Key Insights

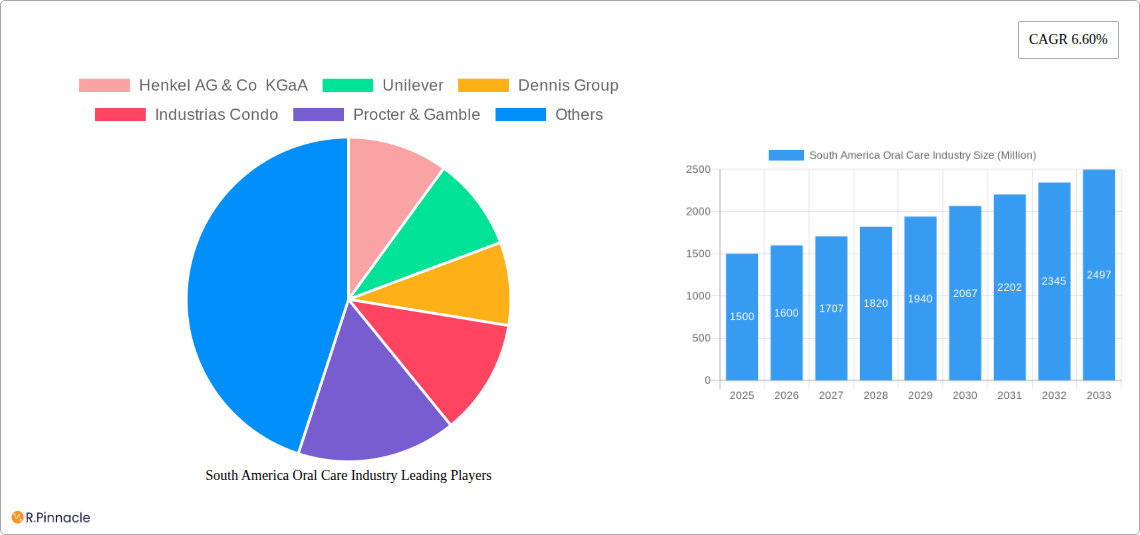

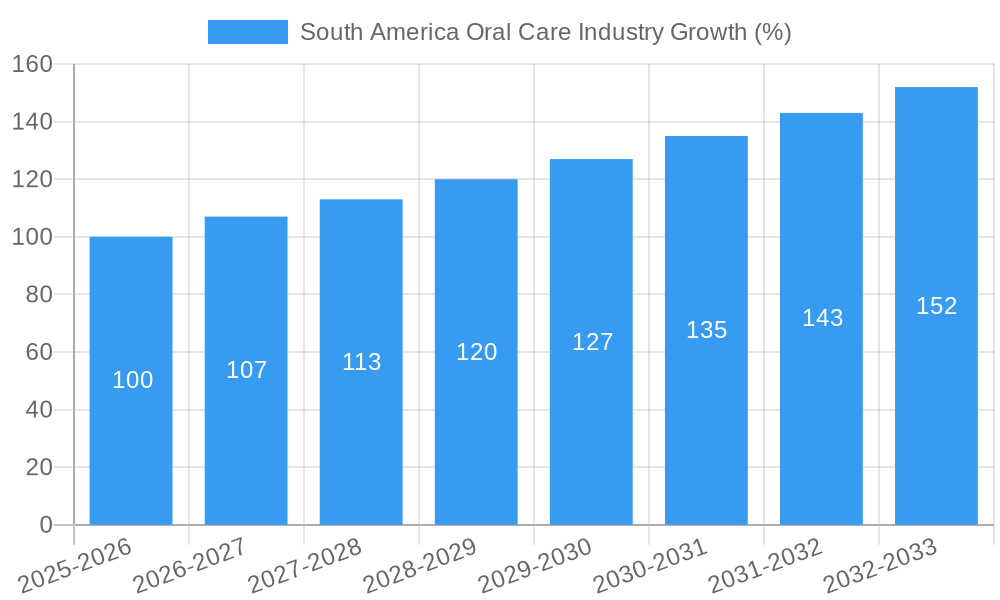

The South American oral care market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 6.60% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes across the region, particularly in Brazil and Argentina, are driving increased consumer spending on personal care products, including oral hygiene items. A growing awareness of oral health, coupled with increasing accessibility to dental care services, further contributes to market expansion. The popularity of whitening products and specialized oral care solutions caters to evolving consumer preferences and demand for premium products. Furthermore, the expanding online retail sector provides new avenues for distribution, enhancing market reach and accessibility, especially in remote areas. However, economic volatility and fluctuating exchange rates in certain South American countries pose challenges to sustained growth. Competition from established international players and local brands creates a dynamic market landscape.

Segmentation analysis reveals that toothpastes and toothbrushes remain the largest product segments, accounting for a significant portion of the market share. Mouthwashes and rinses also exhibit considerable growth potential, driven by rising consumer awareness of oral hygiene benefits beyond basic brushing and flossing. The distribution channel analysis indicates that supermarkets/hypermarkets and pharmacies/drug stores constitute the primary sales channels, though online retail is rapidly gaining traction, transforming the market dynamics and offering new opportunities for growth. Leading players such as Henkel, Unilever, and Procter & Gamble dominate the market through strong brand recognition and extensive distribution networks. However, smaller, regional players are increasingly gaining market share through focused marketing strategies and competitive pricing. The forecast period (2025-2033) will likely see continued market consolidation and innovative product launches, shaping the future competitive landscape.

South America Oral Care Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America oral care industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report analyzes market dynamics, key players, and future growth prospects. The study encompasses detailed segmentation by product type (breath fresheners, dental floss, denture care, mouthwashes and rinses, toothbrushes and replacements, toothpaste) and distribution channel (supermarkets/hypermarkets, convenience/grocery stores, pharmacies and drug stores, online retail stores, other distribution channels). The report also highlights key industry developments and emerging trends shaping the future of this dynamic market. Projected market value exceeds xx Million by 2033.

South America Oral Care Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of the South American oral care market. The market is moderately concentrated, with key players like Henkel AG & Co KGaA, Unilever, Procter & Gamble, and Johnson & Johnson holding significant market share. However, smaller regional players like Industrias Condo and Intradevco Industrial SA also contribute significantly. The estimated combined market share of the top 5 players is approximately 60% in 2025. Innovation is driven by factors such as increasing consumer awareness of oral hygiene, the rise of electric toothbrushes, and the development of natural and organic oral care products. Regulatory frameworks vary across countries but generally focus on product safety and labeling. Significant M&A activity has been observed, with deal values exceeding xx Million in the past five years, primarily focused on expanding market reach and product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding ~60% market share (2025 est.).

- Innovation Drivers: Consumer awareness, electric toothbrush adoption, natural product demand.

- Regulatory Landscape: Varies across countries, focusing on safety and labeling.

- M&A Activity: Significant activity in recent years, with deal values exceeding xx Million.

South America Oral Care Industry Market Dynamics & Trends

The South American oral care market exhibits robust growth, driven by rising disposable incomes, increasing urbanization, and expanding access to healthcare. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the introduction of smart toothbrushes and connected oral care devices, are transforming the market. Consumer preferences are shifting towards natural and organic products, as well as convenient and value-added solutions. Intense competition among established players and emerging brands drives innovation and price competitiveness. Market penetration of electric toothbrushes is projected to reach xx% by 2033, reflecting the growing consumer preference for advanced oral care solutions.

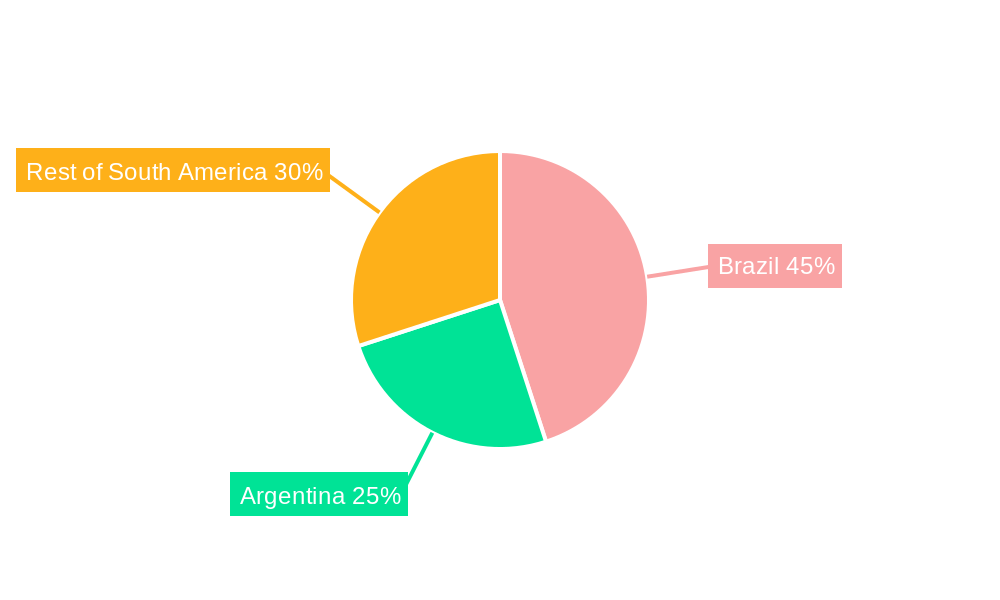

Dominant Regions & Segments in South America Oral Care Industry

Brazil is the dominant market in South America, accounting for the largest share of the oral care market due to its significant population size and increasing disposable incomes. Argentina and Colombia follow closely. Within product types, toothpaste holds the largest market share, followed by toothbrushes. Supermarkets/hypermarkets represent the most significant distribution channel, while online retail is exhibiting strong growth.

- Key Drivers for Brazil: Large population, rising middle class, improved healthcare infrastructure.

- Key Drivers for Argentina: Increasing disposable incomes, growing consumer awareness of oral health.

- Key Drivers for Colombia: Expanding urban population, improving access to modern retail channels.

- Dominant Product Type: Toothpaste

- Dominant Distribution Channel: Supermarkets/Hypermarkets

South America Oral Care Industry Product Innovations

Recent innovations include the rise of electric toothbrushes with advanced features (e.g., Etekcity's multipurpose sonic toothbrush), the development of natural and organic toothpaste formulations incorporating local ingredients (e.g., Bolivian coca-based toothpaste), and the increasing adoption of subscription models for toothbrush replacements. These innovations are driven by consumer demand for improved functionality, natural ingredients, and convenience.

Report Scope & Segmentation Analysis

This report segments the South American oral care market by product type (breath fresheners, dental floss, denture care, mouthwashes & rinses, toothbrushes & replacements, toothpaste) and distribution channel (supermarkets/hypermarkets, convenience/grocery stores, pharmacies & drug stores, online retail stores, other distribution channels). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail. The market size for each segment is projected to show significant growth over the forecast period. The online retail segment is expected to show the fastest growth.

Key Drivers of South America Oral Care Industry Growth

Key growth drivers include rising disposable incomes, increasing awareness of oral health, expanding middle class, and the growing adoption of advanced oral care products, such as electric toothbrushes. Government initiatives promoting oral health awareness also contribute to market growth. Moreover, the increasing penetration of modern retail channels makes oral care products more accessible to a wider consumer base.

Challenges in the South America Oral Care Industry Sector

Challenges include variations in regulatory frameworks across countries, fluctuations in currency exchange rates, the prevalence of counterfeit products, and economic volatility impacting consumer purchasing power. Supply chain disruptions and price sensitivity among consumers also pose significant challenges for companies operating in this market. High import tariffs in some countries add to the cost.

Emerging Opportunities in South America Oral Care Industry

Emerging opportunities lie in the expansion of e-commerce, the growth of the middle class, increased demand for premium and specialized oral care products, and the growing adoption of natural and organic formulations. Focus on preventive oral care and personalized solutions are also emerging trends that present significant opportunities for growth.

Leading Players in the South America Oral Care Industry Market

- Henkel AG & Co KGaA

- Unilever

- Dennis Group

- Industrias Condo

- Procter & Gamble

- Dentek Oral Care Inc

- Johnson & Johnson

- Etekcity

- Intradevco Industrial SA

- Sunstar Suisse SA

- GlaxoSmithKline PLC

Key Developments in South America Oral Care Industry

- Feb 2023: Etekcity launched a multipurpose sonic electric toothbrush.

- Jan 2022: Bolivia announced a coca-based toothpaste production plant.

- Mar 2021: Colgate-Palmolive and Philips partnered to promote electric toothbrushes in Latin America.

Future Outlook for South America Oral Care Industry Market

The South American oral care market is poised for continued growth, driven by increasing disposable incomes, improving oral health awareness, and the adoption of advanced oral care solutions. Strategic partnerships, product innovation, and expansion into emerging markets present significant opportunities for players in this dynamic industry. The market is projected to exceed xx Million by 2033.

South America Oral Care Industry Segmentation

-

1. Product Type

- 1.1. Breath Fresheners

- 1.2. Dental Floss

- 1.3. Denture Care

- 1.4. Mouthwashes and Rinses

- 1.5. Toothbrushes and Replacements

- 1.6. Toothpaste

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Pharmacies And Drug Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Oral Care Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Oral Care Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal For Natural and Organic Hair Care Products; Increased Consumer Spending on Hair Care Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increased Demand for New and Innovative Oral Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Oral Care Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Breath Fresheners

- 5.1.2. Dental Floss

- 5.1.3. Denture Care

- 5.1.4. Mouthwashes and Rinses

- 5.1.5. Toothbrushes and Replacements

- 5.1.6. Toothpaste

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Pharmacies And Drug Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Oral Care Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Breath Fresheners

- 6.1.2. Dental Floss

- 6.1.3. Denture Care

- 6.1.4. Mouthwashes and Rinses

- 6.1.5. Toothbrushes and Replacements

- 6.1.6. Toothpaste

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience/Grocery Stores

- 6.2.3. Pharmacies And Drug Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Oral Care Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Breath Fresheners

- 7.1.2. Dental Floss

- 7.1.3. Denture Care

- 7.1.4. Mouthwashes and Rinses

- 7.1.5. Toothbrushes and Replacements

- 7.1.6. Toothpaste

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience/Grocery Stores

- 7.2.3. Pharmacies And Drug Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Oral Care Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Breath Fresheners

- 8.1.2. Dental Floss

- 8.1.3. Denture Care

- 8.1.4. Mouthwashes and Rinses

- 8.1.5. Toothbrushes and Replacements

- 8.1.6. Toothpaste

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience/Grocery Stores

- 8.2.3. Pharmacies And Drug Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Brazil South America Oral Care Industry Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Oral Care Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Oral Care Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Henkel AG & Co KGaA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Unilever

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Dennis Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Industrias Condo

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Procter & Gamble

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Dentek Oral Care Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Johnson & Johnson

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Etekcity *List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Intradevco Industrial SA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sunstar Suisse SA

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 GlaxoSmithKline PLC

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: South America Oral Care Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Oral Care Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Oral Care Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Oral Care Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South America Oral Care Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South America Oral Care Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Oral Care Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Oral Care Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Oral Care Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Oral Care Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Oral Care Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Oral Care Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: South America Oral Care Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: South America Oral Care Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Oral Care Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Oral Care Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: South America Oral Care Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: South America Oral Care Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Oral Care Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Oral Care Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: South America Oral Care Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: South America Oral Care Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Oral Care Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Oral Care Industry?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the South America Oral Care Industry?

Key companies in the market include Henkel AG & Co KGaA, Unilever, Dennis Group, Industrias Condo, Procter & Gamble, Dentek Oral Care Inc, Johnson & Johnson, Etekcity *List Not Exhaustive, Intradevco Industrial SA, Sunstar Suisse SA, GlaxoSmithKline PLC.

3. What are the main segments of the South America Oral Care Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal For Natural and Organic Hair Care Products; Increased Consumer Spending on Hair Care Products.

6. What are the notable trends driving market growth?

Increased Demand for New and Innovative Oral Care Products.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

Feb 2023: Etekcity announced the launch of its cutting-edge, multipurpose sonic electric toothbrush. The company claims that it is a versatile, cost-effective product that features five different brushing modes, a high-performance design, and practical, user-friendly accessories consisting of a travel case, a brush cover, and eight brush heads. The product is made available on its website as well as online distribution channels such as Amazon, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Oral Care Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Oral Care Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Oral Care Industry?

To stay informed about further developments, trends, and reports in the South America Oral Care Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence