Key Insights

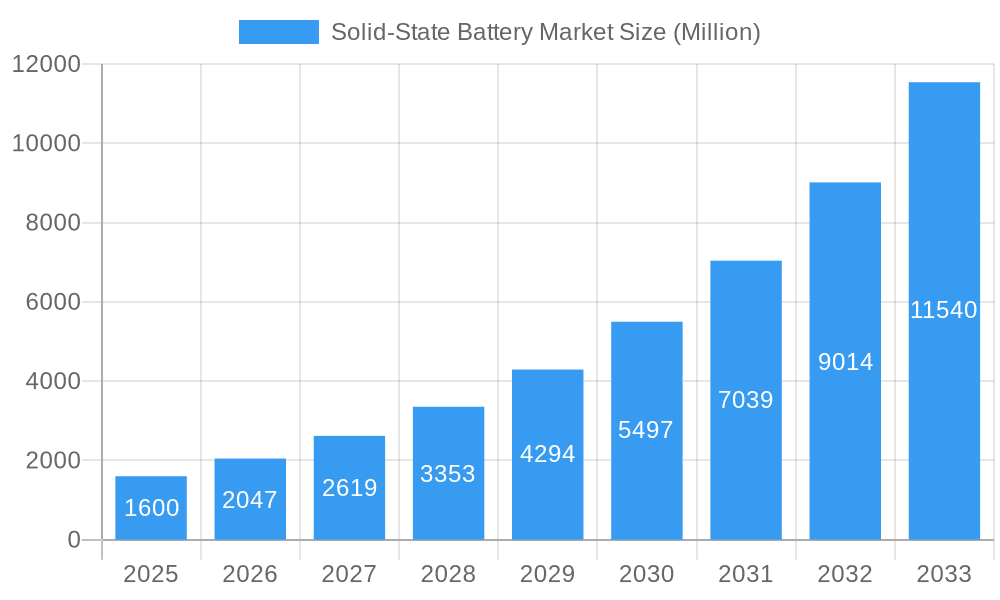

The Solid-State Battery Market is poised for explosive growth, projected to reach $1.6 billion in 2025 and expand at an impressive compound annual growth rate (CAGR) of 31.8% through 2033. This surge is primarily driven by the inherent advantages of solid-state technology over traditional lithium-ion batteries, including enhanced safety, higher energy density, and faster charging capabilities. These attributes make them a game-changer for demanding applications like electric vehicles (EVs), where range anxiety and charging times are critical concerns. The thin-film battery segment, often utilized in smaller electronic devices and specialized applications, is also a significant contributor to this market's expansion, benefiting from the miniaturization trends in consumer electronics.

Solid-State Battery Market Market Size (In Billion)

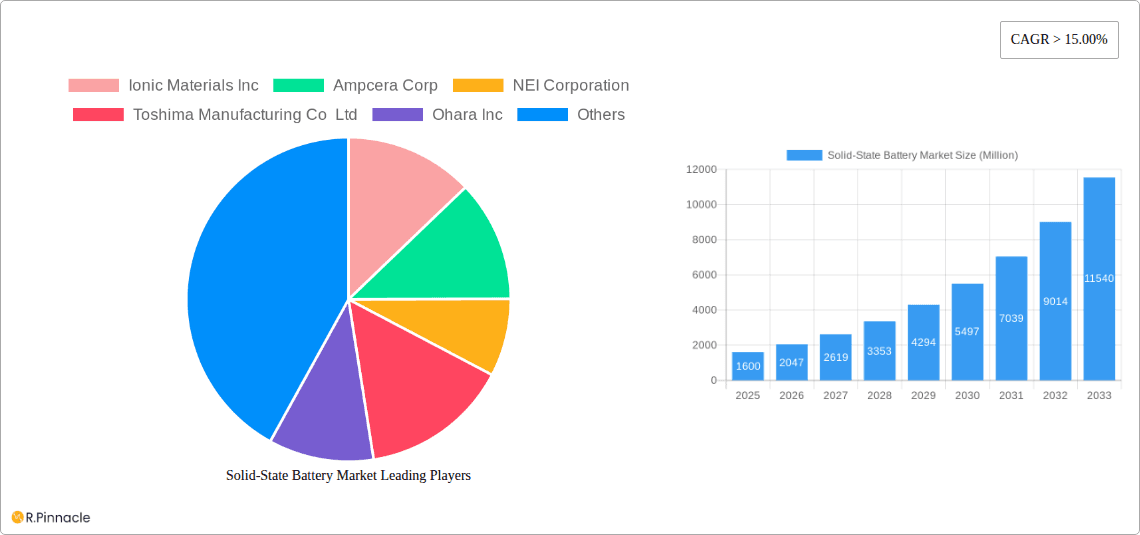

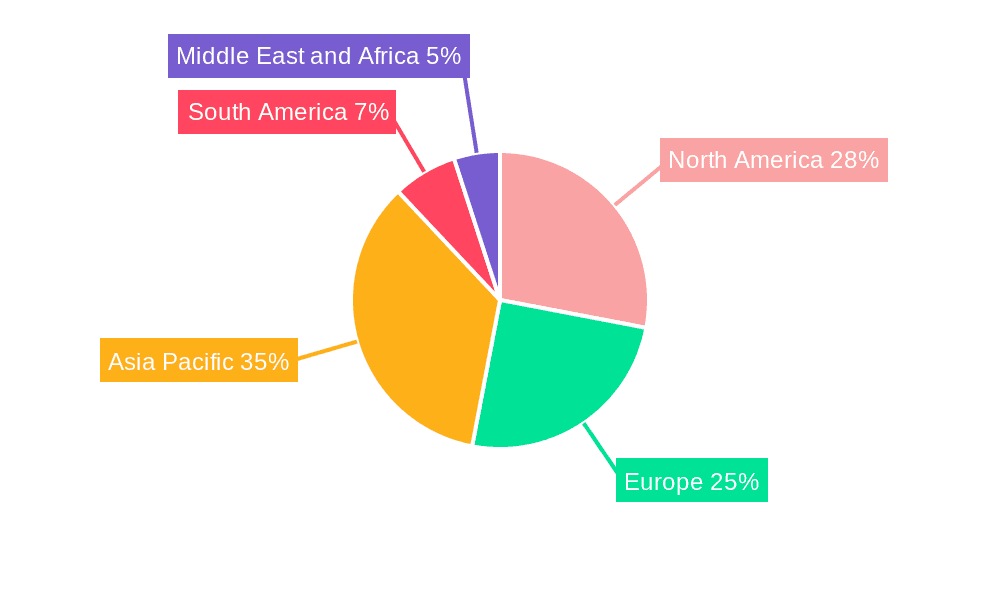

Key market drivers include escalating demand for safer and more powerful battery solutions, stringent government regulations promoting the adoption of electric vehicles, and continuous advancements in materials science leading to improved performance and cost-effectiveness of solid-state electrolytes. While the market is characterized by rapid innovation and substantial investment, certain restraints such as the high manufacturing costs and challenges in scaling up production of solid-state electrolytes and components still exist. However, the unwavering commitment of major industry players like Ionic Materials Inc., Ampcera Corp., and NEI Corporation, along with the emerging contributions from companies like Ohara Inc. and Empower Materials, are actively addressing these challenges. The Asia Pacific region is expected to dominate the market share due to its strong manufacturing base and significant investments in EV and battery technologies, followed by North America and Europe.

Solid-State Battery Market Company Market Share

This in-depth report provides a meticulous analysis of the global Solid-State Battery Market, offering a critical examination of its current landscape and future trajectory. Leveraging extensive data and expert insights, the report delves into market structure, dynamics, regional dominance, product innovations, and key growth drivers. Designed for industry professionals, investors, and researchers, this comprehensive study equips you with actionable intelligence to navigate the evolving solid-state battery ecosystem. The study period spans from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033. Historical data covers 2019–2024.

Solid-State Battery Market Structure & Innovation Trends

The Solid-State Battery Market is characterized by a moderate to high level of concentration, with key players investing heavily in research and development to achieve technological breakthroughs. Innovation is primarily driven by the pursuit of enhanced energy density, faster charging capabilities, improved safety profiles, and extended cycle life. Regulatory frameworks are evolving to support the adoption of advanced battery technologies, especially in the electric vehicle (EV) and consumer electronics sectors. Product substitutes, such as advanced lithium-ion batteries, continue to pose a competitive threat, but the inherent advantages of solid-state technology are steadily eroding this gap. End-user demographics are broad, encompassing automotive manufacturers, consumer electronics giants, and emerging energy storage solution providers. Mergers and acquisitions (M&A) are becoming increasingly prevalent as companies seek to consolidate expertise, acquire intellectual property, and scale production. For instance, recent M&A activities have seen substantial deal values, estimated to be in the hundreds of billions of dollars, as larger entities integrate innovative startups. Market share distribution is dynamic, with leading companies holding significant stakes due to their robust patent portfolios and established manufacturing capabilities.

- Innovation Drivers: Enhanced safety, higher energy density, faster charging, longer cycle life, reduced weight and volume.

- Regulatory Frameworks: Government incentives for clean energy technologies, standardization efforts for battery safety and performance.

- Product Substitutes: Advanced lithium-ion chemistries, other emerging battery technologies.

- End-User Demographics: Automotive, consumer electronics, grid storage, aerospace, medical devices.

- M&A Activities: Strategic acquisitions of startups with proprietary solid-state electrolyte technologies and manufacturing expertise.

Solid-State Battery Market Market Dynamics & Trends

The Solid-State Battery Market is poised for explosive growth, driven by a confluence of escalating demand for safer and more efficient energy storage solutions, coupled with significant technological advancements. The projected Compound Annual Growth Rate (CAGR) for this market is anticipated to be robust, estimated to be between 20% and 30% over the forecast period. Market penetration is currently in its nascent stages but is expected to accelerate rapidly as commercial viability increases and production scales. A primary growth driver is the insatiable demand from the electric vehicle (EV) sector, where solid-state batteries promise to overcome the limitations of current lithium-ion technology by offering extended driving ranges, faster charging times, and enhanced safety, thereby mitigating fire risks. This technological leap is crucial for widespread EV adoption and addressing range anxiety. Furthermore, the consumer electronics industry is increasingly looking towards solid-state batteries to enable sleeker, more durable, and longer-lasting devices, from smartphones and laptops to wearables and IoT devices. The miniaturization potential and inherent safety of solid-state batteries make them ideal for these applications. Beyond consumer-facing products, the burgeoning need for efficient and reliable energy storage in grid applications, renewable energy integration, and specialized sectors like aerospace and defense further fuels market expansion.

Technological disruptions are at the forefront of market dynamics. Continuous innovation in solid electrolyte materials, including ceramic, solid polymer, and hybrid approaches, is yielding breakthroughs in ionic conductivity, electrochemical stability, and manufacturability. The development of cost-effective and scalable manufacturing processes is a critical area of focus, with significant investments being channeled into pilot plants and large-scale production facilities. Consumer preferences are shifting towards devices and vehicles that offer superior safety, longer operational life, and faster charging. Solid-state batteries are uniquely positioned to meet these evolving demands. Competitive dynamics are intensifying, with established battery manufacturers, automotive OEMs, and specialized startups vying for market leadership. Strategic partnerships, joint ventures, and significant R&D investments are key strategies employed by companies to gain a competitive edge. The market penetration of solid-state batteries is projected to increase from a low single-digit percentage in the base year to a substantial double-digit percentage by the end of the forecast period, signifying a transformative shift in the battery landscape. The total market size is estimated to reach several hundred billion dollars by 2033, reflecting the immense potential and transformative impact of this technology.

Dominant Regions & Segments in Solid-State Battery Market

The global Solid-State Battery Market exhibits distinct regional strengths and segment leadership, driven by a combination of technological innovation, governmental support, and industrial demand. Asia-Pacific, particularly China, Japan, and South Korea, is emerging as the dominant region in the solid-state battery market. This dominance is underpinned by substantial government investments in battery research and development, a well-established supply chain for battery materials, and the presence of leading global automotive and electronics manufacturers eager to adopt next-generation battery technologies. China, as the world's largest EV market, plays a pivotal role, with ambitious targets for solid-state battery integration into its automotive sector. Japan and South Korea, with their strong legacy in battery manufacturing and cutting-edge research institutions, are also critical hubs for innovation and production. North America, led by the United States, is witnessing significant growth, propelled by substantial private sector investment and government initiatives aimed at reshoring battery manufacturing and fostering domestic innovation in advanced energy storage. Europe, driven by stringent environmental regulations and a strong focus on sustainable mobility, is also a key market, with significant investments in solid-state battery research and pilot production facilities.

Within the segments, the Electric Vehicle Battery application is the primary growth engine and is expected to capture the largest market share throughout the forecast period. The unparalleled demand for longer range, faster charging, and enhanced safety in EVs makes solid-state batteries a transformative technology for the automotive industry. The ability to overcome current lithium-ion battery limitations, such as thermal runaway and charging speed, positions solid-state batteries as the future of EV power.

Regarding the Type of solid-state batteries, the Ceramic segment is anticipated to hold a significant share and exhibit robust growth. Ceramic solid electrolytes offer excellent thermal stability and high ionic conductivity, making them highly suitable for demanding applications like EVs. However, challenges related to manufacturing scalability and cost are being actively addressed. The Solid Polymer segment is also a key contributor, offering flexibility and potentially lower manufacturing costs, making it attractive for certain applications like thin-film batteries and wearables.

The Thin-Film Battery application, while currently a smaller segment compared to EVs, is expected to witness impressive growth. Its suitability for miniaturized electronics, medical implants, and IoT devices, where space and safety are paramount, drives its expansion. Advancements in thin-film deposition techniques are making these batteries more commercially viable.

- Dominant Region: Asia-Pacific (China, Japan, South Korea)

- Key Drivers: Government incentives for battery R&D and manufacturing, established battery supply chains, strong automotive and electronics industries, leading EV market penetration.

- Dominant Segment (Application): Electric Vehicle Battery

- Key Drivers: Demand for extended range, faster charging, improved safety, regulatory push for zero-emission vehicles, significant OEM investments.

- Key Segment (Type): Ceramic

- Key Drivers: High thermal stability, excellent ionic conductivity, superior safety profile for high-energy applications.

- Growing Segment (Application): Thin-Film Battery

- Key Drivers: Miniaturization of electronics, growth in IoT devices, medical implants, demand for flexible and lightweight power sources.

Solid-State Battery Market Product Innovations

Product innovations in the solid-state battery market are centered on enhancing performance characteristics and addressing manufacturing challenges. Companies are developing novel solid electrolyte materials with improved ionic conductivity at room temperature, such as sulfide-based ceramics and polymer-ceramic composites. Emphasis is placed on achieving higher energy density through optimized electrode designs and electrolyte-electrode interface engineering, enabling batteries that are both smaller and lighter while offering longer operational life. Competitive advantages stem from enhanced safety features, eliminating the risk of thermal runaway associated with liquid electrolytes, and enabling faster charging cycles, a critical demand for EV adoption. These innovations are paving the way for solid-state batteries to power next-generation electric vehicles, consumer electronics, and specialized industrial applications, setting new benchmarks for performance and reliability.

Report Scope & Segmentation Analysis

The Solid-State Battery Market report encompasses a detailed segmentation analysis of the market by Type and Application. The Type segmentation includes Ceramic Solid-State Batteries and Solid Polymer Solid-State Batteries. Ceramic types are projected to lead in market share due to their superior electrochemical stability and thermal resistance, crucial for high-performance applications. Solid polymer types are expected to see significant growth driven by their flexibility and potential for lower-cost manufacturing, particularly in niche applications. The Application segmentation focuses on key sectors such as Thin-Film Batteries and Electric Vehicle Batteries. The Electric Vehicle Battery segment is anticipated to dominate the market, driven by the escalating global demand for electrified transportation and the inherent advantages of solid-state technology in enhancing range and safety. Thin-Film Batteries, while a smaller segment, are projected for substantial growth, catering to the increasing needs of compact electronics, medical devices, and IoT applications. The analysis provides growth projections, market size estimations, and competitive dynamics for each segment, offering a granular view of market opportunities.

Key Drivers of Solid-State Battery Market Growth

The rapid expansion of the Solid-State Battery Market is propelled by several interconnected factors. Foremost is the surging global demand for electric vehicles (EVs), where solid-state batteries offer a compelling solution to overcome range anxiety and enhance charging speeds. The inherent safety advantages of solid-state technology, eliminating flammable liquid electrolytes, are a significant draw for both consumers and manufacturers, particularly in applications where safety is paramount. Technological advancements in solid electrolyte materials, manufacturing processes, and cell design are continuously improving performance metrics like energy density and cycle life. Government initiatives and regulatory support worldwide, aimed at promoting clean energy and reducing carbon emissions, are providing substantial incentives for the development and adoption of advanced battery technologies. Furthermore, the growing need for efficient energy storage solutions across various sectors, including grid stabilization and renewable energy integration, creates a robust market for these next-generation batteries.

Challenges in the Solid-State Battery Market Sector

Despite the immense potential, the Solid-State Battery Market faces several significant hurdles. High manufacturing costs remain a primary challenge, as scaling up production of advanced solid electrolytes and complex cell architectures to meet mass-market demand is expensive. Dendrite formation, particularly in lithium metal solid-state batteries, can lead to short circuits and reduced battery life, posing a significant technical challenge requiring further innovation. Achieving high ionic conductivity at room temperature across various solid electrolyte materials is an ongoing research focus, as lower conductivity can limit power output and charging speeds. Long-term stability and cycle life under demanding real-world conditions need continuous validation and improvement. Finally, establishing a robust and cost-effective supply chain for specialized raw materials required for solid-state battery production presents logistical and economic complexities that need to be addressed for widespread adoption.

Emerging Opportunities in Solid-State Battery Market

The Solid-State Battery Market is ripe with emerging opportunities driven by evolving technological landscapes and shifting consumer demands. The miniaturization of consumer electronics and the proliferation of Internet of Things (IoT) devices present a significant opportunity for thin-film and flexible solid-state batteries, offering power solutions for a new generation of smart devices. The increasing adoption of renewable energy sources and the need for efficient grid-scale energy storage systems create a substantial market for high-capacity, long-duration solid-state batteries. Advancements in solid-state battery chemistries beyond lithium, such as sodium-ion solid-state batteries, offer promising avenues for cost reduction and resource diversification. Furthermore, the growing demand for safer and more reliable batteries in specialized applications like aerospace, medical implants, and military equipment opens up niche but high-value market segments. The continuous development of innovative manufacturing techniques, including additive manufacturing and roll-to-roll processing, promises to drive down costs and accelerate the commercialization of solid-state battery technology.

Leading Players in the Solid-State Battery Market Market

- Ionic Materials Inc

- Ampcera Corp

- NEI Corporation

- Toshima Manufacturing Co Ltd

- Ohara Inc

- Empower Materials

Key Developments in Solid-State Battery Market Industry

- Aug 2022: Ganfeng Lithium began the construction of a solid-state battery production facility. Once completed, the factory in Chongqing will offer annual capacities of 10 GWh each for the production of battery cells as well as battery packs.

- Jul 2022: The University of Houston developed an electrolyte that enables reversible sodium plating. The electrolyte is viable to produce sodium ion-based batteries commercially and on a larger scale. It enables reversible sodium plating and stripping at a greater current density.

Future Outlook for Solid-State Battery Market Market

The future outlook for the Solid-State Battery Market is exceptionally bright, characterized by accelerating adoption and transformative impact across multiple industries. Continued investment in research and development will drive further improvements in energy density, charging speeds, and lifespan, making solid-state batteries increasingly competitive and superior to existing lithium-ion technologies. The scaling up of manufacturing capabilities, coupled with ongoing efforts to reduce production costs, will be critical in unlocking mass-market adoption, particularly within the electric vehicle sector. Strategic collaborations between battery manufacturers, automotive OEMs, and technology developers will accelerate innovation and facilitate market penetration. Emerging applications in consumer electronics, grid storage, and specialized industries will further diversify the market and contribute to its robust growth. The solid-state battery revolution is not a question of if, but when, and the coming years will witness its profound influence on global energy landscapes and technological advancements.

Solid-State Battery Market Segmentation

-

1. Type

- 1.1. Ceramic

- 1.2. Solid Polymer

-

2. Application

- 2.1. Thin-Film Battery

- 2.2. Electric Vehicle Battery

Solid-State Battery Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Solid-State Battery Market Regional Market Share

Geographic Coverage of Solid-State Battery Market

Solid-State Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Amount of Waste Generation

- 3.2.2 Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living4.; Increasing Focus on Non-fossil Fuel Sources of Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Expensive Nature of Incinerators

- 3.4. Market Trends

- 3.4.1. Thin-Film Battery to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solid-State Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ceramic

- 5.1.2. Solid Polymer

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Thin-Film Battery

- 5.2.2. Electric Vehicle Battery

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Solid-State Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ceramic

- 6.1.2. Solid Polymer

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Thin-Film Battery

- 6.2.2. Electric Vehicle Battery

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Solid-State Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ceramic

- 7.1.2. Solid Polymer

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Thin-Film Battery

- 7.2.2. Electric Vehicle Battery

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Solid-State Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ceramic

- 8.1.2. Solid Polymer

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Thin-Film Battery

- 8.2.2. Electric Vehicle Battery

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Solid-State Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ceramic

- 9.1.2. Solid Polymer

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Thin-Film Battery

- 9.2.2. Electric Vehicle Battery

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Solid-State Battery Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ceramic

- 10.1.2. Solid Polymer

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Thin-Film Battery

- 10.2.2. Electric Vehicle Battery

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ionic Materials Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ampcera Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NEI Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshima Manufacturing Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ohara Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Empower Materials

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Ionic Materials Inc

List of Figures

- Figure 1: Global Solid-State Battery Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Solid-State Battery Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Solid-State Battery Market Revenue (undefined), by Type 2025 & 2033

- Figure 4: North America Solid-State Battery Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Solid-State Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Solid-State Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Solid-State Battery Market Revenue (undefined), by Application 2025 & 2033

- Figure 8: North America Solid-State Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Solid-State Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Solid-State Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Solid-State Battery Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Solid-State Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Solid-State Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Solid-State Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Solid-State Battery Market Revenue (undefined), by Type 2025 & 2033

- Figure 16: Europe Solid-State Battery Market Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Solid-State Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Solid-State Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Solid-State Battery Market Revenue (undefined), by Application 2025 & 2033

- Figure 20: Europe Solid-State Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Solid-State Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Solid-State Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Solid-State Battery Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Solid-State Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Solid-State Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Solid-State Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Solid-State Battery Market Revenue (undefined), by Type 2025 & 2033

- Figure 28: Asia Pacific Solid-State Battery Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Solid-State Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Solid-State Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Solid-State Battery Market Revenue (undefined), by Application 2025 & 2033

- Figure 32: Asia Pacific Solid-State Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Solid-State Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Solid-State Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Solid-State Battery Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Solid-State Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Solid-State Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Solid-State Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Solid-State Battery Market Revenue (undefined), by Type 2025 & 2033

- Figure 40: South America Solid-State Battery Market Volume (K Unit), by Type 2025 & 2033

- Figure 41: South America Solid-State Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Solid-State Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Solid-State Battery Market Revenue (undefined), by Application 2025 & 2033

- Figure 44: South America Solid-State Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: South America Solid-State Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Solid-State Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Solid-State Battery Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: South America Solid-State Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: South America Solid-State Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Solid-State Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Solid-State Battery Market Revenue (undefined), by Type 2025 & 2033

- Figure 52: Middle East and Africa Solid-State Battery Market Volume (K Unit), by Type 2025 & 2033

- Figure 53: Middle East and Africa Solid-State Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Solid-State Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Solid-State Battery Market Revenue (undefined), by Application 2025 & 2033

- Figure 56: Middle East and Africa Solid-State Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Solid-State Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Solid-State Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Solid-State Battery Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: Middle East and Africa Solid-State Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Solid-State Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Solid-State Battery Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solid-State Battery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Solid-State Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Solid-State Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Solid-State Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Solid-State Battery Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Solid-State Battery Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Solid-State Battery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Solid-State Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Solid-State Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Solid-State Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Solid-State Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Solid-State Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Solid-State Battery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Solid-State Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Solid-State Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Solid-State Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Global Solid-State Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Solid-State Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Solid-State Battery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Solid-State Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Solid-State Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Solid-State Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Solid-State Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Solid-State Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Solid-State Battery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Solid-State Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Solid-State Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Solid-State Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Global Solid-State Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Solid-State Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Solid-State Battery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 32: Global Solid-State Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Global Solid-State Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Solid-State Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Global Solid-State Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Solid-State Battery Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solid-State Battery Market?

The projected CAGR is approximately 31.8%.

2. Which companies are prominent players in the Solid-State Battery Market?

Key companies in the market include Ionic Materials Inc, Ampcera Corp, NEI Corporation, Toshima Manufacturing Co Ltd, Ohara Inc, Empower Materials.

3. What are the main segments of the Solid-State Battery Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Amount of Waste Generation. Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living4.; Increasing Focus on Non-fossil Fuel Sources of Energy.

6. What are the notable trends driving market growth?

Thin-Film Battery to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Expensive Nature of Incinerators.

8. Can you provide examples of recent developments in the market?

Aug 2022: Ganfeng Lithium began the construction of a solid-state battery production facility. Once completed, the factory in Chongqing will offer annual capacities of 10 GWh each for the production of battery cells as well as battery packs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solid-State Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solid-State Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solid-State Battery Market?

To stay informed about further developments, trends, and reports in the Solid-State Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence