Key Insights

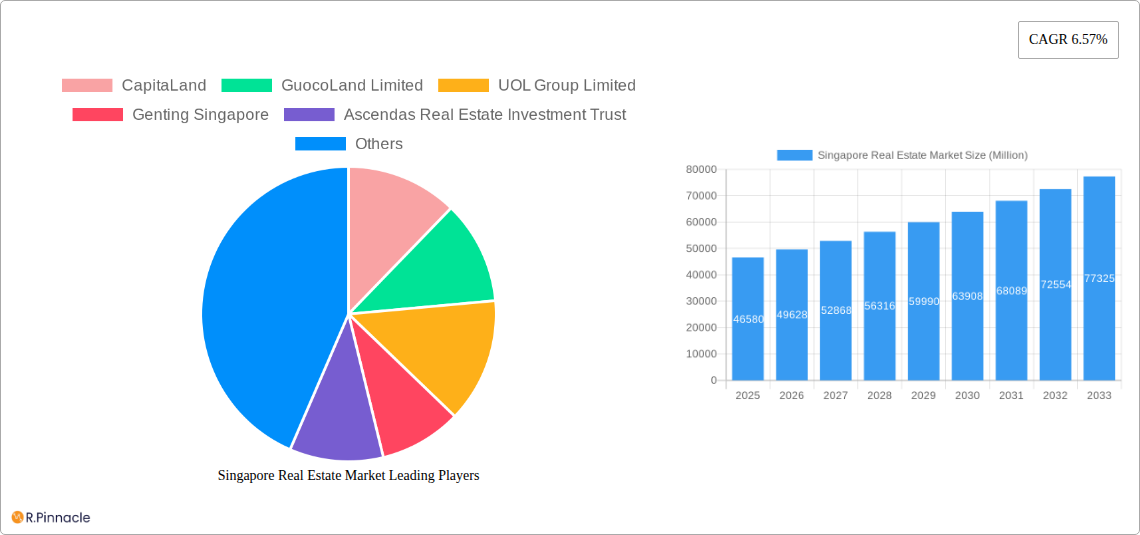

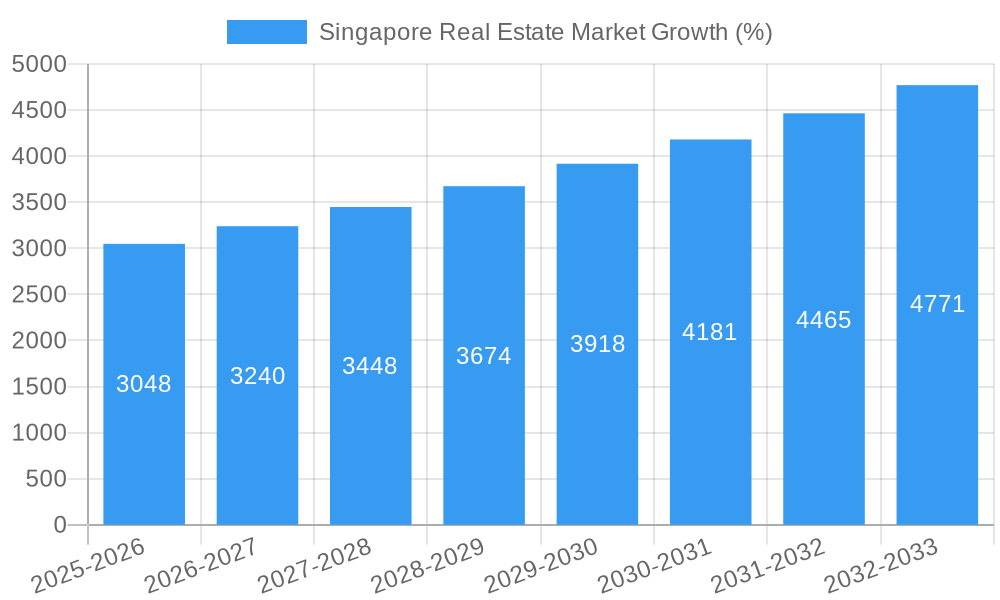

The Singapore real estate market, valued at $46.58 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.57% from 2025 to 2033. This growth is driven by several key factors. Firstly, Singapore's strong economy and consistently high GDP per capita attract significant foreign investment and high-net-worth individuals seeking prime residential and commercial properties. Secondly, government initiatives promoting urban redevelopment and infrastructure improvements continue to fuel demand. Furthermore, a limited land supply creates scarcity, underpinning property values. The market is segmented by property type (apartments, condominiums, villas, and others) and value (premium, luxury, and affordable), catering to diverse buyer preferences and budgets. While rising interest rates and potential economic slowdowns pose some challenges, the long-term outlook remains positive, fueled by sustained population growth and ongoing economic stability. Key players like CapitaLand, GuocoLand, UOL Group, and City Developments Limited continue to shape the market landscape through their development projects and investment strategies.

The market's segmentation offers diverse investment opportunities. The premium and luxury segments are expected to see strong growth due to persistent demand from high-net-worth individuals and investors. The affordable segment, while experiencing competitive pressure, benefits from government housing schemes and a significant portion of the population seeking affordable housing options. The types of properties also reflect market trends, with apartments and condominiums remaining dominant due to their suitability for urban living. However, villas and other property types are expected to witness increased demand from families and individuals seeking more spacious living arrangements. Analyzing the historical period (2019-2024) reveals a period of steady growth, laying a solid foundation for the projected expansion during the forecast period (2025-2033). The continued diversification of the market and its responsiveness to evolving needs promise further development and growth in the coming years.

Singapore Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Singapore real estate market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report forecasts market trends and identifies key opportunities and challenges. The report leverages extensive data analysis to provide actionable intelligence on market dynamics, segmentation, leading players, and future outlook. With a total market value exceeding S$XX Million in 2025, the Singapore real estate market presents significant investment potential.

Singapore Real Estate Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Singapore real estate market. We examine market concentration, highlighting the share held by key players like CapitaLand, GuocoLand Limited, UOL Group Limited, Genting Singapore, Ascendas Real Estate Investment Trust, City Developments Limited, Global Logistics Properties, EL Development Pte Limited, Frasers Property, and Far East Organization (list not exhaustive). The report further explores M&A activities, providing insights into deal values and their impact on market consolidation. Specific metrics like market share for each major player (e.g., CapitaLand holding XX% market share in 2025) and M&A deal values (e.g., total M&A deal value in 2024 exceeding S$XX Million) are included. Regulatory frameworks influencing development, construction, and sales are thoroughly examined, considering their impact on innovation and market growth. Analysis of product substitutes, emerging technologies, and evolving end-user demographics completes this section.

- Market Concentration: Analysis of market share held by top players.

- Innovation Drivers: Technological advancements and government policies fostering innovation.

- Regulatory Frameworks: Impact of regulations on market dynamics.

- M&A Activities: Analysis of major mergers and acquisitions and their financial implications.

- End-User Demographics: Analysis of changing demographics and their impact on housing demand.

Singapore Real Estate Market Market Dynamics & Trends

This section delves into the dynamic forces shaping the Singapore real estate market. We analyze market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report utilizes historical data (2019-2024) to establish trends and projects future growth using a Compound Annual Growth Rate (CAGR) for various segments. Market penetration rates for different property types (apartments, condominiums, villas, etc.) are also presented. Key trends such as increasing urbanization, government housing policies, and shifting consumer preferences (e.g., towards sustainable and smart homes) are analyzed. The impact of technological disruptions, such as PropTech solutions and the increasing use of data analytics in real estate, are discussed, alongside their influence on market efficiency and investment strategies. The competitive landscape analysis explores the strategies adopted by key players and their impact on market dynamics. The CAGR for the overall market is estimated at XX% between 2025 and 2033.

Dominant Regions & Segments in Singapore Real Estate Market

This section identifies the leading regions and segments within the Singapore real estate market. A detailed analysis of market dominance by property type (Apartment, Condominiums, Villas, Other Types) and value (Premium, Luxury, Affordable) is presented. Key drivers for dominance within each segment are examined through the use of bullet points which include economic policies, infrastructure developments, and government initiatives. The report analyzes why certain segments show higher growth rates than others, explaining the factors driving market share.

- Key Drivers for Dominant Segments:

- Economic policies influencing affordability and investment.

- Infrastructure development impacting accessibility and desirability.

- Government initiatives related to housing supply and demand.

Singapore Real Estate Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in the Singapore real estate market. The report highlights innovative building materials, sustainable design practices, and the integration of smart home technologies. Analysis focuses on how these innovations are improving energy efficiency, enhancing security, and increasing the appeal of properties to potential buyers and renters. The section also addresses the market fit of these new products and technologies, analyzing their potential to disrupt traditional practices within the industry.

Report Scope & Segmentation Analysis

This report segments the Singapore real estate market by property type (Apartment, Condominiums, Villas, Other Types) and value (Premium, Luxury, Affordable). Each segment is examined in detail, providing growth projections, market sizes for 2025 and 2033 (in S$ Million), and insights into competitive dynamics. This section offers a clear understanding of the specific opportunities and challenges within each segment.

- Apartments: Market size, growth projections, and competitive analysis.

- Condominiums: Market size, growth projections, and competitive analysis.

- Villas: Market size, growth projections, and competitive analysis.

- Other Types: Market size, growth projections, and competitive analysis.

- Premium: Market size, growth projections, and competitive analysis.

- Luxury: Market size, growth projections, and competitive analysis.

- Affordable: Market size, growth projections, and competitive analysis.

Key Drivers of Singapore Real Estate Market Growth

This section outlines the key factors driving the growth of the Singapore real estate market. These factors include robust economic growth, government policies promoting homeownership, continuous infrastructure development, and increasing urbanization. Specific examples of government initiatives and infrastructure projects are included, along with their estimated contribution to market expansion. Technological advancements, such as the use of Building Information Modeling (BIM) and smart home technologies, further contribute to market growth.

Challenges in the Singapore Real Estate Market Sector

This section addresses the key challenges facing the Singapore real estate market. These challenges include land scarcity, strict regulations, high construction costs, and intense competition among developers. The section quantifies the impact of these challenges using data and illustrates how these factors may constrain market growth. The report also explores potential solutions to mitigate these challenges.

Emerging Opportunities in Singapore Real Estate Market

This section identifies emerging opportunities for growth within the Singapore real estate market. These opportunities include the growing demand for sustainable and green buildings, the rise of co-living spaces, and the increasing adoption of technology in property management. The report highlights specific areas where new market entrants can leverage these opportunities for success.

Leading Players in the Singapore Real Estate Market Market

- CapitaLand

- GuocoLand Limited

- UOL Group Limited

- Genting Singapore

- Ascendas Real Estate Investment Trust

- City Developments Limited

- Global Logistics Properties

- EL Development Pte Limited

- Frasers Property

- Far East Organization

Key Developments in Singapore Real Estate Market Industry

- March 2024: Launch of a new housing area in Yishun (Chencharu estate), with approximately 10,000 new homes planned, including 1,200 Build-to-Order (BTO) units. This initiative aims to address housing demand and increase public housing availability.

- April 2024: Demolition of two historical buildings in Pearl’s Hill to make way for new housing developments, comprising approximately 6,000 new homes over the next decade. This project involves the development of a significant residential site and shows a substantial commitment to increasing housing supply.

Future Outlook for Singapore Real Estate Market Market

The Singapore real estate market is poised for continued growth, driven by strong economic fundamentals, supportive government policies, and ongoing urbanization. The market's future potential is particularly promising in segments catering to evolving consumer preferences, including sustainable housing and smart home technologies. Strategic opportunities exist for developers to innovate, embrace technology, and deliver high-quality developments that meet the changing demands of the market. This positions Singapore's real estate sector for substantial long-term growth and investment potential.

Singapore Real Estate Market Segmentation

-

1. Type

- 1.1. Apartment

- 1.2. Condominiums

- 1.3. Villas

- 1.4. Other Types

-

2. Value

- 2.1. Premium

- 2.2. Luxury

- 2.3. Affordable

Singapore Real Estate Market Segmentation By Geography

- 1. Singapore

Singapore Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Economic Growth; High Demand for Property Boosting the Market

- 3.3. Market Restrains

- 3.3.1. Experiencing Slower Growth due to Government Measures; Rising Interest Rates Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Rise in the Residential Segment of the Singapore Real Estate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartment

- 5.1.2. Condominiums

- 5.1.3. Villas

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Value

- 5.2.1. Premium

- 5.2.2. Luxury

- 5.2.3. Affordable

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CapitaLand

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GuocoLand Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UOL Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Genting Singapore

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ascendas Real Estate Investment Trust

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 City Developments Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Global Logistics Properties

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EL Development Pte Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Frasers Property**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Far East Organization

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CapitaLand

List of Figures

- Figure 1: Singapore Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Singapore Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Singapore Real Estate Market Revenue Million Forecast, by Value 2019 & 2032

- Table 4: Singapore Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Singapore Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Singapore Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Singapore Real Estate Market Revenue Million Forecast, by Value 2019 & 2032

- Table 8: Singapore Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Real Estate Market?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the Singapore Real Estate Market?

Key companies in the market include CapitaLand, GuocoLand Limited, UOL Group Limited, Genting Singapore, Ascendas Real Estate Investment Trust, City Developments Limited, Global Logistics Properties, EL Development Pte Limited, Frasers Property**List Not Exhaustive, Far East Organization.

3. What are the main segments of the Singapore Real Estate Market?

The market segments include Type, Value.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Economic Growth; High Demand for Property Boosting the Market.

6. What are the notable trends driving market growth?

Rise in the Residential Segment of the Singapore Real Estate Market.

7. Are there any restraints impacting market growth?

Experiencing Slower Growth due to Government Measures; Rising Interest Rates Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

April 2024: Two historical buildings in the Pearl’s Hill vicinity are set to be demolished to make way for new housing developments. The government plans to build 6,000 new homes in the area over the next decade. The third housing site is located at the intersection of Chin Swee and Outram roads, while the white site sits primarily atop the underground Outram Park MRT station. The 2.9 ha white site, with a plot ratio of 6.3, has condominium units and long-term serviced apartments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Real Estate Market?

To stay informed about further developments, trends, and reports in the Singapore Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence