Key Insights

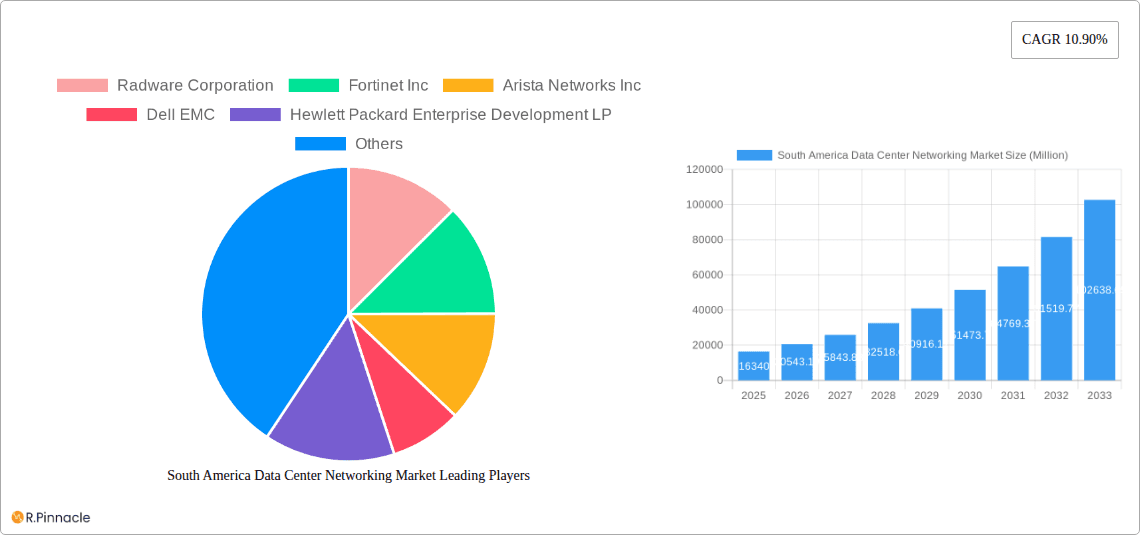

The South America Data Center Networking Market is poised for remarkable expansion, projected to reach an estimated USD 16.34 billion in 2025. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 25.69%, indicating a dynamic and rapidly evolving landscape. Key drivers for this surge include the escalating demand for cloud computing services across the region, necessitating sophisticated and high-performance data center infrastructure. Furthermore, the increasing adoption of digital transformation initiatives by enterprises in sectors like IT & Telecommunication and BFSI is a significant catalyst. The ongoing expansion of 5G networks, which require substantial data processing and storage capabilities, also contributes to the accelerated growth of data center networking solutions. Investments in modernizing existing data center facilities and building new ones to support the burgeoning digital economy are central to this market's trajectory.

South America Data Center Networking Market Market Size (In Billion)

The market's strong growth is further supported by the widespread adoption of advanced networking equipment such as Ethernet Switches and Routers, alongside a rising demand for Application Delivery Controllers (ADCs) to optimize application performance and availability. The services segment, particularly Installation & Integration and Support & Maintenance, is experiencing significant traction as organizations seek expert assistance in deploying and managing complex data center networks. While the market is primarily driven by the IT & Telecommunication and BFSI sectors, the Government and Media & Entertainment industries are also demonstrating a growing interest in enhancing their data center capabilities. Emerging trends such as the increasing adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) are shaping the future of data center networking in South America, offering greater flexibility and efficiency. Despite the strong growth trajectory, challenges such as high initial investment costs and the need for skilled IT professionals could present moderate restraints.

South America Data Center Networking Market Company Market Share

South America Data Center Networking Market: Growth Drivers, Key Trends, and Competitive Landscape (2019–2033)

Unlock the potential of the rapidly expanding South America data center networking market with this comprehensive, data-driven report. Forecasted to reach substantial billion-dollar valuations by 2033, this study provides in-depth analysis and actionable insights into market dynamics, segmentation, and future outlook. Essential for stakeholders seeking to navigate the complex yet lucrative South American digital infrastructure.

This report delves into the intricate landscape of data center networking across South America, offering a detailed examination of market structure, dynamics, leading players, and pivotal developments. With a robust forecast period from 2025 to 2033, our analysis leverages extensive historical data (2019–2024) and a strong base year of 2025 to provide precise projections. Understand the core components driving growth, from Ethernet switches and routers to critical services like installation and support, and identify key end-user industries, including IT & Telecommunication and BFSI.

South America Data Center Networking Market Market Structure & Innovation Trends

The South America data center networking market exhibits a dynamic structure characterized by a blend of established global players and emerging local entities. Market concentration is influenced by significant investments in digital infrastructure, with key companies vying for market share through technological advancements and strategic partnerships. Innovation is primarily driven by the increasing demand for high-speed connectivity, cloud adoption, and the proliferation of data-intensive applications. Regulatory frameworks are evolving to support data localization and cybersecurity, impacting network architecture and vendor selection. While direct product substitutes for core networking hardware are limited, software-defined networking (SDN) and Network Functions Virtualization (NFV) offer alternative approaches to traditional hardware-centric solutions. End-user demographics are shifting towards cloud-native enterprises and government entities prioritizing digital transformation. Mergers and acquisitions (M&A) activity remains a significant factor, with strategic acquisitions aimed at expanding product portfolios and geographical reach. For instance, recent M&A deals within the global networking space, though not specific to South America, indicate a trend towards consolidation and the acquisition of innovative technologies, with deal values often reaching into the billions. Understanding these market dynamics is crucial for forecasting future market share and strategic positioning.

South America Data Center Networking Market Market Dynamics & Trends

The South America data center networking market is poised for robust expansion, propelled by a confluence of compelling growth drivers and transformative technological trends. The escalating demand for cloud services across various industries, coupled with the increasing adoption of big data analytics and the Internet of Things (IoT), is fundamentally reshaping network infrastructure requirements. As businesses in South America increasingly embrace digital transformation initiatives, the need for scalable, high-performance, and reliable data center networks becomes paramount. This surge in demand translates into a projected Compound Annual Growth Rate (CAGR) that is expected to remain consistently high throughout the forecast period.

Technological disruptions are playing a pivotal role in this market evolution. The widespread implementation of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) is enabling greater agility, automation, and cost-efficiency in network management. These technologies allow for dynamic resource allocation and simplified operations, crucial for accommodating the fluctuating demands of modern data centers. Furthermore, the continuous advancement in Ethernet switch speeds, with the increasing adoption of 10GbE, 40GbE, and 100GbE ports, is directly addressing the need for enhanced bandwidth to support growing data volumes and real-time applications.

Consumer preferences are also evolving. Organizations are increasingly seeking integrated networking solutions that offer not just hardware but also comprehensive services, including installation, integration, training, and ongoing support. This shift towards a service-oriented approach underscores the demand for end-to-end solutions that simplify deployment and ensure optimal network performance. The competitive dynamics within the South America data center networking market are intensifying, with both global technology giants and specialized networking providers actively competing to capture market share. Companies are focusing on developing innovative solutions that cater to the specific needs of the South American region, including robust security features and cost-effective deployments. The market penetration of advanced networking technologies is steadily increasing as more businesses recognize the strategic advantage of a modern and efficient data center network.

Dominant Regions & Segments in South America Data Center Networking Market

Brazil consistently emerges as the dominant region within the South America data center networking market, driven by its large economy, significant digital transformation initiatives, and a burgeoning number of data center investments. The country's robust industrial base and expanding e-commerce sector are fueling substantial demand for advanced networking solutions. Furthermore, government initiatives aimed at fostering technological innovation and digital inclusion have created a fertile ground for data center expansion.

Within the Component: By Product segmentation, Ethernet Switches represent the largest and most crucial segment. The exponential growth in data traffic, driven by cloud computing, big data analytics, and the increasing adoption of IoT devices, necessitates high-density, high-speed Ethernet switches for efficient data transfer and network connectivity within data centers.

- Key Drivers for Ethernet Switches Dominance:

- Increased Bandwidth Requirements: The proliferation of 10GbE, 40GbE, and 100GbE interfaces to support high-performance computing and faster data processing.

- Cloud Adoption: The widespread migration of businesses to cloud environments necessitates robust switch infrastructure to manage inter-server communication and external connectivity.

- Data Center Expansion: Continuous investment in building new data centers and upgrading existing ones fuels demand for core networking components like switches.

In the Component: By Services segmentation, Installation & Integration services are witnessing significant growth. As data center networks become more complex, the expertise required for seamless deployment and integration of hardware and software solutions is in high demand. This includes the setup of complex network topologies, configuration of routing and switching protocols, and integration with existing IT infrastructure, often requiring specialized knowledge and skilled personnel.

- Key Drivers for Installation & Integration Dominance:

- Complexity of Modern Networks: The integration of SDN, NFV, and advanced security features requires specialized installation and configuration expertise.

- Need for Reduced Downtime: Efficient installation and integration minimize disruption to ongoing business operations.

- Focus on Core Competencies: Businesses often outsource installation and integration to specialized providers to focus on their core operations.

The End-User segment of IT & Telecommunication stands out as the primary driver of demand. The ever-increasing need for network capacity, data processing, and connectivity services within the telecommunications sector, coupled with the IT industry's continuous innovation and cloud infrastructure development, makes this segment the largest consumer of data center networking solutions.

- Key Drivers for IT & Telecommunication Dominance:

- 5G Network Rollout: The deployment of 5G infrastructure requires massive data handling capabilities and robust network backbones, significantly boosting demand for advanced networking.

- Cloud Service Providers (CSPs): The continuous expansion of cloud infrastructure by CSPs necessitates a constant upgrade and expansion of their data center networking capabilities.

- Data Consumption Growth: The escalating demand for streaming services, online gaming, and other data-intensive applications drives the need for more powerful and efficient network infrastructure.

South America Data Center Networking Market Product Innovations

Product innovation in the South America data center networking market is primarily centered on enhancing performance, security, and efficiency. Companies are developing next-generation Ethernet switches with higher port densities and faster speeds to meet the growing bandwidth demands. Innovations in Software-Defined Networking (SDN) controllers and Network Functions Virtualization (NFV) platforms are enabling greater network programmability and flexibility. Furthermore, the integration of advanced security features, such as threat detection and prevention within networking devices, is a key competitive advantage. The development of modular and scalable networking equipment allows businesses to adapt their infrastructure as their needs evolve, ensuring long-term relevance and cost-effectiveness.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the South America Data Center Networking Market, covering various critical segmentations. The Component segmentation includes By Product, with detailed insights into Ethernet Switches, Routers, Storage Area Network (SAN) solutions, Application Delivery Controllers (ADC), and Other Networking Equipment. The By Services segmentation encompasses Installation & Integration, Training & Consulting, and Support & Maintenance, highlighting the growing demand for end-to-end solutions. The End-User segmentation analyzes the market across IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-Users. Each segment is analyzed for its market size, growth projections, and competitive dynamics within the South American context.

Key Drivers of South America Data Center Networking Market Growth

Several key drivers are propelling the growth of the South America data center networking market. The relentless surge in digital transformation initiatives across all industries, from BFSI to government, necessitates robust and scalable network infrastructure. The rapid adoption of cloud computing services, both public and private, is a significant contributor, as organizations rely on data centers to host their cloud environments. Furthermore, the increasing prevalence of big data analytics and the Internet of Things (IoT) generates vast amounts of data, demanding high-performance networking solutions for efficient processing and transmission. Government investments in digital infrastructure and favorable regulatory policies supporting technology adoption are also playing a crucial role in market expansion.

Challenges in the South America Data Center Networking Market Sector

Despite the promising growth trajectory, the South America data center networking market faces several challenges. High import duties and taxes on networking equipment can significantly increase operational costs for businesses, hindering widespread adoption of advanced technologies. The scarcity of skilled IT professionals with expertise in advanced networking technologies and cybersecurity poses a significant barrier to implementation and effective management of complex data center networks. Furthermore, the fluctuating economic conditions in some South American countries can impact capital expenditure budgets, leading to delays or cancellations of networking infrastructure projects. Supply chain disruptions, particularly for specialized networking components, can also lead to extended lead times and increased costs.

Emerging Opportunities in South America Data Center Networking Market

The South America data center networking market presents numerous emerging opportunities. The increasing demand for edge computing solutions, driven by the need for low-latency data processing closer to end-users, is creating a new avenue for networking hardware and software development. The growing focus on cybersecurity and data privacy is driving demand for advanced network security solutions, including firewalls, intrusion detection systems, and secure network segmentation. The expansion of hyperscale data centers and co-location facilities, fueled by major cloud providers establishing a presence in the region, presents significant opportunities for networking equipment vendors. Furthermore, the adoption of 5G technology across South America will necessitate substantial upgrades to network infrastructure, creating a sustained demand for high-speed networking solutions.

Leading Players in the South America Data Center Networking Market Market

Radware Corporation Fortinet Inc Arista Networks Inc Dell EMC Hewlett Packard Enterprise Development LP Juniper Networks Inc Extreme Networks Inc NEC Corporation A10 Networks Inc VMware Inc TP-Link Corporation Limited Moxa Inc

Key Developments in South America Data Center Networking Market Industry

- July 2023: Moxa Inc. launched its MDS-G4020-L3-4XGS series of Ethernet switches, a versatile line of Layer 3 full Gigabit modular managed switches supporting four 10GbE + sixteen Gigabit ports, including four embedded ports, four interface module expansion slots, and two power module slots to ensure sufficient flexibility for a variety of applications. This development enhances the capabilities of industrial data center networks, particularly in environments requiring robust and modular connectivity.

- November 2022: VMware, Inc. unveiled its next-generation SD-WAN solution, including a new SD-WAN Client, to help enterprises more securely, reliably, and optimally deliver applications, data, and services across any network to any device. This advancement in software-defined networking provides enterprises with enhanced control and visibility over their network traffic, crucial for modern distributed data center environments.

Future Outlook for South America Data Center Networking Market Market

The future outlook for the South America data center networking market is exceptionally bright, driven by sustained digital transformation and increasing demand for robust digital infrastructure. The continued expansion of cloud computing, coupled with the growing adoption of emerging technologies like AI, machine learning, and 5G, will necessitate ongoing investments in high-performance networking solutions. Edge computing will also play an increasingly significant role, requiring distributed and intelligent networking capabilities. Companies that can offer innovative, secure, and cost-effective networking solutions, along with comprehensive service and support, are well-positioned for substantial growth. Strategic partnerships and acquisitions will likely continue to shape the competitive landscape, enabling players to expand their offerings and market reach within this dynamic region.

South America Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Router

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

South America Data Center Networking Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Data Center Networking Market Regional Market Share

Geographic Coverage of South America Data Center Networking Market

South America Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need of Cloud Storage and Rsing Demand for Reliable Application Performance; Increasing Cyberattacks Among Enterprises

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Router

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Radware Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fortinet Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arista Networks Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell EMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hewlett Packard Enterprise Development LP

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Juniper Networks Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Extreme Networks Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 A10 Networks Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VMware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TP-Link Corporation Limited*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Moxa Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Radware Corporation

List of Figures

- Figure 1: South America Data Center Networking Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: South America Data Center Networking Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: South America Data Center Networking Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 3: South America Data Center Networking Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: South America Data Center Networking Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 5: South America Data Center Networking Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 6: South America Data Center Networking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Chile South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Colombia South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Peru South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Venezuela South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Ecuador South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Bolivia South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Paraguay South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Uruguay South America Data Center Networking Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Data Center Networking Market?

The projected CAGR is approximately 25.69%.

2. Which companies are prominent players in the South America Data Center Networking Market?

Key companies in the market include Radware Corporation, Fortinet Inc, Arista Networks Inc, Dell EMC, Hewlett Packard Enterprise Development LP, Juniper Networks Inc, Extreme Networks Inc, NEC Corporation, A10 Networks Inc, VMware Inc, TP-Link Corporation Limited*List Not Exhaustive, Moxa Inc.

3. What are the main segments of the South America Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need of Cloud Storage and Rsing Demand for Reliable Application Performance; Increasing Cyberattacks Among Enterprises.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

July 2023: Moxa Inc. launched its MDS-G4020-L3-4XGS series of Ethernet switches, a versatile line of Layer 3 full Gigabit modular managed switches supporting four 10GbE + sixteen Gigabit ports, including four embedded ports, four interface module expansion slots, and two power module slots to ensure sufficient flexibility for a variety of applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Data Center Networking Market?

To stay informed about further developments, trends, and reports in the South America Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence