Key Insights

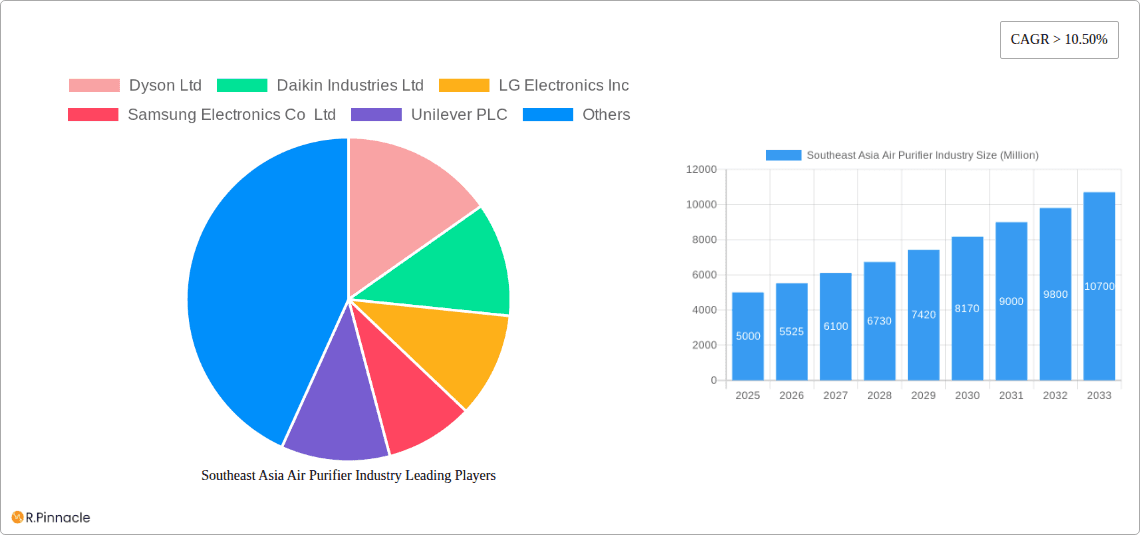

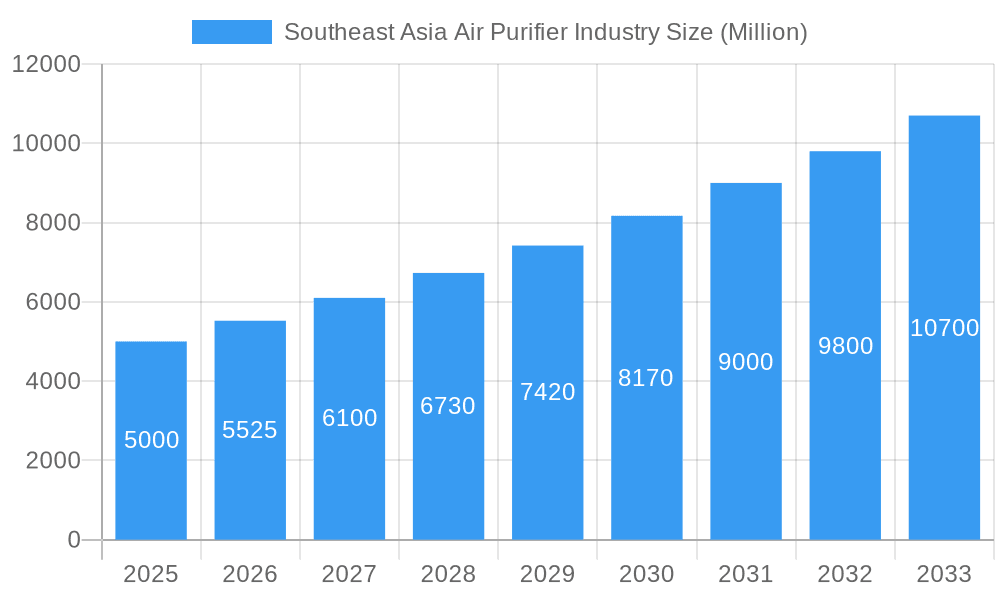

The Southeast Asia air purifier market is experiencing substantial growth, projected to achieve a Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033. This expansion is driven by increasing urbanization and industrialization, leading to heightened air quality concerns and a corresponding rise in demand for air purification solutions. Growing awareness of respiratory health issues and the increasing disposable incomes of a burgeoning middle class are further propelling market growth. Technological innovations, including energy-efficient HEPA filters and advanced filtration systems, are fostering product development and consumer adoption. The market is segmented by filtration technology (HEPA, electrostatic precipitators, ionizers, ozone generators), type (stand-alone, in-duct), and end-user (residential, commercial, industrial). While HEPA filters currently dominate, alternative technologies are gaining traction due to their cost-effectiveness and specific application advantages. The residential sector leads market share, followed by commercial and industrial segments. Leading global brands such as Dyson, Daikin, LG, Samsung, and Philips are actively competing, complemented by a growing landscape of local and regional players. The broader Asia-Pacific region, with significant contributions from China, India, and Japan, plays a crucial role in overall market expansion.

Southeast Asia Air Purifier Industry Market Size (In Billion)

Government initiatives focused on improving air quality and public awareness campaigns highlighting respiratory health are key drivers for the Southeast Asia air purifier market. While the initial cost of premium devices may present a barrier for some consumers, the availability of more affordable models and flexible financing options are mitigating this challenge. The market anticipates further segmentation with new entrants introducing specialized products and services, fostering competition and offering consumers a wider array of choices. The long-term outlook remains highly positive, underpinned by evolving consumer preferences, ongoing technological advancements, and escalating air quality standards throughout Southeast Asia.

Southeast Asia Air Purifier Industry Company Market Share

Southeast Asia Air Purifier Market Analysis: 2019-2033 Overview

This comprehensive report delivers an in-depth analysis of the Southeast Asia air purifier industry, providing critical insights for industry professionals, investors, and strategic stakeholders. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and the forecast period spanning 2025-2033. Market segmentation includes filtration technology (HEPA, ESPs, ionizers, ozone generators), type (stand-alone, in-duct), and end-user (residential, commercial, industrial). Expect detailed insights into market size (7.65 billion), CAGR, market share, and key industry developments.

Southeast Asia Air Purifier Industry Market Structure & Innovation Trends

This section provides a comprehensive analysis of the competitive landscape within the Southeast Asian air purifier market. It delves into market concentration, key innovation drivers shaping the industry, the influence of regulatory frameworks, and the impact of substitute products. Furthermore, it examines the evolving end-user demographics and significant mergers & acquisitions (M&A) activities. The report assesses the market presence of prominent players including Dyson Ltd, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Unilever PLC, Koninklijke Philips N V, Xiaomi Corp, Sharp Corporation, Amway (Malaysia) Holdings Berhad, WINIX Inc, Panasonic Corporation, and IQAir. While a precise, granular market share breakdown for each entity necessitates in-depth primary and secondary research, this analysis quantifies overall market concentration and offers estimates for M&A deal values within the industry for the study period (2019-2024), expressed in millions. The report also scrutinizes the effect of government regulations on air quality standards and their direct influence on market expansion. The competitive positioning of alternative solutions, such as air conditioners with integrated filtration capabilities, is also thoroughly considered. Finally, the dynamic demographic shifts across Southeast Asia and their consequential impact on the demand for air purifiers are meticulously analyzed.

Southeast Asia Air Purifier Industry Market Dynamics & Trends

This section offers an in-depth exploration of the pivotal factors propelling market growth, the impact of technological disruptions, shifting consumer preferences, and the evolving competitive dynamics prevalent in the Southeast Asian air purifier market. The report presents a detailed analysis of the Compound Annual Growth Rate (CAGR) projected for the forecast period (2025-2033) and quantifies market penetration rates across various market segments. Moreover, the report thoroughly examines the influence of escalating air pollution levels, heightened health awareness, and changing lifestyles on market demand. Emerging technologies, particularly smart air purifiers and the integration of the Internet of Things (IoT), are analyzed for their transformative impact on market trends and consumer behavior. The competitive landscape, encompassing sophisticated pricing strategies, distinctive product differentiation tactics, and impactful marketing initiatives, will be extensively investigated.

Dominant Regions & Segments in Southeast Asia Air Purifier Industry

This section identifies the leading regions, countries, and segments within the Southeast Asia air purifier market, based on factors such as market size, growth rate, and key drivers.

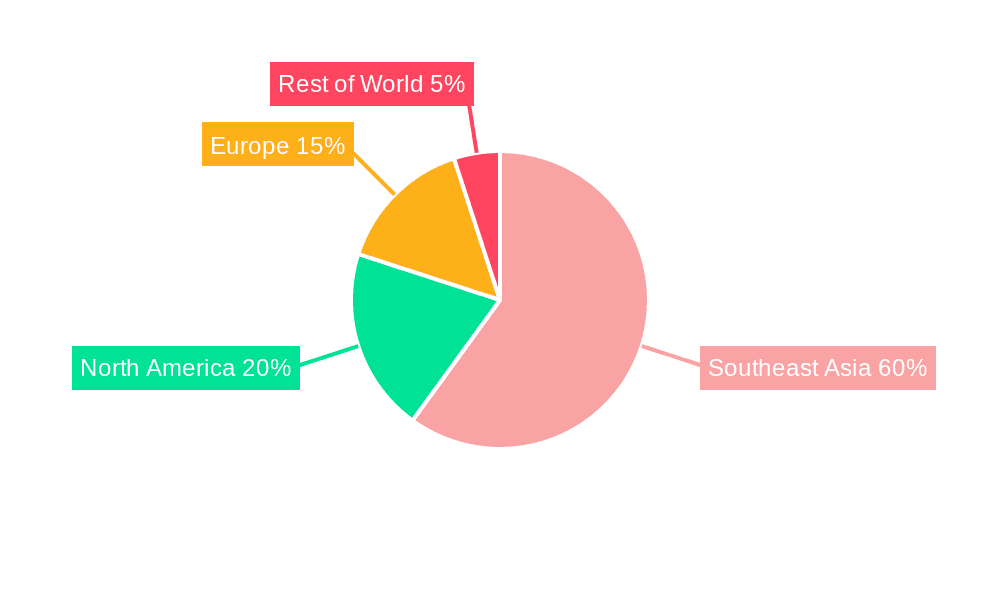

Leading Regions: The report will pinpoint the dominant regions based on various factors like population density, urbanization, industrial activity, and regulatory framework. Specific data supporting the identified dominant region will be presented in the full report.

Leading Countries: This section will analyze individual countries within Southeast Asia, highlighting the key factors contributing to their dominance, such as economic development, air quality concerns, and consumer purchasing power. Expectedly, countries with higher levels of air pollution and disposable income will see higher market penetration.

Dominant Segments: A detailed breakdown of the market segments—filtration technology (HEPA, other filtration technologies), type (stand-alone, in-duct), and end-user (residential, commercial, industrial)—will be provided. The analysis will pinpoint the fastest-growing segments and explain the underlying drivers, focusing on factors like technological advancements, consumer preferences, and cost-effectiveness. For example, the increasing preference for HEPA filters in residential settings will be explored. Similarly, the growth in the commercial sector will be linked to factors such as stringent air quality regulations and improved health consciousness within the workplace.

Key Drivers:

- Economic growth and rising disposable incomes.

- Increasing awareness of air pollution and its health impacts.

- Stringent government regulations on air quality.

- Development of advanced filtration technologies.

- Growing adoption of smart home technologies.

Southeast Asia Air Purifier Industry Product Innovations

This section provides a concise overview of recent product advancements, their practical applications, and the distinct competitive advantages they offer, with a strong focus on prevailing technological trends and their market viability. The report will highlight the integration of advanced smart features, significant improvements in filtration efficiency, and the introduction of novel designs aimed at enhancing product aesthetics and user-friendliness. The competitive edge derived from these innovations will be critically analyzed in the context of the broader market. For instance, the strategic introduction of compact and energy-efficient models tailored to specific consumer segments will be thoroughly discussed. Furthermore, the analysis will extend to new filtration technologies designed to effectively address a range of specific airborne pollutants.

Report Scope & Segmentation Analysis

This section details the market segmentation across filtration technology, type, and end-user. Each segment will have its own dedicated analysis, including growth projections, market sizes (in Millions), and competitive dynamics. The report will forecast the future growth of each segment and assess the competitive landscape within each. Examples include the growth of HEPA filtration relative to other technologies or the market share of stand-alone versus in-duct systems in the residential sector.

Key Drivers of Southeast Asia Air Purifier Industry Growth

Several key factors are driving the growth of the Southeast Asia air purifier industry. These include the increasing prevalence of air pollution in major urban centers, rising health consciousness among consumers, and growing awareness of the health risks associated with poor air quality. Technological advancements, such as the development of more efficient and effective filtration technologies, are also contributing to industry growth. Government initiatives promoting better air quality and supportive regulatory frameworks further encourage market expansion. Finally, rising disposable incomes and increased consumer spending power contribute to stronger demand for these products.

Challenges in the Southeast Asia Air Purifier Industry Sector

The Southeast Asia air purifier industry faces several challenges. These include the high initial cost of air purifiers, which can be a barrier to entry for lower-income consumers. Supply chain disruptions and fluctuating raw material prices also impact profitability. Furthermore, intense competition among established and emerging players leads to price wars and reduced profit margins for some companies. Finally, the diverse regulatory landscape across different Southeast Asian countries can make market entry and expansion complex. The report will quantify the impact of these challenges on market growth in Millions of dollars.

Emerging Opportunities in Southeast Asia Air Purifier Industry

The Southeast Asian air purifier market is ripe with significant growth opportunities. The burgeoning adoption of smart home technologies presents a compelling avenue for the seamless integration of air purifiers into comprehensive home automation ecosystems. Expanding market reach into rural areas, characterized by a growing middle-class population, offers substantial untapped potential. The development of pioneering filtration technologies specifically designed to target and neutralize particular pollutants provides a distinct opportunity for market differentiation. Lastly, fostering strategic collaborations between air purifier manufacturers and healthcare providers could pave the way for the introduction of innovative product offerings and a significant enhancement of market penetration.

Leading Players in the Southeast Asia Air Purifier Industry Market

- Dyson Ltd

- Daikin Industries Ltd

- LG Electronics Inc

- Samsung Electronics Co Ltd

- Unilever PLC

- Koninklijke Philips N V

- Xiaomi Corp

- Sharp Corporation

- Amway (Malaysia) Holdings Berhad

- WINIX Inc

- Panasonic Corporation

- IQAir

Key Developments in Southeast Asia Air Purifier Industry

- December 2022: Philips Malaysia launched the Air Performer 2-in-1 purifier fan, combining air circulation and filtration. This product launch signifies a trend towards multi-functional appliances catering to space-saving needs and consumer preferences for combined functionality.

- December 2022: PT LG Electronics Indonesia launched a series of indoor air treatment products, expanding its presence in the Indonesian market. This signifies strategic market expansion and increased competition in the Indonesian air purifier market.

Future Outlook for Southeast Asia Air Purifier Industry Market

The Southeast Asia air purifier market is poised for substantial growth over the forecast period. Rising urbanization, increasing air pollution levels, growing health consciousness, and the launch of innovative products will drive market expansion. The integration of smart technologies and the development of tailored solutions for specific air quality challenges will create new opportunities. Further government regulations to address air quality will fuel market demand. The report predicts significant growth in market size (in Millions) over the next decade.

Southeast Asia Air Purifier Industry Segmentation

-

1. Filtration Technology

- 1.1. High-efficiency Particulate Air (HEPA)

- 1.2. Other Fi

-

2. Type

- 2.1. Stand-alone

- 2.2. In-duct

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

-

4. Geography

- 4.1. Indonesia

- 4.2. Malaysia

- 4.3. Thailand

- 4.4. Vietnam

- 4.5. Philippines

- 4.6. Singapore

- 4.7. Rest of Southeast Asia

Southeast Asia Air Purifier Industry Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Thailand

- 4. Vietnam

- 5. Philippines

- 6. Singapore

- 7. Rest of Southeast Asia

Southeast Asia Air Purifier Industry Regional Market Share

Geographic Coverage of Southeast Asia Air Purifier Industry

Southeast Asia Air Purifier Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. High-Efficiency Particulate Air (HEPA) Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 5.1.1. High-efficiency Particulate Air (HEPA)

- 5.1.2. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stand-alone

- 5.2.2. In-duct

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Indonesia

- 5.4.2. Malaysia

- 5.4.3. Thailand

- 5.4.4. Vietnam

- 5.4.5. Philippines

- 5.4.6. Singapore

- 5.4.7. Rest of Southeast Asia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.5.2. Malaysia

- 5.5.3. Thailand

- 5.5.4. Vietnam

- 5.5.5. Philippines

- 5.5.6. Singapore

- 5.5.7. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6. Indonesia Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6.1.1. High-efficiency Particulate Air (HEPA)

- 6.1.2. Other Fi

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Stand-alone

- 6.2.2. In-duct

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Industrial

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Indonesia

- 6.4.2. Malaysia

- 6.4.3. Thailand

- 6.4.4. Vietnam

- 6.4.5. Philippines

- 6.4.6. Singapore

- 6.4.7. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 7. Malaysia Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 7.1.1. High-efficiency Particulate Air (HEPA)

- 7.1.2. Other Fi

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Stand-alone

- 7.2.2. In-duct

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Industrial

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Indonesia

- 7.4.2. Malaysia

- 7.4.3. Thailand

- 7.4.4. Vietnam

- 7.4.5. Philippines

- 7.4.6. Singapore

- 7.4.7. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 8. Thailand Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 8.1.1. High-efficiency Particulate Air (HEPA)

- 8.1.2. Other Fi

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Stand-alone

- 8.2.2. In-duct

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.3.3. Industrial

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Indonesia

- 8.4.2. Malaysia

- 8.4.3. Thailand

- 8.4.4. Vietnam

- 8.4.5. Philippines

- 8.4.6. Singapore

- 8.4.7. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 9. Vietnam Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 9.1.1. High-efficiency Particulate Air (HEPA)

- 9.1.2. Other Fi

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Stand-alone

- 9.2.2. In-duct

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.3.3. Industrial

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Indonesia

- 9.4.2. Malaysia

- 9.4.3. Thailand

- 9.4.4. Vietnam

- 9.4.5. Philippines

- 9.4.6. Singapore

- 9.4.7. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 10. Philippines Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 10.1.1. High-efficiency Particulate Air (HEPA)

- 10.1.2. Other Fi

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Stand-alone

- 10.2.2. In-duct

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.3.3. Industrial

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Indonesia

- 10.4.2. Malaysia

- 10.4.3. Thailand

- 10.4.4. Vietnam

- 10.4.5. Philippines

- 10.4.6. Singapore

- 10.4.7. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 11. Singapore Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 11.1.1. High-efficiency Particulate Air (HEPA)

- 11.1.2. Other Fi

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Stand-alone

- 11.2.2. In-duct

- 11.3. Market Analysis, Insights and Forecast - by End-User

- 11.3.1. Residential

- 11.3.2. Commercial

- 11.3.3. Industrial

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Indonesia

- 11.4.2. Malaysia

- 11.4.3. Thailand

- 11.4.4. Vietnam

- 11.4.5. Philippines

- 11.4.6. Singapore

- 11.4.7. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 12. Rest of Southeast Asia Southeast Asia Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 12.1.1. High-efficiency Particulate Air (HEPA)

- 12.1.2. Other Fi

- 12.2. Market Analysis, Insights and Forecast - by Type

- 12.2.1. Stand-alone

- 12.2.2. In-duct

- 12.3. Market Analysis, Insights and Forecast - by End-User

- 12.3.1. Residential

- 12.3.2. Commercial

- 12.3.3. Industrial

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. Indonesia

- 12.4.2. Malaysia

- 12.4.3. Thailand

- 12.4.4. Vietnam

- 12.4.5. Philippines

- 12.4.6. Singapore

- 12.4.7. Rest of Southeast Asia

- 12.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dyson Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Daikin Industries Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 LG Electronics Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Samsung Electronics Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Unilever PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Koninklijke Philips N V

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Xiaomi Corp

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sharp Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Amway (Malaysia) Holdings Berhad*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 WINIX Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Panasonic Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 IQAir

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Dyson Ltd

List of Figures

- Figure 1: Southeast Asia Air Purifier Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Air Purifier Industry Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 2: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 3: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 12: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 13: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 16: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 17: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 22: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 23: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 25: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 27: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 32: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 33: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 35: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 37: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 42: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 43: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 44: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 45: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 46: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 47: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 52: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 53: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 54: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 55: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 56: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 57: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 58: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 59: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 62: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 63: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 64: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 65: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 66: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 67: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 68: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 69: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Filtration Technology 2020 & 2033

- Table 72: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 73: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 74: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 75: Southeast Asia Air Purifier Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 76: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 77: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 78: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 79: Southeast Asia Air Purifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 80: Southeast Asia Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Air Purifier Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Southeast Asia Air Purifier Industry?

Key companies in the market include Dyson Ltd, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Unilever PLC, Koninklijke Philips N V, Xiaomi Corp, Sharp Corporation, Amway (Malaysia) Holdings Berhad*List Not Exhaustive, WINIX Inc, Panasonic Corporation, IQAir.

3. What are the main segments of the Southeast Asia Air Purifier Industry?

The market segments include Filtration Technology, Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.65 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality.

6. What are the notable trends driving market growth?

High-Efficiency Particulate Air (HEPA) Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

December 2022: Philips Malaysia brought in and launched the Air Performer 2-in-1 purifier fan that does the job of circulating and filtering air simultaneously.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Air Purifier Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Air Purifier Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Air Purifier Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Air Purifier Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence