Key Insights

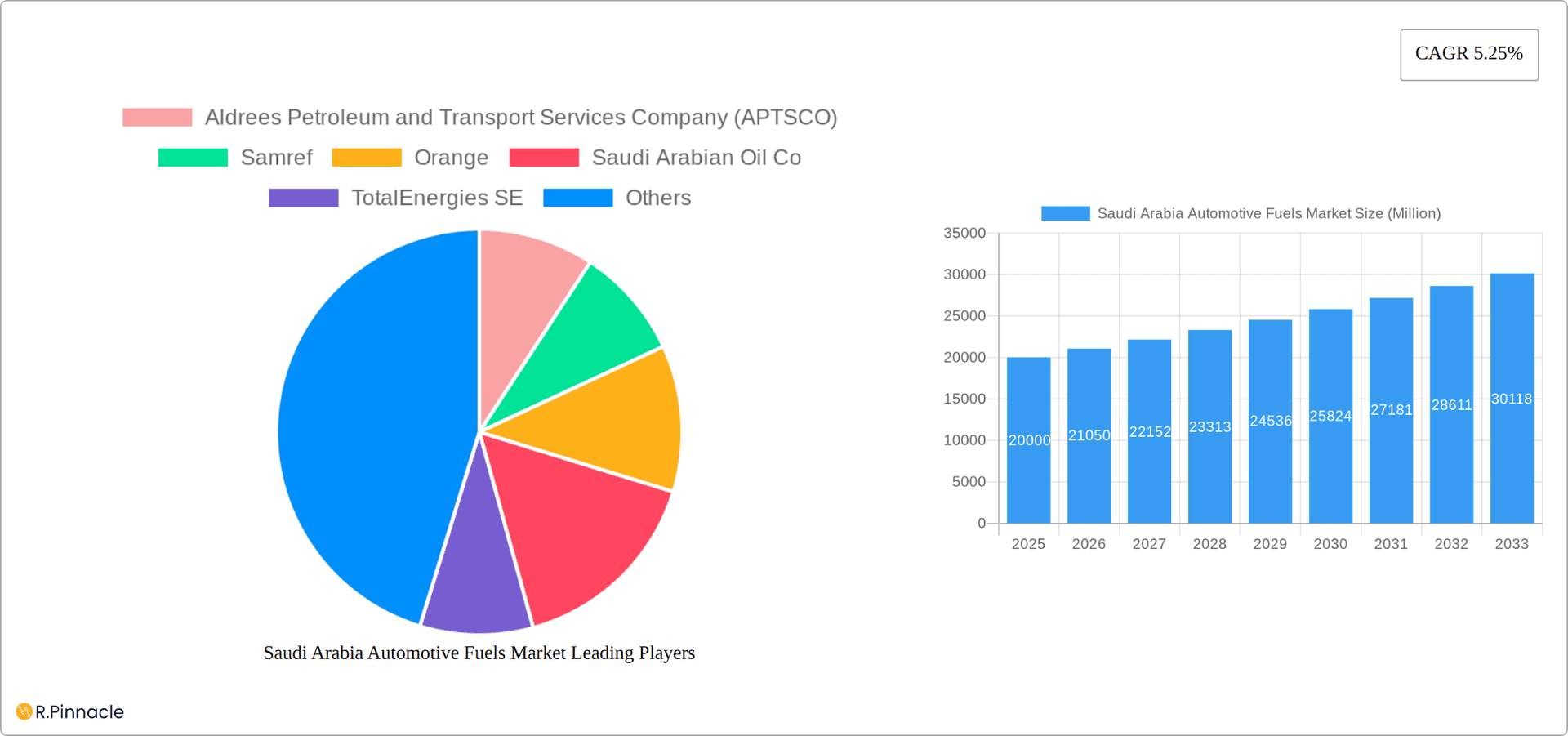

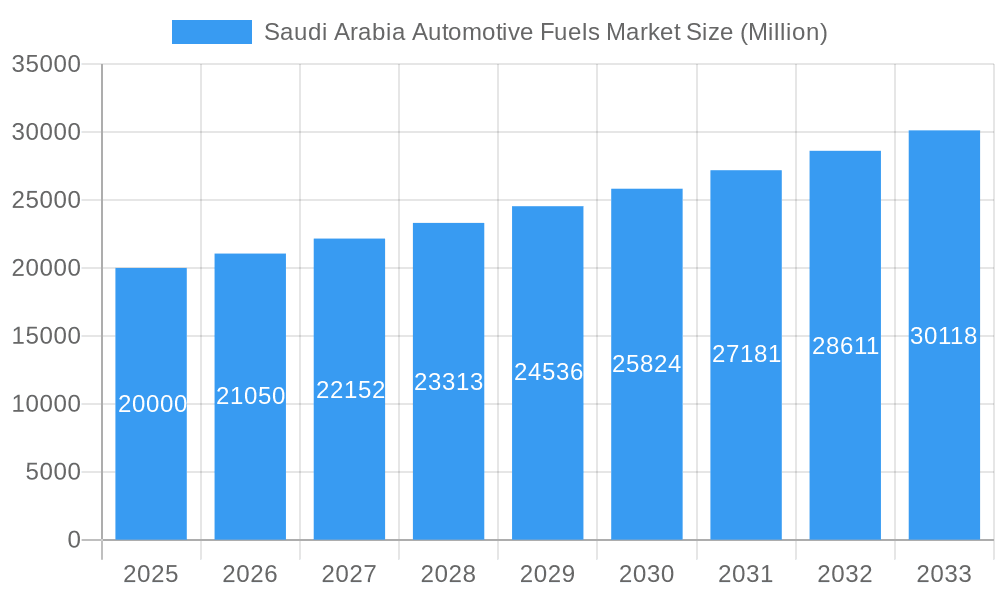

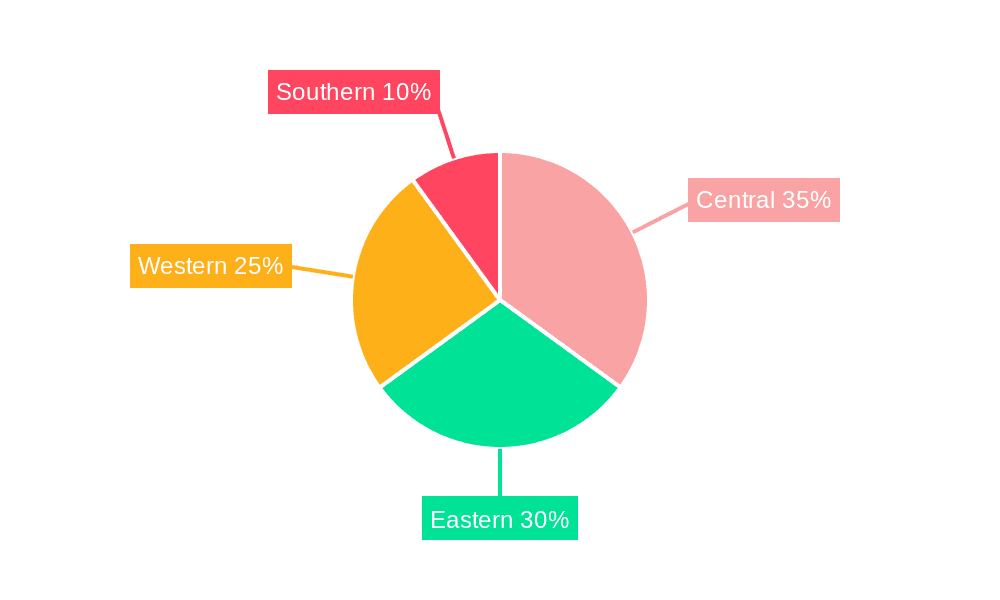

The Saudi Arabian automotive fuels market, projected at $13.23 million in 2024, is set for significant expansion. Driven by a growing automotive sector, enhanced infrastructure, and increasing disposable incomes, the market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% from 2024 to 2033. Key growth catalysts include rising vehicle ownership, especially in metropolitan areas, and government investment in infrastructure and tourism. The market is segmented by fuel type: gasoline (including premium PG95) and diesel. While gasoline currently leads, the diesel segment is poised for notable growth due to the increasing adoption of diesel vehicles and government incentives for fuel efficiency. Leading companies such as Saudi Aramco, TotalEnergies SE, and Aldrees Petroleum are actively influencing market trends through strategic investments, expansion initiatives, and advancements in fuel production and distribution. Regional disparities are evident, with the Central and Eastern regions anticipated to exhibit stronger growth due to higher population density and economic activity. Potential challenges include volatile global crude oil prices and government policies promoting alternative energy sources, which may temper long-term market expansion.

Saudi Arabia Automotive Fuels Market Market Size (In Million)

The forecast period (2024-2033) anticipates continued industry consolidation, with larger entities acquiring smaller firms to achieve economies of scale and strengthen distribution networks. Technological innovations, including the adoption of cleaner fuels and stricter fuel efficiency standards, will also shape market trajectories. Saudi Arabia's Vision 2030 initiative, focused on economic diversification and reduced oil dependency, presents both opportunities and challenges for market stakeholders. While driving innovation and sustainable practices, the sustained demand for automotive fuel within the Kingdom ensures a dynamic and promising market outlook.

Saudi Arabia Automotive Fuels Market Company Market Share

Saudi Arabia Automotive Fuels Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia automotive fuels market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete understanding of past performance, current market dynamics, and future growth potential. Key players like Saudi Arabian Oil Co, TotalEnergies SE, and Aldrees Petroleum and Transport Services Company (APTSCO) are analyzed extensively. The report segments the market by fuel type: Gasoline, PG95 Premium Grade Gasoline, and Diesel. Expect detailed analysis of market size (in Millions), CAGR, and market share.

Saudi Arabia Automotive Fuels Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Saudi Arabian automotive fuels market. We examine market concentration, identifying key players and their respective market shares. The analysis includes an assessment of mergers and acquisitions (M&A) activity, including deal values (in Millions) where available. Furthermore, we explore the impact of government regulations, the presence of substitute products, and evolving end-user demographics. The influence of technological advancements and innovation on market structure is also discussed.

- Market Concentration: The market is moderately concentrated, with xx% market share held by the top three players.

- Innovation Drivers: Government initiatives promoting fuel efficiency and alternative fuels are key drivers.

- Regulatory Framework: Stringent emission standards and fuel quality regulations are in place.

- Product Substitutes: The emergence of electric vehicles and hybrid technology poses a threat.

- M&A Activity: While specific deal values aren't publicly available for all transactions, significant M&A activity has been observed among major players aiming to consolidate market position and gain access to technology and resources. xx Million in M&A deal values were recorded during the historical period.

- End-User Demographics: The growing middle class and increasing vehicle ownership are driving fuel demand.

Saudi Arabia Automotive Fuels Market Dynamics & Trends

This section delves into the key factors influencing the growth and evolution of the Saudi Arabia automotive fuels market. We examine market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing a comprehensive overview of market trends and their impact. This section includes detailed analysis of CAGR and market penetration rates across various fuel types.

Dominant Regions & Segments in Saudi Arabia Automotive Fuels Market

This section identifies the leading regions and segments within the Saudi Arabia automotive fuels market. The analysis focuses on the dominance of Gasoline, PG95 Premium Grade Gasoline, and Diesel fuel types, considering factors such as economic policies, infrastructure development, and consumer preferences.

- Gasoline: High demand driven by the large number of gasoline-powered vehicles.

- PG95 Premium Grade Gasoline: Growing popularity among high-end vehicle owners.

- Diesel: Demand is primarily driven by the commercial vehicle sector.

Detailed analysis of each segment's market share, growth projections, and key drivers will be provided.

Saudi Arabia Automotive Fuels Market Product Innovations

This section summarizes recent product developments and technological advancements in the Saudi Arabia automotive fuels market. We highlight innovative fuel formulations, improved fuel efficiency technologies, and the introduction of alternative fuel options. The competitive advantages offered by these innovations and their market fit are also discussed.

Report Scope & Segmentation Analysis

This comprehensive report provides an in-depth analysis of the Saudi Arabia Automotive Fuels Market, segmenting the market by key fuel types: Gasoline, PG95 Premium Grade Gasoline, and Diesel. For each segment, we meticulously detail market size (in Millions USD), projected growth rates, and the prevailing competitive landscape. Our analysis goes beyond surface-level data, offering insights into the factors influencing each segment's trajectory.

- Gasoline: This segment is estimated to reach a market size of [Insert Market Size in Million USD] by the end of the forecast period, exhibiting a compound annual growth rate (CAGR) of [Insert CAGR]% for the forecast period. The competitive environment is characterized by the strong presence and strategic initiatives of major national and international oil companies.

- PG95 Premium Grade Gasoline: This high-value segment is currently experiencing robust growth at an estimated [Insert Growth %]%, largely fueled by increasing disposable incomes, a growing middle class, and a pronounced consumer preference for superior engine performance and fuel efficiency. Competition in this niche is comparatively less saturated, offering opportunities for specialized providers.

- Diesel: The Diesel segment represents a significant portion of the automotive fuels market in Saudi Arabia. It is anticipated to grow at a steady CAGR of [Insert CAGR]%, primarily driven by the sustained and escalating demand from the commercial vehicle sector, including logistics, transportation, and industrial applications.

Key Drivers of Saudi Arabia Automotive Fuels Market Growth

The Saudi Arabia Automotive Fuels Market is experiencing dynamic growth, propelled by a confluence of factors. Our analysis spotlights crucial drivers including significant technological advancements in fuel refining and distribution, sustained economic growth bolstering vehicle ownership and usage, and proactive government policies aimed at modernizing the energy infrastructure and promoting fuel efficiency. These elements collectively foster an environment conducive to market expansion.

Challenges in the Saudi Arabia Automotive Fuels Market Sector

This section discusses the challenges and restraints facing the Saudi Arabia automotive fuels market. We analyze regulatory hurdles, supply chain disruptions, and intense competition. Quantifiable impacts of these challenges on market growth are provided.

Emerging Opportunities in Saudi Arabia Automotive Fuels Market

This section highlights emerging trends and opportunities in the Saudi Arabia automotive fuels market. We focus on new market segments, technological advancements, and evolving consumer preferences that present growth potential.

Leading Players in the Saudi Arabia Automotive Fuels Market Market

- Aldrees Petroleum and Transport Services Company (APTSCO)

- Samref

- Orange

- Saudi Arabian Oil Co

- TotalEnergies SE

- NAFT Services Company Limited

- Liter Group

- Arabian Petroleum Supply Company

- Al-Dabbagh Group

- Alitco Group

Key Developments in Saudi Arabia Automotive Fuels Market Industry

- July 2023: In a significant development reflecting evolving global energy flows, Saudi Arabia's fuel oil imports from Russia reached an unprecedented high of 193,000 barrels per day (bpd). This surge was attributed to a combination of reduced domestic crude oil production and an amplified demand for electricity during the peak summer season.

- March 2023: A pivotal collaboration agreement was formalized between Saudi Arabia's national oil producer, Geely Automobile Holdings, and Renault SA. This strategic alliance is dedicated to the joint development of advanced automobile engines, focusing on gasoline, alternative fuels, and cutting-edge hybrid technologies. This landmark partnership signifies a proactive embrace of diversified fuel technologies and a commitment to engine innovation within the automotive sector.

Future Outlook for Saudi Arabia Automotive Fuels Market Market

This section summarizes the future growth potential of the Saudi Arabia automotive fuels market. We highlight key growth accelerators, strategic opportunities, and the overall market outlook for the forecast period. The continued expansion of the automotive sector, coupled with government initiatives to enhance fuel efficiency and the introduction of alternative fuels, will shape the market’s future.

Saudi Arabia Automotive Fuels Market Segmentation

-

1. Fuel Type

-

1.1. Gasoline

- 1.1.1. PG91 Regular Grade Gasoline

- 1.1.2. PG95 Premium Grade Gasoline

- 1.2. Diesel

-

1.1. Gasoline

Saudi Arabia Automotive Fuels Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Automotive Fuels Market Regional Market Share

Geographic Coverage of Saudi Arabia Automotive Fuels Market

Saudi Arabia Automotive Fuels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Increasing Automotive Sales in Saudi Arabia to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Automotive Fuels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Gasoline

- 5.1.1.1. PG91 Regular Grade Gasoline

- 5.1.1.2. PG95 Premium Grade Gasoline

- 5.1.2. Diesel

- 5.1.1. Gasoline

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aldrees Petroleum and Transport Services Company (APTSCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samref

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saudi Arabian Oil Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TotalEnergies SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NAFT Services Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Liter Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arabian Petroleum Supply Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Dabbagh Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alitco Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aldrees Petroleum and Transport Services Company (APTSCO)

List of Figures

- Figure 1: Saudi Arabia Automotive Fuels Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Automotive Fuels Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 2: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Fuel Type 2020 & 2033

- Table 3: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 6: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Fuel Type 2020 & 2033

- Table 7: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Automotive Fuels Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Saudi Arabia Automotive Fuels Market?

Key companies in the market include Aldrees Petroleum and Transport Services Company (APTSCO), Samref, Orange, Saudi Arabian Oil Co, TotalEnergies SE, NAFT Services Company Limited, Liter Group, Arabian Petroleum Supply Company, Al-Dabbagh Group, Alitco Group.

3. What are the main segments of the Saudi Arabia Automotive Fuels Market?

The market segments include Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.23 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Increasing Automotive Sales in Saudi Arabia to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

Jul 2023: Saudi Arabia reached a new high in fuel oil imports from Russia, amounting to 193,000 barrels per day (bpd). Fuel oil demand is being driven by the Kingdom's reduction in crude oil production as well as an anticipated increase in summertime electricity consumption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Automotive Fuels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Automotive Fuels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Automotive Fuels Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Automotive Fuels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence