Key Insights

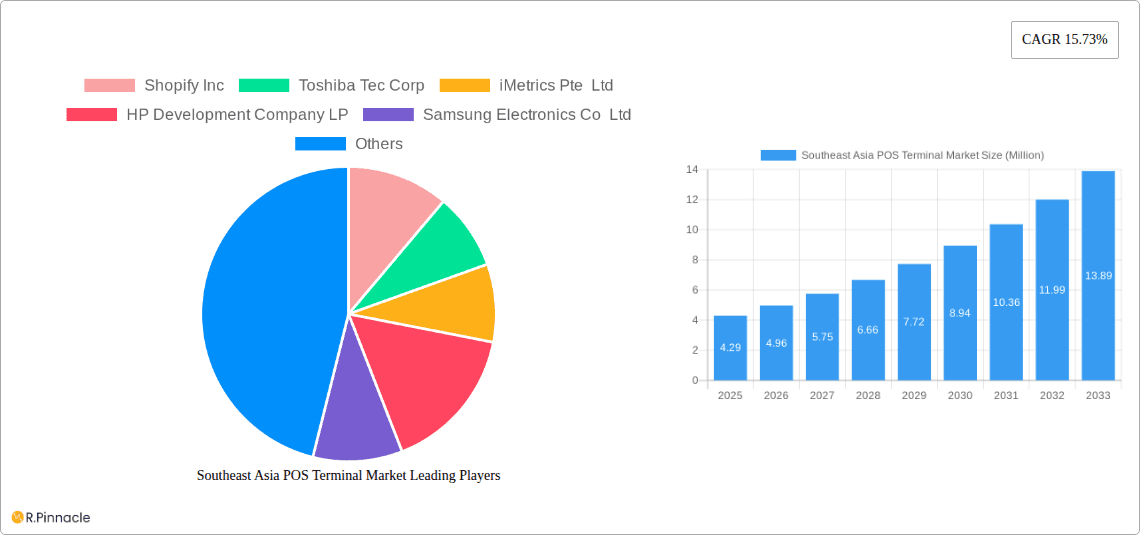

The Southeast Asia Point-of-Sale (POS) Terminal Market is poised for remarkable expansion, projected to reach an estimated USD 4.29 Million by 2025, driven by a robust CAGR of 15.73%. This significant growth is fueled by increasing digitalization across various sectors, particularly retail and hospitality, as businesses increasingly adopt modern POS solutions to streamline operations, enhance customer experience, and manage inventory more effectively. The burgeoning e-commerce landscape further stimulates demand for integrated POS systems that can handle both online and offline transactions seamlessly. Key drivers include government initiatives promoting digital payments and business automation, coupled with the growing adoption of cloud-based POS solutions offering scalability and cost-efficiency. The rising disposable income and a growing middle class in Southeast Asia are also contributing to increased consumer spending, thereby bolstering the demand for advanced retail and service POS terminals.

Southeast Asia POS Terminal Market Market Size (In Million)

The market segmentation highlights a dynamic landscape. The "Hardware" segment is expected to see sustained demand due to the need for reliable and secure transaction devices. Simultaneously, the "Software" and "Services" segments are experiencing accelerated growth as businesses prioritize advanced analytics, inventory management, and customer relationship management features integrated into their POS systems. Mobile/Portable POS terminals are rapidly gaining traction, especially among small and medium-sized enterprises (SMEs) and businesses operating in less traditional retail environments, offering flexibility and mobility. The "Hospitality" and "Retail" sectors are leading the adoption of these advanced solutions, with "Healthcare" also emerging as a significant end-user industry due to the need for efficient patient billing and record-keeping. The competitive landscape features prominent global players alongside agile regional companies, all vying for market share through innovation and tailored solutions for the diverse Southeast Asian market.

Southeast Asia POS Terminal Market Company Market Share

Southeast Asia POS Terminal Market Report: Unlocking Growth & Innovation (2019-2033)

This comprehensive report offers an in-depth analysis of the dynamic Southeast Asia Point-of-Sale (POS) terminal market. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a robust forecast period extending to 2033, this study provides actionable insights for industry stakeholders seeking to capitalize on market opportunities and navigate challenges. With a projected CAGR of XX%, the Southeast Asia POS terminal market is poised for significant expansion driven by digital transformation and increasing demand for efficient payment solutions across diverse industries. This report delves into market structure, dynamics, regional dominance, product innovations, segmentation, key drivers, challenges, emerging opportunities, leading players, recent developments, and the future outlook, making it an indispensable resource for businesses operating within or looking to enter this lucrative region.

Southeast Asia POS Terminal Market Market Structure & Innovation Trends

The Southeast Asia POS terminal market exhibits a moderate to high degree of fragmentation, with a mix of global technology giants and agile local players vying for market share. Innovation is a key differentiator, driven by the increasing adoption of cloud-based solutions, mobile POS capabilities, and enhanced security features. Regulatory frameworks, while evolving, are generally supportive of digital payment infrastructure, fostering growth. Product substitutes, such as traditional cash registers and manual transaction methods, are rapidly diminishing in relevance as businesses prioritize efficiency and customer experience. End-user demographics are increasingly tech-savvy, demanding seamless and integrated payment experiences. Mergers and acquisitions (M&A) are expected to play a crucial role in market consolidation, allowing larger players to expand their geographical reach and product portfolios. For instance, recent M&A activities in the broader APAC region have seen deal values ranging from tens of millions to hundreds of millions of dollars, indicating a healthy appetite for strategic investments. The market share of leading players is still evolving, with no single entity dominating across all sub-segments.

- Market Concentration: Moderate to High Fragmentation.

- Innovation Drivers: Cloud computing, mobile payments, data analytics, AI integration, enhanced security.

- Regulatory Frameworks: Evolving regulations around data privacy, digital payments, and cybersecurity.

- Product Substitutes: Declining relevance of traditional cash registers and manual systems.

- End-User Demographics: Growing tech adoption, demand for convenience and personalized experiences.

- M&A Activities: Expected to increase for market consolidation and expansion.

Southeast Asia POS Terminal Market Market Dynamics & Trends

The Southeast Asia POS terminal market is experiencing robust growth, fueled by a confluence of powerful market dynamics and evolving trends. The accelerating digital transformation across the region stands as a primary growth driver. As economies in Southeast Asia continue to develop, businesses, particularly small and medium-sized enterprises (SMEs), are increasingly recognizing the imperative to adopt modern POS solutions to streamline operations, enhance customer service, and gain a competitive edge. The surge in e-commerce and the subsequent need for omnichannel retail strategies further propel the demand for integrated POS systems that can manage both online and offline transactions seamlessly.

Technological disruptions are at the forefront of this market's evolution. The proliferation of mobile devices and the increasing affordability of smartphones and tablets have significantly boosted the adoption of mobile POS (mPOS) systems. These solutions offer unparalleled flexibility, allowing businesses to accept payments anywhere, anytime, which is particularly beneficial for vendors in bustling markets, food trucks, and service-based industries. Furthermore, the integration of advanced software functionalities, such as inventory management, customer relationship management (CRM), and sales analytics, transforms POS terminals from mere payment devices into comprehensive business management tools. Cloud-based POS solutions are also gaining traction due to their scalability, accessibility, and cost-effectiveness, eliminating the need for substantial upfront hardware investments and enabling businesses to manage their operations remotely.

Consumer preferences are shifting dramatically, with a growing demand for faster, more convenient, and secure payment methods. Contactless payments, QR code payments, and in-app purchasing are becoming the norm, and POS terminals are adapting to accommodate these evolving preferences. Consumers expect a frictionless checkout experience, and businesses are investing in POS systems that can deliver this, thereby enhancing customer loyalty and driving repeat business. The competitive dynamics within the Southeast Asia POS terminal market are intense. Established global players are competing with innovative local startups, leading to a vibrant ecosystem characterized by continuous product development and aggressive pricing strategies. This competition fosters innovation and ensures that businesses have access to a wide array of cost-effective and feature-rich POS solutions. The penetration of POS systems is still relatively low in some segments and countries within Southeast Asia, indicating substantial untapped market potential. The market penetration is estimated to be around XX% in 2024, with significant room for growth as more businesses embrace digital payment solutions. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033, driven by these multifaceted dynamics.

Dominant Regions & Segments in Southeast Asia POS Terminal Market

The Southeast Asia POS terminal market is characterized by significant regional variations and segment-specific dominance, offering distinct opportunities for stakeholders.

Leading Region & Country Dominance:

While specific data for individual countries can vary, Singapore consistently emerges as a leading market due to its advanced digital infrastructure, strong economy, and proactive government initiatives promoting digital payments and cashless societies. Its sophisticated business environment and high adoption rate of new technologies make it a benchmark for POS terminal deployment. Thailand and Malaysia are also experiencing rapid growth, driven by a burgeoning tourism sector and a large base of SMEs actively adopting digital solutions. The retail and hospitality sectors in these countries are particularly driving the demand for advanced POS systems.

Component Dominance:

- Hardware: The Hardware segment holds a significant market share, driven by the foundational need for physical POS devices. This includes robust payment terminals, barcode scanners, receipt printers, and cash drawers. The increasing demand for reliable and secure hardware capable of supporting multiple payment methods and advanced software functionalities is a key driver. The projected market size for hardware in 2025 is estimated at over $XXX Million.

- Software: The Software segment is experiencing the fastest growth. The increasing complexity of business operations and the demand for integrated solutions like inventory management, CRM, and analytics are fueling this expansion. Cloud-based POS software offers scalability and accessibility, making it a preferred choice for many businesses. The projected market size for software in 2025 is estimated at over $XXX Million.

- Services: The Services segment, encompassing installation, maintenance, and support, is crucial for ensuring the seamless operation of POS systems. As POS solutions become more sophisticated, the demand for skilled technical support and comprehensive service packages is on the rise. The projected market size for services in 2025 is estimated at over $XXX Million.

Type Dominance:

- Fixed Point-of-Sale Terminals: Fixed Point-of-Sale Terminals continue to be dominant, particularly in established retail environments, restaurants, and larger enterprises where dedicated checkout counters are standard. Their robust functionality, enhanced security features, and reliability make them a preferred choice for high-volume transaction environments. The projected market size for fixed POS terminals in 2025 is estimated at over $XXX Million.

- Mobile/Portable Point-of-Sale Terminals: Mobile/Portable Point-of-Sale Terminals are witnessing rapid adoption and are expected to gain significant market share. Their flexibility for use in diverse settings, from pop-up shops and outdoor events to table-side ordering in restaurants, is a major advantage. The increasing affordability and improved capabilities of mPOS devices are further accelerating their growth. The projected market size for mobile POS terminals in 2025 is estimated at over $XXX Million.

End-user Industry Dominance:

- Retail: The Retail sector is the largest and most significant end-user industry for POS terminals. The sheer volume of transactions, the need for efficient inventory management, and the drive for enhanced customer experiences make POS solutions indispensable. The growth of omnichannel retail further solidifies the importance of integrated POS systems. The projected market size for retail in 2025 is estimated at over $XXX Million.

- Hospitality: The Hospitality sector, including restaurants, hotels, and cafes, is another major consumer of POS terminals. The demand for table-side ordering, integrated kitchen display systems (KDS), and seamless payment processing is driving significant adoption. The projected market size for hospitality in 2025 is estimated at over $XXX Million.

- Healthcare: The Healthcare industry is increasingly adopting POS terminals for patient check-ins, billing, and pharmacy transactions. The need for secure and efficient management of patient data and payments is a key driver. The projected market size for healthcare in 2025 is estimated at over $XXX Million.

- Entertainment: The Entertainment sector, encompassing cinemas, event venues, and amusement parks, utilizes POS terminals for ticketing, concessions, and merchandise sales. The demand for fast and efficient transaction processing during peak times is crucial. The projected market size for entertainment in 2025 is estimated at over $XXX Million.

Southeast Asia POS Terminal Market Product Innovations

Product innovations in the Southeast Asia POS terminal market are largely focused on enhancing user experience, security, and integration capabilities. The trend towards cloud-native solutions enables continuous updates and feature additions, offering businesses always-on access to the latest functionalities. Advanced analytics are being embedded into POS software, providing actionable insights into sales trends, customer behavior, and inventory levels. Innovations in contactless payment technologies, including NFC and QR code integrations, are becoming standard, catering to the evolving consumer preferences for speed and convenience. Furthermore, the development of robust security protocols and compliance with industry standards like PCI DSS are paramount, assuring businesses and consumers of secure transactions. The competitive advantage for vendors lies in offering tailored solutions that address the specific needs of diverse industries, from specialized features for restaurants to comprehensive inventory management for retail.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the Southeast Asia POS terminal market, providing granular insights into various facets of the industry. The market is analyzed across key segments to understand regional nuances and specific growth trajectories.

Component Segmentation: The market is segmented into Hardware, Software, and Services. The Hardware segment encompasses the physical devices, while Software includes the operating systems and applications driving POS functionality. Services cover installation, maintenance, and support, crucial for operational efficiency. Projections indicate strong growth across all components, with Software expected to exhibit the highest CAGR.

Type Segmentation: This segmentation divides the market into Fixed Point-of-Sale Terminals and Mobile/Portable Point-of-Sale Terminals. Fixed POS terminals are typically found in traditional retail and hospitality settings, while mobile POS offers flexibility for on-the-go transactions. The mobile segment is anticipated to grow at a faster pace due to increasing demand for agility.

End-user Industry Segmentation: The report details the market's penetration across Entertainment, Hospitality, Healthcare, Retail, and Other End-user Industries. The Retail sector currently dominates due to high transaction volumes and the widespread adoption of digital payment systems. However, significant growth is also projected for Hospitality and Healthcare as they increasingly embrace technological advancements to improve operational efficiency and customer service.

Key Drivers of Southeast Asia POS Terminal Market Growth

The growth of the Southeast Asia POS terminal market is propelled by several key factors:

- Digital Transformation Initiatives: Governments and businesses across Southeast Asia are actively promoting digitalization, leading to increased adoption of modern payment solutions.

- Rising E-commerce and Omnichannel Retail: The boom in online shopping necessitates integrated POS systems that can manage both online and offline sales channels, enhancing customer experience and inventory accuracy.

- Growing Demand for Contactless and Mobile Payments: Consumers prefer faster, more convenient, and secure payment methods, driving the adoption of NFC, QR codes, and mobile POS solutions.

- SME Growth and Digitalization: Small and medium-sized enterprises are increasingly recognizing the benefits of POS systems for efficiency, data management, and customer engagement, leading to higher adoption rates.

- Technological Advancements: Continuous innovation in hardware and software, including cloud-based solutions, AI integration, and enhanced security features, makes POS systems more accessible and attractive.

Challenges in the Southeast Asia POS Terminal Market Sector

Despite its robust growth, the Southeast Asia POS terminal market faces several challenges:

- Varying Digital Infrastructure: Uneven internet connectivity and digital literacy across some parts of the region can hinder the adoption of advanced cloud-based POS solutions.

- Data Security and Privacy Concerns: Ensuring robust data security and compliance with evolving data protection regulations is a significant concern for businesses, requiring ongoing investment in security measures.

- High Initial Investment Costs for Some Solutions: While mPOS and cloud solutions are becoming more affordable, some advanced enterprise-level POS systems can still represent a substantial upfront investment for smaller businesses.

- Intense Competition and Price Sensitivity: The crowded market can lead to price wars, potentially impacting profit margins for vendors, especially for standard POS hardware.

- Talent Gap for Technical Support: A shortage of skilled IT professionals capable of installing, maintaining, and supporting sophisticated POS systems can pose a challenge for some businesses.

Emerging Opportunities in Southeast Asia POS Terminal Market

The Southeast Asia POS terminal market presents numerous emerging opportunities:

- Growth in Underserved Markets: Expanding into emerging economies and rural areas with tailored, cost-effective POS solutions can unlock significant new customer bases.

- Integration with IoT and AI: The convergence of POS systems with the Internet of Things (IoT) and Artificial Intelligence (AI) opens avenues for advanced automation, predictive analytics, and hyper-personalized customer experiences.

- Subscription-Based POS Models: Offering Software-as-a-Service (SaaS) POS solutions on a subscription basis can lower the barrier to entry for SMEs and provide recurring revenue streams for vendors.

- Specialized Industry Solutions: Developing niche POS solutions tailored for specific industries like healthcare, education, or specialized retail segments can create unique market advantages.

- Expansion of mPOS and Contactless Payment Ecosystems: Further enhancing the functionality and security of mobile POS devices and expanding the acceptance network for various contactless payment methods presents continuous growth potential.

Leading Players in the Southeast Asia POS Terminal Market Market

- Shopify Inc

- Toshiba Tec Corp

- iMetrics Pte Ltd

- HP Development Company LP

- Samsung Electronics Co Ltd

- NCR Corporation

- Qashier Pte Ltd

- Bindo Labs Inc

- AZ Digital Pte Ltd

- Xilnex

- StoreHub Sdn Bh

- Auto Count Sdn Bhd

Key Developments in Southeast Asia POS Terminal Market Industry

- May 2023: Revel Systems, the premier cloud point of sale (POS) and comprehensive business management platform, announced a partnership with IPORT to offer its best-in-class products to restaurants and retailers. IPORT's stands and enclosures for Apple iPads streamline networking, charging, tablet protection, and presentation.

- February 2023: NPN and Oddle's Partnership is Revolutionizing Restaurant Payment. Together, they are simplifying the point-of-purchase experience for restaurants and empowering them to grow their businesses. With their shared focus on providing cutting-edge hardware and software solutions, NPN and Oddle are transforming how restaurants process payments. By leveraging SUNMI Android payment hardware and stripe payment processing, they deliver a seamless and secure payment experience for restaurants and their customers.

Future Outlook for Southeast Asia POS Terminal Market Market

The future outlook for the Southeast Asia POS terminal market is exceptionally bright, driven by sustained digital adoption and economic growth across the region. We anticipate a continued surge in the demand for cloud-based and mobile POS solutions, offering greater flexibility, scalability, and cost-effectiveness for businesses of all sizes. The integration of advanced technologies like AI for personalized customer engagement and predictive analytics will become increasingly prevalent, transforming POS terminals into intelligent business hubs. Furthermore, the growing emphasis on omnichannel strategies will necessitate seamless integration of online and offline transaction systems, further solidifying the role of robust POS infrastructure. Strategic partnerships and potential M&A activities are expected to shape the market landscape, fostering innovation and expanding market reach. As consumer preferences continue to lean towards convenient and secure digital payments, the Southeast Asia POS terminal market is poised for substantial and sustained expansion.

Southeast Asia POS Terminal Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software and Services

-

2. Type

- 2.1. Fixed Point-of-Sale Terminals

- 2.2. Mobile/Portable Point-of-Sale Terminals

-

3. End-user Industries

- 3.1. Entertainment

- 3.2. Hospitality

- 3.3. Healthcare

- 3.4. Retail

- 3.5. Other End-user Industries

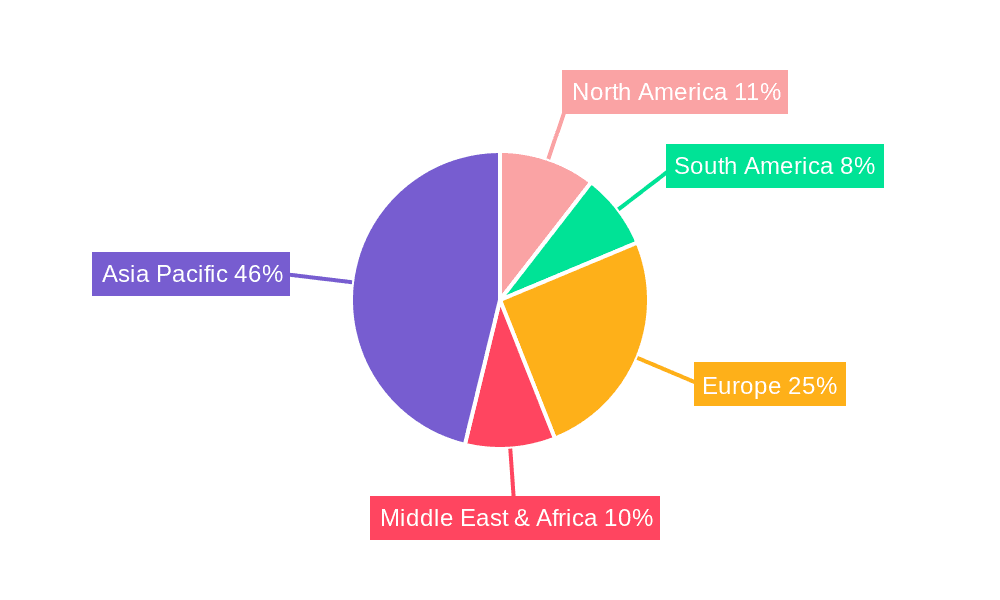

Southeast Asia POS Terminal Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Southeast Asia POS Terminal Market Regional Market Share

Geographic Coverage of Southeast Asia POS Terminal Market

Southeast Asia POS Terminal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investments in POS is Expected to Boost the Market Growth; Increasing Digitalization in the Payment Industry

- 3.3. Market Restrains

- 3.3.1. Security Concerns Related to Cyber Attacks and Data Breaches

- 3.4. Market Trends

- 3.4.1. The Retail Segment is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Southeast Asia POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software and Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fixed Point-of-Sale Terminals

- 5.2.2. Mobile/Portable Point-of-Sale Terminals

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Entertainment

- 5.3.2. Hospitality

- 5.3.3. Healthcare

- 5.3.4. Retail

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Southeast Asia POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software and Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fixed Point-of-Sale Terminals

- 6.2.2. Mobile/Portable Point-of-Sale Terminals

- 6.3. Market Analysis, Insights and Forecast - by End-user Industries

- 6.3.1. Entertainment

- 6.3.2. Hospitality

- 6.3.3. Healthcare

- 6.3.4. Retail

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. South America Southeast Asia POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software and Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fixed Point-of-Sale Terminals

- 7.2.2. Mobile/Portable Point-of-Sale Terminals

- 7.3. Market Analysis, Insights and Forecast - by End-user Industries

- 7.3.1. Entertainment

- 7.3.2. Hospitality

- 7.3.3. Healthcare

- 7.3.4. Retail

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Europe Southeast Asia POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software and Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fixed Point-of-Sale Terminals

- 8.2.2. Mobile/Portable Point-of-Sale Terminals

- 8.3. Market Analysis, Insights and Forecast - by End-user Industries

- 8.3.1. Entertainment

- 8.3.2. Hospitality

- 8.3.3. Healthcare

- 8.3.4. Retail

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East & Africa Southeast Asia POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software and Services

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fixed Point-of-Sale Terminals

- 9.2.2. Mobile/Portable Point-of-Sale Terminals

- 9.3. Market Analysis, Insights and Forecast - by End-user Industries

- 9.3.1. Entertainment

- 9.3.2. Hospitality

- 9.3.3. Healthcare

- 9.3.4. Retail

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Asia Pacific Southeast Asia POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software and Services

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fixed Point-of-Sale Terminals

- 10.2.2. Mobile/Portable Point-of-Sale Terminals

- 10.3. Market Analysis, Insights and Forecast - by End-user Industries

- 10.3.1. Entertainment

- 10.3.2. Hospitality

- 10.3.3. Healthcare

- 10.3.4. Retail

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shopify Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Tec Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 iMetrics Pte Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HP Development Company LP

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Electronics Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NCR Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qashier Pte Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bindo Labs Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AZ Digital Pte Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Xilnex

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 StoreHub Sdn Bh

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Auto Count Sdn Bhd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Shopify Inc

List of Figures

- Figure 1: Global Southeast Asia POS Terminal Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Southeast Asia POS Terminal Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Southeast Asia POS Terminal Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Southeast Asia POS Terminal Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Southeast Asia POS Terminal Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Southeast Asia POS Terminal Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 7: North America Southeast Asia POS Terminal Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 8: North America Southeast Asia POS Terminal Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Southeast Asia POS Terminal Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Southeast Asia POS Terminal Market Revenue (Million), by Component 2025 & 2033

- Figure 11: South America Southeast Asia POS Terminal Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: South America Southeast Asia POS Terminal Market Revenue (Million), by Type 2025 & 2033

- Figure 13: South America Southeast Asia POS Terminal Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America Southeast Asia POS Terminal Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 15: South America Southeast Asia POS Terminal Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 16: South America Southeast Asia POS Terminal Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Southeast Asia POS Terminal Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Southeast Asia POS Terminal Market Revenue (Million), by Component 2025 & 2033

- Figure 19: Europe Southeast Asia POS Terminal Market Revenue Share (%), by Component 2025 & 2033

- Figure 20: Europe Southeast Asia POS Terminal Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe Southeast Asia POS Terminal Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Southeast Asia POS Terminal Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 23: Europe Southeast Asia POS Terminal Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 24: Europe Southeast Asia POS Terminal Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Southeast Asia POS Terminal Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Southeast Asia POS Terminal Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Middle East & Africa Southeast Asia POS Terminal Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East & Africa Southeast Asia POS Terminal Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East & Africa Southeast Asia POS Terminal Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East & Africa Southeast Asia POS Terminal Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 31: Middle East & Africa Southeast Asia POS Terminal Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 32: Middle East & Africa Southeast Asia POS Terminal Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Southeast Asia POS Terminal Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Southeast Asia POS Terminal Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Asia Pacific Southeast Asia POS Terminal Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Asia Pacific Southeast Asia POS Terminal Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Asia Pacific Southeast Asia POS Terminal Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Southeast Asia POS Terminal Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 39: Asia Pacific Southeast Asia POS Terminal Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 40: Asia Pacific Southeast Asia POS Terminal Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Southeast Asia POS Terminal Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 4: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 8: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Component 2020 & 2033

- Table 13: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 15: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Component 2020 & 2033

- Table 20: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 22: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Component 2020 & 2033

- Table 33: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 35: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Component 2020 & 2033

- Table 43: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 45: Global Southeast Asia POS Terminal Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Southeast Asia POS Terminal Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia POS Terminal Market?

The projected CAGR is approximately 15.73%.

2. Which companies are prominent players in the Southeast Asia POS Terminal Market?

Key companies in the market include Shopify Inc, Toshiba Tec Corp, iMetrics Pte Ltd, HP Development Company LP, Samsung Electronics Co Ltd, NCR Corporation, Qashier Pte Ltd, Bindo Labs Inc, AZ Digital Pte Ltd, Xilnex, StoreHub Sdn Bh, Auto Count Sdn Bhd.

3. What are the main segments of the Southeast Asia POS Terminal Market?

The market segments include Component, Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investments in POS is Expected to Boost the Market Growth; Increasing Digitalization in the Payment Industry.

6. What are the notable trends driving market growth?

The Retail Segment is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Security Concerns Related to Cyber Attacks and Data Breaches.

8. Can you provide examples of recent developments in the market?

May 2023: Revel Systems, the premier cloud point of sale (POS) and comprehensive business management platform is excited to announce a partnership with IPORT to offer its best-in-class products to restaurants and retailers. IPORT's stands and enclosures for Apple iPads streamline networking, charging, tablet protection, and presentation

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia POS Terminal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia POS Terminal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia POS Terminal Market?

To stay informed about further developments, trends, and reports in the Southeast Asia POS Terminal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence