Key Insights

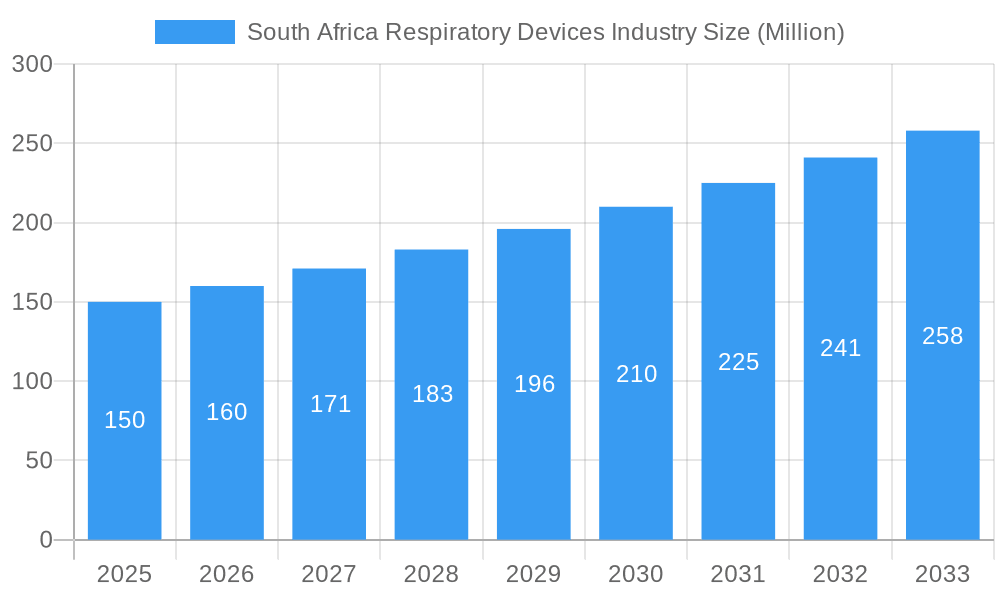

The South African respiratory devices market presents a robust growth outlook. The broader African market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.80% through 2033. Given South Africa's superior healthcare infrastructure and higher per capita income relative to other African nations, its market growth is anticipated to align with or exceed the continental average. Key growth drivers include the rising incidence of chronic respiratory diseases such as asthma and COPD, alongside an aging population susceptible to these conditions. Technological advancements in respiratory devices, enhancing treatment efficacy and patient comfort, are also fueling market expansion. Improved healthcare accessibility, particularly in underserved regions, further bolsters this growth trajectory. However, potential market restraints include high healthcare expenditures and limited insurance penetration within specific demographic segments.

South Africa Respiratory Devices Industry Market Size (In Billion)

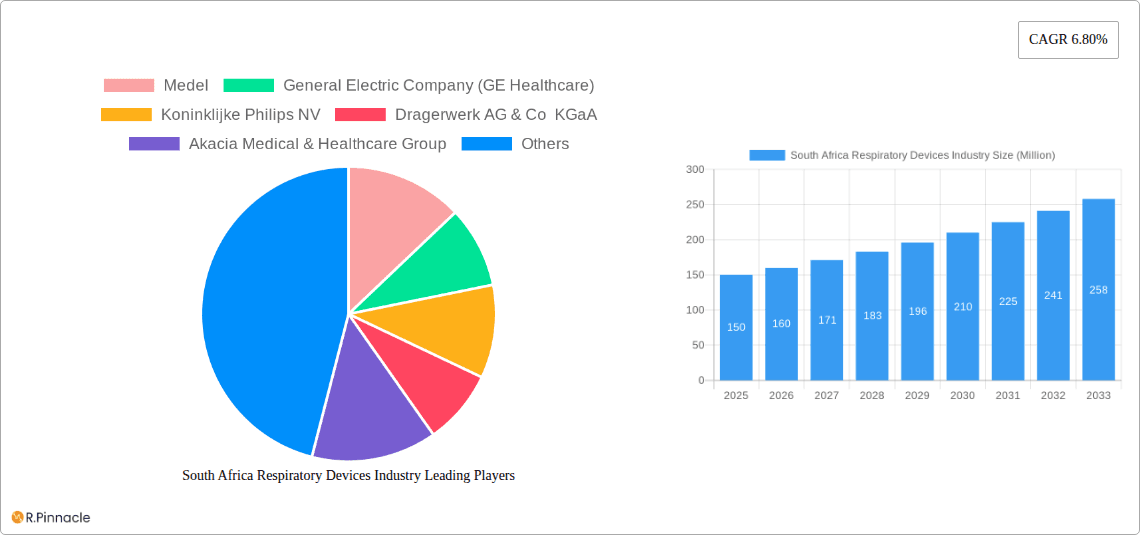

Market segmentation, particularly by diagnostic and monitoring devices, highlights a significant demand for advanced disease management tools. Leading companies such as Medel, GE Healthcare, Philips, and Dräger are expected to retain substantial market share, capitalizing on their established brand recognition and technological leadership. The competitive landscape also includes Akacia Medical & Healthcare Group and Hamilton Bonaduz AG (Hamilton Medical AG), indicating opportunities for both established and emerging innovators. This focused analysis on South Africa, within the African context, provides crucial insights into country-specific market dynamics, influenced by its unique socioeconomic factors and healthcare infrastructure. The study period, encompassing 2019-2033, offers a comprehensive review of historical trends, current conditions, and future projections, supporting informed strategic decisions. Detailed market size figures for South Africa in upcoming years would further enhance this analysis.

South Africa Respiratory Devices Industry Company Market Share

South Africa Respiratory Devices Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the South Africa respiratory devices industry, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033, historical period 2019-2024), this report leverages robust data and expert analysis to illuminate market trends, opportunities, and challenges. The market size is estimated at xx Million in 2025.

South Africa Respiratory Devices Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the South African respiratory devices market. We examine market concentration, identifying key players such as Medel, General Electric Company (GE Healthcare), Koninklijke Philips NV, Drägerwerk AG & Co KGaA, Akacia Medical & Healthcare Group, Teleflex Incorporated, and Hamilton Bonaduz AG (Hamilton Medical AG). Their individual market shares will be analyzed, providing a comprehensive understanding of the competitive dynamics. Furthermore, we delve into M&A activities, including the November 2021 management buyout of Respiratory Care Africa (RCA) by Ata Capital, evaluating their impact on market structure and deal values (xx Million). The report also assesses the influence of regulatory frameworks, technological advancements, and the presence of substitute products on the industry's overall growth trajectory. Analysis of end-user demographics and their evolving needs will also be provided.

South Africa Respiratory Devices Industry Market Dynamics & Trends

This section explores the key factors driving the growth of the South Africa respiratory devices market, including market size projections, CAGR, and market penetration rates. We examine technological disruptions, such as the introduction of telehealth solutions like Tyto Care's FDA-cleared pulse oximeter (January 2021), and their impact on consumer preferences and industry competition. Detailed analysis of market growth drivers, including increasing prevalence of respiratory illnesses, government initiatives, and healthcare infrastructure development, will be provided. We will also analyze shifts in consumer preferences towards technologically advanced and user-friendly devices. The competitive dynamics amongst key players, including pricing strategies and product differentiation, will be thoroughly examined.

Dominant Regions & Segments in South Africa Respiratory Devices Industry

This section identifies the leading regions and segments within the South African respiratory devices market, focusing specifically on the "Diagnostic and Monitoring Devices" segment. We will conduct an in-depth analysis of the dominant regions, highlighting key factors contributing to their leadership. This will include:

- Economic Policies: Government investment in healthcare infrastructure and supportive regulatory frameworks.

- Healthcare Infrastructure: Availability of advanced medical facilities and skilled professionals.

- Disease Prevalence: Higher incidence rates of respiratory diseases in specific regions.

The dominance analysis will consider factors such as market size, growth rates, and competitive intensity within each region and segment.

South Africa Respiratory Devices Industry Product Innovations

This section highlights recent product developments, their applications, and the competitive advantages they offer. We will analyze the technological trends shaping product innovation, focusing on areas such as improved diagnostic accuracy, portability, and ease of use. The market fit of these new products, considering factors like consumer needs and regulatory compliance, will be assessed.

Report Scope & Segmentation Analysis

The report's scope encompasses a detailed segmentation analysis of the South Africa respiratory devices market, primarily focusing on the "Diagnostic and Monitoring Devices" segment. This section will provide a breakdown of the market by various sub-segments, including (but not limited to) specific device types within diagnostic and monitoring. Each segment will receive individual analysis, examining projected growth rates, market sizes, and competitive landscapes. Detailed market size projections for each sub-segment, along with a discussion of the competitive intensity within each, will be presented.

Key Drivers of South Africa Respiratory Devices Industry Growth

The growth of the South African respiratory devices industry is propelled by several key factors, including advancements in medical technology leading to more effective diagnostic and therapeutic tools, increasing government investments in healthcare infrastructure, and rising prevalence of respiratory illnesses such as asthma and COPD. Furthermore, supportive regulatory policies aimed at improving healthcare access contribute significantly to market expansion.

Challenges in the South Africa Respiratory Devices Industry Sector

Several challenges hinder the growth of the South Africa respiratory devices industry. These include regulatory hurdles associated with medical device approvals, complexities in navigating the supply chain, and intense competition among established players and new entrants. These factors can lead to delays in product launches, increased costs, and reduced profitability for companies operating in this market. The quantifiable impact of each challenge on market growth will be assessed.

Emerging Opportunities in South Africa Respiratory Devices Industry

Despite challenges, several promising opportunities exist for growth in the South African respiratory devices market. The rising adoption of telehealth technologies offers new avenues for remote patient monitoring and care delivery. Additionally, the increasing prevalence of chronic respiratory diseases and a growing demand for advanced diagnostic tools create substantial market potential. These opportunities will require investment in research and development, strategic partnerships, and innovative marketing strategies to capitalize on effectively.

Leading Players in the South Africa Respiratory Devices Industry Market

- Medel

- General Electric Company (GE Healthcare)

- Koninklijke Philips NV

- Drägerwerk AG & Co KGaA

- Akacia Medical & Healthcare Group

- Teleflex Incorporated

- Hamilton Bonaduz AG (Hamilton Medical AG)

Key Developments in South Africa Respiratory Devices Industry

- November 2021: Ata Capital completed a management buyout (MBO) of Respiratory Care Africa (RCA) from Ascendis Health, signifying a significant shift in market ownership and potential strategic changes.

- January 2021: Tyto Care launched its FDA-cleared fingertip pulse oximeter, indicating a growing trend towards telehealth solutions and remote patient monitoring within South Africa’s respiratory devices market.

Future Outlook for South Africa Respiratory Devices Industry Market

The future of the South African respiratory devices market appears promising, driven by several growth accelerators. Technological advancements, coupled with rising healthcare expenditure and a growing awareness of respiratory health, are poised to expand the market considerably over the forecast period. Strategic partnerships, innovative product development, and a focus on addressing unmet needs within the healthcare system will be crucial for success in this dynamic market.

South Africa Respiratory Devices Industry Segmentation

-

1. Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Spirometers

- 1.1.2. Sleep Test Devices

- 1.1.3. Peak Flow Meters

- 1.1.4. Pulse Oximeters

- 1.1.5. Capnographs

- 1.1.6. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic Devices

- 1.2.1. CPAP Devices

- 1.2.2. BiPAP Devices

- 1.2.3. Humidifiers

- 1.2.4. Nebulizers

- 1.2.5. Oxygen Concentrators

- 1.2.6. Ventilators

- 1.2.7. Inhalers

- 1.2.8. Other Therapeutic Devices

-

1.3. Disposables

- 1.3.1. Masks

- 1.3.2. Breathing Circuits

- 1.3.3. Other Disposables

-

1.1. Diagnostic and Monitoring Devices

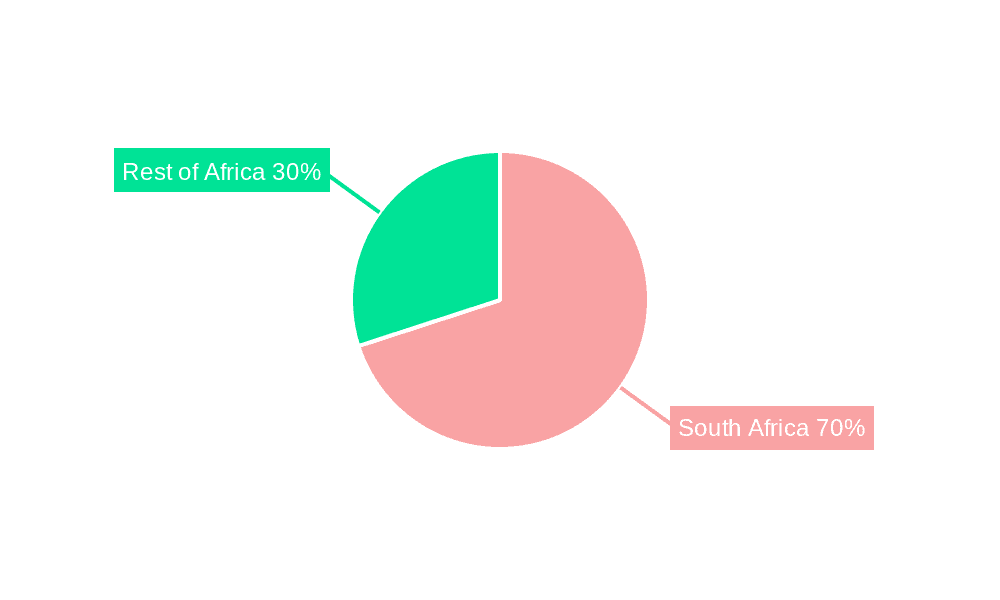

South Africa Respiratory Devices Industry Segmentation By Geography

- 1. South Africa

South Africa Respiratory Devices Industry Regional Market Share

Geographic Coverage of South Africa Respiratory Devices Industry

South Africa Respiratory Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Prevalence of Respiratory Disorders

- 3.2.2 such as COPD

- 3.2.3 TB

- 3.2.4 Asthma

- 3.2.5 and Sleep Apnea; Technological Advancements and Increasing Applications in Homecare Setting

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Spirometers Are Projected to Have Significant Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Respiratory Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Spirometers

- 5.1.1.2. Sleep Test Devices

- 5.1.1.3. Peak Flow Meters

- 5.1.1.4. Pulse Oximeters

- 5.1.1.5. Capnographs

- 5.1.1.6. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic Devices

- 5.1.2.1. CPAP Devices

- 5.1.2.2. BiPAP Devices

- 5.1.2.3. Humidifiers

- 5.1.2.4. Nebulizers

- 5.1.2.5. Oxygen Concentrators

- 5.1.2.6. Ventilators

- 5.1.2.7. Inhalers

- 5.1.2.8. Other Therapeutic Devices

- 5.1.3. Disposables

- 5.1.3.1. Masks

- 5.1.3.2. Breathing Circuits

- 5.1.3.3. Other Disposables

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Medel

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Electric Company (GE Healthcare)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koninklijke Philips NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dragerwerk AG & Co KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Akacia Medical & Healthcare Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teleflex Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hamilton Bonaduz AG (Hamilton Medical AG)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Medel

List of Figures

- Figure 1: South Africa Respiratory Devices Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Respiratory Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Respiratory Devices Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Africa Respiratory Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: South Africa Respiratory Devices Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Africa Respiratory Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: South Africa Respiratory Devices Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South Africa Respiratory Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: South Africa Respiratory Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: South Africa Respiratory Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Respiratory Devices Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the South Africa Respiratory Devices Industry?

Key companies in the market include Medel, General Electric Company (GE Healthcare), Koninklijke Philips NV, Dragerwerk AG & Co KGaA, Akacia Medical & Healthcare Group, Teleflex Incorporated, Hamilton Bonaduz AG (Hamilton Medical AG).

3. What are the main segments of the South Africa Respiratory Devices Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disorders. such as COPD. TB. Asthma. and Sleep Apnea; Technological Advancements and Increasing Applications in Homecare Setting.

6. What are the notable trends driving market growth?

Spirometers Are Projected to Have Significant Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

In November 2021, Ata Capital completed a management buyout (MBO) of Respiratory Care Africa (RCA), a medical devices supplier, from South African healthcare group Ascendis Health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Respiratory Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Respiratory Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Respiratory Devices Industry?

To stay informed about further developments, trends, and reports in the South Africa Respiratory Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence