Key Insights

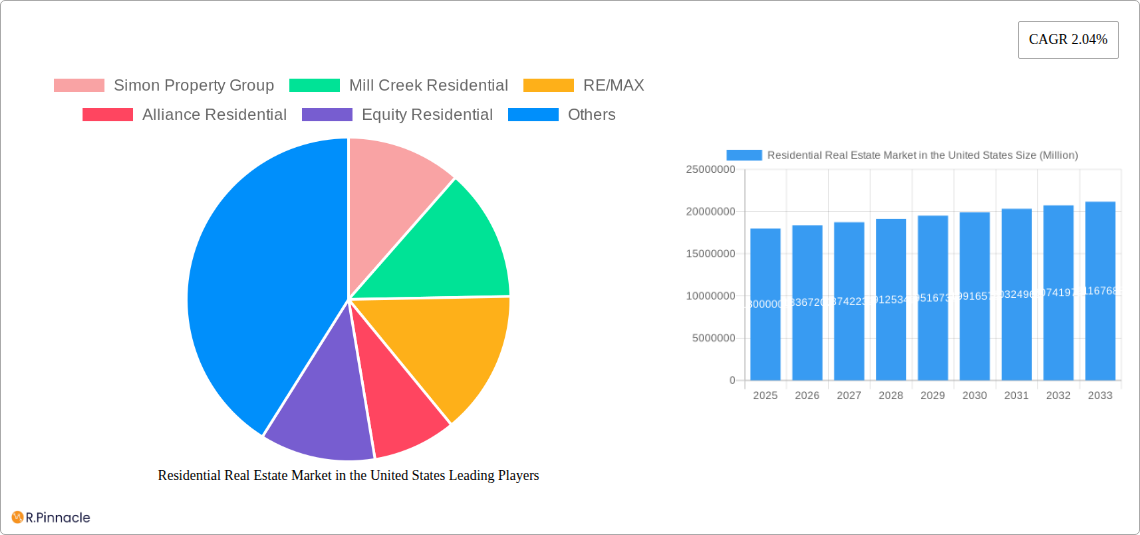

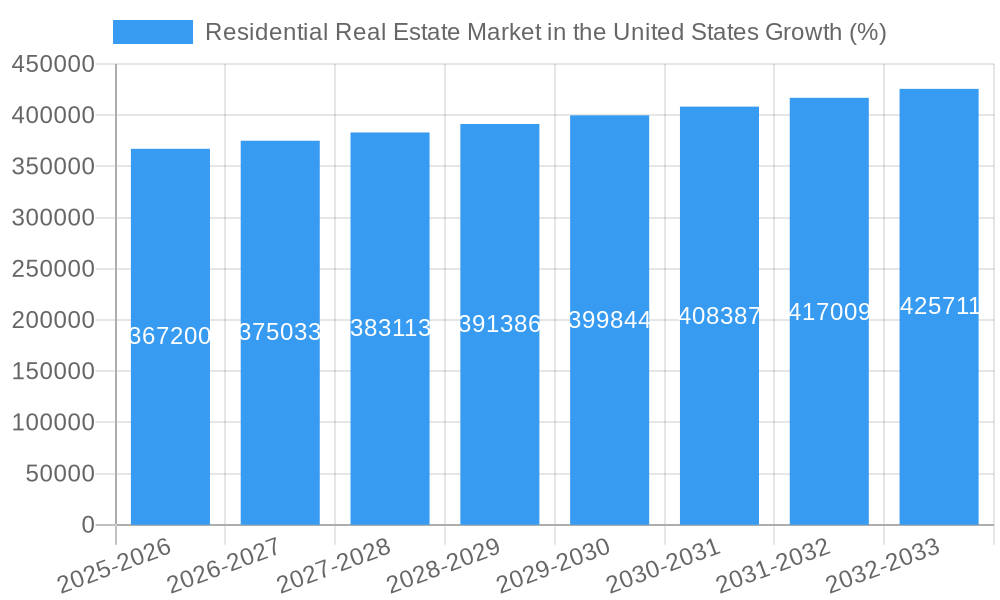

The U.S. residential real estate market, while exhibiting a relatively modest Compound Annual Growth Rate (CAGR) of 2.04%, reveals a dynamic landscape shaped by several key factors. The market's size, while not explicitly stated, can be reasonably estimated based on publicly available data from sources like the National Association of Realtors (NAR) and the U.S. Census Bureau. Considering the significant market size and the provided CAGR, we can infer substantial value, likely in the trillions of dollars, in 2025. Driving market growth are factors such as increasing urbanization, a growing population, low interest rates (historically, though this is subject to fluctuation), and sustained demand for housing, especially in desirable urban and suburban areas. Emerging trends include the rise of sustainable building practices, smart home technology integration, and the increasing adoption of online platforms for real estate transactions. However, restraints such as rising construction costs, limited housing inventory in certain regions, and fluctuating mortgage interest rates pose challenges to continued growth. The market is segmented by property type, with apartments and condominiums, and landed houses and villas representing significant segments. Major players like Simon Property Group, Mill Creek Residential, RE/MAX, and others are actively shaping the market through development, brokerage, and property management services. The regional distribution likely reflects population density and economic conditions, with larger markets found in coastal areas and major metropolitan centers.

The forecast period from 2025 to 2033 suggests continued, albeit measured, expansion. While predicting precise figures without access to complete market data is impossible, the projected growth is anticipated to be driven by the continuing demand for housing coupled with the ongoing adaptations within the industry to address evolving consumer preferences and market challenges. The influence of macroeconomic factors such as inflation and overall economic health will inevitably impact the trajectory of market growth throughout the forecast period. Strategic investment in infrastructure projects and government policies aimed at affordable housing will likely play a crucial role in shaping market dynamics and ensuring a sustainable and equitable distribution of housing resources.

Residential Real Estate Market in the United States: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the US residential real estate market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market structure, dynamics, key players, and future trends. Benefit from detailed segmentation by property type (Apartments & Condominiums, Landed Houses & Villas) and uncover crucial growth drivers and challenges impacting this dynamic sector.

Residential Real Estate Market in the United States Market Structure & Innovation Trends

This section analyzes the competitive landscape of the US residential real estate market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. We delve into market share distribution amongst key players, including Simon Property Group, Mill Creek Residential, RE/MAX, Alliance Residential, Equity Residential, Greystar Real Estate Partners, Keller Williams Realty Inc, Essex Property Trust, Brookfield, The Michaels Organization, AvalonBay Communities, and Lincoln Property Company (list not exhaustive). The analysis includes an evaluation of M&A deal values, revealing the significant financial transactions shaping the market. For example, the impact of the increasing consolidation through large-scale acquisitions is examined, with particular focus on the influence of private equity firms. The report identifies key regulatory changes influencing market dynamics and explores the adoption of innovative technologies, such as PropTech solutions, and their effect on market efficiency and consumer experience. Finally, the analysis details shifts in end-user demographics and their corresponding influence on housing demand across various property types.

Residential Real Estate Market in the United States Market Dynamics & Trends

This section provides a detailed examination of the key market dynamics and trends shaping the US residential real estate market from 2019 to 2033. We analyze market growth drivers, such as population growth, urbanization, and economic expansion, alongside disruptive technological influences, evolving consumer preferences (e.g., preferences for sustainable housing, smart home technology), and the competitive dynamics between major players and emerging entrants. The report will quantify these trends using metrics like Compound Annual Growth Rate (CAGR) and market penetration rates across different property types and geographic locations. Detailed analysis of shifting consumer priorities, like the increased demand for suburban living and remote work options, will be provided. The effects of fluctuating interest rates and inflation on housing affordability are also explored. The report will illustrate the dynamics of supply and demand in relation to evolving consumer preferences.

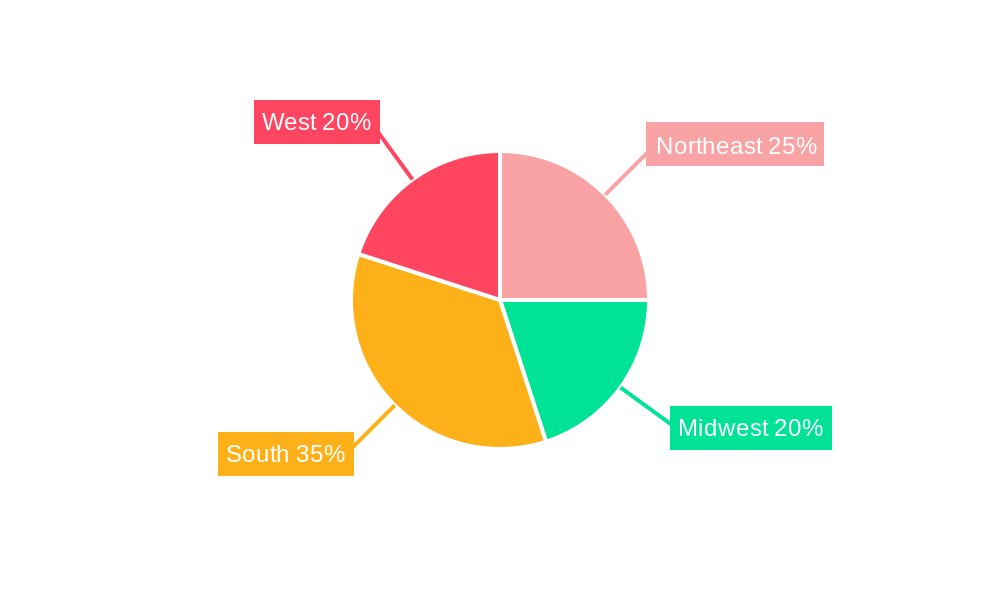

Dominant Regions & Segments in Residential Real Estate Market in the United States

This section identifies the leading regions and segments within the US residential real estate market. A detailed analysis will be performed on the dominance of specific regions based on factors like economic strength, infrastructure development, and population growth. The analysis will also cover the key drivers for growth in each segment (Apartments and Condominiums, Landed Houses and Villas).

- Key Drivers for Dominant Segments:

- Economic policies influencing housing affordability and investment.

- Infrastructure development impacting accessibility and desirability.

- Demographic shifts (e.g., population growth, migration patterns).

- Government regulations and incentives impacting construction and development.

The report will provide a comparative analysis of the performance of each segment across different regions, identifying areas of high growth potential and areas facing challenges. Factors such as price appreciation, rental yields, and inventory levels will inform this analysis.

Residential Real Estate Market in the United States Product Innovations

This section summarizes recent product developments, applications, and competitive advantages within the US residential real estate market. It focuses on the adoption of technological trends such as smart home integration, sustainable building materials, and innovative design concepts, along with an evaluation of their market fit and potential for disrupting traditional construction practices. The section further highlights the competitive landscape regarding innovation, including the strategies employed by leading players to differentiate their offerings. This includes an analysis of the impact of these innovations on consumer demand, pricing, and overall market growth. The role of technology in enhancing efficiency and sustainability within the industry is also discussed.

Report Scope & Segmentation Analysis

This report segments the US residential real estate market by property type: Apartments and Condominiums and Landed Houses and Villas. Each segment's analysis includes growth projections, market size estimations for the forecast period (2025-2033), and a competitive landscape overview.

Apartments and Condominiums: This section details market size, growth projections, and competitive dynamics within the multifamily residential segment.

Landed Houses and Villas: This section presents a similar analysis focusing on the single-family residential segment, including the various sub-segments within this category.

Key Drivers of Residential Real Estate Market in the United States Growth

Key growth drivers for the US residential real estate market include robust economic growth, a growing population, increasing urbanization, and favorable government policies supporting homeownership. Technological advancements in construction and property management further contribute to market expansion. The increasing adoption of smart home technology and sustainable building practices enhances the appeal and value of residential properties. Government initiatives aiming at affordable housing also play a significant role.

Challenges in the Residential Real Estate Market in the United States Sector

Challenges facing the US residential real estate market include regulatory hurdles impacting construction and development, supply chain disruptions causing material shortages and cost increases, and intense competition among developers and real estate companies. These challenges, along with fluctuating interest rates and inflation, can significantly impact housing affordability and market stability. Furthermore, an imbalance between supply and demand in certain regions can lead to price volatility.

Emerging Opportunities in Residential Real Estate Market in the United States

Emerging opportunities include the growth of sustainable and green building practices, the increasing demand for smart homes and technological integration, and the expansion of the rental market. The potential for growth in secondary and tertiary markets with high population growth and affordable land offers promising prospects. Furthermore, the continued advancement of PropTech and FinTech solutions presents substantial opportunities to streamline processes and improve efficiency.

Leading Players in the Residential Real Estate Market in the United States Market

- Simon Property Group

- Mill Creek Residential

- RE/MAX

- Alliance Residential

- Equity Residential

- Greystar Real Estate Partners

- Keller Williams Realty Inc

- Essex Property Trust

- Brookfield

- The Michaels Organization

- AvalonBay Communities

- Lincoln Property Company

Key Developments in Residential Real Estate Market in the United States Industry

- May 2022: Resource REIT Inc. was acquired by Blackstone Real Estate Income Trust Inc. for USD 3.7 Billion, highlighting the ongoing consolidation within the REIT sector.

- February 2022: Blackstone's USD 6 Billion acquisition of Preferred Apartment Communities significantly expanded its residential rental portfolio, demonstrating the substantial investment in the multifamily sector.

Future Outlook for Residential Real Estate Market in the United States Market

The US residential real estate market is poised for continued growth, driven by long-term demographic trends, ongoing urbanization, and the increasing demand for quality housing. Strategic opportunities exist for companies that can adapt to changing consumer preferences, embrace technological advancements, and navigate the evolving regulatory landscape. The market's future trajectory will depend on factors like economic stability, interest rate fluctuations, and government policies impacting housing affordability and development. Continued investment in sustainable and technologically advanced housing solutions will be crucial for long-term success.

Residential Real Estate Market in the United States Segmentation

-

1. Property Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

Residential Real Estate Market in the United States Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Residential Real Estate Market in the United States REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Plan Towards Urban Rail Development

- 3.3. Market Restrains

- 3.3.1. Italy’s Fragmented Approach to Tenders

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. North America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Property Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Property Type

- 7. South America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Property Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Property Type

- 8. Europe Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Property Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Property Type

- 9. Middle East & Africa Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Property Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Property Type

- 10. Asia Pacific Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Property Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Property Type

- 11. Brazil Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Mexico Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Argentina Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Colombia Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Chile Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Rest of Latin America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Simon Property Group

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Mill Creek Residential

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 RE/MAX

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Alliance Residential

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Equity Residential

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Greystar Real Estate Partners

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Keller Williams Realty Inc **List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Essex Property Trust

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Brookfield

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 The Michaels Organization

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 AvalonBay Communities

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Lincoln Property Company

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Simon Property Group

List of Figures

- Figure 1: Global Residential Real Estate Market in the United States Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Brazil Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 3: Brazil Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 4: Mexico Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 5: Mexico Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 6: Argentina Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 7: Argentina Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 8: Colombia Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 9: Colombia Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 10: Chile Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 11: Chile Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 12: Rest of Latin America Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 13: Rest of Latin America Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 15: North America Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 16: North America Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 19: South America Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 20: South America Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 21: South America Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 23: Europe Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 24: Europe Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East & Africa Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 27: Middle East & Africa Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 28: Middle East & Africa Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 29: Middle East & Africa Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 31: Asia Pacific Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 32: Asia Pacific Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 17: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 22: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 27: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 38: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Turkey Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Israel Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: GCC Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: North Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East & Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 46: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market in the United States?

The projected CAGR is approximately 2.04%.

2. Which companies are prominent players in the Residential Real Estate Market in the United States?

Key companies in the market include Simon Property Group, Mill Creek Residential, RE/MAX, Alliance Residential, Equity Residential, Greystar Real Estate Partners, Keller Williams Realty Inc **List Not Exhaustive, Essex Property Trust, Brookfield, The Michaels Organization, AvalonBay Communities, Lincoln Property Company.

3. What are the main segments of the Residential Real Estate Market in the United States?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Investment Plan Towards Urban Rail Development.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

Italy’s Fragmented Approach to Tenders.

8. Can you provide examples of recent developments in the market?

May 2022: Resource REIT Inc. completed the sale of all of its outstanding shares of common stock to Blackstone Real Estate Income Trust Inc. for USD 14.75 per share in an all-cash deal valued at USD 3.7 billion, including the assumption of the REIT's debt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market in the United States," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market in the United States report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market in the United States?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market in the United States, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence