Key Insights

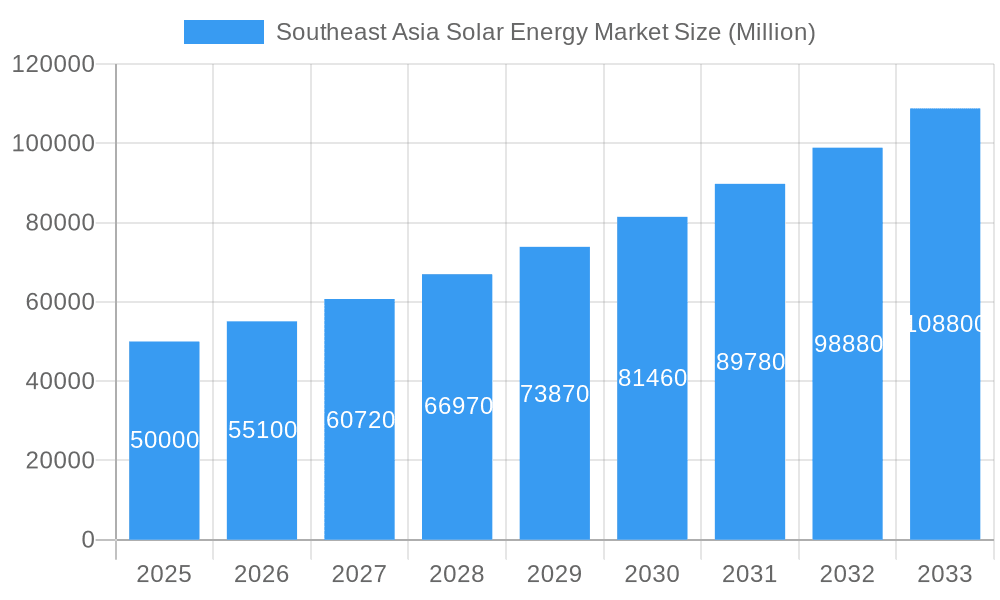

Southeast Asia's solar energy market is poised for significant expansion, propelled by escalating energy demands, favorable government initiatives promoting renewable energy, and the declining costs of solar photovoltaic (PV) systems. Abundant solar irradiation and high energy consumption rates across the region create an optimal environment for substantial solar capacity growth. While specific market size data for Southeast Asia was not provided, global Compound Annual Growth Rate (CAGR) of 30.1%, coupled with the region's strong growth potential, suggests a robust expansion from a market size of 3.3 billion in the base year 2024 over the forecast period. Key drivers include rising electricity prices, heightened awareness of climate change impacts, and the pursuit of energy independence. However, challenges persist, notably the necessity for enhanced grid infrastructure to manage intermittent solar power and the requirement for substantial financing for large-scale projects. The market is primarily segmented into solar photovoltaic (PV) and concentrated solar power (CSP), with PV holding dominance due to its cost-effectiveness and mature technology. Leading global players such as JinkoSolar, Longi Green Energy, and Trina Solar are actively investing in the region, accelerating market development and fostering intense competition that drives innovation and further price reductions, making solar energy increasingly accessible.

Southeast Asia Solar Energy Market Market Size (In Billion)

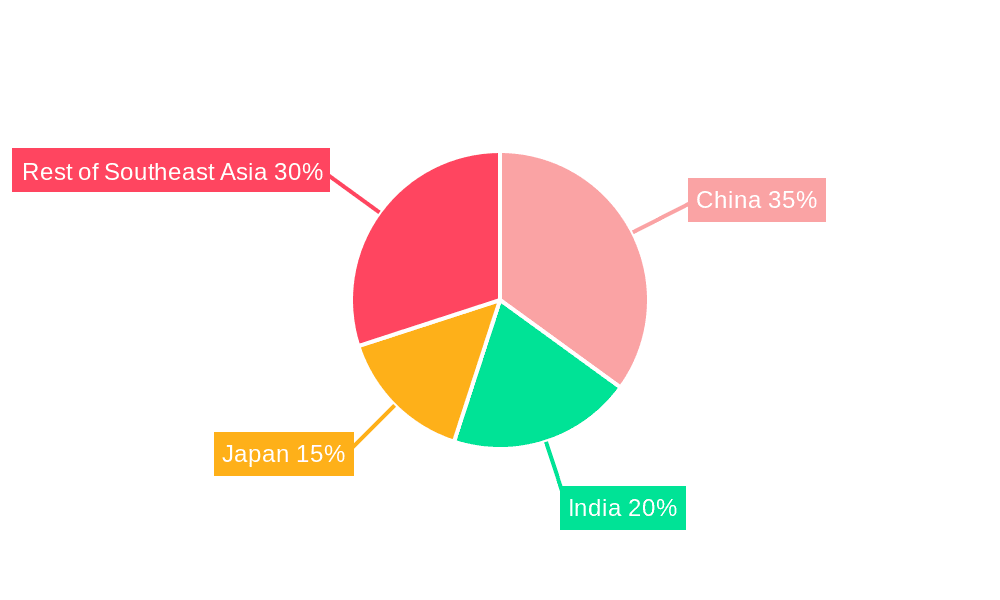

The projected growth trajectory for solar energy in Southeast Asia remains exceptionally strong, particularly influenced by major economies like China, India, and Japan, which are aggressively pursuing renewable energy targets. The broader "Rest of Asia-Pacific" segment also presents considerable opportunity, with adoption rates varying based on national policies and economic landscapes. The market's evolution is characterized by a dual focus on large-scale solar farms and widespread rooftop solar installations, indicating a diversified market structure. Technological advancements, including higher efficiency solar panels and sophisticated energy storage solutions, are anticipated to be critical contributors to future market growth. The integration of smart grids and advanced energy storage systems is paramount for ensuring a stable and reliable energy supply as solar power penetration increases. Continued government support, through subsidies and incentives, will be instrumental in overcoming infrastructure limitations and cultivating a truly sustainable solar energy sector within Southeast Asia.

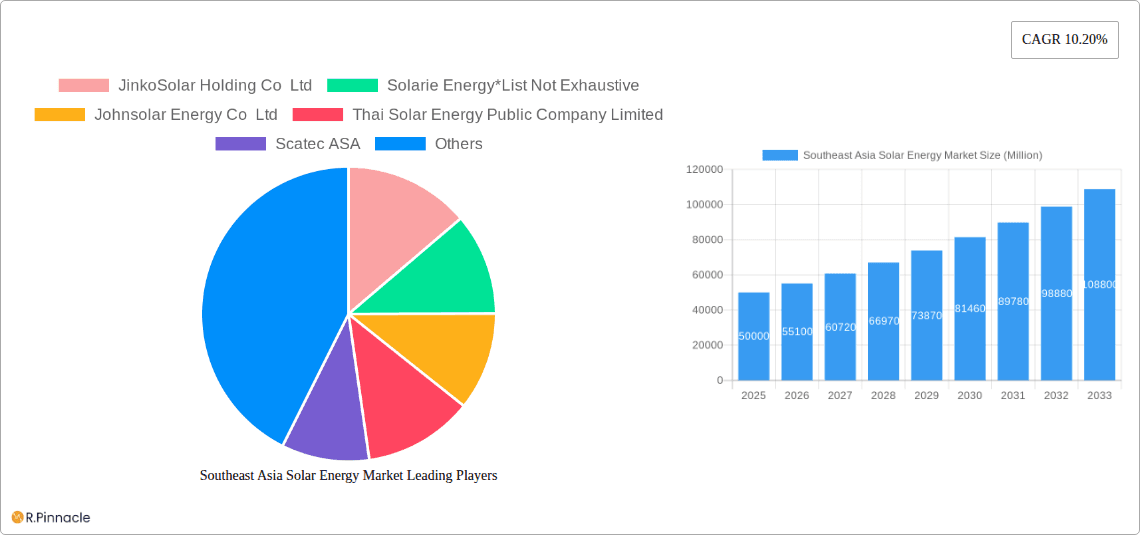

Southeast Asia Solar Energy Market Company Market Share

Southeast Asia Solar Energy Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Southeast Asia solar energy market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The market is segmented by type: Solar Photovoltaic and Concentrated Solar Power. Key players analyzed include JinkoSolar Holding Co Ltd, Solarie Energy, Johnsolar Energy Co Ltd, Thai Solar Energy Public Company Limited, Scatec ASA, Vena Energy Solar Pte Ltd, Canadian Solar Inc, Blue Solar Co Ltd, LONGi Green Energy Technology Co Ltd, and Trina Solar Limited. This is not an exhaustive list.

Southeast Asia Solar Energy Market Structure & Innovation Trends

The Southeast Asia solar energy market exhibits a moderately concentrated structure, with several multinational corporations and regional players vying for market share. Market concentration is expected to remain relatively stable through 2033, with a projected xx% market share held by the top five companies. Innovation is driven by government policies promoting renewable energy, decreasing technology costs, and growing demand for sustainable energy solutions. Regulatory frameworks, while generally supportive, vary across Southeast Asian nations, impacting investment decisions and market development. Product substitutes, such as fossil fuels, continue to compete, though their dominance is waning due to rising environmental concerns and fluctuating fossil fuel prices.

- Market Share (2025): Top 5 players: xx%

- M&A Activity (2019-2024): Total deal value estimated at USD xx Million, with an average deal size of USD xx Million. These activities indicate a drive towards consolidation and expansion within the market.

- End-User Demographics: Primarily utility-scale projects, with growing residential and commercial adoption.

Southeast Asia Solar Energy Market Dynamics & Trends

The Southeast Asia solar energy market is experiencing robust growth, driven by increasing energy demand, supportive government policies aiming for energy independence and reduced carbon emissions, and declining solar PV technology costs. This growth is further propelled by technological advancements, such as improved solar panel efficiency and energy storage solutions. Consumer preferences are shifting towards cleaner energy sources, while competitive dynamics are intensifying, particularly amongst large-scale developers. The market is projected to experience a compound annual growth rate (CAGR) of xx% from 2025 to 2033, with market penetration increasing from xx% in 2025 to xx% in 2033.

Dominant Regions & Segments in Southeast Asia Solar Energy Market

Vietnam and Indonesia are emerging as leading markets, driven by robust economic growth, favorable government policies, and large-scale solar projects. The Solar Photovoltaic (PV) segment dominates the market, accounting for over xx% of total capacity, due to its lower cost and technological maturity compared to Concentrated Solar Power (CSP).

- Key Drivers for Vietnam: Government targets for renewable energy capacity, strong economic growth, and substantial foreign investment.

- Key Drivers for Indonesia: Growing energy demand, government initiatives to diversify energy sources, and abundant solar resources.

- Solar Photovoltaic (PV) Dominance: Lower initial investment costs, readily available technology, and established supply chains.

- Concentrated Solar Power (CSP): While a smaller segment, CSP holds potential for large-scale deployment in areas with high solar irradiance and suitable land availability. However, higher initial investment costs and technological complexities remain challenges.

Southeast Asia Solar Energy Market Product Innovations

Significant innovations are focused on improving solar panel efficiency, reducing production costs, and enhancing energy storage solutions. This includes advancements in thin-film technology, perovskite solar cells, and battery storage technologies. These advancements are enhancing the market fit of solar energy by addressing limitations related to intermittency and energy storage, thus improving grid integration and reliability.

Report Scope & Segmentation Analysis

This report segments the Southeast Asia solar energy market by type: Solar Photovoltaic (PV) and Concentrated Solar Power (CSP). The Solar PV segment is projected to maintain its dominance, driven by cost advantages and widespread adoption. The CSP segment is expected to witness moderate growth, fueled by technological improvements and large-scale projects in regions with high solar irradiance. Both segments are further analyzed across key countries and end-use applications.

Key Drivers of Southeast Asia Solar Energy Market Growth

The market's growth is propelled by several factors: Government incentives and supportive policies aimed at boosting renewable energy adoption, declining solar PV technology costs making it increasingly cost-competitive with fossil fuels, growing awareness of climate change and the need for sustainable energy solutions, and increasing energy demand driven by economic growth and rising population.

Challenges in the Southeast Asia Solar Energy Market Sector

Significant challenges include grid infrastructure limitations in certain regions, inconsistent policy implementation across countries hindering large-scale investments, potential supply chain disruptions impacting raw material availability and component costs, and intense competition among developers leading to price pressures.

Emerging Opportunities in Southeast Asia Solar Energy Market

Significant opportunities exist in expanding solar energy adoption in rural areas, developing innovative financing mechanisms to support solar projects, further integrating solar energy with energy storage systems to improve grid stability, and leveraging technological advancements in thin-film and perovskite solar cells to increase efficiency.

Leading Players in the Southeast Asia Solar Energy Market Market

- JinkoSolar Holding Co Ltd

- Solarie Energy

- Johnsolar Energy Co Ltd

- Thai Solar Energy Public Company Limited

- Scatec ASA

- Vena Energy Solar Pte Ltd

- Canadian Solar Inc

- Blue Solar Co Ltd

- LONGi Green Energy Technology Co Ltd

- Trina Solar Limited

Key Developments in Southeast Asia Solar Energy Market Industry

- October 2022: Acwa Power secured a USD 105 Million contract to build two floating solar PV plants in Indonesia (60 MW Saguling and 50 MW Singkarak), totaling 110 MW. This signifies the growing interest in floating solar technology.

- April 2022: Sunseap Group signed an agreement to build large-scale solar and storage projects in Indonesia's Riau Islands, highlighting the increasing integration of energy storage solutions.

Future Outlook for Southeast Asia Solar Energy Market Market

The Southeast Asia solar energy market is poised for significant growth, driven by continued government support, technological advancements, and increasing demand for sustainable energy. Strategic opportunities abound for companies that can navigate regulatory complexities, efficiently manage supply chains, and offer innovative solutions tailored to the specific needs of each Southeast Asian market. The market's potential is vast, and significant investments are expected in the coming years.

Southeast Asia Solar Energy Market Segmentation

-

1. Type

- 1.1. Solar Photovoltaic

- 1.2. Concentrated Solar Power

-

2. Geography

- 2.1. Vietnam

- 2.2. Indonesia

- 2.3. Philippines

- 2.4. Thailand

- 2.5. Malaysia

- 2.6. Rest of Southeast Asia

Southeast Asia Solar Energy Market Segmentation By Geography

- 1. Vietnam

- 2. Indonesia

- 3. Philippines

- 4. Thailand

- 5. Malaysia

- 6. Rest of Southeast Asia

Southeast Asia Solar Energy Market Regional Market Share

Geographic Coverage of Southeast Asia Solar Energy Market

Southeast Asia Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewable Energy Installation to Reduce the Carbon Emission4.; The Decreasing Price of Solar PV Modules

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Renewable Technologies like Hydropower

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solar Photovoltaic

- 5.1.2. Concentrated Solar Power

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Vietnam

- 5.2.2. Indonesia

- 5.2.3. Philippines

- 5.2.4. Thailand

- 5.2.5. Malaysia

- 5.2.6. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.3.2. Indonesia

- 5.3.3. Philippines

- 5.3.4. Thailand

- 5.3.5. Malaysia

- 5.3.6. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Vietnam Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solar Photovoltaic

- 6.1.2. Concentrated Solar Power

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Vietnam

- 6.2.2. Indonesia

- 6.2.3. Philippines

- 6.2.4. Thailand

- 6.2.5. Malaysia

- 6.2.6. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Indonesia Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solar Photovoltaic

- 7.1.2. Concentrated Solar Power

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Vietnam

- 7.2.2. Indonesia

- 7.2.3. Philippines

- 7.2.4. Thailand

- 7.2.5. Malaysia

- 7.2.6. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Philippines Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solar Photovoltaic

- 8.1.2. Concentrated Solar Power

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Vietnam

- 8.2.2. Indonesia

- 8.2.3. Philippines

- 8.2.4. Thailand

- 8.2.5. Malaysia

- 8.2.6. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Thailand Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solar Photovoltaic

- 9.1.2. Concentrated Solar Power

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Vietnam

- 9.2.2. Indonesia

- 9.2.3. Philippines

- 9.2.4. Thailand

- 9.2.5. Malaysia

- 9.2.6. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Malaysia Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solar Photovoltaic

- 10.1.2. Concentrated Solar Power

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Vietnam

- 10.2.2. Indonesia

- 10.2.3. Philippines

- 10.2.4. Thailand

- 10.2.5. Malaysia

- 10.2.6. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Southeast Asia Southeast Asia Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Solar Photovoltaic

- 11.1.2. Concentrated Solar Power

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Vietnam

- 11.2.2. Indonesia

- 11.2.3. Philippines

- 11.2.4. Thailand

- 11.2.5. Malaysia

- 11.2.6. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 JinkoSolar Holding Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Solarie Energy*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Johnsolar Energy Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Thai Solar Energy Public Company Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Scatec ASA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Vena Energy Solar Pte Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Canadian Solar Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Blue Solar Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 LONGi Green Energy Technology Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Trina Solar Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Southeast Asia Solar Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Solar Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Southeast Asia Solar Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Southeast Asia Solar Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Southeast Asia Solar Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Southeast Asia Solar Energy Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Solar Energy Market?

The projected CAGR is approximately 30.1%.

2. Which companies are prominent players in the Southeast Asia Solar Energy Market?

Key companies in the market include JinkoSolar Holding Co Ltd, Solarie Energy*List Not Exhaustive, Johnsolar Energy Co Ltd, Thai Solar Energy Public Company Limited, Scatec ASA, Vena Energy Solar Pte Ltd, Canadian Solar Inc, Blue Solar Co Ltd, LONGi Green Energy Technology Co Ltd, Trina Solar Limited.

3. What are the main segments of the Southeast Asia Solar Energy Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewable Energy Installation to Reduce the Carbon Emission4.; The Decreasing Price of Solar PV Modules.

6. What are the notable trends driving market growth?

Solar Photovoltaic Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Renewable Technologies like Hydropower.

8. Can you provide examples of recent developments in the market?

October 2022: Acwa Power secured a contract from Indonesia's state-owned utility, PT Perusahaan Listrik Negara (PLN), to build two floating solar photovoltaic (PV) power plants. The deal encompassed the 60 MW Saguling and 50 MW Singkarak floating solar projects. The two projects were likely to have a combined capacity of 110 MW and cost USD 105 million to build.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Solar Energy Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence