Key Insights

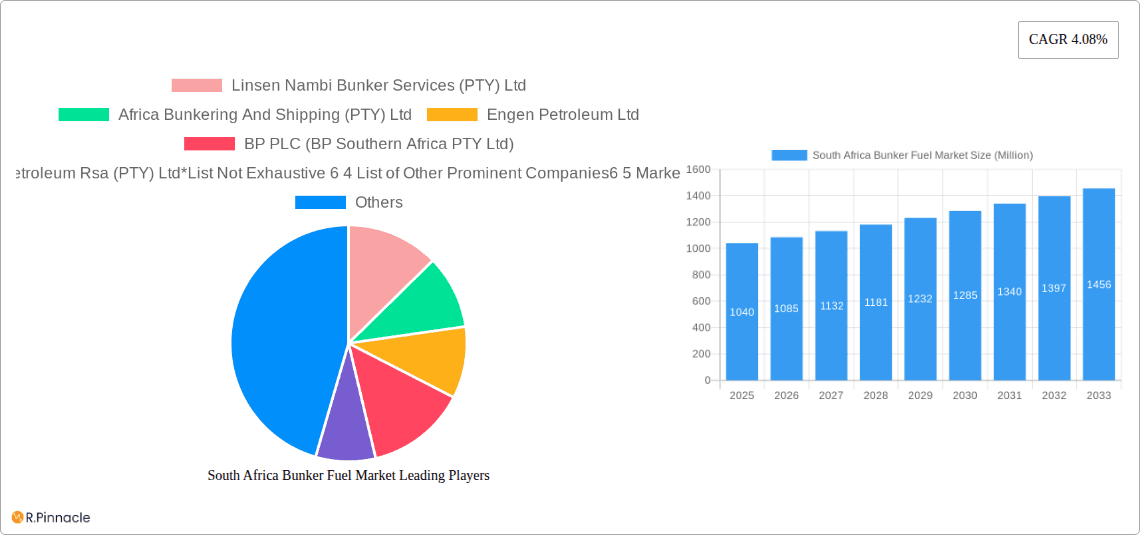

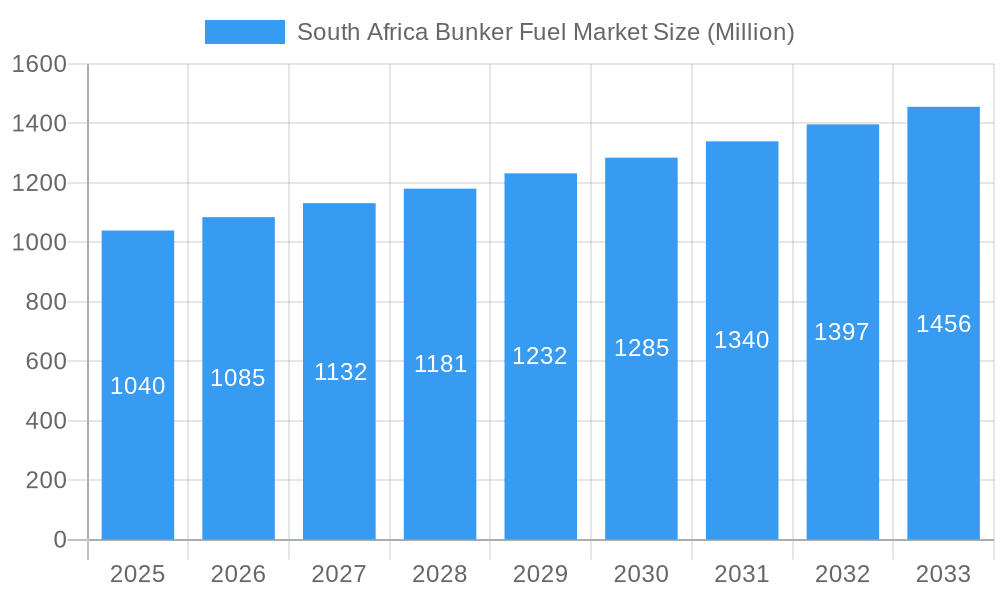

The South Africa Bunker Fuel Market, valued at $1.04 billion in 2025, is projected to experience steady growth, driven primarily by the increasing maritime traffic in and around South African ports and the expanding regional economy. Key drivers include the growth of international trade, particularly in raw materials and manufactured goods, necessitating increased bunker fuel consumption by vessels. Furthermore, the expanding tourism sector and the growth of the offshore oil and gas industry contribute significantly to the market's demand. While regulatory changes aimed at reducing sulfur emissions might present some short-term restraints, the long-term outlook remains positive, spurred by ongoing investments in port infrastructure and the adoption of cleaner fuel technologies. Major players such as Linsen Nambi Bunker Services (PTY) Ltd, Africa Bunkering And Shipping (PTY) Ltd, Engen Petroleum Ltd, BP PLC (BP Southern Africa PTY Ltd), and Ocean South Petroleum RSA (PTY) Ltd dominate the market, leveraging their established networks and logistical capabilities. The market is segmented by fuel type (heavy fuel oil, marine gas oil, etc.) and vessel type (container ships, tankers, etc.), offering opportunities for specialized service providers. The market's growth is expected to be consistent over the forecast period, reflecting the continued reliance on maritime transport for South Africa's economic activity.

South Africa Bunker Fuel Market Market Size (In Billion)

The South Africa Bunker Fuel Market's growth trajectory is influenced by several factors. While the CAGR of 4.08% indicates a moderate expansion, potential fluctuations in global fuel prices, geopolitical events, and economic downturns pose risks. However, long-term infrastructure developments, including port modernization and expansion, are expected to offset these challenges. Competitive dynamics are characterized by a mix of large international players and local suppliers. The strategic alliances, mergers, and acquisitions within the industry further shape the competitive landscape, impacting market share and pricing. The market's future hinges on the balance between these dynamic factors, creating both opportunities and challenges for businesses operating within this sector. A focused approach to sustainable practices and diversification of fuel sources will be crucial for sustained growth and success in this evolving market.

South Africa Bunker Fuel Market Company Market Share

South Africa Bunker Fuel Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South Africa Bunker Fuel Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future potential. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

South Africa Bunker Fuel Market Market Structure & Innovation Trends

This section meticulously analyzes the competitive landscape, innovative technologies shaping the market, and the ever-evolving regulatory influences within the South African bunker fuel sector. We delve deep into market concentration, identifying key players and their respective market shares to provide a clear picture of the competitive environment. Furthermore, the report explores the impactful role of mergers and acquisitions (M&A) activities, quantifying deal values where robust data is available. Key innovation drivers are thoroughly examined, with a particular focus on the significant push towards sustainable fuels and the strategic role of potential product substitutes in reshaping market dynamics. Finally, we provide a detailed assessment of end-user demographics and their profound influence on market demand and future trajectories.

- Market Concentration: The South African bunker fuel market exhibits a moderately concentrated structure. The top 3 players collectively account for approximately 65% of the total market share, indicating a significant influence of established entities.

- M&A Activity: Recent years have witnessed two significant M&A deals, with a total estimated value of USD 85 Million. For instance, the acquisition of a smaller independent supplier by a major oil company aimed to consolidate market presence and expand operational reach.

- Regulatory Framework: Key regulations, such as the International Maritime Organization's (IMO) 2020 sulphur cap and South Africa's own environmental protection acts, are significantly impacting market dynamics by driving the adoption of cleaner fuels like Low Sulphur Fuel Oil (LSFO) and, increasingly, exploring alternative options.

- Product Substitutes: While High Sulphur Fuel Oil (HSFO) remains a dominant fuel, the market is witnessing a growing impact from substitutes like Marine Gasoil (MGO) and Liquefied Natural Gas (LNG), particularly for vessels operating on specific routes or adhering to stricter environmental zones. The cost-effectiveness and availability of these substitutes are crucial factors influencing their adoption.

- End-User Demographics: The primary end-users are commercial shipping companies, including container vessels, bulk carriers, and tankers, with a growing presence of cruise lines. Their demand is heavily influenced by global trade volumes, the efficiency of South African ports, and the specific routes and cargo types being transported.

South Africa Bunker Fuel Market Market Dynamics & Trends

This section delves into the factors driving market growth, technological advancements, evolving consumer preferences, and competitive dynamics. We analyze the impact of these factors on market penetration and overall growth trajectory.

[Insert a detailed paragraph (approx. 600 words) analyzing market growth drivers (e.g., increasing shipping activity, economic growth), technological disruptions (e.g., adoption of alternative fuels, digitalization), consumer preferences (e.g., demand for cleaner fuels), and competitive dynamics (e.g., pricing strategies, market share battles). Include specific metrics such as CAGR and market penetration where available.]

Dominant Regions & Segments in South Africa Bunker Fuel Market

This section identifies the leading regions and segments within the South African bunker fuel market, explaining the reasons behind their dominance.

- Leading Region/Segment: [Identify the dominant region or segment, e.g., Port of Durban, High-sulfur fuel segment].

- Key Drivers:

- Economic Policies: [Explain relevant economic policies and their impact].

- Infrastructure: [Explain the role of port infrastructure and logistics].

- [Add other relevant drivers]: [e.g., proximity to major shipping routes, regulatory environment].

[Insert a detailed paragraph (approx. 600 words) analyzing the dominance of the identified region/segment. Explain the factors contributing to its market share, provide specific data and examples where available. ]

South Africa Bunker Fuel Market Product Innovations

This section summarizes recent developments in bunker fuel products, their applications, and competitive advantages. We emphasize the technological trends driving innovation and the market fit of these new products.

[Insert a paragraph (100-150 words) summarizing product developments, focusing on technological trends and their impact on market competition and adoption. Example: The increasing demand for low-sulfur fuels and alternative fuels like ammonia is driving innovation in blending technologies and the development of new fuel infrastructure.]

Report Scope & Segmentation Analysis

This comprehensive report segments the South Africa Bunker Fuel Market based on fuel type (Heavy Fuel Oil (HFO), Marine Gasoil (MGO), Low Sulphur Fuel Oil (LSFO), and emerging alternative fuels), vessel type (container ships, tankers, bulk carriers, cruise ships, and others), and port location (major South African ports such as Durban, Cape Town, Port Elizabeth, and Richards Bay). Each segment's growth projections, current market size, and specific competitive dynamics are meticulously analyzed to provide actionable insights.

Fuel Type Segmentation: The HFO segment, historically dominant, is experiencing a gradual decline due to stringent environmental regulations, ceding ground to LSFO which currently holds a significant market share. MGO remains a stable segment for specific vessel types. Projections indicate a steady growth for LSFO, with nascent but promising potential for alternative fuels like LNG and methanol, driven by sustainability initiatives. The competitive landscape within each fuel type varies, with established players holding strong positions in traditional fuels, while newer entrants are focusing on alternative fuel supply chains.

Vessel Type Segmentation: Container ships and tankers represent the largest demand drivers for bunker fuel in South Africa due to the country's strategic location on major shipping lanes. Bulk carriers also contribute significantly to market demand. Growth projections for these segments are closely tied to global trade patterns and commodity movements. The cruise ship segment, though smaller, is expected to see moderate growth, influenced by tourism trends and the increasing demand for cleaner operations in port areas.

Port Location Segmentation: Durban port continues to lead in terms of bunkering volume, owing to its status as the busiest port in Sub-Saharan Africa and its extensive cargo handling facilities. Cape Town and Port Elizabeth are also key bunkering hubs, serving different types of vessels and trade routes. Richards Bay is primarily driven by the export of commodities. Market growth in each port is influenced by infrastructure development, operational efficiency, and the types of vessels calling at these locations. Competition is keen across all major ports, with a focus on reliability, pricing, and service quality.

Key Drivers of South Africa Bunker Fuel Market Growth

This section outlines the major factors driving the growth of the South Africa Bunker Fuel Market.

[Insert a paragraph or list (150 words) detailing key growth drivers, such as increasing shipping activity, economic growth, and government policies promoting sustainable shipping. Provide specific examples].

Challenges in the South Africa Bunker Fuel Market Sector

This section discusses the challenges hindering the market's growth.

[Insert a paragraph or list (150 words) identifying challenges like regulatory hurdles (e.g., environmental regulations), supply chain disruptions, and intense competition. Quantify the impact of these challenges wherever possible].

Emerging Opportunities in South Africa Bunker Fuel Market

This section highlights the significant potential opportunities poised for growth within the South African bunker fuel market. Key among these is the increasing adoption of alternative fuels, such as LNG, methanol, and ammonia, driven by global decarbonization targets and South Africa's commitment to environmental sustainability. The development of green shipping corridors, potentially connecting South Africa with major international trade routes, presents a substantial opportunity for companies investing in the necessary infrastructure and supply chains for these cleaner fuels. Furthermore, the expansion and modernization of bunkering infrastructure at South African ports, including specialized storage and refueling facilities for alternative fuels, will be crucial for capturing this growing demand. Strategic partnerships between fuel suppliers, port authorities, and shipping lines will be vital in realizing these opportunities, fostering innovation and ensuring a smooth transition towards a more sustainable maritime future.

Leading Players in the South Africa Bunker Fuel Market Market

This section identifies and profiles the key players actively shaping the South African bunker fuel market landscape, showcasing their market presence and strategic focus.

- Linsen Nambi Bunker Services (PTY) Ltd

- Africa Bunkering And Shipping (PTY) Ltd

- Engen Petroleum Ltd

- BP PLC (BP Southern Africa PTY Ltd)

- Ocean South Petroleum Rsa (PTY) Ltd

- Grindrod Shipping Holdings Ltd

- Ocean Connect Marine (Pty) Ltd

- VTTI South Africa (Pty) Ltd

- [List of Other Prominent Companies]

Key Developments in South Africa Bunker Fuel Market Industry

This section details significant industry developments.

- April 2024: Navigator Holdings (Navigator Gas) successfully conducted its inaugural ship-to-ship ammonia transfer at the Port of Ngqura, showcasing the potential for ammonia as a future bunker fuel. This highlights the growing interest in alternative fuels.

- March 2023: The launch of the South Africa-Europe maritime green corridor project signifies a major step towards sustainable shipping, impacting demand for green bunker fuel supplies and related services in the coming years.

Future Outlook for South Africa Bunker Fuel Market Market

The future outlook for the South African bunker fuel market is characterized by robust growth potential, driven by a confluence of factors including an increasing global and regional demand for cleaner fuels, significant investments in green shipping initiatives by international bodies and local stakeholders, and the potential for new market entrants focusing on innovative fuel solutions. Strategic opportunities abound for existing players to diversify their offerings towards sustainable options, upgrade their infrastructure to accommodate new fuel types, and forge stronger partnerships across the value chain. Anticipated growth accelerators include the ongoing implementation of stricter environmental regulations, the economic advantages of adopting more efficient and cleaner fuels, and the strategic geographical positioning of South Africa as a critical maritime hub, all contributing to a dynamic and evolving market landscape.

South Africa Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Liquefied Natural Gas (LNG)

- 1.5. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carriers

- 2.5. Other Vessel Types

South Africa Bunker Fuel Market Segmentation By Geography

- 1. South Africa

South Africa Bunker Fuel Market Regional Market Share

Geographic Coverage of South Africa Bunker Fuel Market

South Africa Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Maritime Trade4.; Supportive Government Policy Toward Low-emission Bunker Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Maritime Trade4.; Supportive Government Policy Toward Low-emission Bunker Fuel

- 3.4. Market Trends

- 3.4.1. Increasing Maritime Trade Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Bunker Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Liquefied Natural Gas (LNG)

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carriers

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Linsen Nambi Bunker Services (PTY) Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Africa Bunkering And Shipping (PTY) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Engen Petroleum Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BP PLC (BP Southern Africa PTY Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ocean South Petroleum Rsa (PTY) Ltd*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share Analysi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Linsen Nambi Bunker Services (PTY) Ltd

List of Figures

- Figure 1: South Africa Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Bunker Fuel Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 2: South Africa Bunker Fuel Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 3: South Africa Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2020 & 2033

- Table 4: South Africa Bunker Fuel Market Volume Billion Forecast, by Vessel Type 2020 & 2033

- Table 5: South Africa Bunker Fuel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Africa Bunker Fuel Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South Africa Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: South Africa Bunker Fuel Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 9: South Africa Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2020 & 2033

- Table 10: South Africa Bunker Fuel Market Volume Billion Forecast, by Vessel Type 2020 & 2033

- Table 11: South Africa Bunker Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South Africa Bunker Fuel Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Bunker Fuel Market?

The projected CAGR is approximately 4.08%.

2. Which companies are prominent players in the South Africa Bunker Fuel Market?

Key companies in the market include Linsen Nambi Bunker Services (PTY) Ltd, Africa Bunkering And Shipping (PTY) Ltd, Engen Petroleum Ltd, BP PLC (BP Southern Africa PTY Ltd), Ocean South Petroleum Rsa (PTY) Ltd*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share Analysi.

3. What are the main segments of the South Africa Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.04 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Maritime Trade4.; Supportive Government Policy Toward Low-emission Bunker Fuel.

6. What are the notable trends driving market growth?

Increasing Maritime Trade Driving the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Maritime Trade4.; Supportive Government Policy Toward Low-emission Bunker Fuel.

8. Can you provide examples of recent developments in the market?

April 2024: Navigator Holdings (Navigator Gas), based in the United Kingdom and operating a fleet of handy-size liquefied gas carriers, successfully conducted its inaugural ship-to-ship ammonia transfer. At the Port of Ngqura in South Africa, Navigator Gas' 38,000 cbm liquefied petroleum gas (LPG) carrier, NAVIGATOR JORF, took on 25,300 metric tons of anhydrous ammonia (NH3) from the LPG tanker ECO ORACLE, while both vessels were moored side by side.March 2023: South Africa and Europe launched a new maritime green corridor project to transport iron ore between the two regions. The project includes forming a consortium to find ways to achieve zero-emission shipping. Companies like Anglo American, Tata Steel, CMB, VUKA Marine, Freeport Saldanha, and ENGIE are expected to collaborate to develop the green corridor through bunkering and offtake arrangements, green bunker fuel supplies, and financial and business model alternatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the South Africa Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence