Key Insights

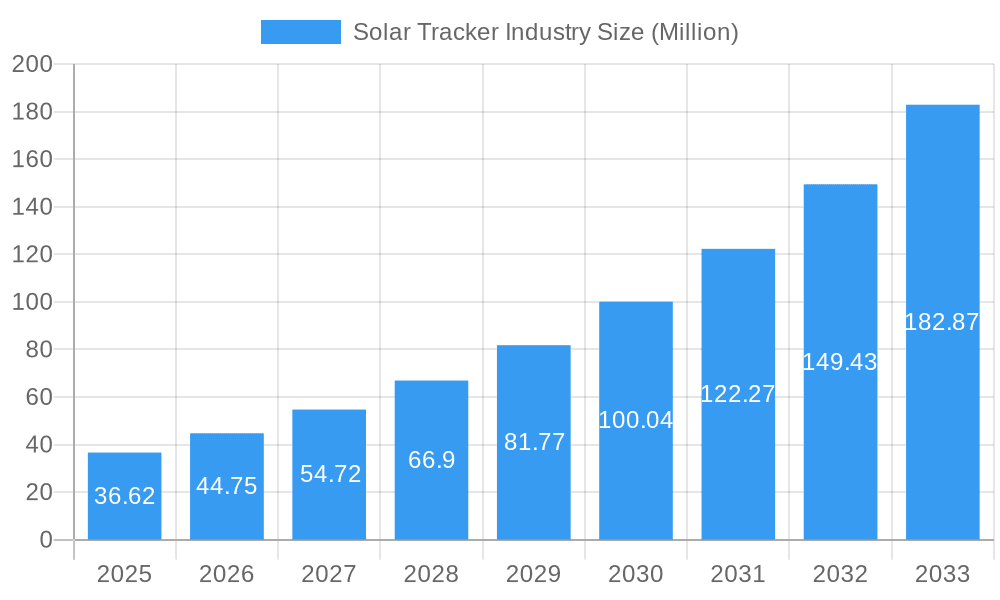

The global Solar Tracker Industry is experiencing robust growth, projected to reach a market size of USD 36.62 Million by 2025, and is poised for further expansion with a compound annual growth rate (CAGR) of 22.38% over the forecast period of 2025-2033. This significant uplift is primarily driven by the escalating demand for renewable energy solutions to combat climate change and achieve energy independence. Governments worldwide are implementing supportive policies, incentives, and regulatory frameworks that favor solar power adoption, further accelerating market penetration. Technological advancements in solar tracker systems, including enhanced precision, improved durability, and smart monitoring capabilities, are also playing a crucial role in boosting their appeal. The increasing cost-effectiveness of solar energy, coupled with the rising efficiency of solar panels, makes solar trackers an essential component for maximizing energy generation and achieving a better return on investment for solar projects.

Solar Tracker Industry Market Size (In Million)

Key market trends shaping the solar tracker landscape include the growing adoption of bifacial solar panels, which necessitates trackers capable of optimizing energy capture from both sides of the panel. Furthermore, the industry is witnessing a trend towards more sophisticated and integrated solar tracking solutions, offering enhanced reliability and reduced maintenance requirements. While the market is characterized by strong growth, potential restraints such as initial capital investment for tracking systems and land availability constraints in certain regions could pose challenges. Nevertheless, the overarching shift towards sustainable energy, coupled with continuous innovation and decreasing costs of solar technology, is expected to drive sustained expansion for the solar tracker market globally. Major players are actively engaged in research and development to introduce next-generation tracking solutions that are more efficient, cost-effective, and adaptable to diverse environmental conditions.

Solar Tracker Industry Company Market Share

This comprehensive report provides an unparalleled deep dive into the global solar tracker market, offering critical insights for stakeholders navigating this rapidly evolving sector. Spanning the historical period of 2019–2024 and projecting through 2033, with a base year and estimated year of 2025, this analysis is your definitive guide to understanding market structures, dynamics, innovations, and growth trajectories. Discover the forces shaping the solar tracking systems market, identify strategic opportunities, and gain a competitive edge in the race to harness solar power more efficiently.

Solar Tracker Industry Market Structure & Innovation Trends

The global solar tracker industry market structure is characterized by a dynamic blend of established players and emerging innovators, with a moderate to high level of market concentration driven by technological expertise and project scale. Key innovation drivers include the relentless pursuit of enhanced energy yield, improved system reliability, and cost reduction for utility-scale and distributed solar projects. Regulatory frameworks worldwide are increasingly favoring renewable energy adoption, acting as a significant catalyst for solar tracker deployment. While direct product substitutes are limited, advancements in fixed-tilt solar mounting systems pose a consideration, though their energy generation potential remains lower. End-user demographics are increasingly diverse, encompassing utility companies, independent power producers (IPPs), commercial & industrial (C&I) entities, and even residential consumers seeking optimal solar performance. Mergers and acquisition (M&A) activities are prevalent, with recent deals valued in the hundreds of Million, signaling a consolidation trend and strategic expansion among leading companies. For instance, Array Technologies Inc. has been a consistent leader, while companies like Nextracker Inc. and PV Hardware (PVH) are rapidly expanding their global footprint. The market share for leading solar tracker manufacturers is substantial, with the top five players holding a significant portion of the global market.

- Market Concentration: Moderate to High, driven by technological barriers and economies of scale.

- Innovation Drivers: Increased energy yield, enhanced durability, cost optimization, smart grid integration.

- Regulatory Frameworks: Favorable government policies, renewable energy mandates, incentives.

- Product Substitutes: Fixed-tilt solar mounting systems (lower energy yield).

- End-User Demographics: Utilities, IPPs, C&I sectors, growing residential interest.

- M&A Activities: Ongoing, with significant deal values in the Million range, indicating strategic consolidation and growth.

Solar Tracker Industry Market Dynamics & Trends

The solar tracker industry market dynamics are characterized by robust and sustained growth, primarily fueled by the escalating global demand for renewable energy and the inherent advantages of solar trackers in maximizing solar panel energy output. This sector is experiencing a significant upward trajectory, with the Compound Annual Growth Rate (CAGR) projected to remain exceptionally strong throughout the forecast period. Technological disruptions are a constant feature, with manufacturers continuously innovating to improve tracker performance, reduce installation complexity, and enhance reliability in diverse environmental conditions. Consumer preferences are increasingly leaning towards solutions that offer the highest return on investment (ROI), making solar trackers an attractive proposition for large-scale solar farms where even marginal gains in energy generation translate to substantial revenue increases. Competitive dynamics are intense, with a landscape populated by global leaders and agile regional players vying for market share through product differentiation, competitive pricing, and strategic partnerships. Market penetration is expanding rapidly, particularly in regions with high solar irradiance and supportive government policies, indicating a growing adoption rate across various solar project types. The solar tracker market size is projected to reach several Billion by 2033, underscoring its critical role in the clean energy transition. Advancements in automation, AI-driven optimization, and robust materials science are further propelling the market forward.

Dominant Regions & Segments in Solar Tracker Industry

The dominant regions in the solar tracker industry are consistently led by Asia Pacific, driven by substantial investments in renewable energy infrastructure and favorable government policies aimed at achieving energy independence and carbon reduction goals. China, in particular, remains a powerhouse, accounting for a significant portion of global solar installations and, consequently, solar tracker demand. North America, especially the United States, also represents a major market due to its ambitious renewable energy targets and a mature solar development ecosystem. Europe, with its strong commitment to sustainability, follows closely, with key markets like Spain and Germany demonstrating significant growth.

Within the segments, Single Axis trackers dominate the market landscape. This dominance is attributed to their superior cost-effectiveness and proven ability to deliver significant energy yield improvements compared to fixed-tilt systems, making them the preferred choice for most utility-scale solar projects.

- Leading Region: Asia Pacific (driven by China and India).

- Key Drivers in Asia Pacific:

- Ambitious renewable energy targets and national solar programs.

- Declining levelized cost of electricity (LCOE) for solar power.

- Massive land availability for large-scale solar farms.

- Government incentives and tax benefits.

- Dominant Segment: Single Axis Trackers.

- Key Drivers for Single Axis Dominance:

- Optimal balance between performance enhancement and cost.

- Proven reliability and scalability for utility-scale projects.

- Wide range of applications across diverse geographical terrains.

- Continuous innovation leading to improved efficiency and ease of installation.

- Growing Segment: Dual Axis Trackers, while holding a smaller market share, are gaining traction in regions with high diffuse solar radiation and for specialized applications where maximum energy capture is paramount, despite their higher initial cost.

Solar Tracker Industry Product Innovations

Product innovations in the solar tracker industry are primarily focused on enhancing energy yield, improving system robustness, and streamlining installation and maintenance processes. Manufacturers are developing trackers with advanced control algorithms that optimize panel orientation in real-time, responding to localized weather patterns and cloud cover for maximum energy harvesting. The introduction of portrait module compatibility in single-axis trackers, such as FTC Solar's Pioneer solution, addresses the growing trend towards larger and more efficient solar panels. Competitive advantages are being gained through the integration of smart features like predictive maintenance, wireless communication, and enhanced wind-stow strategies to protect systems during extreme weather events. These technological advancements are crucial for meeting the demands of increasingly sophisticated solar projects and pushing the boundaries of solar energy efficiency.

Report Scope & Segmentation Analysis

This report meticulously analyzes the solar tracker industry, segmenting the market by axis type to provide granular insights. The primary segmentation includes Single Axis trackers and Dual Axis trackers. The Single Axis segment, representing the larger market share, is projected to experience robust growth due to its widespread adoption in utility-scale solar farms, offering a compelling balance of performance enhancement and cost-effectiveness. Growth projections for this segment are exceptionally strong, driven by ongoing global solar capacity additions. The Dual Axis segment, while smaller, is anticipated to witness a healthy CAGR, driven by niche applications where maximizing energy capture is critical, such as in areas with high diffuse solar radiation or where land constraints necessitate optimal panel orientation. Competitive dynamics within each segment are shaped by technological innovation, pricing strategies, and regional deployment success.

Key Drivers of Solar Tracker Industry Growth

The solar tracker industry is propelled by a confluence of powerful growth drivers, making it a cornerstone of the global renewable energy transition.

- Technological Advancements: Continuous innovation in tracker design, control systems, and materials science leads to increased energy yield and improved reliability. For instance, advanced algorithms can now predict and adapt to complex weather patterns, maximizing energy capture.

- Economic Factors: The declining cost of solar modules, coupled with the substantial increase in energy output provided by trackers, significantly lowers the Levelized Cost of Electricity (LCOE) for solar projects, making them increasingly competitive with traditional energy sources.

- Regulatory Support: Government policies worldwide, including renewable energy mandates, tax incentives, and carbon reduction targets, create a highly favorable environment for solar tracker deployment, incentivizing developers to invest in higher-performing solar solutions.

- Rising Energy Demand: The ever-increasing global demand for electricity, coupled with the urgent need to decarbonize energy grids, drives the expansion of solar power capacity, directly boosting the demand for solar trackers.

Challenges in the Solar Tracker Industry Sector

Despite its robust growth, the solar tracker industry sector faces several significant challenges that can impact market expansion and profitability.

- Regulatory Hurdles: While generally supportive, inconsistent or changing regulatory frameworks in certain regions can create uncertainty and slow down project development. Permitting processes can also be complex and time-consuming.

- Supply Chain Disruptions: The global supply chain, particularly for specialized components and raw materials, can be vulnerable to disruptions caused by geopolitical events, trade disputes, or natural disasters, leading to potential delays and increased costs.

- Competitive Pressures: The market is highly competitive, with numerous players vying for market share. This can lead to price wars and pressure on profit margins, especially for smaller or less established companies.

- Intermittency and Grid Integration: While trackers enhance output, the inherent intermittency of solar power requires significant investment in grid infrastructure and energy storage solutions, which can indirectly affect the pace of solar deployment and tracker adoption.

Emerging Opportunities in Solar Tracker Industry

The solar tracker industry is ripe with emerging opportunities, driven by innovation, expanding markets, and evolving energy landscapes.

- Emerging Markets: Significant growth potential exists in developing economies across Africa, Southeast Asia, and Latin America, where governments are increasingly prioritizing renewable energy to meet growing demand and reduce reliance on fossil fuels.

- Advanced Tracker Technologies: The development and adoption of next-generation trackers, including those with integrated energy storage, AI-powered predictive maintenance, and enhanced resilience to extreme weather, present substantial market opportunities.

- Hybrid Renewable Energy Systems: The integration of solar trackers with other renewable energy sources and battery storage solutions offers opportunities for creating more reliable and dispatchable clean energy systems.

- Repowering and Retrofitting: As older solar farms reach the end of their lifespan, opportunities arise for repowering and retrofitting existing sites with advanced tracker technology to boost energy output and extend the operational life of the solar assets.

Leading Players in the Solar Tracker Industry Market

- Solar Flexrack

- PV Hardware Solutions S L U

- Meca Solar

- Valmont Industries Inc

- Soltec Power Holdings SA

- Nextracker Inc

- DCE Solar

- Ideematec Deutschland GmbH

- Arctech Solar Holdings Co Ltd

- Array Technologies Inc

Key Developments in Solar Tracker Industry Industry

- Feb 2023: PV Hardware (PVH), a leading solar PV tracker manufacturer from Spain's Gransolar Group, plans to build the world's largest solar tracker factory in Spain's Valencia. This expansion aims to increase its annual global manufacturing and supply capability to 25 GW, significantly boosting production capacity.

- Oct 2022: Gonvarri Solar Steel announced an agreement to supply approximately 1.2 GW worth of solar trackers and racks solutions for multiple solar projects in the Iberian Peninsula. Iberdrola SA placed orders for 289 MW of Gonvarri Solar Steel's TracSmarT+ 1V single and double row trackers, alongside 938 MW of its RackSmarT fixed structures, highlighting a substantial supply commitment.

- Sept 2022: FTC Solar Inc., a prominent provider of solar tracker systems, software, and engineering services, launched its new and differentiated module in portrait (1P) Solar Tracker Solution, named Pioneer. This innovation aims to optimize performance and efficiency with larger solar modules.

Future Outlook for Solar Tracker Industry Market

The future outlook for the solar tracker industry market is exceptionally promising, driven by an accelerating global transition towards clean energy and the continuous technological advancements that enhance the efficiency and cost-effectiveness of solar power. Key growth accelerators include supportive government policies, increasingly ambitious renewable energy targets, and the declining overall cost of solar energy systems. The market is poised for sustained expansion as solar tracker manufacturers innovate further, developing smarter, more resilient, and highly efficient tracking solutions. Strategic opportunities lie in the penetration of emerging markets, the integration of solar trackers into hybrid renewable energy systems, and the potential for retrofitting existing solar installations with advanced tracking technologies. The industry's trajectory points towards a significant increase in market size and a pivotal role in achieving global decarbonization goals.

Solar Tracker Industry Segmentation

-

1. Axis Type

- 1.1. Single Axis

- 1.2. Dual Axis

Solar Tracker Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Mexico

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Spain

- 2.6. NORDIC

- 2.7. Turkey

- 2.8. Russia

- 2.9. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Malaysia

- 3.6. Thailand

- 3.7. Indonesia

- 3.8. Vietnam

- 3.9. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. South Africa

- 4.4. Qatar

- 4.5. Nigeria

- 4.6. Egypt

- 4.7. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Colombia

- 5.3. Chile

- 5.4. Rest of South America

Solar Tracker Industry Regional Market Share

Geographic Coverage of Solar Tracker Industry

Solar Tracker Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Single Axis Solar Trackers to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Axis Type

- 5.1.1. Single Axis

- 5.1.2. Dual Axis

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Axis Type

- 6. North America Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Axis Type

- 6.1.1. Single Axis

- 6.1.2. Dual Axis

- 6.1. Market Analysis, Insights and Forecast - by Axis Type

- 7. Europe Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Axis Type

- 7.1.1. Single Axis

- 7.1.2. Dual Axis

- 7.1. Market Analysis, Insights and Forecast - by Axis Type

- 8. Asia Pacific Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Axis Type

- 8.1.1. Single Axis

- 8.1.2. Dual Axis

- 8.1. Market Analysis, Insights and Forecast - by Axis Type

- 9. Middle East and Africa Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Axis Type

- 9.1.1. Single Axis

- 9.1.2. Dual Axis

- 9.1. Market Analysis, Insights and Forecast - by Axis Type

- 10. South America Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Axis Type

- 10.1.1. Single Axis

- 10.1.2. Dual Axis

- 10.1. Market Analysis, Insights and Forecast - by Axis Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Solar Flexrack

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PV Hardware Solutions S L U

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meca Solar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Valmont Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Soltec Power Holdings SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nextracker Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DCE Solar

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ideematec Deutschland GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arctech Solar Holdings Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Array Technologies Inc *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Solar Flexrack

List of Figures

- Figure 1: Global Solar Tracker Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 3: North America Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 4: North America Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 7: Europe Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 8: Europe Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 11: Asia Pacific Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 12: Asia Pacific Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 15: Middle East and Africa Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 16: Middle East and Africa Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East and Africa Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 19: South America Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 20: South America Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 2: Global Solar Tracker Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 4: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Mexico Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 9: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: NORDIC Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Turkey Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 20: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Malaysia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Thailand Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Indonesia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 31: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Saudi Arabia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Africa Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Qatar Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Nigeria Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Egypt Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 40: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Brazil Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Colombia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Chile Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of South America Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solar Tracker Industry?

The projected CAGR is approximately 22.38%.

2. Which companies are prominent players in the Solar Tracker Industry?

Key companies in the market include Solar Flexrack, PV Hardware Solutions S L U, Meca Solar, Valmont Industries Inc, Soltec Power Holdings SA, Nextracker Inc, DCE Solar, Ideematec Deutschland GmbH, Arctech Solar Holdings Co Ltd, Array Technologies Inc *List Not Exhaustive.

3. What are the main segments of the Solar Tracker Industry?

The market segments include Axis Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Single Axis Solar Trackers to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

Feb 2023: PV Hardware (PVH), a leading solar PV tracker manufacturer from Spain's Gransolar Group, plans to build the world's largest solar tracker factory in Spain's Valencia. It will expand its annual global manufacturing and supply capability to 25 GW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solar Tracker Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solar Tracker Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solar Tracker Industry?

To stay informed about further developments, trends, and reports in the Solar Tracker Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence