliance requirements could pose challenges. Nevertheless, the robust demand from diverse end-users like Cloud & IT providers, Telecom companies, Media & Entertainment, and BFSI sectors, alongside a significant number of players like Digital Realty Trust Inc., NTT Ltd., and CoreSite, signifies a dynamic and evolving market poised for sustained advancement.

Northwest Data Center Market Company Market Share

Northwest Data Center Market: Comprehensive Industry Analysis and Growth Forecast (2019-2033)

This in-depth report provides a definitive analysis of the Northwest Data Center Market, a critical hub for digital infrastructure. Leveraging high-ranking keywords such as "Northwest data center," "data center market analysis," "colocation," "hyperscale data centers," "edge computing," and "digital transformation," this report is meticulously crafted for industry professionals seeking actionable insights and strategic advantages. The study encompasses a detailed examination of market structure, dynamics, dominant regions, product innovations, growth drivers, challenges, emerging opportunities, leading players, key developments, and a comprehensive future outlook, covering the period from 2019 to 2033 with a base and estimated year of 2025. The market size is projected to reach billions by 2025, with a significant CAGR throughout the forecast period.

Northwest Data Center Market Market Structure & Innovation Trends

The Northwest Data Center Market exhibits a dynamic and evolving market structure characterized by increasing competition and technological advancements. Market concentration is moderate, with several key players vying for dominance, including Digital Realty Trust Inc, NTT Ltd, Flexential, and CoreSite. Innovation is primarily driven by the escalating demand for high-density computing, AI/ML workloads, and edge deployments. Regulatory frameworks are generally supportive, though environmental considerations are gaining prominence. Product substitutes are limited in the core data center services, but advancements in cloud computing and distributed architectures present evolving competitive landscapes. End-user demographics are increasingly skewed towards cloud providers and large enterprises seeking robust, scalable, and secure data storage and processing solutions. Mergers and acquisitions (M&A) activities are expected to continue, consolidating market share and expanding service offerings. For instance, notable M&A deals in recent years have seen significant billions exchanged, reshaping the competitive arena and facilitating infrastructure expansion. Key innovation drivers include the development of more efficient cooling technologies, renewable energy integration, and advanced cybersecurity measures.

Northwest Data Center Market Market Dynamics & Trends

The Northwest Data Center Market is experiencing robust growth, fueled by a confluence of powerful market growth drivers, relentless technological disruptions, shifting consumer preferences, and an intensely competitive landscape. The insatiable demand for data storage, processing, and connectivity, amplified by the proliferation of IoT devices, the expansion of cloud services, and the burgeoning fields of artificial intelligence and machine learning, serves as a primary growth engine. Technological disruptions are at the forefront, with advancements in high-density computing, liquid cooling solutions, and software-defined networking enabling data centers to handle increasingly complex and demanding workloads. Consumer preferences are evolving towards more distributed, lower-latency solutions, driving the demand for edge data centers and specialized colocation facilities. The competitive dynamics are characterized by a continuous race for market share, with established players investing heavily in capacity expansion and new entrants introducing innovative solutions. Market penetration of hyperscale facilities continues to rise, alongside a growing niche for specialized retail and wholesale colocation services. The projected Compound Annual Growth Rate (CAGR) for the market is anticipated to be in the billions, reflecting sustained expansion throughout the forecast period. Key trends include the increasing adoption of renewable energy sources to power data centers, a focus on sustainability and energy efficiency, and the growing importance of robust network connectivity and peering points. The market is also seeing a rise in demand for specialized data center solutions tailored to specific industry needs, such as those in the BFSI and healthcare sectors.

Dominant Regions & Segments in Northwest Data Center Market

The Northwest Data Center Market showcases distinct regional dominance and segment specialization, driven by a combination of economic policies, robust infrastructure, and evolving industry demands. The Pacific Northwest, particularly regions like Hillsboro, Oregon, and surrounding areas, consistently emerges as the dominant region due to its favorable climate for cooling, access to abundant renewable energy sources, and a strong existing technology ecosystem. Key drivers for this dominance include state-level incentives for data center development and a skilled workforce.

The market segmentation reveals specific areas of significant activity:

DC Size:

- Massive and Mega data centers are experiencing the most significant growth, driven by hyperscale cloud providers and large enterprises requiring vast processing and storage capabilities. These facilities represent a substantial portion of the market's current and projected capacity, valued in the billions.

- Large data centers also continue to play a crucial role, catering to enterprise needs and colocation providers.

- Medium and Small data centers are seeing increased demand for edge deployments and specialized applications, offering localized processing and reduced latency.

Tier Type:

- Tier 3 facilities are the most prevalent, offering a balance of reliability, redundancy, and cost-effectiveness for a wide range of applications.

- Tier 4 data centers are gaining traction for mission-critical applications where zero downtime is paramount, particularly in sectors like BFSI and government. Their premium pricing and complex infrastructure contribute to their significant market value in the billions.

- Tier 1 & 2 facilities are typically found in niche applications or as part of smaller, less critical deployments.

Absorption:

- Utilized Absorption is highest in Hyperscale colocation, reflecting the massive build-outs by global cloud giants. This segment alone accounts for billions in investment and operational expenditure.

- Wholesale colocation is also a major contributor, serving large enterprises and managed service providers.

- Retail colocation caters to smaller businesses and specialized needs, showing steady growth.

- By End-User:

- Cloud & IT services are the largest consumers of data center capacity, driving demand across all segments.

- Telecom providers are significant users, requiring robust infrastructure for network expansion and 5G deployment.

- Media & Entertainment, Government, and BFSI are also key end-users, with growing demands for high-performance computing and secure data storage.

- Manufacturing and E-Commerce are emerging as significant growth areas, driven by industrial automation and online retail expansion, contributing billions to the market.

- Non-Utilized Absorption represents available capacity, which remains competitive in key markets, offering opportunities for new entrants and expansion.

Northwest Data Center Market Product Innovations

Product innovations in the Northwest Data Center Market are rapidly advancing to meet the demands of increased computational power and energy efficiency. Key developments include the integration of advanced cooling technologies, such as liquid immersion and direct-to-chip cooling, which significantly enhance performance and reduce energy consumption for high-density racks. Furthermore, the deployment of AI-driven infrastructure management platforms is optimizing power distribution, thermal management, and security, leading to greater operational efficiency and cost savings, with an estimated market impact of billions. The development of modular and scalable data center designs is also a prominent trend, enabling faster deployment and flexibility to adapt to evolving business needs. These innovations provide a competitive advantage by offering clients more sustainable, performant, and cost-effective data center solutions.

Report Scope & Segmentation Analysis

This report offers a granular segmentation analysis of the Northwest Data Center Market, covering a comprehensive spectrum of DC sizes, tier types, and absorption metrics. The segmentation includes: DC Size: Small, Medium, Large, Massive, Mega; Tier Type: Tier 1 & 2, Tier 3, Tier 4; and Absorption: Utilized (By Colocation Type: Retail, Wholesale, Hyperscale; By End-User: Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, Other End-User), and Non-Utilized. Each segment is analyzed for its current market size, growth projections, and competitive dynamics. For example, the Hyperscale segment is projected to grow significantly, driven by major cloud providers, representing a market value in the billions. Conversely, the Retail colocation segment, while smaller in scale, offers consistent growth and caters to a diverse customer base. Understanding these segment-specific trends and projections is crucial for strategic planning and investment in the Northwest data center landscape.

Key Drivers of Northwest Data Center Market Growth

The Northwest Data Center Market is propelled by several potent growth drivers. Technologically, the exponential growth in data generation, driven by AI, IoT, and big data analytics, necessitates significant expansion of data center capacity. Economically, the increasing digital transformation initiatives across various industries, including BFSI, healthcare, and manufacturing, are fueling demand for cloud services and robust IT infrastructure. Regulatory factors, such as government incentives for technology development and data localization mandates, also play a crucial role. Furthermore, the strategic geographical advantages of the Northwest region, including access to renewable energy and favorable cooling conditions, attract significant investment. The market is projected to see continued expansion in the billions over the forecast period due to these drivers.

Challenges in the Northwest Data Center Market Sector

Despite robust growth, the Northwest Data Center Market faces several significant challenges. Regulatory hurdles, including complex permitting processes and evolving environmental regulations, can slow down development timelines and increase project costs. Supply chain disruptions, particularly for specialized hardware and critical components, can impact construction schedules and operational continuity. Competitive pressures are intense, with established players and new entrants constantly vying for market share, leading to potential pricing pressures. Furthermore, the increasing demand for power and the need for sustainable energy solutions present ongoing challenges for infrastructure development and operational efficiency. These factors collectively represent potential constraints on the market's rapid expansion, with estimated impacts in the billions on project timelines and costs.

Emerging Opportunities in Northwest Data Center Market

The Northwest Data Center Market presents a fertile ground for emerging opportunities. The accelerating adoption of edge computing for low-latency applications in sectors like autonomous vehicles and real-time analytics offers significant growth potential. The increasing demand for specialized data centers focused on AI/ML workloads, high-performance computing (HPC), and blockchain technology is creating niche markets. Furthermore, the growing emphasis on sustainability is driving opportunities for data centers powered by renewable energy sources and employing advanced energy-efficient technologies. Strategic partnerships and M&A activities are also expected to continue, creating opportunities for consolidation and expansion. The market's capacity for growth in these emerging areas is estimated in the billions.

Leading Players in the Northwest Data Center Market Market

- Lunavi

- Quality Technology Services

- Fifteen Forty seven

- Opus Interactive

- Digital Fortress

- EdgeConneX Inc

- Involta

- Flexential

- T5 Datacenters

- Cogent

- CoreSite

- H5 Data centers

- Digital Realty Trust Inc

- OneNeckITSolutionsLLC

- NTT Ltd

Key Developments in Northwest Data Center Market Industry

- January 2023: In collaboration with Principal Asset Management, Crane Data Centers developed a 100MW data center complex in Forest Grove (a few miles from Hillsboro). The first phase is expected to deliver 50MW over 35 acres.

- May 2022: Intel was building a USD 700 million research center in Hillsboro. The facility likely studied new technologies to increase data center operating efficiency. To achieve this, the 200,000-square-foot research lab was expected to primarily focus on reducing data centers' heating, cooling, and water needs. The facility was scheduled to open in late 2023.

These developments underscore the significant investment and innovation occurring within the Northwest data center landscape, particularly in the Hillsboro area, impacting market capacity and technological advancement.

Future Outlook for Northwest Data Center Market Market

The future outlook for the Northwest Data Center Market remains exceptionally bright, characterized by sustained growth and evolving technological paradigms. The continued expansion of cloud computing, the burgeoning demand for AI and machine learning capabilities, and the increasing adoption of edge computing will act as primary growth accelerators. Strategic investments in renewable energy and sustainable infrastructure will be critical for meeting both operational needs and environmental goals, positioning the region as a leader in green data center development. The market is poised for further consolidation and innovation, with ongoing M&A activities and the emergence of new technologies shaping its trajectory. Overall, the Northwest data center sector is expected to witness substantial growth, with market valuations reaching new billions in the coming years, offering significant strategic opportunities for stakeholders.

Northwest Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. By Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. By End-User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End-User

-

3.1.1. By Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Northwest Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Northwest Data Center Market Regional Market Share

Geographic Coverage of Northwest Data Center Market

Northwest Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Hyperscale Data Centers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. By Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. By End-User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End-User

- 5.3.1.1. By Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. By Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. By End-User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End-User

- 6.3.1.1. By Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. By Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. By End-User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End-User

- 7.3.1.1. By Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. By Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. By End-User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End-User

- 8.3.1.1. By Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. By Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. By End-User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End-User

- 9.3.1.1. By Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. By Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. By End-User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End-User

- 10.3.1.1. By Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lunavi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Quality Technology Services

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fifteen Forty seven

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Opus Interactive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Digital Fortress

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EdgeConneX Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Involta

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Flexential

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 T5 Datacenters

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cogent

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CoreSite

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 H5 Data centers

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Digital Realty Trust Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 OneNeckITSolutionsLLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 NTT Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Lunavi

List of Figures

- Figure 1: Global Northwest Data Center Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 3: North America Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 4: North America Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 5: North America Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 6: North America Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 7: North America Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 8: North America Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 11: South America Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 12: South America Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 13: South America Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 14: South America Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 15: South America Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 16: South America Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 19: Europe Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 20: Europe Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 21: Europe Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 22: Europe Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 23: Europe Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 24: Europe Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 27: Middle East & Africa Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 28: Middle East & Africa Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 29: Middle East & Africa Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 30: Middle East & Africa Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 31: Middle East & Africa Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 32: Middle East & Africa Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 35: Asia Pacific Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 36: Asia Pacific Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 37: Asia Pacific Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 38: Asia Pacific Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 39: Asia Pacific Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 40: Asia Pacific Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 2: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 3: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 4: Global Northwest Data Center Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 6: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 7: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 8: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 13: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 14: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 15: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 20: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 21: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 22: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 33: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 34: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 35: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 43: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 44: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 45: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Northwest Data Center Market?

The projected CAGR is approximately 17.5%.

2. Which companies are prominent players in the Northwest Data Center Market?

Key companies in the market include Lunavi, Quality Technology Services, Fifteen Forty seven, Opus Interactive, Digital Fortress, EdgeConneX Inc, Involta, Flexential, T5 Datacenters, Cogent, CoreSite, H5 Data centers, Digital Realty Trust Inc, OneNeckITSolutionsLLC, NTT Ltd.

3. What are the main segments of the Northwest Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.01 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Rising Adoption of Hyperscale Data Centers.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

January 2023: In collaboration with Principal Asset Management, Crane Data Centers developed a 100MW data center complex in Forest Grove (a few miles from Hillsboro). The first phase is expected to deliver 50MW over 35 acres.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Northwest Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Northwest Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Northwest Data Center Market?

To stay informed about further developments, trends, and reports in the Northwest Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence