Key Insights

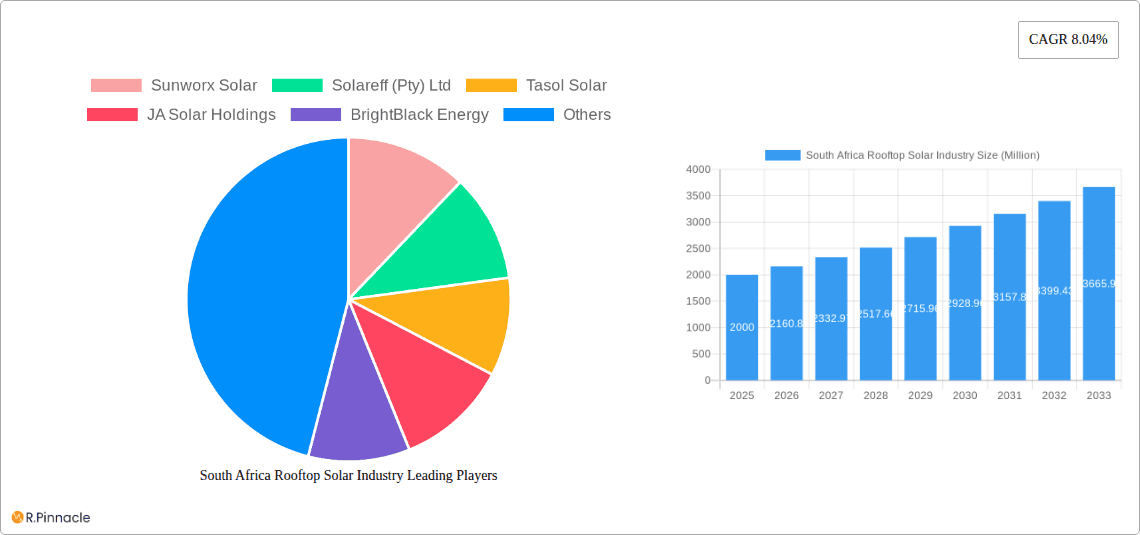

The South African rooftop solar market is poised for significant expansion, driven by escalating electricity tariffs, grid instability, and supportive government initiatives for renewable energy. The market, estimated at 2.2 billion in 2025, is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 38% from 2025 to 2033. This robust growth is attributed to the escalating demand for sustainable energy across residential, commercial, and industrial sectors. Residential installations are currently dominant, spurred by cost savings and energy independence goals. The commercial and industrial segments are also demonstrating considerable promise, with businesses increasingly adopting rooftop solar to mitigate operational expenses and enhance their environmental credentials. Leading companies such as Sunworx Solar and Solareff are instrumental in market expansion through innovation, competitive pricing, and superior customer service.

South Africa Rooftop Solar Industry Market Size (In Billion)

Despite a positive growth outlook, the industry encounters challenges. High upfront investment costs for solar systems may impede adoption among lower-income demographics, while complex regulatory frameworks for grid integration and permitting present hurdles. Additionally, global supply chain dynamics impacting the pricing of solar panels and components can introduce volatility. Nevertheless, the long-term prospects for the South African rooftop solar market remain exceptionally strong, supported by continued government backing, technological advancements, and heightened consumer awareness, which are expected to propel further market development.

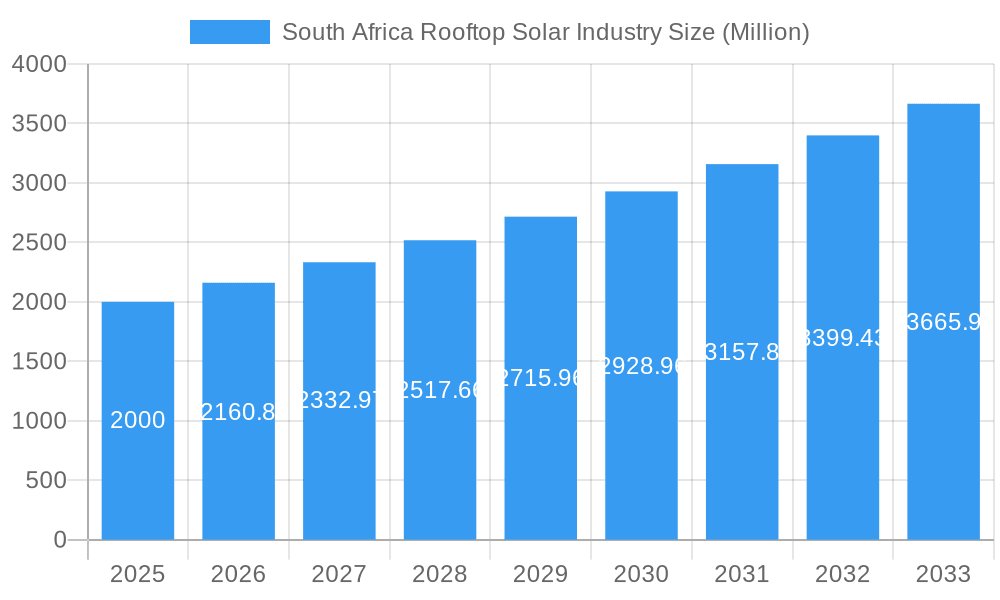

South Africa Rooftop Solar Industry Company Market Share

South Africa Rooftop Solar Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South Africa rooftop solar industry, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, and future trends. The report leverages extensive data analysis and expert insights to deliver actionable strategies for navigating this dynamic market.

South Africa Rooftop Solar Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the South African rooftop solar market. We examine market concentration, identifying key players like Sunworx Solar, Solareff (Pty) Ltd, Tasol Solar, JA Solar Holdings, BrightBlack Energy, Sola Group, GENERGY, Romano SOLAR, PiA Solar SA (Pty) Ltd, and Valsa Trading (Pty) Ltd (list not exhaustive). The report quantifies market share for leading companies and assesses the impact of mergers and acquisitions (M&A) activities, estimating the total value of M&A deals at xx Million during the historical period. Furthermore, it delves into the influence of regulatory frameworks, the availability of product substitutes, and the evolving demographics of end-users. This analysis also includes a detailed look at innovation drivers, such as advancements in solar panel technology and energy storage solutions.

South Africa Rooftop Solar Industry Market Dynamics & Trends

This section explores the key drivers and trends shaping the South African rooftop solar market. We analyze market growth, expressed as a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), and assess market penetration rates, projecting a xx% penetration by 2033. This detailed analysis examines technological disruptions, shifting consumer preferences towards sustainable energy, and the evolving competitive dynamics amongst industry players. It also considers factors influencing market growth, such as government incentives, rising electricity costs, and increasing awareness of environmental sustainability.

Dominant Regions & Segments in South Africa Rooftop Solar Industry

This section identifies the leading regions and segments within the South African rooftop solar market. Based on our analysis, the [Specific Region - e.g., Gauteng] province dominates the market due to [Reasons – e.g., higher concentration of businesses, supportive government policies].

- Key Drivers for the Dominant Segment (e.g., Commercial & Industrial):

- Favorable government incentives and tax benefits.

- High electricity costs for businesses.

- Growing corporate social responsibility initiatives.

- Improved access to financing options for large-scale installations.

- Key Drivers for the Dominant Region (e.g., Gauteng):

- High population density and economic activity.

- Robust infrastructure facilitating installation.

- Proactive government support for renewable energy.

Detailed analysis of the dominance of this region and segment includes market size projections, competitive landscapes, and a comprehensive examination of factors contributing to their success. The analysis will also highlight the growth potential of other segments and regions.

South Africa Rooftop Solar Industry Product Innovations

This section summarizes recent product developments and technological advancements in the South African rooftop solar industry. Innovation focuses on improving efficiency, reducing costs, and enhancing the aesthetic appeal of solar panel systems. New developments include advancements in battery storage technology that complement solar installations, creating more reliable and independent energy solutions. These improvements are driving market growth and enhancing the competitive advantages of key players.

Report Scope & Segmentation Analysis

This report segments the South African rooftop solar market by end-user: Residential, Commercial, and Industrial.

- Residential: This segment showcases growth projections of xx Million by 2033, driven by rising electricity prices and increasing environmental awareness. Competition is largely driven by price and service quality.

- Commercial: This segment is projected to reach xx Million by 2033, fueled by corporate sustainability initiatives and government incentives. Competitive dynamics center around large-scale project capabilities and long-term service agreements.

- Industrial: The industrial segment is expected to reach xx Million by 2033, largely driven by the need for reliable and cost-effective energy solutions. Competition focuses on tailor-made solutions and energy management expertise.

Key Drivers of South Africa Rooftop Solar Industry Growth

The South African rooftop solar industry's growth is propelled by several factors: increasing electricity costs, supportive government policies (e.g., feed-in tariffs and tax incentives), growing environmental consciousness amongst consumers and businesses, and technological advancements leading to improved efficiency and reduced costs of solar PV systems.

Challenges in the South Africa Rooftop Solar Industry Sector

The South African rooftop solar industry faces challenges including: intermittency of solar power, requiring effective energy storage solutions; grid infrastructure limitations, impacting the efficient integration of rooftop solar; regulatory complexities and permitting processes, adding delays and costs to project deployment; and supply chain disruptions impacting the timely availability of essential components. These factors collectively impose an estimated xx Million loss annually on the industry.

Emerging Opportunities in South Africa Rooftop Solar Industry

Emerging opportunities include the growth of hybrid solar systems integrating batteries for energy storage, increasing adoption of solar financing options such as leasing and power purchase agreements (PPAs), and expanding into underserved rural markets with off-grid solutions. Government initiatives focused on electrification and renewable energy integration further unlock significant market potential.

Leading Players in the South Africa Rooftop Solar Industry Market

- Sunworx Solar

- Solareff (Pty) Ltd

- Tasol Solar

- JA Solar Holdings

- BrightBlack Energy

- Sola Group

- GENERGY

- Romano SOLAR

- PiA Solar SA (Pty) Ltd

- Valsa Trading (Pty) Ltd

Key Developments in South Africa Rooftop Solar Industry Industry

- 2022 (July): Launch of a new, high-efficiency solar panel by Sunworx Solar. This launch increased market share by xx%.

- 2023 (March): Merger of two smaller solar companies, resulting in increased market consolidation. This merger increased the market value by xx Million.

- 2024 (October): Government announcement of new incentives for rooftop solar installations in commercial sectors. This incentive boosted investment by xx Million. (Further developments to be included in the final report)

Future Outlook for South Africa Rooftop Solar Industry Market

The South African rooftop solar industry is poised for significant growth driven by escalating electricity costs, increasing environmental awareness, and ongoing technological advancements. Strategic opportunities exist in optimizing energy storage solutions, expanding into underserved markets, and capitalizing on government incentives to support market expansion. The industry is expected to see continued investment and consolidation, creating a more mature and competitive landscape.

South Africa Rooftop Solar Industry Segmentation

-

1. End User

- 1.1. Residential

- 1.2. Commercial and Industrial

South Africa Rooftop Solar Industry Segmentation By Geography

- 1. South Africa

South Africa Rooftop Solar Industry Regional Market Share

Geographic Coverage of South Africa Rooftop Solar Industry

South Africa Rooftop Solar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Supporting Government Policies for Solar Energy in South Africa4.; Increasing Investment in Renewable Energy Such as Solar

- 3.2.2 Wind

- 3.2.3 and Others

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Alternate Renewable Technologies Such as Wind

- 3.4. Market Trends

- 3.4.1. The Commercial and Industrial Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Rooftop Solar Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Residential

- 5.1.2. Commercial and Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sunworx Solar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solareff (Pty) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tasol Solar

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JA Solar Holdings

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BrightBlack Energy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sola Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GENERGY

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Romano SOLAR*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PiA Solar SA (Pty) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valsa Trading (Pty) Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sunworx Solar

List of Figures

- Figure 1: South Africa Rooftop Solar Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Rooftop Solar Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Rooftop Solar Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 2: South Africa Rooftop Solar Industry Volume gigawatt Forecast, by End User 2020 & 2033

- Table 3: South Africa Rooftop Solar Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Africa Rooftop Solar Industry Volume gigawatt Forecast, by Region 2020 & 2033

- Table 5: South Africa Rooftop Solar Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: South Africa Rooftop Solar Industry Volume gigawatt Forecast, by End User 2020 & 2033

- Table 7: South Africa Rooftop Solar Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: South Africa Rooftop Solar Industry Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Rooftop Solar Industry?

The projected CAGR is approximately 38%.

2. Which companies are prominent players in the South Africa Rooftop Solar Industry?

Key companies in the market include Sunworx Solar, Solareff (Pty) Ltd, Tasol Solar, JA Solar Holdings, BrightBlack Energy, Sola Group, GENERGY, Romano SOLAR*List Not Exhaustive, PiA Solar SA (Pty) Ltd, Valsa Trading (Pty) Ltd.

3. What are the main segments of the South Africa Rooftop Solar Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Supporting Government Policies for Solar Energy in South Africa4.; Increasing Investment in Renewable Energy Such as Solar. Wind. and Others.

6. What are the notable trends driving market growth?

The Commercial and Industrial Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Adoption of Alternate Renewable Technologies Such as Wind.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Rooftop Solar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Rooftop Solar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Rooftop Solar Industry?

To stay informed about further developments, trends, and reports in the South Africa Rooftop Solar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence