Key Insights

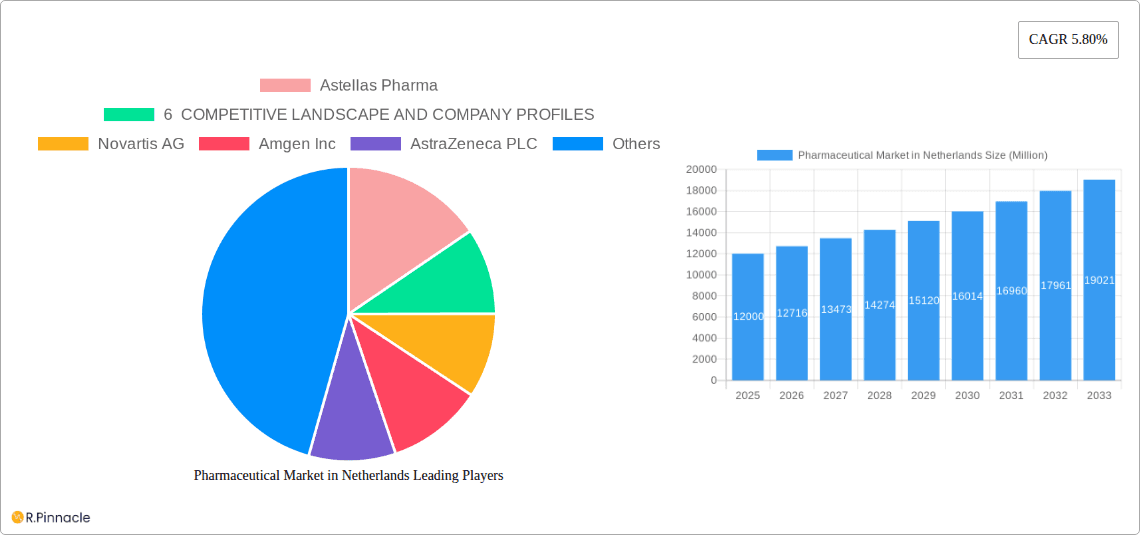

The Netherlands pharmaceutical market, driven by an aging population, increasing chronic disease prevalence, and robust healthcare spending, is poised for significant growth. While specific data for the Netherlands is not provided, leveraging the global Compound Annual Growth Rate (CAGR) of 5.80% and regional trends offers valuable insights. Given the Netherlands' advanced healthcare system and high per capita expenditure, a growth rate mirroring or exceeding the global average is anticipated. The market is segmented by therapeutic area, including cardiovascular, oncology, and CNS, and by dispensing mode, encompassing prescription and over-the-counter (OTC) drugs. Key global players are expected to maintain a strong presence, fostering intense competition. Emerging trends such as the adoption of biosimilars, personalized medicine, and digital health technologies will shape market dynamics. However, stringent regulatory approval processes and government pricing policies may pose challenges. Based on the global market size and the Netherlands' economic and healthcare standing within Europe, the market size is estimated at 9.92 billion in 2025. The market is projected to grow at a CAGR of 7.5 through the forecast period (2025-2033).

Pharmaceutical Market in Netherlands Market Size (In Billion)

The pharmaceutical landscape in the Netherlands is expected to align with broader European patterns, with prescription drugs dominating the market share over OTC alternatives. Therapeutic segments such as cardiovascular, oncology, and CNS are likely to represent the largest segments, reflecting global public health priorities. The presence of major multinational pharmaceutical corporations signifies a competitive environment characterized by both established brands and innovative therapies. Future growth will be propelled by evolving healthcare policies, technological advancements, and the demographic shift towards an older population with a higher burden of chronic diseases. Projections indicate sustained positive market growth, primarily fueled by pharmaceutical innovation and the increasing demand for effective treatments.

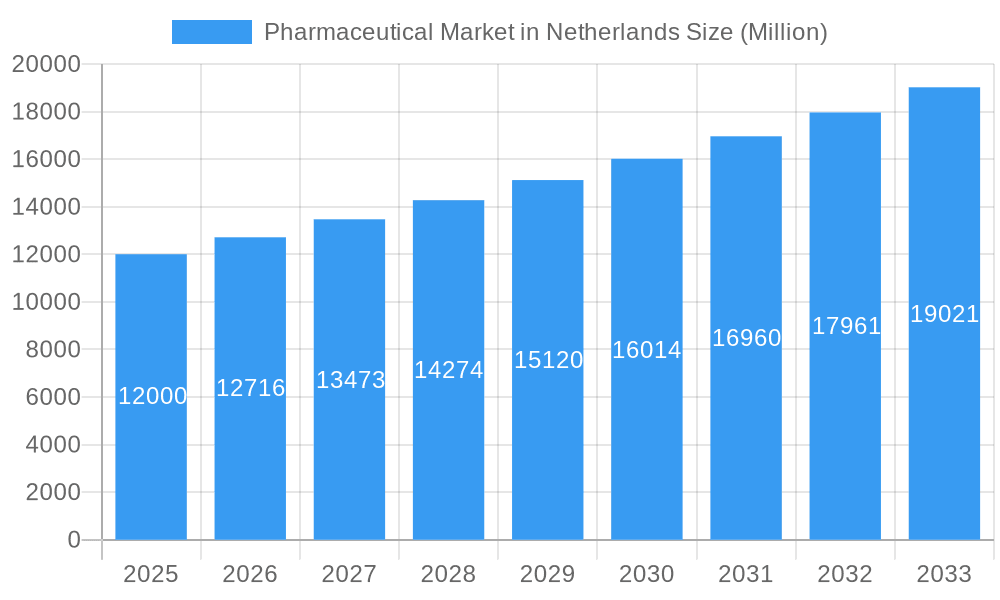

Pharmaceutical Market in Netherlands Company Market Share

Pharmaceutical Market in Netherlands: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Netherlands pharmaceutical market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research and data analysis to deliver actionable intelligence. The report covers key segments, dominant players, and emerging trends, offering a detailed picture of this dynamic market. Expect precise market sizing (in Millions) and insightful CAGR projections throughout.

Pharmaceutical Market in Netherlands Market Structure & Innovation Trends

The Netherlands pharmaceutical market exhibits a moderately concentrated structure, with several multinational giants holding significant market share. Key players include Astellas Pharma, Novartis AG, Amgen Inc, AstraZeneca PLC, Abbott Laboratories, F Hoffmann-La Roche AG, AbbVie Inc, Johnson & Johnson, Merck & Co, and Pfizer Inc. Market concentration is estimated at xx%, with the top 5 companies accounting for approximately xx Million in revenue in 2024. Innovation is driven by factors such as a robust R&D ecosystem, supportive government policies, and a focus on personalized medicine. Regulatory frameworks, aligned with European Union standards, influence product development and market entry. The market experiences moderate M&A activity, with deal values typically ranging from xx Million to xx Million. Recent deals focused on expanding therapeutic areas and geographical reach. Substitutes, particularly generic drugs, exert pressure on pricing. The end-user demographic is largely comprised of an aging population, driving demand for chronic disease treatments.

- Market Concentration: xx% (estimated)

- Top 5 Companies Revenue (2024): xx Million

- Average M&A Deal Value: xx - xx Million

Pharmaceutical Market in Netherlands Market Dynamics & Trends

The Netherlands pharmaceutical market is characterized by robust growth, driven primarily by an aging population and rising prevalence of chronic diseases. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as advancements in biotechnology and personalized medicine, are reshaping the landscape. Consumer preferences are shifting towards more convenient and accessible treatment options, including biosimilars and home-based therapies. Competitive dynamics are influenced by pricing pressures, patent expiries, and the emergence of innovative therapies. Market penetration of novel therapies varies considerably across therapeutic areas, with higher penetration observed in oncology and immunology. Specific therapeutic areas like cardiovascular and metabolic diseases account for a substantial portion of the market share, indicating significant future growth opportunity. The increasing pressure on healthcare costs is another vital aspect affecting market trends.

Dominant Regions & Segments in Pharmaceutical Market in Netherlands

While the Netherlands is a relatively small country, market dominance is concentrated in the urban areas with high population density and better healthcare infrastructure. The Prescription segment significantly surpasses the OTC market segment in terms of revenue and growth. Within therapeutic classes, Cardiovascular System and Antineoplastic and Immunomodulating Agents show the largest market share and growth potential.

- Dominant Regions: Urban areas with high population density.

- Leading ATC Classes: Cardiovascular System, Antineoplastic and Immunomodulating Agents, Alimentary Tract and Metabolism.

- Dominant Mode of Dispensing: Prescription

Key Drivers (all segments):

- Aging population leading to increased chronic disease prevalence.

- Growing healthcare expenditure.

- Government support for pharmaceutical innovation.

- Strong healthcare infrastructure.

Pharmaceutical Market in Netherlands Product Innovations

Recent product innovations in the Netherlands pharmaceutical market focus on advanced therapies like targeted cancer treatments and biologics. These advancements cater to unmet medical needs and offer improved efficacy and safety profiles. Companies are leveraging technological breakthroughs in drug delivery systems to enhance patient compliance and minimize side effects. Market fit is primarily determined by regulatory approvals, pricing strategies, and reimbursement policies.

Report Scope & Segmentation Analysis

This report segments the Netherlands pharmaceutical market by ATC/Therapeutic Class (Alimentary Tract and Metabolism, Blood and Blood-forming Organs, Cardiovascular System, Dermatological Drugs, Genitourinary System and Reproductive Hormones, Systemic, Antiinfectives for Systemic Use, Antineoplastic and Immunomodulating Agents, Musculoskeletal System, Nervous System, Antiparasitic Products, Respiratory System, Sensory Organs, Various ATC Structures) and Mode of Dispensing (Prescription, OTC). Each segment's growth projection, market size, and competitive dynamics are comprehensively analyzed. The report provides detailed data for each segment, including market size and growth predictions, and detailed competitive landscape analysis with an evaluation of the market share of major players. Detailed analysis for each segment is beyond the scope of this description.

Key Drivers of Pharmaceutical Market in Netherlands Growth

The growth of the Netherlands pharmaceutical market is propelled by several factors: a rapidly aging population increasing the demand for chronic disease treatments, rising healthcare expenditure driven by government initiatives and increased health awareness, and a supportive regulatory environment that encourages innovation and investment. Technological advancements in drug discovery and development, alongside an increase in the adoption of new treatments, also significantly contribute to market expansion.

Challenges in the Pharmaceutical Market in Netherlands Sector

The Netherlands pharmaceutical market faces challenges such as stringent regulatory hurdles that increase drug development costs and time-to-market, potential supply chain disruptions due to global events, and intense price competition from generic drugs impacting profitability. These factors can hinder market growth and necessitate strategic responses from pharmaceutical companies. The impact of these challenges is estimated to reduce the market growth by approximately xx% in the next 5 years.

Emerging Opportunities in Pharmaceutical Market in Netherlands

Emerging opportunities include the growing demand for personalized medicine, the increasing adoption of digital health technologies for patient engagement and remote monitoring, and the potential for growth in emerging therapeutic areas. Further, increased focus on preventative care presents a large opportunity for the pharmaceutical industry, and the biosimilars market is predicted to experience significant growth in the next few years.

Leading Players in the Pharmaceutical Market in Netherlands Market

Key Developments in Pharmaceutical Market in Netherlands Industry

- July 2022: The US FDA issued a warning letter to a Dutch producer of active pharmaceutical ingredients (APIs), highlighting concerns about equipment cleaning practices and cross-contamination prevention. This impacted the supply chain and emphasized the need for improved quality control.

- May 2022: Centrient Pharmaceuticals achieved 100% compliance with stringent Predicted No Effect Concentration (PNEC) discharge targets, demonstrating a commitment to sustainable manufacturing practices and addressing antimicrobial resistance concerns. This positive development enhances the Netherlands' reputation for responsible pharmaceutical manufacturing.

Future Outlook for Pharmaceutical Market in Netherlands Market

The future of the Netherlands pharmaceutical market appears promising, driven by sustained growth in healthcare expenditure, continued innovation in drug development, and the increasing adoption of advanced therapies. Strategic opportunities exist for companies to capitalize on the growing demand for personalized medicine, digital health solutions, and biosimilars. The market is poised for substantial growth, exceeding xx Million by 2033, driven by these factors and strong government support for the sector.

Pharmaceutical Market in Netherlands Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Alimentary Tract and Metabolisma

- 1.2. Blood and Blood-forming Organs

- 1.3. Cardiovascular System

- 1.4. Dermatological Drugs

- 1.5. Genitourinary System and Reproductive Hormones

- 1.6. Systemic

- 1.7. Antiinfectives for Systemic Use

- 1.8. Antineoplastic and Immunomodulating Agents

- 1.9. Musculoskeletal System

- 1.10. Nervous System

- 1.11. Antipara

- 1.12. Respiratory System

- 1.13. Sensory Organs

- 1.14. Various ATC Structures

-

2. Mode of Dispensing

- 2.1. Prescription

- 2.2. OTC

Pharmaceutical Market in Netherlands Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pharmaceutical Market in Netherlands Regional Market Share

Geographic Coverage of Pharmaceutical Market in Netherlands

Pharmaceutical Market in Netherlands REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Presence of Better Research Institutes

- 3.2.2 Excellent Healthcare System

- 3.2.3 and an Innovation-friendly Government; Rising Cases of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. High Failure Rate and Developing Cost of New Products

- 3.4. Market Trends

- 3.4.1. Cardiovascular Segment is Expected to Hold a Significant Market Share over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Alimentary Tract and Metabolisma

- 5.1.2. Blood and Blood-forming Organs

- 5.1.3. Cardiovascular System

- 5.1.4. Dermatological Drugs

- 5.1.5. Genitourinary System and Reproductive Hormones

- 5.1.6. Systemic

- 5.1.7. Antiinfectives for Systemic Use

- 5.1.8. Antineoplastic and Immunomodulating Agents

- 5.1.9. Musculoskeletal System

- 5.1.10. Nervous System

- 5.1.11. Antipara

- 5.1.12. Respiratory System

- 5.1.13. Sensory Organs

- 5.1.14. Various ATC Structures

- 5.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 5.2.1. Prescription

- 5.2.2. OTC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. North America Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6.1.1. Alimentary Tract and Metabolisma

- 6.1.2. Blood and Blood-forming Organs

- 6.1.3. Cardiovascular System

- 6.1.4. Dermatological Drugs

- 6.1.5. Genitourinary System and Reproductive Hormones

- 6.1.6. Systemic

- 6.1.7. Antiinfectives for Systemic Use

- 6.1.8. Antineoplastic and Immunomodulating Agents

- 6.1.9. Musculoskeletal System

- 6.1.10. Nervous System

- 6.1.11. Antipara

- 6.1.12. Respiratory System

- 6.1.13. Sensory Organs

- 6.1.14. Various ATC Structures

- 6.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 6.2.1. Prescription

- 6.2.2. OTC

- 6.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 7. South America Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 7.1.1. Alimentary Tract and Metabolisma

- 7.1.2. Blood and Blood-forming Organs

- 7.1.3. Cardiovascular System

- 7.1.4. Dermatological Drugs

- 7.1.5. Genitourinary System and Reproductive Hormones

- 7.1.6. Systemic

- 7.1.7. Antiinfectives for Systemic Use

- 7.1.8. Antineoplastic and Immunomodulating Agents

- 7.1.9. Musculoskeletal System

- 7.1.10. Nervous System

- 7.1.11. Antipara

- 7.1.12. Respiratory System

- 7.1.13. Sensory Organs

- 7.1.14. Various ATC Structures

- 7.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 7.2.1. Prescription

- 7.2.2. OTC

- 7.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 8. Europe Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 8.1.1. Alimentary Tract and Metabolisma

- 8.1.2. Blood and Blood-forming Organs

- 8.1.3. Cardiovascular System

- 8.1.4. Dermatological Drugs

- 8.1.5. Genitourinary System and Reproductive Hormones

- 8.1.6. Systemic

- 8.1.7. Antiinfectives for Systemic Use

- 8.1.8. Antineoplastic and Immunomodulating Agents

- 8.1.9. Musculoskeletal System

- 8.1.10. Nervous System

- 8.1.11. Antipara

- 8.1.12. Respiratory System

- 8.1.13. Sensory Organs

- 8.1.14. Various ATC Structures

- 8.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 8.2.1. Prescription

- 8.2.2. OTC

- 8.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 9. Middle East & Africa Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 9.1.1. Alimentary Tract and Metabolisma

- 9.1.2. Blood and Blood-forming Organs

- 9.1.3. Cardiovascular System

- 9.1.4. Dermatological Drugs

- 9.1.5. Genitourinary System and Reproductive Hormones

- 9.1.6. Systemic

- 9.1.7. Antiinfectives for Systemic Use

- 9.1.8. Antineoplastic and Immunomodulating Agents

- 9.1.9. Musculoskeletal System

- 9.1.10. Nervous System

- 9.1.11. Antipara

- 9.1.12. Respiratory System

- 9.1.13. Sensory Organs

- 9.1.14. Various ATC Structures

- 9.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 9.2.1. Prescription

- 9.2.2. OTC

- 9.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 10. Asia Pacific Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 10.1.1. Alimentary Tract and Metabolisma

- 10.1.2. Blood and Blood-forming Organs

- 10.1.3. Cardiovascular System

- 10.1.4. Dermatological Drugs

- 10.1.5. Genitourinary System and Reproductive Hormones

- 10.1.6. Systemic

- 10.1.7. Antiinfectives for Systemic Use

- 10.1.8. Antineoplastic and Immunomodulating Agents

- 10.1.9. Musculoskeletal System

- 10.1.10. Nervous System

- 10.1.11. Antipara

- 10.1.12. Respiratory System

- 10.1.13. Sensory Organs

- 10.1.14. Various ATC Structures

- 10.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 10.2.1. Prescription

- 10.2.2. OTC

- 10.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Astellas Pharma

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 6 COMPETITIVE LANDSCAPE AND COMPANY PROFILES

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amgen Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AstraZeneca PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abbott Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 F Hoffmann-La Roche AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AbbVie Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Merck & Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfizer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Astellas Pharma

List of Figures

- Figure 1: Global Pharmaceutical Market in Netherlands Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Pharmaceutical Market in Netherlands Revenue (billion), by ATC/Therapeutic Class 2025 & 2033

- Figure 3: North America Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2025 & 2033

- Figure 4: North America Pharmaceutical Market in Netherlands Revenue (billion), by Mode of Dispensing 2025 & 2033

- Figure 5: North America Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2025 & 2033

- Figure 6: North America Pharmaceutical Market in Netherlands Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Pharmaceutical Market in Netherlands Revenue (billion), by ATC/Therapeutic Class 2025 & 2033

- Figure 9: South America Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2025 & 2033

- Figure 10: South America Pharmaceutical Market in Netherlands Revenue (billion), by Mode of Dispensing 2025 & 2033

- Figure 11: South America Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2025 & 2033

- Figure 12: South America Pharmaceutical Market in Netherlands Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Pharmaceutical Market in Netherlands Revenue (billion), by ATC/Therapeutic Class 2025 & 2033

- Figure 15: Europe Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2025 & 2033

- Figure 16: Europe Pharmaceutical Market in Netherlands Revenue (billion), by Mode of Dispensing 2025 & 2033

- Figure 17: Europe Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2025 & 2033

- Figure 18: Europe Pharmaceutical Market in Netherlands Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Pharmaceutical Market in Netherlands Revenue (billion), by ATC/Therapeutic Class 2025 & 2033

- Figure 21: Middle East & Africa Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2025 & 2033

- Figure 22: Middle East & Africa Pharmaceutical Market in Netherlands Revenue (billion), by Mode of Dispensing 2025 & 2033

- Figure 23: Middle East & Africa Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2025 & 2033

- Figure 24: Middle East & Africa Pharmaceutical Market in Netherlands Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Pharmaceutical Market in Netherlands Revenue (billion), by ATC/Therapeutic Class 2025 & 2033

- Figure 27: Asia Pacific Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2025 & 2033

- Figure 28: Asia Pacific Pharmaceutical Market in Netherlands Revenue (billion), by Mode of Dispensing 2025 & 2033

- Figure 29: Asia Pacific Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2025 & 2033

- Figure 30: Asia Pacific Pharmaceutical Market in Netherlands Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 2: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Mode of Dispensing 2020 & 2033

- Table 3: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 5: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Mode of Dispensing 2020 & 2033

- Table 6: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 11: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Mode of Dispensing 2020 & 2033

- Table 12: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 17: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Mode of Dispensing 2020 & 2033

- Table 18: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 29: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Mode of Dispensing 2020 & 2033

- Table 30: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 38: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Mode of Dispensing 2020 & 2033

- Table 39: Global Pharmaceutical Market in Netherlands Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Pharmaceutical Market in Netherlands Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Market in Netherlands?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Pharmaceutical Market in Netherlands?

Key companies in the market include Astellas Pharma, 6 COMPETITIVE LANDSCAPE AND COMPANY PROFILES, Novartis AG, Amgen Inc, AstraZeneca PLC, Abbott Laboratories, F Hoffmann-La Roche AG, AbbVie Inc, Johnson & Johnson, Merck & Co, Pfizer Inc.

3. What are the main segments of the Pharmaceutical Market in Netherlands?

The market segments include ATC/Therapeutic Class , Mode of Dispensing.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Presence of Better Research Institutes. Excellent Healthcare System. and an Innovation-friendly Government; Rising Cases of Chronic Diseases.

6. What are the notable trends driving market growth?

Cardiovascular Segment is Expected to Hold a Significant Market Share over the Forecast Period.

7. Are there any restraints impacting market growth?

High Failure Rate and Developing Cost of New Products.

8. Can you provide examples of recent developments in the market?

July 2022: The US FDA issued a warning letter to a dutch producer of active pharmaceutical ingredients (APIs). It was put on notice to adopt more robust equipment cleaning practices and use better safeguards to prevent cross-contamination.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Market in Netherlands," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Market in Netherlands report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Market in Netherlands?

To stay informed about further developments, trends, and reports in the Pharmaceutical Market in Netherlands, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence