Key Insights

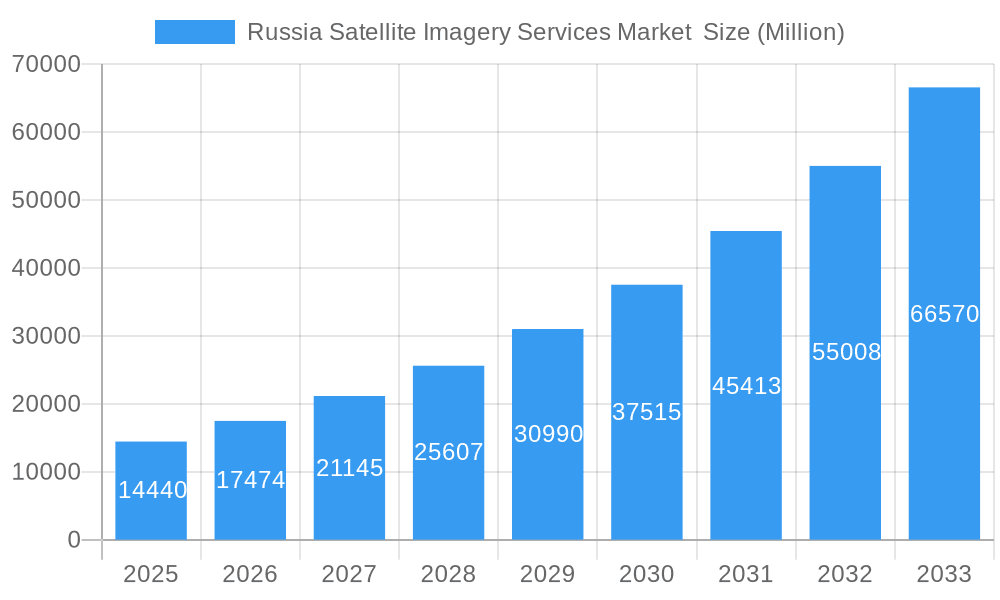

The Russia Satellite Imagery Services Market is poised for substantial expansion, with a projected market size of $14.44 billion in 2025, and is anticipated to grow at an impressive Compound Annual Growth Rate (CAGR) of 21.1% from 2025 to 2033. This robust growth trajectory is primarily fueled by escalating demand across critical sectors such as natural resource management, surveillance and security, and disaster management. The increasing adoption of geospatial data acquisition and mapping for infrastructure development, urban planning, and environmental monitoring further propels market expansion. Emerging trends like the integration of artificial intelligence and machine learning for advanced data analysis, alongside the proliferation of high-resolution satellite imagery, are expected to unlock new opportunities and enhance service capabilities, driving innovation and adoption across various end-user segments including government, construction, and transportation.

Russia Satellite Imagery Services Market Market Size (In Billion)

While the market demonstrates a strong upward trend, certain factors could influence its growth. Challenges such as the high initial investment for satellite infrastructure and data processing, coupled with the need for skilled personnel to interpret and utilize complex geospatial data, may present hurdles. However, these are increasingly being addressed through technological advancements and strategic partnerships. The military and defense sector, along with forestry and agriculture, represent significant end-user segments that are leveraging satellite imagery for strategic planning, resource optimization, and risk mitigation. Companies like Roscosmos space agency, Geospatial Agency Innoter, and NextGIS are at the forefront, developing and offering advanced satellite imagery services that cater to these diverse and evolving market needs.

Russia Satellite Imagery Services Market Company Market Share

Gain unparalleled insights into the burgeoning Russia Satellite Imagery Services Market with our in-depth report. Spanning from 2019 to 2033, with a base year of 2025, this comprehensive analysis delves into market structure, dynamics, key drivers, challenges, and future outlook. We dissect crucial segments like Geospatial Data Acquisition and Mapping, Natural Resource Management, Surveillance and Security, and the vital End-User segments of Government, Military and Defense, and Transportation and Logistics. Discover critical industry developments, product innovations, and the competitive landscape shaped by leading players such as Roscosmos space agency and Geospatial Agency Innoter. This report provides actionable intelligence for stakeholders seeking to capitalize on the evolving Russian satellite imagery ecosystem.

Russia Satellite Imagery Services Market Market Structure & Innovation Trends

The Russia Satellite Imagery Services Market is characterized by a moderate market concentration, with key players like the Roscosmos space agency and established entities such as Geospatial Agency Innoter, Racurs, and SCANEX Group holding significant influence. Innovation drivers are primarily fueled by national security imperatives, advancements in remote sensing technology, and the increasing demand for precise geospatial data across various sectors. Regulatory frameworks, while evolving, are crucial in shaping market access and data utilization, with governmental initiatives playing a pivotal role. The substitution threat is relatively low for specialized satellite imagery services, given their unique capabilities, though advancements in drone-based imaging present a partial alternative for localized applications. End-user demographics are increasingly diverse, with government and defense sectors being dominant, followed by growing adoption in construction and natural resource management. Merger and acquisition (M&A) activities, while not yet at peak levels, are anticipated to increase as the market matures, consolidating market share and fostering synergistic growth. For instance, strategic alliances and smaller acquisitions by larger entities to expand service portfolios and technological capabilities are expected.

Russia Satellite Imagery Services Market Market Dynamics & Trends

The Russia Satellite Imagery Services Market is on a robust growth trajectory, driven by a confluence of technological advancements, expanding applications, and increasing governmental and commercial adoption. The Compound Annual Growth Rate (CAGR) is projected to be approximately 12.5% during the forecast period of 2025–2033. This surge is primarily attributed to the escalating demand for high-resolution satellite imagery for a wide array of applications, including infrastructure development, environmental monitoring, and national security. Technological disruptions, such as the development of advanced sensor technologies, artificial intelligence (AI) for data analysis, and the proliferation of smaller, more agile satellite constellations, are significantly enhancing the capabilities and cost-effectiveness of satellite imagery services. Consumer preferences are shifting towards more integrated geospatial solutions, requiring not just raw imagery but also value-added analytics and actionable intelligence. This evolution is pushing service providers to invest in sophisticated data processing and interpretation tools. The competitive dynamics are intensifying, with both established state-backed entities and emerging private players vying for market share. The increasing penetration of satellite imagery services across various industries, from agriculture and forestry to urban planning and disaster management, underscores its growing indispensability. For example, the implementation of precision agriculture techniques relies heavily on satellite data for crop health monitoring and yield prediction, showcasing a significant market penetration in the agricultural sector. Furthermore, the continuous need for surveillance and reconnaissance, particularly in the context of geopolitical developments, ensures a sustained demand from the military and defense sectors, further fueling market growth. The ongoing investment in space infrastructure and the development of domestic satellite capabilities by Russia are also key factors supporting this expansion. The market's ability to adapt to new data formats and delivery mechanisms will be crucial for continued success.

Dominant Regions & Segments in Russia Satellite Imagery Services Market

The Russia Satellite Imagery Services Market exhibits strong dominance in specific applications and end-user segments, driven by strategic national priorities and economic development.

Dominant Applications:

Geospatial Data Acquisition and Mapping: This segment forms the bedrock of the market, with substantial demand driven by government initiatives for national mapping, urban planning, and infrastructure development. The need for accurate, up-to-date geographic information underpins its consistent growth.

- Key Drivers: Large-scale infrastructure projects, cadastral surveys, and national cartography modernization programs.

- Dominance Analysis: The Russian government's commitment to developing its vast territories necessitates comprehensive geospatial data for planning and resource allocation. Investments in digital infrastructure further enhance the utility and demand for these services.

Surveillance and Security: This is a critical and high-value segment, propelled by national security concerns, border monitoring, and defense applications. The increasing geopolitical landscape fuels consistent demand for real-time and historical satellite imagery for intelligence gathering and operational planning.

- Key Drivers: National defense strategies, border security, counter-terrorism efforts, and monitoring of critical infrastructure.

- Dominance Analysis: Russia's strategic objectives and expansive borders make surveillance and security a primary driver for satellite imagery services. The integration of satellite intelligence into defense doctrines is a significant factor.

Natural Resource Management: With Russia's vast natural resources, this segment plays a vital role in sustainable extraction, environmental monitoring, and regulatory compliance. Satellite imagery is instrumental in tracking deforestation, mining activities, and managing vast ecological reserves.

- Key Drivers: Oil and gas exploration, mining operations, forestry management, and environmental protection initiatives.

- Dominance Analysis: The economic importance of its natural resource sector necessitates sophisticated monitoring and management tools, making satellite imagery indispensable for efficiency and compliance.

Dominant End-Users:

Government: The government is the largest end-user, driving demand across multiple applications, from defense and security to infrastructure planning, emergency management, and scientific research.

- Key Drivers: National development programs, public safety mandates, and defense spending.

- Dominance Analysis: Government agencies are major procurers of satellite imagery services due to their broad mandates and the critical nature of the data for national operations and strategic planning.

Military and Defense: As highlighted in the "Surveillance and Security" application, this sector is a paramount consumer of satellite imagery. Its demand is driven by intelligence, reconnaissance, targeting, and situational awareness requirements.

- Key Drivers: Modernization of defense capabilities, operational readiness, and strategic intelligence gathering.

- Dominance Analysis: The military and defense sector's reliance on advanced geospatial intelligence positions it as a key driver of technological innovation and market growth in Russia.

Construction: The construction industry is increasingly leveraging satellite imagery for site selection, project monitoring, progress tracking, and environmental impact assessments, especially for large-scale infrastructure projects.

- Key Drivers: Urban expansion, infrastructure development projects, and real estate development.

- Dominance Analysis: As Russia continues to invest in infrastructure and urban development, the demand for precise aerial and satellite data for planning and execution in the construction sector is steadily increasing.

Russia Satellite Imagery Services Market Product Innovations

Product innovation in the Russia Satellite Imagery Services Market is centered on enhancing resolution, expanding spectral capabilities, and integrating advanced analytics. Developments focus on higher-resolution imaging, enabling more detailed object detection and analysis for applications like urban planning and infrastructure monitoring. The integration of AI and machine learning algorithms is a significant trend, transforming raw imagery into actionable insights for sectors such as natural resource management and surveillance. Furthermore, advancements in data fusion, combining satellite imagery with other geospatial data sources like drone imagery and IoT sensor data, are creating more comprehensive and powerful solutions. These innovations provide competitive advantages by offering superior accuracy, faster processing times, and more tailored insights to meet evolving end-user demands across diverse applications.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Russia Satellite Imagery Services Market, segmented by Application and End-User. The Application segments include: Geospatial Data Acquisition and Mapping, Natural Resource Management, Surveillance and Security, Conservation and Research, Disaster Management, and Intelligence. The End-User segments encompass: Government, Construction, Transportation and Logistics, Military and Defense, Forestry and Agriculture, and Other End-Users. Each segment's growth projections, market sizes, and competitive dynamics are meticulously analyzed throughout the study period. For instance, the Government segment is expected to maintain its leading position with an estimated market share of over 35% by 2033, driven by consistent demand for national security and infrastructure development. The Military and Defense segment, though smaller, is projected to exhibit the highest growth rate due to ongoing strategic imperatives.

Key Drivers of Russia Satellite Imagery Services Market Growth

The growth of the Russia Satellite Imagery Services Market is propelled by several key factors. Firstly, increasing government investment in space technology and national security initiatives directly translates to higher demand for satellite imagery for defense, intelligence, and infrastructure monitoring. Secondly, advancements in remote sensing technology, including higher resolution sensors and improved data processing capabilities, are making satellite imagery more accessible and valuable across diverse applications. Thirdly, the growing adoption of geospatial data in commercial sectors such as construction, agriculture, and resource management for efficiency gains and informed decision-making is a significant accelerator. Finally, Russia's vast geographical expanse and rich natural resources necessitate continuous monitoring and management, further fueling the demand for satellite-based solutions.

Challenges in the Russia Satellite Imagery Services Market Sector

Despite its growth, the Russia Satellite Imagery Services Market faces several challenges. Regulatory complexities and data access restrictions can sometimes impede swift market penetration and collaboration. The high initial investment required for satellite development and ground infrastructure poses a barrier for smaller players. Competition from alternative imaging technologies, such as high-resolution aerial photography and drone imagery, presents a challenge for specific niche applications, particularly in urban environments. Furthermore, reliance on legacy systems and potential cyber security threats can impact the reliability and integrity of satellite data and services. Economic volatility and the need for continuous technological upgrades also contribute to market pressures.

Emerging Opportunities in Russia Satellite Imagery Services Market

Emerging opportunities in the Russia Satellite Imagery Services Market are abundant, driven by technological innovation and evolving user needs. The development of AI-powered analytics platforms for automated data interpretation presents a significant opportunity for delivering value-added services. The increasing focus on environmental monitoring and climate change adaptation is creating demand for specialized satellite data for tracking emissions, deforestation, and natural disaster prediction. Furthermore, the expansion of commercial space activities and potential collaborations with international partners could open new avenues for market growth. The growing demand for real-time data delivery and integrated geospatial solutions from sectors like logistics and precision agriculture also offers substantial potential for service providers.

Leading Players in the Russia Satellite Imagery Services Market Market

- Roscosmos space agency

- Geospatial Agency Innoter

- Racurs

- SCANEX Group

- Data East LLC

- Geoaler

- NextGIS

- glavkosmos

- EAST VIEW GEOSPATIAL INC

Key Developments in Russia Satellite Imagery Services Market Industry

- April 2023: The Russian government has agreed to continue participation in the International Space Station (ISS) until at least 2028 with NASA, the Canadian Space Agency, the Japan Aerospace Agency, and the European Space Agency, which has extended their agreement with the ISS, and would support the growth of the country's satellite ecosystem and would support the need for satellite imagery services in Russia.

- August 2022: Russia has launched an earth observatory satellite to provide satellite services in Iran, including satellite imagery features. Additionally, the country planned to increase its surveillance of military targets using this launched satellite in Ukraine due to the war, which would further fuel the adoption of satellite imagery services in the Military and Defence sector.

Future Outlook for Russia Satellite Imagery Services Market Market

The future outlook for the Russia Satellite Imagery Services Market is highly promising, characterized by sustained growth and diversification. Advancements in satellite technology, including the development of more sophisticated optical and radar sensors, alongside enhanced data processing capabilities driven by AI and machine learning, will unlock new applications and improve existing ones. The increasing emphasis on national security, infrastructure development, and effective natural resource management will continue to be significant growth accelerators. Furthermore, the potential for increased private sector participation and international collaborations could further boost innovation and market reach. The market is poised to evolve towards more integrated, end-to-end geospatial solutions, offering real-time data and actionable intelligence to a broader spectrum of end-users, solidifying its crucial role in Russia's economic and strategic landscape.

Russia Satellite Imagery Services Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Disaster Management

- 1.6. Intelligence

-

2. End-User

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Forestry and Agriculture

- 2.6. Other End-Users

Russia Satellite Imagery Services Market Segmentation By Geography

- 1. Russia

Russia Satellite Imagery Services Market Regional Market Share

Geographic Coverage of Russia Satellite Imagery Services Market

Russia Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The country's Investments in Space Technology and Defence; Adoption of Big Data and Imagery Analytics

- 3.3. Market Restrains

- 3.3.1. High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. The country's Investments in Space Technology and Defence Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Satellite Imagery Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Disaster Management

- 5.1.6. Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Forestry and Agriculture

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roscosmos space agency

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Geospatial Agency Innoter

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Racurs

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SCANEX Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Data East LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Geoaler

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NextGIS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 glavkosmos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EAST VIEW GEOSPATIAL INC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Roscosmos space agency

List of Figures

- Figure 1: Russia Satellite Imagery Services Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Russia Satellite Imagery Services Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Satellite Imagery Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Russia Satellite Imagery Services Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 3: Russia Satellite Imagery Services Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Russia Satellite Imagery Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Russia Satellite Imagery Services Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 6: Russia Satellite Imagery Services Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Satellite Imagery Services Market ?

The projected CAGR is approximately 21.1%.

2. Which companies are prominent players in the Russia Satellite Imagery Services Market ?

Key companies in the market include Roscosmos space agency, Geospatial Agency Innoter, Racurs, SCANEX Group, Data East LLC, Geoaler, NextGIS, glavkosmos, EAST VIEW GEOSPATIAL INC.

3. What are the main segments of the Russia Satellite Imagery Services Market ?

The market segments include Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

The country's Investments in Space Technology and Defence; Adoption of Big Data and Imagery Analytics.

6. What are the notable trends driving market growth?

The country's Investments in Space Technology and Defence Drives the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

April 2023: The Russian government has agreed to continue participation in the International Space Station (ISS) until at least 2028 with NASA, the Canadian Space Agency, the Japan Aerospace Agency, and the European Space Agency, which has extended their agreement with the ISS, and would support the growth of the country's satellite ecosystem and would support the need for satellite imagery services in Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Satellite Imagery Services Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Satellite Imagery Services Market ?

To stay informed about further developments, trends, and reports in the Russia Satellite Imagery Services Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence