Key Insights

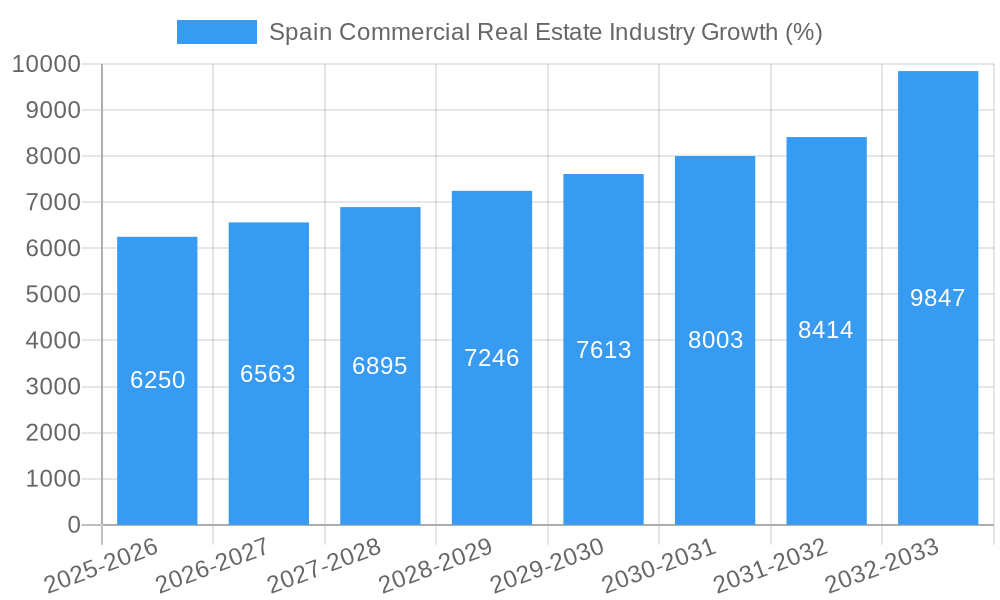

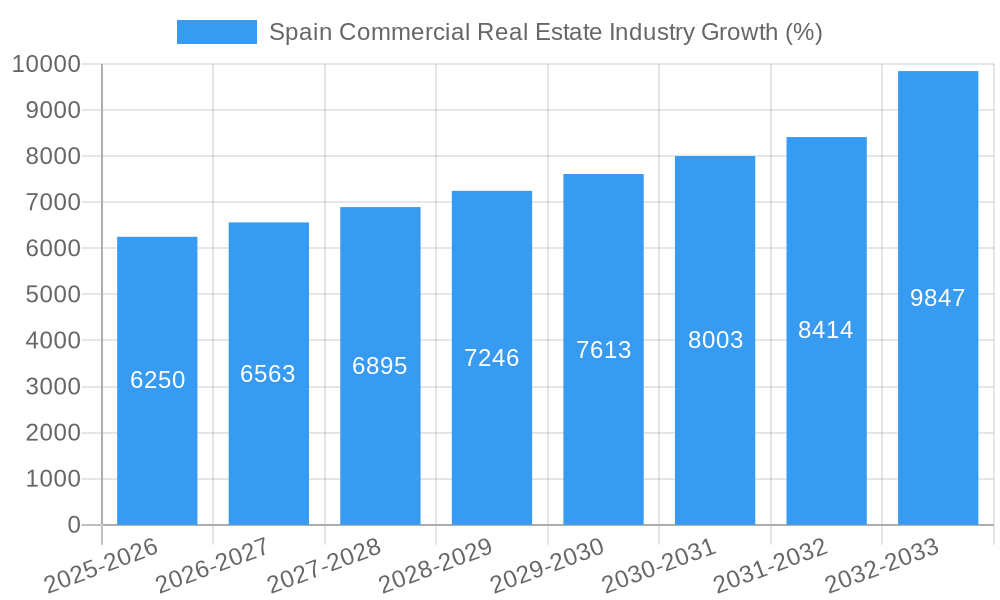

The Spanish commercial real estate market, valued at approximately €[Estimate based on available data and market trends. For example, if the market size XX is a placeholder for a number like 100 million, and the CAGR is >5%, a reasonable estimation for 2025 could be between €120 and €130 million. Let's assume €125 million for this example] in 2025, exhibits robust growth potential with a Compound Annual Growth Rate (CAGR) exceeding 5%. Key drivers include increasing urbanization, a growing tourism sector fueling demand for hospitality and retail spaces, and sustained foreign investment in major cities like Madrid and Barcelona. The market is segmented by property type (offices, retail, industrial, logistics, multi-family, and hospitality) and key cities (Madrid, Valencia, Barcelona, Catalonia, Malaga, and others), reflecting varied investment opportunities and localized market dynamics. Significant players such as Merlin Properties, Klepierre, and Via Celere dominate the development landscape, indicating a competitive but consolidated market.

However, challenges remain. Economic fluctuations, potential interest rate hikes, and regional variations in property values could pose restraints on market expansion. While Madrid and Barcelona generally experience higher demand and values, other cities offer potentially lucrative investment opportunities depending on specific market segments and localized economic conditions. The forecast period (2025-2033) suggests continued growth, albeit potentially moderated by these external factors. A strategic approach considering both the sector's strengths and potential risks is crucial for investors aiming to capitalize on the Spanish commercial real estate market's long-term growth prospects. Further research into specific segments and city-level analyses would refine investment strategies and mitigate potential risks.

Spain Commercial Real Estate Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Spain Commercial Real Estate Industry, covering market structure, dynamics, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for investors, developers, and industry professionals seeking to understand the current landscape and future trajectory of this dynamic market.

Spain Commercial Real Estate Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory frameworks, and M&A activities within the Spanish commercial real estate sector from 2019-2024.

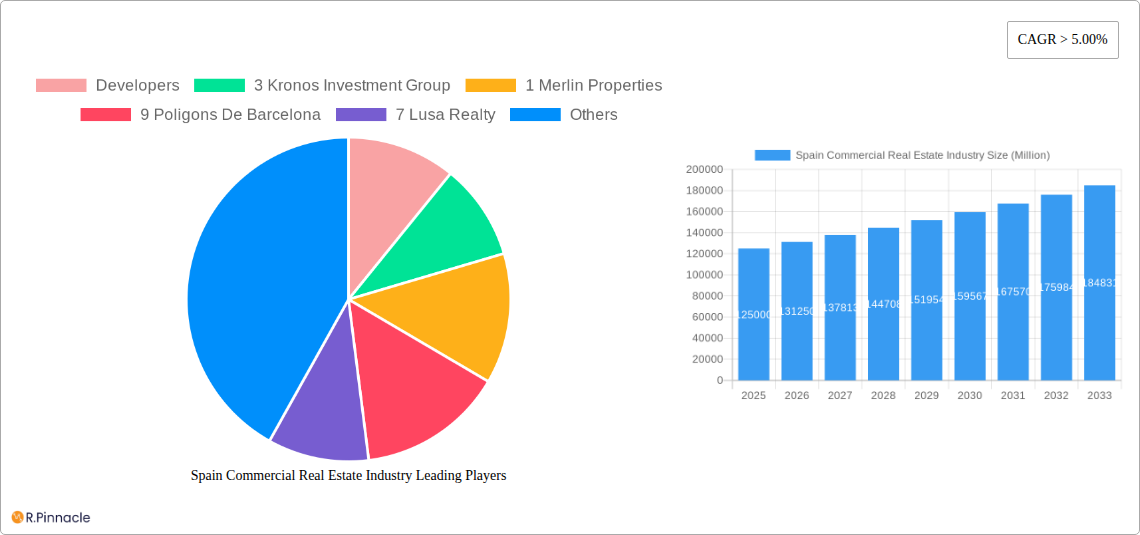

The Spanish commercial real estate market exhibits a moderately concentrated structure, with several key players holding significant market share. While exact market share figures are proprietary, Merlin Properties (9), Klepierre (6), and Poligons De Barcelona (7) are among the largest players, alongside numerous smaller developers and investment firms. Mergers and acquisitions (M&A) activity has been significant, with deals totaling an estimated xx Million in the last five years. This activity is driven by the consolidation of the market and the pursuit of economies of scale.

Key Market Structure Aspects:

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Government incentives, technological advancements (e.g., PropTech), and growing demand for sustainable buildings.

- Regulatory Frameworks: Spanish regulations impact development, zoning, and taxation, influencing investment decisions.

- Product Substitutes: Limited direct substitutes, but alternative investment options can affect market demand.

- End-User Demographics: Demand is driven by a mix of domestic and international investors, businesses, and individuals.

- M&A Activity: Significant M&A activity observed, with deal values in the xx Million range in recent years. Notable examples include Allianz Real Estate's acquisition of residential buildings in Madrid (June 2022).

Spain Commercial Real Estate Industry Market Dynamics & Trends

This section delves into the market growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the Spain commercial real estate market from 2019-2033.

The Spanish commercial real estate market is projected to experience steady growth, driven by factors such as increasing urbanization, strong tourism, and rising foreign investment. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be xx%, influenced by fluctuations in economic conditions and government policies. Technological disruption, particularly through PropTech solutions, is improving efficiency and transparency across the sector. Consumer preferences are shifting towards sustainable and technologically advanced properties, impacting development strategies. Intense competition among developers and investors necessitates innovative approaches to stand out. Market penetration of new technologies is increasing steadily, with a notable rise in the use of digital platforms for property management and marketing.

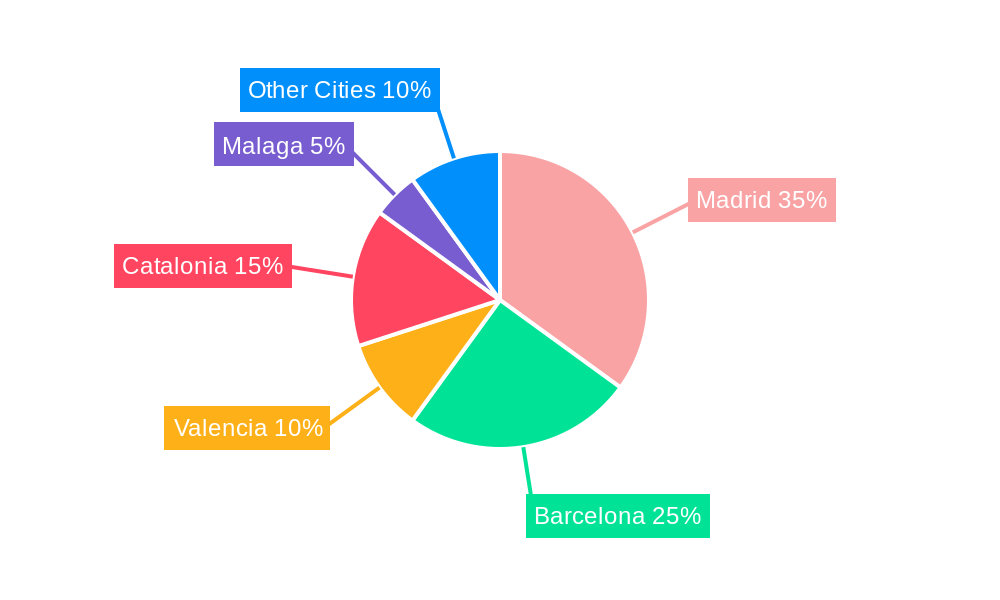

Dominant Regions & Segments in Spain Commercial Real Estate Industry

This section identifies the leading regions and segments within the Spain commercial real estate market.

By Key City: Madrid and Barcelona remain the dominant regions, driven by strong economic activity, infrastructure, and a large talent pool. Catalonia also experiences high demand, although political factors can influence market stability. Valencia and Malaga show consistent growth, but at a slower pace. Other cities contribute to the overall market but hold smaller shares.

By Type: The office, retail, and logistics segments are currently the most prominent, fueled by strong demand and limited supply in prime locations. The multi-family residential sector is experiencing notable growth, particularly in Madrid, driven by increased demand and foreign investment in the PRS (Private Rented Sector). Hospitality shows some resilience but is more susceptible to external economic shocks and tourism trends.

Key Drivers for Dominant Regions & Segments:

- Madrid: Strong economy, central location, substantial infrastructure, and high demand for office and residential space.

- Barcelona: Tourism, innovation hub, and a sizable workforce driving demand for commercial real estate across sectors.

- Catalonia: Regional economic strength and tourism but subject to political sensitivities.

- Office: Strong corporate demand, limited new supply, and high occupancy rates.

- Retail: Robust consumer spending, strategic location, and growth in e-commerce fulfillment centers.

- Logistics: Growth in e-commerce, strategic location for distribution, and improved infrastructure.

Spain Commercial Real Estate Industry Product Innovations

Recent product innovations in the Spanish commercial real estate sector include the integration of smart building technologies, improved sustainability features in new constructions, and the development of flexible workspaces. These innovations aim to enhance operational efficiency, reduce environmental impact, and cater to changing tenant preferences. The market is witnessing growing adoption of PropTech solutions for property management, marketing, and investment analysis. The market fit for these innovations is positive, driving both efficiency gains and attracting investors.

Report Scope & Segmentation Analysis

This report segments the Spanish commercial real estate market by property type (Offices, Retail, Industrial, Logistics, Multi-family, Hospitality) and key city (Madrid, Valencia, Barcelona, Catalonia, Malaga, Other Cities). Each segment presents unique growth projections and competitive dynamics. For example, the office segment in Madrid shows strong growth, while the hospitality sector is more sensitive to tourism fluctuations. Market sizes for each segment are estimated based on available data, with growth projections extending to 2033. Detailed competitive analysis is provided for each segment, highlighting key players and their market share estimates.

Key Drivers of Spain Commercial Real Estate Industry Growth

The growth of the Spanish commercial real estate industry is driven by several key factors: a robust tourism sector, increasing urbanization, a growing economy that attracts foreign direct investment, and government initiatives promoting sustainable development. Technological advancements, specifically in the PropTech sector, are further improving efficiency and transparency.

Challenges in the Spain Commercial Real Estate Industry Sector

Challenges include the relatively limited supply of prime commercial properties in key cities, regulatory hurdles and permitting processes, and increasing construction costs. Supply chain disruptions, particularly in the wake of global events, may impact construction timelines and project costs. Intense competition among developers also presents a challenge. These factors can impact profitability and overall market growth.

Emerging Opportunities in Spain Commercial Real Estate Industry

Emerging opportunities include the growing demand for sustainable and energy-efficient buildings, the expansion of the PRS market, and the increasing adoption of PropTech solutions. New markets are opening up in secondary cities as economic activity diversifies beyond the major metropolitan areas.

Leading Players in the Spain Commercial Real Estate Industry Market

- Developers (3)

- Kronos Investment Group (1)

- Merlin Properties (9)

- Poligons De Barcelona (7)

- Lusa Realty (10)

- Directo de Propietario (5)

- Quabit Immobilaria (4)

- Klepierre (6)

- Finques Garvi (2)

- Via Celere (8)

- Invertica-Irels

Key Developments in Spain Commercial Real Estate Industry

- June 2022: Allianz Real Estate acquired a portfolio of nine prime residential buildings in Madrid for USD 196.95 Million, expanding its presence in the PRS sector.

- December 2022: Aena announced a tender for 86 duty-free shops across 27 airports, totaling over 66,000 square meters of commercial space, signifying significant investment in airport retail.

Future Outlook for Spain Commercial Real Estate Industry Market

The Spanish commercial real estate market is poised for continued growth, driven by strong fundamentals and emerging opportunities. The increasing demand for sustainable and technologically advanced properties, coupled with ongoing foreign investment, points to a positive outlook. Strategic investments in emerging markets and technological advancements will be key to success in the coming years.

Spain Commercial Real Estate Industry Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial

- 1.4. Logistics

- 1.5. Multi-family

- 1.6. Hospitality

-

2. Key City

- 2.1. Madrid

- 2.2. Valencia

- 2.3. Barcelona

- 2.4. Catalonia

- 2.5. Malaga

- 2.6. Other Cities

Spain Commercial Real Estate Industry Segmentation By Geography

- 1. Spain

Spain Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Fluctuating Construction Materials Costs

- 3.4. Market Trends

- 3.4.1. Increasing demand for logistics property driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Commercial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Logistics

- 5.1.5. Multi-family

- 5.1.6. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key City

- 5.2.1. Madrid

- 5.2.2. Valencia

- 5.2.3. Barcelona

- 5.2.4. Catalonia

- 5.2.5. Malaga

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Developers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3 Kronos Investment Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 1 Merlin Properties

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 9 Poligons De Barcelona

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 7 Lusa Realty

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 10 Directo de Propietario**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 5 Quabit Immobilaria

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 4 Klepierre

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 6 Finques Garvi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 2 Via Celere

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 8 Invertica-Irels

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Developers

List of Figures

- Figure 1: Spain Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Commercial Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Spain Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Commercial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Spain Commercial Real Estate Industry Revenue Million Forecast, by Key City 2019 & 2032

- Table 4: Spain Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Spain Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Spain Commercial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Spain Commercial Real Estate Industry Revenue Million Forecast, by Key City 2019 & 2032

- Table 8: Spain Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Commercial Real Estate Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Spain Commercial Real Estate Industry?

Key companies in the market include Developers, 3 Kronos Investment Group, 1 Merlin Properties, 9 Poligons De Barcelona, 7 Lusa Realty, 10 Directo de Propietario**List Not Exhaustive, 5 Quabit Immobilaria, 4 Klepierre, 6 Finques Garvi, 2 Via Celere, 8 Invertica-Irels.

3. What are the main segments of the Spain Commercial Real Estate Industry?

The market segments include Type, Key City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Increasing demand for logistics property driving the market.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Fluctuating Construction Materials Costs.

8. Can you provide examples of recent developments in the market?

December 2022: GAena, the Spanish public company in charge of general aviation airports in Spain, announced today a call for tenders for 86 duty-free shops, all of which are indivisible, at 27 airports in its network. The bidding documents include six lots in total, which is twice the number of lots available in the previous tender. According to a press release issued by Aena, the tender will double the number of lots to increase and favor competition among global operators. The total commercial space available will exceed 66.000 square meters, allowing for the development of economies of scale.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Spain Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence