Key Insights

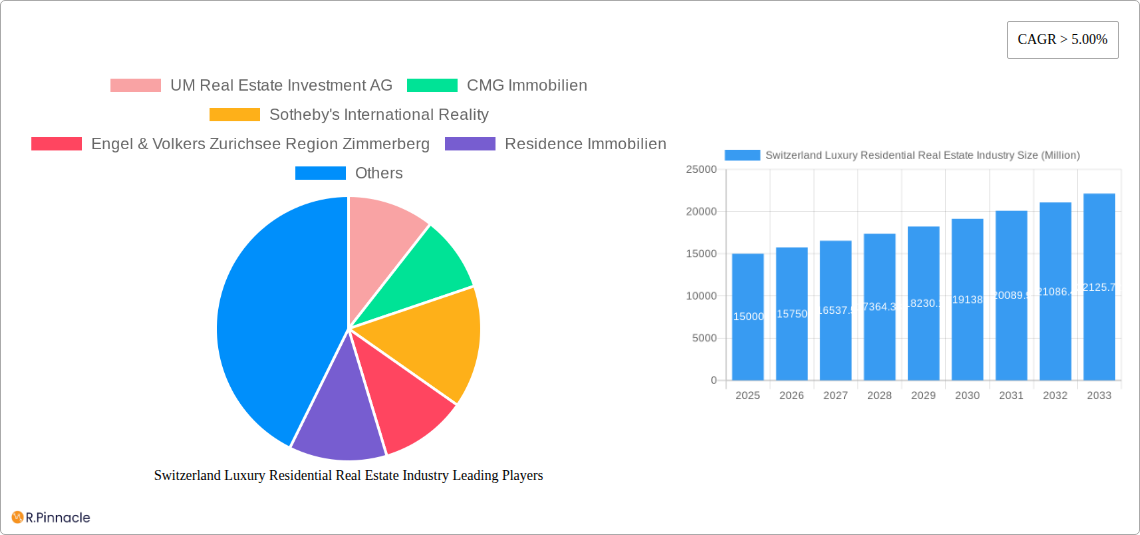

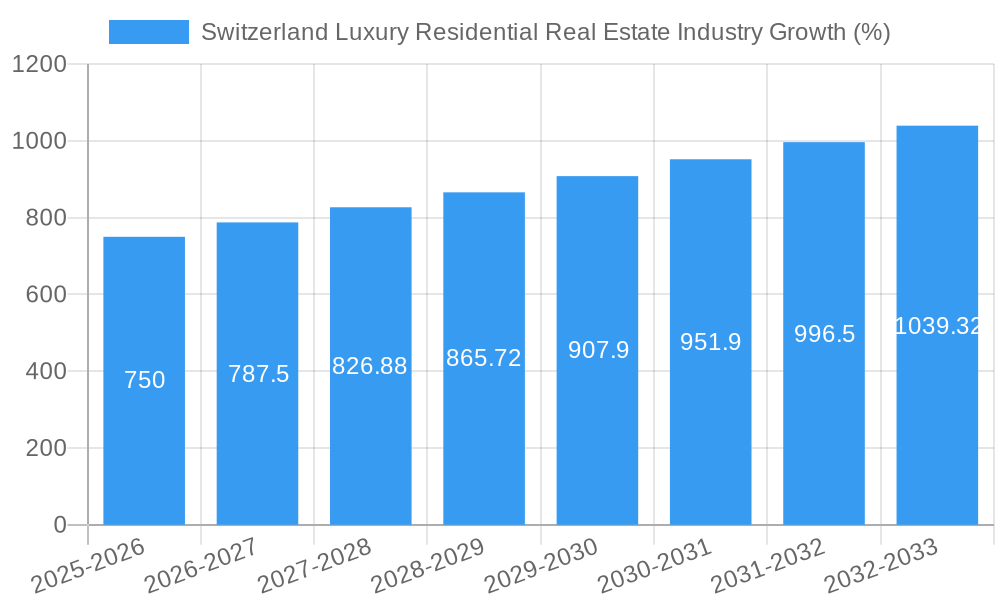

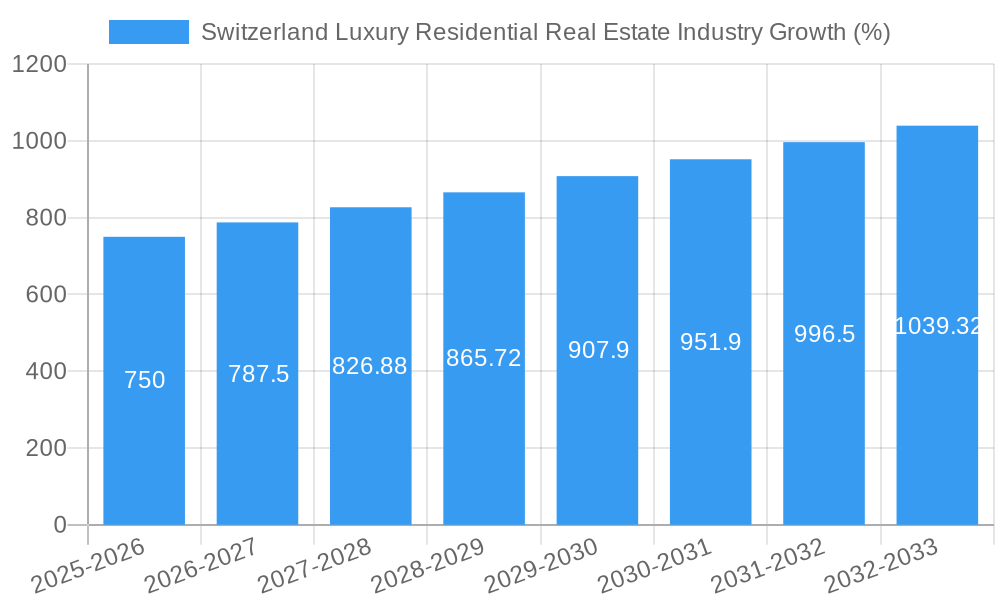

The Switzerland luxury residential real estate market, valued at approximately CHF 15 billion in 2025, exhibits robust growth potential with a Compound Annual Growth Rate (CAGR) exceeding 5%. This expansion is driven by several factors: a consistently strong Swiss franc, attracting high-net-worth individuals (HNWIs) from around the globe; increasing demand for exclusive properties in prime locations like Bern, Zurich, Geneva, and Basel; and a limited supply of luxury homes, creating a seller's market. Furthermore, the country's political and economic stability, coupled with its high quality of life and excellent infrastructure, continue to attract investors seeking safe haven assets. The market is segmented by property type (villas & landed houses, apartments & condominiums) and by city, reflecting varying price points and demand levels across different regions. While the "Other Cities" segment contributes notably, the major cities maintain the highest concentration of luxury properties and transactions, influencing the overall market performance. Potential restraints include stricter lending regulations, potential economic slowdown affecting HNWIs, and increased construction costs impacting new luxury development.

The forecast period of 2025-2033 indicates a continued upward trajectory for the Swiss luxury residential market. The projected CAGR suggests a significant increase in market value by 2033. Key players like UM Real Estate Investment AG, CMG Immobilien, and Sotheby's International Realty are well-positioned to capitalize on this growth, while smaller, boutique firms cater to niche luxury segments. The market's success hinges on effectively addressing potential restraints, adapting to evolving consumer preferences (e.g., sustainable luxury features), and leveraging innovative marketing strategies to reach the global HNWIs who form the primary clientele. The strong presence of international real estate firms highlights the global appeal of Switzerland's luxury housing sector and its integral role within the broader international luxury property landscape.

Switzerland Luxury Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Switzerland luxury residential real estate market, covering the period 2019-2033. It offers actionable insights for industry professionals, investors, and stakeholders seeking to understand market trends, competitive dynamics, and future growth opportunities within this lucrative sector. The report leverages extensive data analysis to provide a detailed forecast, including market size estimations and CAGR projections for the forecast period (2025-2033), with a base year of 2025 and a historical period of 2019-2024. The total market value in 2025 is estimated at xx Million.

Switzerland Luxury Residential Real Estate Industry Market Structure & Innovation Trends

This section analyzes the Swiss luxury residential real estate market's structure, examining market concentration, key innovation drivers, regulatory frameworks, and competitive activity. The report investigates the impact of product substitutes and evolving end-user demographics, including high-net-worth individuals and international investors. Mergers and acquisitions (M&A) within the industry are also explored, including deal values and their effect on market share.

Market Concentration: The Swiss luxury real estate market exhibits a moderately concentrated structure with several key players commanding significant market share. UM Real Estate Investment AG, CMG Immobilien, and Sotheby's International Realty are among the leading firms, although precise market share figures are proprietary and not publicly released.

Innovation Drivers: Technological advancements, such as virtual reality property tours and sophisticated data analytics for market intelligence, are driving innovation. Sustainable building practices and environmentally conscious developments are also gaining traction.

Regulatory Framework: Strict regulations concerning building codes, environmental protection, and property transactions shape the market. These regulations impact both development costs and market entry barriers.

Product Substitutes: While direct substitutes are limited, alternative investment vehicles, such as private equity and art, compete for high-net-worth investor capital.

End-User Demographics: The primary end-users are high-net-worth individuals, both domestic and international, seeking prime properties in desirable locations. The demographic is characterized by a preference for luxury amenities, sophisticated design, and prime locations.

M&A Activities: The report tracks significant M&A activity in the Swiss luxury residential real estate market, noting deal values exceeding xx Million in recent years. These transactions often reflect consolidation efforts and strategies to expand market reach. Specific details are analyzed in the report.

Switzerland Luxury Residential Real Estate Industry Market Dynamics & Trends

This section delves into the market dynamics, examining growth drivers, disruptive technologies, evolving consumer preferences, and competitive landscapes. Quantitative metrics, such as CAGR and market penetration rates, are utilized to illustrate key trends. The current market value is estimated at xx Million. The analysis covers the factors influencing the anticipated compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). Consumer preferences are shifting toward sustainability, smart home technology, and properties offering unique lifestyle experiences. These preferences are influencing pricing trends and design choices.

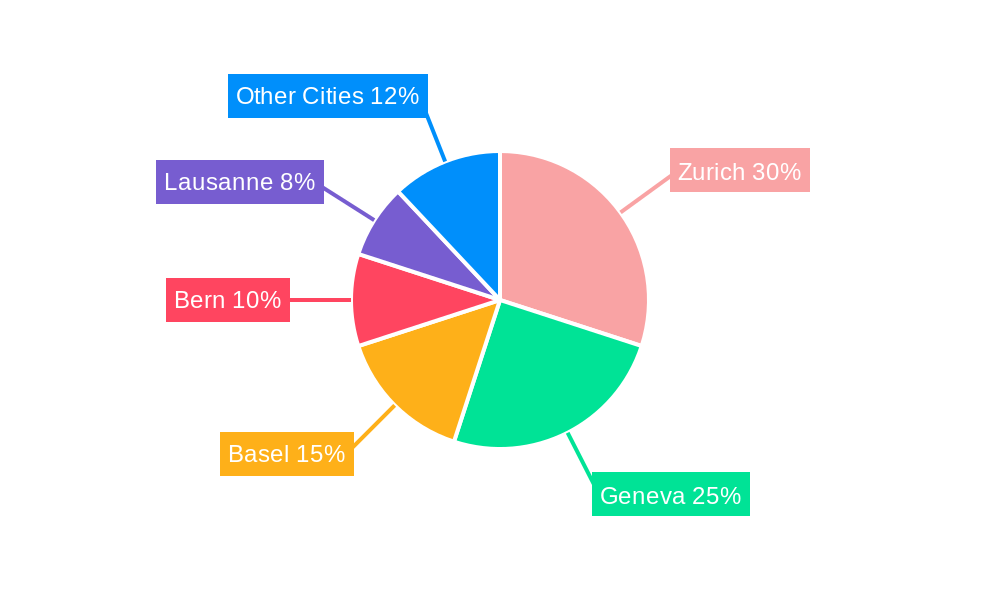

Dominant Regions & Segments in Switzerland Luxury Residential Real Estate Industry

This section identifies the dominant regions and property types within the Swiss luxury real estate market. Zurich, Geneva, and Lausanne consistently rank among the leading cities, driven by strong economic activity, high-quality infrastructure, and a desirable lifestyle. Detailed analysis examines the dominance of specific segments and cities.

By Type: Villas and landed houses command a premium in the luxury market due to their exclusivity and ample space. Apartments and condominiums in prime locations also constitute a significant segment. Growth projections vary by property type, reflecting differing demand levels.

By Cities:

- Zurich: Strong financial sector, high-quality infrastructure, and established luxury market.

- Geneva: International organizations, diplomatic presence, and stunning lake views contribute to high demand.

- Basel: Strong industrial base and art scene support a thriving luxury residential market.

- Lausanne: Lake Geneva location, Olympic history, and growing international presence contribute to high demand.

- Bern: Political center and attractive cultural scene draw luxury buyers.

- Other Cities: Smaller cities across Switzerland offer unique charm and luxury properties with comparative advantages.

Key Drivers:

- Strong Economy: Switzerland's stable economy and high per capita income drive demand.

- Political Stability: The nation's political stability makes it a secure investment destination.

- High-Quality Infrastructure: Excellent transportation, healthcare, and education systems support a high quality of life.

- Tourism: Tourism contributes to the appeal of Swiss luxury properties as investment or second homes.

Switzerland Luxury Residential Real Estate Industry Product Innovations

This section summarizes recent product innovations within the Swiss luxury residential real estate sector. A focus on technological advances, like smart home integrations and sustainable building materials, is emphasized. Market fit and competitive advantages gained through innovation are also highlighted. Emerging technologies are reshaping the landscape by offering greater efficiency, luxury, and sustainability in new residential developments.

Report Scope & Segmentation Analysis

This report comprehensively segments the Swiss luxury residential real estate market by property type (villas and landed houses, apartments and condominiums) and city (Bern, Zurich, Geneva, Basel, Lausanne, and other cities). Growth projections and market size estimations are provided for each segment, along with an analysis of competitive dynamics. The report further delineates each segment's unique characteristics, growth potential, and competitive landscape.

Key Drivers of Switzerland Luxury Residential Real Estate Industry Growth

This section identifies and explains the key drivers fueling growth within the Swiss luxury residential real estate market. Factors such as strong economic performance, political stability, high-quality infrastructure, tourism, and increasing demand from high-net-worth individuals are considered.

Challenges in the Switzerland Luxury Residential Real Estate Industry Sector

This section addresses significant challenges and barriers impacting the Swiss luxury residential real estate industry. These may include land scarcity, stringent regulations, fluctuations in the global economy, and intense competition. The potential impact of these challenges on market growth is quantified within the report.

Emerging Opportunities in Switzerland Luxury Residential Real Estate Industry

This section highlights emerging opportunities, such as the rise of eco-friendly luxury developments, technological advancements within property management, and shifts in consumer preferences towards unique lifestyle-focused properties.

Leading Players in the Switzerland Luxury Residential Real Estate Industry Market

- UM Real Estate Investment AG

- CMG Immobilien

- Sotheby's International Realty (Sotheby's International Realty)

- Engel & Volkers Zurichsee Region Zimmerberg (Engel & Völkers)

- Residence Immobilien

- Honeywell Immobilier

- SJS ImmoArch AG

- Swiss Capital Property

- Luxury Places SA

- La Roche Residential

Key Developments in Switzerland Luxury Residential Real Estate Industry Industry

March 2023: Honeywell Immobilier partnered with the Watershed Organization Trust (WOTR) for soil and water conservation initiatives, demonstrating a commitment to sustainability.

January 2022: Engel & Volkers Zurichsee Region Zimmerberg expanded to over 50 locations, increasing market presence and local brand recognition.

Future Outlook for Switzerland Luxury Residential Real Estate Industry Market

The Swiss luxury residential real estate market is poised for continued growth, driven by robust economic conditions, and high demand for prime properties. Strategic opportunities exist for developers focusing on sustainable practices, innovative technologies, and properties catering to evolving consumer preferences. The market's resilience and appeal to high-net-worth investors ensure its long-term prospects remain strong.

Switzerland Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Cities

- 2.1. Bern

- 2.2. Zurich

- 2.3. Geneva

- 2.4. Basel

- 2.5. Lausanne

- 2.6. Other Cities

Switzerland Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Switzerland

Switzerland Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Bern

- 5.2.2. Zurich

- 5.2.3. Geneva

- 5.2.4. Basel

- 5.2.5. Lausanne

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 UM Real Estate Investment AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CMG Immobilien

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sotheby's International Reality

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engel & Volkers Zurichsee Region Zimmerberg

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Residence Immobilien

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell Immobilier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SJS ImmoArch AG**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Swiss Capital Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Luxury places SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 La Roche Residential

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UM Real Estate Investment AG

List of Figures

- Figure 1: Switzerland Luxury Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Luxury Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Cities 2019 & 2032

- Table 4: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Cities 2019 & 2032

- Table 8: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Luxury Residential Real Estate Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Switzerland Luxury Residential Real Estate Industry?

Key companies in the market include UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Reality, Engel & Volkers Zurichsee Region Zimmerberg, Residence Immobilien, Honeywell Immobilier, SJS ImmoArch AG**List Not Exhaustive, Swiss Capital Property, Luxury places SA, La Roche Residential.

3. What are the main segments of the Switzerland Luxury Residential Real Estate Industry?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

March 2023: Honeywell Immobilier recently entered into a partnership with Watershed Organization Trust (WOTR) to focus on soil and water conservation in rural ecosystems. WOTR is involved in restoring rural water bodies, boosting the water table and helping farmers and women with livelihood opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Switzerland Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence