Key Insights

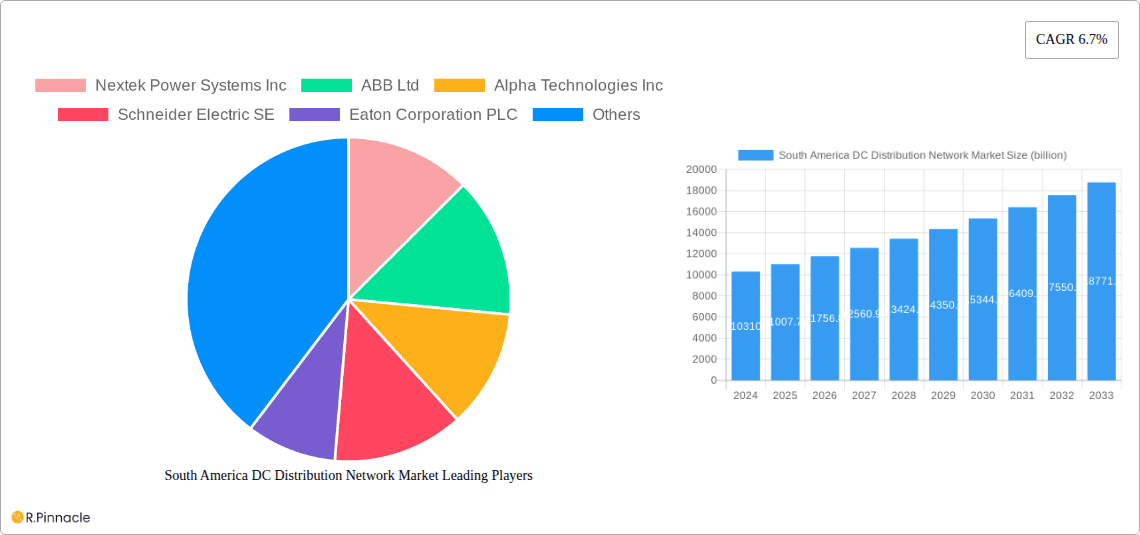

The South America DC Distribution Network Market is poised for significant expansion, projected to reach an estimated USD 10.31 billion in 2024. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.7% over the forecast period. A primary catalyst for this upward trajectory is the increasing adoption of renewable energy sources and the growing demand for efficient power distribution solutions across various sectors. Key sectors driving this demand include the expansion of remote cell towers to enhance telecommunications coverage, the deployment of EV fast-charging infrastructure to support electric mobility, and the increasing need for reliable power in commercial buildings and data centers. Furthermore, the modernization of military applications and the ongoing infrastructure development in countries like Brazil, Argentina, and Colombia are contributing to market expansion.

South America DC Distribution Network Market Market Size (In Billion)

The market's growth is further fueled by advancements in DC power distribution technologies, offering superior efficiency and reduced energy loss compared to traditional AC systems. Trends such as the rise of smart grids, the integration of energy storage solutions, and the increasing focus on energy sustainability are also propelling the market forward. While opportunities abound, certain restraints, such as the initial high investment costs for new DC infrastructure and the need for skilled labor for installation and maintenance, may temper the pace of adoption in some segments. Nevertheless, the overarching trend towards digitalization, electrification, and sustainable energy management across South America presents a fertile ground for the DC distribution network market to thrive, with continued innovation expected to address existing challenges and unlock new avenues for growth.

South America DC Distribution Network Market Company Market Share

South America DC Distribution Network Market: In-Depth Analysis & Future Projections (2019-2033)

Gain unparalleled insights into the burgeoning South America DC distribution network market with this comprehensive report. Covering the historical period of 2019-2024 and projecting growth through 2033, this study offers granular analysis of market dynamics, emerging trends, and key players. Explore the impact of technological advancements, renewable energy integration, and evolving end-user demands on the region's DC distribution infrastructure. This report is an essential resource for stakeholders seeking to capitalize on the significant growth opportunities within the South American power and energy sector.

South America DC Distribution Network Market Market Structure & Innovation Trends

The South America DC distribution network market exhibits a moderately consolidated structure, with leading global players holding significant market share. Innovation is primarily driven by the increasing demand for efficient energy management, the integration of renewable energy sources, and the rapid expansion of data centers and EV charging infrastructure. Regulatory frameworks are evolving to support grid modernization and the adoption of advanced DC distribution technologies, fostering an environment conducive to market growth. While direct product substitutes are limited, advancements in AC distribution technologies and localized microgrids present indirect competitive pressures. End-user demographics are increasingly skewed towards sectors requiring high reliability and specialized power solutions, such as data centers and remote communication facilities. Mergers and acquisitions (M&A) activities are expected to play a crucial role in market consolidation, with an estimated M&A deal value of $5.7 billion in the historical period, indicating strategic investments aimed at expanding technological capabilities and market reach.

- Market Concentration: Moderate to High

- Innovation Drivers: Renewable energy integration, data center expansion, EV charging infrastructure, grid modernization, energy efficiency.

- Regulatory Frameworks: Evolving to support DC adoption, renewable energy incentives, grid reliability standards.

- Product Substitutes: Advanced AC distribution systems, localized microgrids.

- End-User Demographics: Shift towards high-demand, high-reliability sectors.

- M&A Activities: Strategic acquisitions to enhance technological portfolios and market presence.

South America DC Distribution Network Market Market Dynamics & Trends

The South America DC distribution network market is poised for substantial expansion, driven by a confluence of technological advancements, evolving consumer preferences, and robust economic development across the region. The escalating integration of renewable energy sources, particularly solar and wind power, necessitates more efficient and flexible distribution systems, creating a strong demand for DC technologies that minimize energy losses during conversion. Furthermore, the exponential growth of data centers, fueled by cloud computing adoption and the proliferation of digital services, requires highly reliable and scalable power solutions, a niche where DC distribution networks excel. The rapid expansion of electric vehicle (EV) charging infrastructure, especially fast-charging systems, is another significant growth catalyst, as DC power is inherently suited for rapid battery replenishment. Consumer preferences are increasingly leaning towards energy-efficient and resilient power solutions, further bolstering the adoption of DC networks.

Technological disruptions, including advancements in power electronics, smart grid technologies, and energy storage solutions, are continuously enhancing the performance and cost-effectiveness of DC distribution systems. The development of High-Voltage Direct Current (HVDC) transmission technology is particularly impactful, enabling the efficient transport of large amounts of power over long distances with minimal losses, facilitating the connection of remote renewable energy sources to population centers. The market penetration of DC distribution solutions is projected to reach XX% by 2033, with a compound annual growth rate (CAGR) of 12.5% over the forecast period. Competitive dynamics are characterized by intense innovation and strategic partnerships among established power solutions providers and emerging technology companies. The focus is on developing modular, scalable, and intelligent DC distribution systems that can adapt to diverse end-user requirements and evolving grid conditions.

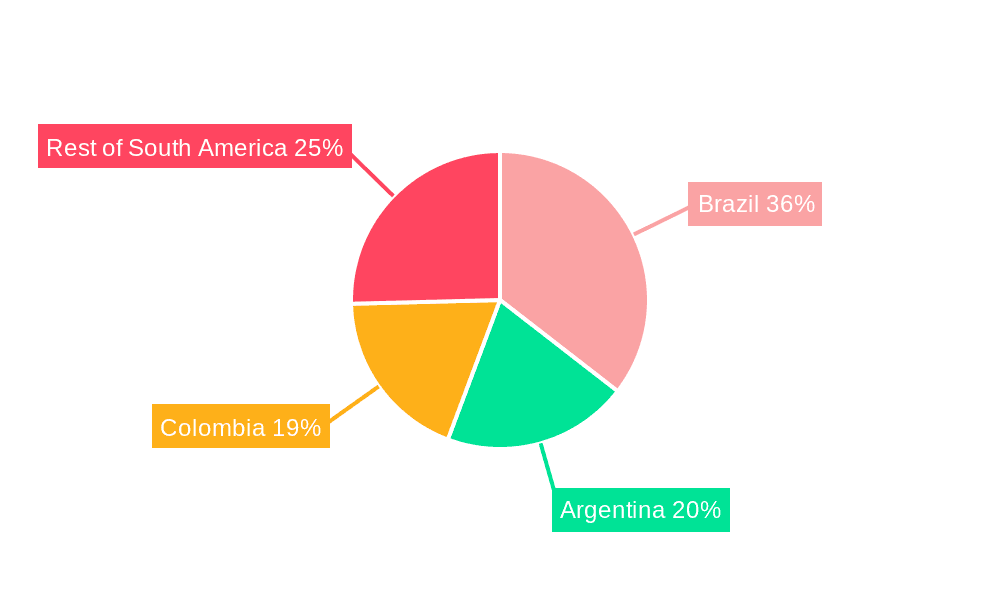

Dominant Regions & Segments in South America DC Distribution Network Market

Brazil stands out as the dominant region in the South America DC distribution network market, driven by its large economy, significant investments in infrastructure development, and ambitious renewable energy targets. The country's extensive geographical area and the need to connect remote renewable energy generation sites to its industrial and population centers make it a prime market for HVDC transmission and advanced DC distribution solutions. Economic policies that encourage foreign investment in the energy sector and robust government initiatives aimed at modernizing the national grid further solidify Brazil's leadership position. The combination of a growing demand for reliable power from industrial and commercial sectors, coupled with an accelerating adoption of electric vehicles, creates a fertile ground for DC distribution network expansion.

Within the end-user segments, Data Centers are emerging as a leading consumer of DC distribution networks, driven by the insatiable demand for cloud computing, big data analytics, and digital services across South America. The inherent efficiency and reliability of DC power for IT equipment, coupled with the reduced conversion losses, make it a preferred choice for modern data center designs. The continuous expansion of existing facilities and the construction of new hyperscale data centers are significant drivers in this segment.

Dominant Region: Brazil

- Key Drivers:

- Large economy and significant infrastructure investments.

- Ambitious renewable energy targets and integration.

- Need for long-distance power transmission.

- Favorable economic policies and government initiatives for grid modernization.

- Growing demand from industrial, commercial, and residential sectors.

- Accelerating adoption of electric vehicles.

- Key Drivers:

Leading End-User Segment: Data Centers

- Key Drivers:

- Exponential growth in cloud computing and digital services.

- Demand for high reliability and low latency in IT operations.

- Reduced energy conversion losses with DC power for IT equipment.

- Scalability and flexibility of DC distribution for evolving data center needs.

- Increased investment in hyperscale and edge data centers.

- Key Drivers:

South America DC Distribution Network Market Product Innovations

Product innovations in the South America DC distribution network market are centered on enhancing efficiency, reliability, and scalability. Key developments include advanced modular DC power systems for data centers, intelligent microgrid controllers, and high-efficiency HVDC converters. These innovations address the growing demand for integrated energy solutions that can seamlessly manage renewable energy inputs, optimize power distribution, and ensure uninterrupted supply to critical infrastructure. The competitive advantage lies in offering solutions that reduce energy losses, improve power quality, and provide greater operational flexibility to end-users.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the South America DC Distribution Network Market across various segmentations. The End-User segments include Remote Cell Towers, Commercial Buildings, Data Centers, Military Applications, EV Fast Charging Systems, and Other End Users. Geographically, the market is segmented into Brazil, Argentina, Colombia, and the Rest of South America. Each segment's market size, growth projections, and competitive dynamics are meticulously detailed, providing stakeholders with a granular understanding of the market landscape. For instance, the Data Centers segment is projected to exhibit a CAGR of 15.2% during the forecast period, driven by rapid digitalization.

- Remote Cell Towers: Experiencing growth due to expanding mobile network coverage, requiring efficient and reliable power solutions.

- Commercial Buildings: Increasing adoption of smart building technologies and demand for energy-efficient power distribution.

- Data Centers: Rapid expansion fueled by cloud computing, big data, and digital services, demanding high-reliability DC power.

- Military Applications: Growing need for secure, resilient, and mobile power solutions in defense operations.

- EV Fast Charging Systems: Significant growth anticipated with the accelerating adoption of electric vehicles across the region.

- Other End Users: Encompassing industrial facilities, utilities, and specialized applications.

Key Drivers of South America DC Distribution Network Market Growth

The South America DC distribution network market is experiencing robust growth driven by several key factors. The rapid integration of renewable energy sources, such as solar and wind power, necessitates more efficient power transmission and distribution, a role where DC technology excels. The burgeoning demand from the data center sector, fueled by cloud computing and digital transformation, requires reliable and scalable power solutions. Furthermore, the accelerating adoption of electric vehicles (EVs) is creating a significant demand for advanced EV fast-charging infrastructure, which heavily relies on DC power. Government initiatives promoting grid modernization, energy efficiency, and the development of smart grids are also substantial growth accelerators, encouraging investments in advanced DC distribution technologies.

Challenges in the South America DC Distribution Network Market Sector

Despite the strong growth trajectory, the South America DC distribution network market faces several challenges. Regulatory hurdles and the slow pace of policy implementation in some countries can impede the adoption of new technologies. Supply chain complexities and the availability of specialized components can also pose constraints, particularly for large-scale projects. High initial investment costs for advanced DC distribution infrastructure can be a deterrent for some end-users, although long-term operational savings often compensate for this. Interoperability issues between different DC systems and existing AC grids, along with the need for skilled labor to install and maintain these sophisticated systems, present further challenges that need to be addressed for sustained market growth.

Emerging Opportunities in South America DC Distribution Network Market

Emerging opportunities in the South America DC distribution network market are abundant, particularly in areas aligned with sustainable development and technological innovation. The increasing focus on decentralized energy generation and the proliferation of microgrids present significant avenues for DC distribution solutions, especially in remote or off-grid areas. The rapid expansion of the electric vehicle ecosystem, beyond just charging stations to include vehicle-to-grid (V2G) technologies, offers substantial growth potential. Furthermore, the ongoing digitalization of industries, including manufacturing and mining, creates demand for efficient and reliable power systems that DC distribution can provide. Investments in smart city initiatives across the region will also drive the adoption of advanced DC networks for various urban infrastructure applications.

Leading Players in the South America DC Distribution Network Market Market

- Nextek Power Systems Inc

- ABB Ltd

- Alpha Technologies Inc

- Schneider Electric SE

- Eaton Corporation PLC

- Robert Bosch GmbH

- Siemens Energy AG

- Vertiv Group Corp

- Secheron SA

Key Developments in South America DC Distribution Network Market Industry

- December 2022: The government of Colombia announced plans to connect up to 3,000 MW of its renewable energy capacity to the national grid via an overhead high-voltage direct current (HVDC) transmission line in the country's north, signifying a major investment in DC transmission infrastructure.

- July 2022: Sterlite Power Grid Ventures Limited announced that it had won two HVDC transmission projects in Brazil through its subsidiary Sterlite Brazil. The projects are spanned across 5,425 kilometers of transmission lines in Brazil, indicating significant expansion in HVDC network development.

Future Outlook for South America DC Distribution Network Market Market

The future outlook for the South America DC distribution network market is exceptionally positive, fueled by accelerating trends in renewable energy integration, digitalization, and electrification. Continued investments in HVDC technology will be crucial for efficiently transmitting power from renewable energy-rich regions to demand centers, driving market expansion. The growing demand for highly reliable and efficient power solutions from data centers and the burgeoning EV charging infrastructure will further stimulate market growth. As governments continue to prioritize grid modernization and sustainable energy development, the adoption of advanced DC distribution networks is set to become a cornerstone of the region's energy landscape. Strategic partnerships, technological advancements, and supportive regulatory frameworks will be key to unlocking the full market potential, leading to sustained high growth rates and significant opportunities for stakeholders.

South America DC Distribution Network Market Segmentation

-

1. End-User

- 1.1. Remote Cell Towers

- 1.2. Commercial Buildings

- 1.3. Data Centers

- 1.4. Military Applications

- 1.5. EV Fast Charging Systems

- 1.6. Other End Users

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America DC Distribution Network Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America DC Distribution Network Market Regional Market Share

Geographic Coverage of South America DC Distribution Network Market

South America DC Distribution Network Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Substantial Investments and Efforts to Modernize the T&D Grid

- 3.3. Market Restrains

- 3.3.1. 4.; Expansion of High Voltage Direct Current (HVDC) Networks

- 3.4. Market Trends

- 3.4.1. EV Fast Charging Systems to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Remote Cell Towers

- 5.1.2. Commercial Buildings

- 5.1.3. Data Centers

- 5.1.4. Military Applications

- 5.1.5. EV Fast Charging Systems

- 5.1.6. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Brazil South America DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Remote Cell Towers

- 6.1.2. Commercial Buildings

- 6.1.3. Data Centers

- 6.1.4. Military Applications

- 6.1.5. EV Fast Charging Systems

- 6.1.6. Other End Users

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. Argentina South America DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Remote Cell Towers

- 7.1.2. Commercial Buildings

- 7.1.3. Data Centers

- 7.1.4. Military Applications

- 7.1.5. EV Fast Charging Systems

- 7.1.6. Other End Users

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Colombia South America DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Remote Cell Towers

- 8.1.2. Commercial Buildings

- 8.1.3. Data Centers

- 8.1.4. Military Applications

- 8.1.5. EV Fast Charging Systems

- 8.1.6. Other End Users

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Rest of South America South America DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Remote Cell Towers

- 9.1.2. Commercial Buildings

- 9.1.3. Data Centers

- 9.1.4. Military Applications

- 9.1.5. EV Fast Charging Systems

- 9.1.6. Other End Users

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nextek Power Systems Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Alpha Technologies Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Schneider Electric SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Eaton Corporation PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Robert Bosch GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Siemens Energy AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vertiv Group Corp

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Secheron SA*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Nextek Power Systems Inc

List of Figures

- Figure 1: South America DC Distribution Network Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America DC Distribution Network Market Share (%) by Company 2025

List of Tables

- Table 1: South America DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: South America DC Distribution Network Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: South America DC Distribution Network Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South America DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: South America DC Distribution Network Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America DC Distribution Network Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: South America DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: South America DC Distribution Network Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: South America DC Distribution Network Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: South America DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 11: South America DC Distribution Network Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America DC Distribution Network Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: South America DC Distribution Network Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: South America DC Distribution Network Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America DC Distribution Network Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the South America DC Distribution Network Market?

Key companies in the market include Nextek Power Systems Inc, ABB Ltd, Alpha Technologies Inc, Schneider Electric SE, Eaton Corporation PLC, Robert Bosch GmbH, Siemens Energy AG, Vertiv Group Corp, Secheron SA*List Not Exhaustive.

3. What are the main segments of the South America DC Distribution Network Market?

The market segments include End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.31 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Substantial Investments and Efforts to Modernize the T&D Grid.

6. What are the notable trends driving market growth?

EV Fast Charging Systems to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Expansion of High Voltage Direct Current (HVDC) Networks.

8. Can you provide examples of recent developments in the market?

December 2022: The government of Colombia announced that it plans to connect up to 3,000 MW of its renewable energy capacity to the national grid via an overhead high-voltage direct current (HVDC) transmission line in the country's north.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America DC Distribution Network Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America DC Distribution Network Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America DC Distribution Network Market?

To stay informed about further developments, trends, and reports in the South America DC Distribution Network Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence