Key Insights

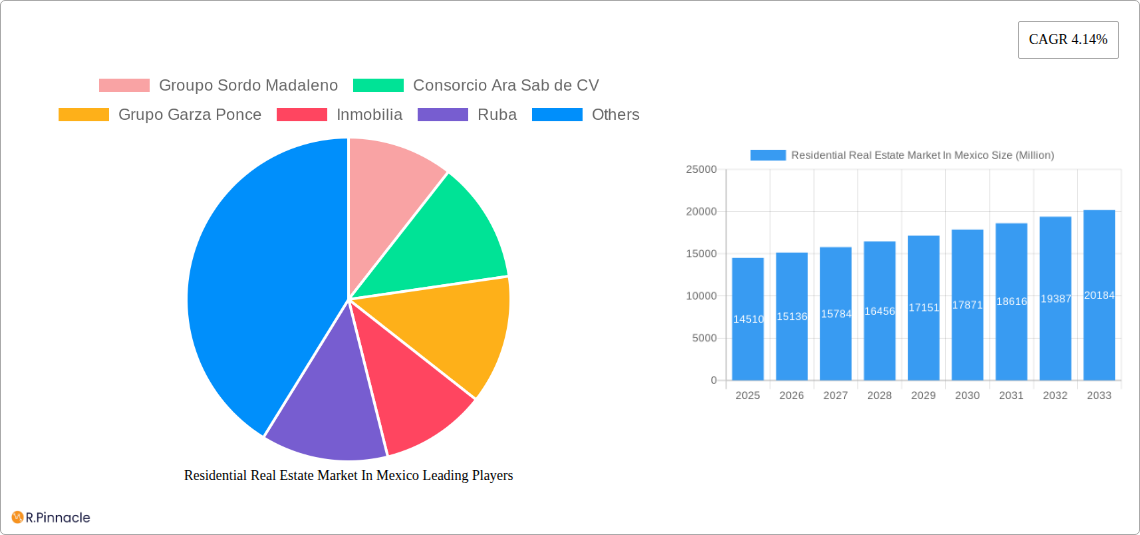

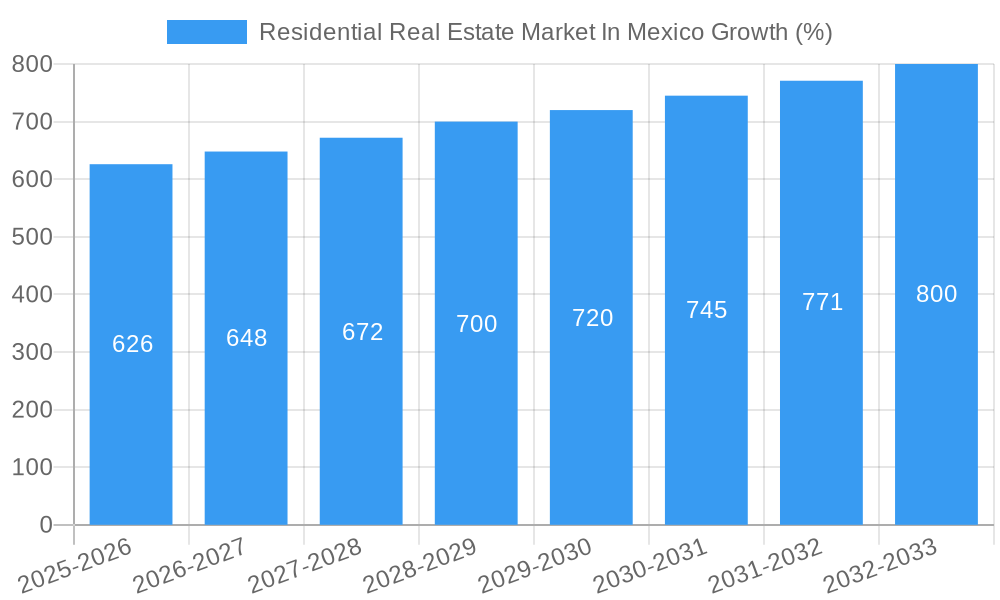

The Mexican residential real estate market, valued at $14.51 billion in 2025, exhibits robust growth potential. A compound annual growth rate (CAGR) of 4.14% from 2019-2033 projects significant expansion over the forecast period (2025-2033). This growth is fueled by several key factors. A burgeoning middle class with increasing disposable income is driving demand for housing, particularly in urban centers. Government initiatives aimed at improving infrastructure and affordable housing contribute positively. Furthermore, Mexico's attractive tourism sector and foreign investment further stimulate demand for residential properties, especially in coastal and resort areas. However, challenges remain. Economic volatility and fluctuations in interest rates can impact affordability and investment decisions. Regulatory hurdles and land scarcity, especially in prime locations, also pose constraints to market expansion. Segmentation reveals that apartments and condominiums dominate the market share, reflecting a preference for urban living and higher density housing options. Prominent players like Grupo Sordo Madaleno, Consorcio Ara Sab de CV, and Grupo Garza Ponce are shaping the market landscape through large-scale projects and innovative developments. The continued growth of the Mexican economy and strategic investments in infrastructure are expected to mitigate some of the market constraints, ultimately leading to a positive trajectory for the residential real estate sector.

The market’s segmentation by property type highlights varying growth trajectories. While apartments and condominiums are projected to maintain a larger market share due to higher demand in urban areas, the landed houses and villas segment shows potential for growth, driven by affluent buyers and those seeking larger living spaces in suburban or resort areas. Competition among major developers is intense, emphasizing the need for innovative designs, sustainable building practices, and strategic location selection to capture market share. Future growth will likely depend on the government's success in addressing affordability concerns, improving infrastructure, and streamlining regulations. Analyzing historical data alongside current market trends indicates that the Mexican residential real estate market is poised for sustained expansion, albeit with moderate fluctuations influenced by macroeconomic factors and governmental policies. Understanding these nuances is crucial for investors, developers, and potential homeowners to make informed decisions in this dynamic sector.

Residential Real Estate Market in Mexico: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Residential Real Estate Market in Mexico, covering market structure, dynamics, key players, and future growth projections from 2019 to 2033. Designed for industry professionals, investors, and researchers, this report offers actionable insights into this dynamic market. With a base year of 2025 and a forecast period extending to 2033, this report is an invaluable resource for navigating the complexities of the Mexican residential real estate landscape. The report uses USD Million for all value references.

Residential Real Estate Market In Mexico Market Structure & Innovation Trends

This section analyzes the structure of Mexico's residential real estate market, encompassing market concentration, innovation drivers, regulatory landscapes, product substitutes, end-user demographics, and merger and acquisition (M&A) activity. The historical period covered is 2019-2024, with the study period extending to 2033.

The Mexican residential real estate market exhibits a moderately concentrated structure, with several large players holding significant market share. While precise market share data for individual companies is challenging to obtain publicly, estimates suggest that the top ten developers collectively control approximately xx% of the market. Consorcio Ara Sab de CV and Grupo Garza Ponce are amongst the key players estimated to command a combined market share exceeding xx%. The market is characterized by significant regional variations in concentration levels, with larger cities generally exhibiting higher concentration than smaller towns.

- Innovation Drivers: Technological advancements (e.g., proptech solutions, virtual tours) are reshaping the industry, driving efficiency and transparency. Government initiatives focused on sustainable building practices and affordable housing are also important factors.

- Regulatory Framework: Regulations concerning property ownership, building codes, and environmental standards significantly influence market dynamics. Changes in these regulations can significantly impact investment decisions and construction activity.

- Product Substitutes: Rental markets and alternative housing models (e.g., co-living spaces) offer viable alternatives to homeownership, impacting demand for certain segments.

- End-User Demographics: Mexico's growing population and urbanization trends are key drivers of residential real estate demand, with millennials and Gen Z increasingly shaping market preferences.

- M&A Activity: The sector has witnessed considerable M&A activity in recent years, with transaction values totaling an estimated xx Million over the past five years. Some notable deals involved smaller players merging to enhance market presence. This trend is expected to continue, driven by consolidation and expansion strategies.

Residential Real Estate Market In Mexico Market Dynamics & Trends

This section delves into the market dynamics and trends influencing Mexico's residential real estate sector. We analyze market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, using a mix of qualitative and quantitative data. The CAGR (Compound Annual Growth Rate) for the market is projected to be xx% during the forecast period (2025-2033). Market penetration of green building technologies is expected to increase from xx% in 2025 to xx% by 2033.

Market growth is driven primarily by population growth, urbanization, rising middle-class incomes, and favorable government policies aimed at stimulating the housing sector. Technological disruptions, such as online property portals and digital mortgage applications, are enhancing market transparency and efficiency. Consumer preferences are shifting towards sustainable and technologically advanced housing options, increasing demand for smart homes and energy-efficient designs. Competitive dynamics are marked by increasing competition among developers, leading to innovative product offerings and pricing strategies. The rising cost of construction materials and interest rates pose challenges to market growth.

Dominant Regions & Segments in Residential Real Estate Market In Mexico

This section identifies the leading regions and segments within the Mexican residential real estate market. The analysis focuses on 'Apartments and Condominiums' and 'Landed Houses and Villas,' considering factors like economic policies, infrastructure development, and consumer preferences. Mexico City and Guadalajara consistently rank among the top performing regions due to their robust economies, large populations, and well-established infrastructure.

Dominant Segment: Apartments and Condominiums

- Key Drivers: High population density in urban areas, affordability concerns for a large segment of the population, and the convenience of condominium living fuel the demand for apartments and condominiums.

- Dominance Analysis: The apartment and condominium segment consistently constitutes a significant portion of the total residential market, exceeding xx% in 2024 and expected to remain the largest segment through 2033. This is driven by the affordability and convenience factors mentioned above, alongside robust investment from major developers like Grupo Sordo Madaleno and Grupo Lar. The increasing trend of young professionals preferring urban lifestyles also contributes to the segment's dominance.

Landed Houses and Villas:

While smaller than the apartments and condominiums segment, the demand for landed houses and villas remains considerable, particularly in suburban areas and among high-income earners. Growth in this sector is propelled by a desire for more space, privacy, and outdoor living. Regions like Cancun and other coastal areas experience high demand for luxury villas due to tourism and second home ownership trends.

Residential Real Estate Market In Mexico Product Innovations

The Mexican residential real estate market is witnessing significant product innovations, driven by technological advancements and changing consumer preferences. Smart home technologies, sustainable building materials, and energy-efficient designs are gaining traction. Developers are increasingly incorporating features like automated lighting systems, renewable energy sources, and improved insulation to meet the demand for eco-friendly and technologically advanced housing solutions. These innovations are crucial for attracting environmentally-conscious buyers and enhancing the overall value proposition of new residential projects.

Report Scope & Segmentation Analysis

This report segments the Mexican residential real estate market primarily by property type: Apartments and Condominiums, and Landed Houses and Villas. Both segments are experiencing growth, albeit at different rates. The Apartments and Condominiums segment is projected to maintain a larger market share due to population density and affordability considerations, registering a CAGR of xx% during the forecast period. The Landed Houses and Villas segment, while exhibiting slower growth (CAGR of xx%), is still expected to attract significant investment, particularly in suburban and resort areas. Competitive dynamics vary across segments, with larger developers focusing on high-rise apartment developments and smaller, specialized firms catering to the luxury villa market.

Key Drivers of Residential Real Estate Market In Mexico Growth

Several factors contribute to the growth of Mexico's residential real estate market. Firstly, rapid urbanization continues to drive demand for housing in major cities. Secondly, a growing middle class with increased disposable income fuels the demand for better housing. Thirdly, government initiatives such as affordable housing programs and infrastructure development projects boost the construction sector and enhance market attractiveness. Finally, continuous inflow of foreign investment in the real estate sector provides additional capital and enhances development activity.

Challenges in the Residential Real Estate Market in Mexico Sector

The Mexican residential real estate market faces several challenges. High construction costs and fluctuating interest rates pose significant hurdles for developers and buyers. The availability of land and permitting processes can also delay construction projects. Furthermore, the informal housing sector and the complexities of land tenure can negatively impact the market. These factors collectively contribute to uncertainty and can make project planning and execution more complex, leading to decreased investments in certain segments. The impact of these challenges can result in a xx% reduction in the overall market activity in certain years.

Emerging Opportunities in Residential Real Estate Market In Mexico

Despite challenges, significant opportunities exist. The increasing adoption of sustainable building practices presents a major opportunity for developers. Government initiatives focused on affordable housing and infrastructure development also create openings for investment in this sector. The rise of proptech companies further revolutionizes how transactions take place, enhancing transparency and efficiency. Developing eco-friendly and affordable housing solutions can tap into the market while aligning with sustainability goals.

Leading Players in the Residential Real Estate Market In Mexico Market

- Groupo Sordo Madaleno

- Consorcio Ara Sab de CV

- Grupo Garza Ponce

- Inmobilia

- Ruba

- Ideal Impulsora Del Desarrollo

- Grupo Jomer

- Groupo Lar

- Aleatica

- Grupo HIR

Key Developments in Residential Real Estate Market In Mexico Industry

- June 2023: Habi secures USD 15 Million (potential USD 50 Million) from IDB Invest to expand its operations and leverage technology to improve liquidity in Mexico's secondary real estate markets. This significantly boosts the technological advancement and market efficiency in the sector.

- June 2023: Celaya Tequila partners with New Story to fund affordable housing projects in Jalisco, demonstrating corporate social responsibility and potentially stimulating the affordable housing segment.

Future Outlook for Residential Real Estate Market In Mexico Market

The future outlook for Mexico's residential real estate market is positive. Continued urbanization, economic growth, and government support will drive market expansion. The increasing adoption of technology and sustainable practices will shape future development trends. Strategic partnerships between developers, technology firms, and financial institutions will play a crucial role in shaping the future landscape of the market. The market is expected to experience sustained growth in the next decade, fueled by these factors, despite occasional cyclical variations related to economic conditions and regulatory changes.

Residential Real Estate Market In Mexico Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

Residential Real Estate Market In Mexico Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Residential Real Estate Market In Mexico REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.14% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1 Demand for Residential Real Estate Witnessing Notable Surge

- 3.4.2 Primarily Driven by Young Homebuyers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Groupo Sordo Madaleno

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Consorcio Ara Sab de CV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Grupo Garza Ponce

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inmobilia

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ruba

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ideal Impulsora Del Desarrollo**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grupo Jomer

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Groupo Lar

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aleatica

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Grupo HIR

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Groupo Sordo Madaleno

List of Figures

- Figure 1: Global Residential Real Estate Market In Mexico Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Mexico Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 3: Mexico Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 5: North America Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 9: South America Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 13: Europe Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 14: Europe Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 17: Middle East & Africa Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 18: Middle East & Africa Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Pacific Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market In Mexico?

The projected CAGR is approximately 4.14%.

2. Which companies are prominent players in the Residential Real Estate Market In Mexico?

Key companies in the market include Groupo Sordo Madaleno, Consorcio Ara Sab de CV, Grupo Garza Ponce, Inmobilia, Ruba, Ideal Impulsora Del Desarrollo**List Not Exhaustive, Grupo Jomer, Groupo Lar, Aleatica, Grupo HIR.

3. What are the main segments of the Residential Real Estate Market In Mexico?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.51 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico.

6. What are the notable trends driving market growth?

Demand for Residential Real Estate Witnessing Notable Surge. Primarily Driven by Young Homebuyers.

7. Are there any restraints impacting market growth?

4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Habi, a prominent real estate technology platform, is set to receive a substantial financial boost of USD 15 million from IDB Invest. This funding, spread over four years, aims to fuel Habi's expansion plans in Mexico. While the structured loan has the potential to reach USD 50 million, its primary focus is to cater to Habi's working capital needs. IDB Invest's strategic move is not just about bolstering Habi's growth; it also aims to leverage technology to enhance liquidity and agility in Mexico's secondary real estate markets. By addressing the housing gap in Mexico, this funding initiative is poised to elevate market efficiency, bolster transparency, encourage local contractors for home renovations, and expand Habi's corridor network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market In Mexico," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market In Mexico report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market In Mexico?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market In Mexico, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence