Key Insights

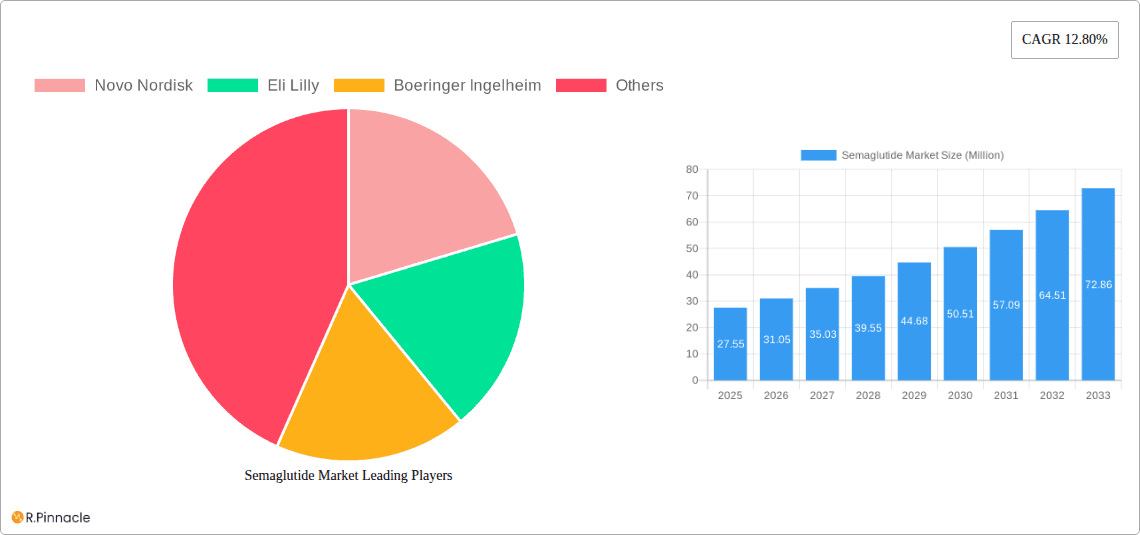

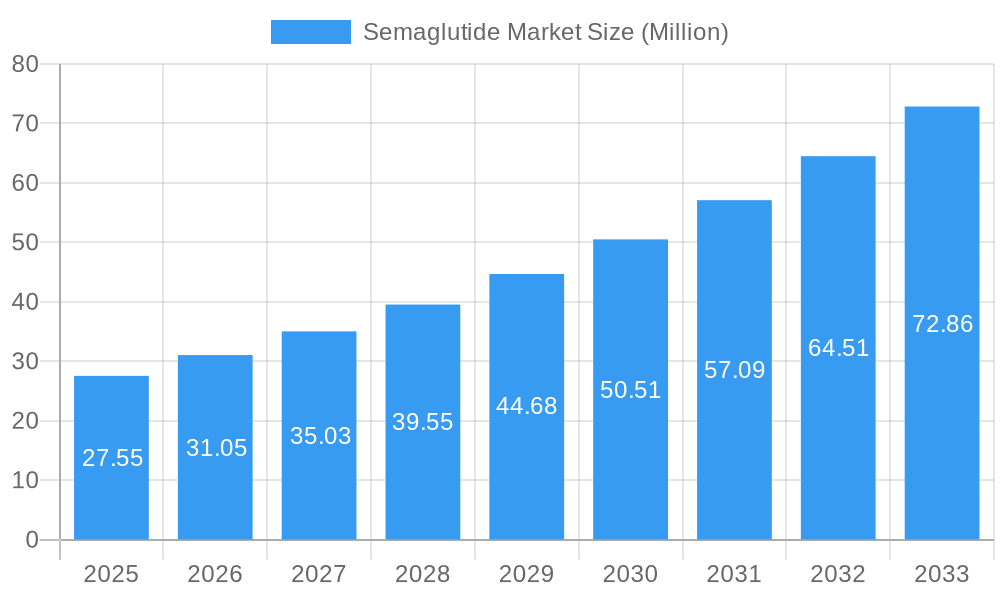

The global Semaglutide market is poised for substantial growth, projected to reach USD 27.55 Billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.80% throughout the forecast period of 2025-2033. This robust expansion is primarily fueled by the increasing prevalence of type 2 diabetes and obesity worldwide, alongside a growing demand for effective weight management solutions. The therapeutic efficacy of semaglutide in managing blood glucose levels and facilitating significant weight loss has positioned it as a cornerstone treatment in endocrinology and bariatric medicine. Key market drivers include the ongoing innovation in drug delivery systems, the expanding pipeline of semaglutide-based therapies for new indications, and heightened awareness among healthcare providers and patients regarding its benefits. The market is characterized by intense competition, with major pharmaceutical players heavily investing in research and development to enhance existing formulations and explore novel applications.

Semaglutide Market Market Size (In Million)

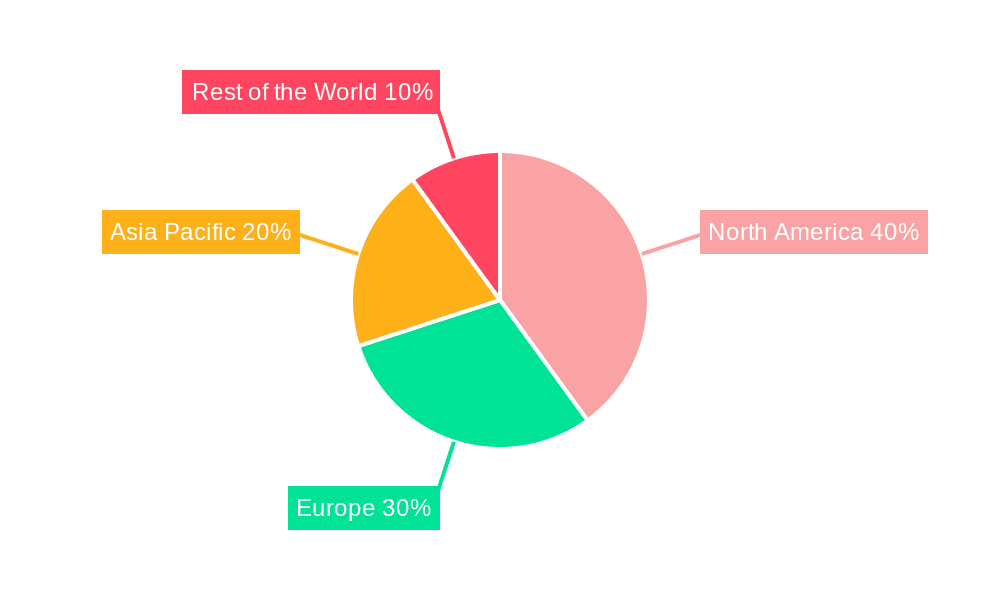

The market landscape is dynamically shaped by escalating patient adherence, supported by improved patient education and accessible treatment pathways. While the market demonstrates immense potential, certain restraints, such as the high cost of treatment and potential side effects, may influence widespread adoption in specific demographics. Nevertheless, the overarching trend indicates a strong upward trajectory driven by the unmet medical needs in chronic disease management and the proven success of semaglutide. Emerging markets, particularly in the Asia Pacific region, present significant growth opportunities due to a burgeoning patient population and increasing healthcare expenditure. Strategic collaborations, mergers, and acquisitions are expected to further consolidate the market, fostering innovation and expanding market reach for leading companies in the semaglutide space.

Semaglutide Market Company Market Share

Unlock critical insights into the rapidly evolving Semaglutide market with this in-depth report. Covering historical trends, current dynamics, and future projections, this analysis is essential for pharmaceutical manufacturers, healthcare providers, investors, and policymakers navigating the complexities of GLP-1 receptor agonists. Our comprehensive study, encompassing the Study Period: 2019–2033, with a Base Year: 2025, an Estimated Year: 2025, and a Forecast Period: 2025–2033, provides an unparalleled understanding of market drivers, restraints, opportunities, and competitive landscapes. Dive deep into segment-specific growth, regional dominance, and the innovative strategies employed by key industry players.

Semaglutide Market Market Structure & Innovation Trends

The Semaglutide market exhibits a highly concentrated structure, dominated by a few key pharmaceutical giants. Novo Nordisk and Eli Lilly are the primary innovators and manufacturers, holding a significant market share. Innovation is primarily driven by ongoing clinical trials exploring new indications for semaglutide, particularly in cardiovascular health and other metabolic disorders, alongside the development of novel delivery mechanisms and formulations. The regulatory framework is stringent, with FDA and EMA approvals being critical for market access. However, the burgeoning demand has also led to increased scrutiny and potential for new entrants, though significant barriers to entry exist due to extensive R&D costs and intellectual property. Product substitutes are emerging, but semaglutide’s demonstrated efficacy in weight management and diabetes control currently gives it a strong competitive edge. End-user demographics are broadening from primarily Type 2 diabetes patients to include individuals seeking effective weight management solutions, a significant demographic shift. Mergers and acquisitions (M&A) are less prevalent in the core semaglutide manufacturing space due to existing market dominance, but strategic partnerships and licensing agreements for complementary technologies are on the rise. For instance, collaborations focused on developing new drug combinations or delivery systems could represent significant future M&A deal values.

Semaglutide Market Market Dynamics & Trends

The global Semaglutide market is experiencing an unprecedented surge, driven by a confluence of factors including rising global obesity rates, increasing prevalence of Type 2 diabetes, and a growing consumer demand for effective weight management solutions. The market's compound annual growth rate (CAGR) is projected to remain exceptionally high throughout the forecast period, fueled by extensive clinical evidence supporting semaglutide's efficacy and safety profile. Technological disruptions are primarily centered around advancing drug delivery systems, aiming for greater convenience and improved patient adherence. Furthermore, ongoing research into semaglutide's potential therapeutic benefits beyond diabetes and obesity, such as its impact on cardiovascular disease and non-alcoholic steatohepatitis (NASH), is a significant growth catalyst. Consumer preferences are increasingly shifting towards evidence-based treatments with demonstrable long-term health outcomes. The market penetration of semaglutide has rapidly expanded, moving from a niche therapeutic agent to a mainstream option for weight management and diabetes care. This rapid adoption, however, has also led to significant supply chain challenges and shortages, particularly for the lower dosage formulations. Competitive dynamics are intense, with key players investing heavily in manufacturing capacity expansion and R&D to maintain their market leadership and address the escalating demand. The 'off-label' use of semaglutide for weight loss has further amplified demand, creating both opportunities and challenges for market players and regulatory bodies. The therapeutic landscape is evolving, with semaglutide often being prescribed as a first-line or adjunct therapy, underscoring its pivotal role in modern metabolic disease management. The market is poised for continued robust growth, predicated on ongoing innovation, expanding indications, and strategies to mitigate supply constraints.

Dominant Regions & Segments in Semaglutide Market

The North America region currently dominates the global Semaglutide market, primarily driven by the United States. This regional dominance is attributed to several key factors. Firstly, the high prevalence of obesity and Type 2 diabetes in the US population, coupled with a robust healthcare infrastructure and high per capita healthcare spending, creates a substantial patient pool receptive to semaglutide therapies. Secondly, strong market access and reimbursement policies for innovative pharmaceuticals, alongside a proactive approach to adopting new treatment modalities, further bolster its position. Economic policies that encourage pharmaceutical research and development, along with established distribution networks and advanced clinical trial infrastructure, contribute significantly to North America's leading role.

Among the key brands, Wegovy is emerging as a dominant force, particularly in the weight management segment. Its approval for chronic weight management has unlocked a vast new patient demographic beyond those with Type 2 diabetes. The extensive clinical data supporting its efficacy in significant weight loss has fueled its rapid uptake. Ozempic, while primarily indicated for Type 2 diabetes, has also seen substantial demand for weight management due to its GLP-1 mechanism, leading to widespread 'off-label' use and contributing to its market prominence. Rybelsus, the oral formulation, offers a distinct advantage in terms of patient convenience and adherence, carving out its own significant market share.

Key drivers for this regional and segmental dominance include:

- High Disease Burden: The disproportionately high rates of obesity and diabetes in North America create a vast and immediate market need.

- Healthcare Spending & Access: High disposable income and advanced healthcare systems allow for greater patient access to expensive, novel therapies.

- Regulatory Approvals: Swift and favorable regulatory pathways in countries like the US accelerate market entry and uptake.

- Physician and Patient Awareness: Extensive marketing efforts and robust clinical trial data have fostered high levels of awareness and acceptance among both healthcare professionals and patients.

- Innovation Hubs: North America serves as a leading hub for pharmaceutical research and development, allowing for faster introduction of new semaglutide-based products and formulations.

The competitive dynamics within these segments are characterized by aggressive marketing, continuous R&D investment, and strategic efforts to expand manufacturing capacity to meet soaring demand. The dominance of Wegovy and Ozempic highlights the market's strong responsiveness to therapies with proven efficacy in addressing critical unmet medical needs in metabolic health.

Semaglutide Market Product Innovations

Product innovations in the Semaglutide market are primarily focused on enhancing therapeutic outcomes and improving patient experience. This includes the development of higher-dose formulations and novel delivery systems aimed at simplifying administration and increasing patient adherence. Ongoing research into expanded therapeutic applications, particularly in areas like cardiovascular risk reduction, further bolsters semaglutide's market position. The competitive advantage lies in demonstrating superior efficacy and safety profiles through rigorous clinical trials, alongside addressing manufacturing and supply chain efficiencies to meet escalating global demand.

Report Scope & Segmentation Analysis

This report segments the Semaglutide market by Brand, analyzing the performance and growth projections of Wegovy, Rybelsus, and Ozempic.

- Wegovy: This segment is projected to witness robust growth, driven by its established efficacy in chronic weight management and expanding indications, particularly in cardiovascular disease risk reduction. Market size is significant and expected to increase substantially as manufacturing capacity expands.

- Rybelsus: The oral formulation of semaglutide offers a unique competitive advantage in patient convenience. Growth is steady, appealing to a segment of patients who prefer oral administration over injectables, contributing to market share expansion.

- Ozempic: While primarily an anti-diabetic drug, Ozempic's significant impact on weight loss continues to drive its market presence. Its established efficacy in Type 2 diabetes management ensures continued strong demand, with 'off-label' use further contributing to its market size.

Key Drivers of Semaglutide Market Growth

The semaglutide market is propelled by a multi-faceted growth engine. Firstly, the epidemic of obesity and Type 2 diabetes globally creates an immense and growing patient population requiring effective therapeutic interventions. Secondly, advancements in clinical research consistently demonstrate semaglutide's efficacy not only in glycemic control and weight loss but also in reducing cardiovascular events, thereby expanding its therapeutic utility and market appeal. Thirdly, increasing patient and physician awareness regarding the benefits of GLP-1 receptor agonists, coupled with favorable reimbursement policies in many developed nations, facilitates wider adoption. Lastly, technological innovations in drug formulation and delivery systems are enhancing patient convenience and adherence, further stimulating market growth.

Challenges in the Semaglutide Market Sector

Despite its remarkable growth, the semaglutide market faces significant challenges. The most pressing is the exacerbated supply chain constraint, with demand far outstripping manufacturing capacity, leading to drug shortages for key formulations. This scarcity impacts patient access and treatment continuity. Secondly, high drug costs present a barrier to access, particularly in developing economies and for underinsured populations, limiting market penetration. Regulatory hurdles, while necessary for safety, can also delay the approval of new indications or manufacturing expansions. Furthermore, the emergence of competitor products and potential for 'off-label' prescribing misuse require continuous monitoring and strategic positioning by market leaders.

Emerging Opportunities in Semaglutide Market

The semaglutide market presents substantial emerging opportunities. Expansion into new therapeutic areas beyond diabetes and obesity, such as NASH and other metabolic disorders, holds significant promise for increasing market size and revenue. Geographic expansion into emerging markets with rising rates of metabolic diseases offers vast untapped potential. Furthermore, innovation in delivery mechanisms, including more convenient long-acting formulations or smart delivery devices, can enhance patient compliance and market penetration. The growing understanding of semaglutide's multifaceted physiological effects opens avenues for combination therapies that could offer synergistic benefits and create novel treatment paradigms.

Leading Players in the Semaglutide Market Market

- Novo Nordisk

- Eli Lilly

- Boeringer Ingelheim

Key Developments in Semaglutide Market Industry

- November 2023: Novo Nordisk announced that Wegovy was shown to reduce the risk in people with cardiovascular disease or another cardiovascular event by 20%. The results were confirmed in a presentation of the entire dataset at the American Heart Association conference in Philadelphia. This significant development expands Wegovy's therapeutic value beyond weight management and diabetes, potentially broadening its market appeal.

- September 2023: Novo Nordisk advised the Ozempic Medicine Shortage Action Group and Therapeutic Goods Administration that the supply of weight loss drugs throughout FY 2023 and FY 2024 will be limited. The company stated that the demand for this drug has surged in recent months, particularly for the low-dose (0.25/0.5 mg) version, and additional demand is created by a rapid increase in prescription for ‘off-label’ use. This highlights the intense demand and supply challenges impacting the market.

Future Outlook for Semaglutide Market Market

The future outlook for the Semaglutide market remains exceptionally robust, driven by sustained demand for effective obesity and diabetes management solutions. The proven cardiovascular benefits of semaglutide will further solidify its position as a multi-purpose therapeutic agent, expanding its reach across different patient populations. Significant investments in manufacturing capacity by leading players are expected to gradually alleviate supply constraints, enabling broader market access. Continued research into novel indications, such as non-alcoholic steatohepatitis (NASH) and potential neurological benefits, promises to unlock new revenue streams and further diversify the market. Strategic partnerships and potential pipeline advancements from other industry players will ensure a dynamic and competitive landscape, all contributing to sustained, high-magnitude growth throughout the forecast period.

Semaglutide Market Segmentation

-

1. Brand

- 1.1. Wegovy

- 1.2. Rybelsus

- 1.3. Ozempic

Semaglutide Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. Italy

- 2.4. France

- 2.5. United Kingdom

- 2.6. Switzerland

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. India

- 3.3. Rest of Asia Pacific

- 4. Rest of the World

Semaglutide Market Regional Market Share

Geographic Coverage of Semaglutide Market

Semaglutide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Prevalence of Diabetes Increases Risk of Diabetic Retinopathy; Availability of Advanced Technology and Minimally Invasive Laser Technique

- 3.3. Market Restrains

- 3.3.1. ; Extended Approval Time for Drugs

- 3.4. Market Trends

- 3.4.1. Wegovy is Expected to Register Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Brand

- 5.1.1. Wegovy

- 5.1.2. Rybelsus

- 5.1.3. Ozempic

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Brand

- 6. North America Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Brand

- 6.1.1. Wegovy

- 6.1.2. Rybelsus

- 6.1.3. Ozempic

- 6.1. Market Analysis, Insights and Forecast - by Brand

- 7. Europe Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Brand

- 7.1.1. Wegovy

- 7.1.2. Rybelsus

- 7.1.3. Ozempic

- 7.1. Market Analysis, Insights and Forecast - by Brand

- 8. Asia Pacific Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Brand

- 8.1.1. Wegovy

- 8.1.2. Rybelsus

- 8.1.3. Ozempic

- 8.1. Market Analysis, Insights and Forecast - by Brand

- 9. Rest of the World Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Brand

- 9.1.1. Wegovy

- 9.1.2. Rybelsus

- 9.1.3. Ozempic

- 9.1. Market Analysis, Insights and Forecast - by Brand

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Novo Nordisk

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Eli Lilly

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Boeringer Ingelheim

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.1 Novo Nordisk

List of Figures

- Figure 1: Global Semaglutide Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Semaglutide Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Semaglutide Market Revenue (Million), by Brand 2025 & 2033

- Figure 4: North America Semaglutide Market Volume (K Unit), by Brand 2025 & 2033

- Figure 5: North America Semaglutide Market Revenue Share (%), by Brand 2025 & 2033

- Figure 6: North America Semaglutide Market Volume Share (%), by Brand 2025 & 2033

- Figure 7: North America Semaglutide Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Semaglutide Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Semaglutide Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Semaglutide Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Semaglutide Market Revenue (Million), by Brand 2025 & 2033

- Figure 12: Europe Semaglutide Market Volume (K Unit), by Brand 2025 & 2033

- Figure 13: Europe Semaglutide Market Revenue Share (%), by Brand 2025 & 2033

- Figure 14: Europe Semaglutide Market Volume Share (%), by Brand 2025 & 2033

- Figure 15: Europe Semaglutide Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Semaglutide Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Semaglutide Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Semaglutide Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Semaglutide Market Revenue (Million), by Brand 2025 & 2033

- Figure 20: Asia Pacific Semaglutide Market Volume (K Unit), by Brand 2025 & 2033

- Figure 21: Asia Pacific Semaglutide Market Revenue Share (%), by Brand 2025 & 2033

- Figure 22: Asia Pacific Semaglutide Market Volume Share (%), by Brand 2025 & 2033

- Figure 23: Asia Pacific Semaglutide Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Semaglutide Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Semaglutide Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Semaglutide Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Semaglutide Market Revenue (Million), by Brand 2025 & 2033

- Figure 28: Rest of the World Semaglutide Market Volume (K Unit), by Brand 2025 & 2033

- Figure 29: Rest of the World Semaglutide Market Revenue Share (%), by Brand 2025 & 2033

- Figure 30: Rest of the World Semaglutide Market Volume Share (%), by Brand 2025 & 2033

- Figure 31: Rest of the World Semaglutide Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Rest of the World Semaglutide Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Rest of the World Semaglutide Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Semaglutide Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 2: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 3: Global Semaglutide Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Semaglutide Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 6: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 7: Global Semaglutide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Semaglutide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 16: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 17: Global Semaglutide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Semaglutide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Italy Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: France Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Switzerland Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Switzerland Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 34: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 35: Global Semaglutide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Semaglutide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Japan Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Japan Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: India Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Asia Pacific Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Asia Pacific Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 44: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 45: Global Semaglutide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Semaglutide Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semaglutide Market?

The projected CAGR is approximately 12.80%.

2. Which companies are prominent players in the Semaglutide Market?

Key companies in the market include Novo Nordisk, Eli Lilly, Boeringer Ingelheim.

3. What are the main segments of the Semaglutide Market?

The market segments include Brand.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.55 Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Prevalence of Diabetes Increases Risk of Diabetic Retinopathy; Availability of Advanced Technology and Minimally Invasive Laser Technique.

6. What are the notable trends driving market growth?

Wegovy is Expected to Register Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Extended Approval Time for Drugs.

8. Can you provide examples of recent developments in the market?

November 2023: Novo Nordisk announced that Wegovy was shown to reduce the risk in people with cardiovascular disease or another cardiovascular event by 20%. The results were confirmed in a presentation of the entire dataset at the American Heart Association conference in Philadelphia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semaglutide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semaglutide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semaglutide Market?

To stay informed about further developments, trends, and reports in the Semaglutide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence