Key Insights

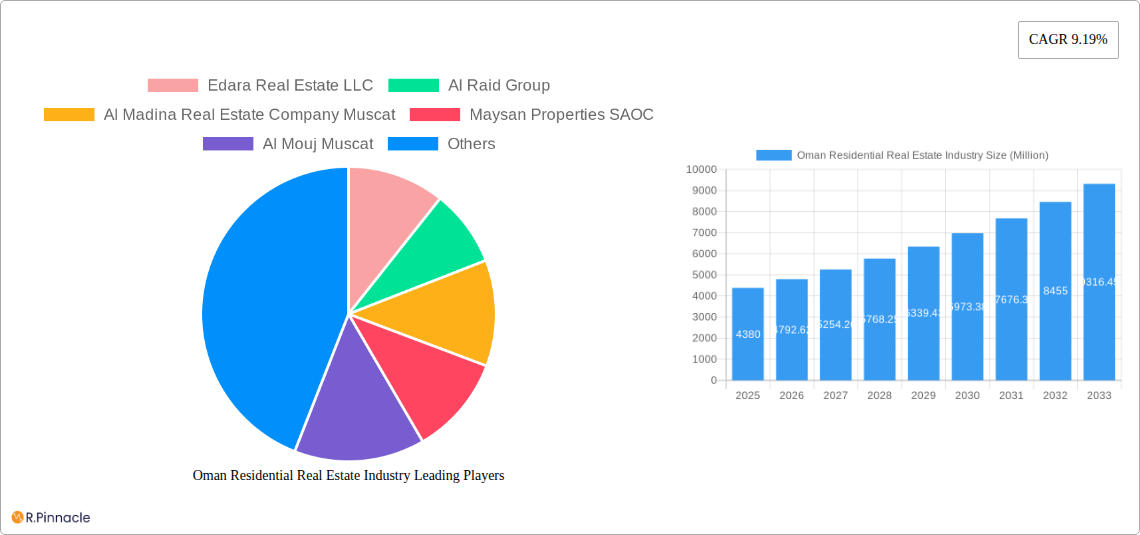

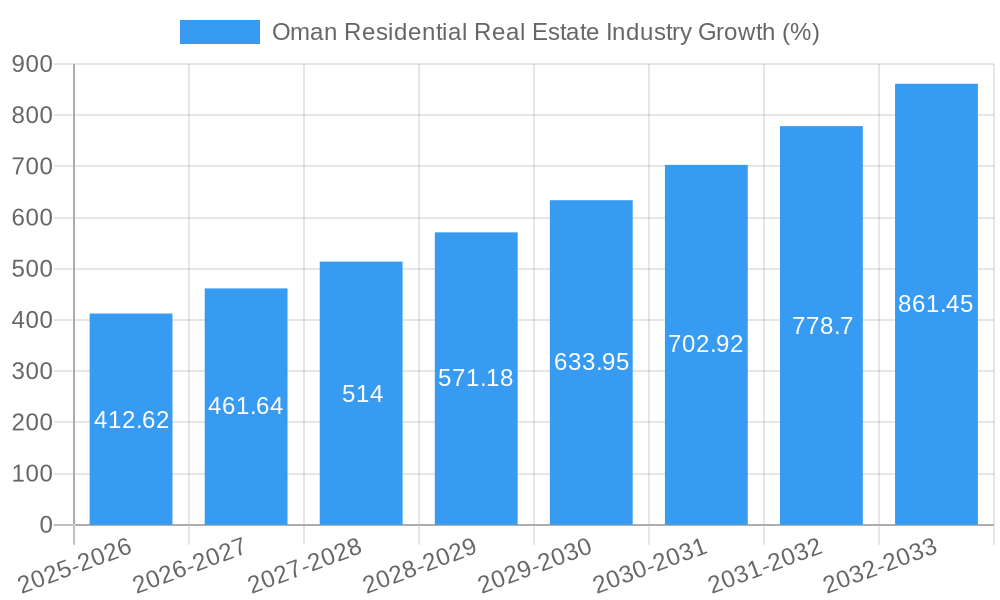

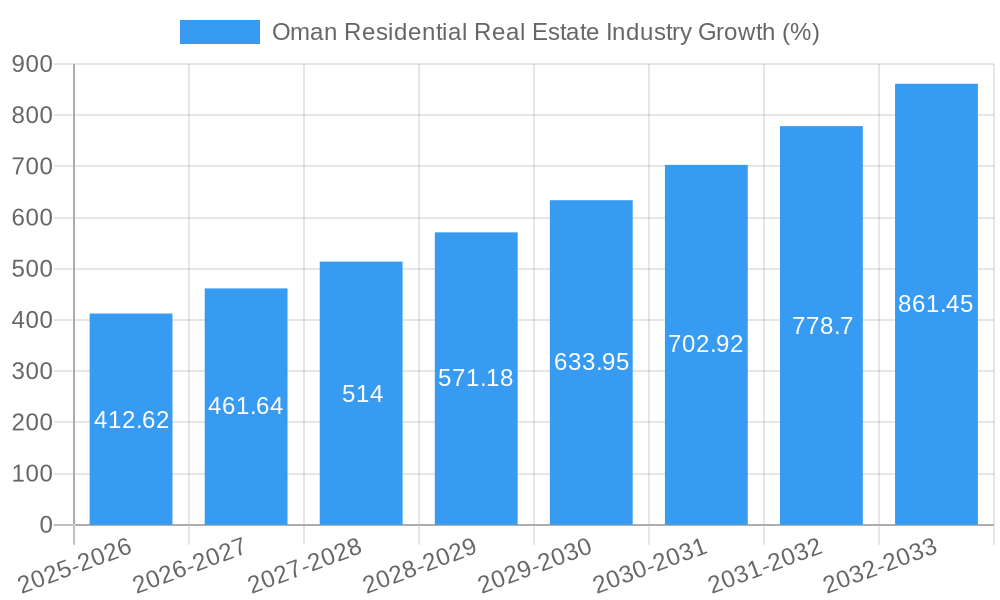

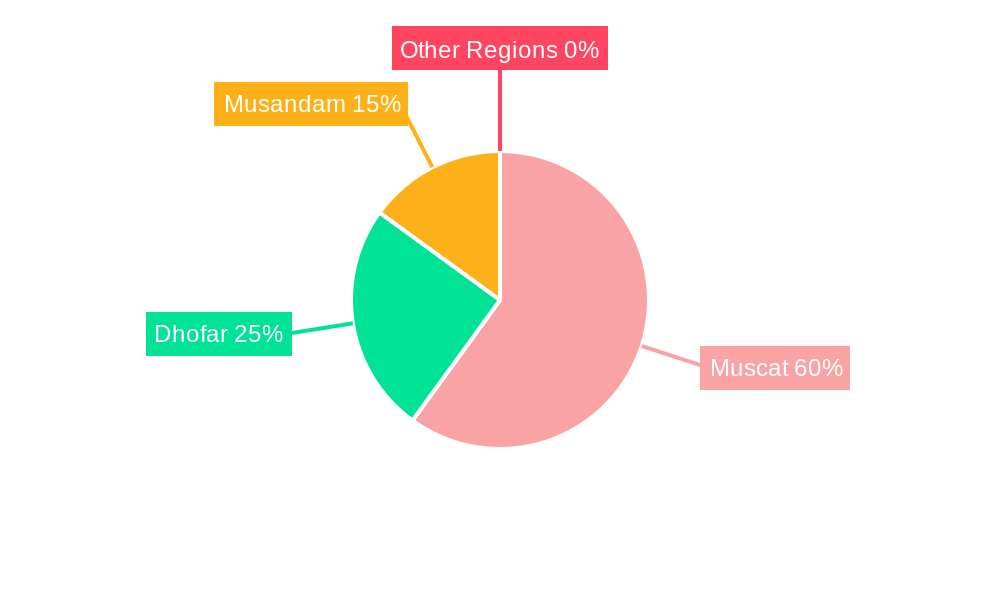

The Oman residential real estate market, valued at $4.38 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 9.19% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Oman's burgeoning population and a rising middle class are increasing demand for housing, particularly in urban centers like Muscat, Dhofar, and Musandam. Secondly, government initiatives aimed at infrastructure development and affordable housing projects are further stimulating the market. Tourism growth also contributes significantly, driving demand for rental properties and second homes, especially in coastal areas. The market segmentation reveals a diverse range of property types, with apartments and condominiums catering to a wider segment, while villas and landed houses appeal to high-net-worth individuals. The presence of prominent real estate developers like Edara Real Estate LLC, Al Raid Group, and international players such as Coldwell Banker and Savills indicates a mature and competitive market. However, challenges remain, including potential fluctuations in oil prices which can impact overall economic growth and subsequently affect investment in real estate. Furthermore, the availability of land and construction costs could influence future growth trajectories.

The forecast period (2025-2033) anticipates continued growth, with significant investment expected in both the development of new residential properties and the refurbishment of existing ones. This will likely lead to increased competition among developers, potentially driving innovation and improvements in quality and service. Strategic partnerships between Omani developers and international firms are expected to further enhance market competitiveness and introduce new technologies and investment into the sector. The regional distribution of the market shows that Muscat, as the capital city, commands a larger market share due to its concentration of employment opportunities and infrastructure, followed by Dhofar and Musandam which benefit from tourism and their unique geographic characteristics. Careful monitoring of macroeconomic factors and the implementation of sustainable development practices will be key to ensuring the long-term health and sustainability of Oman's residential real estate market.

This comprehensive report provides an in-depth analysis of the Oman residential real estate market, offering invaluable insights for investors, developers, and industry professionals. With a focus on market trends, key players, and future growth potential, this report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data analysis to provide actionable intelligence on market size, segmentation, and key performance indicators (KPIs).

Oman Residential Real Estate Industry Market Structure & Innovation Trends

This section analyzes the structure of Oman's residential real estate market, examining market concentration, innovation drivers, regulatory frameworks, and competitive dynamics. We explore the influence of product substitutes, end-user demographics, and mergers & acquisitions (M&A) activity. The report includes quantitative data on market share distribution amongst key players and the value of significant M&A deals. For example, we analyze the market share of leading companies like Al Mouj Muscat and Edara Real Estate LLC, providing insight into the competitive landscape. The impact of government regulations and policies on market growth are also detailed. The analysis considers the influence of factors such as population growth, urbanization, and economic development on market demand, providing a holistic view of market dynamics. The total market value in 2024 is estimated at xx Million and is projected to reach xx Million by 2033. M&A deal values in the past five years totalled approximately xx Million.

Oman Residential Real Estate Industry Market Dynamics & Trends

This section delves into the key dynamics shaping the Oman residential real estate market, including growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We examine the Compound Annual Growth Rate (CAGR) of the market during the historical period (2019-2024) and forecast the CAGR for the forecast period (2025-2033). Market penetration of different property types (apartments, villas) in key cities (Muscat, Dhofar, Musandam) is analyzed. The influence of factors such as changes in interest rates, government policies, and economic conditions on market activity will be explored. The impact of technological advancements like PropTech on the industry's efficiency and customer experience is also evaluated. Finally, the report identifies emerging trends impacting consumer preferences and their effect on the demand for different types of residential properties.

Dominant Regions & Segments in Oman Residential Real Estate Industry

This section identifies the dominant regions and segments within the Oman residential real estate market. We analyze the performance of key cities (Muscat, Dhofar, Musandam) and property types (Apartments & Condominiums, Villas & Landed Houses). The dominance analysis considers factors including:

- Muscat: High population density, established infrastructure, and proximity to employment centers.

- Dhofar: Growing tourism sector and increasing demand for vacation homes.

- Musandam: Unique geographical location and potential for luxury tourism-related development.

- Apartments & Condominiums: Affordable housing options catering to a larger segment of the population.

- Villas & Landed Houses: Appeal to high-net-worth individuals and families seeking larger living spaces.

The report provides a detailed analysis of the factors driving the dominance of each region and segment, including economic policies, infrastructure development, and consumer preferences.

Oman Residential Real Estate Industry Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in the Oman residential real estate market. We highlight technological trends, including smart home technologies, sustainable building materials, and innovative design solutions. The analysis will assess the market fit of these innovations and their potential to disrupt the market. The focus is on how these innovations are shaping the competitive landscape and influencing consumer choices.

Report Scope & Segmentation Analysis

This report segments the Oman residential real estate market by property type (Apartments and Condominiums, Villas and Landed Houses) and key cities (Muscat, Dhofar, Musandam). Each segment's growth projections, market size (in Millions), and competitive dynamics are analyzed.

Apartments and Condominiums: This segment represents a significant portion of the market, catering to a wide range of buyers. Growth is expected to be driven by factors like affordability and increasing urbanization. Competitive dynamics are influenced by the number of developers and the availability of land.

Villas and Landed Houses: This segment caters to the high-end market, driven by demand for luxury housing and larger living spaces. Growth projections are influenced by economic factors and the availability of prime land. Competition is more concentrated, with fewer major players.

Muscat: This segment dominates the market, owing to the city's established infrastructure, economic activity, and population density. Growth is projected to remain strong.

Dhofar and Musandam: These segments represent emerging markets with high growth potential but limited overall market size compared to Muscat.

Key Drivers of Oman Residential Real Estate Industry Growth

Several key factors drive the growth of Oman's residential real estate industry. These include sustained economic growth, government initiatives to improve infrastructure, a growing population, and increasing urbanization. Furthermore, the development of new tourism destinations and the government's focus on attracting foreign investment play a significant role. Technological advancements in construction and property management also contribute to market expansion.

Challenges in the Oman Residential Real Estate Industry Sector

The Oman residential real estate industry faces several challenges. These include the availability of land, strict building regulations that can increase development costs, and fluctuations in economic conditions. Competition among developers, particularly in the high-end market segments, also presents a significant challenge. Furthermore, the impact of external factors like global economic uncertainty can influence investor confidence and market stability. The market experienced a slowdown in 2024, impacting transaction volumes by approximately xx%.

Emerging Opportunities in Oman Residential Real Estate Industry

Despite the challenges, several opportunities exist for growth. The development of sustainable and eco-friendly housing solutions, the increasing adoption of PropTech solutions, and catering to the growing expatriate community present significant market potential. The government's focus on diversifying the economy and creating new employment opportunities further supports growth. Additionally, investing in new infrastructure projects can attract increased investment in the residential real estate sector.

Leading Players in the Oman Residential Real Estate Industry Market

- Edara Real Estate LLC

- Al Raid Group

- Al Madina Real Estate Company Muscat

- Maysan Properties SAOC

- Al Mouj Muscat

- Coldwell Banker (Coldwell Banker)

- Better Homes (Better Homes)

- Harbor Real Estate

- Hilal Properties

- Al-Taher Group

- Abu Malak Global Enterprises Muscat

- Savills (Savills)

- Wujha Real Estate

- Saraya Bandar Jissah

- Orascom Development Holding AG (Orascom Development Holding AG)

- Engel & Voelkers (Engel & Voelkers)

List Not Exhaustive

Key Developments in Oman Residential Real Estate Industry Industry

October 2022: Al Mouj Muscat launched phase 2 of Zunairah Mansions in the Shatti District, featuring six-bedroom mansions with significant amenities. This launch signifies a focus on luxury residential developments.

April 2022: Oman Post and Asyad Express partnered with WUJHA Real Estate to invest in land development, indicating a collaboration between different sectors to enhance land investment strategies. This reflects a growing interest in real estate from non-traditional players.

Future Outlook for Oman Residential Real Estate Industry Market

The future outlook for the Oman residential real estate market is positive. Government initiatives to stimulate economic growth, coupled with continued investment in infrastructure and tourism, will propel market expansion. The rising population and increasing urbanization will further fuel demand. The adoption of sustainable practices and technological advancements will shape the future landscape, creating opportunities for innovation and efficiency. The market is expected to experience a steady growth trajectory over the forecast period, driven primarily by these factors.

Oman Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Muscat

- 2.2. Dhofar

- 2.3. Musandam

Oman Residential Real Estate Industry Segmentation By Geography

- 1. Oman

Oman Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urabanization4.; Increasing government investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market

- 3.4. Market Trends

- 3.4.1. Supply of Residential Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Muscat

- 5.2.2. Dhofar

- 5.2.3. Musandam

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Edara Real Estate LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al Raid Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Madina Real Estate Company Muscat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Maysan Properties SAOC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al Mouj Muscat

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coldwell Banker

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Better Homes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harbor Real Estate

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hilal Properties

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al-Taher Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Abu Malak Global Enterprises Muscat

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Savills

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Wujha Real Estate

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Saraya Bandar Jissah**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Orascom Development Holding AG

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Engel & Voelkers

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Edara Real Estate LLC

List of Figures

- Figure 1: Oman Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Oman Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Oman Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Oman Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Oman Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Oman Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Oman Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Oman Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Residential Real Estate Industry?

The projected CAGR is approximately 9.19%.

2. Which companies are prominent players in the Oman Residential Real Estate Industry?

Key companies in the market include Edara Real Estate LLC, Al Raid Group, Al Madina Real Estate Company Muscat, Maysan Properties SAOC, Al Mouj Muscat, Coldwell Banker, Better Homes, Harbor Real Estate, Hilal Properties, Al-Taher Group, Abu Malak Global Enterprises Muscat, Savills, Wujha Real Estate, Saraya Bandar Jissah**List Not Exhaustive, Orascom Development Holding AG, Engel & Voelkers.

3. What are the main segments of the Oman Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.38 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urabanization4.; Increasing government investments.

6. What are the notable trends driving market growth?

Supply of Residential Buildings.

7. Are there any restraints impacting market growth?

4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market.

8. Can you provide examples of recent developments in the market?

October 2022, Al Mouj Muscat launched phase 2 of Zunairah Mansions in the Shatti District. The new phase of the mansions comes in different styles and features six opulent bedrooms with a built-up area of 933 square meters, a garage, covered parking for up to six automobiles, and roomy servant quarters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Oman Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence