Key Insights

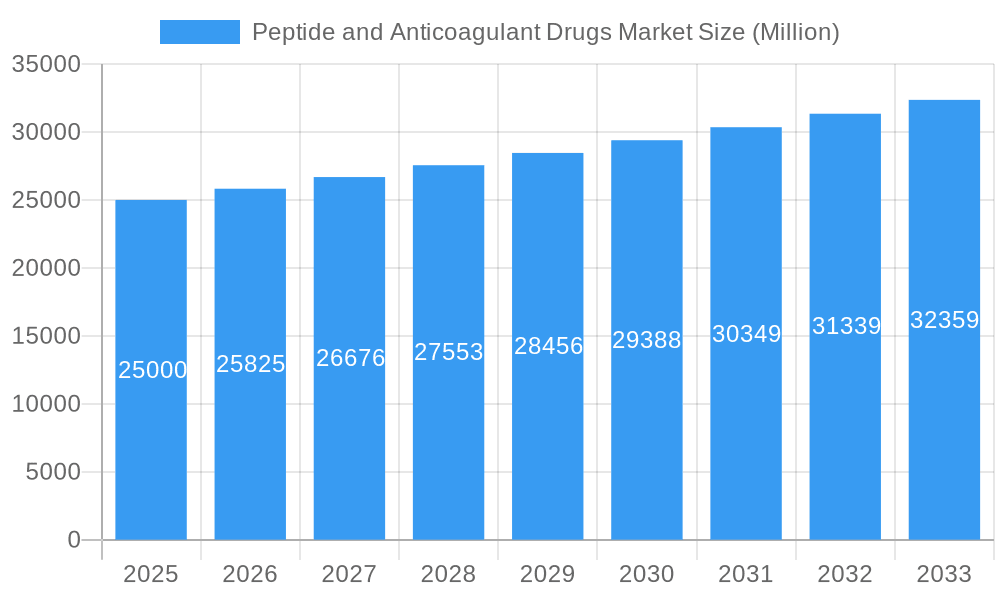

The global Peptide and Anticoagulant Drugs Market is projected for substantial growth, expected to reach $2.22 billion by 2025 and grow at a CAGR of 9.3% through 2033. This expansion is driven by the rising incidence of chronic diseases, including metabolic disorders, cancer, and cardiovascular conditions such as atrial fibrillation, stroke, deep vein thrombosis (DVT), and pulmonary embolism. Growing understanding of peptide therapeutics and advancements in drug delivery are key catalysts. Increased global healthcare expenditure and an aging population further sustain demand.

Peptide and Anticoagulant Drugs Market Market Size (In Billion)

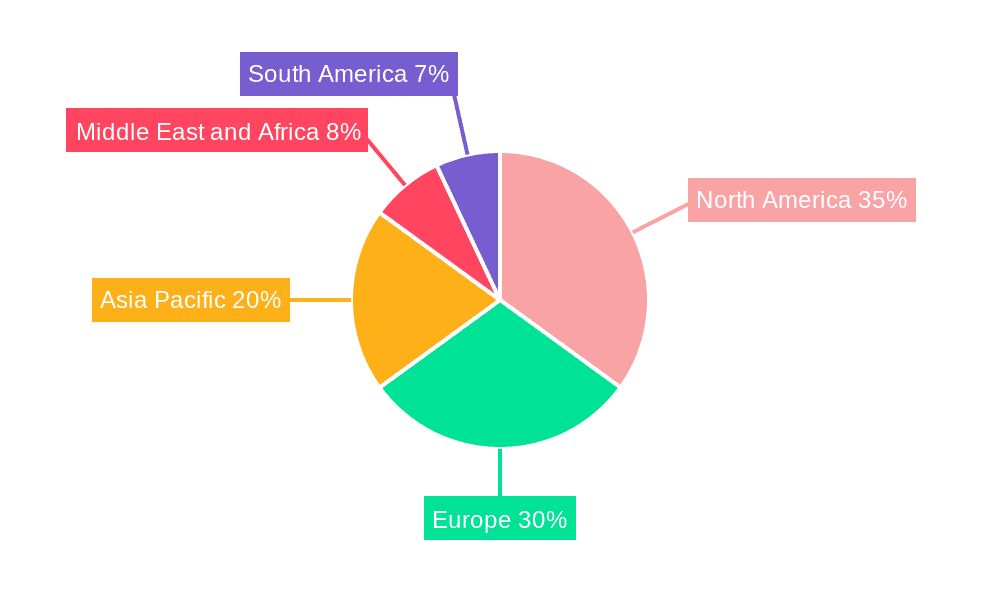

Market segmentation reveals distinct growth areas. For peptide drugs, while parenteral administration remains dominant, research into oral and mucosal delivery systems is intensifying. Key application areas include gastrointestinal, neurological, metabolic disorders, and oncology. For anticoagulant drugs, Atrial Fibrillation and Heart Attack are the leading application segments, followed by Stroke, DVT, and PE, benefiting from improved diagnostics and treatments. Geographically, North America and Europe lead, but the Asia Pacific region is anticipated to exhibit the fastest growth due to a large patient base and increasing R&D investments. Key players are actively pursuing strategic partnerships and product innovations.

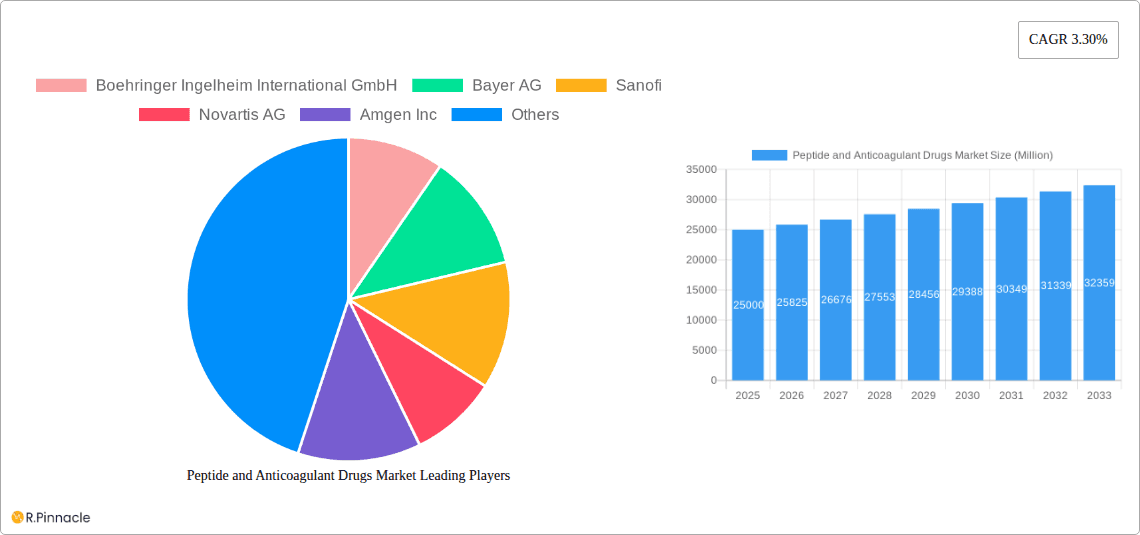

Peptide and Anticoagulant Drugs Market Company Market Share

This report offers an in-depth analysis of the global Peptide and Anticoagulant Drugs Market from 2019 to 2033, with a base year of 2025. It examines market structure, dynamics, regional trends, product innovations, and future outlook. This essential resource provides actionable insights for pharmaceutical manufacturers, biotech firms, research institutions, and investors.

Peptide and Anticoagulant Drugs Market Market Structure & Innovation Trends

The Peptide and Anticoagulant Drugs Market exhibits a moderately concentrated structure, with key players investing heavily in research and development to drive innovation. The market is shaped by stringent regulatory frameworks governing drug approval and pricing, influencing product lifecycles and market entry strategies. Innovation is primarily driven by advancements in peptide synthesis, delivery mechanisms, and the development of novel anticoagulant mechanisms of action, aiming to improve efficacy and patient safety. Product substitutes are emerging, particularly in the anticoagulant segment, with newer oral anticoagulants (NOACs) posing competition to traditional options. End-user demographics are increasingly characterized by an aging global population and a rise in chronic diseases, boosting demand for both therapeutic classes. Mergers and acquisitions (M&A) activities are significant, with companies aiming to expand their product portfolios and gain market share. For instance, recent M&A deals in the broader pharmaceutical landscape, valued in the hundreds of millions, highlight the strategic importance of acquiring innovative drug candidates and established market positions. The market share distribution among the top players is dynamic, influenced by patent expirations and the launch of new blockbuster drugs.

Peptide and Anticoagulant Drugs Market Market Dynamics & Trends

The Peptide and Anticoagulant Drugs Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is fueled by several critical market growth drivers. The escalating prevalence of cardiovascular diseases, including atrial fibrillation, stroke, deep vein thrombosis (DVT), and pulmonary embolism (PE), directly translates into a sustained demand for effective anticoagulant therapies. Concurrently, the increasing incidence of metabolic disorders, gastrointestinal disorders, neurological disorders, and cancer continues to propel the development and adoption of peptide-based therapeutics, which offer targeted and often more efficacious treatment options. Technological disruptions are playing a pivotal role, with ongoing advancements in drug discovery platforms, such as artificial intelligence and machine learning, accelerating the identification of novel drug candidates. Innovations in drug delivery systems, including long-acting injectables and oral peptide formulations, are enhancing patient compliance and therapeutic outcomes, thereby driving market penetration. Consumer preferences are shifting towards less invasive and more convenient treatment regimens, favoring oral anticoagulants and improved peptide delivery methods. The competitive landscape is characterized by intense R&D efforts, strategic collaborations, and a continuous stream of new product launches and approvals. Furthermore, the growing awareness among healthcare professionals and patients about the benefits of newer generation anticoagulants and peptide therapies is contributing to their increased market penetration, estimated to reach XX% by 2033.

Dominant Regions & Segments in Peptide and Anticoagulant Drugs Market

North America, particularly the United States, currently dominates the global Peptide and Anticoagulant Drugs Market, driven by a high prevalence of cardiovascular and metabolic diseases, advanced healthcare infrastructure, and significant R&D investments. The region’s well-established regulatory framework, coupled with strong reimbursement policies, further supports market growth.

- Route of Administration (Peptide Drugs): The Parenteral route of administration for peptide drugs holds a dominant position. This is due to the inherent nature of many peptides, which are susceptible to degradation in the gastrointestinal tract, necessitating injection for optimal bioavailability. Advancements in subcutaneous and intravenous delivery systems continue to refine this administration route, making it more patient-friendly and efficient for conditions like diabetes and growth hormone deficiencies.

- Route of Administration (Anticoagulant Drugs): The Injectable route remains crucial for certain anticoagulant therapies, especially in acute settings and for patients unable to manage oral medications. However, the market share is gradually shifting towards oral formulations.

- Application (Peptide Drugs): Metabolic Disorders, primarily diabetes and obesity, represent a significant application segment for peptide drugs. The development of GLP-1 receptor agonists has revolutionized the management of these conditions. Cancer is another rapidly growing segment, with peptide-based therapies showing promise in targeted drug delivery and immunotherapy.

- Application (Anticoagulant Drugs): Atrial Fibrillation and Heart Attack represent the largest application segment for anticoagulant drugs, reflecting the high incidence of these conditions globally. The need for effective stroke prevention in patients with atrial fibrillation is a primary market driver. Stroke and Deep Vein Thrombosis (DVT) & Pulmonary Embolism (PE) are also substantial segments, underscoring the critical role of anticoagulants in managing and preventing life-threatening thromboembolic events.

Peptide and Anticoagulant Drugs Market Product Innovations

The Peptide and Anticoagulant Drugs Market is witnessing a surge in product innovations focused on enhancing therapeutic efficacy, reducing side effects, and improving patient convenience. Key developments include the creation of novel peptide analogs with improved pharmacokinetics and pharmacodynamics, offering better disease management for conditions like diabetes and obesity. In the anticoagulant space, the development of direct oral anticoagulants (DOACs) has been a major innovation, providing a safer and more predictable alternative to warfarin. Innovations are also geared towards targeted drug delivery systems, such as antibody-drug conjugates and nanocarriers, which aim to deliver peptide therapeutics directly to disease sites, minimizing systemic exposure and enhancing treatment outcomes. These advancements are crucial for gaining a competitive edge and addressing unmet medical needs.

Report Scope & Segmentation Analysis

This report provides a granular segmentation of the Peptide and Anticoagulant Drugs Market. For Peptide Drugs, we analyze the Route of Administration, including Parenteral, Oral, Mucosal, and Other Routes, with Parenteral expected to lead due to established efficacy. Key applications include Gastrointestinal Disorders, Neurological Disorders, Metabolic Disorders, Cancer, and Other Applications, with Metabolic Disorders and Cancer showing strong growth potential. For Anticoagulant Drugs, the primary focus is on the Injectable route of administration, although oral formulations are dominant overall. Applications are segmented into Atrial Fibrillation and Heart Attack, Stroke, Deep Vein Thrombosis (DVT), and Pulmonary Embolism (PE), all representing significant market segments due to the high disease burden. Growth projections and competitive dynamics are detailed for each segment, providing a comprehensive market overview.

Key Drivers of Peptide and Anticoagulant Drugs Market Growth

The growth of the Peptide and Anticoagulant Drugs Market is propelled by several key factors. The increasing global burden of chronic diseases, particularly cardiovascular and metabolic disorders, is a primary driver, leading to sustained demand for both therapeutic classes. Technological advancements in drug discovery and development, including genetic engineering and novel formulation techniques, are enabling the creation of more effective and safer peptide and anticoagulant therapies. Favorable regulatory landscapes in developed economies, coupled with government initiatives to promote healthcare access and innovation, also contribute significantly. Furthermore, the growing awareness and acceptance of newer generation anticoagulants and advanced peptide treatments among healthcare providers and patients are accelerating market penetration and adoption rates.

Challenges in the Peptide and Anticoagulant Drugs Market Sector

Despite robust growth prospects, the Peptide and Anticoagulant Drugs Market faces several challenges. High research and development costs, coupled with stringent and lengthy regulatory approval processes, can hinder the timely launch of new products. The expiration of patents for blockbuster drugs leads to increased competition from generic manufacturers, impacting revenue streams. Supply chain complexities, particularly for biologics and specialized peptide manufacturing, can pose logistical hurdles. Additionally, pricing pressures from healthcare payers and government bodies, aiming to control healthcare expenditures, can affect profitability. The emergence of alternative therapies and the need for continuous monitoring and patient education for certain anticoagulants also present ongoing challenges.

Emerging Opportunities in Peptide and Anticoagulant Drugs Market

The Peptide and Anticoagulant Drugs Market presents numerous emerging opportunities. The growing demand for personalized medicine is driving research into peptide-based therapies tailored to individual patient profiles and genetic markers. Advancements in nanotechnology and drug delivery systems offer opportunities for developing more targeted and sustained-release formulations for both peptides and anticoagulants, enhancing efficacy and reducing dosing frequency. The expanding healthcare infrastructure and increasing disposable incomes in emerging economies, such as Asia-Pacific and Latin America, represent significant untapped markets for these therapeutics. Furthermore, the exploration of novel peptide applications in areas beyond traditional metabolic and oncological indications, such as dermatology and regenerative medicine, holds substantial future potential.

Leading Players in the Peptide and Anticoagulant Drugs Market Market

- Boehringer Ingelheim International GmbH

- Bayer AG

- Sanofi

- Novartis AG

- Amgen Inc

- Daiichi Sankyo Company

- Johnson & Johnson

- Novo Nordisk AS

- EVER Pharma

- Bristol-Myers Squibb Company

- Pfizer Inc

Key Developments in Peptide and Anticoagulant Drugs Market Industry

- October 2022: Tiefeenbacher Pharmaceuticals launched the generic version of Apixaban for an early market entry in Canada. Apixaban is an oral anticoagulant (blood thinner) indicated for preventing venous thromboembolism (VTE) in adult patients.

- February 2022: Bayer AG won fast-track status from the US FDA drug regulators for a new blood thinner designed to prevent certain types of strokes. The FDA granted fast-track designation for the review of drug candidate asundexian when tested to prevent a repeat in patients that suffered a non-cardioembolic stroke from clogged vessels.

Future Outlook for Peptide and Anticoagulant Drugs Market Market

The future outlook for the Peptide and Anticoagulant Drugs Market remains exceptionally positive, driven by sustained innovation and expanding therapeutic applications. The ongoing advancements in biotechnology will continue to fuel the development of more potent and targeted peptide therapies for a wider range of diseases, including rare genetic disorders and autoimmune conditions. In the anticoagulant segment, the focus will likely shift towards even safer and more effective oral options, potentially with improved reversal agents. Strategic collaborations between pharmaceutical giants and biotech startups will accelerate the translation of novel research into commercially viable products. Furthermore, the increasing global emphasis on preventative healthcare and the management of chronic diseases will ensure a consistent and growing demand for both peptide and anticoagulant drugs, positioning the market for significant long-term expansion and profitability.

Peptide and Anticoagulant Drugs Market Segmentation

-

1. Route of Administration

-

1.1. Peptide Drugs

- 1.1.1. Parenteral

- 1.1.2. Oral

- 1.1.3. Mucosal

- 1.1.4. Other Routes of Administration

-

1.2. Anticoagulant Drugs

- 1.2.1. Injectable

-

1.1. Peptide Drugs

-

2. Application

-

2.1. Peptide Drugs

- 2.1.1. Gastrointestinal Disorders

- 2.1.2. Neurological Disorders

- 2.1.3. Metabolic Disorders

- 2.1.4. Cancer

- 2.1.5. Other Applications

-

2.2. Anticoagulant Drugs

- 2.2.1. Atrial Fibrillation and Heart Attack

- 2.2.2. Stroke

- 2.2.3. Deep Vein Thrombosis (DVT)

- 2.2.4. Pulmonary Embolism (PE)

-

2.1. Peptide Drugs

Peptide and Anticoagulant Drugs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Peptide and Anticoagulant Drugs Market Regional Market Share

Geographic Coverage of Peptide and Anticoagulant Drugs Market

Peptide and Anticoagulant Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cancer and Metabolic Disorders; Rising Investments in R&D of Novel Drugs; Technological Advancements in Drug Development

- 3.3. Market Restrains

- 3.3.1. High Cost of Developing Drugs; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Cancer Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Peptide and Anticoagulant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Peptide Drugs

- 5.1.1.1. Parenteral

- 5.1.1.2. Oral

- 5.1.1.3. Mucosal

- 5.1.1.4. Other Routes of Administration

- 5.1.2. Anticoagulant Drugs

- 5.1.2.1. Injectable

- 5.1.1. Peptide Drugs

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Peptide Drugs

- 5.2.1.1. Gastrointestinal Disorders

- 5.2.1.2. Neurological Disorders

- 5.2.1.3. Metabolic Disorders

- 5.2.1.4. Cancer

- 5.2.1.5. Other Applications

- 5.2.2. Anticoagulant Drugs

- 5.2.2.1. Atrial Fibrillation and Heart Attack

- 5.2.2.2. Stroke

- 5.2.2.3. Deep Vein Thrombosis (DVT)

- 5.2.2.4. Pulmonary Embolism (PE)

- 5.2.1. Peptide Drugs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. North America Peptide and Anticoagulant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6.1.1. Peptide Drugs

- 6.1.1.1. Parenteral

- 6.1.1.2. Oral

- 6.1.1.3. Mucosal

- 6.1.1.4. Other Routes of Administration

- 6.1.2. Anticoagulant Drugs

- 6.1.2.1. Injectable

- 6.1.1. Peptide Drugs

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Peptide Drugs

- 6.2.1.1. Gastrointestinal Disorders

- 6.2.1.2. Neurological Disorders

- 6.2.1.3. Metabolic Disorders

- 6.2.1.4. Cancer

- 6.2.1.5. Other Applications

- 6.2.2. Anticoagulant Drugs

- 6.2.2.1. Atrial Fibrillation and Heart Attack

- 6.2.2.2. Stroke

- 6.2.2.3. Deep Vein Thrombosis (DVT)

- 6.2.2.4. Pulmonary Embolism (PE)

- 6.2.1. Peptide Drugs

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7. Europe Peptide and Anticoagulant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7.1.1. Peptide Drugs

- 7.1.1.1. Parenteral

- 7.1.1.2. Oral

- 7.1.1.3. Mucosal

- 7.1.1.4. Other Routes of Administration

- 7.1.2. Anticoagulant Drugs

- 7.1.2.1. Injectable

- 7.1.1. Peptide Drugs

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Peptide Drugs

- 7.2.1.1. Gastrointestinal Disorders

- 7.2.1.2. Neurological Disorders

- 7.2.1.3. Metabolic Disorders

- 7.2.1.4. Cancer

- 7.2.1.5. Other Applications

- 7.2.2. Anticoagulant Drugs

- 7.2.2.1. Atrial Fibrillation and Heart Attack

- 7.2.2.2. Stroke

- 7.2.2.3. Deep Vein Thrombosis (DVT)

- 7.2.2.4. Pulmonary Embolism (PE)

- 7.2.1. Peptide Drugs

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8. Asia Pacific Peptide and Anticoagulant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8.1.1. Peptide Drugs

- 8.1.1.1. Parenteral

- 8.1.1.2. Oral

- 8.1.1.3. Mucosal

- 8.1.1.4. Other Routes of Administration

- 8.1.2. Anticoagulant Drugs

- 8.1.2.1. Injectable

- 8.1.1. Peptide Drugs

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Peptide Drugs

- 8.2.1.1. Gastrointestinal Disorders

- 8.2.1.2. Neurological Disorders

- 8.2.1.3. Metabolic Disorders

- 8.2.1.4. Cancer

- 8.2.1.5. Other Applications

- 8.2.2. Anticoagulant Drugs

- 8.2.2.1. Atrial Fibrillation and Heart Attack

- 8.2.2.2. Stroke

- 8.2.2.3. Deep Vein Thrombosis (DVT)

- 8.2.2.4. Pulmonary Embolism (PE)

- 8.2.1. Peptide Drugs

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 9. Middle East and Africa Peptide and Anticoagulant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Route of Administration

- 9.1.1. Peptide Drugs

- 9.1.1.1. Parenteral

- 9.1.1.2. Oral

- 9.1.1.3. Mucosal

- 9.1.1.4. Other Routes of Administration

- 9.1.2. Anticoagulant Drugs

- 9.1.2.1. Injectable

- 9.1.1. Peptide Drugs

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Peptide Drugs

- 9.2.1.1. Gastrointestinal Disorders

- 9.2.1.2. Neurological Disorders

- 9.2.1.3. Metabolic Disorders

- 9.2.1.4. Cancer

- 9.2.1.5. Other Applications

- 9.2.2. Anticoagulant Drugs

- 9.2.2.1. Atrial Fibrillation and Heart Attack

- 9.2.2.2. Stroke

- 9.2.2.3. Deep Vein Thrombosis (DVT)

- 9.2.2.4. Pulmonary Embolism (PE)

- 9.2.1. Peptide Drugs

- 9.1. Market Analysis, Insights and Forecast - by Route of Administration

- 10. South America Peptide and Anticoagulant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Route of Administration

- 10.1.1. Peptide Drugs

- 10.1.1.1. Parenteral

- 10.1.1.2. Oral

- 10.1.1.3. Mucosal

- 10.1.1.4. Other Routes of Administration

- 10.1.2. Anticoagulant Drugs

- 10.1.2.1. Injectable

- 10.1.1. Peptide Drugs

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Peptide Drugs

- 10.2.1.1. Gastrointestinal Disorders

- 10.2.1.2. Neurological Disorders

- 10.2.1.3. Metabolic Disorders

- 10.2.1.4. Cancer

- 10.2.1.5. Other Applications

- 10.2.2. Anticoagulant Drugs

- 10.2.2.1. Atrial Fibrillation and Heart Attack

- 10.2.2.2. Stroke

- 10.2.2.3. Deep Vein Thrombosis (DVT)

- 10.2.2.4. Pulmonary Embolism (PE)

- 10.2.1. Peptide Drugs

- 10.1. Market Analysis, Insights and Forecast - by Route of Administration

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim International GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sanofi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Novartis AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amgen Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Daiichi Sankyo Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Novo Nordisk AS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EVER Pharma

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bristol-Myers Squibb Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfizer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim International GmbH

List of Figures

- Figure 1: Global Peptide and Anticoagulant Drugs Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Peptide and Anticoagulant Drugs Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Peptide and Anticoagulant Drugs Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 4: North America Peptide and Anticoagulant Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 5: North America Peptide and Anticoagulant Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 6: North America Peptide and Anticoagulant Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 7: North America Peptide and Anticoagulant Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Peptide and Anticoagulant Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Peptide and Anticoagulant Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Peptide and Anticoagulant Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Peptide and Anticoagulant Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Peptide and Anticoagulant Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Peptide and Anticoagulant Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Peptide and Anticoagulant Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Peptide and Anticoagulant Drugs Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 16: Europe Peptide and Anticoagulant Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 17: Europe Peptide and Anticoagulant Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 18: Europe Peptide and Anticoagulant Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 19: Europe Peptide and Anticoagulant Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Peptide and Anticoagulant Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Peptide and Anticoagulant Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Peptide and Anticoagulant Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Peptide and Anticoagulant Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Peptide and Anticoagulant Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Peptide and Anticoagulant Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Peptide and Anticoagulant Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Peptide and Anticoagulant Drugs Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 28: Asia Pacific Peptide and Anticoagulant Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 29: Asia Pacific Peptide and Anticoagulant Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 30: Asia Pacific Peptide and Anticoagulant Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 31: Asia Pacific Peptide and Anticoagulant Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Pacific Peptide and Anticoagulant Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Peptide and Anticoagulant Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Peptide and Anticoagulant Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Peptide and Anticoagulant Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Peptide and Anticoagulant Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Peptide and Anticoagulant Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Peptide and Anticoagulant Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Peptide and Anticoagulant Drugs Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 40: Middle East and Africa Peptide and Anticoagulant Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 41: Middle East and Africa Peptide and Anticoagulant Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 42: Middle East and Africa Peptide and Anticoagulant Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 43: Middle East and Africa Peptide and Anticoagulant Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 44: Middle East and Africa Peptide and Anticoagulant Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Peptide and Anticoagulant Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Peptide and Anticoagulant Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Peptide and Anticoagulant Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Peptide and Anticoagulant Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Peptide and Anticoagulant Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Peptide and Anticoagulant Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Peptide and Anticoagulant Drugs Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 52: South America Peptide and Anticoagulant Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 53: South America Peptide and Anticoagulant Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 54: South America Peptide and Anticoagulant Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 55: South America Peptide and Anticoagulant Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 56: South America Peptide and Anticoagulant Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: South America Peptide and Anticoagulant Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Peptide and Anticoagulant Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Peptide and Anticoagulant Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Peptide and Anticoagulant Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Peptide and Anticoagulant Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Peptide and Anticoagulant Drugs Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 2: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 3: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 8: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 9: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 20: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 21: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 38: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 39: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 56: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 57: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 58: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 68: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 69: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 70: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 71: Global Peptide and Anticoagulant Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Peptide and Anticoagulant Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Peptide and Anticoagulant Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Peptide and Anticoagulant Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peptide and Anticoagulant Drugs Market?

The projected CAGR is approximately 9.3%.

2. Which companies are prominent players in the Peptide and Anticoagulant Drugs Market?

Key companies in the market include Boehringer Ingelheim International GmbH, Bayer AG, Sanofi, Novartis AG, Amgen Inc, Daiichi Sankyo Company, Johnson & Johnson, Novo Nordisk AS, EVER Pharma, Bristol-Myers Squibb Company, Pfizer Inc.

3. What are the main segments of the Peptide and Anticoagulant Drugs Market?

The market segments include Route of Administration, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.22 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cancer and Metabolic Disorders; Rising Investments in R&D of Novel Drugs; Technological Advancements in Drug Development.

6. What are the notable trends driving market growth?

Cancer Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Developing Drugs; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

In October 2022, Tiefeenbacher Pharmaceuticals launched the generic version of Apixaban for an early market entry in Canada. Apixaban is an oral anticoagulant (blood thinner) indicated for preventing venous thromboembolism (VTE) in adult patients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peptide and Anticoagulant Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peptide and Anticoagulant Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peptide and Anticoagulant Drugs Market?

To stay informed about further developments, trends, and reports in the Peptide and Anticoagulant Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence