Key Insights

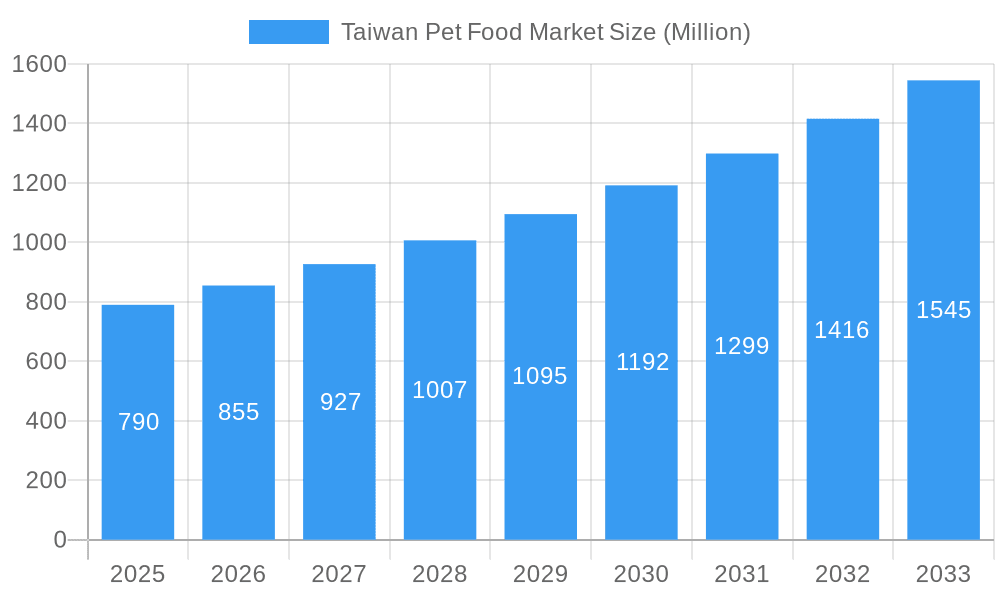

The Taiwan pet food market, valued at $0.79 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.37% from 2025 to 2033. This growth is fueled by several key factors. Increasing pet ownership, particularly of dogs and cats, coupled with rising disposable incomes among Taiwanese households, drives demand for premium and specialized pet foods. A growing awareness of pet nutrition and health contributes to the preference for high-quality ingredients, such as animal-derived proteins and plant-based options, boosting the market for both dry and wet pet food, as well as treats and veterinary diets. The convenience of online sales channels is also a significant contributor, supplementing traditional retail outlets like specialized pet shops and hypermarkets. The market segmentation reveals a strong preference for dog and cat food, reflecting the prevalent pet ownership patterns in Taiwan. However, the "Other Animal Types" segment presents an opportunity for future growth, given the increasing diversification of companion animals. Competition within the market is significant, with both international and domestic players vying for market share. Successful players are those who strategically address the evolving preferences of Taiwanese pet owners by offering innovative products catering to specific dietary needs and preferences, emphasizing transparency in ingredient sourcing, and leveraging effective online marketing strategies.

Taiwan Pet Food Market Market Size (In Million)

The continued expansion of the Taiwanese pet food market relies on sustained economic growth and a consistent rise in pet ownership. Maintaining the current CAGR will require adapting to evolving consumer demands for sustainable and ethically sourced ingredients. Brands focusing on natural, organic, and functional pet foods are expected to gain traction. Furthermore, innovation in product formulations, including addressing specific health concerns like allergies and obesity, will be crucial for maintaining competitive edge. The market's success hinges on addressing concerns related to food safety and transparency, which is paramount to maintaining consumer trust. Growth in the online segment will also require ongoing investments in efficient delivery systems and customer service to meet the expectations of the digitally savvy Taiwanese consumer.

Taiwan Pet Food Market Company Market Share

Taiwan Pet Food Market: A Comprehensive Report (2019-2033)

This report provides a detailed analysis of the Taiwan pet food market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market structure, dynamics, and future trends, this study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. The report leverages rigorous data analysis and expert insights to present a comprehensive understanding of this dynamic market. Expect detailed breakdowns by ingredient type, sales channel, product type, and animal type, along with profiles of key players and an examination of significant industry developments. The market value is presented in Millions.

Taiwan Pet Food Market Market Structure & Innovation Trends

The Taiwan pet food market exhibits a moderately concentrated structure, with key players such as Nestle SA (Purina), Mars Inc, and Colgate Palmolive (Hill's Pet Nutrition) holding significant market share. However, smaller, specialized brands are also making inroads, particularly in the premium and niche segments. Innovation is driven by increasing consumer demand for premium, natural, and functional pet foods catering to specific dietary needs and animal breeds. Regulatory frameworks are evolving to focus on pet food safety and labeling transparency. The market is witnessing a rise in the availability of functional pet foods addressing specific health concerns. This trend is fueled by the growing humanization of pets, coupled with increased pet owner awareness of pet health and nutrition.

- Market Concentration: Nestle SA (Purina) and Mars Inc hold an estimated combined market share of xx%.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals with a total value of approximately xx Million. Further consolidation is anticipated in the forecast period.

- Innovation Drivers: Growing demand for natural ingredients, functional foods, and specialized diets.

- Regulatory Framework: Emphasis on food safety and transparent labeling, which are expected to shape the market's future landscape.

- Product Substitutes: Limited substitutes exist, given the specialized nature of pet food. The primary substitute is homemade pet food, but its consistency and nutritional value are often questionable.

- End-User Demographics: Growing number of pet owners, increased pet humanization, and rising disposable incomes are contributing to market growth.

Taiwan Pet Food Market Market Dynamics & Trends

The Taiwan pet food market is experiencing robust growth, driven by several factors. The increasing pet ownership rate, coupled with rising disposable incomes and a growing preference for premium pet food, are key contributors. Technological advancements in pet food manufacturing and the rise of e-commerce are also transforming the market. Consumer preferences are shifting towards natural, grain-free, and functional pet foods. Competitive dynamics are characterized by both established multinational players and smaller, specialized brands vying for market share. The market is experiencing a shift towards specialty pet food, including organic and hypoallergenic options.

- CAGR (2025-2033): Estimated at xx%.

- Market Penetration: xx% of pet owners are estimated to purchase premium pet food in 2025.

- Technological Disruptions: E-commerce and direct-to-consumer sales are gaining traction, alongside innovation in pet food formulation and packaging.

Dominant Regions & Segments in Taiwan Pet Food Market

While detailed regional data is not available, the market is likely concentrated in major urban areas with higher pet ownership rates. In terms of segments, the following observations are crucial:

Ingredient Type: Animal-derived ingredients dominate, owing to their nutritional value. However, plant-derived ingredients are gaining popularity due to increasing consumer demand for vegetarian/vegan options. Cereals and cereal derivatives remain significant, but their proportion is decreasing due to the focus on alternative ingredients.

Sales Channel: Specialized pet shops remain a major sales channel, although internet sales and hypermarkets are rapidly gaining ground.

Product Type: Dry pet food holds the largest market share, followed by wet pet food. Veterinary diets and treats/snacks are showing substantial growth.

Animal Type: Dogs and cats constitute the largest segments, with significant growth in other small animal categories.

Key Drivers for Dominant Segments:

- Economic Policies: Government support for the pet industry and rising disposable incomes.

- Infrastructure: Improved logistics and e-commerce infrastructure facilitating efficient distribution.

Taiwan Pet Food Market Product Innovations

Recent product innovations focus on functional benefits, addressing specific health concerns like joint health, digestion, and allergies. Premiumization of pet food is a major trend, with brands emphasizing natural ingredients and specialized formulations. Technological advancements in manufacturing processes are resulting in improved product quality, shelf life, and nutritional value. The market is also seeing an increase in sustainably sourced ingredients.

Report Scope & Segmentation Analysis

This report segments the Taiwan pet food market by ingredient type (animal-derived, plant-derived, cereals and cereal derivatives, other), sales channel (specialized pet shops, internet sales, hypermarkets, other), product type (dry pet food, wet pet food, veterinary diet, treats/snacks, other), and animal type (dog, cat, bird, other). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail.

Key Drivers of Taiwan Pet Food Market Growth

Key growth drivers include rising pet ownership, increasing disposable incomes, growing consumer awareness of pet health and nutrition, and the premiumization of pet food. Government initiatives supporting the pet industry further contribute to the market expansion. The increasing popularity of pet insurance also fosters greater investment in pet health and wellness products, including premium pet foods.

Challenges in the Taiwan Pet Food Market Sector

Challenges include maintaining ingredient supply chain stability, particularly given global economic volatility. Ensuring compliance with evolving regulatory frameworks related to labeling and food safety is also important. Intense competition from both domestic and international players is another factor impacting market players. This may cause price pressures and reduce profit margins.

Emerging Opportunities in Taiwan Pet Food Market

Emerging opportunities lie in the growing demand for functional and premium pet foods tailored to specific dietary needs, pet breeds, or life stages. Innovation in sustainable and ethically sourced pet food ingredients is a considerable opportunity. The pet food subscription model presents a major opportunity for companies able to successfully implement and manage their service.

Leading Players in the Taiwan Pet Food Market Market

- Blue Buffalo

- Colgate Palmolive (Hill's Pet Nutrition)

- Yamahisa Pet Care

- InVivo NSA

- Merrick Pet Care

- Wellpet

- Sunshine Mills

- Deuerer

- Nestle SA (Purina) https://www.purina.com/

- Mogiana Alimentos SA

- Agrolimen SA

- Diamond Pet Foods

- Ainsworth Pet Nutrition

- Debifu Pet Products Co Lt

- Mars Inc https://www.mars.com/

- J M Smucker (Big Heart) https://www.jmsmucker.com/

- Heristo AG

Key Developments in Taiwan Pet Food Market Industry

- April 2022: Launch of a new government department for pets, enhancing regulatory oversight and market development.

- January 2022: Royal Canin (Mars) launched new products addressing specific sensitivities and behavioral issues in cats and dogs, reflecting a focus on functional pet food.

Future Outlook for Taiwan Pet Food Market Market

The Taiwan pet food market is poised for continued growth, driven by increasing pet ownership, rising disposable incomes, and sustained consumer demand for premium and functional pet food products. Strategic investments in research and development, coupled with adapting to evolving consumer preferences, will be vital for success in this dynamic market.

Taiwan Pet Food Market Segmentation

-

1. Product Type

- 1.1. Dry Pet Food

- 1.2. Wet Pet Food

- 1.3. Veterinary Diet

- 1.4. Treats/Snacks

- 1.5. Other Product Types

-

2. Animal Type

- 2.1. Dog

- 2.2. Cat

- 2.3. Bird

- 2.4. Other Animal Types

-

3. Ingredient Type

- 3.1. Animal-derived

- 3.2. Plant-derived

- 3.3. Cereals and Cereal Derivatives

- 3.4. Other Ingredient Types

-

4. Sales Channel

- 4.1. Specialized Pet Shops

- 4.2. Internet Sales

- 4.3. Hypermarkets

- 4.4. Other Sales Channels

Taiwan Pet Food Market Segmentation By Geography

- 1. Taiwan

Taiwan Pet Food Market Regional Market Share

Geographic Coverage of Taiwan Pet Food Market

Taiwan Pet Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed

- 3.3. Market Restrains

- 3.3.1. High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves

- 3.4. Market Trends

- 3.4.1. Demand for Premium Quality Pet Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Pet Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dry Pet Food

- 5.1.2. Wet Pet Food

- 5.1.3. Veterinary Diet

- 5.1.4. Treats/Snacks

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dog

- 5.2.2. Cat

- 5.2.3. Bird

- 5.2.4. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.3.1. Animal-derived

- 5.3.2. Plant-derived

- 5.3.3. Cereals and Cereal Derivatives

- 5.3.4. Other Ingredient Types

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Specialized Pet Shops

- 5.4.2. Internet Sales

- 5.4.3. Hypermarkets

- 5.4.4. Other Sales Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Blue Buffalo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colgate Palmolive (Hill's Pet Nutrition)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yamahisa Pet Care

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 InVivo NSA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Merrick Pet Care

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wellpet

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunshine Mills

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deuerer

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nestle SA (Purina)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mogiana Alimentos SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Agrolimen SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Diamond Pet Foods

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Ainsworth Pet Nutrition

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Debifu Pet Products Co Lt

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Mars Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 J M Smucker (Big Heart)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Heristo AG

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Blue Buffalo

List of Figures

- Figure 1: Taiwan Pet Food Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Taiwan Pet Food Market Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Pet Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Taiwan Pet Food Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Taiwan Pet Food Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 4: Taiwan Pet Food Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: Taiwan Pet Food Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Taiwan Pet Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Taiwan Pet Food Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 8: Taiwan Pet Food Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 9: Taiwan Pet Food Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 10: Taiwan Pet Food Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Pet Food Market?

The projected CAGR is approximately 8.37%.

2. Which companies are prominent players in the Taiwan Pet Food Market?

Key companies in the market include Blue Buffalo, Colgate Palmolive (Hill's Pet Nutrition), Yamahisa Pet Care, InVivo NSA, Merrick Pet Care, Wellpet, Sunshine Mills, Deuerer, Nestle SA (Purina), Mogiana Alimentos SA, Agrolimen SA, Diamond Pet Foods, Ainsworth Pet Nutrition, Debifu Pet Products Co Lt, Mars Inc, J M Smucker (Big Heart), Heristo AG.

3. What are the main segments of the Taiwan Pet Food Market?

The market segments include Product Type, Animal Type, Ingredient Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed.

6. What are the notable trends driving market growth?

Demand for Premium Quality Pet Food.

7. Are there any restraints impacting market growth?

High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves.

8. Can you provide examples of recent developments in the market?

April 2022: Taiwan launched a new government department for pets. This new section in the country's council of agriculture will manage all aspects of a pet's life, from pet food to grooming, training, pet-sitting, and pet insurance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Pet Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Pet Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Pet Food Market?

To stay informed about further developments, trends, and reports in the Taiwan Pet Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence